Market Overview:

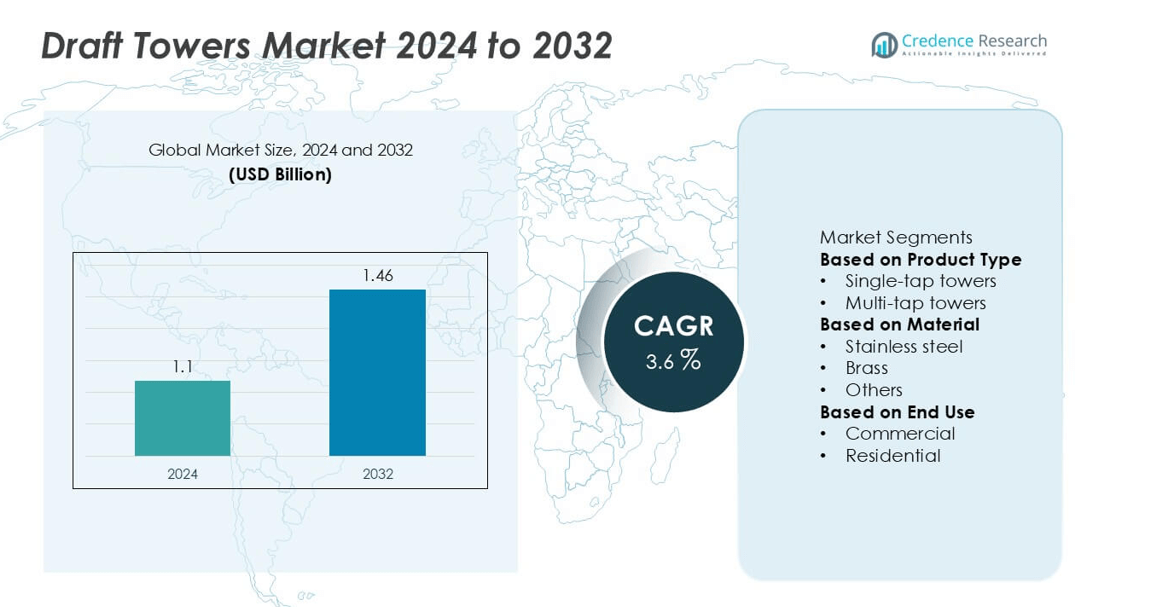

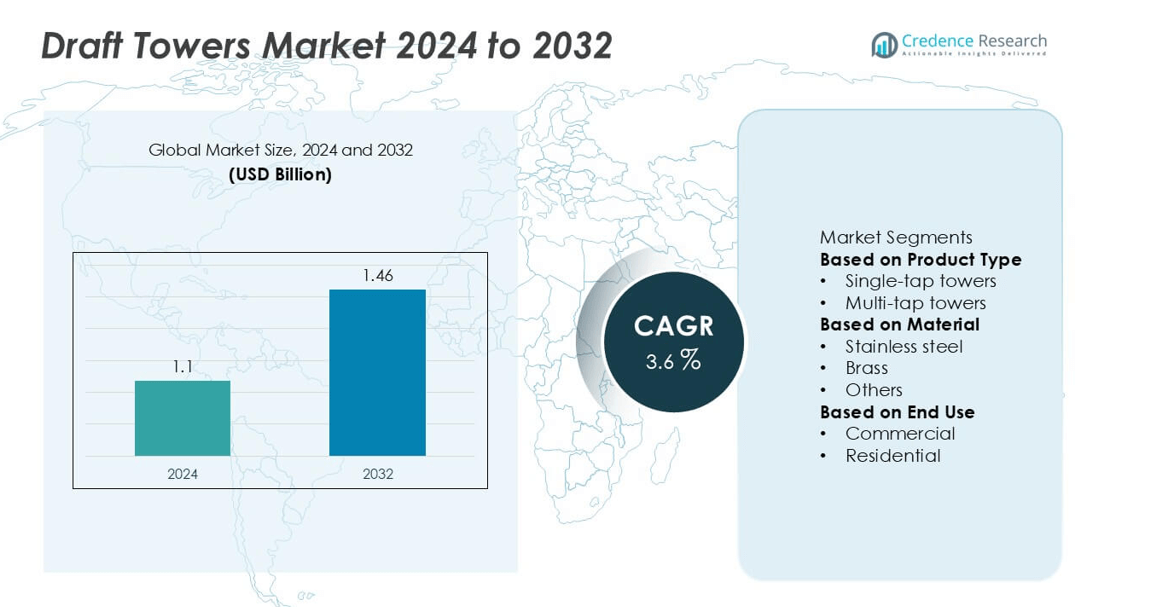

The Draft Towers market was valued at USD 1.1 billion in 2024 and is projected to reach USD 1.46 billion by 2032, growing at a compound annual growth rate CAGR of 3.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Draft Towers Market Size 2024 |

