Market Overview

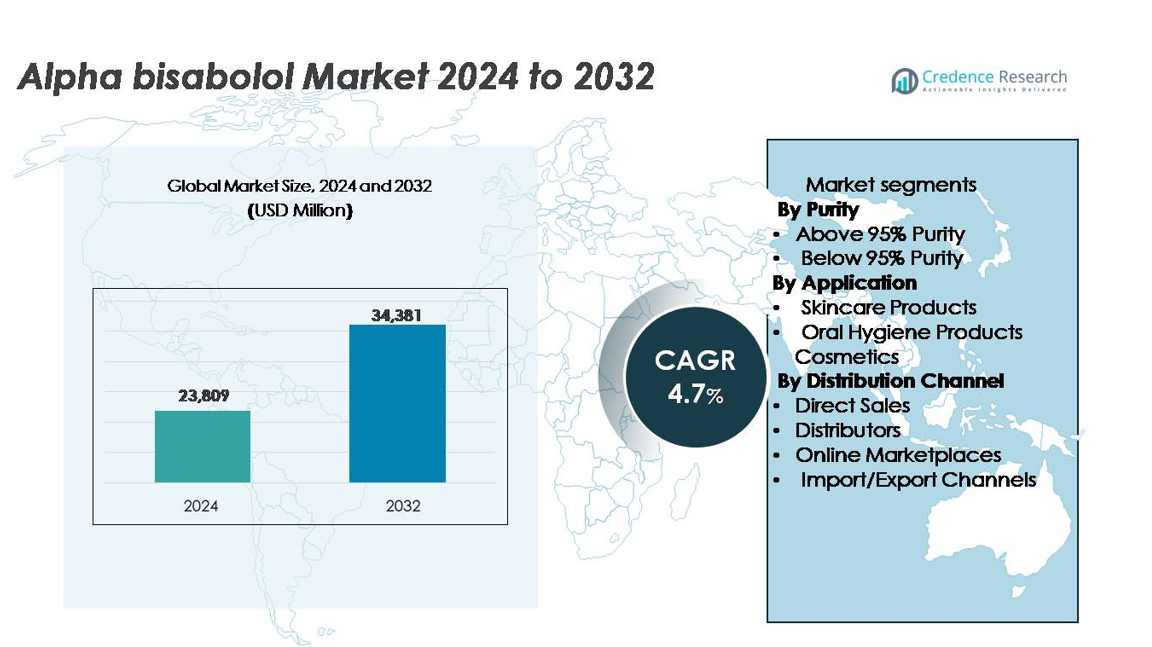

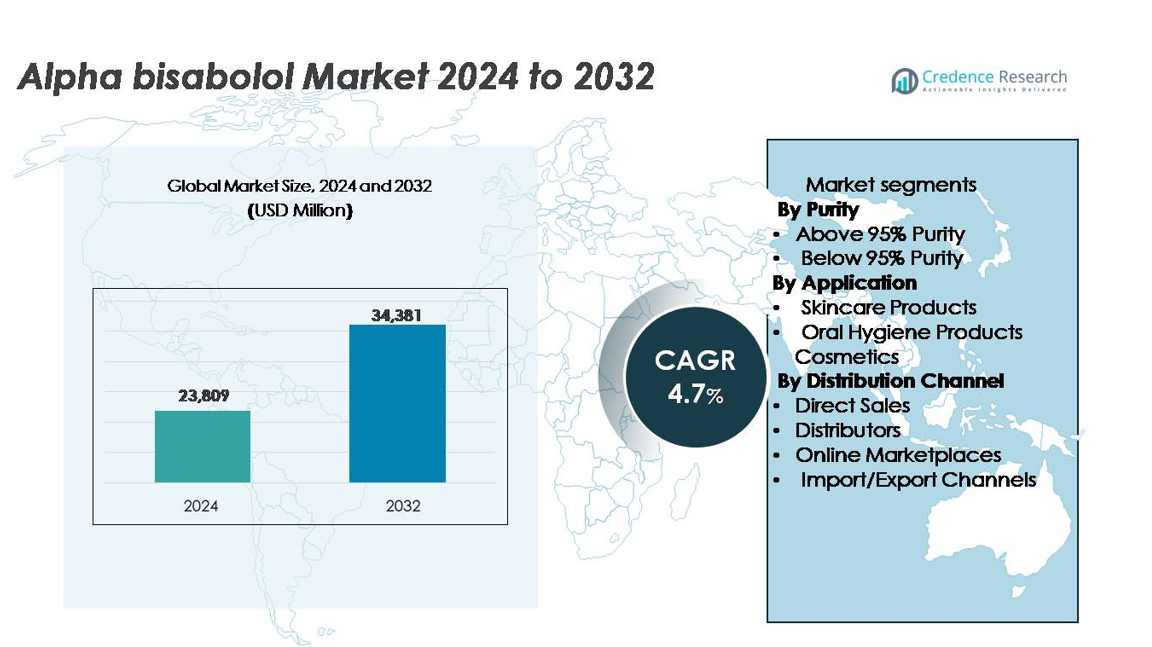

The Alpha Bisabolol market was valued at USD 23,809 million in 2024 and is projected to reach USD 34,381 million by 2032, expanding at a CAGR of 4.7% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Alpha Bisabolol Market Size 2024 |

USD 23,809 million |

| Alpha Bisabolol Market, CAGR |

4.7% |

| Alpha Bisabolol Market Size 2032 |

USD 34,381 million |

The Alpha Bisabolol market is led by major players such as BASF SE, Symrise AG, Ernesto Ventós S.A., Beraca Ingredientes Naturais S.A., Citroleo Group, and Givaudan SA, all competing through innovation, sustainable sourcing, and product diversification. These companies focus on high-purity extraction, biotechnological synthesis, and the development of eco-friendly ingredients for cosmetics and pharmaceuticals. BASF and Symrise dominate through large-scale production capacity and strong global distribution networks. North America leads the market with a 32% share, followed closely by Europe at 28%, supported by advanced R&D infrastructure and high consumer preference for natural, clean-label personal care products.

Market Insights

- The Alpha Bisabolol market was valued at USD 23,809 million in 2024 and is projected to reach USD 34,381 million by 2032, growing at a CAGR of 4.7% during the forecast period.

- Growing consumer demand for natural and sustainable cosmetic ingredients drives market growth, supported by the rising use of Alpha Bisabolol in skincare and pharmaceutical formulations.

- Increasing adoption of biotechnology-based production and expansion into men’s grooming and therapeutic skincare represent key market trends enhancing innovation and product diversity.

- The market is moderately consolidated, with BASF SE, Symrise AG, and Beraca Ingredientes Naturais S.A. leading through sustainable sourcing, high-purity grades, and strong global distribution.

