Market Overview:

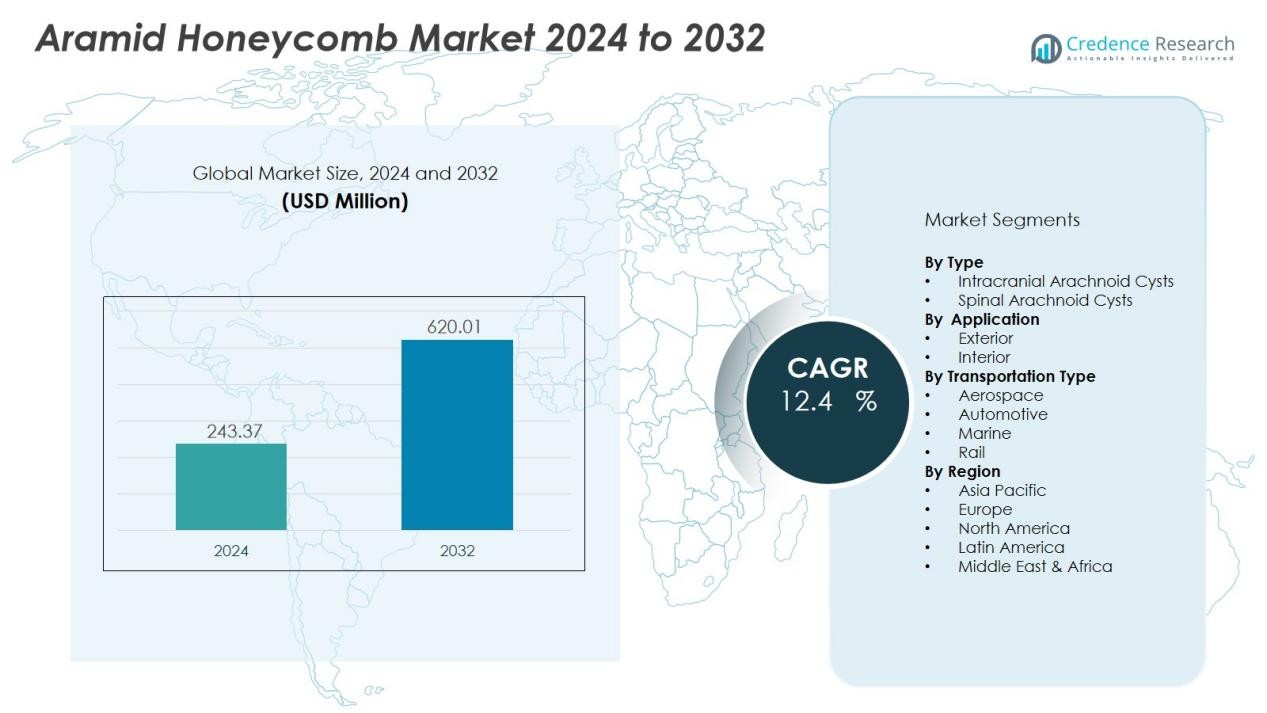

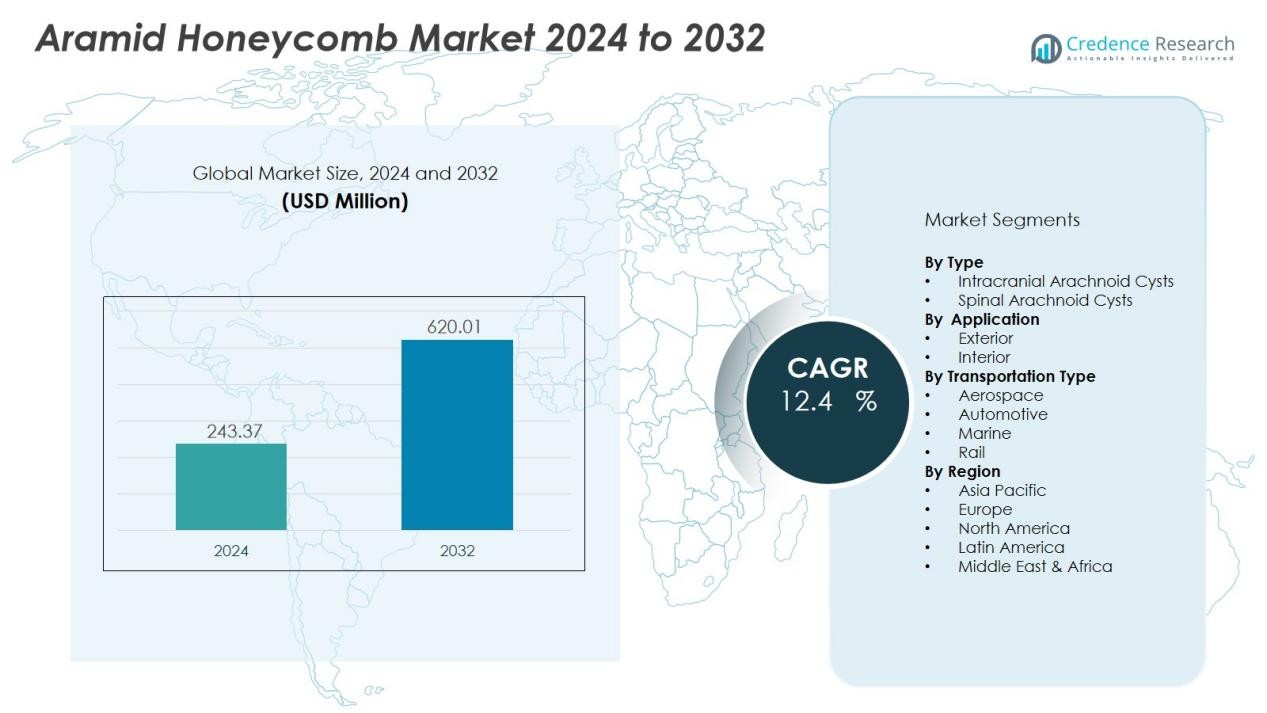

The Aramid Honeycomb Market size was valued at USD 243.37 million in 2024 and is anticipated to reach USD 620.01 million by 2032, at a CAGR of 12.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aramid Honeycomb Market Size 2024 |

USD 243.37 Million |

| Aramid Honeycomb Market, CAGR |

12.4% |

| Aramid Honeycomb Market Size 2032 |

USD 620.01 Million |

Market drivers include the rising demand for lightweight, high-strength materials driven by fuel-efficiency and emissions-reduction goals across aerospace and automotive industries. The exceptional strength-to-weight ratio, flame resistance, and acoustic insulation properties of aramid honeycomb cores also boost usage in marine, rail, and sports equipment applications. Additionally, increased investment in next-generation aircraft, electric vehicles, and high-speed rail systems further propels demand for these materials.

Regionally, North America holds the largest share owing to a strong aerospace and defense base and established manufacturers. Europe also commands a substantial portion, supported by stringent regulations on lightweight composites and high-end manufacturing. Meanwhile, the Asia-Pacific region is expected to register the fastest growth rate, driven by expanding automotive, rail, and aerospace infrastructure in China, India, and Southeast Asia.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Aramid Honeycomb Market size was valued at USD 243.37 million in 2024 and is anticipated to reach USD 620.01 million by 2032, growing at a CAGR of 12.4% during the forecast period.

- North America holds approximately 40%-45% of the market share due to its strong aerospace and defense industry, substantial investment in lightweight materials, and a well-established manufacturing base.

- Asia-Pacific represents about 35%-42% of the market share and is the fastest-growing region, driven by expanding automotive, aerospace, and infrastructure sectors, particularly in China, India, and Southeast Asia.

- Europe accounts for 12%-15% of the market share, supported by high-end manufacturing in aerospace and strict sustainability regulations in the automotive and rail industries.

- In product segmentation, Nomex holds a dominant market share, while the “Others” category is gaining traction due to competitive pricing and sufficient performance across various applications.

Market Drivers:

Market Drivers:

Increased Demand for Lightweight Materials

The demand for lightweight materials in aerospace, automotive, and construction sectors is a significant driver of the Aramid Honeycomb Market. As industries seek to improve fuel efficiency, reduce emissions, and enhance performance, Aramid honeycomb’s low weight and high strength make it an ideal solution. It contributes to lighter aircraft, vehicles, and buildings without compromising on structural integrity. This trend aligns with global sustainability goals and the ongoing push for more efficient energy consumption.

