Market Overview

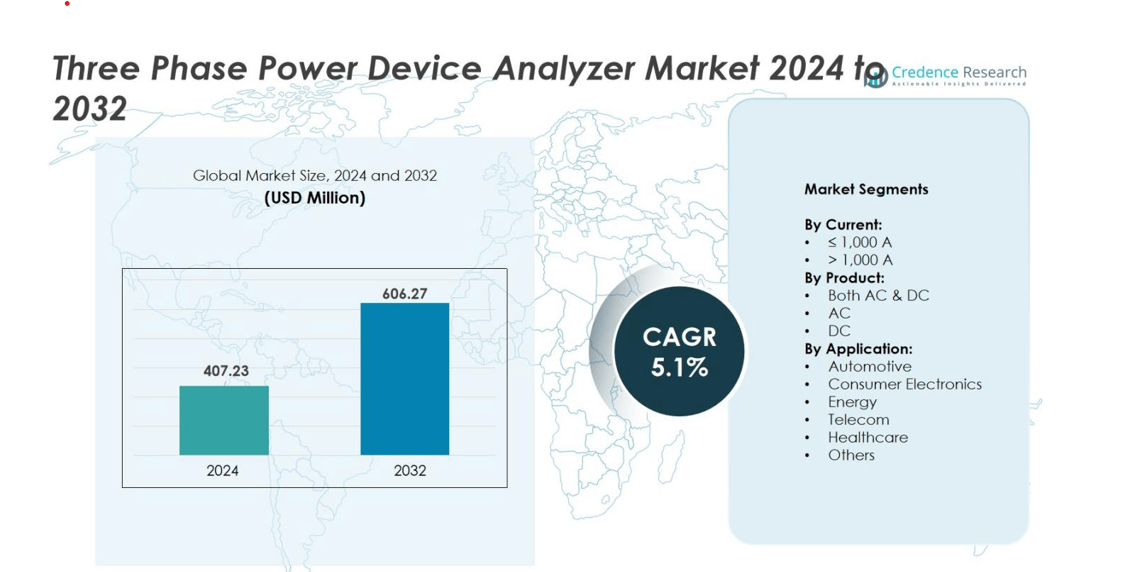

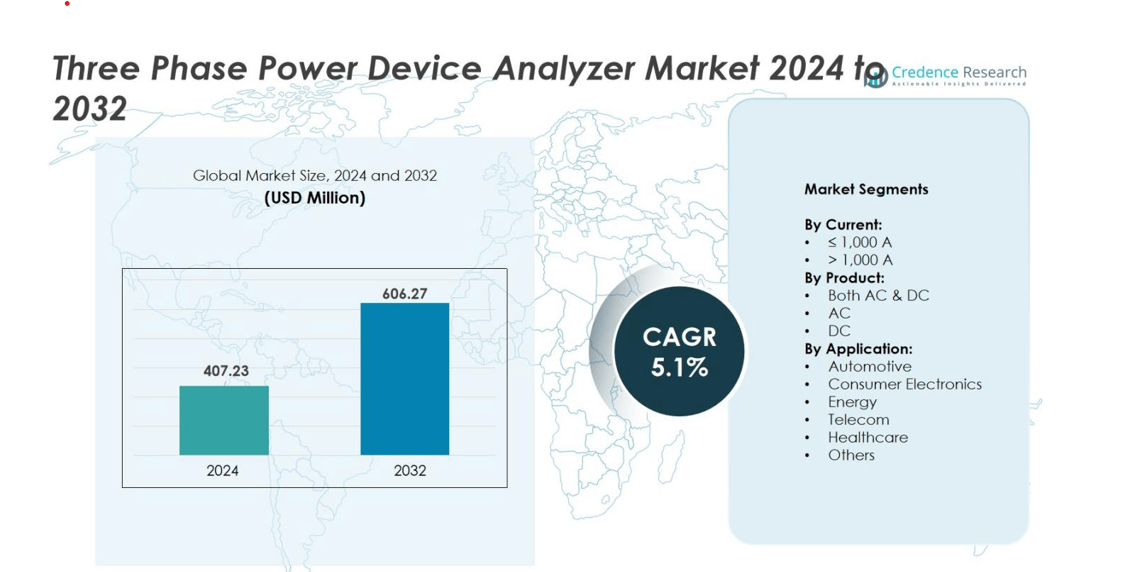

The Three Phase Power Device Analyzer market size was valued at USD 407.23 million in 2024 and is anticipated to reach USD 606.27 million by 2032, growing at a CAGR of 5.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Three Phase Power Device Analyzer Market Size 2024 |

