Market Overviews

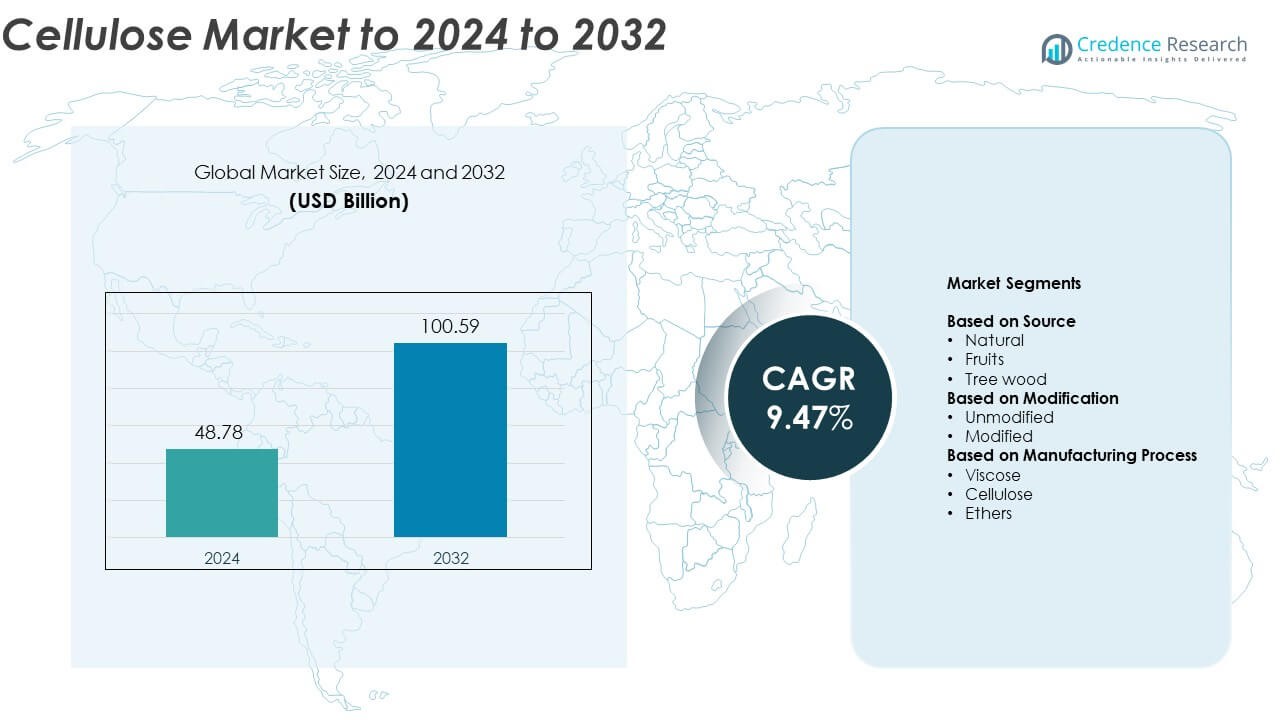

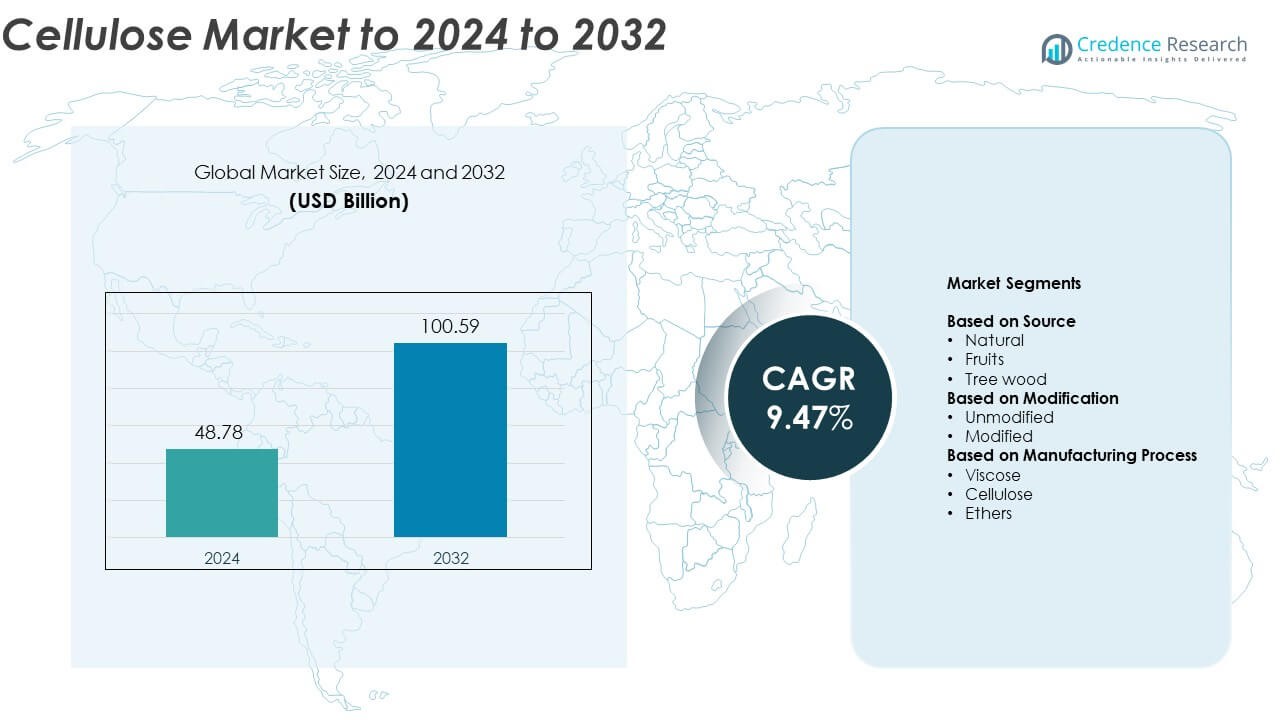

Cellulose market size was valued at USD 48.78 Billion in 2024 and is anticipated to reach USD 100.59 Billion by 2032, at a CAGR of 9.47% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cellulose Market Size 2024 |

USD 48.78 Billion |

| Cellulose Market, CAGR |

9.47% |

| Cellulose Market Size 2032 |

USD 100.59 Billion |

The cellulose market is led by major companies such as Lenzing AG, Celanese Corporation, Eastman Chemical Company, Daicel Corporation, Bracell, Shin-Etsu Chemical Co., Ltd., Dupont De Nemours, Inc., and NEC Corporation. These players focus on sustainable production, technological innovation, and expanding their product portfolios across packaging, textiles, and pharmaceutical applications. Asia-Pacific dominates the global cellulose market with approximately 34.1% share in 2024, driven by strong demand from pulp, paper, and textile industries. North America follows with about 32.6% share, supported by advanced R&D capabilities and growing adoption of eco-friendly materials across multiple sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global cellulose market was valued at USD 48.78 Billion in 2024 and is projected to reach USD 100.59 Billion by 2032, growing at a CAGR of 9.47%.

- Rising demand for biodegradable and renewable materials across packaging, textiles, and pharmaceuticals drives market expansion.

- Increasing adoption of nanocellulose and cellulose derivatives in advanced applications such as composites and coatings highlights ongoing innovation trends.

