Market Overview:

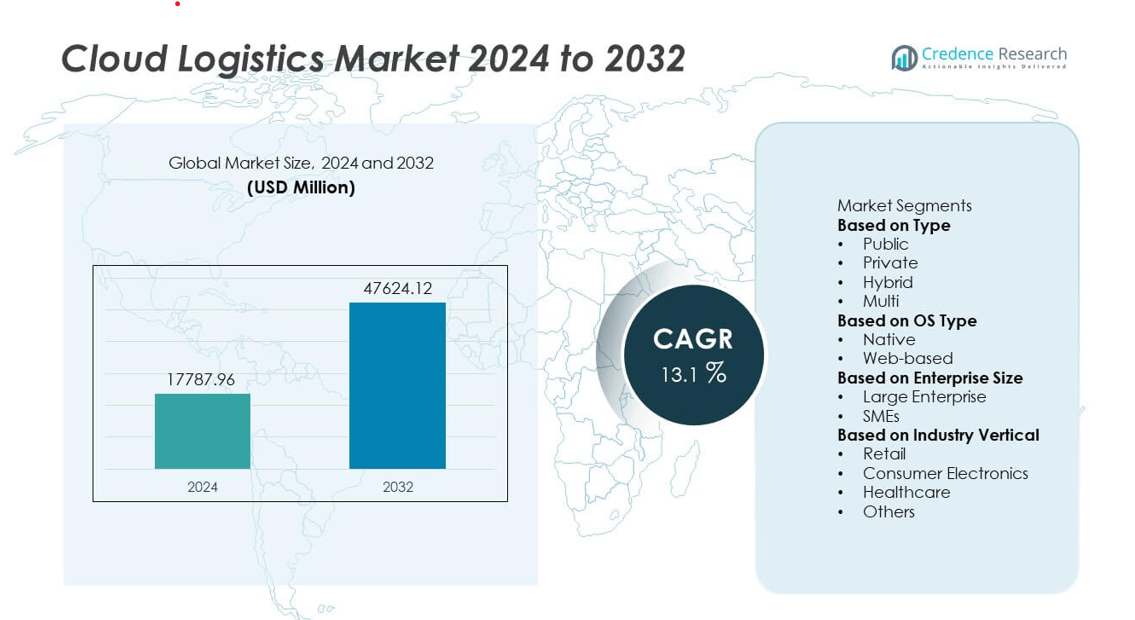

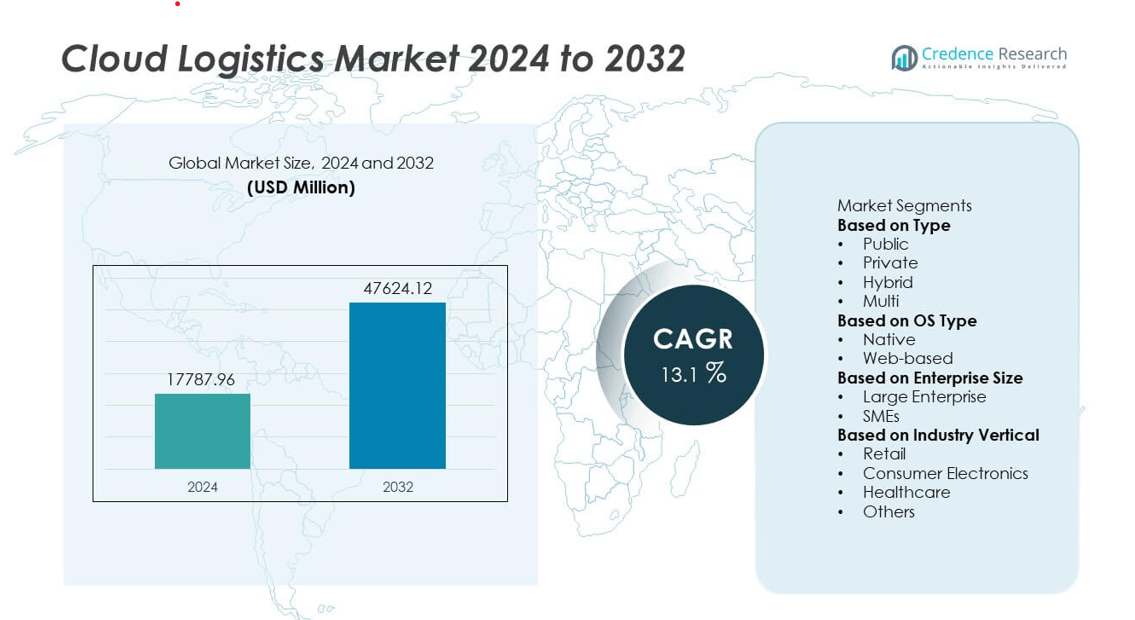

The Cloud Logistics Market was valued at USD 17787.96 million in 2024 and is projected to reach USD 47624.12 million by 2032, expanding at a CAGR of 13.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cloud Logistics Market Size 2024 |

USD 17787.96 million |

| Cloud Logistics Market, CAGR |

13.1% |

| Cloud Logistics Market Size 2032 |

USD 47624.12 million |

The Cloud Logistics market is led by major players such as Uber Freight, Trimble, SAP, BWISE, Oracle Corporation, The Descartes Systems Group Inc, C.H. Robinson Worldwide, Inc., IBM Corporation, Microsoft Corporation, and Thomson Reuters. These companies dominate through innovative cloud-based supply chain and transportation management solutions that enhance visibility, automation, and real-time decision-making. Oracle, SAP, and Microsoft lead in enterprise logistics cloud platforms, while Uber Freight and C.H. Robinson strengthen market presence through digital freight and connectivity services. North America held the largest share of 39.4% in 2024, driven by strong digital infrastructure and e-commerce expansion, followed by Europe with 27.1% and Asia-Pacific with 25.8%, the fastest-growing region due to rapid logistics modernization and government smart transport initiatives.

Market Insights

- The Cloud Logistics market was valued at USD 17787.96 million in 2024 and is projected to reach USD 47624.12 million by 2032, growing at a CAGR of 13.1% during the forecast period.

- Growing demand for real-time supply chain visibility and increased adoption of AI and IoT technologies are driving market growth across logistics operations.

- Key trends include the integration of blockchain for secure transactions, use of predictive analytics for demand forecasting, and the rising shift toward hybrid and multi-cloud logistics models.

- The market is competitive, with leading players such as Oracle, SAP, Microsoft, Uber Freight, and C.H. Robinson focusing on automation, analytics, and cloud-based transportation management solutions.