USD 407.23 million |

| Three Phase Power Device Analyzer Market, CAGR |

5.1% |

| Three Phase Power Device Analyzer Market Size 2032 |

USD 606.27 million |

Leading players include Dewesoft, Fluke Corporation, Keysight Technologies, Hioki E.E. Corporation, Chroma ATE Inc., Delta Electronics, Iwatsu Electric Co., Ltd., Carlo Gavazzi, Arbiter Systems, B&K Precision Corporation, Circutor, Advantest Corporation, and Janitza LP. Vendors compete on high-accuracy measurement, wide bandwidth, EV and renewable testing capability, and IoT/cloud connectivity for real-time diagnostics. North America leads the market with 34% share, supported by advanced manufacturing, strict power-quality standards, and strong EV and grid modernization programs.

Market Insights

- The Three Phase Power Device Analyzer market was valued at USD 407.23 million in 2024 and is projected to reach USD 606.27 million by 2032, growing at a CAGR of 5.1% during the forecast period.

- Increasing emphasis on energy efficiency and power quality analysis across industries drives market expansion, with widespread use in automotive, manufacturing, and utility sectors.

- Technological advancements such as IoT-enabled analyzers, cloud integration, and digital monitoring trends enhance operational accuracy and efficiency.

- The market remains competitive, with key players like Dewesoft, Fluke Corporation, and Keysight Technologies focusing on innovation, though high equipment costs and calibration complexity limit adoption among small enterprises.

- North America leads with a 34% share, followed by Europe at 28% and Asia-Pacific at 27%, while the ≤1,000 A segment holds the dominant share due to its broad industrial application in energy and manufacturing environments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Current

The ≤1,000 A segment dominates the Three Phase Power Device Analyzer market, holding the largest market share in 2024. Its strong position stems from widespread use in low- and medium-voltage applications across industrial, commercial, and research settings. These analyzers provide accurate measurements, efficient energy audits, and real-time performance monitoring. Their compact design and compatibility with modern electronic systems make them ideal for laboratories and production lines. Increasing focus on power efficiency and precision measurement in manufacturing and utilities continues to drive demand for ≤1,000 A analyzers globally.

- For instance, GFUVE Group’s GF335 portable power quality analyzer supports measurement up to 1000A, offering high accuracy and harmonic analysis, making it ideal for industrial and manufacturing enterprises.

By Product

The Both AC & DC segment leads the market, supported by its versatility across hybrid power systems and renewable applications. These analyzers measure parameters from both alternating and direct currents, making them suitable for testing electric vehicles, solar inverters, and smart grid systems. The growing adoption of multi-source energy systems enhances their relevance in industrial and R&D environments. Manufacturers emphasize integrated functionalities, such as real-time harmonic analysis and power factor correction, to ensure comprehensive performance monitoring, which strengthens this segment’s dominance over single-mode AC or DC devices.

- For instance, Keysight Technologies offers the PA2203A Integra Vision Power Analyzer, which measures voltage, current, and power across DC and multi-phase AC systems with high accuracy, supporting various test scenarios with isolated inputs for enhanced performance monitoring.

By Application

The Automotive segment holds the largest market share, driven by the rapid transition toward electric and hybrid vehicle technologies. Three Phase Power Device Analyzers are crucial for testing inverters, motors, and battery systems in automotive R&D. The need for precise power efficiency validation and system optimization during EV development boosts demand. Expanding global EV production, along with government incentives for clean mobility, supports the automotive sector’s dominance. Meanwhile, consumer electronics and energy sectors show strong growth potential as industries prioritize energy-efficient systems and advanced power measurement tools.

Key Growth Drivers

Rising Demand for Energy Efficiency and Power Quality Analysis

The growing focus on optimizing energy consumption across industries drives the adoption of three phase power device analyzers. These devices enable accurate measurement of power parameters, harmonics, and waveform distortions, ensuring compliance with energy efficiency standards. Governments and corporations are emphasizing reduced power losses and improved operational efficiency in manufacturing and utilities. For instance, regulatory initiatives promoting ISO 50001 energy management systems have encouraged industries to invest in advanced power analyzers. The increasing deployment of renewable energy systems also boosts demand for precision testing tools that maintain power stability in variable energy environments.

- For instance, Marelli Motherson Automotive Lighting in India utilized power analyzers and online energy monitoring systems as part of their ISO 50001 energy management implementation to identify excess consumption and improve machine-level energy efficiency systematically.

