Market Overview

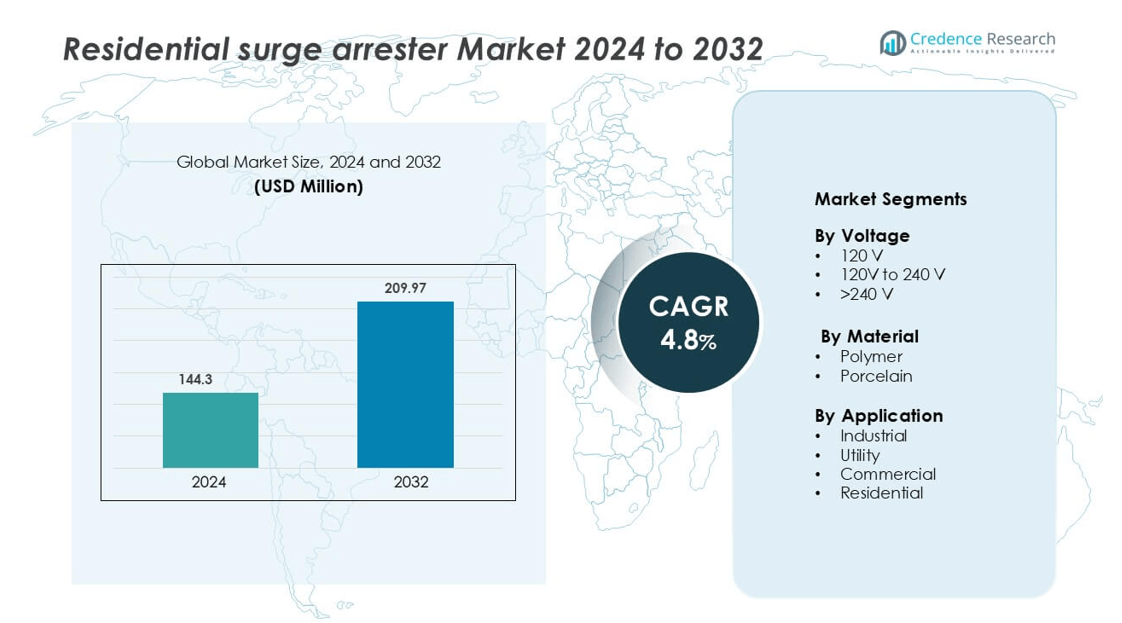

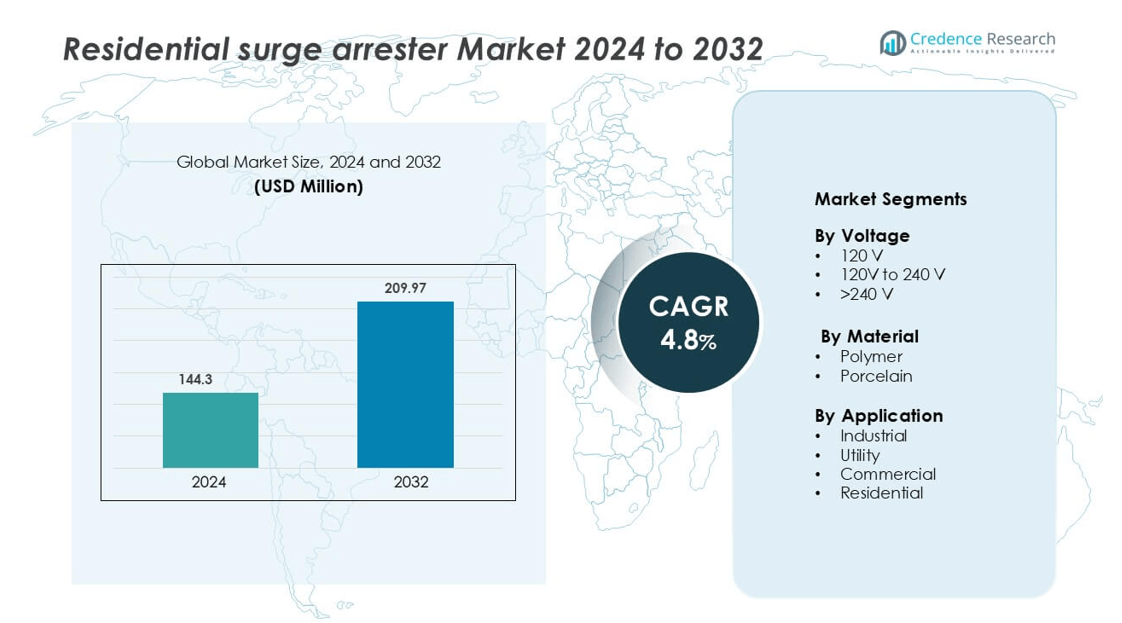

Residential surge arrester market was valued at USD 144.3 million in 2024 and is anticipated to reach USD 209.97 million by 2032, growing at a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Residential Surge Arrester Market Size 2024 |

