Market Overview

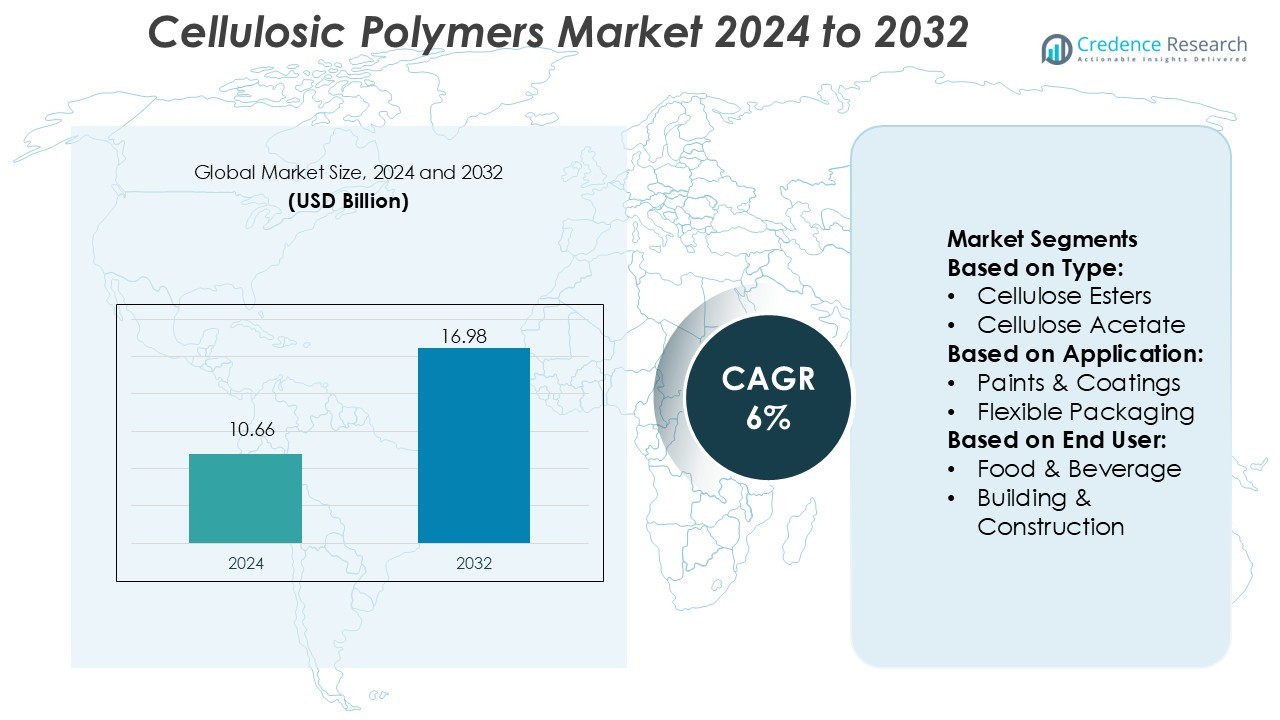

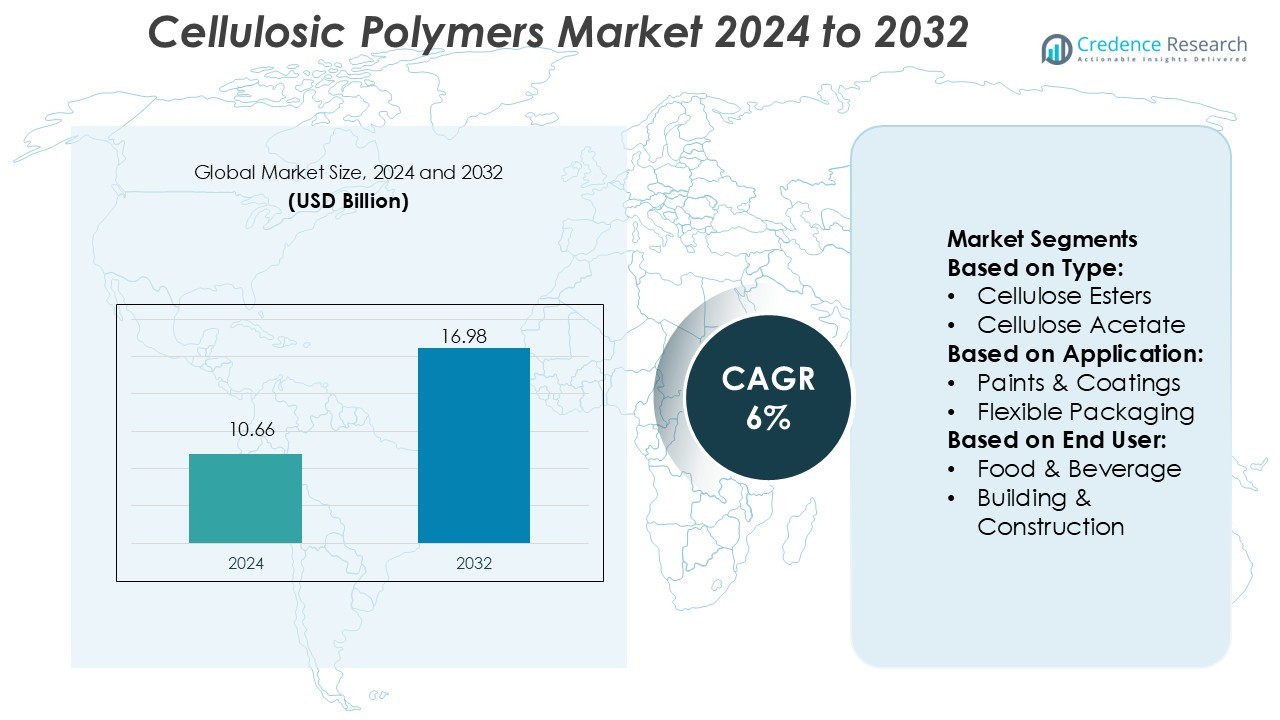

Cellulosic Polymers Market size was valued USD 10.66 billion in 2024 and is anticipated to reach USD 16.98 billion by 2032, at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cellulosic Polymers Market Size 2024 |

USD 10.66 Billion |

| Cellulosic Polymers Market, CAGR |

6% |

| Cellulosic Polymers Market Size 2032 |

USD 16.98 Billion |

The Cellulosic Polymers Market is led by key players including Ashland, Mitsubishi Chemical Group Corporation, CP Kelco U.S., Inc., Lenzing AG, Eastman Chemical Company, Daicel Corporation, Dow, Inc., Shin-Etsu Chemical, Co., Ltd., Nouryon Chemicals Holding B.V., and Celanese Corporation. These companies focus on developing advanced cellulose derivatives with enhanced biodegradability, film strength, and chemical resistance for applications in packaging, coatings, pharmaceuticals, and personal care. Continuous investments in R&D, process innovation, and sustainable production have strengthened their global presence. Europe dominates the market with a 35% share, driven by strict environmental regulations, strong adoption of bio-based materials, and well-established manufacturing infrastructure supporting cellulose ester and ether production across countries such as Germany, France, and the U.K.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Cellulosic Polymers Market was valued at USD 10.66 billion in 2024 and is projected to reach USD 16.98 billion by 2032, growing at a CAGR of 6%.

- Rising demand for biodegradable and renewable materials in packaging, coatings, and pharmaceuticals is driving steady market growth.

- Key players are investing in R&D to develop high-performance cellulose esters and ethers with improved thermal stability and film-forming properties.

- High production costs and limited scalability of bio-based processing technologies remain key challenges affecting profit margins.

- Europe leads the market with a 35% regional share, while cellulose esters dominate product segmentation with strong adoption across industrial and consumer applications supported by sustainability initiatives and advanced manufacturing infrastructure.

Market Segmentation Analysis:

By Type

Cellulose esters dominate the Cellulosic Polymers Market with over 42% share due to their versatile use in coatings, films, and fibers. Cellulose acetate, a major sub-segment, is widely used in photographic films, textiles, and cigarette filters owing to its biodegradability and thermal stability. The increasing adoption of eco-friendly polymers in packaging and automotive coatings further drives demand. Cellulose ethers and regenerated cellulose follow, supported by growing usage in pharmaceuticals, personal care, and industrial applications where high viscosity and chemical resistance are required.

- For instance, Ashland’s Aqualon™ EC-N200 ethylcellulose grade supports flexible film formation across temperature ranges and enables clear solvent-based coatings with fine particle sizes tailored for electronic pastes and specialty industrial applications.

By Application

The paints and coatings segment leads the market, accounting for nearly 35% share, driven by rising demand for sustainable, high-performance coating materials. Cellulosic polymers enhance film formation, adhesion, and viscosity control, improving the durability and finish of paints. Flexible packaging applications are expanding due to the increasing need for biodegradable and transparent films. The use of cellulosic polymers in skin care and laminations is growing steadily, supported by their biocompatibility, moisture retention, and film-forming properties in personal care and industrial applications.

- For instance, Mitsubishi Chemical Group Corporation offers advanced film-forming resin grades for highly specific applications. Their ACRYKING™ F-328 hard coat for automotive headlamps can be applied with a recommended coating thickness as low as 6 to 10 µm.

By End User

The medical and pharmaceutical sector dominates the market with around 38% share, fueled by the growing use of cellulose derivatives in drug delivery systems, capsules, and wound dressings. Their excellent biocompatibility, stability, and controlled-release properties make them ideal for modern formulations. The food and beverage industry follows, utilizing cellulosic polymers as stabilizers and thickeners. Personal and cosmetic care applications continue to rise as manufacturers adopt biodegradable ingredients. In building and construction, cellulose-based additives enhance cement consistency, improving workability and water retention in sustainable construction materials.

Key Growth Drivers

- Rising Demand for Sustainable and Biodegradable Materials

Growing environmental concerns and regulatory pressure to reduce plastic waste are accelerating the adoption of cellulosic polymers. Derived from renewable plant sources, these polymers offer excellent biodegradability and lower carbon footprints compared to synthetic plastics. Industries such as packaging, textiles, and coatings are increasingly shifting toward eco-friendly alternatives. The material’s compatibility with water-based formulations and recyclability enhances its appeal. Governments promoting green materials further support market expansion, positioning cellulosic polymers as a key substitute for petroleum-based counterparts in various end-use sectors.

- For instance, Lenzing AG’s biorefinery operations at its Austrian, Czech and Brazilian sites reach nominal dissolving-wood-pulp capacities of 320,000 tons, 285,000 tons and 500,000 tons respectively.

- Expanding Use in Medical and Pharmaceutical Applications

The medical and pharmaceutical industries are driving strong demand for cellulosic polymers due to their non-toxic, biocompatible, and stable properties. They are widely used in controlled drug release systems, capsules, and wound dressings. These polymers provide excellent film-forming and binding characteristics, improving product performance and patient safety. Ongoing innovation in drug delivery technologies and rising healthcare expenditure contribute to growing market adoption. Pharmaceutical companies increasingly rely on cellulose ethers and esters for high-precision and sustainable formulation development.

- For instance, Daicel’s BELLOCEA® S7 and BELLOCEA® BS7 spherical cellulose acetate particles are designed for use as texture improvers in cosmetics. These products feature a smooth surface, high sphericity, and an average particle diameter of 7 µm.

- Growth in Packaging and Coating Industries

The rapid rise in flexible packaging and high-performance coatings boosts the demand for cellulosic polymers. Their ability to enhance film strength, clarity, and moisture resistance makes them ideal for packaging applications. In coatings, they improve adhesion, viscosity control, and gloss retention while offering environmental benefits through reduced VOC emissions. The shift toward bio-based coatings in the construction and automotive industries further strengthens this segment. Global expansion of the packaging sector and consumer demand for sustainable materials are key factors fueling growth.

Key Trends & Opportunities

- Innovation in Bio-Based Composite Development

Manufacturers are developing cellulosic polymer composites reinforced with natural fibers to improve strength and flexibility. These composites are increasingly used in automotive interiors, consumer goods, and electronics. The trend toward replacing single-use plastics with high-performance, renewable materials continues to gain traction. Advances in processing technologies enable better mechanical stability and transparency in cellulose films. Companies investing in R&D to improve thermal and chemical resistance of cellulose-based composites are likely to capture significant market opportunities in sustainable materials development.

- For instance, Dow Inc. showcased its VORAFORCE™ TP resin system that supports fiber loadings greater than 80 wt% in composite mouldings.

- Expansion of Nanocellulose Applications

Nanocellulose, derived from cellulose polymers, is emerging as a high-value material with superior mechanical strength and lightweight properties. It is being integrated into biomedical devices, electronic components, and high-barrier packaging films. Nanocellulose enhances product durability, reduces material usage, and provides excellent gas and moisture resistance. The growing demand for advanced materials in healthcare, food packaging, and electronics opens new opportunities. Ongoing research into scalable nanocellulose production methods is expected to further commercialize its applications in industrial and specialty sectors.

- For instance, Shin‑Etsu Chemical Co., Ltd. developed a water-soluble cellulose ether grade, METOLOSE® 90SH-15000SR, that has a labeled viscosity of approximately 15,000 mPa·s (measured as a 2 wt% aqueous solution at 20 °C).

- Increasing Focus on Circular Economy Practices

The global emphasis on circular economy models is creating opportunities for cellulosic polymers. These materials align with sustainable production and recycling principles, offering low environmental impact and high renewability. Companies are implementing closed-loop manufacturing systems to reuse cellulose waste and minimize resource consumption. Collaborative efforts between governments and manufacturers to reduce single-use plastics are enhancing adoption. The integration of life-cycle analysis and sustainability certifications is becoming a competitive differentiator in the growing bio-based materials market.

Key Challenges

- High Production Costs and Limited Industrial Scalability

Despite their environmental benefits, cellulosic polymers face cost challenges due to complex extraction and processing methods. The need for specialized equipment and raw material pretreatment raises production expenses. Limited scalability and dependence on agricultural resources hinder price competitiveness against synthetic alternatives. Manufacturers are working to optimize yield efficiency and reduce processing energy consumption. Until large-scale production technologies mature, cost parity remains a major barrier to widespread commercial adoption of cellulosic polymers across industries.

- Technical Limitations in Performance and Stability

Cellulosic polymers, though sustainable, often exhibit lower thermal stability and moisture resistance compared to conventional plastics. These limitations restrict their application in high-temperature or high-humidity environments. Inconsistent mechanical properties across grades also affect product reliability in industrial use. Continuous innovation is needed to enhance film durability, processability, and compatibility with other materials. Balancing biodegradability with performance remains a key challenge, as industries demand materials that meet both environmental and functional performance standards.

Regional Analysis

North America

North America accounts for nearly 27% of the global Cellulosic Polymers Market share, driven by strong demand from packaging, coatings, and pharmaceutical industries. The U.S. leads the region due to high consumption of biodegradable materials and strict environmental regulations promoting sustainable alternatives to plastics. Growing adoption of cellulose derivatives in personal care and drug delivery systems also supports regional growth. Major manufacturers are investing in R&D to improve material performance and recyclability. Canada’s initiatives in bio-based product innovation further enhance market expansion, positioning North America as a key region for advanced cellulose applications.

Europe

Europe holds the largest share of approximately 35% in the global market, supported by strict EU regulations on plastic waste and growing sustainability initiatives. Germany, France, and the U.K. dominate due to advanced chemical processing infrastructure and strong demand from the coatings, packaging, and construction sectors. The shift toward bio-economy policies and circular material use has accelerated cellulose polymer adoption. European firms are investing in nanocellulose and bio-composites to enhance product strength and barrier performance. The presence of key research institutes and green innovation programs continues to solidify Europe’s leadership in cellulosic polymer production.

Asia-Pacific

Asia-Pacific commands around 30% of the global market share, with China, Japan, and India driving rapid expansion. The region benefits from abundant raw material availability and large-scale manufacturing capacity for cellulose derivatives. Rising demand for sustainable packaging, pharmaceuticals, and cosmetics fuels steady growth. China leads production through capacity expansions in cellulose acetate and ethers, while Japan focuses on advanced films and fiber applications. Increasing environmental awareness and government incentives for bio-based materials strengthen regional competitiveness. The rapid industrialization and adoption of eco-friendly polymers in multiple sectors position Asia-Pacific as the fastest-growing regional market.

Latin America

Latin America represents about 5% of the Cellulosic Polymers Market share, with Brazil and Mexico leading regional demand. Growth is driven by expanding packaging, food processing, and construction industries that are shifting toward biodegradable materials. Government support for green manufacturing and foreign investments in cellulose-based production facilities are contributing to market penetration. The pharmaceutical and personal care sectors are adopting cellulose ethers for formulation stability and viscosity control. Despite challenges such as infrastructure limitations, ongoing industrial modernization and sustainability-driven initiatives are gradually strengthening Latin America’s role in the bio-based materials market.

Middle East & Africa

The Middle East & Africa account for roughly 3% of the global Cellulosic Polymers Market share, supported by growing awareness of eco-friendly materials and diversification into sustainable industries. The UAE, Saudi Arabia, and South Africa are investing in bio-based chemical projects and packaging solutions. Adoption in construction and cosmetics industries is rising, driven by the need for environmentally safe alternatives. However, limited production capacity and dependency on imports constrain rapid market growth. Increasing government-led sustainability programs and partnerships with global producers are expected to enhance future market expansion across this emerging region.

Market Segmentations:

By Type:

- Cellulose Esters

- Cellulose Acetate

By Application:

- Paints & Coatings

- Flexible Packaging

By End User:

- Food & Beverage

- Building & Construction

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Cellulosic Polymers Market is highly competitive, with major players such as Ashland, Mitsubishi Chemical Group Corporation, CP Kelco U.S., Inc., Lenzing AG, Eastman Chemical Company, Daicel Corporation, Dow, Inc., Shin-Etsu Chemical, Co., Ltd., Nouryon Chemicals Holding B.V., and Celanese Corporation. The Cellulosic Polymers Market is characterized by strong competition, technological innovation, and increasing focus on sustainability. Manufacturers are investing heavily in research to enhance the performance, durability, and biodegradability of cellulose-based materials. The development of high-purity cellulose derivatives for packaging, coatings, and pharmaceutical applications is driving product differentiation. Companies are expanding production capacities and adopting energy-efficient manufacturing technologies to meet global demand for eco-friendly materials. Strategic partnerships and advancements in bio-based chemistry are reshaping the competitive dynamics. The growing emphasis on circular economy practices and carbon reduction initiatives continues to define the market’s evolution toward sustainable industrial solutions.

Key Player Analysis

- Ashland

- Mitsubishi Chemical Group Corporation

- CP Kelco U.S., Inc.

- Lenzing AG

- Eastman Chemical Company

- Daicel Corporation

- Dow, Inc.

- Shin-Etsu Chemical, Co., Ltd.

- Nouryon Chemicals Holding B.V.

- Celanese Corporation

Recent Developments

- In June 2025, Teknor Apex has purchased Danimer Scientific, bioplastics company that offers biodegradable materials such as PHAs and PLA. This purchase enhances Teknor Apex’s innovative frontier in sustainability and broadens the company’s product portfolio as well as R&D capabilities.

- In May 2024, Kydex and Kasiglas collaborated on a transparent, scratch-resistant aviation polymer designed for aircraft interiors. This new material is intended for use in decorative panels and other specialized accents within the cabin.

- In August 2023, Toray Industries, Inc. made a strategic investment of an additional into Cellulosic Biomass Technology Co., Ltd. (CBT), increasing its ownership stake from 67% to 84.4%.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for biodegradable and renewable polymers will continue to rise across packaging and coatings.

- Advancements in cellulose modification technologies will improve product strength and chemical stability.

- Nanocellulose applications will expand in medical devices, electronics, and barrier films.

- Manufacturers will focus on large-scale, energy-efficient production to reduce costs.

- Strategic partnerships will strengthen research into bio-based and recyclable material solutions.

- Growth in pharmaceutical and cosmetic sectors will drive adoption of high-purity cellulose derivatives.

- Circular economy initiatives will accelerate recycling and reuse of cellulose-based materials.

- Governments will increase incentives for eco-friendly polymers to replace conventional plastics.

- Integration of digital manufacturing and automation will enhance process control and efficiency.

- Asia-Pacific and Europe will remain key growth regions, supported by strong industrial and sustainability policies.