Expansion of Electric Vehicle and Automotive Testing Applications

The rapid rise of electric and hybrid vehicles has significantly increased the need for advanced testing instruments. Three phase power device analyzers are vital for analyzing inverter performance, battery management, and motor efficiency in EVs. Automakers and component manufacturers depend on high-accuracy analyzers to validate energy conversion and system reliability. For example, EV production lines utilize multi-channel analyzers capable of monitoring voltage, current, and torque in real time. As the global automotive industry accelerates electrification efforts, demand for power analyzers tailored to EV testing environments continues to surge, reinforcing their role in automotive innovation and quality assurance.

- For instance, Dewesoft’s R2DB Power Analyzer is used in EV production lines for simultaneous measurement of multiple three-phase systems, integrating functions of a power analyzer, oscilloscope, and data logger with 0.03% measurement accuracy, which is crucial for real-time voltage, current, and torque monitoring during development and testing.

Technological Advancements and Integration of Smart Measurement Features

Advancements in digital technology and sensor integration have transformed the performance of modern power analyzers. Manufacturers are incorporating IoT connectivity, cloud-based monitoring, and AI-assisted diagnostics to enhance data analysis accuracy. These features enable remote supervision and predictive maintenance, reducing operational downtime and improving asset management. For example, new-generation analyzers support simultaneous measurement of multiple parameters across three-phase circuits with data synchronization to cloud dashboards. The adoption of such intelligent, automated systems enhances process transparency and efficiency, making them indispensable for industries pursuing digital transformation and energy optimization.

Key Trends & Opportunities

Growing Adoption of Renewable and Hybrid Power Systems

The transition toward renewable energy sources creates a substantial opportunity for the Three Phase Power Device Analyzer market. These analyzers play a critical role in monitoring hybrid systems combining solar, wind, and grid power. Their ability to measure efficiency, detect faults, and ensure grid compliance supports sustainable power integration. Companies are increasingly investing in analyzers with wide voltage and current ranges suited for renewable systems. As global renewable capacity expands, power analyzers become essential for optimizing inverter efficiency and maintaining energy quality, driving long-term market growth in the green energy sector.

- For instance, Siemens deploys advanced meters that monitor solar arrays and battery energy storage systems to optimize energy flow and reduce grid dependence.

Rising Demand from the Industrial Automation and Manufacturing Sector

The manufacturing sector’s shift toward automation and smart production lines has boosted demand for precision power measurement tools. Three phase power device analyzers are being integrated into automated systems for real-time energy monitoring and equipment diagnostics. Industries like electronics, semiconductors, and heavy machinery rely on these devices to ensure consistent power quality and operational reliability. The adoption of Industry 4.0 technologies further amplifies the need for analyzers with high-speed data acquisition and digital interfaces. This trend is expected to continue as industries prioritize sustainability, reduced downtime, and predictive maintenance through advanced testing solutions.

- For instance, ABB has deployed its Ekip trip circuit breaker with embedded power quality monitoring in industrial facilities, enabling real-time detection of harmonics and voltage sags to prevent equipment damage and optimize energy efficiency.

Key Challenges

High Initial Cost and Complex Calibration Requirements

Despite their technological advantages, three phase power device analyzers come with high upfront costs, limiting adoption among small and mid-sized enterprises. The complexity of setup, calibration, and maintenance adds to operational expenses. Skilled technicians are required to interpret advanced measurement data, further increasing total cost of ownership. In regions with limited technical expertise, these challenges hinder market penetration. Manufacturers are addressing this by developing cost-effective models with simplified user interfaces, but widespread affordability remains a critical barrier to faster adoption across emerging economies.

Data Accuracy Issues Under Variable Load Conditions

Maintaining measurement precision under fluctuating or non-linear load conditions remains a challenge for many power analyzers. Factors such as harmonic distortion, transient spikes, and phase imbalance can affect data accuracy, particularly in dynamic industrial environments. These inaccuracies may lead to incorrect efficiency assessments or compliance issues. While manufacturers continue to improve sensor resolution and sampling rates, ensuring stability across varied operating scenarios demands continuous innovation. Overcoming this limitation is crucial for expanding the reliability and acceptance of three phase power analyzers in high-performance testing and real-time monitoring applications.

Regional Analysis

North America

North America holds the largest share of the Three Phase Power Device Analyzer market, accounting for 34% of global revenue in 2024. The region’s dominance is supported by advanced manufacturing infrastructure, high adoption of automation technologies, and strict energy efficiency standards. The U.S. leads due to extensive use of power analyzers in automotive, aerospace, and renewable energy sectors. Continuous investment in smart grid modernization and electric vehicle testing also strengthens market demand. Furthermore, the presence of major industry players and R&D centers enhances technological innovation and product integration across industrial applications.