USD 144.3 million |

| Residential Surge Arrester Market, CAGR |

4.8% |

| Residential Surge Arrester Market Size 2032 |

USD 209.97 million |

The residential surge arrester market features key players such as DITEK, Hager Group, General Electric, Ensto, DEHN SE, CHINT Group, Littelfuse, Eaton, Elpro, and ABB. These companies focus on advanced polymer-based materials, compact surge protection designs, and smart monitoring systems to meet growing residential safety demands. Strategic investments in R&D and regional expansion strengthen their global presence. Asia-Pacific leads the market with a 36% share, driven by rapid urbanization, large-scale housing developments, and government-backed electrification programs that promote modern surge protection installations across residential infrastructure.

Market Insights

- The residential surge arrester market was valued at USD 144.3 million in 2024 and is projected to reach USD 209.97 million by 2032, growing at a CAGR of 4.8%.

- Rising power fluctuations and increased use of electronic appliances drive strong demand for surge protection in residential buildings.

- Technological trends include smart, IoT-enabled arresters with compact polymer designs offering enhanced insulation and thermal resistance.

- Leading companies such as ABB, Eaton, Littelfuse, and Hager Group focus on innovation, product reliability, and strategic partnerships to strengthen their global footprint.

- Asia-Pacific dominates the market with a 36% share, followed by North America with 32%, while the 120V–240V voltage segment leads with a 47% share due to its suitability for modern household electrical systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Voltage

The 120V to 240V segment dominates the residential surge arrester market, holding a 47% share in 2024. Its leadership is driven by widespread use in home appliances, HVAC systems, and lighting circuits. These arresters provide efficient overvoltage protection in modern residential setups where dual-voltage compatibility is essential. Growth in household electrification and the adoption of energy-efficient appliances further enhance product demand. Manufacturers focus on compact, maintenance-free models to improve safety and durability, making this voltage range the preferred choice among residential users.

- For instance, Mersen’s Surge-Trap® STLC240S025 supports a discharge current rating of 10 kA and a surge capacity of 25 kA per phase for 120/240 V residential panels.

By Material

Polymer-based surge arresters lead the market with a 62% share, outperforming porcelain types due to their superior mechanical strength and weather resistance. They offer lightweight construction, corrosion resistance, and better insulation, making them ideal for both indoor and outdoor installations. Advancements in polymer composites extend lifespan while reducing maintenance costs. Porcelain arresters remain in use for legacy systems, but polymer types are gaining traction due to easier installation and improved performance in harsh environmental conditions, aligning with modern housing standards and grid reliability requirements.

- For instance, TE Connectivity’s Bowthorpe DOV polymeric surge arrester family delivers a cantilever strength (specified short-term load, SSL) of 225 Nm (Newton meters) and supports distribution voltage ratings up to 36 kV.

By Application

The residential segment holds the largest share at 39%, driven by rising power fluctuations in urban and semi-urban homes. Increased usage of electronics, smart appliances, and solar inverters has intensified the need for protection systems. Energy efficiency programs and safety regulations also promote surge arrester installations in residential infrastructure. Meanwhile, industrial and utility segments see moderate growth, supported by grid expansion and automation. The residential sector continues to lead, reflecting the growing importance of home electrical safety and equipment longevity.

Key Growth Drivers

Rising Incidence of Power Surges in Residential Areas

The increasing frequency of voltage fluctuations and transient surges in residential areas is driving strong demand for surge arresters. Rapid urbanization, unstable grid infrastructure, and higher appliance density have heightened the risk of equipment damage. Homeowners are prioritizing protective solutions to safeguard electronics, HVAC systems, and renewable energy installations such as rooftop solar. The integration of smart meters and distributed power sources also contributes to higher surge exposure. As a result, manufacturers are focusing on compact, cost-effective arresters designed for low-voltage residential circuits, ensuring enhanced reliability and improved safety standards across modern homes.

- For instance, Schneider Electric’s Acti9 iPF K series low-voltage surge arrester covers nominal discharge currents from 20 kA up to 65 kA.

Expansion of Smart Homes and IoT-Enabled Devices

The widespread adoption of smart home technologies is a major growth catalyst for the residential surge arrester market. Connected devices, automation systems, and EV chargers require uninterrupted, clean power supply to operate efficiently. Surge arresters play a vital role in protecting these sensitive systems from voltage spikes caused by grid instability or lightning. Governments and utility providers are supporting smart infrastructure development, accelerating installation rates in new housing projects. The trend toward energy-efficient, digitally controlled homes ensures sustained demand for advanced, integrated surge protection solutions compatible with IoT frameworks.

