Market Overview

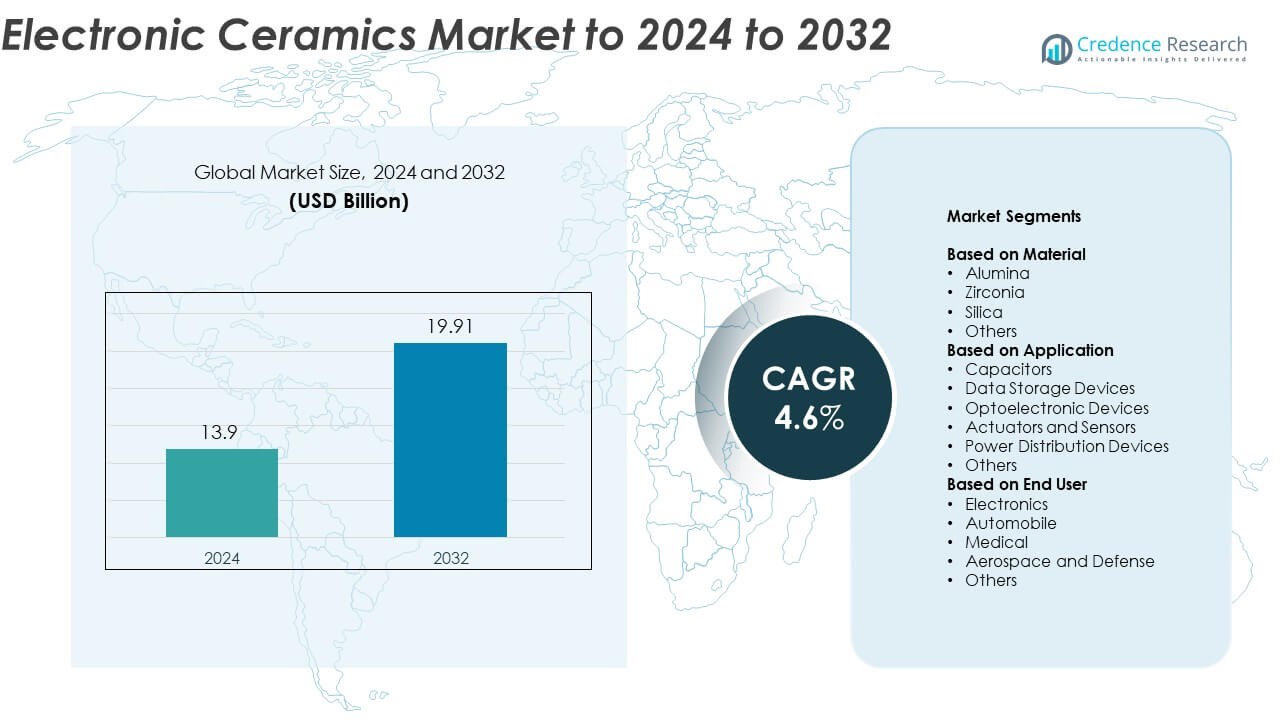

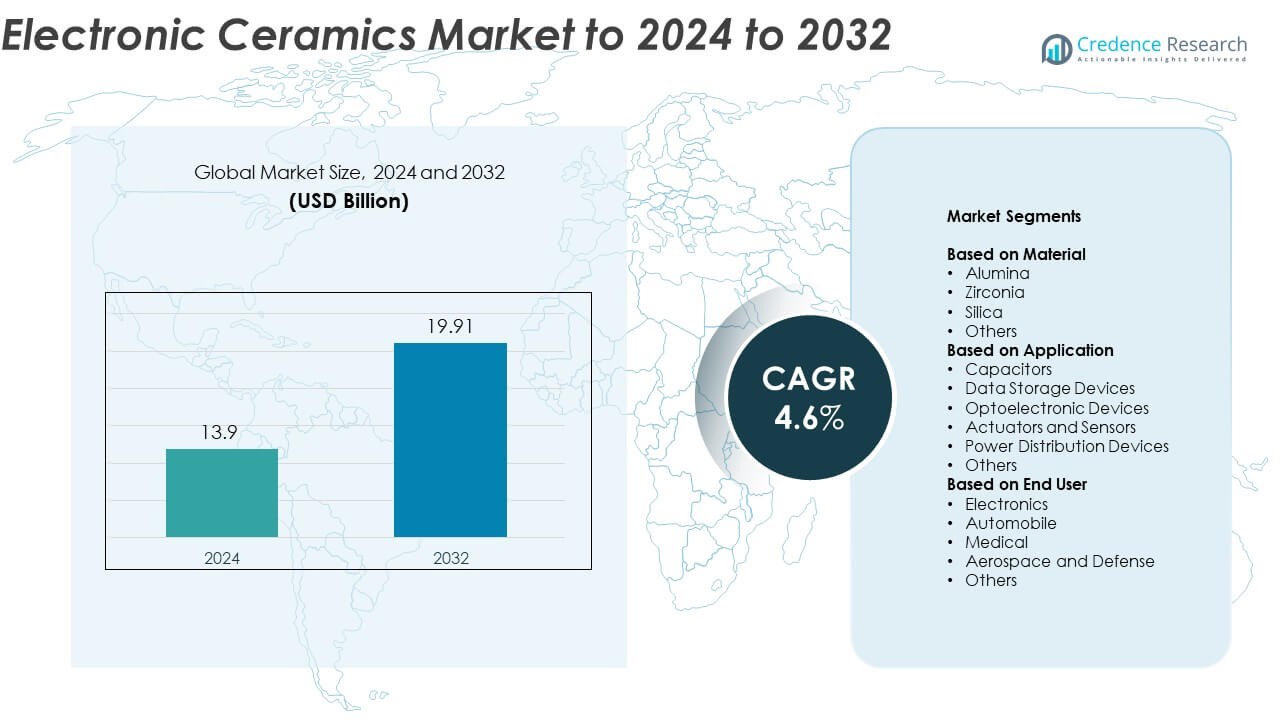

The Electronic Ceramics Market size was valued at USD 13.9 Billion in 2024 and is anticipated to reach USD 19.91 Billion by 2032, at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electronic Ceramics Market Size 2024 |

USD 13.9 Billion |

| Electronic Ceramics Market, CAGR |

4.6% |

| Electronic Ceramics Market Size 2032 |

USD 19.91 Billion |

The electronic ceramics market is characterized by strong competition among major players such as CoorsTek Inc., CeramTec GmbH, Venator Materials PLC (Huntsman Corporation), Central Electronics Limited, Noritake Co. Limited, Compagnie de Saint-Gobain S.A., and Ferro Corporation. These companies emphasize innovation in dielectric, piezoelectric, and insulating materials to meet the demands of high-performance electronics, electric vehicles, and medical devices. North America leads the global market with a 37.6% share in 2024, supported by robust R&D infrastructure and growing adoption of advanced materials in semiconductor and defense industries. Asia Pacific follows closely, driven by large-scale electronics manufacturing in China, Japan, and South Korea.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The electronic ceramics market was valued at USD 13.9 billion in 2024 and is projected to reach USD 19.91 billion by 2032, expanding at a CAGR of 4.6%.

- Rising demand for high-performance electronic components in electric vehicles, 5G infrastructure, and renewable energy systems is driving steady market growth.

- Advancements in miniaturization, dielectric materials, and additive manufacturing are shaping new trends, improving product reliability and design flexibility.

- The market remains moderately consolidated, with companies focusing on innovation and material optimization to enhance thermal and electrical performance.