- North America dominated the market in 2024 with a 39.4% share, followed by Europe at 27.1% and Asia-Pacific at 25.8%, while the hybrid cloud segment accounted for 46.2% of total share due to its flexibility and secure data management.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The hybrid segment dominated the Cloud Logistics market in 2024, holding 46.2% of the total share. This segment leads due to its flexibility in combining public and private cloud environments, enabling efficient data management and secure collaboration across logistics networks. Hybrid cloud models provide scalability and real-time visibility for supply chain operations, which helps organizations handle dynamic logistics demands. Increasing adoption among 3PL providers and multinational logistics firms supports growth, as hybrid infrastructure enhances integration with IoT and analytics tools for efficient inventory and transportation management.

- For instance, DHL Global Forwarding utilizes Google Cloud’s predictive data analytics to monitor freight and predict potential shipping delays with up to 98% accuracy. Furthermore, the broader Deutsche Post DHL Group has leveraged Google Cloud’s Apigee API management platform to handle over one billion API transactions per month

By OS Type

The web-based segment held the largest share of 59.8% in the Cloud Logistics market in 2024. Its dominance is driven by the rising use of web-enabled logistics platforms that allow real-time tracking and collaboration without the need for complex installations. Web-based systems improve accessibility for distributed teams and enable seamless integration with ERP, CRM, and fleet management solutions. The demand for browser-compatible, cost-effective logistics applications continues to rise among SMEs and large enterprises. Companies are increasingly using web-based cloud logistics to optimize delivery scheduling and streamline warehouse operations.

- For instance, C.H. Robinson’s Navisphere platform handles over 37 million shipments annually via a web-based interface. The platform supports integration with more than 450,000 contract carriers, allowing real-time order visibility and data synchronization across logistics partners worldwide.

By Enterprise Size

Large enterprises accounted for 63.7% of the Cloud Logistics market share in 2024, maintaining their leadership due to the scale and complexity of global logistics operations. These organizations are investing in advanced cloud solutions to enhance supply chain transparency, automate documentation, and manage multi-regional fleets. The growing need for predictive analytics and centralized logistics control supports adoption among large players in manufacturing, retail, and e-commerce. Cloud logistics platforms enable real-time route optimization, reducing costs and improving efficiency. Major logistics firms are integrating AI-driven systems to strengthen delivery accuracy and customer satisfaction.

Key Growth Drivers

Rising Demand for Real-Time Supply Chain Visibility

Enterprises are increasingly adopting cloud logistics solutions to achieve real-time visibility across global supply chains. Cloud-based platforms enable continuous tracking of shipments, warehouse inventory, and transportation networks, reducing delays and inefficiencies. Integration of IoT and GPS technologies enhances monitoring accuracy, allowing logistics providers to make data-driven decisions. As e-commerce expands and customer expectations for transparency grow, the demand for cloud-enabled logistics visibility continues to rise, driving operational agility and better service delivery across industries.

- For instance, IBM’s Sterling Supply Chain Intelligence platform leverages its multi-enterprise business network, which processes over 3 billion data transactions annually. It leverages AI and IoT to monitor shipment conditions in real time across 180 countries, enabling predictive insights and proactive risk management for enterprise clients.

Expansion of E-Commerce and Omnichannel Logistics

The rapid growth of e-commerce is a major catalyst for cloud logistics adoption. Retailers and logistics providers rely on cloud-based systems to manage fluctuating order volumes, optimize fulfillment, and improve last-mile delivery. These solutions enable synchronization across multiple sales channels, ensuring timely delivery and efficient inventory management. Cloud platforms support automated order processing and real-time analytics, improving scalability during peak periods. The rise of omnichannel retailing further drives integration of warehouse, transportation, and customer service through unified cloud logistics systems.

- For instance, Oracle Cloud SCM is a platform that many corporations worldwide trust to manage mission-critical business functions, including omnichannel operations. The platform helps link order fulfillment and transportation data to enhance accuracy and delivery efficiency across online and physical retail channels.

Growing Adoption of AI and Automation in Logistics Operations

The use of artificial intelligence and automation is transforming cloud logistics management. AI-driven tools optimize route planning, predict demand, and automate warehouse operations, significantly improving efficiency and reducing costs. Cloud-based automation also facilitates predictive maintenance for fleets and real-time performance tracking. Integration with robotic process automation (RPA) and machine learning enhances accuracy in order handling and reduces human error. As logistics firms prioritize cost efficiency and faster delivery, AI-enabled cloud logistics solutions are becoming essential for maintaining competitive advantage.

Key Trends & Opportunities

Integration of Blockchain for Secure and Transparent Logistics

Blockchain technology is emerging as a key enabler in cloud logistics by enhancing data security and transaction transparency. It ensures traceability of goods, reduces fraud, and provides immutable records of shipment data. Combining blockchain with cloud platforms allows multiple stakeholders—manufacturers, carriers, and customers—to access shared data securely. This integration improves trust and accountability across supply chains. As businesses focus on ethical sourcing and regulatory compliance, blockchain-enabled cloud logistics solutions present strong opportunities for future adoption.

