Market Overview

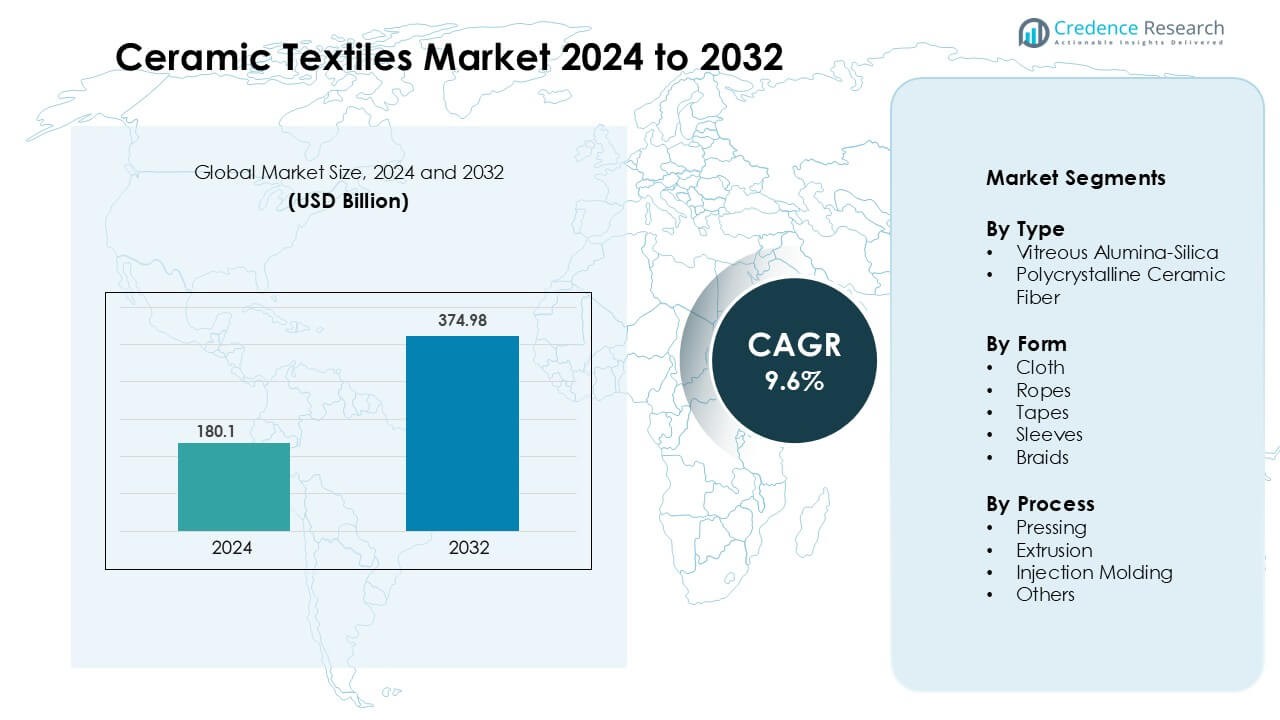

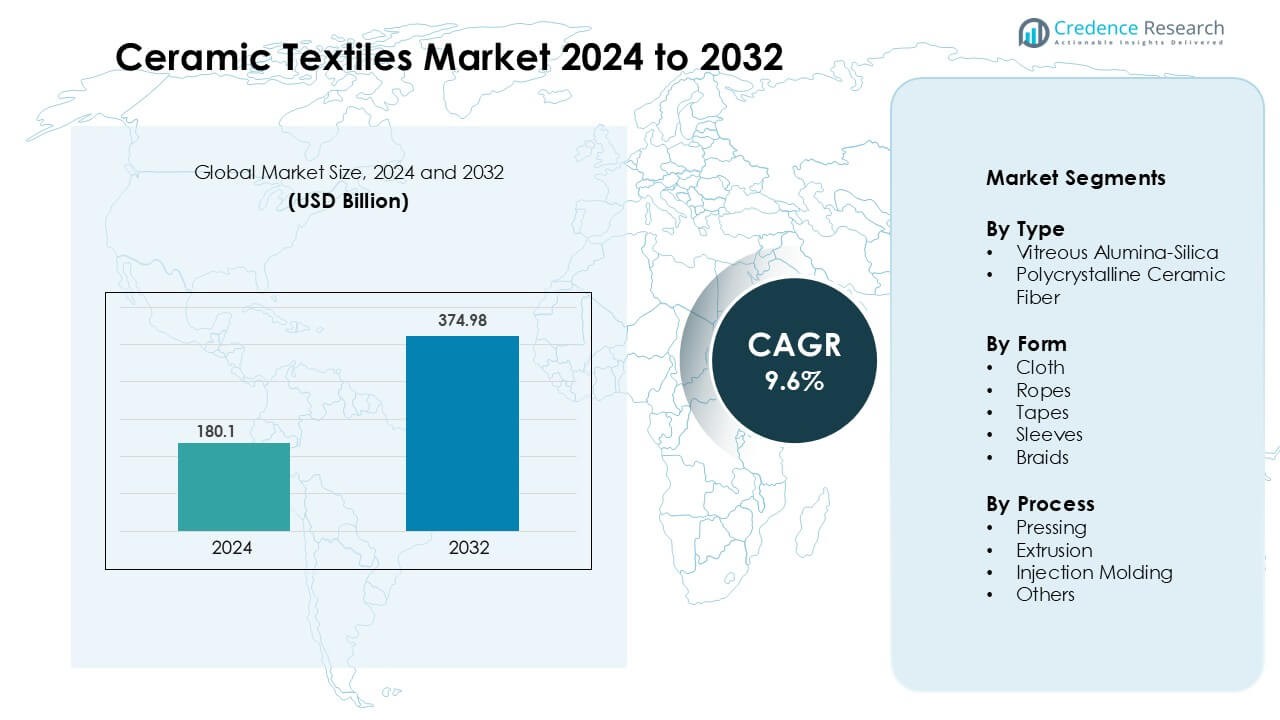

Ceramic Textiles Market was valued at USD 180.1 billion in 2024 and is anticipated to reach USD 374.98 billion by 2032, growing at a CAGR of 9.6 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ceramic Textiles Market Size 2024 |

USD 180.1 Billion |

| Ceramic Textiles Market, CAGR |

9.6 % |

| Ceramic Textiles Market Size 2032 |

USD 374.98 Billion |

The ceramic textiles market is led by prominent players such as 3M, Kyocera Corporation, Morgan Advanced Materials Corporation, Unifrax, Luyang Energy-Saving Materials Co., Ltd., Isolite Insulating Products Co., Ltd., Rath Group, Rauschert GmbH, Zircar Zirconia, Inc., and Ibiden. These companies focus on product innovation, high-performance insulation materials, and strategic partnerships to strengthen their global presence. Asia-Pacific emerges as the leading region, commanding over 35% of the global market share, driven by rapid industrialization, expanding manufacturing activities, and strong demand for high-temperature insulation solutions. The region’s cost-effective production capabilities and growing investments in energy-efficient materials continue to reinforce its dominance in the global ceramic textiles market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global ceramic textiles market was valued at USD 180.1 billion in 2024 and is projected to grow at a CAGR of 9.6% from 2025 to 2032, driven by increasing demand for high-temperature insulation materials.

- Key market drivers include the rising adoption of energy-efficient insulation solutions, expanding applications in aerospace and automotive industries, and strict industrial safety regulations promoting the use of flame- and heat-resistant materials.

- Emerging trends highlight advancements in fiber technology, lightweight ceramic composites, and increased use of ceramic textiles in renewable energy and power generation sectors.

- The market is moderately consolidated, with major players such as 3M, Unifrax, Kyocera, and Morgan Advanced Materials leading through R&D investments, product innovation, and global expansion strategies.

- Regionally, Asia-Pacific dominates with over 35% market share, while by type, vitreous alumina-silica accounts for more than 60%, supported by strong industrial growth and cost-effective production capabilities.