- For instance, Siemens incorporated Kevlar honeycomb core in the wing structure of the Solar Impulse 2 aircraft, reducing the wing material weight from 100 grams per square meter to 25 grams per square meter, which was critical for achieving long-duration, fuel-free flight.

Growth in Aerospace and Defense Applications

The aerospace and defense industries continue to be major consumers of Aramid honeycomb materials. With the increasing need for high-performance components in aircraft, spacecraft, and military vehicles, Aramid honeycomb provides the perfect balance of durability and lightness. Its applications, such as in wings, fuselage panels, and rocket components, allow these industries to meet stringent weight and performance standards. The constant development of advanced technologies further strengthens its demand in these sectors.

- For instance, Hexcel Corporation’s HexWeb® Aramid honeycomb is specified in more than 600 aircraft and defense programs globally, such as the Airbus A350 XWB, where each aircraft utilizes over 1,000 square meters of Aramid honeycomb in its structural panels.

Rising Need for Fire-Resistant and Durable Materials

Aramid honeycomb is favored for its excellent fire-resistant properties, which drive its demand in various industries. The material’s ability to withstand high temperatures without compromising its mechanical properties makes it highly desirable for applications requiring durability and safety. Industries such as construction, transportation, and defense are increasingly adopting Aramid honeycomb for fire-resistant and long-lasting structures.

Growing Focus on Sustainable and Eco-Friendly Solutions

The rising emphasis on sustainability has encouraged the adoption of environmentally friendly materials like Aramid honeycomb. Its recyclability and reduced environmental impact compared to traditional materials are key factors driving its growth. The shift towards green building practices and eco-conscious manufacturing processes has contributed to a steady increase in demand across several industries.

Market Trends:

Increasing Adoption of Advanced Manufacturing Techniques

The Aramid Honeycomb Market is witnessing a shift towards advanced manufacturing techniques, such as 3D printing and automated production methods. These technologies enable manufacturers to create more complex and customized designs while reducing production time and costs. It allows for precise control over the material properties and enhances the overall quality of Aramid honeycomb structures. Industries, particularly aerospace and automotive, are increasingly leveraging these innovations to meet growing performance and design requirements. The shift toward these modern manufacturing processes is expected to drive further growth in the market, offering opportunities for high-performance applications and cost-efficient solutions.

- For instance, ARGOSY International has implemented highly efficient, technologically advanced automated production lines capable of producing large-sized aramid honeycomb up to 2,440 mm in width, 1,220 mm in length, and 914 mm in height, with an annual production capacity of 5,000 cubic meters.

Rise in Customization for Specific Applications

Another key trend shaping the Aramid Honeycomb Market is the growing demand for customized solutions tailored to specific industry needs. The material’s versatility in design and strength-to-weight ratio allows manufacturers to produce honeycomb cores suited to various applications, from lightweight aircraft components to fire-resistant building materials. Customized products that meet exact specifications, such as enhanced insulation or tailored mechanical properties, are gaining traction across several sectors. As industries continue to seek specialized solutions for demanding environments, the focus on Aramid honeycomb’s ability to cater to niche needs will further expand its market reach.

- For instance, DuPont’s Kevlar® N636 1 mil paper was used in a recent project with Composites Technology Center GmbH (CTC, an Airbus company) and Euro-Composites to develop an ultra-light sidewall panel for a twin-aisle aircraft.

Market Challenges Analysis:

High Production Costs and Material Sourcing

One of the primary challenges in the Aramid Honeycomb Market is the high production cost associated with its manufacturing. Aramid fibers, the core material used in the production of honeycomb structures, are expensive to source and process. This drives up the overall cost of Aramid honeycomb products, limiting their accessibility for certain industries, especially small-scale manufacturers. The need for specialized equipment and skilled labor to maintain high-quality standards further compounds these cost issues, hindering wider adoption in cost-sensitive sectors.

Limited Awareness and Market Education

Another challenge facing the Aramid Honeycomb Market is the lack of widespread awareness and education about its benefits and applications. While industries like aerospace and defense have long recognized its advantages, other sectors are slower to adopt it due to insufficient understanding of its value. The complexity of the material and its specific use cases require significant investment in training and educating potential customers. This barrier limits the material’s adoption across diverse industries, which could otherwise benefit from its unique properties.