- For instance, the former IBM and Maersk’s TradeLens blockchain platform, had connected more than 300 organizations, including ports and customs authorities, and demonstrated the potential to reduce document processing time by up to 40%.

Rising Adoption of Multi-Cloud Strategies

Organizations are increasingly implementing multi-cloud architectures to enhance flexibility, reduce dependency on single providers, and improve data redundancy. Multi-cloud logistics solutions allow seamless data exchange between platforms, ensuring high availability and optimized performance. This strategy also supports compliance with regional data regulations while improving disaster recovery. Logistics firms benefit from enhanced scalability and integration across different operational layers. The shift toward multi-cloud ecosystems enables better resource management and paves the way for advanced analytics and AI-driven logistics optimization.

- For instance, FedEx adopted Microsoft Azure and Oracle Cloud Infrastructure to manage its logistics data globally. The dual-cloud setup handles over 18 million package tracking updates per day, enhancing visibility, predictive analytics, and uptime reliability across its global delivery network.

Key Challenges

Data Security and Privacy Concerns

Data breaches and cyber threats remain significant challenges for cloud logistics adoption. Logistics networks handle sensitive data related to shipments, customers, and financial transactions, making them prime targets for cyberattacks. Ensuring end-to-end encryption, access control, and compliance with data protection regulations is critical. Small and medium enterprises often lack the expertise and resources to implement robust cybersecurity measures. As the volume of interconnected logistics data grows, addressing security vulnerabilities and maintaining trust among stakeholders becomes a top industry priority.

Integration with Legacy Systems

Many logistics companies still rely on legacy IT systems that lack compatibility with modern cloud solutions. Integrating these outdated systems with advanced cloud logistics platforms can be complex and costly. Disruptions during migration can hinder operational continuity and data consistency. The lack of standardized APIs further complicates seamless connectivity between platforms. To overcome this, vendors are offering modular and scalable integration frameworks. However, modernization remains a challenge for traditional logistics operators aiming to transition smoothly to cloud-based infrastructures.

Regional Analysis

North America

North America dominated the Cloud Logistics market in 2024, holding a 39.4% share. The region’s leadership is driven by strong cloud infrastructure, widespread digital transformation, and the presence of key logistics service providers. The U.S. leads market growth through early adoption of AI and IoT-based logistics systems, improving visibility and efficiency. Cloud-based platforms are increasingly used to streamline e-commerce fulfillment and transportation management. Strategic investments by major companies in predictive analytics and automation are reinforcing the region’s position as a technology-driven logistics hub focused on real-time supply chain optimization.

Europe

Europe accounted for 27.1% of the Cloud Logistics market in 2024, supported by robust adoption of advanced supply chain technologies and strong regulatory frameworks. Countries such as Germany, the United Kingdom, and France are leading digital logistics transformation through investments in IoT-enabled platforms and smart warehousing. The European Union’s focus on sustainable logistics operations and carbon reduction initiatives promotes cloud integration for efficiency tracking. Partnerships between logistics providers and cloud technology firms continue to enhance interoperability and scalability. The region’s growing e-commerce penetration further accelerates cloud logistics adoption across transportation and warehouse management.

Asia-Pacific

Asia-Pacific held 25.8% of the Cloud Logistics market in 2024 and is expected to record the fastest growth through 2032. The region’s expansion is fueled by rapid industrialization, booming e-commerce activity, and strong investments in logistics automation. Major economies like China, India, Japan, and South Korea are deploying cloud-based logistics solutions to enhance transparency and reduce operational costs. Government-led smart infrastructure projects and 5G connectivity are supporting advanced cloud adoption. Increasing collaboration between technology providers and logistics firms is driving innovation, positioning Asia-Pacific as a critical growth hub for next-generation logistics solutions.

