Market Overview:

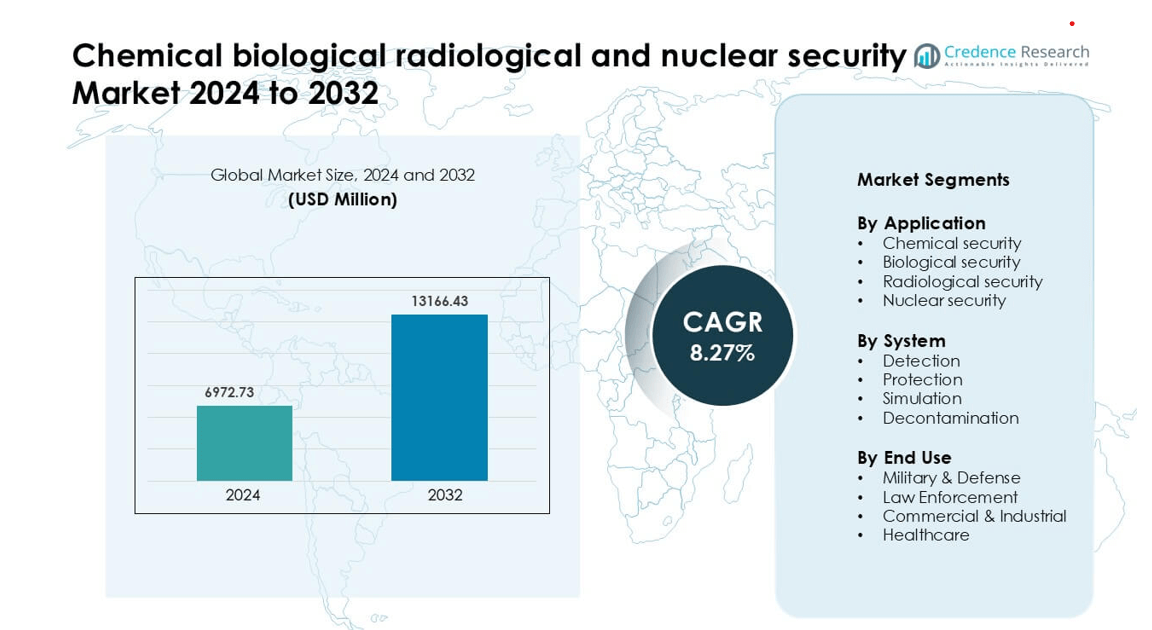

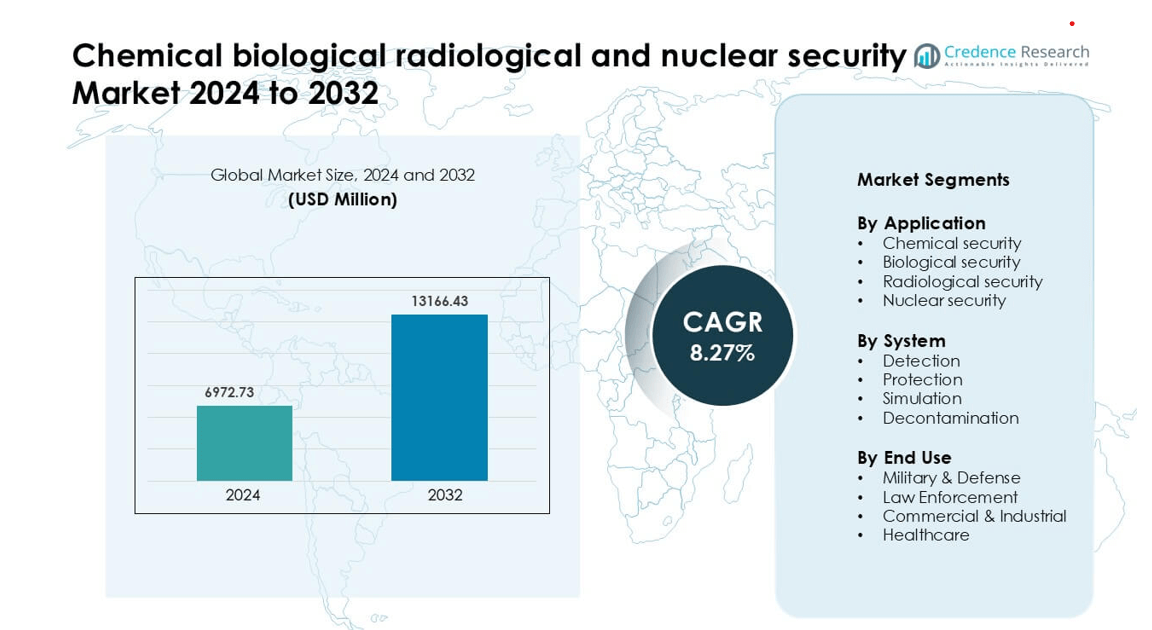

Chemical biological radiological and nuclear security market was valued at USD 6972.73 million in 2024 and is anticipated to reach USD 13166.43 million by 2032, growing at a CAGR of 8.27% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chemical, Biological, Radiological and Nuclear (CBRN) Security Market Size 2024 |

USD 6972.73 million |

| Chemical, Biological, Radiological and Nuclear (CBRN) Security Market , CAGR |

8.27% |

| Chemical, Biological, Radiological and Nuclear (CBRN) Security Market Size 2032 |

USD 13166.43 million |

Leading companies in the chemical, biological, radiological, and nuclear security market focus on advanced detection, protective gear, robotics, and decontamination solutions for defense and industrial safety. Key players include Bruker Corporation, Bioquell, Thales Group, Alfred Kärcher GmbH & Co. KG, MSA Safety, Smiths Group Plc, Battelle, Chemring Group Plc, America Corporation, Rheinmetall AG, and FLIR Systems, Inc. These firms expand portfolios through AI-enabled detection, rugged field systems, and military-grade protective equipment. Governments favor suppliers with strong R&D, proven field performance, and reliable after-sales service. North America leads the market with 37% share, driven by high homeland security spending, border surveillance upgrades, industrial safety regulations, and strong presence of major technology developers.

Market Insights

- The Chemical, Biological, Radiological, and Nuclear security market is projected to grow from USD 6972.73 in 2024 to USD 13166.43 by 2032 at a CAGR of 8.72%.

- Growing investments in border surveillance, emergency response systems, and industrial safety drive adoption of advanced detection, protection, and decontamination technologies across defense and civilian sectors.

