Market Overview:

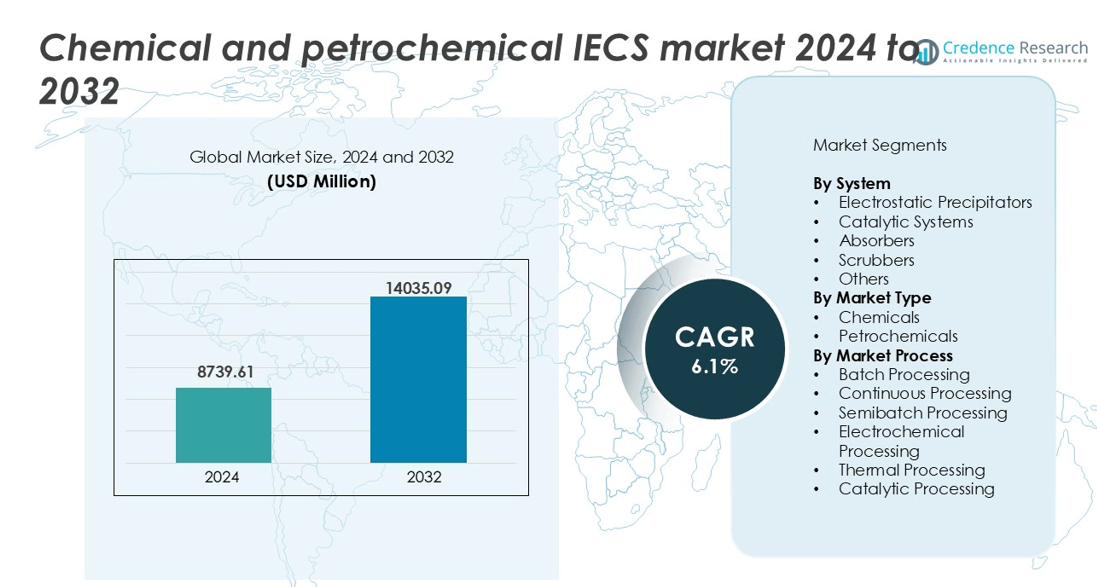

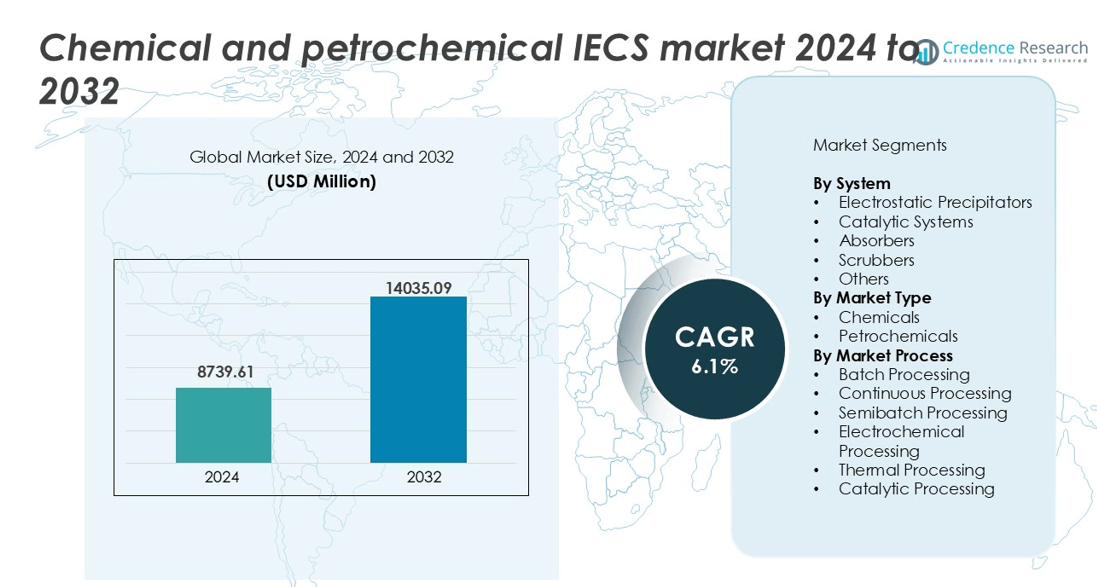

Chemical and petrochemical IECS market was valued at USD 8739.61 million in 2024 and is anticipated to reach USD 14035.09 million by 2032, growing at a CAGR of 6.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chemical and Petrochemical IECS Market Size 2024 |

USD 8739.61 million |

| Chemical and Petrochemical IECS Market, CAGR |

6.1% |

| Chemical and Petrochemical IECS Market Size 2032 |

USD 14035.09 million |

The Chemical and Petrochemical IECS market features strong competition among global and regional suppliers such as APC Technologies, BASF SE, Fujian Longking, GEA Group, CECO Environmental, Babcock & Wilcox, DÜRR Group, Fuel Tech, FLSmidth, and General Electric. These companies provide electrostatic precipitators, catalytic systems, scrubbers, and absorbers tailored for refineries, petrochemical complexes, and chemical processing plants. Product innovation focuses on energy-efficient designs, modular retrofits, and automation-driven emission monitoring to meet strict air-quality regulations. Asia-Pacific leads the market with 39% share, supported by large refinery-to-chemical projects, expansion of polymer capacity, and modernization of older production units across China, India, and Southeast Asia

Market Insights

- The Chemical and Petrochemical IECS market is valued in 8739.61millions of USD in 2024 and grows at a steady CAGR of 6.1% during the forecast period.

- Emission control demand rises due to strict SOx, NOx, VOC, and particulate regulations in refineries, petrochemical plants, and chemical processing units, pushing operators to upgrade scrubbing and catalytic systems.

- A key trend is the shift toward energy-efficient and modular systems, along with digital monitoring platforms that reduce operational costs and support real-time compliance.

- Top players such as APC Technologies, Fujian Longking, CECO Environmental, Babcock & Wilcox, and GEA Group compete through technology upgrades, retrofit-friendly designs, and turnkey installation capabilities.

- Asia-Pacific holds the highest regional share at 39%, while electrostatic precipitators lead system adoption with the largest segment share, driven by high-volume particulate control requirements in large integrated petrochemical and chemical complexes.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By System

Electrostatic precipitators lead this segment with 42% market share due to their high dust removal efficiency in large chemical and petrochemical plants. These systems support regulations on particulate matter and hazardous emissions. Scrubbers and absorbers see steady adoption for controlling SOx, NOx, and VOCs, mainly in fertilizer and specialty chemical units. Catalytic systems gain traction in downstream petrochemical facilities focused on cleaner fuel production. Growth is driven by strict air-quality laws, plant modernization, and demand for reliable, low-maintenance emission solutions.

- For instance, Babcock & Wilcox’s (B&W) confirms that its dry electrostatic precipitators (ESPs) are capable of achieving a high particulate collection efficiency of “up to 99.9+%”.

By Market Type

The petrochemicals segment dominates with 57% market share, supported by large-scale refining and polymer production. High emission volumes from crackers, reformers, and catalytic units push refineries to invest in advanced emission control technologies. The chemicals segment expands with demand from dyes, agrochemicals, and industrial gases. Rising green regulations, global fuel-standard upgrades, and expansion of petrochemical complexes across Asia and the Middle East drive steady equipment procurement across both segments.

- For instance, CECO Environmental (specifically its HEE-Duall brand) manufactures fans for systems with airflows up to 165,000 cfm. 165,000 cfm is approximately 280,000 Nm³/h (depending on exact pressure and temperature), so a flow rate of 250,000 Nm³/h is within the range of their equipment’s capabilities.

By Market Process

Continuous processing holds the largest share at 48%, driven by high-throughput plants and integrated production lines that require uninterrupted emission control. Thermal and catalytic processing units also adopt advanced systems due to high-temperature gas streams and stricter SOx/NOx control needs. Batch and semibatch processes show growth in pharmaceuticals, fine chemicals, and specialty polymers. The shift toward energy-efficient, automated, and compliance-ready emission management pushes investment in robust systems that operate reliably in continuous production environments.

Key Growth Drivers

Stringent Global Emission Regulations

Governments continue to tighten emission standards for SOx, NOx, hydrocarbons, particulate matter, and hazardous air pollutants released from refineries and chemical plants. Compliance deadlines push operators to replace outdated control systems with modern electrostatic precipitators, scrubbers, catalytic converters, and absorbers. Regulators in the U.S., EU, India, and China enforce strict limits on stack emissions, leak detection, and continuous monitoring, making emission control equipment essential for plant expansions and new projects. The rise in petrochemical investments, including polymer and specialty chemical capacity, further increases the demand for high-efficiency equipment. As companies focus on environment, sustainability, and governance (ESG) commitments, adoption of low-maintenance, energy-efficient emission control technologies accelerates. Investments in refinery upgrades, clean fuel standards, and carbon-reduction programs also strengthen long-term growth.

- For instance, A new EnviNOx® unit at the Ludwigshafen site, operational in the second half of 2022, demonstrated an effective reduction of N₂O emissions by more than 99%.

Expansion of Petrochemical and Specialty Chemical Production

Global demand for plastics, synthetic rubbers, detergents, fertilizers, dyes, and industrial chemicals continues to expand, boosting capacity additions in petrochemical and specialty chemical industries. Large-scale crackers, polymer units, and chemical reactors generate high-volume exhaust streams containing dust, VOCs, and greenhouse gases, making modern emission control systems critical. Producers in Asia-Pacific and the Middle East drive demand through new refinery-integrated petrochemical complexes aimed at exports and domestic consumption. Investment in downstream chemical processing, fuel-quality enhancements, and waste-to-chemical technologies also pushes procurement of absorbers, catalytic systems, and scrubbers. As production scales up, companies need reliable, automated solutions to reduce operational downtime and meet safety norms, increasing adoption of integrated emission control systems.

- For instance, DÜRR Group supplied VOC abatement systems to a petrochemical resin producer with a documented treatment capacity exceeding 300,000 Nm³/h of solvent-laden air, achieving certified VOC destruction efficiency of 99.8% according to plant performance records.

Technological Advancements and Automation

Modern emission control systems are shifting toward digital monitoring, advanced filtration media, high-efficiency catalysts, corrosion-resistant materials, and automated process control. Remote diagnostics and predictive maintenance reduce downtime and long-term operating costs, making them attractive for high-capacity plants. New designs in electrostatic precipitators, regenerative thermal oxidizers, wet scrubbers, and catalytic reduction systems deliver higher removal efficiency for diverse pollutants, including VOCs, toxic gases, and odors. Manufacturers also offer compact, modular solutions suitable for plant retrofits. As industries prioritize energy-efficient and eco-friendly operations, adoption of advanced emission control technologies strengthens market growth. Integration with IoT-based monitoring platforms and continuous emission monitoring systems (CEMS) further supports compliance and performance reporting.

Key Trend & Opportunity

Growing Shift Toward Energy-Efficient Emission Control

Energy consumption is a major cost factor in traditional pollution control equipment, especially in refineries and heavy chemical plants. A key trend is the adoption of low-energy scrubbers, heat recovery solutions, hybrid absorbers, and advanced catalysts that reduce power use while maintaining high removal efficiency. Manufacturers are launching optimized fan systems, corrosion-resistant internals, lightweight materials, and smart control systems to cut operating costs. Increasing focus on decarbonization and carbon capture also opens new opportunities for emission control suppliers. Plants now prefer systems that combine particulate removal, odor control, and gas scrubbing in a single integrated unit, supporting space-saving and energy-efficient operations.

- For instance, DÜRR Group’s regenerative thermal oxidizer platform has delivered heat recovery efficiencies of 95%, confirmed in operational data from installations treating more than 250,000 Nm³/h of VOC-laden exhaust.