Latin America

Latin America captured 4.5% of the Cloud Logistics market in 2024, driven by expanding digitalization in transportation and retail sectors. Countries such as Brazil, Mexico, and Chile are adopting cloud-based supply chain management systems to enhance efficiency and visibility. The region’s rising e-commerce demand is fueling adoption of web-based logistics platforms for order tracking and route optimization. Although infrastructure limitations and cybersecurity challenges persist, cloud logistics solutions are helping local enterprises modernize operations. Regional investments in automation, coupled with collaborations with global technology firms, are expected to accelerate market growth in the coming years.

Middle East & Africa

The Middle East & Africa held 3.2% of the global Cloud Logistics market in 2024. Growth is supported by increasing government investments in digital transformation and logistics modernization. Countries such as the UAE, Saudi Arabia, and South Africa are integrating cloud logistics platforms to improve supply chain efficiency and transparency. The expansion of free trade zones, smart port initiatives, and e-commerce logistics hubs is boosting cloud adoption. While limited IT infrastructure in some regions poses challenges, the ongoing rollout of 5G networks and public-private collaborations are expected to strengthen the region’s cloud logistics ecosystem.

Market Segmentations:

By Type

- Public

- Private

- Hybrid

- Multi

By OS Type

By Enterprise Size

By Industry Vertical

- Retail

- Consumer Electronics

- Healthcare

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Cloud Logistics market is highly competitive, with key players including Uber Freight, Trimble, SAP, BWISE, Oracle Corporation, The Descartes Systems Group Inc, C.H. Robinson Worldwide, Inc., IBM Corporation, Microsoft Corporation, and Thomson Reuters driving global expansion and technological advancement. These companies focus on integrating cloud platforms with AI, IoT, and analytics to enhance supply chain visibility and operational efficiency. Leading firms such as Oracle, SAP, and Microsoft are investing heavily in digital logistics ecosystems that support real-time tracking, route optimization, and demand forecasting. Meanwhile, Uber Freight and C.H. Robinson are leveraging cloud-enabled transportation management to optimize freight operations and improve delivery accuracy. Strategic partnerships, mergers, and cloud service integrations remain key strategies among top players to strengthen their market presence. Continuous innovation in automation, blockchain, and multi-cloud platforms is further intensifying competition, shaping the next phase of digital transformation in the logistics industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Uber Freight

- Trimble

- SAP

- BWISE

- Oracle Corporation

- The Descartes Systems Group Inc

- H. Robinson Worldwide, Inc.

- IBM Corporation

- Microsoft Corporation

- Thomson Reuters

Recent Developments

- In September 2024, Rose Rocket, Inc., a Canada-based provider of cloud-based transportation software, announced a partnership with CartonCloud to introduce its logistics solutions to Australia and New Zealand.

- In December 2023, Fujitsu announced a new cloud-based logistics data standardization and visualization service aimed at enhancing sustainability and addressing challenges like driver shortages, emissions reduction, and regulatory compliance.

- In September 2023, Trimble Inc. partnered with Next Generation Logistics to make its “Engage Lane” solution available via the Trimble Transportation Cloud.

Report Coverage

The research report offers an in-depth analysis based on Type, OS Type, Enterprise Size, Industry Vertical and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily as logistics companies accelerate cloud adoption for efficiency.

- AI and IoT integration will enhance real-time tracking and route optimization.

- Hybrid and multi-cloud deployments will gain traction for secure and flexible data handling.

- Blockchain technology will improve supply chain transparency and transaction accuracy.

- Predictive analytics will become essential for demand forecasting and inventory management.

- Automation will reduce manual errors and improve last-mile delivery performance.

- Collaboration between tech providers and logistics firms will expand digital ecosystems.

- Cloud-based transportation management systems will dominate enterprise logistics operations.

- Emerging markets in Asia-Pacific and Latin America will drive future adoption.

- Sustainability-focused logistics solutions will leverage cloud technology for carbon tracking and optimization.