- For instance, ABB THQLSURGE2 is a Type-1 plug-on SPD rated for full-home protection at 120/240 V, with a surge capacity of 25 kA per phase and a nominal discharge current of 10 kA.

Growth in Renewable Energy Integration and Distributed Power Systems

The rising penetration of residential solar power systems and distributed generation sources boosts the need for surge arresters. Photovoltaic installations and battery storage units are vulnerable to voltage surges induced by lightning or grid faults. Installing surge protection ensures the safety and longevity of inverters, converters, and control circuits. Moreover, government incentives promoting clean energy adoption have led to a surge in rooftop solar installations globally. This shift toward decentralized power generation directly increases the deployment of surge arresters in homes to maintain equipment reliability and ensure compliance with safety standards.

Key Trends & Opportunities

Development of Compact and Aesthetic Surge Protection Devices

Modern residential consumers demand surge arresters that blend safety with design appeal. Manufacturers are responding by introducing compact, lightweight, and aesthetically designed models suitable for indoor installations. Polymer-based materials and modular configurations have enabled sleek, space-saving devices that can fit modern electrical panels. Additionally, integration of monitoring features that alert users to system faults through LEDs or wireless notifications is gaining popularity. This shift toward consumer-centric design not only enhances usability but also opens new opportunities in home renovation and smart retrofit markets.

- For instance, Schneider Electric Acti9 iPRD40 features dimensions of 72 mm × 85 mm × 69 mm, a weight of around 450 g, and supports a nominal discharge current rating of 15 kA for the 3-pole + neutral variant.

Increasing Adoption of Smart Surge Protection Systems

Smart surge protection devices equipped with IoT and cloud connectivity are emerging as a key trend in the residential market. These systems enable real-time monitoring, fault detection, and predictive maintenance. Homeowners can track surge activity through mobile applications and receive alerts for necessary replacements or overvoltage incidents. Such intelligent solutions align with broader smart home ecosystems and enhance overall energy management. As the demand for connected electrical systems rises, manufacturers are investing in digital surge arresters with remote diagnostics and adaptive response capabilities to improve system resilience.

- For instance, Eaton introduced its Power Defense series circuit breakers featuring an embedded communication module that enables predictive diagnostics and cloud-based analytics through Eaton’s Brightlayer platform.

Rising Focus on Safety Compliance and Energy Efficiency Standards

Governments and regulatory bodies are strengthening safety norms for residential electrical systems. Compliance with IEC, IEEE, and UL standards is now essential, pushing manufacturers to enhance quality and performance. Surge arresters designed with low energy dissipation and high fault endurance are gaining market traction. Programs promoting energy efficiency certifications also encourage the integration of surge protection in building codes. This policy-driven focus on safety and sustainability creates long-term opportunities for producers offering certified, eco-friendly solutions with minimal power loss and superior insulation performance.

Key Challenges

High Cost of Advanced Surge Protection Systems

One of the major challenges limiting market expansion is the high cost of smart and advanced surge arresters. While basic devices are affordable, models featuring IoT connectivity, modular housings, and high-end insulation materials increase installation costs. This price barrier restricts adoption among low- and middle-income households, particularly in developing regions. Additionally, limited consumer awareness of the long-term benefits of surge protection discourages investment. To overcome this, manufacturers must focus on cost optimization, local sourcing, and awareness campaigns highlighting the economic value of avoiding equipment failures.

Limited Awareness and Improper Installation Practices

Despite technological advancements, lack of awareness about surge protection remains a critical barrier. Many residential users underestimate the risks of voltage surges, leading to minimal adoption outside urban centers. Improper installation practices further reduce arrester efficiency and lifespan, especially when performed by untrained technicians. Inadequate grounding or incorrect positioning can compromise protection levels and create safety hazards. Manufacturers and regulatory agencies are increasingly emphasizing installer training, certification programs, and end-user education to address these issues and ensure reliable performance in residential power networks.Top of Form

Regional Analysis

North America

North America holds a 32% share of the residential surge arrester market, driven by advanced power infrastructure and strong consumer awareness of electrical safety. The United States leads the region, supported by widespread use of smart home devices, EV chargers, and solar power systems. Strict regulatory standards and growing adoption of polymer-based arresters enhance product reliability and lifespan. Canada also contributes significantly due to its focus on energy-efficient housing and modernized electrical systems. Ongoing grid modernization projects and high replacement demand continue to strengthen the regional market outlook.