Rising Adoption of Modular and Retrofit-Friendly Systems

Many refineries and chemical units operate older infrastructure, making equipment replacement costly and complex. A growing trend is demand for modular, plug-and-play emission control systems that offer shorter installation time and minimal production interruptions. Compact catalytic units, skid-mounted scrubbers, and modular precipitators help upgrade aging plants without major structural changes. Suppliers also offer retrofit packages that enhance performance of existing systems through upgraded internals, high-efficiency filters, or digital monitoring layers. This creates strong growth potential in developing markets that operate legacy chemical plants and aim to meet new emission standards without fully rebuilding facilities.

- For instance, Fuel Tech is a legitimate company that provides air pollution control (APC) technologies, including systems for particulate matter (PM) control designed to increase the capture of fine particulates.

Key Challenge

High Capital and Operating Costs

Advanced emission control systems require significant investment in procurement, installation, utilities, maintenance, and periodic replacement of filters, catalysts, and corrosion components. Small and mid-sized chemical producers often struggle with cost barriers, especially in competitive or low-margin product segments. Energy-intensive technologies such as thermal oxidizers and heavy-duty scrubbers add long-term operational burden. For many regions, funding support or subsidies remain limited, slowing adoption. Companies aiming for compliance may delay upgrades to manage budgets, particularly when existing systems operate near threshold limits. Price sensitivity and lack of flexible financing options continue to be major challenges in widespread modernization.

Complex Integration with Legacy Plant Infrastructure

Many chemical and petrochemical plants run on decades-old layouts, making integration of modern emission systems difficult. Space restrictions, outdated ducting, inconsistent gas volumes, and fluctuating temperatures can limit the effectiveness of new technologies unless customized engineering is used. Retrofitting requires shutdowns, structural modification, and technical adjustments that increase cost and risk. Older facilities also lack digital monitoring and automation, making it harder to pair advanced sensors or CEMS platforms with existing equipment. This challenge is significant in regions where older plants dominate production, slowing large-scale deployment of advanced emission control solutions.

Regional Analysis

North America

North America holds 28% market share, driven by strict emission compliance for refineries, chemical processing units, and fertilizer plants. The U.S. enforces strong EPA mandates for SOx, NOx, VOCs, and particulate emissions, pushing operators to install high-efficiency scrubbers, catalytic converters, and electrostatic precipitators. Growth also comes from refinery modernization, shale-based petrochemicals, and strong adoption of continuous emission monitoring systems. Canada increases investment in clean-fuel upgrades and low-carbon chemical production, supporting equipment demand. Technology-driven retrofits strengthen replacement cycles, while strong sustainability targets encourage energy-efficient and automated emission control systems.

Europe

Europe commands 24% market share, supported by aggressive decarbonization policies and strict industrial emission directives. Refineries, polymer producers, and specialty chemical manufacturers adopt catalytic and absorber systems to meet VOC and greenhouse-gas regulations. Germany, France, Italy, and the Netherlands lead adoption through modern integrated chemical parks. The shift toward hydrogen, bio-based chemicals, and circular plastics increases requirement for advanced emission control in high-temperature and solvent-rich processes. Strong compliance frameworks and early adoption of automation and continuous monitoring technologies reinforce steady equipment replacement cycles across the region.

Asia-Pacific

Asia-Pacific leads globally with 39% market share, driven by rapid petrochemical expansion in China, India, South Korea, and Southeast Asia. Massive refinery-to-chemicals complexes, polymer plants, and fertilizer projects generate large exhaust streams, creating strong demand for scrubbers, absorbers, and electrostatic precipitators. Governments enforce stricter air-quality standards in industrial hubs, accelerating modernization of older equipment. Local manufacturing capacity and cost-competitive system suppliers support high-volume installations. Growing investment in specialty chemicals, synthetic rubbers, and intermediates also boosts procurement of automated, high-efficiency emission control systems across the region.