- AI-enabled detectors, remote robotic monitoring, and simulation-based training systems represent key trends, with companies innovating portable field devices, lightweight protective gear, and automated decontamination platforms.

- The competitive landscape features Bruker Corporation, Bioquell, Thales Group, Kärcher GmbH, MSA Safety, Smiths Group Plc, Battelle, Chemring Group Plc, and FLIR Systems, Inc., competing through R&D strength, rugged product design, and government supply contracts.

- North America leads with 37% share, while detection systems hold the dominant segment with 38% share, supported by airport screening, industrial hazard monitoring, and military CBRN units across major regional markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

Chemical security holds the dominant share of 34% in the market due to rising risks linked to toxic industrial chemicals, chemical weapons, and hazardous spills. Governments fund advanced monitoring systems, chemical detectors, and training programs to strengthen national preparedness. Biological security follows as healthcare agencies push for pathogen surveillance and bio-threat detection after recent global outbreaks. Radiological and nuclear security gain traction through investment in isotope monitoring, border screening, and material tracking. Strong regulatory focus, international safety conventions, and modernization of critical infrastructure continue to push chemical security ahead of other application areas.

- For instance, Bruker’s RAID-XP chemical detection platform can detect, identify, and continuously monitor nerve, blood, and blister agents using high-end Ion Mobility Spectrometry (IMS). It provides rapid detection of threats, and is described as having high sensitivity down to the low parts per million (ppm) and parts per billion (ppb) ranges.

