Market Overview:

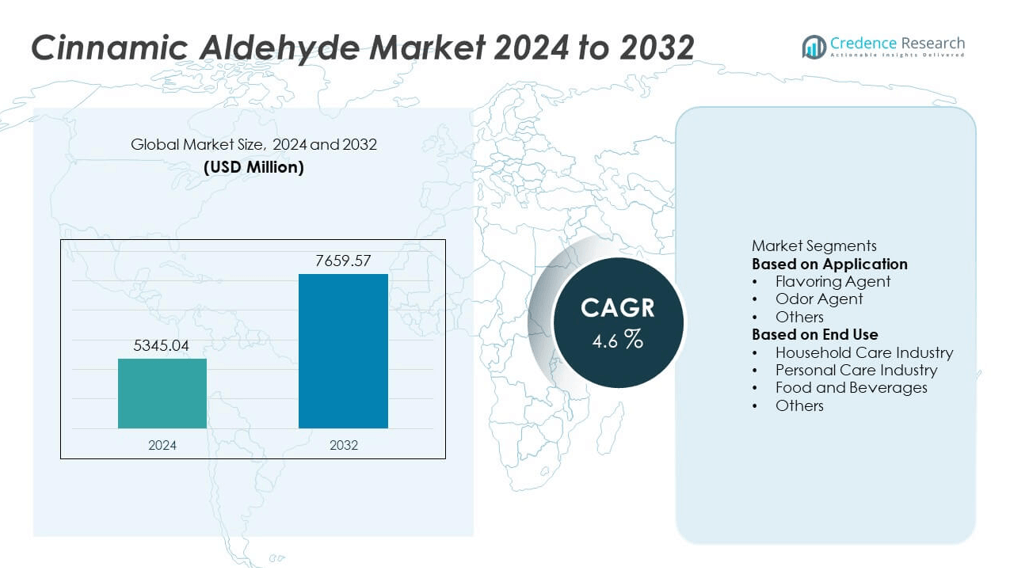

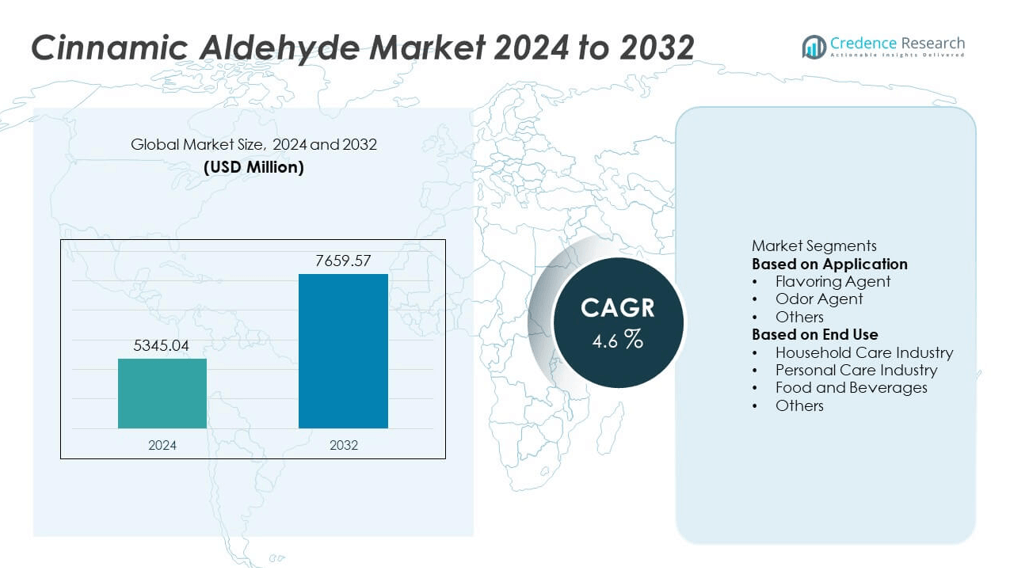

The Cinnamic Aldehyde market was valued at USD 5345.04 million in 2024 and is projected to reach USD 7659.57 million by 2032, growing at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cinnamic Aldehyde Market Size 2024 |

