Market Overview

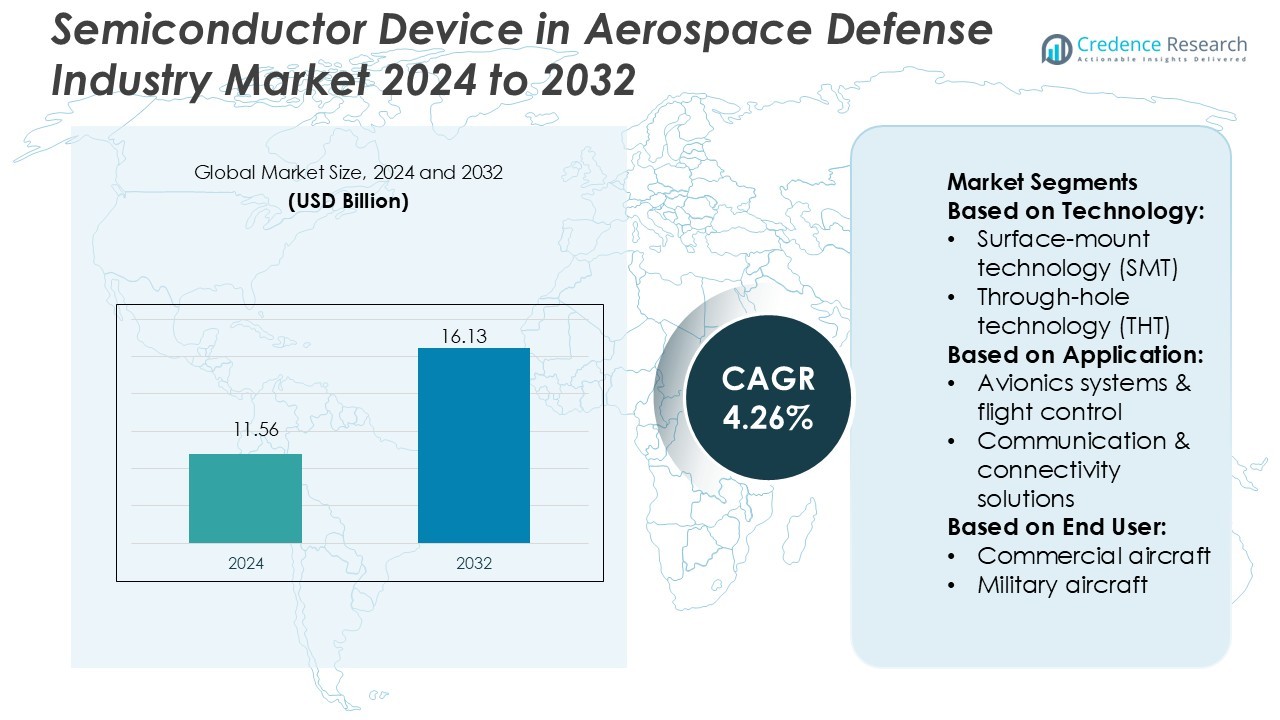

Semiconductor Device In Aerospace Defense Industry Market size was valued USD 11.56 billion in 2024 and is anticipated to reach USD 16.13 billion by 2032, at a CAGR of 4.26% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Semiconductor Device In Aerospace Defense Industry Market Size 2024 |

USD 11.56 Billion |

| Semiconductor Device In Aerospace Defense Industry Market, CAGR |

4.26% |

| Semiconductor Device In Aerospace Defense Industry Market Size 2032 |

USD 16.13 Billion |

The Semiconductor Device in Aerospace and Defense Industry Market is dominated by major players including STMicroelectronics, Renesas Electronics, Intel Corporation, ON Semiconductor (onsemi), Texas Instruments, NXP Semiconductors, Analog Devices, Infineon Technologies, Xilinx (AMD), and Microchip Technology. These companies lead through advanced product innovation, high-reliability designs, and strategic partnerships with defense and aerospace OEMs. The market emphasizes the development of radiation-hardened, AI-enabled, and energy-efficient semiconductors for avionics, radar, and satellite systems. Regionally, North America holds the largest market share at 39%, driven by significant defense modernization programs, extensive R&D investments, and strong collaboration between semiconductor manufacturers and aerospace organizations, ensuring technological leadership and global competitiveness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Semiconductor Device in Aerospace and Defense Industry Market was valued at USD 11.56 billion in 2024 and is projected to reach USD 16.13 billion by 2032, growing at a CAGR of 4.26%.

- Growing demand for high-performance, radiation-hardened chips in avionics, radar, and satellite systems drives market expansion.

- Trends such as AI integration, miniaturization, and GaN and SiC semiconductor adoption enhance power efficiency and operational reliability.

- The market remains moderately consolidated, with leading players focusing on innovation, defense partnerships, and energy-efficient semiconductor manufacturing.

- North America holds a 39% share due to strong defense modernization, while the avionics systems and flight control segment leads application use with widespread adoption in commercial and military aircraft.

Market Segmentation Analysis:

By Technology

The Semiconductor Device in Aerospace and Defense Industry Market is segmented into surface-mount technology (SMT) and through-hole technology (THT). SMT dominates with a 64% share due to its compact design, automated assembly, and improved vibration resistance. Its high-density configuration enables lighter circuit assemblies crucial for avionics and radar systems. The growing use of miniaturized sensors and communication chips in satellite payloads also drives SMT demand. THT remains vital for high-power and thermal-critical applications such as missile guidance systems, ensuring durability and mechanical stability in extreme conditions.

- For instance, STMicroelectronics’ A/D-converter range uses 0.25 µm and 130 nm CMOS nodes and is radiation-hardened for satellite workloads. Its SMT modules support lightweight circuit assemblies for avionics and radar platforms.

By Application

Among applications, avionics systems and flight control dominate with a 38% share. This segment benefits from the rising integration of advanced semiconductor-based processors, microcontrollers, and sensors for real-time data management. Increasing aircraft automation and the need for redundant flight control architectures drive demand. Semiconductor devices also enhance efficiency in communication, navigation, and safety systems. Power management applications are expanding rapidly with modern aircraft adopting energy-efficient subsystems and intelligent voltage regulation components to optimize overall performance.

- For instance, Renesas Electronics Corporation offers radiation-hardened SMD products compliant with MIL-PRF-38535 and Class V standards in hermetic packages supporting temperature ranges from –55 °C to +125 °C.

By End User

The military aircraft segment leads with a 46% share due to extensive adoption of radar, electronic warfare, and guidance technologies. High-reliability semiconductors support mission-critical operations, improving responsiveness and survivability in hostile environments. Commercial aircraft follow, supported by rising deliveries of next-generation fleets with digital cockpit systems. Semiconductor devices also power satellite launch vehicles through radiation-hardened circuits ensuring operational stability in space. The “Others” category, including unmanned aerial vehicles and space probes, shows steady growth driven by ongoing R&D investments in lightweight and energy-efficient semiconductor architectures.

Key Growth Drivers

Rising Demand for Advanced Avionics Systems

The growing integration of advanced avionics and flight control technologies drives semiconductor adoption across the aerospace and defense industry. Semiconductor devices enable faster data processing, efficient power control, and improved signal integrity in modern aircraft. The shift toward digital cockpits, fly-by-wire systems, and real-time monitoring further boosts demand. Defense aircraft modernization programs also prioritize semiconductor-based radar, communication, and navigation modules for enhanced mission performance and reliability under extreme operational conditions.

- For instance, onsemi’s vertical GaN (vGaN) devices support voltages up to 1,200 V, switch at higher frequencies, and reduce system losses by approximately 50% compared to earlier GaN‐on‐silicon solutions.

Expansion of Satellite and Space Programs

Increasing investments in satellite constellations and space exploration missions fuel the need for radiation-hardened semiconductor devices. These components ensure performance stability under high-radiation and temperature variations in orbit. Growing participation from commercial satellite operators for communication and remote sensing applications amplifies semiconductor demand. The development of lightweight, power-efficient chips supports compact satellite designs, improving launch efficiency. Government-led programs and private collaborations continue to drive long-term growth in aerospace-grade semiconductor manufacturing.

- For instance, TPS7H6003-SP half-bridge GaN gate driver handles input voltages of up to 200 V, and its SN55HVD233-SEP CAN transceiver is immune to latch-up at 43 MeV⋅cm²/mg and qualified for total ionizing dose (TID) of 20 krad(Si).

Growth in Defense Electronics and Cybersecurity Systems

Rising defense budgets and strategic digitalization accelerate semiconductor deployment in communication, surveillance, and missile guidance systems. Modern defense platforms depend on high-speed processors, microcontrollers, and secure communication chips to maintain operational superiority. Semiconductor devices are essential for next-generation radar systems, electronic warfare equipment, and cybersecurity infrastructure. The focus on interoperability, real-time data sharing, and autonomous defense systems further amplifies the adoption of high-performance and AI-enabled semiconductor technologies.