Europe

Europe captures 28% of the market share, driven by strong emphasis on sustainability and energy optimization. The European Union’s regulations promoting carbon reduction and efficient power systems have accelerated adoption of high-precision power analyzers. Germany, France, and the U.K. represent the leading contributors, supported by their robust automotive and renewable energy sectors. The region’s growing focus on industrial automation, coupled with initiatives under the European Green Deal, promotes continuous upgrades to advanced testing instruments. European manufacturers are also expanding export capabilities, further fueling the region’s influence in the global market.

Asia-Pacific

Asia-Pacific follows closely with a 27% market share, emerging as the fastest-growing regional market. Rapid industrialization, increasing demand for electric vehicles, and expanding renewable energy infrastructure drive adoption of power analyzers. China, Japan, and South Korea dominate due to strong electronics and manufacturing bases. Additionally, government-led initiatives promoting energy efficiency and smart manufacturing support significant market expansion. Rising investments in research facilities and product testing centers further accelerate innovation, positioning Asia-Pacific as a major hub for technological advancement and cost-effective analyzer production.

Latin America

Latin America accounts for 7% of the Three Phase Power Device Analyzer market, supported by gradual industrial modernization and expanding energy projects. Countries like Brazil and Mexico are investing in power quality assessment tools for industrial, automotive, and utility applications. The growth of renewable power generation and telecom infrastructure encourages greater use of advanced power analyzers. However, limited technological expertise and higher import dependence slightly restrain growth. Despite this, increasing government emphasis on grid stability and energy efficiency creates promising opportunities for market development across key Latin American economies.

Middle East & Africa

The Middle East & Africa region holds a 4% market share, primarily driven by ongoing infrastructure expansion and energy diversification initiatives. GCC nations, including Saudi Arabia and the UAE, are investing heavily in renewable energy and industrial automation. Power analyzers are increasingly used for grid monitoring and ensuring system reliability in high-temperature environments. Africa’s emerging industrial zones also exhibit growing demand for energy monitoring equipment. Although adoption rates remain moderate, supportive government policies and international collaborations are expected to enhance regional market penetration over the forecast period.

Market Segmentations:

By Current:

By Product:

By Application:

- Automotive

- Consumer Electronics

- Energy

- Telecom

- Healthcare

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Three Phase Power Device Analyzer market is highly competitive, featuring a mix of global and regional players focusing on innovation, precision, and digital integration. Leading companies such as Dewesoft, Fluke Corporation, Delta Electronics, IWATSU ELECTRIC CO., LTD., Carlo Gavazzi, Keysight Technologies, Chroma ATE Inc., Arbiter Systems, ADVANTEST CORPORATION, Circutor, B&K Precision Corporation, HIOKI E.E. CORPORATION, and Janitza LP compete through advancements in power measurement accuracy, connectivity, and automation features. Firms are expanding portfolios with IoT-enabled and cloud-compatible analyzers to support remote diagnostics and real-time monitoring. Strategic mergers, product launches, and R&D collaborations strengthen global market presence. For instance, companies are developing analyzers capable of high-frequency harmonic testing and integration with EV and renewable energy systems. Continuous innovation, coupled with demand from energy, automotive, and electronics industries, keeps competition intense, pushing manufacturers to prioritize performance optimization and compliance with evolving energy efficiency standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Dewesoft

- Fluke Corporation

- Delta Electronics, Inc.

- IWATSU ELECTRIC CO., LTD.

- Carlo Gavazzi

- Keysight Technologies

- Chroma ATE Inc.

- Arbiter Systems

- ADVANTEST CORPORATION

- Circutor

Recent Developments

- In April 2024, Rohde & Schwarz introduced the R&S NGC 100 power supply series offering up to 32 V, 10 A, and 100 W output with a compact rack-mountable design.

- In February 2022, Carlo Gavazzi launched WM15 M-Bus power analyzers for three-phase systems, integrating M-Bus ports to simplify installation, reduce wiring, and eliminate external gateway requirements.

Report Coverage

The research report offers an in-depth analysis based on Current, Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by rising energy efficiency initiatives.

- Adoption of analyzers in electric vehicle testing will continue to expand.

- Technological innovation will enhance precision and real-time monitoring capabilities.

- Integration of IoT and cloud connectivity will improve remote data access.

- Demand from renewable energy systems will increase significantly.

- Manufacturers will focus on developing compact and multifunctional analyzer models.

- Industrial automation trends will boost deployment across production facilities.

- Partnerships and collaborations will strengthen product innovation and market reach.

- Asia-Pacific will emerge as the fastest-growing regional market.

- Increasing regulatory focus on power quality will sustain long-term demand.