USD 5345.04 million |

| Cinnamic Aldehyde Market, CAGR |

4.6% |

| Cinnamic Aldehyde Market Size 2032 |

USD 7659.57 million |

The Cinnamic Aldehyde market is led by prominent players such as Emerald Performance Materials, Lanxess AG, Merck KGaA, Symrise AG, Kao Corporation, Vigon International, Alfa Aesar (Thermo Fisher Scientific), Indukern Group, TCI Chemicals Pvt. Ltd., and Wuhan Senwayer Century Chemical Co., Ltd. These companies dominate through extensive product portfolios, advanced synthesis technologies, and strong global distribution networks. North America led the global market with a 34.2% share in 2024, driven by high consumption in food, fragrance, and personal care sectors. Europe followed with a 27.5% share, supported by stringent quality standards and growing demand for natural aroma ingredients, while Asia-Pacific emerged as the fastest-growing region due to expanding manufacturing capacities and rising consumer demand for natural additives.

Market Insights

- The Cinnamic Aldehyde market was valued at USD 5345.04 million in 2024 and is projected to reach USD 7659.57 million by 2032, growing at a CAGR of 4.6%.

- Rising demand for natural flavoring and fragrance ingredients across food, personal care, and household sectors is driving market growth globally.

- Growing adoption of bio-based production methods and clean-label ingredients is a key trend shaping product innovation and sustainability efforts.

- The market is moderately competitive, with key players such as Lanxess AG, Merck KGaA, and Symrise AG focusing on technological advancements and regional expansion.

- North America led the market with a 34.2% share in 2024, followed by Europe with 27.5%, while the flavoring agent segment dominated by application with a 54.7% share due to its extensive use in food and beverage formulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

Flavoring agents dominated the Cinnamic Aldehyde market in 2024, accounting for 54.7% of the total share. This segment’s growth is driven by rising demand from the food and beverage industry, where cinnamic aldehyde is widely used for its sweet, spicy aroma and natural flavor-enhancing properties. Its use in confectionery, beverages, and baked goods has expanded as consumers increasingly prefer natural flavoring alternatives over synthetic additives. Additionally, growing utilization in pharmaceuticals and oral care formulations further supports demand due to its antimicrobial and preservative characteristics.

- For instance, Symrise AG enhances its natural flavor formulation portfolio by utilizing cinnamic aldehyde, a naturally occurring compound that provides a warm, spicy cinnamon note to products across beverages, confectioneries, and baked goods.

By End Use

The food and beverages segment held the largest share of 46.3% in the Cinnamic Aldehyde market in 2024. Its dominance is attributed to the ingredient’s extensive use in flavoring candies, soft drinks, and bakery products. The global trend toward clean-label and plant-based ingredients is fueling its adoption across major food brands. Moreover, its GRAS (Generally Recognized As Safe) status by regulatory bodies promotes widespread use in consumable products. Expanding applications in flavor innovation and natural ingredient-based product development continue to drive segment growth globally.

- For instance, Takasago International Corporation’s facility in Singapore has a production capacity of up to 30,000 tons of flavors and fragrances annually, supporting applications across a variety of food and beverage formulations.

Key Growth Drivers

Rising Demand for Natural Flavoring and Fragrance Ingredients

The increasing consumer preference for natural and plant-based ingredients is a key driver of the Cinnamic Aldehyde market. Derived mainly from cinnamon oil, it is widely used as a natural flavoring and fragrance compound in foods, beverages, and cosmetics. Manufacturers are replacing synthetic additives with bio-based compounds to meet clean-label trends. Its multifunctional properties, including antimicrobial and antioxidant benefits, further enhance its use in diverse applications such as oral care, pharmaceuticals, and personal care products, driving consistent market expansion worldwide.

- For instance, Symrise AG utilizes more than 10,000 natural raw materials to develop flavor and fragrance compounds across its global portfolio, integrating advanced distillation and extraction systems that process over 250,000 metric tons of botanical feedstock annually to meet growing natural ingredient demand.

Expanding Applications in Food and Beverage Industry

Cinnamic aldehyde’s role as a flavor enhancer is gaining traction across bakery, confectionery, and beverage sectors. The growing demand for natural food additives and the rise of premium product formulations have increased its consumption. Food manufacturers utilize cinnamic aldehyde for its sweet-spicy profile and natural preservative properties. The compound’s approval as a safe additive by global regulatory authorities further boosts its use in packaged and functional foods, supporting sustained growth across both developed and emerging markets.

- For instance, Givaudan SA expanded its Flavour Innovation Centre (FIC) at its Singapore facility, investing CHF 5 million to enhance its innovation capabilities in the Asia Pacific region.

