Market Overview:

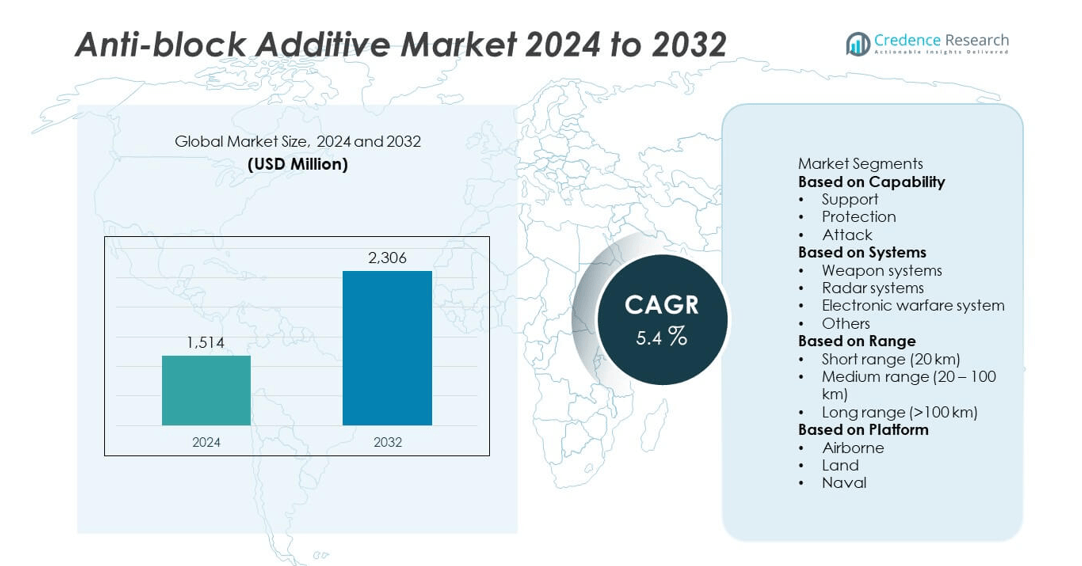

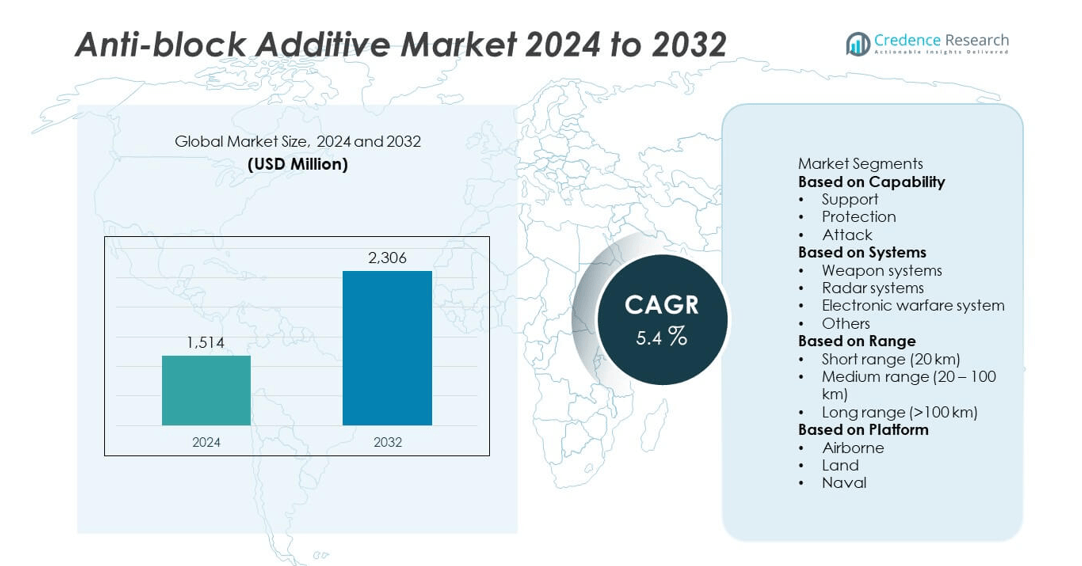

The global anti-block additive market was valued at USD 1,514 million in 2024 and is projected to reach USD 2,306 million by 2032, expanding at a compound annual growth rate (CAGR) of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Anti-block Additive Market Size 2024 |

USD 1,514 million |

| Anti-block Additive Market, CAGR |

5.4% |

| Anti-block Additive Market Size 2032 |

USD 2,306 million |

The top players in the anti-block additive market include Evonik Industries AG, Momentive, Cargill, Imerys Performance Additives, Honeywell International Inc., Croda International PLC, LyondellBasell, BYK, Biesterfield, and Ampacet Corporation. These companies lead through technological advancements, capacity expansion, and a focus on sustainable additive solutions. Asia-Pacific emerged as the leading region, accounting for 36.2% of the global market share in 2024, driven by rapid industrialization, packaging demand, and expanding polymer film production in China and India. Europe followed with 25.7% share, supported by stringent regulations promoting recyclable and food-safe additives, while North America held 28.4% share with strong R&D and advanced packaging sectors.

Market Insights

- The global anti-block additive market was valued at USD 1,514 million in 2024 and is projected to reach USD 2,306 million by 2032, growing at a CAGR of 5.4% during the forecast period.

- Rising demand for flexible and recyclable packaging materials across food, medical, and industrial sectors drives market growth, with LDPE films holding a 38.6% share due to high application in food packaging.

- Key trends include growing use of low-migration, food-contact-safe additives and engineered silica technologies that enhance optical clarity and process efficiency.

- Leading companies such as Evonik Industries AG, Croda International PLC, Honeywell International Inc., and Ampacet Corporation focus on sustainable, high-performance solutions, intensifying competition in the market.

- Asia-Pacific dominated the market with a 36.2% share in 2024, followed by North America with 28.4% and Europe with 25.7%, driven by strong packaging and polymer manufacturing industries across these regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

In the type segment, the organic sub-segment leads, capturing approximately 57.6 % of the market by value, driven by its regulatory-friendly profile and compatibility with food-grade flexible films. For example, organic amides and natural waxes are increasingly used in packaging applications that demand non-toxic solutions. The primary driver for this dominance is rising demand for sustainable additives in food and consumer packaging, where organic chemistries provide performance with fewer regulatory risks.

- For instance, Cargill expanded its Optislip™ range of bio-based slip and anti-block additives, achieving up to 100% renewable carbon content verified under the International Sustainability and Carbon Certification (ISCC PLUS) framework.

By Polymer Type

Within the polymer-type segment, the low-density polyethylene (LDPE) sub-segment holds the largest share at about 38.6 % in 2024, reflecting its widespread use in flexible packaging films, bags and shrink wraps. LDPE’s film applications enable smooth integration of anti-block additives and benefit from improved processing and roll-handling. Growth is driven by increasing demand for packaged consumer goods globally and the adoption of thinner, high-clarity films that require effective anti-block protection.

- For instance, LyondellBasell markets its low-density polyethylene grades for film applications under the Lupolen trade name, with specific products like Lupolen 2426K and Lupolen 3026K designed with anti-block and slip additives to ensure smooth processing and good film properties.

By End-Use Industry

In the end-use industry segment, the packaging industry sub-segment dominates with roughly 45.3 % share in 2024, supported by the expanding volumes of flexible films and multilayer packaging in food, beverage and pharmaceuticals. The rise of e-commerce and demand for convenient ready-to-eat products place higher stress on film handling, boosting anti-block additive use. Key drivers include stringent packaging performance requirements, increasing film throughput, and the shift to sustainable mono-material packaging solutions.

Key Growth Drivers

Expansion of Flexible Packaging

Flexible packaging continues to grow rapidly across food, beverage, and personal care industries. Manufacturers are increasing film line speeds and reducing thickness to cut costs and enhance sustainability. These films require high-performance anti-block additives to prevent sticking and improve machinability. Additives help maintain film clarity and performance during automated packaging. The surge in e-commerce packaging and ready-to-eat foods further strengthens this demand, as converters need materials that combine strength, flexibility, and smooth handling during production.

- For instance, Ampacet Corporation developed its LIAD Smart ColorSave-1000 dosing system, enabling precise additive distribution for high-speed film lines operating up to 600 meters per minute. The system improves film uniformity and reduces anti-block additive waste by nearly 30 kilograms per production shift, enhancing throughput efficiency for flexible packaging converters.

Shift to Recyclable and Mono-Material Structures

The global shift toward recyclable and mono-material packaging drives the need for advanced anti-block solutions. PE and PP films with single-material designs reduce environmental impact but are prone to blocking. Anti-block additives ensure slip performance and transparency while remaining compatible with recycling processes. Growing use of post-consumer resin (PCR) and strict food-contact safety norms push suppliers to develop low-migration grades. This sustainability shift provides long-term growth opportunities for compliant, performance-optimized anti-block technologies.

- For instance, BYK Additives & Instruments confirms that many of its food-contact additive products comply with the EU Regulation EC 1935/2004 framework, including detailed documentation for migration testing and recipe records.

