Market Overview:

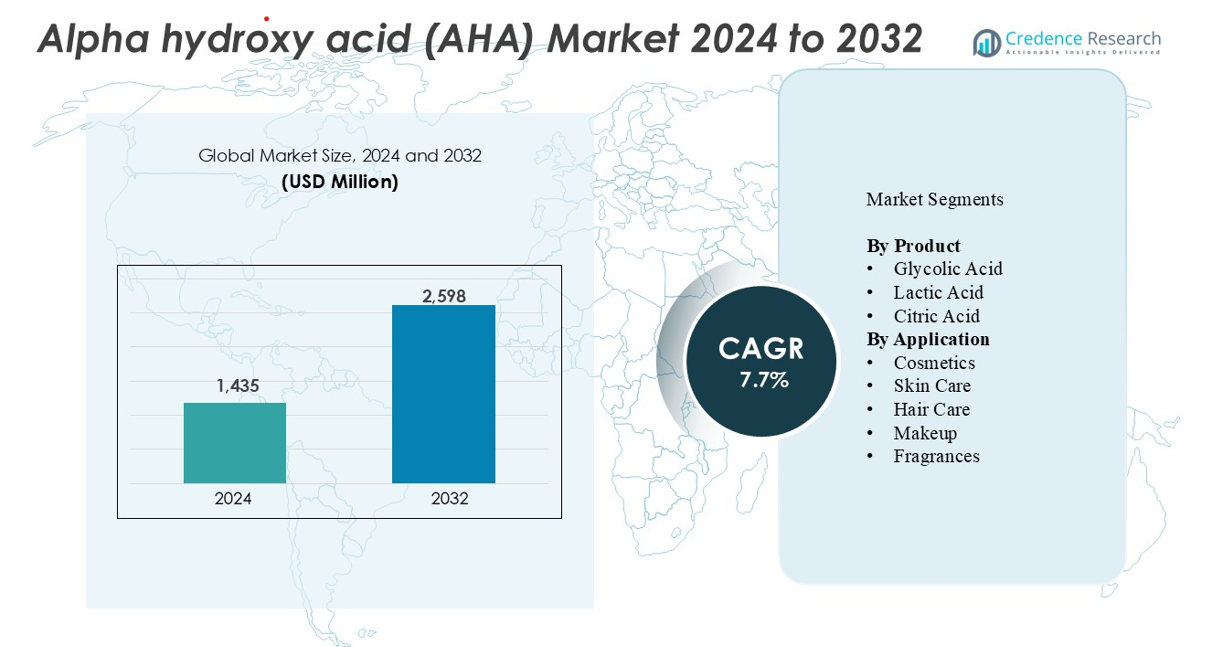

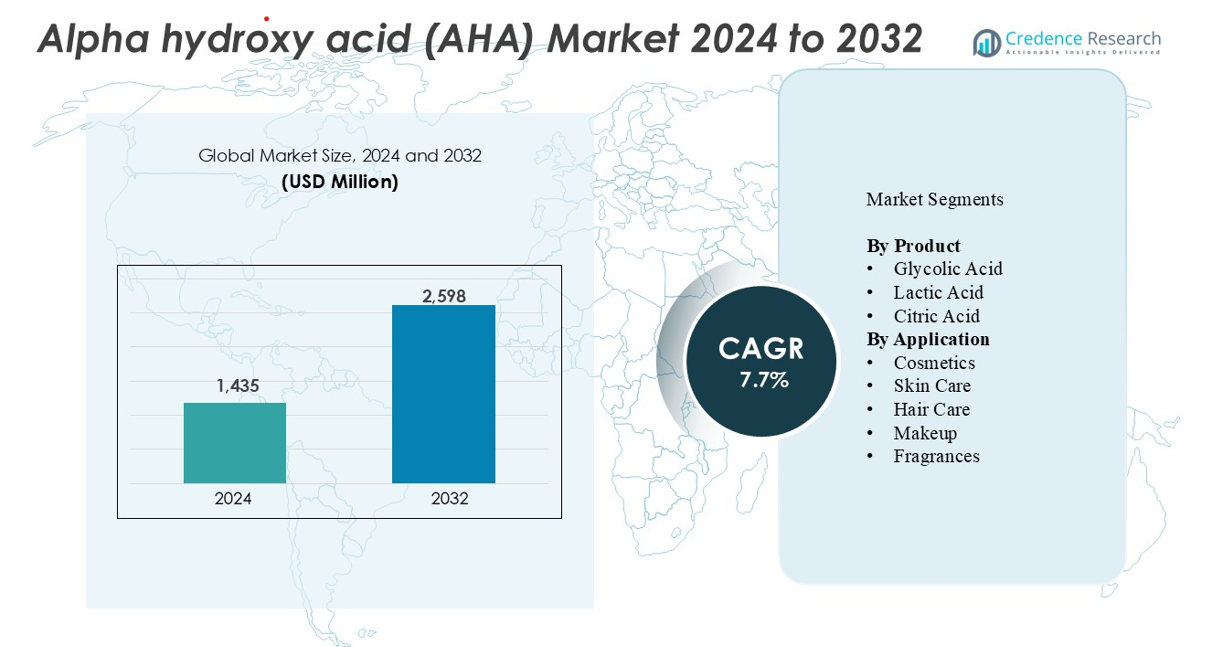

The Alpha Hydroxy Acid (AHA) Market was valued at USD 1,435 million in 2024 and is projected to reach USD 2,598 million by 2032, expanding at a CAGR of 7.7% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Alpha Hydroxy Acid (AHA) Market Size 2024 |

USD 1,435 million |

| Alpha Hydroxy Acid (AHA) Market, CAGR |

7.7% |

| Alpha Hydroxy Acid (AHA) Market Size 2032 |

USD 2,598 million |

Key players in the Alpha Hydroxy Acid (AHA) market include DuPont, Dow, Parchem Fine & Specialty Chemicals, CrossChem Ltd., and Ava Chemicals Pvt. Ltd. These companies maintain leadership through advanced production technologies, strong R&D capabilities, and a focus on high-purity formulations that meet stringent cosmetic and pharmaceutical standards. DuPont and Dow have invested heavily in sustainable chemical processes and bio-based raw material sourcing to meet growing consumer preference for clean-label skincare products. Regionally, North America dominates the market with about 33.2% share in 2024, supported by high consumer demand for premium skincare products and a well-established regulatory framework that promotes safe use of AHA-based formulations.

Market Insights

- The market size of the AHA market stood at USD 1,435 million in 2024, and is projected to reach USD 2,598 million by 2032, at a CAGR of 7.7%.

- Rising consumer focus on anti‑aging and skin‑renewal formulations drives the demand for glycolic and lactic acids in the product mix.

- Increasing launches of innovative multi‑acid blends and clean‑beauty AHAs present significant growth opportunities for manufacturers.

- Stringent regulations on AHA concentration and potential skin‑irritation risks act as primary restraints across regions.

- Regionally, North America holds about 33.2% share, the skin‑care application leads with ~60.2% share, and the glycolic acid sub‑segment dominates by product type.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Glycolic acid dominates the Alpha Hydroxy Acid (AHA) market with a 39% share in 2024. Its small molecular size enables deep skin penetration, making it highly effective in exfoliation and skin renewal. The growing demand for anti-aging and skin-brightening products drives its strong adoption across premium skincare and cosmetic formulations. Lactic acid follows closely due to its mild exfoliating nature and superior hydration properties, suitable for sensitive skin. Citric acid and other AHAs, such as malic and tartaric acids, are gaining traction for their antioxidant benefits and use in multi-acid formulations enhancing overall product efficacy.

- For instance, Industry data indicates that lactic acid is a very common and versatile ingredient used in a vast number of cosmetic products, including moisturizers, serums, cleansers, and chemical peels, with thousands of different formulations available on the global market.

By Application

Skin care is the leading application segment, holding 46% of the Alpha Hydroxy Acid market in 2024. The segment benefits from increasing consumer preference for chemical exfoliants and clinically proven ingredients that improve skin texture and tone. AHAs are widely used in serums, peels, and moisturizers targeting pigmentation, acne, and fine lines. Cosmetic and hair care applications are also expanding due to product diversification and AHA integration into scalp treatments and hair-conditioning formulas. Additionally, makeup and fragrance products increasingly incorporate AHAs for their skin-conditioning and stabilizing functions.

- For instance, according to the Cosmetic Ingredient Review, the ingredient Glycolic Acid appeared in 337 distinct cosmetic formulations in a recent assessment.

Key Growth Drivers

Rising Demand for Anti-Aging and Skin Renewal Products

The growing consumer focus on youthful and radiant skin strongly drives the Alpha Hydroxy Acid (AHA) market. Glycolic and lactic acids are increasingly used in anti-aging formulations due to their proven ability to exfoliate, stimulate collagen synthesis, and improve skin elasticity. Consumers are shifting from physical exfoliants to chemical alternatives for safer and more effective skin renewal. Brands are introducing advanced AHA-based serums, creams, and masks catering to diverse skin types. The rising influence of social media beauty trends and dermatologist-endorsed products continues to boost product adoption, especially among millennials and Gen Z consumers globally.

- For instance, CrossChem Ltd. markets its GlyAcid® 99 HP glycolic acid in crystalline form with a purity of 99.3% total acid and iron content below 1 ppm, produced without formaldehyde.

Expanding Application in Cosmetic and Personal Care Formulations

The growing integration of AHAs in cosmetics and personal care products is a key market driver. Manufacturers are adding AHAs to multifunctional products, including cleansers, toners, hair care, and even color cosmetics, to provide exfoliation, hydration, and enhanced absorption of active ingredients. AHAs improve product performance, creating smoother textures and better skin feel, enhancing consumer satisfaction. Increasing demand for premium formulations and clinical-grade cosmetic products is fueling innovation. Global cosmetic manufacturers invest in R&D to achieve optimal AHA concentrations that deliver efficacy while maintaining safety standards, further supporting market growth across developed and emerging economies.

- For instance, CrossChem Ltd. developed its GlyAcid® 70 HP grade with a total acid content of 71.1% and iron impurities at 2.19 ppm, enabling cleaner exfoliant formulations.

Growing Shift Toward Natural and Sustainable Ingredients

Sustainability and clean beauty trends are accelerating the adoption of naturally derived AHAs from fruits, sugarcane, and milk. Consumers are becoming more aware of ingredient sourcing, leading companies to focus on bio-based extraction and eco-friendly production processes. Brands such as The Ordinary and Paula’s Choice highlight transparency and ingredient origin, influencing consumer purchasing behavior. This shift also aligns with regulatory emphasis on biodegradable and non-toxic components. As formulators increasingly favor plant-based AHAs like citric and malic acids, the demand for sustainable raw material sourcing continues to strengthen the market’s growth trajectory.

Key Trends & Opportunities

Rising Innovation in Multi-Acid Formulations

Manufacturers are developing advanced multi-acid blends combining glycolic, lactic, and citric acids to deliver broader skincare benefits. These formulations enhance exfoliation, promote even skin tone, and reduce irritation associated with single-acid products. The trend toward customizable skincare and multifunctional actives supports innovation in this space. Companies are adopting encapsulation technologies to control AHA release and minimize sensitivity, improving consumer safety. This innovation is creating opportunities for brands to target diverse skin concerns such as hyperpigmentation, acne scars, and dullness through precise formulation strategies.

- For instance, Melumé introduced its Pro Strength Multi‑Acid Micro Peel³ combining three exfoliants and demonstrated through internal testing that the product reduced rough skin texture and improved radiance across more than 94 % of participants within eight weeks of supervised use.

Increasing Adoption of AHAs in Dermatological and Professional Treatments

Dermatologists and aesthetic clinics increasingly recommend AHA-based chemical peels and treatments due to their proven efficacy and minimal downtime. Clinical-grade formulations with controlled acid concentrations are widely used for acne management, photodamage repair, and wrinkle reduction. The rising number of professional skincare centers and growing acceptance of clinical beauty regimens drive market expansion. Furthermore, partnerships between skincare brands and dermatologists are promoting education on safe AHA use, enabling broader acceptance among consumers seeking science-backed skincare solutions.

- For instance, research published in Clinical, Cosmetic and Investigative Dermatology noted the use of glycolic acid peel concentrations of 30 %–50 % in skin explant models, which boosted markers of collagen and elastin synthesis, supporting use for photodamage repair and wrinkle reduction.

Growing Penetration of E-Commerce and Personalized Skincare Platforms

The rise of digital retail platforms and AI-driven skincare diagnostics is providing strong growth opportunities for AHA-based products. Online channels allow consumers to access detailed product information, reviews, and dermatologist recommendations. Personalized skincare platforms use data analytics to recommend specific AHA concentrations and combinations tailored to individual skin types. This shift toward customization strengthens consumer engagement and brand loyalty while expanding access to high-quality AHA formulations across global markets.

Key Challenges

Risk of Skin Irritation and Sensitivity

One of the major challenges in the Alpha Hydroxy Acid market is the potential for skin irritation and sensitivity, particularly at high acid concentrations. AHAs can cause redness, dryness, or peeling when not used correctly, discouraging some consumers from regular application. Regulatory guidelines, such as the U.S. FDA’s limit of 10% AHA in over-the-counter formulations, constrain product formulation flexibility. Brands must balance efficacy with safety through careful concentration control and pH adjustment. Continuous consumer education and dermatologist-endorsed usage instructions remain critical to overcoming safety concerns.

Stringent Regulatory and Labeling Requirements

The AHA market faces increasing regulatory scrutiny regarding ingredient safety, labeling, and permissible concentration levels across regions. Regulatory frameworks in North America, Europe, and Asia-Pacific vary, complicating global product launches. Manufacturers must invest in extensive testing and compliance documentation to meet these standards, increasing operational costs. Non-compliance risks product recalls and brand reputation damage. To address these challenges, leading players are adopting standardized testing protocols, transparency initiatives, and ingredient traceability systems, ensuring compliance while maintaining consumer trust in product safety and performance.

Regional Analysis

North America

North America holds a leading position with about 33.2% of the global AHA market. Robust demand stems from high skincare awareness, strong anti‑aging product adoption and advanced cosmetic industry infrastructure. The United States and Canada feature well‑established regulatory frameworks and wide availability of professional skincare treatments. Premium pricing, innovative formulations and a shift toward chemical exfoliants boost growth. Market expansion is supported by consumer spending power and digital retail channels that drive product discovery and adoption across skincare, hair‑care and makeup applications.

Europe

Europe accounts for approximately 29.5% of the AHA market share. The region benefits from mature beauty and personal‑care sectors, strong regulatory oversight and consumer preference for high‑quality, dermatologist‑endorsed products. Growth is driven by demand for anti‑aging, skin‑brightening and natural‑derived AHA variants. Countries like Germany, France and the UK lead via strong brand presence and innovation. While growth is somewhat slower than emerging regions, opportunities exist in premium niche segments and multifunctional formulations that appeal to discerning European consumers.

Asia‑Pacific

The Asia‑Pacific region holds around 25.3% of the global market share. Rapid growth stems from rising disposable incomes, growing skin‑care awareness in countries such as China, India, Japan and South Korea, and expanding e‑commerce penetration. Local brands and international entrants increasingly launch AHA‑based serums, masks and hair‑care innovations to meet demand. Cultural emphasis on skin health and anti‑aging, combined with urbanisation and digital beauty influencers, amplify adoption. This region offers strong upside potential, though regulatory fragmentation and varied consumer preferences present challenges.

Latin America

Latin America holds an estimated 5.3% of the AHA market share. Growth is driven by increasing skincare and personal‑care awareness, rising retail infrastructure, and growing access to global beauty brands. Regional demand is supported by climate‑related skin concerns and a younger demographic seeking affordable anti‑aging solutions. However, market penetration remains lower compared to North America and Europe due to economic volatility and less reticence in professional skincare channels. Brands that tailor pricing, distribution and product education stand to gain in this regional segment.

Middle East & Africa

The Middle East & Africa region contributes roughly 6.7% of the market share. Growth in this region is driven by rising affluence in Gulf states, expanding beauty retail networks, and growing acceptance of skincare treatments. Demand for luxury skincare and chemical exfoliants, including AHAs, is increasing among consumers seeking premium benefits. Challenges include regulatory variations, fragmented markets and lower overall penetration. However, the region presents opportunity through high‑end brand positioning, skincare tourism hubs and expansion of e‑commerce platforms.

Market Segmentations:

By Product

- Glycolic Acid

- Lactic Acid

- Citric Acid

By Application

- Cosmetics

- Skin Care

- Hair Care

- Makeup

- Fragrances

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

In the global Alpha‑Hydroxy Acids (AHAs) market, the competitive landscape features a mix of large chemical and specialty ingredient firms alongside agile niche players. Major suppliers such as DuPont, Dow Chemical Company, Parchem and CrossChem lead based on established production infrastructure, high‑purity acid grades and global distribution networks. These companies differentiate through formulation support, regulatory compliance, and customized blends tailored for cosmetic and dermatology uses. Niche players focus on bio‑based feedstocks, small‑batch production and sustainable sourcing to capture emerging “clean beauty” demand. The industry shows moderate concentration: the top tier of players serves the bulk of demand while specialized firms pursue growth in premium and niche segments. Suppliers compete on quality, cost‑leadership and innovation, driving consolidation, strategic partnerships and regional expansion as key strategic levers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Dow

- Mehul Dye Chem Industries

- Crosschem

- DuPont

- H Plus Limited

- Lotion Crafter

- Ava Chemicals

- Sculptra Aesthetics

- Parchem

- Airedale Chemical Company Limited

Recent Developments

- In February 2025, India’s automotive manufacturing sector saw adoption of ambient-temperature phosphate pretreatment (JSW MG Motor India–PPG Asian Paints initiative).

- In 2024, Foxtale collaborated with Nykaa to introduce body care products. It includes a body wash and lotion comprising glycolic acid and other ingredients. Glycolic acid is one of the types of alpha hydroxy acid and it is widely used in body care products to enhance skin tone and texture, further accelerating the market.

- In 2023, PureTech Scientific LLC acquired the glycolic acid business from The Chemours Company for USD 137 million. It makes PureTech Scientific a global leader in the organic synthesis of ultra-high purity alpha hydroxy acids for the Life Sciences and Specialty Chemical industries.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market for AHAs will expand as demand intensifies for effective exfoliation and skin renewal.

- Innovation in multi‑functional formulations blending glycolic, lactic and citric acids will open new consumer segments.

- Growth in e‑commerce and personalized skincare platforms will widen the reach of AHA‑based products.

- Rising consumer preference for clean‑label and plant‑derived AHAs will encourage eco‑friendly sourcing and branding.

- Geographic expansion into Asia Pacific and Latin America will drive fresh volume gains with emerging middle‑class consumers.

- Adoption of AHAs in hair care, makeup and non‑facial applications will broaden the product landscape.

- Strategic alliances and production scale‑up for bio‑based AHAs will reduce costs and stabilize supply chains.

- Regulatory harmonisation and clearer labeling standards will boost consumer trust and market penetration.

- Intense competitive pressure will push leadership toward premiumisation and high‑margin segments.

- Technical challenges around skin sensitivity and derivative safety will spur safer delivery systems and lower concentration formulations.