Growth of Personal and Household Care Segments

The increasing use of cinnamic aldehyde in personal care and household products is fueling market demand. Its pleasant aroma, antimicrobial properties, and stability make it ideal for soaps, detergents, deodorants, and perfumes. The trend toward natural and sustainable fragrance ingredients in consumer products has strengthened its market position. Expanding demand for eco-friendly formulations and the rising adoption of bio-based aroma chemicals by major FMCG companies continue to create significant growth opportunities across global personal and home care sectors.

Key Trends & Opportunities

Shift Toward Bio-Based and Sustainable Production

The industry is witnessing a transition toward bio-based production processes for cinnamic aldehyde, reducing dependence on synthetic chemical synthesis. Companies are investing in green chemistry and fermentation-based extraction to enhance sustainability. Growing regulatory support for natural ingredients and environmentally friendly manufacturing practices is fostering this shift. The focus on carbon-neutral and biodegradable ingredients in flavor and fragrance industries presents new opportunities for manufacturers to expand their portfolios with eco-conscious cinnamic aldehyde variants.

- For instance, BASF SE has developed fermentation-based aroma ingredients using biotechnology platforms which offer a reliable, sustainable supply and contribute to a reduced product carbon footprint compared to conventional products, though they are a smaller part of their total aroma ingredients portfolio, whose overall annual production capacity.

Increasing Use in Pharmaceutical and Antimicrobial Formulations

The expanding use of cinnamic aldehyde in pharmaceutical and healthcare products is emerging as a major opportunity. Its anti-inflammatory, antibacterial, and antioxidant properties make it suitable for drug formulations, wound-healing ointments, and oral care applications. Rising R&D investments in natural therapeutic ingredients further accelerate its adoption in the medical field. The compound’s ability to act as a bioactive agent with low toxicity supports its growing use in nutraceuticals and herbal-based healthcare products, driving long-term market potential.

- For instance, a clinical trial using cinnamaldehyde-containing mucoadhesive patches reported that ulcer size in the treatment group was reduced significantly by Day 5, and mean pain intensity dropped to under 1 on a standard 10-point pain scale, showing strong therapeutic effect in recurrent aphthous stomatitis patients.

Key Challenges

Price Volatility of Raw Materials

The market faces challenges due to fluctuations in the availability and cost of raw materials such as cinnamon oil and benzaldehyde. Seasonal variations and supply disruptions impact production consistency and pricing. Dependence on agricultural sources in specific regions increases vulnerability to climatic and trade-related risks. Manufacturers are focusing on synthetic and bioengineered production alternatives to stabilize supply chains, but raw material price volatility remains a constraint affecting profitability and pricing competitiveness across the global cinnamic aldehyde market.

Stringent Regulatory Standards and Safety Concerns

Compliance with stringent international regulations governing flavoring and fragrance substances presents a challenge for manufacturers. Overexposure or excessive use of cinnamic aldehyde in formulations may lead to skin irritation or allergic reactions, prompting cautious application in personal care products. Regulatory authorities such as the FDA and EFSA impose strict limits on permissible concentrations. Companies must invest in quality control and safety validation processes to meet global standards, which increases production costs and may limit the speed of market expansion.

Regional Analysis

North America

North America held a 34.2% share of the Cinnamic Aldehyde market in 2024, driven by strong demand from the food, beverage, and personal care sectors. The United States leads regional growth due to widespread use of natural flavoring and fragrance agents in consumer products. Rising adoption of plant-based ingredients and stringent regulations favoring safe, sustainable additives support market expansion. The presence of major flavor and fragrance manufacturers and growing investments in clean-label formulations further strengthen regional dominance, positioning North America as a key hub for innovation and product development in the cinnamic aldehyde industry.

Europe

Europe accounted for 27.5% of the Cinnamic Aldehyde market share in 2024, supported by high consumer preference for natural ingredients in cosmetics, household, and food products. Countries such as Germany, France, and the United Kingdom are key contributors, with strong industrial standards emphasizing product safety and sustainability. The European market benefits from established fragrance and flavor production clusters and increasing adoption of eco-friendly formulations. Continuous R&D efforts focused on bio-based aroma chemicals and compliance with REACH and EFSA regulations further enhance regional growth, making Europe a leader in quality-driven cinnamic aldehyde applications.