- The market is moderately consolidated, with leading players focusing on sustainability, capacity expansion, and partnerships to enhance competitiveness.

- Asia-Pacific leads with 34.1% share, followed by North America at 32.6% and Europe at 27.4%, while the tree wood segment dominates the market with around 63.4% share in 2024.

Market Segmentation Analysis:

By Source

The tree wood segment dominates the cellulose market, accounting for around 63.4% share in 2024. Its leadership is driven by the abundant availability of wood pulp and established industrial infrastructure for large-scale cellulose extraction. Tree wood offers high purity and consistent fiber quality, making it the preferred raw material for paper, textile, and bioplastic production. Growing demand for sustainable materials and the expansion of pulp and paper industries in Asia-Pacific further strengthen the dominance of tree wood-based cellulose across global markets.

- For instance, Suzano started a 2.55 million-ton-per-year eucalyptus pulp line, lifting total pulp capacity to about 13.5 million tons.

By Modification

The unmodified cellulose segment leads the market with nearly 57.8% share in 2024. This dominance stems from its wide applications in textiles, packaging, and pharmaceutical formulations due to its biodegradability and cost-effectiveness. Unmodified cellulose offers excellent mechanical strength and moisture resistance, making it suitable for industrial and consumer products. Rising use in eco-friendly packaging and renewable composites further boosts segment growth, while ongoing innovation in natural polymer processing enhances its sustainability appeal.

- For instance, Sappi reports paper-pulp capacity of 2.3 million tons per year across its operations.

By Manufacturing Process

The viscose process segment holds the largest market share of about 49.2% in 2024. Its leadership is supported by extensive use in textile fibers, films, and hygiene products. The viscose route enables efficient conversion of cellulose into versatile forms with superior luster and breathability, suitable for apparel and industrial applications. Growing preference for semi-synthetic fibers and the expansion of textile manufacturing in emerging economies continue to drive the dominance of viscose-based cellulose production globally.

Key Growth Drivers

Rising Demand for Sustainable and Biodegradable Materials

The global shift toward eco-friendly materials is driving strong demand for cellulose-based products. Cellulose, derived from renewable sources, offers biodegradability and minimal environmental impact compared to synthetic alternatives. Its growing use in packaging, textiles, and bioplastics supports sustainability goals across industries. Increasing government regulations on single-use plastics and consumer preference for green materials continue to propel cellulose adoption globally.

- For instance, Tetra Pak the company reported that around 1.3 million tonnes of its carton packages were collected and sent for recycling, an increase of 7% in material collection compared to 2022.

Expanding Applications in Pharmaceuticals and Food Industry

Cellulose plays a critical role as a stabilizer, thickener, and emulsifier in food and pharmaceutical formulations. The growth of processed foods and demand for controlled-release drug systems are fueling consumption. Its non-toxic, inert, and biocompatible nature ensures widespread use in capsules, coatings, and dietary supplements. Continuous product innovation and increased regulatory approvals for cellulose derivatives further strengthen market growth.

- For instance, Sigachi Industries had a total installed microcrystalline cellulose (MCC) capacity of 18,000 metric tons per annum (MTPA), which it planned to expand to 30,000 MTPA with the addition of a new 12,000 MTPA project at its Dahej SEZ unit, according to company announcements in August 2025.

Technological Advancements in Cellulose Modification

Innovations in modification techniques are enhancing cellulose performance across industries. Advanced chemical and enzymatic treatments improve solubility, thermal stability, and compatibility with polymers. Modified cellulose is increasingly used in coatings, composites, and electronic materials, creating new commercial avenues. The development of nanocellulose and microcrystalline cellulose also expands industrial use in lightweight and high-strength materials, boosting market potential.

Key Trends & Opportunities

Growth of Nanocellulose in High-Performance Applications

Nanocellulose is emerging as a transformative material due to its superior strength, lightweight nature, and biodegradability. It finds growing use in electronics, composites, and filtration systems. Manufacturers are investing in large-scale production technologies to meet increasing industrial demand. Expanding R&D activities and collaborations with packaging and automotive sectors offer strong commercial opportunities in the coming years.

- For instance, Nippon Paper’s Ishinomaki facility has cellulose nanofiber capacity of about 500 tons per year.

Rising Investment in Bio-Based Packaging Solutions

Cellulose is increasingly adopted as a sustainable alternative in flexible packaging applications. Growing awareness about plastic waste and circular economy initiatives accelerates the transition to cellulose-based films and coatings. Companies are focusing on developing recyclable and compostable cellulose materials that maintain product integrity. This trend aligns with global sustainability goals and provides long-term market opportunities.

- For instance, Tetra Pak and Lactogal released 25 million paper-barrier aseptic cartons in Portugal during a 2023 consumer launch.

Key Challenges

High Production Costs and Complex Processing

Despite growing demand, cellulose production involves energy-intensive and costly processes, especially for modified and nanocellulose forms. Dependence on chemical treatments and purification steps raises operational expenses and limits affordability. Small-scale producers face barriers in scaling due to high equipment and raw material costs. Streamlining production technologies remains crucial to improve competitiveness and accessibility.

Competition from Synthetic and Alternative Bio-Polymers

The cellulose market faces strong competition from synthetic and emerging bio-based polymers offering similar mechanical and functional properties. Materials like polylactic acid (PLA) and polyhydroxyalkanoates (PHA) challenge cellulose’s position in packaging and textile industries. Differences in cost-efficiency and performance under certain conditions restrict wider substitution. Continuous innovation and application diversification are vital to maintaining cellulose’s market edge.

Regional Analysis

North America

North America holds around 32.6% share of the global cellulose market in 2024. The region benefits from strong demand in packaging, textiles, and pharmaceuticals supported by well-established manufacturing infrastructure. Growing adoption of biodegradable materials and rising regulatory pressure to reduce plastic waste drive cellulose consumption. The United States leads regional growth with increasing investments in nanocellulose research and production. Expanding use in food additives and coatings, coupled with innovation in cellulose-based composites, further strengthens the region’s position as a key market contributor.