Europe

Europe accounts for a 27% market share, supported by stringent safety regulations and renewable energy integration. Countries such as Germany, the U.K., and France are leading adopters, with extensive use of surge protection in smart homes and solar-equipped residences. The shift toward sustainable housing and increasing electrification of transport infrastructure fuel product demand. European manufacturers focus on compact and environmentally friendly designs that comply with IEC and RoHS standards. Rising investments in power distribution networks and building automation systems further strengthen market penetration across the continent.

Asia-Pacific

Asia-Pacific dominates the residential surge arrester market with a 36% share, led by rapid urbanization, electrification, and smart grid initiatives. China, Japan, and India drive demand through large-scale housing projects and increasing household appliance use. Expanding adoption of rooftop solar systems and government-supported electrification programs further boost arrester installations. Local manufacturers offer cost-effective polymer-based solutions tailored for regional voltage conditions. Rapid digitalization and energy infrastructure upgrades position Asia-Pacific as the fastest-growing market, with strong potential in both new residential developments and rural electrification projects.

Latin America

Latin America captures a 3% share of the residential surge arrester market, influenced by infrastructure modernization and renewable energy expansion. Brazil and Mexico are the primary contributors, focusing on electrical safety improvements in urban and semi-urban housing. Increased deployment of solar energy systems and grid upgrades encourages the use of surge protection devices. Although cost sensitivity remains a concern, partnerships between global manufacturers and local distributors enhance product accessibility. Gradual adoption of international safety standards is expected to drive consistent market growth in the coming years.

Middle East & Africa

The Middle East & Africa region accounts for a 2% market share, with growth supported by rising urban construction and electrification initiatives. The Gulf countries lead due to rapid smart city development and the need for surge protection in high-end residential buildings. In Africa, expanding power access and renewable energy adoption are boosting demand for affordable, durable arresters. Manufacturers focus on heat-resistant polymer units suited for extreme climates. While market penetration is still developing, infrastructure investments and housing expansion are expected to accelerate future adoption across both regions.

Market Segmentations:

By Voltage

- 120 V

- 120V to 240 V

- >240 V

By Material

By Application

- Industrial

- Utility

- Commercial

- Residential

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The residential surge arrester market is moderately consolidated, with global players focusing on product innovation, strategic expansion, and technology upgrades to strengthen their positions. Leading companies such as DITEK, Hager Group, General Electric, Ensto, DEHN SE, CHINT Group, Littelfuse, Eaton, Elpro, and ABB dominate the market through diverse portfolios catering to various voltage levels and residential applications. These firms emphasize polymer-based arresters with enhanced thermal stability, compact designs, and IoT-enabled monitoring features. ABB and Eaton invest heavily in smart protection technologies, while Littelfuse and DEHN SE focus on surge suppression solutions for energy-efficient homes. Strategic mergers, R&D initiatives, and collaborations with utility providers are enhancing market competitiveness. Regional players are also emerging by offering cost-effective solutions tailored for developing markets, ensuring a balance between performance, affordability, and compliance with international safety standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DITEK

- Hager Group

- General Electric

- Ensto

- DEHN SE

- CHINT Group

- Littelfuse

- Eaton

- Elpro

- ABB

Recent Developments

- In October 2024, DEHN revealed its EZ50-S Guard series which is a Type 1 NEMA 4X surge suppressor; the product exceeds expectations in provision of surge suppression and servicing within maintenance windows. It is suitable for use in residential buildings, industry, commerce and even data centers, energy and EV charging operations and is remarkably reliable, minimizing system failures and enhancing system uptime. The solution offers efficient protection against alternating current (AC) power to critical systems and their functions while also being very economical.

- In December 2023, Ensto launched a new sub-range of compact VARISIL™ HE distribution surge arresters designed for distribution networks with optimized size and cost benefits, enhancing reliability for residential and other equipment.

Report Coverage

The research report offers an in-depth analysis based on Voltage, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing smart home adoption will drive demand for intelligent surge protection systems.

- Manufacturers will focus on compact, energy-efficient, and design-friendly arresters for modern homes.

- Integration of IoT and remote monitoring features will enhance user safety and maintenance efficiency.

- Rising renewable energy installations, especially rooftop solar, will expand arrester applications.

- Increasing government regulations on electrical safety will accelerate product standardization.

- Polymer-based arresters will replace porcelain types due to better durability and weather resistance.

- Emerging economies will witness rapid adoption through rural electrification programs.

- Collaboration between utilities and manufacturers will improve product accessibility and performance.

- Technological innovation will reduce product costs, supporting wider market penetration.

- Asia-Pacific will remain the growth leader, supported by infrastructure expansion and urban housing projects.