Market Opportunities:

Expansion into Emerging Mobility and Defense Sectors

The Aramid Honeycomb Market presents strong opportunities driven by greater demand in electric vehicles, unmanned aerial systems, and next‑gen defence platforms. Manufacturers can leverage its low‑weight, high‑strength characteristics to supply vehicle body panels, rotorcraft structural elements and missiles. It can meet regulatory pressure on emissions and fuel efficiency, enabling auto and aerospace OEMs to optimise designs. Regional clusters in Asia Pacific and the Middle East offer growth thanks to rising aerospace and military investment. Producers that scale capacity efficiently and align with regional programmes stand to gain. Customised product developments for these segments will accelerate market penetration.

Growth Via Sustainable Applications and Material Innovation

Another opportunity lies in meeting the demand for environmentally responsible materials and innovative honeycomb architectures. The Aramid Honeycomb Market can capture sectors such as green construction, renewable‑energy platforms and marine vessels seeking long‑life, fire‑resistant core materials. It can also benefit from advances in para‑aramid formulations and hybrid honeycomb structures that improve mechanical and thermal performance. R&D investments will enable producers to access new use‑cases beyond traditional aerospace and defence. Strategic partnerships with end‑users will help providers deliver tailored solutions and open untapped niche markets.

Market Segmentation Analysis:

By Product

The product segmentation in the Aramid Honeycomb Market typically divides materials into core types such as “Nomex” and “Others.” Industry data show that the Nomex core type maintains a dominant share given its widespread use and proven performance. The “Others” category appeals to cost‑sensitive buyers and is gaining adoption due to competitive pricing and adequate performance. Manufacturers focus on tailoring cell geometry and material formulations under each product type to meet varying strength, fire‑resistance, and thermal stability needs.

- For Instance, Plascore Inc. custom-engineers aramid honeycomb core for high-performance applications such as mass transit and defense programs globally. The company offers various standard cell sizes, typically ranging from 1/8″ to 3/8″ (approximately 3.175 mm to 9.525 mm), and can provide other cell sizes and specifications upon request to meet specific project requirements.

By Application

Application segmentation breaks down into “Interior” and “Exterior” uses across aerospace, transportation, marine, and other sectors. The exterior applications command a larger share because the material’s lightweight, fire‑resistant, and structural benefits strongly align with exterior panels and load‑bearing components. Interior applications—such as floorboards, compartments, and decorative panels—also drive demand where weight and safety matter. In total, this segmentation highlights where manufacturers should focus product adaptation and certification efforts.

- For Instance, Boeing’s 787 Dreamliner made extensive use of thermoset composite materials (primarily carbon fiber reinforced plastic) for its airframe, wings, tail, and doors, which account for roughly 50% of the aircraft’s weight.

By End‑Use (Application)

Within the Aramid Honeycomb Market, the key end‑use segments include aerospace (aviation & defense), automotive & transportation, marine, rail, and others. The aerospace segment holds the largest share due to strict weight, safety, and performance requirements in airframes and defense platforms. Transportation and marine sectors grow steadily as lightweighting and fire regulation intensify in those industries. This end‑use analysis helps suppliers and OEMs prioritize investment and strategic partnerships across high‑growth verticals.

Segmentations:

By Type

By Application

By Transportation Type

- Aerospace

- Automotive

- Marine

- Rail

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The region holds roughly 40 %–45 % of the Aramid Honeycomb Market share, driven by strong aerospace and defence demand. It benefits from the presence of major aerospace manufacturers and significant investment in lightweight materials. Manufacturers collaborate closely with OEMs to deliver advanced honeycomb core structures to meet stringent safety and performance standards. The automotive industry in this region also pushes adoption via lightweighting initiatives for electric vehicles. It faces pressure from raw‐material cost fluctuations and regulatory compliance challenges. Suppliers in North America gain an edge through established production capability and technical expertise.

Asia Pacific

This region represents approximately 35 %–42 % of the market share and shows the fastest growth trajectory. It features expanding automotive production hubs, growing aerospace fleets, and infrastructure developments that require lightweight structural solutions. Chinese, Japanese, and South Korean players invest heavily in aramid technology and manufacturing plants. They benefit from regional supply‐chain integration and government support for advanced materials. It still faces challenges such as skill gaps and supply‐chain volatility in some countries. Local producers leverage scale to compete in both domestic and export markets.

Europe

Europe contributes around 12 %–15 % to the Aramid Honeycomb Market share, supported by its advanced transportation manufacturing and regulatory emphasis on sustainability. The region’s rail, marine, and construction sectors adopt aramid‑honeycomb core solutions to meet fire‑safety and efficiency standards. It also hosts key material and component manufacturers that serve global markets. High production costs and stringent certification processes limit rapid expansion. Firms in Europe focus on niche, high‑performance applications and forge partnerships to access emerging global demand.

Key Player Analysis:

- Hexcel Corporation

- Plascore, Inc.

- The Gill Corporation

- EURO-COMPOSITES

- ACP Composites, Inc.

- Toray Advanced Composites

- Argosy International Inc.

- Showa Aircraft Industry Co., Ltd.

- Teijin Aramid B.V.

- HONEYCOMB CELLPACK A/S

- DuPont

- Honeylite

Competitive Analysis:

The competitive environment of the Aramid Honeycomb Market features several established players that maintain significant presence and technical capability. Leading companies such as Hexcel Corporation, Plascore, Inc., The Gill Corporation, EURO‑COMPOSITES, ACP Composites, Inc., Toray Advanced Composites, Argosy International Inc., Showa Aircraft Industry Co., Ltd., and Teijin Aramid B.V. hold strong technology portfolios and global client footprints. Hexcel offers its HexWeb® aramid‑fiber reinforced honeycomb core for aerospace and industrial applications. Plascore addresses high‑performance aerospace needs with its meta‑aramid and para‑aramid honeycomb cores, solidifying its position in weight‑sensitive sectors. The Gill Corporation supplies para‑aramid fiber reinforced honeycomb cores coated with phenolic resin, offering advanced stiffness and fatigue performance for commercial and defence segments. The competitive scene drives firms to emphasise innovation, product differentiation, and cost management. It pressures new entrants to secure performance credentials and certification clearance from OEMs. Buyers seek validated quality, supply‑chain reliability, and technical support when selecting suppliers. Companies cultivate long‑term relationships with aerospace and defence OEMs to lock in contracts and protect margins. The need to serve emerging industries such as electric mobility and advanced aircraft compels firms to expand capacity and upgrade technology. Participants that manage raw‑material costs, maintain supply flexibility, and anticipate regulation stand higher odds of success in this niche market.

Recent Developments:

- In November 2023, Plascore, Inc. announced strategic investments in new technologies and referenced ongoing partnerships, though no major product launches or acquisitions were recorded for 2025.

- In October 2025, The Gill Corporation appointed Andrew Brandenburg as Chief Operating Officer, enhancing leadership capacity to support future growth and strategic partnerships.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Transportation Type and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Future Outlook:

- The demand for lightweight, durable materials in aerospace, automotive, and defense will continue to propel the Aramid Honeycomb Market.

- Increased regulatory pressure for fuel efficiency and lower emissions will drive further adoption of Aramid honeycomb in transportation sectors.

- Aerospace manufacturers will increasingly integrate Aramid honeycomb cores into aircraft structures to meet strict performance and safety standards.

- Advancements in 3D printing and other manufacturing technologies will enable more complex, customizable Aramid honeycomb designs.

- The automotive sector will further embrace Aramid honeycomb for electric vehicle lightweighting and enhanced structural integrity.

- Growing infrastructure projects, particularly in fire-resistant and energy-efficient buildings, will fuel demand for Aramid honeycomb in construction.

- The marine and rail industries will continue to adopt Aramid honeycomb for its lightweight and safety-enhancing properties.

- Environmental sustainability trends will push manufacturers to explore eco-friendly production methods and recyclable Aramid honeycomb materials.

- The demand for Aramid honeycomb will rise in emerging markets, particularly in Asia-Pacific, driven by industrial growth and infrastructure development.

- Companies will focus on expanding their product portfolios and establishing strategic partnerships to capture new market opportunities across diverse applications.

Market Drivers:

Market Drivers: