Market Overview:

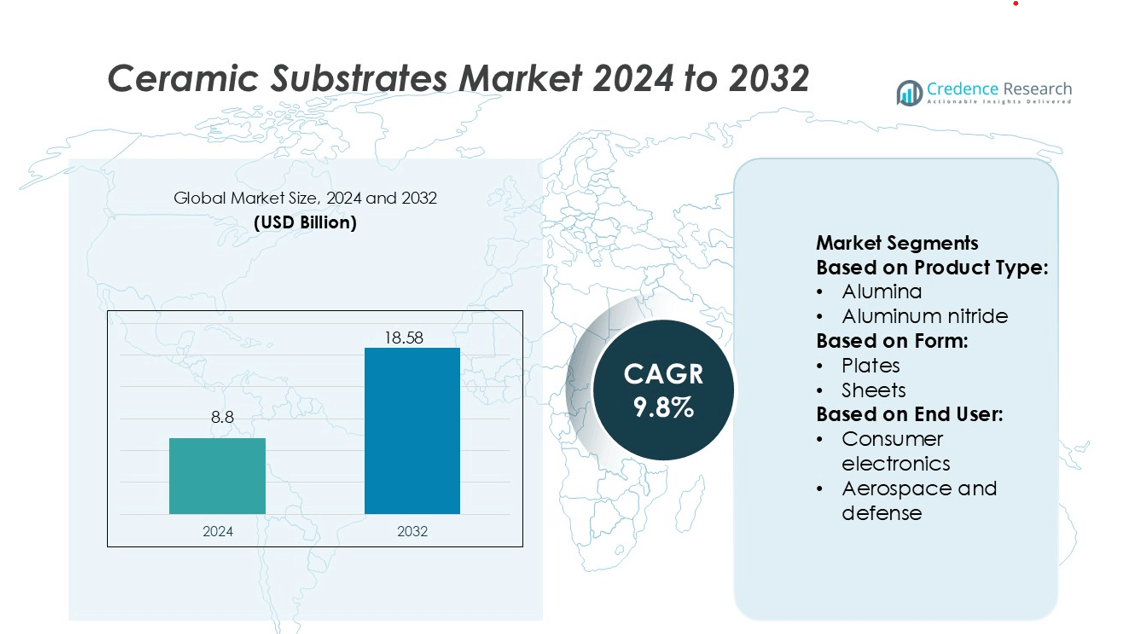

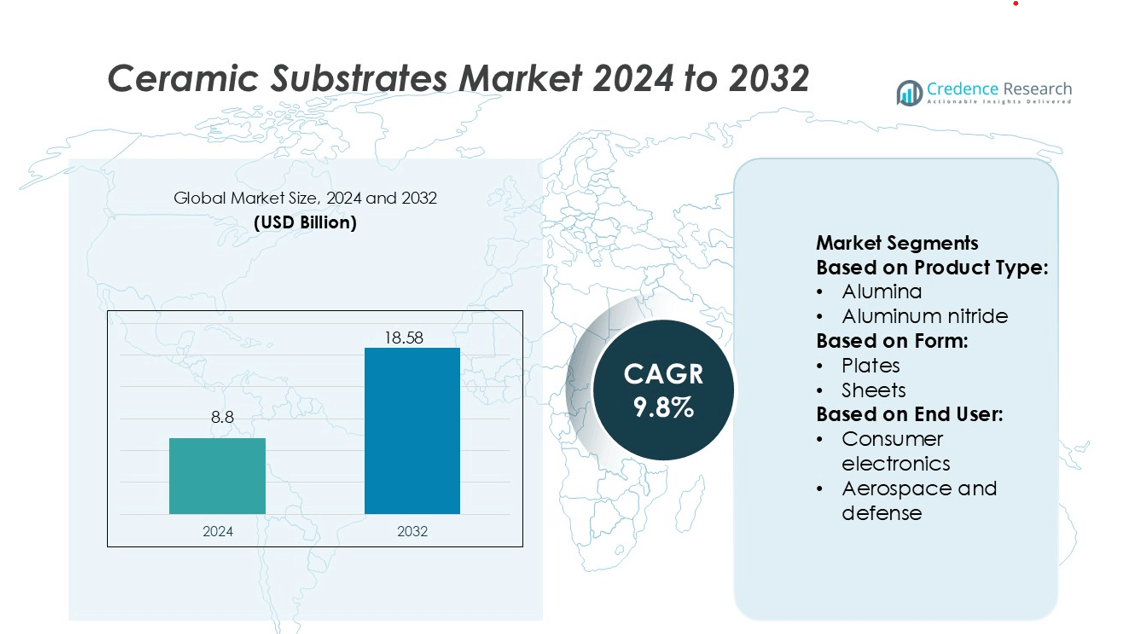

Ceramic Substrates Market size was valued USD 8.8 billion in 2024 and is anticipated to reach USD 18.58 billion by 2032, at a CAGR of 9.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ceramic Substrates Market Size 2024 |

USD 8.8 billion |

| Ceramic Substrates Market, CAGR |

9.8% |

| Ceramic Substrates Market Size 2032 |

USD 18.58 billion |

The Ceramic Substrates Market is led by major players including Ohara Inc., Dai Nippon Printing Co., Ltd., Schott AG, Shin-Etsu Chemical Co., Ltd., PLANOPTIK AG, Samtec, Corning Incorporated, SKC, AGC Inc., and Nippon Electric Glass Co., Ltd. These companies dominate through strategic investments in R&D and technological advancements, catering to high-demand industries such as automotive, electronics, and renewable energy. Asia-Pacific remains the leading region in the market, holding a significant market share due to rapid industrialization and strong demand from key economies like China and Japan. The region accounts for approximately 40-45% of the global market share, driven by robust manufacturing sectors and technological innovations in countries such as China and Japan. These companies are also expanding their global footprint to strengthen their position in Europe and North America.

Market Insights

- The Ceramic Substrates Market size was valued at USD 8.8 billion in 2024 and is projected to reach USD 18.58 billion by 2032, growing at a CAGR of 9.8% during the forecast period.

- The market is driven by increasing demand for high-performance ceramics in automotive, electronics, and renewable energy sectors.

- Technological advancements in ceramic materials, particularly for high-frequency devices and miniaturized electronics, are key market trends.

- The market faces challenges such as high production costs and limited availability of raw materials, which could restrain growth.

- Asia-Pacific is the dominant region, holding a 40-45% market share, driven by rapid industrialization and technological innovations in China and Japan, while North America and Europe continue to expand their presence.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

In the ceramic substrates market, the alumina sub‑segment is the dominant player, accounting for the largest share due to its combination of affordability, mechanical strength, and electrical insulating properties. Alumina substrates are widely used across industries, particularly in electronics and power modules, where reliable insulation and heat dissipation are crucial. The cost‑effectiveness of alumina, along with advances in manufacturing techniques, has made it the preferred choice for many applications, including thick‑film circuits, sensors, and LED packaging. Its dominance is further supported by its ability to meet the growing demand for compact and high‑performance electronic components.

- For instance, GRUPO PAMESA utilizes modern, large-scale continuous roller kilns, which are standard in high-volume porcelain tile manufacturing. The firing temperatures for durable porcelain and stoneware tiles generally exceed 1,200 °C.

By Form

Plates lead the form segmentation in the ceramic substrates market due to their ability to provide superior thermal management, mechanical strength, and stability, especially in high‑power applications. Ceramic plates are commonly used in power electronics, including automotive power modules, telecommunications base stations, and LED devices. Their versatility and reliability in heat dissipation and insulation have made them the go‑to choice in sectors that require high‑performance materials. The increasing demand for efficient, long‑lasting, and compact electronic components continues to drive the growth of the plates sub‑segment.

- For instance, Schott AG developed its “low‑loss glass” substrate solution with a dielectric constant of εr = 4.0 and a dielectric loss tangent of tan δ = 0.0021 at 10 GHz to support high‑frequency electronics. Ceramic plates are commonly used in power electronics including automotive modules, telecom base stations, and LED devices.

By End User

The consumer electronics sector holds the largest share of the ceramic substrates market, driven by the increasing need for high‑performance and miniaturized components in smartphones, laptops, and other portable devices. Ceramic substrates are essential in these devices due to their excellent electrical insulation and thermal management capabilities, which help prevent overheating and ensure stable performance. As the demand for smaller, more powerful, and energy‑efficient electronic devices grows, the need for reliable ceramic substrates continues to rise, making consumer electronics the dominant end‑user segment.

Key Growth Drivers

Growth in Consumer Electronics and 5G

The demand for ceramic substrates is increasing due to the growth of consumer electronics and the expansion of 5G networks. As more electronic devices require efficient thermal and electrical insulation, ceramics, particularly in semiconductor packaging, are essential. The rapid adoption of smartphones and other devices, along with the need for advanced 5G components, is driving the demand for high-quality ceramic substrates.

- For instance, Shin‑Etsu Chemical Co., Ltd. reports that its synthetic quartz glass substrate “VIOSIL‑SQ” exhibits dielectric loss tangent values of less than 0.0002 at frequencies above 10 GHz, making it suitable for high‑frequency RF device applications.

Expansion in Electric Vehicles and Power Electronics

Ceramic substrates are increasingly used in electric vehicles (EVs) and power electronics due to their ability to manage heat and enhance performance. With the rise of electric vehicles and stricter emissions regulations, the need for ceramic substrates in power modules and battery management systems is growing. This presents a significant opportunity for manufacturers in the automotive and energy sectors.

- For instance, Shin‑Etsu Chemical Co., Ltd. reports that its synthetic quartz glass substrate “VIOSIL‑SQ” exhibits a dielectric loss tangent of less than 0.0002 at frequencies above 10 GHz, making it highly suitable for high‑frequency RF components.

Advancements in Manufacturing Technology

Improvements in manufacturing processes, such as precision machining and advanced sintering, are reducing costs and improving the performance of ceramic substrates. These innovations are enabling more efficient production and expanding the range of applications for ceramic substrates, leading to increased adoption in high-performance industries.

Key Trends & Opportunities

Rising Demand for Aluminum Nitride and Silicon Nitride

Substrates made from aluminum nitride (AlN) and silicon nitride are becoming more popular due to their superior thermal conductivity. As industries demand better performance for high-power applications, these materials are gaining traction, opening opportunities for manufacturers to diversify their offerings.

- For instance, Samtec’s EXTreme Ten60Power™ connectors are rated at 60 A per power blade and support current-to-length density in low-profile 10 mm housings.

Opportunities in Emerging Markets

Emerging markets in regions like Asia‑Pacific, Latin America, and Eastern Europe are driving the growth of ceramic substrates. As electronics and automotive manufacturing rise in these regions, the demand for ceramic substrates is increasing. Manufacturers can tap into these growing markets by offering cost-effective solutions tailored to local needs.

- For instance, Corning Incorporated has advanced its ceramic substrate portfolio with the “Alumina Ribbon Ceramic” series, produced via a roll‑to‑roll format achieving substrate thicknesses as low as 40 µm and widths up to 100 mm.

Key Challenges

High Production Costs

The production of ceramic substrates remains expensive due to high raw material costs and energy requirements for manufacturing. This makes them less accessible for low-cost applications, limiting their adoption in price-sensitive markets. The high cost is a barrier for widespread use in certain industries.

Competition from Alternative Materials

Ceramic substrates face competition from other materials like metal core substrates and printed circuit boards. These alternatives often come at a lower cost and can sometimes offer similar performance. As a result, the ceramic substrate market must continue to innovate to maintain its competitive edge.

Regional Analysis

North America

North America holds around 25% of the global ceramic substrates market. The region benefits from strong demand in automotive electronics, aerospace, and high‑end consumer devices that require advanced substrates. With manufacturing hubs in the U.S. and Canada, companies increasingly invest in next‑generation ceramic platforms for power modules and semiconductors. The mature consumer electronics ecosystem and rising adoption of electric vehicles further support regional demand for ceramic substrates with better thermal and electrical performance.

Europe

Europe commands approximately 20% of the ceramic substrates market globally. The region’s share is driven by its strong automotive and aerospace sectors as well as well‑established electronics manufacturing in countries like Germany, France, and the UK. Manufacturers here focus on high‑reliability ceramic solutions for power electronics and industrial applications. The push for energy‑efficient components and stringent quality standards in Europe underpins the growth and sustained market presence of ceramic substrates.

Asia‑Pacific

Asia‑Pacific leads the ceramic substrates market with about 45% share worldwide. The region benefits from large electronics manufacturing bases in China, India, and Southeast Asia, and booming automotive and telecom sectors. Low manufacturing costs and rapid scaling of production facilities for ceramic substrates support this dominance. As consumer devices and power‑electronics applications surge in the region, Asia‑Pacific continues to command the largest volume in substrate consumption.

Latin America

Latin America accounts for approximately 8% of the global ceramic substrates market. Growth in this region is supported by increasing electronics manufacturing and automotive component production in countries such as Brazil and Mexico. However, price sensitivity and less developed manufacturing infrastructure limit broader penetration of advanced ceramic substrates. Companies that offer cost‑effective, regional‑specific solutions may tap into this evolving market.

Middle East & Africa (MEA)

The Middle East & Africa region holds nearly 2% of the ceramic substrates market. While demand is currently modest, growth is emerging through investments in telecommunications and industrial infrastructure. The adoption of ceramic substrates in power electronics and telecom equipment is gradually increasing. However, limited local manufacturing and dependence on imports constrain rapid expansion in the region.

Market Segmentations:

By Product Type:

By Form:

By End User:

- Consumer electronics

- Aerospace and defense

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Ceramic Substrates Market is highly competitive, with key players such as Ohara Inc., Dai Nippon Printing Co., Ltd., Schott AG, Shin-Etsu Chemical Co., Ltd., PLANOPTIK AG, Samtec, Corning Incorporated, SKC, AGC Inc., and Nippon Electric Glass Co., Ltd. The Ceramic Substrates Market is characterized by intense competition, driven by technological advancements and ongoing product innovations. Companies within the market are focusing on expanding their capabilities to meet the growing demand across various sectors, including electronics, automotive, and telecommunications. Investment in research and development is crucial, with key players developing specialized materials for applications in renewable energy and high-performance devices. Furthermore, as the market evolves, companies are increasingly looking to strengthen their global presence through strategic partnerships, mergers, and acquisitions. These efforts aim to leverage emerging opportunities and enhance production capabilities to cater to diverse industry requirements, positioning firms to thrive in an ever-changing market landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2025, AT&S secured a sustainability-linked loan from the International Finance Corporation (IFC), a World Bank Group institution, to support the development of its modern IC substrate plant in Kulim, Malaysia.

- In February 2025, ASE Group inaugurated its fifth chip packaging and testing facility in Penang, Malaysia. This new plant expanded its footprint to square feet. It introduced AIoT-driven automation for yield optimization and environmental sensing, reinforcing ASE’s global capacity to support GenAI, EV, and autonomous driving chip packaging.

- In June 2024, CeramTec has unveiled Sinalit, a new ceramic substrate crafted from silicon nitride (Si3N4). Designed to bolster power electronic modules, Sinalit boasts impressive flexural strength, commendable thermal conductivity, and top-notch electrical insulation. These attributes position it perfectly for high-demand sectors like e-mobility and renewable energy.

- In May 2023, CeramTec introduced Rubalit ZTA, a high-performance ceramic substrate that stands for Zirconia Toughened Alumina. This material combines aluminum oxide with zirconium oxide to create a substrate with enhanced properties like high flexural strength, excellent electrical insulation, and good thermal conductivity

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for ceramic substrates is expected to rise due to increasing applications in automotive electronics and renewable energy sectors.

- Technological advancements in ceramic materials will drive market growth, enhancing performance in high-frequency devices.

- The growing need for miniaturization in electronic components will create new opportunities for thin and advanced ceramic substrates.

- The market will benefit from the increasing adoption of electric vehicles, which require high-performance ceramic substrates for power electronics.

- A shift toward greener technologies will fuel the demand for ceramic substrates in energy-efficient devices and solar power applications.

- Asia-Pacific will continue to dominate the market due to rapid industrialization, especially in China and Japan.

- High-performance ceramics for aerospace and defense applications will become a key driver of growth in niche markets.

- The rise of 5G networks will increase demand for ceramic substrates in telecom infrastructure and electronic devices.

- Automation and Industry 4.0 will drive the need for precision ceramics in manufacturing processes.

- Companies will increasingly focus on sustainable production practices, leading to innovations in eco-friendly ceramic materials.