Market Overview

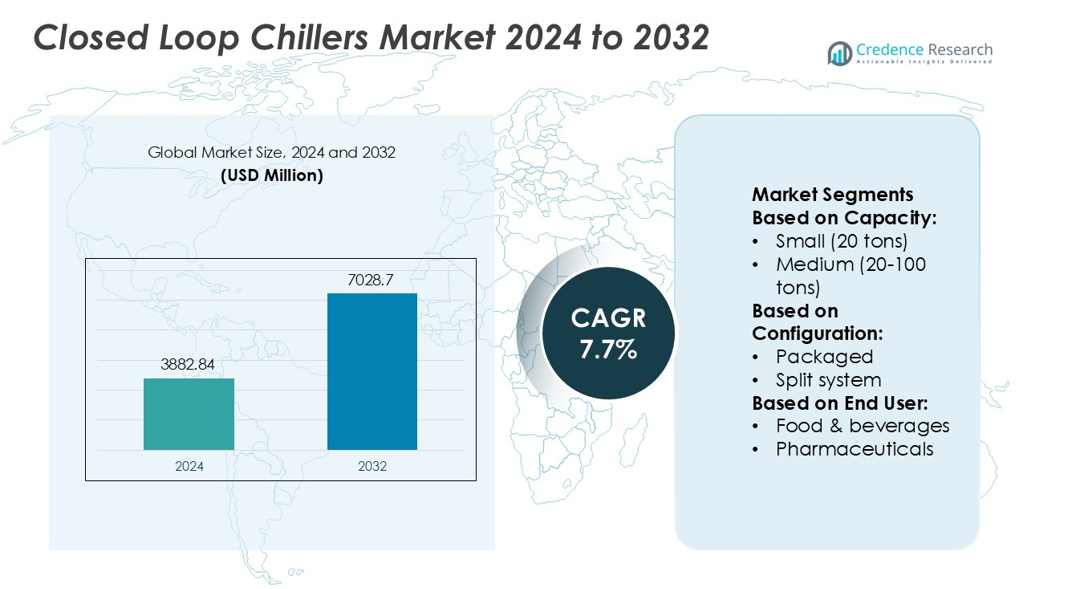

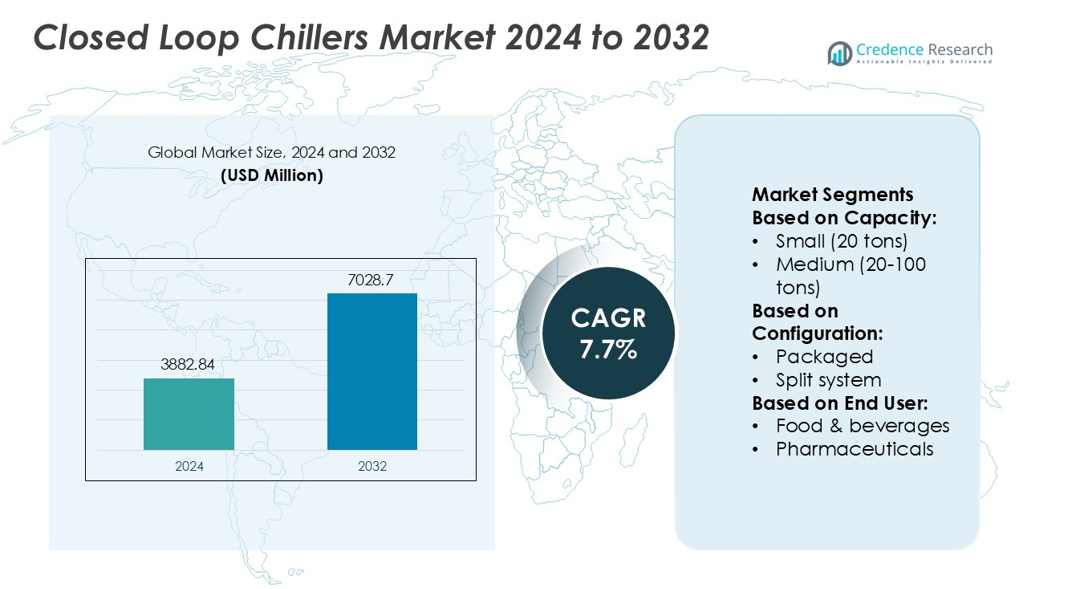

Closed Loop Chillers Market size was valued USD 3882.84 million in 2024 and is anticipated to reach USD 7028.7 million by 2032, at a CAGR of 7.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Closed Loop Chillers Market Size 2024 |

USD 3882.84 million |

| Closed Loop Chillers Market, CAGR |

7.7% |

| Closed Loop Chillers Market Size 2032 |

USD 7028.7 million |

The Closed Loop Chillers Market features strong competition among Honeywell International, Daikin Applied, Johnson Controls, Ingersoll Rand, Carrier Corporation, Danfoss, Bosch Thermotechnology, Blue Star Limited, Lennox International, and Hitachi Air Conditioning. These companies focus on high-efficiency chillers, advanced heat exchangers, smart controls, and remote monitoring to reduce energy use and improve process stability. The leading region is Asia Pacific with 36% market share, driven by rapid industrial expansion, rising data center construction, and growing pharmaceutical and electronics manufacturing. Local production capacity, cost-competitive systems, and government-supported industrial growth continue to strengthen the region’s dominance in global installations.

