Market Overview

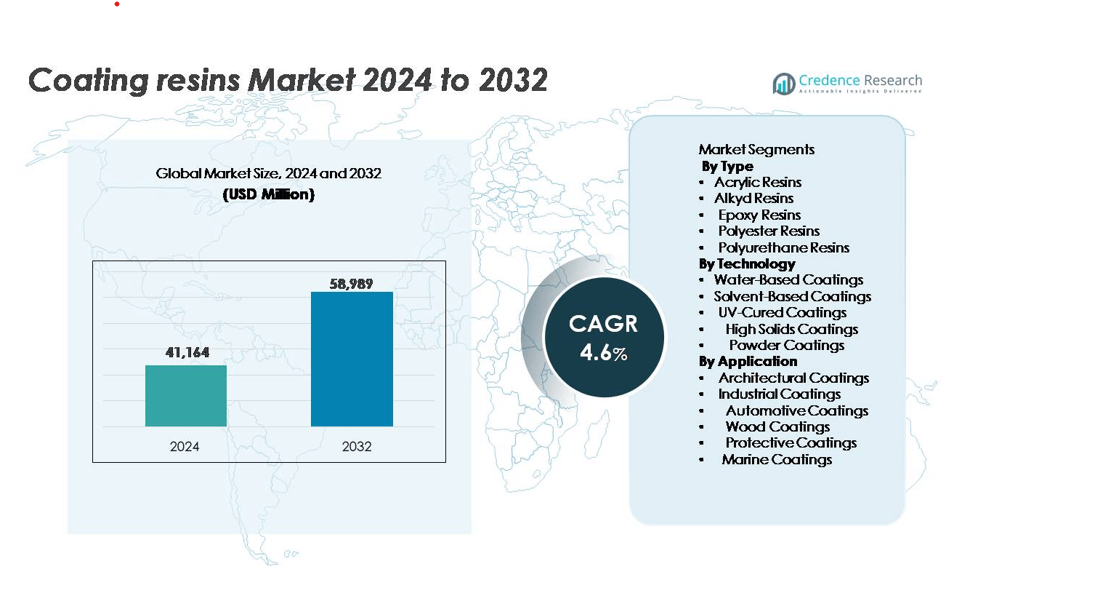

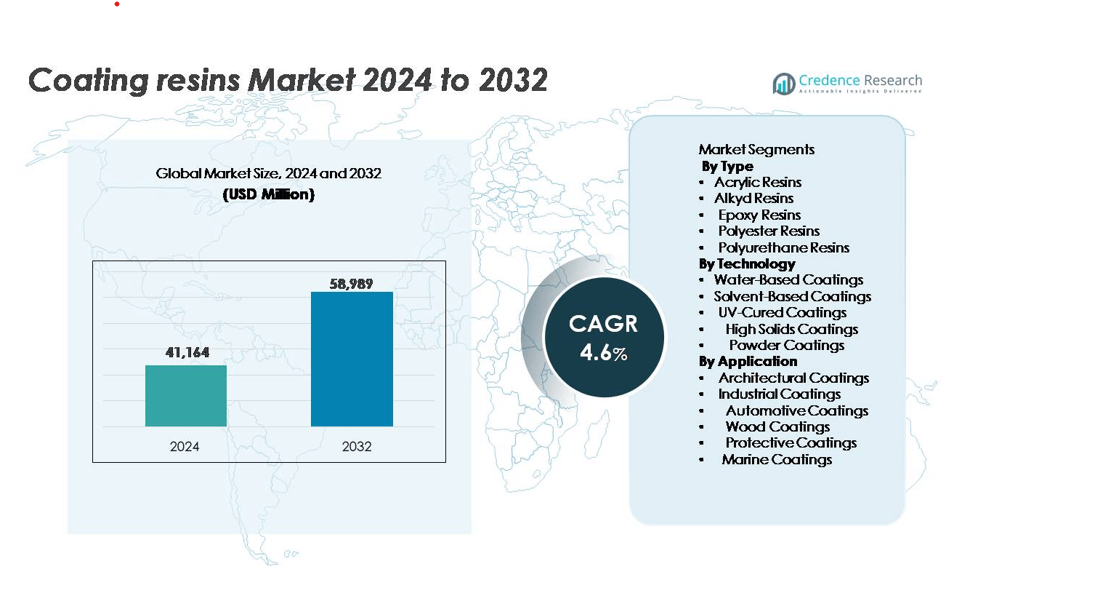

The global coating resins market was valued at USD 41,164 million in 2024 and is projected to reach USD 58,989 million by 2032, growing at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Coating Resins Market Size 2024 |

USD 41,164 million |

| Coating Resins Market, CAGR |

4.6% |

| Coating Resins Market Size 2032 |

USD 58,989 million |

The global coating resins market is led by major companies such as BASF SE, Dow Inc., Arkema S.A., Allnex GmbH, and Evonik Industries AG, which collectively account for a substantial portion of global revenue. These companies dominate through advanced product innovation, strong distribution networks, and sustainable resin development for automotive, architectural, and industrial coatings. BASF SE and Dow Inc. hold leading positions due to their broad resin portfolios and global reach, while Arkema and Allnex excel in low-VOC and UV-curable technologies. Asia-Pacific remains the largest regional market, commanding 44% of global share in 2024, driven by rapid industrialization, infrastructure expansion, and growing construction activity across China, India, and Southeast Asia.

Market Insights

- The coating resins market was valued at USD 41,164 million in 2024 and is projected to reach USD 58,989 million by 2032, growing at a CAGR of 4.6%.

- Market growth is driven by rising demand for durable and eco-friendly coatings across construction, automotive, and industrial sectors, supported by increased infrastructure spending.

- The market trend leans toward water-based and UV-cured coatings, favored for low VOC emissions and regulatory compliance, especially in Europe and North America.

- The competitive landscape is led by BASF SE, Dow Inc., Arkema S.A., Allnex GmbH, and Evonik Industries AG, focusing on sustainable resin innovations and expansion in emerging markets.

- Asia-Pacific dominates with 44% share, driven by rapid urbanization and construction activity, while acrylic resins lead the product segment with over 35% share, followed by epoxy and polyurethane resins gaining traction in high-performance applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Acrylic resins dominate the coating resins market, accounting for over 35% share in 2024. Their popularity stems from superior weather resistance, gloss retention, and color stability across architectural and automotive coatings. The demand for waterborne acrylics has surged due to low VOC emissions and improved adhesion. Epoxy and polyester resins follow, driven by applications in industrial and marine coatings requiring high corrosion resistance. Polyurethane resins continue to grow in protective and wood coatings due to their durability and chemical resistance, while alkyd resins remain preferred for cost-effective decorative coatings.

- For instance, BASF SE developed the Joncryl® 9530 waterborne acrylic dispersion, which is characterized by its very fine particle size that allows for excellent grain enhancement and clarity in wood coatings. The product enables formulators to achieve low to zero VOC levels in their final products, which is a significant improvement over traditional solvent-based system.

By Technology

Water-based coatings lead the market with around 42% share in 2024, supported by environmental regulations promoting low-VOC formulations. They are widely adopted in construction and automotive sectors for superior adhesion and easy cleanup. Powder coatings and UV-cured coatings are gaining traction due to high efficiency, solvent-free nature, and rapid curing time. Solvent-based coatings still serve industrial sectors where quick drying and high film thickness are critical, while high-solids coatings bridge performance and sustainability needs across metal and machinery applications.

- For instance, in solvent-based systems, PARALOID thermosetting acrylic resins by Dow Inc. (such as AT-400/AT-410) support formulations with solids levels greater than 50 % for efficient spray application.

By Application

Architectural coatings represent the dominant segment with over 40% market share in 2024, driven by global infrastructure development and renovation projects. The segment benefits from the use of acrylic and alkyd resins that ensure UV resistance and long-lasting color. Industrial coatings follow closely, fueled by corrosion protection and enhanced durability requirements in manufacturing. Automotive coatings show steady growth due to rising vehicle production and demand for aesthetic finishes. Meanwhile, wood, marine, and protective coatings expand steadily, driven by product innovations in weatherable and high-performance resin formulations.

Key Growth Drivers

Rising Demand from Construction and Infrastructure Sector

The expanding construction industry remains a key growth driver for the coating resins market. Acrylic, alkyd, and polyurethane resins are widely used in architectural coatings for buildings, bridges, and infrastructure due to their excellent weatherability, adhesion, and protection against corrosion. Rapid urbanization in Asia-Pacific and the Middle East fuels demand for waterborne and UV-stable resins in both residential and commercial projects. Government investments in smart city developments and infrastructure modernization further support market growth. Additionally, the need for energy-efficient coatings with heat-reflective and self-cleaning properties strengthens the adoption of advanced resin formulations.

- For instance, Arkema’s Kynar Aquatec® ARC resin latex contains 70 % PVDF by weight with 30 % proprietary acrylic resin, delivers a Minimum Film-Forming Temperature (MFFT) of 27 °C, and a VOC content below 1 g/L when supplied.

Shift Toward Sustainable and Low-VOC Coatings

Stringent environmental regulations on volatile organic compounds (VOCs) have accelerated the transition from solvent-based to eco-friendly coatings. Waterborne, powder, and high-solid resin systems are increasingly preferred across automotive, industrial, and architectural sectors. Manufacturers focus on developing bio-based and renewable resin solutions to reduce carbon footprints and enhance sustainability. Technological innovations, such as hybrid acrylic-polyester and polyurethane dispersions, are gaining prominence for offering both performance and environmental compliance. This sustainability-driven shift aligns with global green initiatives, particularly in Europe and North America, where strict emission norms guide formulation advancements.

- For instance, HYBRIDUR® 878 dispersion from Evonik Industries is NMP-free (<0.1 % solvent), contains 40 % solids by weight, and features a particle size of 75–85 nm

Expanding Automotive and Industrial Applications

Coating resins are critical in automotive, machinery, and equipment coatings, offering durability, abrasion resistance, and chemical protection. The rise in vehicle production, coupled with the shift toward electric mobility, boosts demand for high-performance coatings resistant to heat and corrosion. Epoxy and polyurethane resins are especially valued in automotive primers and clearcoats for superior finish and longevity. The industrial sector’s adoption of powder and UV-cured coatings to achieve faster curing and reduced emissions further drives growth. Moreover, technological innovations like nanocomposite and self-healing resin systems enhance surface protection and extend product lifespan.

Key Trends & Opportunities

Growth of Smart and Functional Coatings

The integration of smart functionalities in coatings, such as self-cleaning, anti-microbial, and heat-reflective properties, is reshaping the coating resins market. Innovations in resin chemistry enable coatings that respond to environmental changes or provide added protection against corrosion and microbial growth. The trend is particularly strong in healthcare, construction, and automotive industries. Nanotechnology-based resins and hybrid polymer systems are opening new revenue opportunities by improving performance while maintaining eco-compliance. The demand for such intelligent coatings is expected to rise further with technological advances in formulation science.

- For instance, BASF SE offers Acronal® PRO 770 NA, a waterborne, self-crosslinking styrene acrylic dispersion primarily designed for high-performance direct-to-metal (DTM) and anticorrosive primers. This binder offers superior corrosion protection and excellent UV resistance, allowing for robust coatings in industrial applications, and can be used in zinc-free formulations.

Rising Adoption of Bio-Based and Recyclable Resins

Sustainability trends continue to influence the industry as manufacturers invest in bio-based feedstocks derived from vegetable oils, lignin, and other renewable sources. These resins offer similar mechanical strength and gloss retention compared to petroleum-based counterparts but with a reduced environmental impact. Growing consumer preference for green products, combined with corporate ESG commitments, promotes large-scale adoption. Partnerships between chemical producers and biotech firms further accelerate innovation in recyclable and low-carbon coatings, creating long-term opportunities for the global coating resins market.

- For instance, Covestro AG developed its Decovery® SP-8310 bio-based resin, formulated with 37% renewable carbon content, which maintains comparable hardness and adhesion to synthetic alternatives in industrial coatings.

Digitalization and Process Automation in Coatings Production

The use of AI, IoT, and automation in resin formulation and manufacturing is improving consistency, efficiency, and cost-effectiveness. Smart production systems allow real-time monitoring of viscosity, curing, and VOC emissions, enabling precise control and waste reduction. Digital tools also help companies develop customized resin blends faster, reducing time-to-market for new products. This digital transformation trend enhances competitiveness while supporting sustainability goals, making process innovation a critical opportunity for manufacturers.

Key Challenges

Volatility in Raw Material Prices

Fluctuating prices of crude oil derivatives such as styrene, epoxies, and polyols significantly impact coating resin production costs. Supply chain disruptions, geopolitical tensions, and rising transportation costs further strain profit margins. Manufacturers face challenges in maintaining stable pricing while ensuring product quality. This volatility often forces producers to seek alternative raw materials or local sourcing strategies. However, these adjustments require investment in reformulation and testing, affecting short-term profitability and production efficiency across the coating resins industry.

Stringent Environmental and Regulatory Compliance

The coating resins market faces increasing regulatory pressure to limit hazardous emissions and waste generation. Compliance with global standards such as REACH, EPA, and VOC directives requires manufacturers to reformulate products using sustainable and non-toxic components. Meeting these evolving standards increases R&D expenses and slows down product approvals. Additionally, smaller players struggle to adapt due to the high cost of environmental testing and certification. While regulations drive innovation toward greener resins, they also pose operational challenges for maintaining competitiveness and market entry speed.

Regional Analysis

Asia-Pacific

The Asia-Pacific region accounted for about 44% of global market share in 2024, led by heavy industrialisation and expansive infrastructure development. Growth in China and India in construction, automotive and protective coatings drives resin demand. Urbanisation and increasing disposable income in emerging economies further boost the architectural and industrial coatings segments. Manufacturers benefit from cost-efficient production bases in the region, enabling competitive pricing and rapid capacity expansion.

Europe

Europe held roughly 25% of the global coating resins market share in 2024, characterised by stringent environmental regulations and advanced manufacturing sectors. Demand for low-VOC and waterborne resin technologies remains high across Germany, France and the UK. The automotive and industrial coatings segments dominate the region’s resin consumption, demanding high performance and durability. Sustainability initiatives and circular economy mandates continue to push innovation toward bio-based and recycled resin solutions across European markets.

North America

North America accounted for approximately 20% of global market share in 2024, driven primarily by the United States’ large coatings industry and rising renovation and infrastructure projects. The region benefits from strong R&D capabilities, mature regulatory frameworks and high adoption of premium coating systems (e.g., powder, UV-cured). Growth arises from industrial manufacturing, automotive refinishing, and protective coatings for infrastructure, though cost pressures and raw material volatility present challenges.

Latin America

Latin America represents a smaller share of the market (estimated below 10%), but shows potential growth, especially in Brazil and Argentina where construction and automotive sectors are expanding. Resin demand in the region is increasing for architectural coatings, industrial maintenance and decorative coatings. However, economic instability, import dependency and fluctuating currency values may slow down growth compared to other regions.

Middle East & Africa

The Middle East & Africa region holds a modest share of the global coating resins market, driven by infrastructure investments in the Gulf and emerging industrialisation in Africa. Demand centres around protective coatings for oil & gas facilities, marine coatings and construction coatings for new development. Growth is moderated by political volatility and fluctuating commodity prices, though the trend toward specialized high-performance resins remains promising.

Market Segmentations

By Type

- Acrylic Resins

- Alkyd Resins

- Epoxy Resins

- Polyester Resins

- Polyurethane Resins

By Technology

- Water-Based Coatings

- Solvent-Based Coatings

- UV-Cured Coatings

- High Solids Coatings

- Powder Coatings

By Application

- Architectural Coatings

- Industrial Coatings

- Automotive Coatings

- Wood Coatings

- Protective Coatings

- Marine Coatings

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the global Coating Resins Market features a concentrated set of leading chemical companies that drive innovation and capture significant market share. Key players such as Dow Inc., BASF SE, Arkema S.A., Allnex GmbH and Evonik Industries AG dominate the field, thanks to broad product portfolios and strategic global footprints. These firms invest heavily in R&D and strategic alliances to develop low-VOC, high-performance resin systems tailored for architectural, automotive and industrial coatings application.In addition, smaller specialist-resin companies and regional producers carve niche positions by focusing on bio-based, customised or regionalised resin systems. The level of competition drives margin pressure, as raw material volatility and regulatory compliance raise costs. Operators respond by scaling operations, integrating vertically and optimizing supply chains. As customers increasingly demand sustainable and high-value resin solutions, companies that combine technical innovation with global supply networks will hold competitive advantage going forward.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Covestro AG (Leverkusen, Germany)

- TORAY INDUSTRIES, INC. (Tokyo, Japan)

- Sherwin-Williams (Ohio, U.S.)

- BASF SE (Ludwigshafen, Germany)

- Solvay (Brussels, Belgium)

- ALLNEX NETHERLANDS B.V. (Bergen Op Zoom, The Netherlands)

- Dow (Michigan, U.S.)

- Mitsubishi Chemical Corporation (Tokyo, Japan)

- Wacker Chemie AG (Munich, Germany)

- Evonik (Essen, Germany)

Recent Developments

- In February 2024, DIC Corporation inaugurated a new Application Lab in India to assess the application of coating resins in infrastructure development and the automotive sector. The facility aims to enhance customer support by offering localized solutions and strengthening the company’s market presence.

- In October 2023, Arkema doubled its production capacity of Sartomer UV/LED curing resins at its expanded Nansha facility in China. The expansion supports sustainable solutions in the rapidly growing Asian renewable energy and 5G device markets.

- In May 2023, Polynt Group expanded its alkyds, urethanes, and water-based technologies capacity to meet the rising coatings market demand. The company achieved this by constructing a new plant in Canada and expanding resin production across North America.

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for water-based and low-VOC resins will continue to rise due to strict environmental rules.

- Asia-Pacific will remain the leading regional market as construction and automotive output expands.

- Bio-based and recyclable resins will gain adoption as manufacturers push sustainability goals.

- UV-cured and powder resins will grow faster because of rapid curing, high durability, and low emissions.

- Automotive OEMs will increase the use of high-performance polyurethane and epoxy resins for long-lasting finishes.

- Smart and functional coatings, including self-cleaning and anti-microbial systems, will create new revenue streams.

- Digitalization and automation in resin production will improve efficiency, quality, and customization.

- Infrastructure renovation projects in North America and Europe will support steady industrial and architectural coating demand.

- Raw material volatility will push companies to secure local sourcing and develop alternative formulations.

- Strategic mergers, acquisitions, and capacity expansions will shape competition among leading global resin producers.