- North America leads with a 37.6% share, followed by Asia Pacific at 29.8%, while the alumina segment dominates material usage with 41.2% share, supported by expanding applications in capacitors and sensors.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Material

The alumina segment dominates the electronic ceramics market with approximately 41.2% share in 2024. Its leadership is attributed to high thermal conductivity, electrical insulation, and mechanical strength, making it suitable for substrates, sensors, and electronic packaging. Alumina ceramics are extensively used in integrated circuits and power modules due to their cost-effectiveness and reliability under high-temperature operations. Increasing demand for miniaturized electronic components in consumer devices and automotive electronics continues to boost alumina’s adoption, while zirconia and silica are gaining traction in high-performance applications requiring enhanced toughness and dielectric properties.

- For instance, Kyocera’s 99.6% alumina thin-film substrates are produced up to 120 × 120 mm with standard thicknesses of 0.25/0.38/0.635 mm, supporting high-heat, high-insulation uses.

By Application

The capacitors segment leads the market with nearly 33.6% share in 2024. This dominance is driven by the extensive use of multilayer ceramic capacitors in consumer electronics, telecommunication equipment, and electric vehicles. Rising demand for compact, energy-efficient components in 5G infrastructure and EV powertrains supports steady market growth. Ceramic materials offer high dielectric constants and stability across temperature ranges, ensuring superior performance and reliability. Growing production of miniaturized capacitors for smartphones and data storage devices further strengthens this segment’s position globally.

- For instance, Murata began mass production of a 47 µF MLCC in the 0402 size (1.0 × 0.5 mm) in July 2025, a world-first achievement enabling higher energy density and more compact electronic designs compared to previous 0603 size products of the same capacitance.

By End User

The electronics segment holds the largest market share of about 45.8% in 2024. Its dominance results from strong demand across semiconductors, sensors, and passive components in consumer and industrial devices. Expanding production of smartphones, wearable electronics, and electric vehicles fuels adoption of advanced ceramic materials due to their high insulation and heat resistance. Additionally, the shift toward IoT-enabled systems and renewable energy infrastructure drives further utilization of electronic ceramics. The automobile and medical sectors are emerging growth areas, supported by increasing use in actuators, sensors, and implantable devices.

Key Growth Drivers

Rising Demand for Advanced Electronic Components

The growing adoption of advanced electronic components in consumer electronics, electric vehicles, and industrial automation systems is a primary growth driver. Electronic ceramics enable high thermal stability, insulation, and miniaturization, which are critical for high-frequency and high-voltage devices. The rising penetration of 5G networks and smart devices further accelerates the demand for multilayer ceramic capacitors and piezoelectric sensors. Continuous innovations in materials with improved dielectric and piezoelectric properties are also expanding their use in power modules and signal processing components.

- For instance, TDK’s automotive-grade MLCC portfolio spans down to 0.4 × 0.2 mm (EIA 01005) with rated voltages from 2.5 V to 630 V, backing miniaturized, high-reliability designs.

Expansion of Electric Vehicles and Renewable Energy Systems

The global shift toward electric mobility and renewable energy generation is fueling the demand for electronic ceramics in energy storage and power control systems. Ceramic-based components such as insulators, actuators, and capacitors are essential for managing high-voltage operations in EV batteries and inverters. Their superior durability and temperature resistance ensure reliable performance in harsh environments. Governments promoting sustainable transportation and grid modernization are further boosting investment in electronic ceramics for clean energy applications.

- For instance, Samsung Electro-Mechanics notes an electric vehicle can require about 20,000–30,000 MLCCs, showing the scale of ceramic components in power and control electronics.

Growth in Healthcare and Medical Electronics

Increasing adoption of advanced medical electronics, including imaging systems, diagnostic sensors, and implantable devices, drives significant demand for electronic ceramics. These materials are used in ultrasound transducers, pacemakers, and bio-compatible sensors due to their stable piezoelectric properties and chemical inertness. The growing aging population and rising healthcare investments globally enhance market expansion. Additionally, advancements in miniaturized and high-precision medical instruments are further strengthening the application scope of ceramics in the medical device sector.