USD 1.1 billion |

| Draft Towers Market, CAGR |

3.6% |

| Draft Towers Market Size 2032 |

USD 1.46 billion |

The Draft Towers market features several prominent players, including Micro Matic USA Inc, Kegco, Felix Storch Inc, Fizzics Group, Komos, KEG KING, Klarstein, Brew Driver, kegwerks, and BARRAID. These companies collectively drive innovation through advanced dispensing technologies, customizable designs, and energy-efficient systems. Among them, Micro Matic USA Inc and Kegco hold strong positions due to their extensive distribution networks and broad product portfolios catering to both commercial and residential applications. North America leads the global market with a 38% share, supported by a well-developed hospitality sector and high adoption of multi-tap systems, followed by Europe with 32%, driven by its strong beer culture and modernization of bar infrastructure.

Market Insights

- The Draft Towers market was valued at USD 1.1 billion in 2024 and is projected to reach USD 1.46 billion by 2032, growing at a CAGR of 3.6% during the forecast period.

- Market growth is driven by rising demand for craft beer, the expansion of bars and breweries, and increasing consumer preference for freshly poured beverages.

- Key trends include technological advancements in dispensing systems, growing adoption of stainless steel and multi-tap towers, and a shift toward sustainable and customizable designs.

- The market is moderately fragmented, with major players such as Micro Matic USA Inc, Kegco, and Komos focusing on innovation, product diversification, and strategic partnerships to strengthen global presence.

- North America holds 38% of the market, followed by Europe with 32%, while the multi-tap towers segment leads with 65% and stainless steel material accounts for 58%, driven by durability and hygiene advantages.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The Draft Towers market is segmented into single-tap towers and multi-tap towers. The multi-tap towers segment dominated the market in 2024, accounting for over 65% of the total share. This dominance is driven by the rising demand for versatile dispensing systems in bars, pubs, and restaurants, which prefer multiple tap options to offer a wider variety of beverages simultaneously. Increasing popularity of craft beers and the expansion of commercial breweries have further fueled the adoption of multi-tap systems, enhancing operational efficiency and customer experience.

- For instance, Micro Matic USA offers a Pro-Line 6 Tap Tower Series that can be equipped with glycol recirculation technology to ensure consistent temperature control. Each tower supports up to six independent beverage lines, which improves service throughput in high-volume bars. The models with stainless steel contact parts use 304-grade stainless steel.

By Material

Based on material, the market is divided into stainless steel, brass, and others. The stainless steel segment held the largest share of approximately 58% in 2024, owing to its superior durability, corrosion resistance, and hygienic properties. Stainless steel draft towers are favored in commercial establishments due to their long lifespan and minimal maintenance requirements. Additionally, increasing investments in premium bar infrastructure and the growing preference for aesthetically appealing, easy-to-clean equipment have supported the dominance of stainless steel in the overall material segment.

- For instance, Kegco manufactures its DTSS series of stainless steel draft towers using 304-grade stainless steel, ensuring consistent hygiene and reliability in commercial use. This material provides a 100% stainless steel contact surface to protect the flavor of the beer from impurities.

By End Use

By end use, the market is categorized into commercial and residential segments. The commercial segment accounted for the largest share, capturing around 72% of the market in 2024. This dominance is attributed to the expanding network of bars, breweries, hotels, and restaurants worldwide, where draft systems are a key feature for beverage dispensing. The surge in social dining trends and craft beer consumption has increased demand for high-capacity draft towers in commercial spaces. Conversely, the residential segment is witnessing gradual growth, driven by rising interest in home bars and personal brewing systems.Top of Form

Key Growth Drivers

Rising Popularity of Craft Beer and Premium Beverages

The increasing global consumption of craft beer and premium beverages is a major driver for the Draft Towers market. Consumers are showing a growing preference for artisanal and locally brewed beers served on tap, promoting installations in bars, restaurants, and breweries. The demand for authentic, fresh, and customizable beverage experiences has encouraged establishments to invest in advanced draft systems, thereby boosting market expansion. This trend is particularly strong in North America and Europe, where craft breweries continue to proliferate rapidly.

- For instance, Fizzics technology uses sound waves to convert a beer’s natural carbonation into uniform, dense, “micro-foam” to enhance aroma and flavor from standard cans and bottles. This consumer device is designed to improve the drinking experience by providing a “nitro-style” pour, creating a creamy head for a wide variety of craft beer styles.