Key Trends & Opportunities

Integration of GaN and SiC Power Devices

The adoption of gallium nitride (GaN) and silicon carbide (SiC) semiconductors is transforming aerospace and defense power electronics. These materials deliver higher power efficiency, faster switching speeds, and better thermal management. Aircraft power systems and satellite converters increasingly use GaN and SiC components to reduce weight and improve energy density. Manufacturers invest in high-voltage modules and wide-bandgap semiconductor technologies, creating opportunities for improved efficiency in radar transmitters, electric propulsion, and high-frequency communication systems.

- For instance, NXP Semiconductors’s MMRF5014H GaN-on-SiC transistor delivers 125 W CW output at 50 V in the 1-2700 MHz bandwidth and demonstrates over 20:1 VSWR ruggedness.

Miniaturization and Lightweight Semiconductor Packaging

The demand for miniaturized, lightweight semiconductor solutions continues to rise with the focus on reducing payload weight and enhancing fuel efficiency. Advanced packaging technologies such as 3D integration and system-on-chip (SoC) designs improve performance while lowering space requirements. This trend benefits unmanned aerial vehicles (UAVs), small satellites, and compact avionics systems. Industry leaders are developing robust microelectronics capable of enduring extreme vibration and temperature conditions, creating opportunities for innovative, high-reliability aerospace semiconductors.

- For instance, Analog Devices, Inc. (ADI) introduced a system-in-package (SiP) module compliant with MIL-PRF-38535 QML Level V, offering traceability to individual wafer lots and fabricated in facilities certified to AS9100 standards.

Increasing Use of AI and IoT in Aerospace Defense

Artificial intelligence (AI) and the Internet of Things (IoT) are revolutionizing aerospace and defense systems through smarter semiconductor integration. AI-driven chips enable predictive maintenance, adaptive flight control, and real-time threat analysis. IoT-connected sensors enhance situational awareness and system monitoring in aircraft and defense networks. Semiconductor manufacturers are designing edge AI processors and secure IoT modules tailored for high-speed communication, enabling data-driven decision-making and automation across complex defense architectures.

Key Challenges

High Manufacturing and Design Complexity

Producing aerospace-grade semiconductors involves stringent reliability, radiation tolerance, and temperature stability requirements. The complex fabrication process raises development costs and lengthens design cycles. Manufacturers face challenges in ensuring consistent performance under extreme environmental conditions. Achieving certification standards for military and space applications demands precision testing, specialized materials, and long-term validation. These factors limit scalability for smaller suppliers and slow new product commercialization timelines.

Supply Chain Constraints and Raw Material Shortages

The semiconductor supply chain remains vulnerable to disruptions in raw material sourcing and fabrication capacity. Critical components such as gallium, silicon carbide, and rare earth elements face global shortages, delaying production schedules. Defense procurement cycles further compound supply challenges due to strict security and traceability requirements. Dependence on a limited number of specialized foundries also restricts flexibility in meeting urgent military and aerospace demands, creating a need for localized manufacturing resilience.

Regional Analysis

North America

North America dominates the Semiconductor Device in Aerospace and Defense Industry Market with a 39% share. The United States leads due to strong defense modernization programs and extensive adoption of semiconductor-based radar, navigation, and surveillance systems. The presence of major aerospace manufacturers and semiconductor firms enhances regional innovation. High investments in AI-integrated avionics and satellite communication technologies further boost market growth. Canada supports this expansion through its increasing focus on advanced defense electronics and participation in joint space missions, strengthening North America’s leadership in high-performance semiconductor solutions.

Europe

Europe holds a 28% share in the Semiconductor Device in Aerospace and Defense Industry Market, driven by robust investments in defense electronics and space exploration. Countries such as Germany, France, and the United Kingdom spearhead semiconductor integration in military aircraft and satellite systems. The European Space Agency’s technology programs accelerate the adoption of radiation-hardened chips and high-reliability sensors. Collaborative defense projects like FCAS (Future Combat Air System) strengthen demand for advanced semiconductors. Increasing emphasis on sustainability and efficient energy management across aircraft systems further enhances Europe’s role in the global market.

Asia-Pacific

Asia-Pacific captures a 25% market share, propelled by rapid advancements in aerospace manufacturing and rising defense expenditures. China, Japan, South Korea, and India are key contributors, investing heavily in indigenous satellite programs and next-generation fighter aircraft. The region’s strong semiconductor fabrication base supports local supply capabilities for aerospace applications. Expanding partnerships between defense agencies and chipmakers foster innovation in avionics, radar, and communication modules. The growing demand for lightweight, high-efficiency semiconductors in UAVs and space vehicles continues to reinforce Asia-Pacific’s position as a high-growth market.

Latin America

Latin America accounts for a 5% share, supported by expanding aerospace maintenance, repair, and defense programs. Brazil leads regional adoption, leveraging semiconductor technologies in satellite development and air defense systems. Mexico follows with growing investments in aircraft component manufacturing and electronic system integration. Collaborative projects with global defense suppliers promote technology transfer and capability building. While the market remains in an early development phase, increased government initiatives in air traffic modernization and space research are expected to accelerate semiconductor deployment across the region.

Middle East & Africa

The Middle East & Africa region holds a 3% share of the Semiconductor Device in Aerospace and Defense Industry Market. The United Arab Emirates and Saudi Arabia drive demand through large-scale defense modernization and aerospace infrastructure projects. Investments in radar, surveillance, and communication systems stimulate semiconductor usage. Africa’s participation is growing through satellite communication and defense collaborations, particularly in South Africa and Nigeria. Limited local semiconductor manufacturing capacity remains a challenge; however, ongoing regional defense programs and industrial diversification strategies signal steady long-term growth potential.

Market Segmentations:

By Technology:

- Surface-mount technology (SMT)

- Through-hole technology (THT)

By Application:

- Avionics systems & flight control

- Communication & connectivity solutions

By End User:

- Commercial aircraft

- Military aircraft

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Semiconductor Device in Aerospace and Defense Industry Market players such as STMicroelectronics, Renesas Electronics, Intel Corporation, ON Semiconductor (onsemi), Texas Instruments, NXP Semiconductors, Analog Devices, Infineon Technologies, Xilinx (AMD), and Microchip Technology. The Semiconductor Device in Aerospace and Defense Industry Market features moderate consolidation, marked by innovation-driven competition among global semiconductor manufacturers. Companies focus on developing radiation-hardened, high-temperature, and ultra-reliable devices to support avionics, radar, satellite communication, and defense electronics. The market emphasizes compact and energy-efficient chipsets that enhance real-time data processing, system responsiveness, and safety under extreme environments. Continuous R&D in gallium nitride (GaN), silicon carbide (SiC), and AI-enabled semiconductors strengthens product differentiation. Strategic alliances with aerospace OEMs and defense contractors expand supply chain resilience and customization capabilities. Government-backed defense programs and satellite missions continue to stimulate technological collaboration and long-term demand for mission-critical semiconductor components worldwide.

Key Player Analysis

- STMicroelectronics

- Renesas Electronics

- Intel Corporation

- ON Semiconductor (onsemi)

- Texas Instruments

- NXP Semiconductors

- Analog Devices

- Infineon Technologies

- Xilinx (AMD)

- Microchip Technology

Recent Developments

- In January 2025, Honeywell and NXP Semiconductors announced their collaboration that will accelerate product development for the aviation industry, aiming to build systems that can securely control energy consumption. Honeywell Anthem cockpit, powered by NXP’s i.MX 8 applications processors, will enhance operational efficiency and safety while creating value for pilots and operators.

- In February 2024, Intel Corp. launched its Intel Foundry, a sustainable systems foundry aimed at supporting the AI era. This initiative seeks to address the increasing demand for AI-optimized semiconductors, which require cutting-edge, high-efficiency manufacturing processes that meet rigorous performance, energy, and environmental standards.

- In March 2023, Accenture Federal Services received a contract from the U.S. Customs and Border Protection (CBP) for IT infrastructure operations and modernization. Under this contract, the company will provide comprehensive technology support to several projects in charge of defending the country’s borders and facilitating authorized foreign travel & trade.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising investments in defense modernization and space exploration programs.

- Integration of GaN and SiC semiconductors will improve efficiency and thermal performance in high-power systems.

- AI-enabled chips will enhance automation, surveillance, and predictive maintenance in defense operations.

- Growing demand for radiation-hardened components will strengthen the satellite and deep-space segment.

- Miniaturization trends will drive development of lightweight, high-density semiconductor packaging for aircraft and UAVs.

- Increased cybersecurity requirements will boost adoption of secure embedded processors and encryption chips.

- Collaboration between semiconductor firms and aerospace OEMs will accelerate design of mission-specific solutions.

- Expanding use of 5G and IoT in defense networks will fuel semiconductor innovation for real-time communication.

- Regional semiconductor manufacturing initiatives will reduce supply chain dependency and enhance resilience.

- Government funding and R&D incentives will continue to advance next-generation aerospace semiconductor technologies.