By System

Detection systems account for the largest share at 38%, driven by high deployment of sensors, handheld analyzers, radiation monitors, and explosive detectors across airports, seaports, and industrial plants. Rapid threat identification, data analytics, and integration with command-control platforms make detection equipment the preferred choice for emergency response agencies. Protection equipment grows as demand rises for protective suits, shelters, and gas filtration systems. Simulation and training systems expand through defense modernization, while decontamination systems see steady uptake from industrial hazardous-waste handling and urban emergency clean-up operations.

- For instance, the FLIR Systems identiFINDER R440 handheld radiation spectrometer can detect and identify gamma-emitting isotopes with a resolution of ≤ 7% FWHM at 662 keV and supports continuous operation for approximately 6 hours on a single lithium-ion smartpack battery cycle (or up to 12 hours with the two supplied batteries using hot-swap functionality).

By End Use

Military and defense lead the market with 41% share because armed forces invest heavily in CBRN reconnaissance vehicles, protective gear, mobile labs, and battlefield detection systems. Border protection, counter-terror missions, and joint NATO-standardization programs also support high spending. Law enforcement agencies increase adoption of portable detectors and decontamination kits for urban threats. Commercial and industrial facilities use solutions to safeguard workers and comply with safety regulations, especially in oil, gas, chemical, and power sectors. Healthcare institutions strengthen biological security through hospital-grade biosurveillance and isolation protocols.

Key Growth Drivers

Growth in Cross-Border Threat Surveillance and Modernization Programs

Countries are upgrading national security programs to manage growing risks from toxic chemicals, biological pathogens, radiological leaks, and nuclear material trafficking. Defense agencies deploy advanced detection sensors, unmanned CBRN reconnaissance systems, and radiation monitoring portals at airports, seaports, and ground borders. International bodies encourage standardized preparedness frameworks and faster information sharing, which increases investment in real-time surveillance, mobile laboratories, and analytics platforms. Rising geopolitical tensions and illicit material smuggling push governments to modernize early-warning infrastructure. Public-private R&D partnerships also accelerate innovation, making surveillance faster and more accurate. Together, these factors create long-term demand for integrated detection and response systems.

- For instance, Rheinmetall’s Mission Master SP unmanned ground vehicle can be configured as a CBRN reconnaissance vehicle, carrying Bruker’s multi-gas detectors and the MM2 mass spectrometer, capable of detecting chemical warfare agents from the low parts per billion (ppb) to low parts per million (ppm) range, depending on the specific analytical procedure used (e.g., adsorbent enrichment or on-line monitoring).

Rising Industrial Hazards and Regulatory Compliance Pressure

Industrial plants that handle chemicals, pharmaceuticals, fertilizers, and radioactive materials face heightened regulations and stricter workplace safety mandates. Companies invest in gas detectors, decontamination units, and personal protective gear to avoid plant shutdowns, accidents, and liability risks. High-risk sites such as refineries, chemical storage depots, nuclear power facilities, and research labs deploy continuous monitoring and emergency response systems. Governments require compliance with standards governing hazardous waste, emissions, and radiation safety. Increased awareness of industrial disasters and occupational health drives adoption of automated threat detection, safety audits, and worker training systems, supporting steady market expansion.

- For instance, MSA Safety’s ALTAIR 4XR industrial gas detector uses an XCell sensor pack that delivers full response to hydrogen sulfide in under 15 seconds and supports Bluetooth telemetry for remote alarm notifications

Increased Focus on Public Health Security After Global Outbreaks

The pandemic reshaped biological defense planning across hospitals, research labs, and public-health agencies. Investments rose in pathogen screening devices, air sampling systems, isolation chambers, and biosurveillance networks. National programs fund genomic surveillance, rapid testing technology, and biological threat modeling to detect emerging variants and bio-terror events. Healthcare facilities adopt higher biosafety protocols and emergency stockpiles, including protective suits and decontamination tools. Demand also increases for integrated digital platforms that provide real-time alerts, case tracking, and coordinated response between hospitals and emergency responders. This long-term shift toward health infrastructure resilience boosts the biological security segment.

Key Trends & Opportunities

AI-Driven CBRN Detection and Remote Monitoring Expansion

AI, machine learning, and IoT sensors transform CBRN threat detection. Smart detectors now identify toxic gases, radiation patterns, or bio-agents faster with fewer false alarms. Remote surveillance through drones, robots, and fixed sensor networks reduces risk to response teams and supports continuous monitoring of critical infrastructure. Predictive analytics helps agencies forecast spread patterns, contamination zones, and material movement. This technological shift opens strong opportunities for solution providers offering cloud-based monitoring, automated alert systems, edge data processing, and centralized command-control dashboards for national security and industrial safety applications.

- For instance, Teledyne FLIR’s MUVE C360 multi-gas chemical sensor, mounted on autonomous drones, can detect various volatile industrial compounds at concentrations measured in parts per million (ppm) and transmit live plume data through wireless links over a flight range determined by the host drone’s capabilities, such as the several kilometers possible with compatible professional platforms.

Growing Demand for Protective Gear and Decontamination Solutions

Frontline workers need high-performance equipment such as advanced hazmat suits, respirators, filtration systems, and self-contained breathing apparatus. Innovation in lightweight materials, heat resistance, and chemical impermeability boosts comfort and safety. Decontamination solutions improve through portable spray systems, antimicrobial coatings, and automated wash-down units used in hospitals, airports, and industrial sites. Governments maintain emergency stockpiles and rapid-response units, creating recurring procurement cycles. Manufacturers gain opportunities by offering modular, easy-deploy solutions that reduce training time and improve field operability.

- For instance, DuPont’s Tychem TK Level A hazmat suit is certified to withstand more than 200 industrial chemicals and enables continuous use for 4 hours in liquid splash scenarios, based on third-party permeability tests.

Key Challenges

High Capital Costs and Complex Technology Integration

CBRN security systems require specialized hardware, continuous calibration, skilled operators, and integration with command networks. Many agencies face budget constraints, especially in developing regions where basic infrastructure must improve before advanced tools are adopted. Installation of monitoring systems in large industrial plants or border checkpoints demands complex engineering and high maintenance spending. Long procurement cycles further slow deployment. These barriers limit adoption of advanced systems and restrict revenue growth for suppliers that rely on government contracts.

Shortage of Skilled Personnel and Operational Training Gaps

Operating CBRN detection or decontamination tools demands trained professionals who understand hazardous materials, emergency protocols, and equipment diagnostics. Many regions face shortages of specialized technicians, especially in healthcare and law enforcement. Limited training infrastructure reduces operational readiness and increases the risk of misinterpretation or system misuse. Response teams sometimes lack standard operating procedures across agencies, causing delays during emergencies. Vendors must invest in simulation-based training, virtual drills, and user-friendly software to address skill limitations and improve field deployment.

Regional Analysis

North America

North America holds the largest share of 37%, supported by high defense spending, advanced homeland security programs, and strong industrial safety regulations. The United States leads with widespread deployment of chemical detectors, radiation monitoring portals, biological surveillance labs, and training centers for emergency response. Airports, nuclear plants, petrochemical facilities, and public health agencies adopt advanced CBRN equipment to meet federal safety guidelines. Canada increases investment in border security, hazardous-material handling, and joint response exercises. Strong presence of established technology providers, government grants, and R&D partnerships keeps North America at the forefront of innovation and operational readiness.

Europe

Europe accounts for 29% of the market due to strict safety regulations, NATO-aligned modernization programs, and strong investment in radiological and chemical monitoring. Countries such as Germany, France, and the United Kingdom deploy CBRN systems in military units, civilian emergency services, healthcare facilities, and transportation hubs. The EU promotes harmonized security standards, cross-border training, and technology sharing to improve response capability. Industrial sectors handling hazardous chemicals and nuclear materials drive demand for decontamination, detection, and workforce protective gear. Growing focus on critical infrastructure protection strengthens long-term procurement across public- and private-sector institutions.

Asia-Pacific

Asia-Pacific holds 23% share and ranks among the fastest-growing regions due to rising defense budgets, border security upgrades, and industrial expansion. China, India, Japan, and South Korea invest in chemical and radiological monitoring systems at ports, airports, and high-risk industrial zones. Rapid urbanization and frequent hazardous-material transport increase need for emergency response infrastructure. Public-health agencies strengthen biosurveillance capacity after recent global outbreaks, while defense forces develop CBRN response units. Local manufacturing and technology partnerships lower costs and improve accessibility, creating strong growth opportunities for detection and decontamination providers across the region.

Middle East & Africa

The Middle East & Africa region represents 7% market share, driven by security risks, petrochemical industry hazards, and protection of critical energy infrastructure. Gulf countries invest in gas detectors, radiation monitors, protective gear, and military CBRN units. Industrial zones handling chemicals and hazardous waste increase adoption of decontamination and emergency-response systems. African nations focus on basic preparedness, border screening, and training programs supported by global organizations. While spending remains limited in some countries, rising demand for industrial safety, public health protection, and defense modernization supports gradual market growth.

Latin America

Latin America accounts for 4% of the market, with demand emerging from security agencies, oil and gas companies, and public-health institutions. Brazil and Mexico deploy radiation and chemical detection systems at major ports, refineries, and transportation networks. Governments strengthen biosurveillance programs and disaster-response capabilities to address industrial accidents and biological risks. Limited budgets and procurement delays slow adoption of advanced technologies, but increasing awareness of occupational hazards and cross-border trafficking drives steady investment. Partnerships with international vendors and training initiatives improve access to modern CBRN equipment across the region.

Market Segmentations:

By Application

- Chemical security

- Biological security

- Radiological security

- Nuclear security

By System

- Detection

- Protection

- Simulation

- Decontamination

By End Use

- Military & Defense

- Law Enforcement

- Commercial & Industrial

- Healthcare

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the chemical, biological, radiological, and nuclear security market features established defense contractors, detection technology specialists, and safety equipment manufacturers offering a wide range of integrated solutions. Major players compete through advanced sensors, mobile detection units, wearable protection systems, and automated decontamination platforms. Companies form government partnerships, supply long-term military procurement programs, and invest in R&D to meet evolving national security requirements. Vendors expand portfolios with AI-based analytics, robotic surveillance, real-time monitoring networks, and rugged field-deployable devices. Strategic moves include acquisitions, defense modernization contracts, and collaboration with research institutes to enhance detection accuracy and response time. Firms also pursue international expansion by targeting airports, nuclear power plants, industrial safety markets, and public health agencies. Strong after-sales support, training services, and customization give suppliers a competitive edge in bid-based defense procurement cycles, strengthening long-term market presence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bruker Corporation

- Bioquell (U.K.)

- Thales Group

- Alfred Kärcher GmbH & Co. KG (Germany)

- MSA Safety, Inc.

- Smiths Group Plc

- Battelle (U.S.)

- Chemring Group Plc

- America Corporation (U.S.)

- Rheinmetall AG (Germany)

- FLIR Systems, Inc

Recent Developments

- In August 2025, Bruker Corporation: Reaffirmed strategy around airline safety, airport security, and chemical reconnaissance within its Detection business. Emphasis on integrated CBRNE threat detection portfolio.

- In April 2025, Bioquell (U.K.), Released an updated Europe product range brochure for hydrogen peroxide vapour systems and indicators. Materials note BPR approvals and ambient-condition operation

Report Coverage

The research report offers an in-depth analysis based on Application, System, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Governments will continue increasing investments in CBRN detection and response capabilities.

- AI and automation will improve detection accuracy and reduce false alarms.

- Portable and wearable detection systems will become standard for emergency teams.

- Biosurveillance networks will expand across hospitals, airports, and research facilities.

- Industrial plants handling hazardous materials will adopt advanced protection and monitoring tools.

- Robots and drones will handle inspections in contaminated or high-risk areas.

- Training and simulation platforms will support faster decision-making during emergencies.

- Integrated command systems will link sensors, responders, and medical support in real time.

- Companies will focus on partnerships and technology upgrades to meet defense contracts.

- Demand for lightweight protective gear and rapid decontamination solutions will rise across civilian and military sectors.