Asia-Pacific

Asia-Pacific accounted for 25.8% of the global Cinnamic Aldehyde market in 2024 and is expected to witness the fastest growth through 2032. Rapid industrialization, expanding food processing, and increasing personal care consumption are fueling demand across China, India, and Japan. Rising disposable incomes and shifting consumer preferences toward natural ingredients drive adoption in packaged foods, fragrances, and pharmaceuticals. Growing manufacturing capacities and favorable government policies supporting bio-based chemical production further strengthen regional competitiveness. The presence of cost-efficient raw material sources and a thriving export market for aroma chemicals enhance Asia-Pacific’s growth outlook.

Latin America

Latin America captured a 7.6% share of the Cinnamic Aldehyde market in 2024, supported by expanding applications in household care and food flavoring industries. Brazil and Mexico lead regional demand due to growing middle-class populations and rising consumer spending on personal and home care products. Increasing partnerships with global flavor and fragrance companies are enhancing supply chain capabilities. The shift toward natural and organic product formulations continues to boost demand. Despite infrastructure limitations, improving trade relations and regional manufacturing investments are fostering steady market development across Latin America’s emerging economies.

Middle East & Africa

The Middle East & Africa held a 4.9% share of the Cinnamic Aldehyde market in 2024, with growth driven by expanding applications in personal care, fragrance, and household cleaning products. The Gulf Cooperation Council (GCC) countries are key contributors, supported by a rising focus on premium cosmetics and perfumery manufacturing. Increasing imports of aroma chemicals and investments in the regional FMCG sector drive market expansion. However, high dependency on external suppliers and limited local production facilities pose challenges. Continued efforts to diversify chemical manufacturing capabilities are expected to enhance future market growth.

Market Segmentations:

By Application

- Flavoring Agent

- Odor Agent

- Others

By End Use

- Household Care Industry

- Personal Care Industry

- Food and Beverages

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Cinnamic Aldehyde market is moderately fragmented, featuring key players such as Emerald Performance Materials, Kao Corporation, Lanxess AG, Merck KGaA, Symrise AG, Vigon International, TCI Chemicals Pvt. Ltd., Alfa Aesar (Thermo Fisher Scientific), Indukern Group, and Wuhan Senwayer Century Chemical Co., Ltd. These companies focus on product quality, innovation, and sustainable manufacturing to strengthen their market presence. Strategic initiatives such as capacity expansion, mergers, and collaborations with fragrance and flavor manufacturers are common across leading players. Growing investment in bio-based production and green chemistry solutions is reshaping competition. Major firms are also emphasizing research to enhance product stability, purity, and sensory performance. Additionally, companies are targeting emerging markets in Asia-Pacific and Latin America to expand their distribution networks and customer base, leveraging the global shift toward natural and environmentally friendly aromatic compounds.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Emerald Performance Materials

- Kao Corporation

- Lanxess AG

- Merck KGaA

- Symrise AG

- Vigon International, Inc.

- TCI Chemicals Pvt. Ltd.

- Alfa Aesar (Thermo Fisher Scientific)

- Indukern Group

- Wuhan Senwayer Century Chemical Co., Ltd.

Recent Developments

- In October 2025, Symrise partnered with Aplantex to enhance access to plant-based molecules, strengthening sustainable sourcing of botanical actives for flavor and fragrance applications.

- In June 2025, Rajkeerth Aromatics & Biotech expanded its natural cinnamic aldehyde output through advanced cinnamon bark oil distillation and began supplying bulk export-grade material for food and perfumery use.

- In June 2025, Green Valley Aromas established a long-term partnership with Zhengzhou Citra Biotech to increase production capacity and support the global distribution of certified natural cinnamaldehyde.

Report Coverage

The research report offers an in-depth analysis based on Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Cinnamic Aldehyde market will grow steadily with increasing demand for natural and bio-based ingredients.

- Rising use in flavor and fragrance formulations will continue to drive global consumption.

- Innovation in green chemistry and sustainable extraction methods will enhance production efficiency.

- Expanding applications in pharmaceuticals and personal care will create new growth opportunities.

- Manufacturers will focus on developing high-purity and allergen-free cinnamic aldehyde grades.

- Growing demand from the food and beverage sector will strengthen long-term market potential.

- Asia-Pacific will emerge as a key growth hub due to rising industrial and consumer demand.

- Strategic collaborations between aroma chemical producers and FMCG companies will expand market reach.

- Regulatory support for natural ingredient adoption will favor market expansion in developed regions.

- Continuous R&D in bio-synthesis and cost optimization will improve product availability and competitiveness.