Expansion of the Hospitality and Foodservice Industry

The rapid growth of the hospitality and foodservice sectors, including bars, pubs, hotels, and restaurants, significantly drives demand for draft towers. These establishments rely on efficient beverage dispensing systems to enhance customer service and maintain beverage quality. Post-pandemic recovery and the rise of social dining trends have accelerated new outlet openings globally. Furthermore, the integration of aesthetic and ergonomic tower designs supports venue branding and customer engagement, contributing to sustained demand from the commercial segment.

- For instance, Klarstein offers consumer-grade beer dispensers, such as the Klarstein Beerkules or Klarstein Skal models, designed for home use with standard 5-liter universal or 6-liter tapped kegs. These appliances feature active cooling and aim to maintain a constant drinking temperature, often digitally controlled, allowing users to enjoy a fresh beer experience at home

Technological Advancements in Dispensing Systems

Continuous innovation in draft tower design and dispensing technology is enhancing market growth. Manufacturers are incorporating temperature control systems, energy-efficient cooling units, and customizable tap configurations to improve functionality and sustainability. The adoption of digital monitoring systems for real-time maintenance alerts and pour tracking also boosts operational efficiency. These advancements not only improve beverage quality and consistency but also attract commercial establishments seeking durable and efficient solutions, thereby reinforcing the market’s long-term growth outlook.

Key Trends & Opportunities

Increasing Adoption of Sustainable and Energy-Efficient Designs

Sustainability has become a major trend shaping the draft towers market. Manufacturers are focusing on eco-friendly materials, such as recyclable stainless steel and low-emission components, to reduce environmental impact. Energy-efficient cooling technologies and smart control systems are gaining popularity for lowering operational costs. This trend aligns with broader green initiatives in the hospitality sector, creating opportunities for brands that prioritize environmentally responsible designs and production methods while appealing to environmentally conscious consumers.

- For instance, the company ecoCOOL offers an “EcoCool” glycol refrigeration system that uses natural R290 refrigerant and can significantly reduce energy consumption and associated CO₂ emissions compared to traditional HFC systems, helping breweries and bars meet green certification standards.

Growing Demand for Customization and Aesthetic Appeal

Rising competition among bars and restaurants has increased the demand for visually appealing and customizable draft towers. Establishments are opting for unique designs, branding elements, and lighting features to create distinctive customer experiences. This customization trend presents opportunities for manufacturers to offer premium, design-oriented products tailored to specific venue themes. Enhanced aesthetic integration not only strengthens brand identity but also adds perceived value, particularly in upscale hospitality environments focused on ambiance and customer engagement.

- For instance, Komos introduced its high-quality, stainless steel draft towers with forward-sealing faucets designed to reduce foaming issues. Each model features a tower-cooling fan to direct chilled air upwards and comes standard with Duotight push-to-connect fittings and EVABarrier double-walled tubing for easy assembly and protection against oxidation and microbial growth.

Key Challenges

High Initial Investment and Maintenance Costs

One of the primary challenges in the draft towers market is the high initial investment required for installation and setup, especially for multi-tap systems. Small and mid-sized establishments often face budget constraints, limiting market penetration in emerging regions. Additionally, ongoing maintenance, cleaning, and compliance with hygiene standards add to operational costs. These financial barriers can deter new entrants and slow adoption rates, particularly in price-sensitive markets where cost-efficiency remains a key purchasing factor.

Limited Awareness in Emerging Economies

Despite strong growth in developed markets, limited awareness and lack of infrastructure in emerging economies hinder market expansion. Many small-scale restaurants and bars in developing regions still rely on traditional beverage dispensing methods due to low exposure to draft technology benefits. Insufficient technical expertise and after-sales support further restrict adoption. Addressing these challenges through targeted education campaigns, distribution partnerships, and affordable product offerings will be essential to unlocking untapped market potential in these regions.

Regional Analysis

North America

North America held the largest share of the Draft Towers market in 2024, accounting for 38% of the global revenue. The region’s dominance is driven by a well-established craft beer culture, widespread presence of breweries, and a strong hospitality sector. The United States leads regional demand, supported by growing consumer preference for premium and freshly poured beverages. The increasing adoption of multi-tap systems in bars and restaurants, combined with innovations in design and dispensing technology, continues to enhance market penetration. Canada also contributes notably, with rising investments in microbreweries and specialty beverage venues.