Growth in BOPP, LLDPE, and Specialty Films

Rising demand for BOPP and LLDPE films in Asia-Pacific and the Middle East supports anti-block additive adoption. These films are preferred for packaging, labeling, and lamination applications due to their clarity and strength. Anti-block additives ensure smooth processing, stable reel quality, and consistent coefficient of friction during high-speed runs. Specialty films used in medical and electronics applications also rely on precision anti-block systems. The trend toward thinner, high-performance films further strengthens demand for engineered additive packages.

Key Trends and Opportunities

Low-Migration and Food-Contact Compliant Additives

Food packaging regulations are becoming more stringent across regions, pushing demand for low-migration additives. Suppliers are developing anti-block systems with enhanced purity and reduced extractables to meet global compliance standards. These innovations are essential for hot-fill, retort, and microwaveable packaging applications. The expansion of processed and convenience foods presents new opportunities for food-contact-safe solutions. Compliance-ready additives with certifications such as FDA or EFSA approval are gaining strong market preference.

- For instance, Honeywell International Inc. supplies its Aclar® films used in pharmaceutical and food packaging, tested to comply with FDA 21 CFR 177.1520 regulations for food-contact safety. The company’s barrier films can withstand thermal exposure up to 121 °C during sterilization cycles while maintaining less than 0.01 mg/dm² migration in simulated fatty food conditions, ensuring long-term chemical stability in heat-sealed containers.

Advancements in Engineered Silica and Hybrid Chemistries

Manufacturers are investing in next-generation precipitated silica with fine particle size distribution to balance clarity and anti-block performance. Hybrid chemistries combining inorganic silica with polymeric carriers optimize optical and mechanical properties. These systems enhance processing efficiency and reduce dust generation. Masterbatch formulations improve additive dispersion and minimize feeding inconsistencies. Digital process monitoring is emerging to optimize anti-block dosage, enabling higher productivity and quality control.

- For instance, Evonik Industries AG produces its SPHERILEX® 60 AB precipitated silica, a hydrophilic spherical precipitated silica powder with a median particle size (d50) typically around 5.7 micrometers (µm) and a linseed oil absorption value of 80 ml/100g, engineered for high-clarity polyethylene and polypropylene films.

Integration of Recycled and PCR-Based Films

The rise in recycled content packaging, including post-consumer resin (PCR), creates demand for improved anti-blocking performance. Recycled films often have surface tack and inconsistent flow properties, requiring tailored additive formulations. Anti-block solutions designed for PCR films enhance clarity, sealing, and machinability. Collaboration between additive producers and recyclers is strengthening, promoting circular economy adoption. Certified recyclable additives further help converters meet brand sustainability targets.

Key Challenges

Raw Material Volatility and Price Pressure

Fluctuating costs of silica, talc, and organic compounds create uncertainty in the supply chain. Energy price changes and currency shifts amplify production costs, squeezing converter margins. Film manufacturers face limited flexibility to pass on price increases, intensifying competition. Additive suppliers respond by improving product efficiency and yield. Strategic sourcing, long-term contracts, and dual supplier models are key measures to stabilize production and maintain profitability.

Performance Trade-Offs and Processing Complexities

Achieving the right balance between slip, haze, and sealing remains a critical challenge. Inconsistent dispersion or particle migration can affect optical clarity and packaging performance. Multilayer films and coextrusion setups demand precise control of additive compatibility. Manufacturers are investing in advanced testing and in-line monitoring to maintain uniformity. Technical collaboration between additive producers and film processors is essential to ensure performance consistency and reduce rework rates.

Regional Analysis

North America

North America held a 28.4% share of the anti-block additive market in 2024, driven by strong packaging and automotive demand in the United States and Canada. The region benefits from high consumption of polyethylene and polypropylene films for food packaging, medical devices, and industrial wraps. Stringent FDA compliance encourages the use of low-migration and food-safe anti-block grades. Continuous innovation in flexible packaging materials and recycling initiatives also boost adoption. Major additive producers and film converters in the U.S. lead investments in sustainable and high-performance formulations, supporting steady regional growth.

Europe

Europe accounted for 25.7% of the market share in 2024, supported by strict regulatory standards on food safety, recyclability, and sustainable packaging. Countries such as Germany, France, and Italy are major consumers due to advanced film-converting and printing sectors. The European Green Deal and circular economy policies drive demand for recyclable and bio-based anti-block additives. Local manufacturers are focusing on silica-based and hybrid solutions with enhanced dispersion efficiency. Growth in mono-material films and expansion in pharmaceutical packaging further strengthen regional demand. Strong R&D and compliance frameworks keep Europe a key innovation hub.

Asia-Pacific

Asia-Pacific dominated the anti-block additive market with a 36.2% share in 2024, led by China, India, Japan, and South Korea. Rapid industrialization, growing packaging consumption, and expansion of polymer film production lines fuel market growth. China remains a major producer and exporter of BOPP and LLDPE films, requiring advanced anti-block systems for processing stability. Rising food delivery, e-commerce, and FMCG packaging also accelerate adoption. Increasing local production capacities and cost-efficient raw materials attract global players to establish manufacturing bases in the region. Strong government emphasis on recycling adds momentum to sustainable product development.

Latin America

Latin America captured 5.6% of the global anti-block additive market in 2024, driven by expanding packaging and agricultural film applications in Brazil and Mexico. Growing urbanization and middle-class consumption increase demand for flexible packaging in food and beverage sectors. The region is witnessing gradual adoption of advanced anti-block technologies for polyethylene and polypropylene films. Local converters focus on improving processing efficiency and film clarity to meet international export standards. Partnerships with global additive suppliers are helping to modernize film production and enhance sustainability. Government incentives for packaging innovation further support market penetration.

Middle East & Africa

The Middle East and Africa region held a 4.1% share in 2024, supported by industrial expansion and rising polymer film manufacturing in Saudi Arabia, the UAE, and South Africa. The region’s growing petrochemical base ensures stable raw material supply for additive production. Increasing use of flexible packaging in food, healthcare, and industrial goods drives anti-block consumption. Local initiatives promoting plastic recycling and lightweight films strengthen demand for advanced additives. Multinational players are investing in regional distribution networks to serve emerging markets efficiently, while government-backed diversification projects encourage long-term industrial growth.

Market Segmentations:

By Type

By Polymer Type

- Low Density Polyethylene (LDPE)

- Linear low-density polyethylene (LLDPE)

- Biaxially-oriented polypropylene (BOPP)

- Other

By End-Use Industry

- Packaging Industry

- Medical Industry

- Automotive Industry

- Other

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the anti-block additive market features key players such as Evonik Industries AG, Momentive, Cargill, Imerys Performance Additives, Honeywell International Inc., Croda International PLC, LyondellBasell, BYK, Biesterfield, and Ampacet Corporation. These companies focus on developing high-performance additive solutions that enhance film clarity, processability, and sustainability. Strategic initiatives include capacity expansions, new product launches, and partnerships with polymer manufacturers to meet growing demand in packaging and industrial applications. For instance, Evonik and Croda emphasize bio-based and low-migration additives aligned with global food-contact standards. Honeywell and BYK are advancing silica-based formulations offering improved dispersion and optical balance. Meanwhile, Ampacet and LyondellBasell invest in masterbatch innovations supporting recyclable and mono-material film production. The market remains moderately consolidated, with ongoing R&D efforts to optimize cost efficiency, compatibility, and performance across evolving polymer systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Evonik Industries AG

- Momentive

- Cargill

- Imerys Performance Additives

- Honeywell International Inc.

- Croda International PLC

- LyondellBasell

- BYK

- Biesterfield

- Ampacet Corporation

Recent Developments

- In March 2025, Evonik’s Coating Additives business launched its first two “mass balanced” products (TEGO® Wet 270 eCO and TEGO® Foamex 812 eCO) designed with traceable bio- or recycled-feedstock approach.

- In October 2024, Evonik confirmed that the European Food Safety Authority (EFSA) once again concluded that silica (used in various additives including anti-caking and anti-block contexts) is safe for food applications.

- In April 2023, Cargill announced the re-branding of its Crodamide™ slip & anti-blocking additives range to Optislip™ to better align with the performance value proposition.

Report Coverage

The research report offers an in-depth analysis based on Type, Polymer Type, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The anti-block additive market will experience steady growth driven by expanding flexible packaging demand.

- Adoption of recyclable and mono-material films will boost the need for compatible anti-block solutions.

- Manufacturers will invest in bio-based and low-migration additives to meet global safety regulations.

- Technological advancements in engineered silica will enhance film clarity and processing stability.

- Collaboration between additive producers and polymer manufacturers will support product customization.

- Automation in film extrusion and packaging lines will increase demand for precision anti-block formulations.

- Asia-Pacific will remain the fastest-growing region due to industrial expansion and rising packaging consumption.

- Sustainability initiatives will accelerate the shift toward eco-friendly and high-performance masterbatches.

- Competitive pressure will encourage R&D in hybrid chemistries and advanced dispersion technologies.

- Increasing integration of post-consumer recycled materials will create new opportunities for specialized additive systems.