Market Segmentation Analysis:

By Type

The vitreous alumina-silica segment dominates the ceramic textiles market, accounting for the largest share of over 60% in 2024. This dominance stems from its superior thermal resistance, lightweight structure, and cost-effectiveness compared to other high-performance fibers. Its ability to withstand temperatures exceeding 1,200°C makes it ideal for applications in industrial furnaces, welding protection, and aerospace insulation. The segment’s growth is further driven by the rising demand for energy-efficient insulation materials in high-temperature operations across manufacturing, petrochemical, and automotive industries.

- For instance, Unifrax’s Fiberfrax® alumina-silica textile products demonstrate high temperature stability up to approximately 1,426 °C (2,600 °F) in some grades.

By Form

Among various forms, the cloth segment holds the leading market share of around 40%, attributed to its versatility, flexibility, and ease of installation in thermal insulation systems. Ceramic textile cloths are extensively used in protective clothing, heat shields, and furnace linings, where they provide exceptional heat and flame resistance. Increasing adoption of fireproof and heat-resistant materials in industrial safety equipment supports market growth. The demand is further propelled by advancements in weaving technologies that enhance fabric strength and performance under extreme conditions.

- For instance, Standard Fiberfrax® cloth products (types L-126 and L-144) have a temperature grade of 1260°C (2300°F), with a recommended operating temperature of around 1175°C (2150°F).

By Process

The pressing process segment leads the market, capturing a significant share of approximately 35%. This method is favored for its ability to produce dense and uniform ceramic textile structures with enhanced mechanical strength and dimensional stability. Pressing ensures superior performance in high-temperature and corrosive environments, making it suitable for aerospace, power generation, and metallurgical applications. Market expansion is supported by technological innovations in hot pressing and isostatic pressing techniques that improve product quality, reduce porosity, and lower manufacturing costs, driving broader adoption across industries.

Key Growth Drivers

Rising Demand for High-Temperature Insulation Materials

The increasing need for high-temperature insulation across industries such as petrochemical, aerospace, and metallurgy is a major driver of the ceramic textiles market. Ceramic textiles provide exceptional resistance to heat, corrosion, and mechanical stress, making them essential for applications like furnace linings, welding protection, and exhaust systems. With industrial operations aiming to improve energy efficiency and reduce thermal losses, the adoption of ceramic fibers has accelerated. Additionally, regulatory mandates promoting energy conservation and emission control further strengthen market demand. The shift toward cleaner and more sustainable industrial processes has also led manufacturers to integrate advanced ceramic materials that enhance operational safety and longevity.

- For instance, Morgan Advanced Materials’ Superwool XTRA fibre offers a classification temperature of 1450 °C, enabling use in high‑temperature refinery furnaces.

Expanding Applications in Aerospace and Automotive Sectors

The aerospace and automotive industries are increasingly adopting ceramic textiles due to their lightweight, thermal stability, and resistance to extreme conditions. In aerospace, these materials are used for heat shields, engine insulation, and fire protection systems. In automotive manufacturing, ceramic textiles serve in exhaust wraps, catalytic converters, and thermal barriers to improve performance and safety. The growing demand for electric and hybrid vehicles has intensified the need for efficient thermal management systems, further driving product adoption. Moreover, stringent safety and emission standards encourage manufacturers to incorporate advanced materials that offer high durability and reduced maintenance costs, positioning ceramic textiles as a preferred solution in next-generation mobility applications.

- For instance, 3M™ Nextel™ ceramic textiles have been used in aircraft firewalls and space components, including blankets sewn to protect the Delta II rocket engine plume, and they comply with the FAA’s flame‑penetration criteria for 15 minutes at 1,093 °C.

Growth in Industrial Safety and Fire Protection Applications

Increasing awareness of worker safety and stringent workplace safety regulations are boosting the demand for ceramic textiles in protective clothing and equipment. Their excellent heat resistance and non-combustible nature make them ideal for manufacturing flame-resistant garments, gloves, and blankets used in welding, foundry, and power generation sectors. Industries are prioritizing materials that not only protect workers but also maintain flexibility and comfort under high-stress conditions. The integration of ceramic textiles in safety solutions aligns with global occupational safety standards such as OSHA and ISO, driving their adoption across high-risk industries. Additionally, the rising focus on industrial automation and the maintenance of high-temperature machinery further amplifies the need for reliable thermal protection materials.

Key Trends & Opportunities

Advancements in Fiber Technology and Manufacturing Processes

Continuous innovation in fiber technology, such as the development of next-generation alumina-silica and polycrystalline fibers, is creating new opportunities in the ceramic textiles market. These advancements have led to improved thermal insulation, lower density, and enhanced flexibility, enabling broader use across diverse industries. Automated weaving and coating processes have also enhanced production efficiency and consistency in product quality. Manufacturers are investing in nanotechnology-based ceramic fibers that offer superior heat resistance and mechanical strength at reduced thickness. This trend supports the creation of lightweight, high-performance solutions for aerospace, defense, and energy applications. Such technological progress is expected to lower production costs while broadening the application scope of ceramic textiles globally.

- For instance, Unifrax I LLC’s Fibermax® polycrystalline mullite fibers show a maximum recommended service temperature of 1540 °C and an alumina content of 72‑75 % and silica of 25‑28 %.

Growing Adoption in Renewable Energy and Power Generation

The rapid expansion of renewable energy sectors—especially solar and wind—presents significant growth opportunities for ceramic textiles. These materials are vital in insulation systems for high-temperature applications like solar receivers, gas turbines, and thermal energy storage units. In addition, the increasing number of power plants and the modernization of aging energy infrastructure are fueling demand for heat-resistant and durable materials. The push toward sustainable and low-emission energy systems drives investment in advanced materials that enhance operational safety and efficiency. Ceramic textiles play a key role in improving the performance and lifespan of energy equipment, making them a strategic choice in the global transition toward cleaner energy solutions.

- For instance, Kyocera Corporation developed a silicon nitride heater able to operate at up to 1,400 °C, showcasing ceramic materials’ ability to serve in energy‑intensive components.

Key Challenges

High Production Costs and Complex Manufacturing Processes

One of the major challenges facing the ceramic textiles market is the high cost associated with production and processing. The manufacturing of ceramic fibers requires advanced raw materials, high-temperature furnaces, and specialized equipment, all contributing to increased operational expenses. Additionally, maintaining consistency in fiber quality and performance demands precise control over manufacturing parameters. Small and medium-sized enterprises often struggle with the capital investment required for such advanced production systems. These cost constraints limit widespread adoption, particularly in cost-sensitive markets. As a result, producers are focusing on optimizing production efficiency and exploring alternative raw materials to mitigate cost pressures and improve market competitiveness.

Limited Mechanical Strength and Brittleness Under Stress

Despite their excellent thermal properties, ceramic textiles often face limitations related to brittleness and low mechanical strength, especially under dynamic or impact conditions. This restricts their application in areas requiring high flexibility or durability under mechanical stress. In industrial environments with frequent movement or vibration, ceramic fibers may fracture, leading to reduced lifespan and performance issues. Manufacturers are addressing this challenge through the development of hybrid materials that combine ceramic and polymer fibers for improved flexibility and toughness. However, achieving a balance between thermal resistance and mechanical resilience remains a key technical barrier, influencing long-term market growth and product innovation.

Regional Analysis

North America

North America holds a significant share of approximately 30% in the global ceramic textiles market, driven by strong demand from aerospace, defense, and industrial manufacturing sectors. The United States dominates regional consumption due to its advanced industrial infrastructure and stringent safety regulations promoting high-performance thermal insulation materials. Continuous investment in energy-efficient systems and growing adoption in fire protection and automotive applications further support market expansion. Additionally, technological advancements and the presence of key industry players contribute to North America’s sustained leadership and steady growth outlook in the ceramic textiles market.

Europe

Europe accounts for around 25% of the global ceramic textiles market, supported by robust industrial standards and strong environmental regulations. The region’s emphasis on workplace safety and energy efficiency fuels the adoption of ceramic textiles in manufacturing, automotive, and energy generation applications. Germany, France, and the United Kingdom lead regional demand, with growing use in high-temperature insulation and fire protection systems. The shift toward sustainable materials and continuous innovation in fiber technology further enhance Europe’s market position, ensuring consistent growth across key industrial sectors and compliance-driven applications.