Europe

Europe accounted for 32% of the global Draft Towers market share in 2024, fueled by its rich beer culture and strong presence of traditional breweries. Countries such as Germany, the United Kingdom, Belgium, and the Czech Republic remain key contributors due to high beer consumption rates and growing interest in craft brewing. The adoption of stainless steel draft systems and emphasis on energy-efficient dispensing solutions have supported steady regional growth. Additionally, rising modernization of bars and restaurants and expansion of beer festivals have strengthened market demand across the European region.

Asia-Pacific

The Asia-Pacific region captured 20% of the Draft Towers market share in 2024 and is expected to witness the fastest growth through 2032. Expanding urbanization, increasing disposable incomes, and growing popularity of Western-style dining and nightlife are driving demand. Countries like China, Japan, Australia, and India are experiencing rapid growth in the hospitality and craft beer sectors. The emergence of local breweries and the rising influence of international beverage brands further support market expansion. Manufacturers are targeting this region through partnerships and localized production to meet evolving consumer preferences efficiently.

Latin America

Latin America accounted for 6% of the global Draft Towers market share in 2024, with Brazil, Mexico, and Argentina leading demand. The region’s growing bar and restaurant industry, combined with increasing interest in premium and artisanal beverages, is fueling market development. Economic recovery and the expansion of tourism have encouraged more establishments to upgrade beverage dispensing systems. However, limited technological adoption and price sensitivity in smaller markets slightly restrain growth. Ongoing investments in hospitality infrastructure and regional brewing initiatives are expected to create new opportunities during the forecast period.

Middle East & Africa

The Middle East & Africa region represented 4% of the Draft Towers market share in 2024, emerging as a niche but steadily growing market. Increasing tourism, urban development, and expansion of high-end hotels and resorts are driving adoption, particularly in the United Arab Emirates and South Africa. Rising social dining trends and gradual relaxation of beverage regulations in selected markets are encouraging investments in premium bar infrastructure. However, limited local manufacturing and higher import costs remain key challenges. Despite these hurdles, the region shows promising long-term potential for premium hospitality growth.

Market Segmentations:

By Product Type

- Single-tap towers

- Multi-tap towers

By Material

- Stainless steel

- Brass

- Others

By End Use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Draft Towers market is characterized by the presence of several established and emerging players, including Micro Matic USA Inc, Kegco, Felix Storch Inc, Fizzics Group, Komos, KEG KING, Klarstein, Brew Driver, kegwerks, and BARRAID. These companies compete through product innovation, design enhancements, and technological integration to strengthen their market positions. Leading players are focusing on developing energy-efficient, durable, and customizable draft tower solutions to meet the evolving needs of commercial and residential users. Strategic initiatives such as mergers, partnerships, and distribution expansions are being pursued to enhance global reach and brand visibility. Furthermore, increasing emphasis on stainless steel and multi-tap system production underscores the shift toward premiumization and performance efficiency. The market remains moderately fragmented, with regional players gaining traction through niche offerings and competitive pricing strategies. Continuous product innovation and sustainable manufacturing practices are expected to shape future competition across the industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In December 2024, BeerBoard and GoTab announced a strategic integration partnership to connect BeerBoard’s beverage management and analytics platform with GoTab’s point-of-sale and guest commerce system.

- In September 2023, Perlick entered a partnership with Draught Guard to enhance beer line maintenance technology. The alliance focuses on providing advanced automated cleaning systems that improve draft quality, efficiency, and beverage consistency in bars and restaurants.

- In 2023, Micro Matic partnered with BarTrack to launch the Smart Draft System powered by BarTrack. This advanced solution integrates IoT sensors and analytics for real-time tracking of draft-line temperature, pressure, cleanliness, foam quality, keg levels, and overall system health.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Draft Towers market is expected to maintain steady growth through 2032, supported by increasing global demand for craft beer and premium beverages.

- Continuous innovation in dispensing technology will enhance product efficiency, durability, and hygiene standards.

- Manufacturers will increasingly adopt eco-friendly materials and energy-efficient systems to align with sustainability goals.

- Multi-tap towers will continue to dominate due to their versatility and ability to serve multiple beverages simultaneously.

- The commercial segment will remain the primary revenue contributor, driven by expanding hospitality and foodservice sectors.

- Asia-Pacific will witness the fastest growth, fueled by urbanization, rising incomes, and emerging brewery culture.

- Customization and aesthetic product designs will gain traction as bars and restaurants focus on enhancing consumer experience.

- Strategic mergers and collaborations among key players will strengthen global supply networks and market reach.

- Digital integration, including smart monitoring and temperature control features, will become standard offerings.

- Growing investment in bar infrastructure and premium beverage experiences will sustain long-term market momentum.