Key Trends & Opportunities

Integration of IoT and Smart Technologies

The integration of Internet of Things (IoT) and smart technologies is creating new opportunities for electronic ceramics in connected devices. These materials support compact, efficient, and high-performance components that enable seamless data transmission and energy efficiency. Expanding smart home systems, wearable electronics, and industrial sensors are key contributors to market growth. Manufacturers are focusing on developing thin-film and nanostructured ceramics to meet the evolving performance requirements of next-generation electronic systems.

- For instance, Murata began mass production of the world’s first 006003-inch size (0.16 × 0.08 mm) multilayer ceramic capacitor (MLCC) in September 2024, enabling extreme miniaturization for use in sensors and modules within connected devices.

Advancements in Ceramic Additive Manufacturing

The adoption of additive manufacturing for producing complex ceramic components is emerging as a major trend. 3D printing allows precise customization of ceramic structures for electronic applications, reducing waste and production costs. This technological shift enhances design flexibility and accelerates prototyping for specialized components such as sensors and substrates. Increased research in high-performance ceramic inks and powders is expected to expand the scalability of additive manufacturing within electronic ceramics production.

- For instance, Lithoz demonstrated that a network of 100 CeraFab S65 printers can produce nearly 14 million identical ceramic parts per year at 3:46 minutes per part, showcasing scalable serial production.

Key Challenges

High Production and Processing Costs

The manufacturing of electronic ceramics involves complex sintering and machining processes that require high temperatures and precise control. These procedures significantly increase production costs, limiting the adoption of ceramics in low-cost applications. The need for advanced equipment and raw material purity further raises capital investment. Cost reduction through process optimization and recycling of ceramic waste remains a key challenge for manufacturers seeking large-scale deployment in mass-market electronic devices.

Performance Limitations Under Extreme Conditions

Although electronic ceramics offer superior electrical and thermal properties, they can exhibit brittleness and reduced mechanical strength under extreme mechanical stress or rapid temperature changes. This limitation poses challenges in high-vibration or thermal-cycling environments such as aerospace and automotive systems. Ongoing research aims to enhance toughness and flexibility without compromising functional performance. Developing hybrid composites and advanced coatings presents an opportunity to overcome these durability constraints in demanding operational settings.

Regional Analysis

North America

North America dominates the electronic ceramics market with a 37.6% share in 2024. The region’s leadership stems from strong demand across consumer electronics, automotive electronics, and defense applications. High investment in advanced manufacturing and materials research supports technological progress in ceramic components. The presence of key semiconductor and aerospace companies accelerates product innovation in sensors, capacitors, and actuators. Expanding electric vehicle adoption and renewable energy integration further strengthen market growth, while the United States remains the key contributor due to robust industrial and R&D infrastructure.

Europe

Europe holds a 26.3% share of the electronic ceramics market in 2024. The region benefits from a strong base of automotive and aerospace industries, driving consistent use of ceramic-based components. Stringent environmental regulations encourage the adoption of durable, energy-efficient materials in power electronics and sensors. Germany, France, and the United Kingdom lead demand due to their advanced electronics and renewable energy sectors. Increased focus on miniaturization and lightweight materials in high-performance systems continues to propel market expansion across industrial and medical applications.

Asia Pacific

Asia Pacific accounts for a 29.8% share of the global electronic ceramics market in 2024. The region’s dominance is supported by large-scale electronics manufacturing in China, Japan, South Korea, and Taiwan. Strong production capabilities for semiconductors, sensors, and capacitors fuel steady demand for advanced ceramics. Rapid urbanization, expansion of 5G infrastructure, and the growing electric vehicle market contribute to sustained growth. Continuous investment in R&D and material innovation strengthens the regional supply chain, while rising consumer electronics demand ensures long-term market expansion.