Asia-Pacific

Asia-Pacific dominates the global ceramic textiles market with a market share exceeding 35%, driven by rapid industrialization and expanding manufacturing activities in China, India, and Japan. The region’s strong demand for high-temperature insulation in metal processing, petrochemical, and automotive industries propels growth. Government initiatives promoting energy conservation and industrial safety further accelerate adoption. Additionally, increasing foreign investments in infrastructure and power generation enhance the regional outlook. Competitive manufacturing costs and rising technological capabilities position Asia-Pacific as the fastest-growing and most influential market for ceramic textiles globally.

Latin America

Latin America holds a moderate share of around 5% in the global ceramic textiles market, primarily driven by the expansion of mining, metal processing, and energy industries. Brazil and Mexico are leading contributors, supported by growing industrial safety standards and infrastructure development. Rising awareness of heat-resistant materials for protective clothing and insulation applications further supports regional growth. However, limited technological infrastructure and high product costs restrain broader adoption. Continued foreign investment and modernization of industrial facilities are expected to gradually strengthen the market presence across the region.

Middle East & Africa

The Middle East & Africa region captures approximately 5% of the global ceramic textiles market, fueled by growing demand from the oil & gas, petrochemical, and power generation sectors. High-temperature operations in refineries and industrial plants drive the need for advanced insulation and fire-resistant materials. The United Arab Emirates and Saudi Arabia lead regional adoption, supported by rapid industrial expansion and energy diversification initiatives. Although infrastructure limitations and higher import dependence pose challenges, increasing investment in industrial safety and high-performance materials is expected to enhance market penetration over the forecast period.

Market Segmentations:

By Type

- Vitreous Alumina-Silica

- Polycrystalline Ceramic Fiber

By Form

- Cloth

- Ropes

- Tapes

- Sleeves

- Braids

By Process

- Pressing

- Extrusion

- Injection Molding

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the ceramic textiles market is characterized by the presence of several global and regional players focusing on technological innovation, product diversification, and strategic expansion. Leading companies such as 3M, Kyocera Corporation, Morgan Advanced Materials Corporation, and Unifrax dominate the market through advanced manufacturing capabilities and strong distribution networks. These players emphasize research and development to enhance thermal resistance, mechanical strength, and flexibility of ceramic fibers. Emerging firms, including Luyang Energy-Saving Materials Co., Ltd. and Isolite Insulating Products Co., Ltd., are strengthening their market positions through cost-effective solutions and regional expansion across Asia-Pacific. Strategic collaborations, mergers, and acquisitions remain common as companies aim to enhance their product portfolios and expand into high-growth industries such as aerospace, power generation, and automotive. Continuous innovation, sustainability initiatives, and digital manufacturing technologies are expected to further intensify competition and shape the future dynamics of the ceramic textiles market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- 3M

- Luyang Energy-Saving Materials Co., Ltd.

- Rauschert GmbH

- Isolite Insulating Products Co., Ltd.

- Morgan Advanced Materials Corporation

- Rath Group

- Kyocera Corporation

- Unifrax

- Zircar Zirconia, Inc.

- Ibiden

Recent Developments

- In October 2025, Luyang showcased advanced ceramic fiber blankets and soluble fiber modules. The update emphasized low thermal conductivity and high chemical stability.

- In 2025, 3M presented Nextel ceramic fibers at JEC World 2025. A workshop previewed new Nextel developments enabling automated ox/ox CMC production.

Report Coverage

The research report offers an in-depth analysis based on Type, Form, Process and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The ceramic textiles market will experience steady growth due to increasing demand for high-temperature and energy-efficient insulation materials.

- Advancements in fiber technology will enhance material performance, flexibility, and heat resistance.

- The aerospace and automotive sectors will continue to drive adoption through lightweight and high-strength applications.

- Expanding use in renewable energy and power generation will create new opportunities for manufacturers.

- Increased emphasis on worker safety and industrial fire protection will sustain product demand.

- Asia-Pacific will remain the leading region, supported by rapid industrialization and infrastructure development.

- Strategic collaborations and mergers among key players will strengthen global market presence.

- Innovation in sustainable and recyclable ceramic fibers will align with global environmental goals.

- Automation and digital manufacturing will improve production efficiency and reduce costs.

- Growing investments in research and development will support long-term competitiveness and technological advancement.