Europe

Europe accounts for nearly 27.4% share of the global cellulose market in 2024. The region’s focus on circular economy initiatives and strict environmental policies accelerates demand for bio-based cellulose materials. Countries such as Germany, France, and the Netherlands dominate production due to advanced pulp and paper industries. Rising applications in sustainable packaging and green textiles reinforce market expansion. The European Union’s push for plastic reduction and strong investments in biopolymer innovation continue to enhance cellulose utilization across multiple industries.

Asia-Pacific

Asia-Pacific leads the global cellulose market with approximately 34.1% share in 2024. Rapid industrialization, growing paper production, and expanding textile manufacturing drive strong demand. China, Japan, and India remain major producers and consumers due to large-scale pulp processing and chemical industries. Increasing awareness of eco-friendly materials and government incentives for sustainable manufacturing further support growth. Rising consumption of processed foods and pharmaceutical products also contributes to cellulose demand, making Asia-Pacific the fastest-growing regional market during the forecast period.

Latin America

Latin America captures around 3.4% share of the global cellulose market in 2024. The region’s growth is primarily supported by expanding paper and packaging industries in Brazil, Chile, and Argentina. Abundant forest resources provide access to raw materials for cellulose extraction, enhancing regional supply stability. Increasing demand for sustainable packaging and bio-based materials in consumer goods fuels gradual expansion. Government efforts to promote green manufacturing and export-oriented pulp industries continue to strengthen Latin America’s cellulose production base.

Middle East & Africa

The Middle East and Africa region holds about 2.5% share of the global cellulose market in 2024. Growing demand from the food processing, construction, and pharmaceutical sectors supports gradual adoption. Limited local production capacity leads to heavy dependence on imports from Asia and Europe. Investments in sustainable packaging and industrial diversification, particularly in South Africa and the United Arab Emirates, drive future market opportunities. The rising shift toward renewable materials and increasing urbanization contribute to the region’s emerging cellulose demand base.

Market Segmentations:

By Source

By Modification

By Manufacturing Process

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the cellulose market features major participants such as Lenzing AG, Celanese Corporation, Eastman Chemical Company, Daicel Corporation, Bracell, Shin-Etsu Chemical Co., Ltd., Dupont De Nemours, Inc., and NEC Corporation. The market is characterized by strong vertical integration, advanced manufacturing technologies, and continuous innovation in cellulose derivatives and nanocellulose production. Companies are focusing on expanding production capacities, optimizing sustainability practices, and enhancing product performance through R&D investments. Strategic collaborations with packaging, textile, and pharmaceutical industries are becoming common to meet evolving application demands. Leading producers are also emphasizing environmentally responsible sourcing and circular economy initiatives to align with global sustainability goals. Additionally, regional expansion through mergers, acquisitions, and joint ventures strengthens supply chains and helps achieve economies of scale. The competitive environment remains moderately consolidated, with key players leveraging technological expertise and product diversification to maintain market leadership and address rising global demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Eastman launched Esmeri CC1N10, a high-performance, readily biodegradable cellulose ester micropowder for color cosmetics, meeting stringent EU regulations and improving product performance in lipstick, foundations, and powders.

- In 2025, Daicel launched “BELLOCEA® BS7,” an eco-friendly cellulose acetate spherical particle product designed as a biodegradable substitute for microplastic beads in cosmetics.

- In 2025, Lenzing AG introduced new production processes for regenerated cellulose fibers that further reduce water consumption and carbon emissions, in line with growing consumer and regulatory demand for sustainable textiles and hygiene products.

Report Coverage

The research report offers an in-depth analysis based on Source, Modification, Manufacturing Process and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for bio-based and biodegradable cellulose materials will continue to rise globally.

- Nanocellulose will gain wider use in electronics, composites, and medical applications.

- Sustainable packaging solutions will remain a major growth area for cellulose producers.

- Technological advancements will improve cellulose extraction efficiency and reduce production costs.

- Asia-Pacific will maintain dominance due to strong industrial and consumer demand.

- Pharmaceutical and food industries will expand cellulose usage in formulations and coatings.

- Collaboration between manufacturers and research institutes will accelerate innovation in cellulose derivatives.

- Circular economy initiatives will boost cellulose adoption in textile and paper sectors.

- Increasing investment in green manufacturing will enhance cellulose market competitiveness.

- Development of advanced cellulose composites will open opportunities in automotive and construction industries.