Market Insights

- Closed Loop Chillers Market size was valued at USD 3882.84 million in 2024 and is expected to reach USD 7028.7 million by 2032, growing at a CAGR of 7.7%.

- Rising demand for precision cooling in pharmaceuticals, food processing, and data centers drives market adoption, with industrial manufacturing holding a major segment share due to high operational reliability needs.

- Smart controls, IoT monitoring, and energy-efficient compressors represent key market trends as users focus on reducing energy costs and improving system uptime.

- Strong competition exists among leading companies offering high-efficiency designs, remote diagnostics, and customized solutions, but high initial setup costs and skilled maintenance needs act as restraints for small facilities.

- Asia Pacific leads with 36% share, driven by rapid industrial growth and large-scale data center investments, while North America and Europe maintain steady demand through upgrades and replacement of older cooling systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Capacity

Small closed loop chillers, with capacities up to 20 tons, dominate the market with nearly 45% share due to high use in laboratories, small production units, beverage filling lines, and medical cooling systems. These compact units offer easy installation, lower power consumption, and high reliability for continuous, precise temperature control. Demand rises in SMEs focused on short-run production and clean environmental operations. Medium units (20–100 tons) are preferred in mid-scale factories and food plants, while large chillers serve heavy-duty cooling in petrochemical and data center facilities where uninterrupted operation is critical.

- For instance, Daikin Applied’s Magnitude™ magnetic-bearing chiller line operates with an integrated compressor that removes mechanical contact, cutting vibration levels to 0.01 inches per second and lowering oil-related maintenance to zero, while achieving an IPLV of 0.29 kW/ton as certified by AHRI.

By Configuration

Packaged systems hold close to 50% share and remain the dominant configuration. They integrate pumps, tanks, and controls into a single unit, enabling fast installation, minimal piping, and compact footprint. Industries choose packaged systems for plug-and-play deployment and reduced maintenance needs. Split systems are used in facilities with space limits, keeping condensers outdoors to reduce heat load in production halls. Modular systems grow among data centers and large factories seeking scalable cooling, as modules can be added without operational downtime.

- For instance, Johnson Controls’ YORK® YLAA air-cooled chiller is delivered as a factory-packaged unit utilizing microchannel condensers. This design significantly reduces the required refrigerant volume by up to 50% and makes the overall unit approximately 20–35% lighter compared to traditional chillers using copper-tube/aluminum-fin systems in the same class.

By End User

Food and beverage processing leads with nearly 30% share, driven by strict temperature requirements in fermentation, dairies, meat processing, and packaging lines. Closed loop chillers prevent contamination from open water circuits and ensure stable product quality. Pharmaceutical and biotechnology firms rely on them for reactor cooling and lab processes demanding precise temperature stability. Plastics, data centers, chemicals, and industrial manufacturing use chillers to protect machinery, molds, and IT infrastructure from heat-related breakdowns. Rising automation and equipment digitization continue to widen adoption across multiple industries.

Key Growth Drivers

Growing Demand for Precision Cooling in Industrial Applications

Industrial facilities rely on stable cooling to protect high-value equipment from heat damage. Closed loop chillers deliver consistent temperature control for semiconductor lines, CNC machines, and laser systems. Rising automation and precision manufacturing increase reliance on these systems to maintain process accuracy and reduce product defects. Manufacturers in electronics, medical devices, and aerospace prefer closed loop systems because they avoid contamination and support cleanroom standards. Expanding global production capacity boosts adoption, as facilities replace outdated open cooling systems with energy-efficient and low-maintenance closed loop models.

- For instance, Blue Star’s “Air-Cooled VFD Screw Chiller” series (70-400 TR) features twin compressors and variable-frequency drives offering continuous capacity modulation from 25% to 100% load, and is AHRI-certified at its factory-test facility.

Expansion of Food, Beverage, and Pharmaceutical Production

Food and drug processing plants require hygienic and stable cooling to ensure product safety and compliance with regulatory norms. Closed loop chillers prevent external contaminants from entering the cooling stream, helping maintain sanitary conditions. Growth in packaged food demand, cold-chain logistics, and biologic drug manufacturing supports market adoption. Pharmaceutical labs use chillers for fermentation, crystallization, and storage stability. Regulatory focus on safety and precise temperature control encourages investment in closed-loop solutions. Global capacity expansions and new plant setups are increasing chiller installations across these sectors.

- For instance, Bosch Thermotechnology’s products within their Compress range (such as the Compress 5000 AW heat pump line) incorporate efficient components like inverter-driven compressors and plate heat exchangers to provide reliable heating and cooling.

Rising Data Center Construction and Heat Management Needs

Data centers generate high heat loads from dense server racks, networking devices, and storage hardware. Operators need reliable cooling to prevent system failures and ensure 24×7 uptime. Closed loop chillers support mission-critical cooling with reduced water loss and better energy efficiency than open systems. Cloud adoption, AI computing, and edge data center growth push cooling infrastructure upgrades. Hyperscale operators use advanced chiller systems to improve power usage effectiveness and lower operating expenses. Growing data traffic and storage needs directly strengthen demand for high-capacity closed loop chillers.

Key Trends & Opportunities

Shift Toward Energy-Efficient and Low-Maintenance Designs

Industries want cooling systems that cut electricity bills and minimize downtime. Manufacturers are releasing variable-speed compressors, smart controllers, and high-efficiency heat exchangers. IoT monitoring, fault prediction, and automated alerts reduce manual inspection. Customers prefer chillers that extend equipment life and reduce refrigerant usage. The shift to sustainable manufacturing and green building standards creates demand for systems with lower carbon emissions. This trend opens opportunities for advanced heat recovery models and chillers compatible with eco-friendly refrigerants.

- For instance, Carrier’s AquaEdge® 19DV centrifugal chiller utilizes a two-stage compressor system with refrigerant-lubricated ceramic bearings that last the life of the chiller.

Increased Adoption of Modular and Custom-Built Systems

Users need flexible cooling that adapts to changing production capacity. Modular closed loop chillers allow easy expansion without replacing full infrastructure. Facilities with limited space use compact and stackable units to handle peak loads. Custom chillers for pharmaceuticals, chemicals, and semiconductors are gaining traction due to specific temperature tolerances. Manufacturers offer custom pumps, filtration systems, and power configurations for specialized needs. This creates new sales opportunities for OEMs that can deliver application-specific solutions.

- For instance, Danfoss Turbocor® TT series oil-free compressors support modular chiller architecture, delivering cooling capacity in the range of approximately 60 to 150 tons of refrigeration (TR) per compressor.

Digital Monitoring and Smart Controls Creating New Value Streams

IoT and cloud-based monitoring tools improve efficiency, track performance, and alert operators of failures early. Smart chillers help reduce energy waste and optimize water usage. Predictive maintenance lowers operational risk and downtime in high-value production lines. Remote diagnostics support faster service response and longer asset life. These capabilities create premium product segments and allow manufacturers to add subscription-based services for monitoring and data analytics.

Key Challenges

High Initial Investment and Ownership Costs

Closed loop chillers involve higher purchase and installation costs compared to open systems. Small and mid-sized factories delay upgrades because they find the initial investment difficult. Operating expenses increase when specialized pumps, heat exchangers, or smart monitoring systems are involved. Companies with tight budgets often choose low-cost alternatives or extend the life of old systems, reducing new chiller demand. Limited awareness of long-term energy savings also slows adoption in cost-sensitive markets.

Complex Maintenance and Technical Skill Requirements

Closed loop systems require regular monitoring of coolant quality, pump performance, and filtration. Advanced systems with automation and IoT sensors need skilled technicians for setup and troubleshooting. Many industrial plants lack trained staff, leading to dependence on external service providers. Supply chain issues for spare parts add delays and increase downtime. Users in emerging markets face difficulty sourcing qualified service teams, which limits installation of advanced chiller models.

Regional Analysis

North America

North America holds 32% share in the Closed Loop Chillers Market, driven by strong adoption in data centers, pharmaceuticals, aerospace, and semiconductor production. The United States leads due to extensive manufacturing capacity and rising investment in automation. Data center cooling requirements continue to rise as cloud providers expand server capacity across hyperscale facilities. Strict environmental norms support the use of energy-efficient chillers with smart controls and low-emission refrigerants. Replacement of aging industrial cooling systems also supports market growth. Canada contributes through food and beverage processing investments and increasing deployment of precision cooling systems in industrial plants.

Europe

Europe accounts for 27% share, supported by robust demand from automotive, chemical, and food processing industries. Germany, Italy, France, and the United Kingdom remain leading adopters due to high penetration of advanced manufacturing and pharmaceutical production facilities. EU energy-efficiency regulations and carbon-reduction standards encourage industries to switch from open cooling to closed loop systems. Expansion of electric vehicle battery plants and automation upgrades in industrial workshops further strengthen adoption. OEM partnerships, service contracts, and customized chiller configurations support long-term demand, while retrofit programs in legacy factories add steady revenue.

Asia Pacific

Asia Pacific dominates the market with 36% share, backed by rapid industrialization and growing manufacturing capacity across China, Japan, India, and South Korea. Electronics, automotive, packaging, and chemical processing sectors continue to add new production lines, requiring reliable and contamination-free cooling. Surge in data center construction and cloud expansion increases chiller installations across major cities. Government-led industrial modernization and foreign manufacturing investments also fuel demand. Local production of cost-competitive chillers improves market access and shortens delivery timelines. The region shows the fastest growth due to capacity expansions in pharmaceuticals, semiconductors, and food processing.

Latin America

Latin America holds 3% share, supported by moderate adoption in food processing, beverage manufacturing, and industrial utilities. Brazil and Mexico lead due to large commercial and industrial bases. Growing investments in packaging, printing, and plastics manufacturing create demand for temperature-stable cooling solutions. Data center construction and cloud service expansion also generate new installations. However, price-sensitive buyers and slow replacement cycles limit rapid penetration of advanced systems. Distributors focus on offering compact, efficient, and low-maintenance models tailored for local industries, helping improve steady market uptake across the region.

Middle East & Africa

Middle East & Africa captures 2% share, driven by industrial cooling needs in chemicals, petrochemicals, power plants, and data centers. The United Arab Emirates and Saudi Arabia lead due to expanding infrastructure and energy projects. Harsh climatic conditions increase reliance on efficient cooling technologies to maintain operational stability in plants and commercial facilities. Industrial diversification and manufacturing expansion in Gulf countries support demand. However, supply chain gaps and limited availability of skilled service personnel slow adoption in several African nations. International OEM partnerships and local service centers are improving accessibility and long-term market potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Capacity:

- Small (20 tons)

- Medium (20-100 tons)

By Configuration:

By End User:

- Food & beverages

- Pharmaceuticals

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Closed Loop Chillers Market includes major players such as Honeywell International, Daikin Applied, Johnson Controls, Ingersoll Rand, Lennox International, Blue Star Limited, Bosch Thermotechnology, Carrier Corporation, Danfoss, and Hitachi Air Conditioning. The Closed Loop Chillers Market shows a strong competitive environment driven by energy efficiency, precision cooling needs, and increasing industrial automation. Manufacturers focus on delivering systems with advanced compressors, smart controls, and IoT-based monitoring to reduce downtime and improve process stability. The rise in data centers, pharmaceuticals, and semiconductor production pushes companies to introduce high-capacity and low-maintenance cooling solutions. Strategic expansions include regional manufacturing facilities, distributor partnerships, and customized offerings for temperature-sensitive applications. Product innovation, long service life, and reduced operational costs remain key differentiation factors. Service contracts, remote diagnostics, and retrofit solutions help vendors secure long-term customer relationships and recurring revenue.

Key Player Analysis

- Honeywell International

- Daikin Applied

- Johnson Controls

- Ingersoll Rand

- Lennox International

- Blue Star Limited

- Bosch Thermotechnology

- Carrier Corporation

- Danfoss

- Hitachi Air Conditioning

Recent Developments

- In October 2025, Daikin Applied released the Magnitude® WME-C Quad Chiller with magnetic-bearing technology for data centers, featuring ultra-low GWP refrigerants and advanced operational features for mission-critical facilities.

- In April 2025, Ingersoll Rand enhanced its air treatment capabilities by expanding its manufacturing, engineering, and Engineer-to-Order (ETO) capabilities for chillers, particularly targeting the North American market.

- In February 2025, Carrier introduced QuantumLeap, a next-generation suite of thermal management solutions targeting the data center market. This includes advanced chillers, air handling units, and a new cooling distribution unit enabling direct-to-chip liquid cooling for high-density AI racks.

- In October 2023, ThermalWorks, a subsidiary of Endeavour, launched a new modular, waterless cooling system for data centers designed to significantly cut energy and eliminate water consumption.

Report Coverage

The research report offers an in-depth analysis based on Capacity, Configuration, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise due to growth in data centers and cloud infrastructure.

- Manufacturers will adopt IoT and smart controls for predictive maintenance.

- Energy-efficient chillers will gain preference as industries target lower emissions.

- Food and pharmaceutical production growth will boost sanitary cooling adoption.

- Modular and compact systems will expand in small and mid-size factories.

- Replacement of aging open cooling systems will increase market opportunities.

- Eco-friendly refrigerants will gain wider acceptance due to global regulations.

- Custom-built chillers will rise in semiconductor and chemical processing plants.

- Remote diagnostics and service-based models will create new revenue streams.

- Emerging economies in Asia-Pacific will drive the fastest installation growth.