Middle East & Africa

The Middle East & Africa hold 6% market share, supported by large-scale refining and gas-to-chemical investments in Saudi Arabia, UAE, and Qatar. New integrated petrochemical complexes use advanced catalytic and thermal emission control systems to meet environmental and ESG standards for exports. Older refinery units in Africa upgrade scrubbers and absorbers as governments tighten pollution limits. Growth remains steady, driven by modernization of existing fuel and chemical plants and technology adoption in cleaner fuel processing. However, cost sensitivity and limited local system suppliers slow widespread retrofits.

Latin America

Latin America accounts for 3% market share, with demand concentrated in Brazil, Mexico, and Argentina. Chemical producers and refineries upgrade emission systems to meet evolving regulatory requirements, especially for VOCs and particulate control. Investments in fertilizers, coatings, resins, and polymers support new installations of absorbers and catalytic systems. Adoption remains moderate due to economic constraints and reliance on imported technologies. However, modernization of aging refineries and increased environmental monitoring requirements create long-term opportunities for efficient, automated emission control equipment in regional chemical hubs.

Market Segmentations:

By System

- Electrostatic Precipitators

- Catalytic Systems

- Absorbers

- Scrubbers

- Others

By Market Type

By Market Process

- Batch Processing

- Continuous Processing

- Semibatch Processing

- Electrochemical Processing

- Thermal Processing

- Catalytic Processing

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Chemical and Petrochemical Industrial Emission Control Systems market features global engineering companies, technology innovators, and specialized system suppliers offering scrubbers, catalytic converters, absorbers, and electrostatic precipitators. Players differentiate through energy-efficient designs, corrosion-resistant materials, modular construction, and automated monitoring platforms that support continuous compliance. Companies expand portfolios with retrofit-friendly solutions and turnkey installations to meet strict regulatory norms across refineries, polymer units, fertilizer plants, and specialty chemical facilities. Many firms focus on R&D to improve pollutant removal efficiency for SOx, NOx, VOCs, and particulate emissions. Strategic partnerships with EPC contractors, refinery operators, and chemical producers strengthen market visibility. Asia-Pacific suppliers offer cost-competitive systems, while North American and European manufacturers compete on technological depth and advanced digital control. As industries modernize and adopt sustainable operations, competition shifts toward smarter, low-maintenance, and high-efficiency solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DÜRR Group

- General Electric

- APC Technologies, Inc.

- Fujian Longking Co., Ltd.

- Fuel Tech Inc.

- BASF SE

- CECO ENVIRONMENTAL

- GEA Group

- FLD Smidth

- Babcock & Wilcox Enterprises, Inc.

Recent Developments

- In November 2025 November, Dürr Group Completed sale of its environmental technology unit to Stellex; launched “Dürr CTS” as a standalone air-pollution control business focused on VOC and noise abatement for process industries.

- In June 2024, APC Technologies, Inc. Released a chemical-sector case study for adhesives production showing control of condensed VOCs and aerosols to meet opacity limit

Report Coverage

The research report offers an in-depth analysis based on System, Market Type, Market Process and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of smart and automated emission control systems will increase across large chemical complexes.

- More refineries and petrochemical plants will replace aging scrubbers and catalytic units with high-efficiency designs.

- Demand for retrofit-friendly and modular systems will rise as older plants upgrade without long shutdowns.

- Energy-efficient emission control equipment will gain priority to reduce long-term operating costs.

- Continuous emission monitoring and digital diagnostics will become standard for compliance reporting.

- Growth in specialty chemicals and polymer capacity will create steady demand for advanced systems.

- Hydrogen, bio-based chemicals, and cleaner fuel projects will require new emission handling solutions.

- Local manufacturing of emission control equipment will expand in Asia-Pacific to support rapid installations.

- More companies will integrate corrosion-resistant materials to improve equipment life in harsh chemical environments.

- Stronger ESG targets and air-quality regulations will continue to drive investment in pollution control technologies.