Latin America

Latin America captures a 4.1% share of the electronic ceramics market in 2024. Market growth is driven by increasing adoption of electronic components in automotive and industrial automation sectors. Brazil and Mexico are key contributors due to expanding electronics assembly operations and growing renewable energy projects. The rising focus on smart manufacturing and electric mobility supports the use of high-performance ceramics. However, limited domestic production and reliance on imports present challenges, though growing regional investments are expected to enhance future market potential.

Middle East & Africa

The Middle East and Africa hold a 2.2% share of the electronic ceramics market in 2024. Growth in the region is supported by expanding power generation, healthcare, and defense applications. The UAE and Saudi Arabia are witnessing increased demand for advanced electronic components in automation and energy systems. Infrastructure development and industrial diversification initiatives are boosting electronics manufacturing activity. However, the market remains in a developing stage, with import dependence and limited technological capacity being key constraints to large-scale adoption.

Market Segmentations:

By Material

- Alumina

- Zirconia

- Silica

- Others

By Application

- Capacitors

- Data Storage Devices

- Optoelectronic Devices

- Actuators and Sensors

- Power Distribution Devices

- Others

By End User

- Electronics

- Automobile

- Medical

- Aerospace and Defense

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the electronic ceramics market features prominent players such as CoorsTek Inc., CeramTec GmbH, Venator Materials PLC (Huntsman Corporation), Central Electronics Limited, Noritake Co. Limited, Compagnie de Saint-Gobain S.A., Physik Instrumente (PI) GmbH & Co. KG., APC International Ltd., Ferro Corporation, Almatis GmbH, American Elements, Ishihara Sangyo Kaisha Ltd., and Sensor Technology Ltd. The market is moderately consolidated, with competition driven by product innovation, material quality, and customization capabilities. Companies focus on developing advanced ceramics with superior dielectric and thermal properties to meet evolving performance standards in automotive, medical, and semiconductor applications. Strategic partnerships and R&D investments are enhancing product portfolios and global reach, particularly in Asia Pacific and North America. Growing adoption of electric vehicles and 5G infrastructure is encouraging manufacturers to scale production of multilayer ceramic capacitors and piezoelectric components. Continuous focus on sustainability and high-temperature resilience further shapes competitive differentiation.

Key Player Analysis

- CoorsTek Inc.

- CeramTec GmbH

- Venator Materials PLC (Huntsman Corporation)

- Central Electronics Limited

- Noritake Co. Limited

- Compagnie de Saint-Gobain S.A.

- Physik Instrumente (PI) GmbH & Co. KG.

- APC International Ltd.

- Ferro Corporation

- Almatis GmbH

- American Elements

- Ishihara Sangyo Kaisha Ltd.

- Sensor Technology Ltd.

Recent Developments

- In 2025, Almatis broke ground on a new calcined alumina plant in the Qingdao Economic Development Zone, China.

- In 2025, CeramTec launched a new 98% alumina substrate for power electronics applications, showcasing this innovation at the PCIM Expo in Nuremberg, Germany.

- In 2025, Noritake Co. Limited Announced corporate split covering thick-film circuit substrate business. Move streamlines industrial ceramics operations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Material, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for electronic ceramics will rise with the growing adoption of electric vehicles.

- Advancements in 5G infrastructure will boost the use of multilayer ceramic capacitors.

- Increased miniaturization of electronic devices will drive innovation in ceramic substrates.

- Medical electronics will expand applications for biocompatible and piezoelectric ceramics.

- Integration of IoT and AI-based systems will enhance the need for high-performance components.

- The shift toward renewable energy will support ceramics in power distribution equipment.

- Additive manufacturing will enable customized ceramic parts with improved efficiency.

- Asia Pacific will remain a key production hub due to strong semiconductor manufacturing.

- Research in nanoceramics will create new opportunities for high-frequency electronics.

- Sustainability goals will encourage the development of energy-efficient ceramic materials.

Market Segmentation Analysis:

Market Segmentation Analysis: