Market Overview:

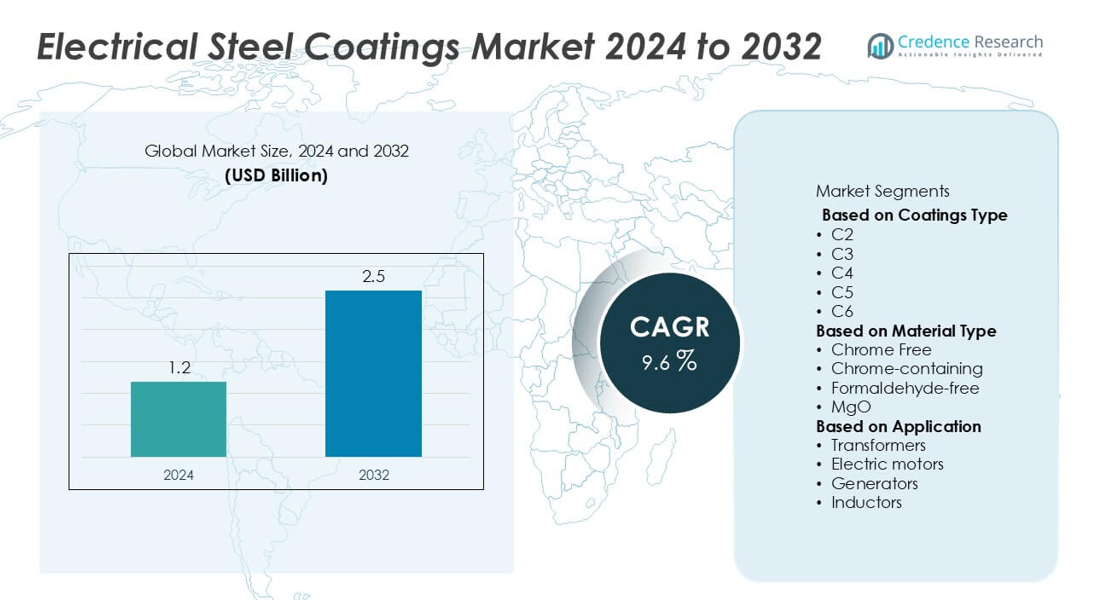

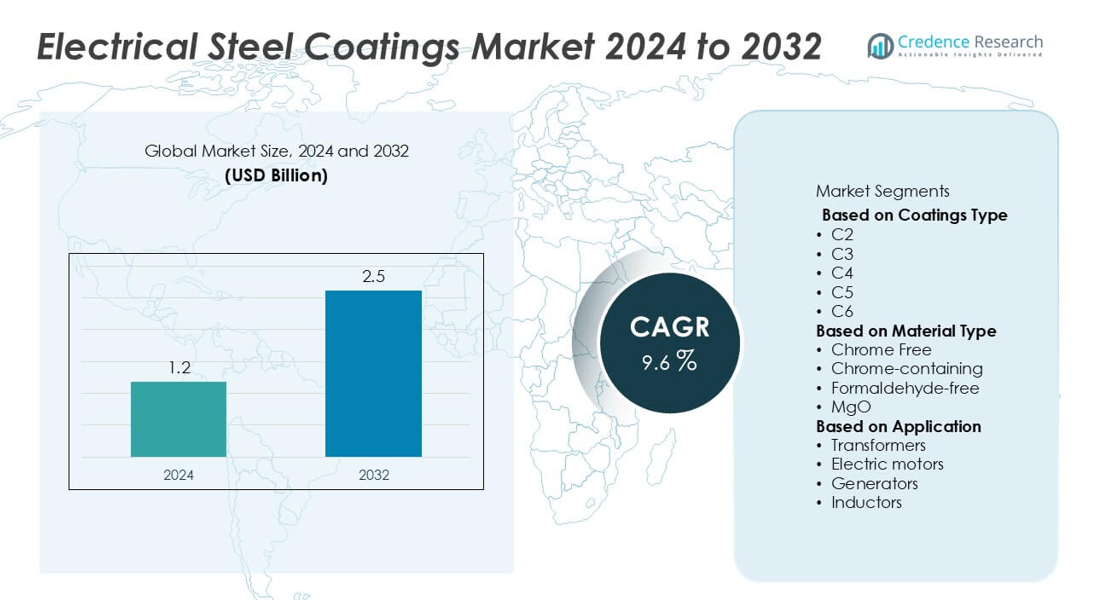

The global Electrical Steel Coatings market was valued at USD 1.2 billion in 2024 and is projected to reach USD 2.5 billion by 2032, growing at a compound annual growth rate CAGR of 9.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electrical Steel Coatings Market Size 2024 |

USD 1.1 billion |

| Electrical Steel Coatings Market, CAGR |

9.6% |

| Electrical Steel Coatings Market Size 2032 |

USD 2.5 billion |

The electrical steel coatings market is led by prominent players such as JFE Steel Corporation, Baosteel, ArcelorMittal SA, Nippon Steel & Sumitomo Metal Corporation (NSSMC), AK Steel Holding Corporation, Cogent Power Limited, Chemetall GmbH, Dorf Ketal Chemicals, Filtra Catalysts and Chemicals Ltd., and Polaris Laser Laminations, LLC. These companies dominate the market through advanced coating technologies, strong regional presence, and strategic partnerships with electrical equipment manufacturers. Asia-Pacific stands as the leading region, accounting for 38% of the global market share in 2024, driven by large-scale power infrastructure development, rapid industrialization, and the growing demand for energy-efficient transformers and electric motors across China, India, Japan, and South Korea.

Market Insights

- The global electrical steel coatings market was valued at USD 1.2 billion in 2024 and is projected to reach USD 2.5 billion by 2032, expanding at a CAGR of 9.6% during the forecast period.

- The market growth is primarily driven by rising demand for energy-efficient transformers, motors, and generators, supported by rapid industrialization and grid modernization initiatives across major economies.

- Key trends include the shift toward chrome-free and eco-friendly coatings, increasing use of coated electrical steel in electric vehicles, and technological advancements improving insulation and corrosion resistance.

- The competitive landscape features major players such as JFE Steel Corporation, Baosteel, ArcelorMittal SA, and NSSMC, focusing on sustainable coating technologies, strategic collaborations, and product innovation to strengthen global market presence.

- Asia-Pacific dominates with 38% market share, followed by Europe (27%) and North America (22%); the C3 coating type (35%) and transformer application (45%) remain the leading segments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Coating Type

The C3 coating segment dominated the electrical steel coatings market in 2024, accounting for approximately 35% of the total market share. Its superior corrosion resistance, excellent adhesion properties, and compatibility with high-performance electrical steel grades drive its widespread use in industrial applications. C3 coatings are preferred in environments with moderate humidity and chemical exposure, making them ideal for transformers and electric motors. Growing demand for energy-efficient electrical devices and stricter performance standards for laminated steel components continue to strengthen the adoption of C3 coatings across major manufacturing sectors.

- For instance, JFE Steel Corporation offers various high-performance non-oriented electrical steel products under the JFE Super Core™ brand, which features proprietary insulation coatings. One common coating type used across the industry, designated as C3 (an organic enamel or varnish), provides very high levels of surface insulation resistance and rust protection and is typically applied for applications such as small motors and transformers.

By Material Type

The chrome-free coating segment held the leading position in 2024, capturing around 40% of the market share. The shift toward environmentally sustainable materials and stringent regulatory frameworks restricting chromium use have fueled its dominance. Chrome-free coatings offer comparable insulation and corrosion resistance while meeting RoHS and REACH compliance. Manufacturers increasingly adopt these coatings to reduce environmental impact and enhance worker safety. Additionally, technological advancements in eco-friendly coating formulations and rising demand from Europe and Asia-Pacific contribute to the steady expansion of the chrome-free material segment.

- For instance, Chemetall GmbH launched its Oxsilan chrome-free coating system, a silane-based multipurpose pretreatment product used as a replacement for chromate conversion coatings on various metal substrates, including steel and aluminum alloys, to enhance paint adhesion and painted corrosion performance, supporting large-scale compliance with European environmental directives.

By Application

The transformers segment emerged as the largest application area in 2024, accounting for approximately 45% of the market share. The surge in global power distribution network expansion and growing investments in renewable energy infrastructure are driving demand for coated electrical steel in transformers. Electrical steel coatings enhance lamination insulation, reduce core losses, and improve magnetic efficiency—key factors in transformer performance. The modernization of grid systems, particularly in developing economies, and the increasing focus on energy-efficient power equipment further reinforce the dominance of the transformer segment in the market.

Key Growth Drivers

Rising Demand for Energy-Efficient Electrical Equipment

The global shift toward energy efficiency is a major driver of the electrical steel coatings market. Coated electrical steels are essential for minimizing core losses and improving magnetic performance in transformers, motors, and generators. As governments implement stricter energy efficiency regulations, manufacturers are focusing on producing advanced coated steels that meet these standards. The rapid expansion of industrial automation and the growing adoption of electric vehicles (EVs) further fuel demand for high-performance electrical steels with superior insulation and corrosion resistance.

- For instance, Baosteel produces B27R085 electrical steel, a grade typically named to indicate a nominal core loss value of 0.85 W/kg at 1.5 T and 50 Hz, designed for use in motors and generators. The steel is available with various insulating coatings that provide surface resistance as part of the material’s specifications.

Expansion of Power Generation and Transmission Infrastructure

The continuous development of power infrastructure, particularly in emerging economies, significantly boosts the market for electrical steel coatings. Increasing investments in renewable energy projects and smart grid modernization are driving the need for efficient transformers and electrical components. Coated electrical steel improves operational reliability and reduces energy losses, making it critical for grid performance. Countries across Asia-Pacific and the Middle East are accelerating power capacity expansions, thereby creating robust opportunities for coating manufacturers specializing in high-grade electrical steels.

- For instance, POSCO has supplied its high-grade, grain-oriented electrical steel for power transformers deployed in the Saudi Electricity Company’s grid infrastructure. This material is characterized by high magnetic flux density and superior surface insulation resistance, which contributes to improved transformer efficiency.

Technological Advancements in Eco-Friendly Coatings

The market is witnessing strong growth due to technological advancements in environmentally sustainable coating formulations. Manufacturers are increasingly developing chrome-free and formaldehyde-free coatings that offer excellent insulation, corrosion resistance, and environmental compliance. These innovations align with global environmental standards, including RoHS and REACH directives. The integration of nanotechnology and advanced chemical processes is enhancing coating durability and performance, creating a competitive edge for producers. As sustainability becomes a key differentiator, companies investing in green coating technologies are gaining traction in the global market.

Key Trends & Opportunities

Growing Adoption of Chrome-Free and Formaldehyde-Free Coatings

Environmental sustainability is shaping market trends, with chrome-free and formaldehyde-free coatings gaining widespread acceptance. These coatings eliminate hazardous substances while maintaining high insulation performance and thermal stability. The transition supports global compliance initiatives and enhances brand reputation for manufacturers prioritizing eco-friendly solutions. Continuous innovation in coating chemistry and the rising preference for sustainable production processes create lucrative opportunities for suppliers offering non-toxic, high-performance alternatives in the electrical steel coatings market.

- For instance, Tata Steel Europe’s subsidiary, Cogent Power, develops new electrical steel grades used in energy-efficient transformers and electric machines. These non-grain oriented (NGO) and grain-oriented (GO) electrical steels are designed to meet specific electromagnetic and mechanical properties for optimal performance in power industry applications and meet relevant safety and environmental standards.

Increasing Integration of Coated Steel in Electric Vehicles (EVs)

The rapid growth of the EV industry is generating new opportunities for electrical steel coating manufacturers. Coated electrical steels are essential in producing efficient electric motors that ensure reduced energy loss and improved torque. With automakers expanding EV production capacity, the demand for high-grade coated steels is projected to rise substantially. This trend is encouraging strategic partnerships between coating producers and automotive component manufacturers to develop customized solutions optimized for EV propulsion systems and power electronics.

- For instance, Nippon Steel Corporation supplied its high-grade, grain-oriented electrical steel, such as 23ZDKH85 or B23R085, coated with an inorganic phosphate-insulation layer for high-efficiency transformers.

Key Challenges

High Production Costs and Raw Material Volatility

Fluctuating prices of raw materials such as silicon steel and specialized coating chemicals present a key challenge for manufacturers. The production of high-grade coatings requires precise formulations and controlled processes, leading to increased manufacturing costs. Additionally, energy-intensive production cycles and rising operational expenses impact profit margins. To remain competitive, companies must focus on optimizing supply chains, improving process efficiency, and investing in advanced manufacturing technologies that reduce waste and enhance cost-effectiveness.

Stringent Environmental and Regulatory Compliance

The tightening of global environmental regulations poses significant challenges for the electrical steel coatings industry. Restrictions on hazardous materials like hexavalent chromium have compelled manufacturers to reformulate coating products, often requiring substantial R&D investments. Compliance with diverse international standards-such as REACH in Europe and EPA regulations in the U.S.-increases operational complexity. Companies failing to adapt risk market exclusion or reputational damage. Hence, balancing regulatory adherence with performance and cost efficiency remains a major concern for coating producers.

Regional Analysis

North America

North America held a market share of 22% in the global electrical steel coatings market in 2024. The region’s growth is driven by strong demand for high-efficiency transformers, electric motors, and renewable energy systems. The U.S. and Canada are leading in modernizing their aging power infrastructure and expanding smart grid networks, which boosts the adoption of coated electrical steels. The increasing penetration of electric vehicles and industrial automation further strengthens market growth. Manufacturers in this region are also focusing on developing chrome-free and environmentally sustainable coating solutions to comply with stringent environmental standards.

Europe

Europe accounted for 27% of the electrical steel coatings market in 2024, supported by its advanced manufacturing base and strict environmental regulations. The region’s focus on sustainability and energy efficiency has encouraged the rapid adoption of chrome-free and formaldehyde-free coatings. Countries such as Germany, France, and the United Kingdom are leading in renewable energy projects and grid modernization initiatives, driving demand for coated electrical steels in transformers and motors. Continuous investments in green technologies and stringent compliance with REACH regulations are propelling European manufacturers toward innovation in eco-friendly coating formulations.

Asia-Pacific

Asia-Pacific dominated the electrical steel coatings market with a 38% market share in 2024. The region’s leadership stems from its massive power infrastructure development and rapid industrialization, particularly in China, India, Japan, and South Korea. Strong demand for transformers, electric motors, and electric vehicles fuels the use of high-performance coated electrical steels. Government initiatives promoting renewable energy and smart grid deployment further enhance market prospects. The presence of major steel producers and coating manufacturers, along with competitive production costs, positions Asia-Pacific as the fastest-growing and most dynamic regional market through 2032.

Latin America

Latin America captured 7% of the global electrical steel coatings market in 2024, driven by growing investments in power transmission and renewable energy sectors. Brazil and Mexico are leading markets, supported by expanding industrial bases and the modernization of their energy infrastructure. Increasing adoption of efficient transformers and electric motors to reduce energy losses is accelerating demand for coated electrical steels. Although the region faces challenges related to economic volatility, supportive government policies promoting energy efficiency and sustainable industrial practices are expected to create long-term opportunities for coating manufacturers.

Middle East & Africa

The Middle East & Africa region accounted for 6% of the electrical steel coatings market in 2024. Growth in this region is primarily driven by ongoing power generation projects, grid expansion, and industrial development initiatives. Countries such as Saudi Arabia, the United Arab Emirates, and South Africa are investing in energy diversification and smart infrastructure, boosting demand for coated electrical steels in transformers and generators. Rising investments in renewable energy and efforts to strengthen domestic manufacturing capabilities are further supporting market expansion across the region during the forecast period.Top of Form

Market Segmentations:

By Coatings Type

By Material Type

- Chrome Free

- Chrome-containing

- Formaldehyde-free

- MgO

By Application

- Transformers

- Electric motors

- Generators

- Inductors

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the electrical steel coatings market is characterized by the presence of major global players such as JFE Steel Corporation, Dorf Ketal Chemicals, Baosteel, Polaris Laser Laminations, Chemetall GmbH, Cogent Power Limited, Nippon Steel & Sumitomo Metal Corporation (NSSMC), Filtra Catalysts and Chemicals Ltd., ArcelorMittal SA, and AK Steel Holding Corporation. These companies focus on expanding their product portfolios, enhancing coating performance, and adopting environmentally sustainable technologies. Strategic initiatives such as mergers, acquisitions, and capacity expansions are common as firms aim to strengthen their global market positions. Technological innovation-particularly in chrome-free and high-performance coating formulations-remains a key competitive factor. Additionally, leading manufacturers are investing in R&D to develop coatings that enhance insulation, reduce core losses, and comply with stringent energy-efficiency and environmental regulations. Partnerships with transformer and motor manufacturers also play a critical role in gaining a competitive advantage in this evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- JFE Steel Corporation

- Dorf Ketal Chemicals

- Baosteel

- Polaris Laser Laminations, LLC

- Chemetall GmbH

- Cogent Power Limited

- Nippon Steel & Sumitomo Metal Corporation (NSSMC)

- Filtra Catalysts and Chemicals Ltd.

- ArcelorMittal SA

- AK Steel Holding Corporation

Recent Developments

- In September 2025, ArcelorMittal SA unveiled upgraded non-oriented electrical steel grades and new self-bonding varnish coating solutions at Coiltech Italia.

- In February 2025, ArcelorMittal announced plans to build a new non-grain-oriented electrical steel manufacturing facility in Alabama, including an annealing and coating line supplied by ANDRITZ.

- In January 2025, JFE Steel Corporation completed the acquisition of an electrical steel sheet manufacturing company in India as part of its strategy to expand electrical-steel production capacity

Report Coverage

The research report offers an in-depth analysis based on Coatings Type, Material Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The electrical steel coatings market will continue to grow steadily, driven by rising demand for high-efficiency electrical equipment across industrial and energy sectors.

- The adoption of chrome-free and formaldehyde-free coatings will accelerate as global environmental regulations become more stringent.

- Increasing investments in renewable energy projects and smart grid modernization will enhance the use of coated electrical steels in transformers and generators.

- Asia-Pacific will remain the dominant regional market, supported by rapid industrialization and expanding power infrastructure.

- Technological advancements in nanocoatings and eco-friendly formulations will improve insulation performance and corrosion resistance.

- The growing electric vehicle market will create new opportunities for coated steels used in high-efficiency electric motors.

- Strategic partnerships between coating manufacturers and electrical equipment producers will strengthen global supply chains.

- Rising R&D investments will focus on developing cost-effective and sustainable coating technologies.

- Market consolidation through mergers and acquisitions will intensify competition among leading players.

- Manufacturers will increasingly emphasize sustainability, energy efficiency, and compliance to maintain a competitive edge in the evolving market landscape.