- North America holds a 32% share, followed by Europe with 28%, and Asia-Pacific with 26%; the above 95% purity segment dominates with 67% share, driven by premium skincare and pharmaceutical applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Purity

The above 95% purity segment dominates the Alpha Bisabolol market with a 67% share. This grade is preferred across pharmaceutical, cosmetic, and skincare formulations due to its higher efficacy and safety profile. Manufacturers focus on ultra-refined extraction processes to maintain superior purity and stability. Its anti-inflammatory and antioxidant properties make it suitable for sensitive-skin formulations and premium personal care products. The below 95% purity segment serves cost-sensitive applications but faces limited demand due to lower bioactive performance compared to high-purity Alpha Bisabolol.

- For instance, BASF SE produces high-purity Alpha Bisabolol with a minimum assay of 98.5%, verified through gas chromatography, ensuring exceptional consistency in cosmetic and pharmaceutical applications.

By Application

The skincare products segment leads the market with a 52% share, driven by the rising use of Alpha Bisabolol in soothing and anti-aging formulations. The compound’s ability to enhance skin regeneration and reduce irritation supports its demand in moisturizers, serums, and sunscreens. Cosmetics and oral hygiene products also show notable growth as manufacturers integrate Alpha Bisabolol for its antimicrobial and fragrance-stabilizing properties. The increasing consumer preference for natural and sustainable ingredients further fuels product adoption across these applications.

- For instance, Symrise AG integrates Alpha Bisabolol with a purity level exceeding 99% in its SymRelief® 100 formulation, which demonstrated a 42% reduction in skin redness within 30 minutes of application during in-vitro testing.

By Distribution Channel

Direct sales hold the dominant position with a 44% market share, as leading producers and formulators establish long-term supply partnerships with cosmetics and pharmaceutical companies. This channel ensures product quality, consistency, and regulatory compliance, strengthening brand trust. Distributors and online marketplaces are expanding rapidly due to e-commerce growth and global accessibility of cosmetic-grade ingredients. Import and export channels play a key role in supplying high-purity Alpha Bisabolol across Europe, North America, and Asia-Pacific, enhancing international trade volumes.

Key Growth Drivers

Rising Demand for Natural and Sustainable Cosmetic Ingredients

The growing preference for plant-derived, eco-friendly ingredients is a key driver for the Alpha Bisabolol market. Consumers increasingly seek sustainable skincare and personal care products free from synthetic additives. Alpha Bisabolol, extracted mainly from Matricaria chamomilla and Vanillosmopsis erythropappa, offers strong anti-inflammatory and soothing properties. Its use in organic-certified formulations has surged, particularly in Europe and North America, where clean-label regulations are strict. Leading cosmetic manufacturers are reformulating products to include Alpha Bisabolol as a natural alternative to synthetic actives, strengthening its market penetration across premium skincare, haircare, and baby care categories.

- For instance, Symrise AG developed its Dragosantol® 100 product with a purity level exceeding 95 % and less than 0.1 % farnesol, enabling formulation into clean-label skincare lines.

Expanding Applications in Dermatological and Pharmaceutical Formulations

Alpha Bisabolol’s therapeutic potential is expanding its use in dermatological and pharmaceutical products. The compound’s antimicrobial, antioxidant, and wound-healing properties support its integration into creams, ointments, and medicated gels. Its high skin compatibility and penetration efficiency enhance drug delivery in topical formulations. Pharmaceutical companies leverage Alpha Bisabolol to reduce irritation in active compounds, improving treatment outcomes for eczema and dermatitis. Increasing clinical validation of its biological activities is encouraging broader pharmaceutical adoption. The rising consumer focus on multifunctional and safe dermatological solutions continues to boost Alpha Bisabolol’s growth in healthcare applications.

- For instance, Symrise AG’s ingredient, Dragosantol 100, is a highly purified, nature-identical alpha-bisabolol (α-bisabolol). Numerous in vitro and in vivo studies have consistently shown that α-bisabolol possesses significant anti-inflammatory and soothing properties.

Growing Utilization in Premium Personal Care and Fragrance Products

The global rise in luxury cosmetics and fine fragrances has boosted demand for Alpha Bisabolol as a functional and aromatic ingredient. Its mild floral scent and stability make it ideal for perfumes, lotions, and deodorants. The ingredient also acts as a fixative, enhancing fragrance longevity in premium products. Leading fragrance houses are integrating sustainably sourced Alpha Bisabolol to meet consumer expectations for natural compositions. The growing market for anti-aging and sensitive-skin care products further strengthens demand, as Alpha Bisabolol provides both functional performance and sensory appeal in high-end formulations.

Key Trends & Opportunities

Technological Advancements in Biotechnological Production

The shift toward biotechnology-based Alpha Bisabolol production is a major trend reshaping the market. Traditional extraction from candeia trees faces sustainability challenges, prompting a transition to fermentation-based methods using genetically engineered yeasts. This process enables consistent yield, purity control, and cost efficiency. Companies such as BASF and DSM are investing in bio-based production to align with green chemistry standards and reduce ecological impact. The growing acceptance of biotech-derived Alpha Bisabolol across cosmetics and pharmaceuticals creates a strong opportunity for scaling sustainable manufacturing globally.

- For instance, DSM produces a bio-based Alpha Bisabolol through a fermentation process, which is claimed to be a more efficient and sustainable method than conventional extraction from the Candeia tree, offering significant reductions in carbon emissions.

Rising Adoption in Men’s Grooming and Therapeutic Skincare

The rapid growth of the men’s grooming industry presents a new opportunity for Alpha Bisabolol applications. Its soothing and anti-inflammatory benefits are increasingly valued in aftershaves, beard oils, and post-sun products. Brands targeting sensitive skin and acne-prone consumers are incorporating Alpha Bisabolol to enhance product gentleness and efficacy. Moreover, its compatibility with essential oils and botanical extracts supports innovation in natural grooming formulations. The trend toward holistic wellness and preventive skincare will continue to expand its adoption across diverse personal care categories.

- For instance, Nivea Men formulates Alpha-bisabolol (also known simply as bisabolol or levomenol) into its Protect & Care (and other) ranges, and it is a known skin-soothing and anti-inflammatory ingredient typically derived from chamomile.

Expansion into Emerging Markets and Online Distribution Channels

Emerging economies in Asia-Pacific and Latin America are witnessing a surge in demand for cosmetic ingredients like Alpha Bisabolol due to rising disposable income and awareness of skincare benefits. Online distribution channels further support accessibility for small and medium manufacturers. E-commerce platforms allow ingredient suppliers to reach direct buyers globally, reducing dependency on traditional distributors. This digital shift enables price transparency and facilitates the adoption of high-purity grades among regional producers, driving overall market expansion.

Key Challenges

Supply Chain Constraints and Raw Material Sustainability

The Alpha Bisabolol market faces challenges in ensuring sustainable sourcing of candeia wood, the primary raw material for extraction. Overharvesting and limited availability have raised concerns about long-term supply stability and environmental impact. Regulatory restrictions on deforestation in Brazil, a key production hub, further constrain output. Companies are investing in reforestation projects and biotechnological alternatives to mitigate this issue. However, establishing sustainable supply chains remains costly and complex, creating a bottleneck for manufacturers relying on natural extraction methods.

High Production Costs and Market Price Volatility

The high cost of extraction and purification processes affects the overall profitability of Alpha Bisabolol producers. Maintaining consistent purity levels above 95% requires advanced equipment and strict quality control, increasing operational expenses. Additionally, fluctuations in raw material prices and transportation costs impact final product pricing, limiting competitiveness against synthetic substitutes. Manufacturers are addressing this challenge through process optimization and biotechnology innovations, yet balancing cost efficiency with sustainability and quality remains a significant barrier to broader market adoption.

Regional Analysis

North America

North America holds a 32% share of the Alpha Bisabolol market, driven by strong demand for natural and dermatologically safe ingredients in cosmetics and pharmaceuticals. The United States leads the region, supported by a high concentration of personal care brands focusing on anti-aging and sensitive-skin formulations. The growing trend toward clean-label and sustainable products further supports the adoption of bio-based Alpha Bisabolol. Strategic partnerships between cosmetic manufacturers and biotechnology firms are also enhancing supply chain efficiency and expanding product innovation in skincare and therapeutic applications.

Europe

Europe accounts for 28% of the Alpha Bisabolol market, anchored by robust demand from premium skincare and fragrance manufacturers in Germany, France, and the U.K. Strict regulatory frameworks promoting natural ingredients and sustainable sourcing have driven the preference for high-purity, plant-based Alpha Bisabolol. Major cosmetic brands are integrating the ingredient into organic-certified formulations to meet consumer expectations for eco-conscious beauty products. The European market benefits from technological advancements in biotechnological production, ensuring consistent quality and compliance with REACH and EU cosmetic regulations.

Asia-Pacific

Asia-Pacific commands a 26% share of the global Alpha Bisabolol market, emerging as the fastest-growing region. Rising disposable income, expanding beauty-conscious populations, and growing awareness of natural skincare benefits are key drivers. China, Japan, and South Korea dominate regional demand with strong cosmetic manufacturing bases. Local producers increasingly adopt biotechnological synthesis methods to reduce dependence on imported raw materials. The surge in e-commerce channels and K-beauty product exports further enhances Alpha Bisabolol’s visibility and accessibility across diverse personal care and pharmaceutical segments.

Latin America

Latin America represents 8% of the global Alpha Bisabolol market, with Brazil serving as both a leading producer and consumer. The region’s abundance of candeia trees provides a critical raw material source for natural Alpha Bisabolol extraction. Growing domestic demand for herbal cosmetics and pharmaceutical formulations supports market expansion. However, environmental regulations on deforestation are prompting a gradual shift toward sustainable forestry and synthetic alternatives. Local manufacturers are investing in eco-friendly extraction methods to align with international sustainability standards and attract export opportunities.

Middle East & Africa

The Middle East & Africa hold a 6% share of the Alpha Bisabolol market, driven by increasing adoption in luxury skincare and aromatherapy products. The demand is concentrated in the UAE, Saudi Arabia, and South Africa, where consumers favor premium and natural cosmetics. Import-dependent markets are witnessing growth through partnerships with European and Asian suppliers offering high-purity grades. Rising awareness of natural ingredient benefits and the expansion of regional distribution networks are expected to strengthen market presence across both personal care and pharmaceutical applications.

Market Segmentations:

By Purity

- Above 95% Purity

- Below 95% Purity

By Application

- Skincare Products

- Oral Hygiene Products

- Cosmetics

By Distribution Channel

- Direct Sales

- Distributors

- Online Marketplaces

- Import/Export Channels

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Alpha Bisabolol market is moderately consolidated, with key players focusing on product innovation, sustainable sourcing, and biotechnology integration to gain a competitive edge. Leading companies such as BASF SE, Symrise AG, Ernesto Ventós S.A., and Beraca Ingredientes Naturais S.A. dominate through advanced extraction and fermentation-based production technologies. These firms emphasize eco-friendly processes to reduce reliance on candeia wood, ensuring long-term supply stability. Strategic collaborations and acquisitions strengthen global distribution networks and enhance access to high-purity formulations. Mid-sized players are expanding through customized ingredient blends for skincare, pharmaceuticals, and fragrances. Additionally, technological advancements in bioengineering and increased investment in R&D enable consistent purity and performance, aligning with rising consumer demand for natural and sustainable products. The growing presence of Asian manufacturers offering competitively priced alternatives further intensifies market competition while pushing established brands to adopt transparent sourcing and certification practices.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Performance Chemicals

- HallStar

- Atina Sasol

- DKSH North America

- Kobo Products

- Biocosmethic

- Extracts & Ingredients

- BASF Care Creations

- EMD Chemicals

- Beijing Brilliance Bio

Recent Developments

- In October 2023, Isobionics®, a subsidiary of BASF Aroma Ingredients, announced that it is introducing two novel natural products to the taste industry. Isobionics® Natural alpha-Bisabolene 98 and Isobionics® Natural (-)-alpha-Bisabolol 99 are recent additions to the Isobionics portfolio, demonstrating our dedication to creating natural tastes based on consumer demands.

- In April 2023, AMRS announced the completion of the earlier strategic deal with Givaudan SA for the worldwide exclusive license of certain cosmetic ingredients, including Neossance Hemisqualane, Neossance Squalane, and CleanScreen. This marketing agreement builds on creating and commercializing the world’s largest supply of Bisabolol from Amyris’ precision fermentation technology.

- In 2023, BASF Aroma Ingredients will expand its Isobionics portfolio with new natural flavors. It includes Isobionics® Natural alpha-Bisabolene 98 and Isobionics® Natural alpha-Bisabolol 99. Further, Isobionics® Natural alpha-Bisabolol 99 offers a subtle hint of chamomile, along with hints of sweet, woody undertones, resulting in a truly unique flavor experience.

Report Coverage

The research report offers an in-depth analysis based on Purity, Application, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness steady growth driven by rising demand for natural cosmetic ingredients.

- Biotechnological production methods will gain prominence, ensuring sustainable and consistent supply.

- High-purity Alpha Bisabolol will remain the preferred grade for premium skincare and pharmaceutical products.

- Expanding use in men’s grooming and therapeutic skincare will create new opportunities.

- Global brands will increase investment in eco-friendly sourcing and sustainable manufacturing practices.

- The Asia-Pacific region will emerge as the fastest-growing market due to strong cosmetic manufacturing bases.

- Innovations in product formulations will enhance Alpha Bisabolol’s role in multifunctional skincare solutions.

- Strategic collaborations between biotechnology firms and cosmetic companies will boost product development.

- Market competition will intensify as new regional producers offer cost-effective, bio-based alternatives.

- Rising consumer awareness of clean-label and cruelty-free products will continue to drive long-term demand.