Market Overview:

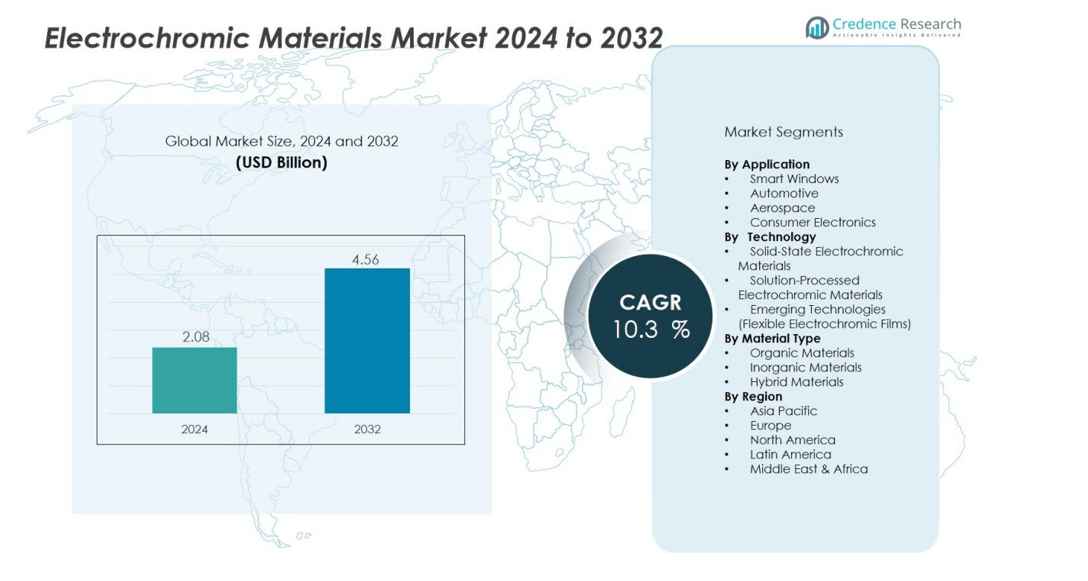

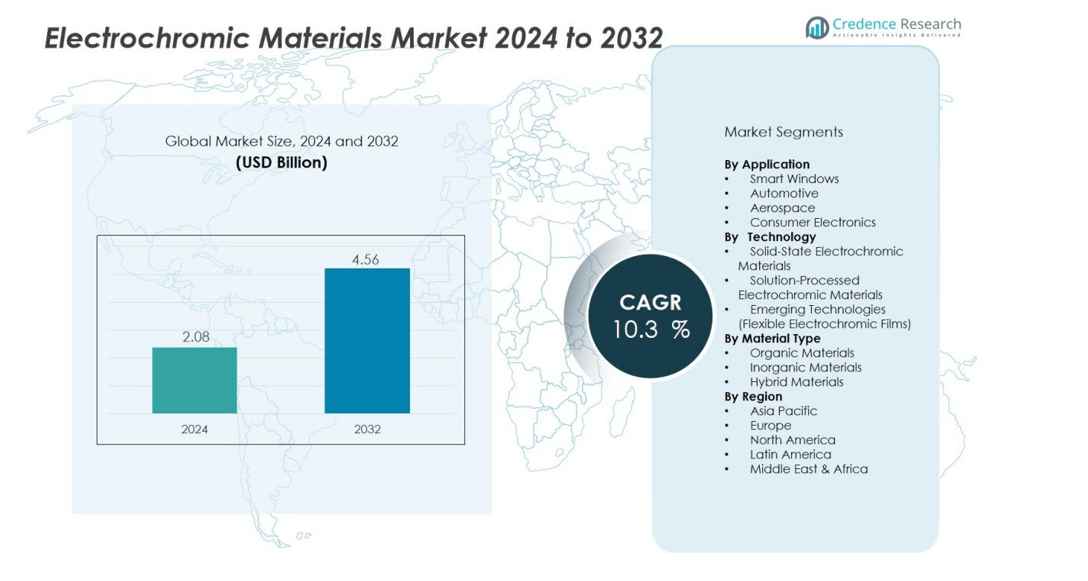

The Electrochromic Materials Market size was valued at USD 2.08 billion in 2024 and is anticipated to reach USD 4.56 billion by 2032, at a CAGR of 10.3 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electrochromic Materials Market Size 2024 |

USD 2.08 billion |

| Electrochromic Materials Market, CAGR |

10.3% |

| Electrochromic Materials Market Size 2032 |

USD 4.56 billion |

The market’s growth is primarily driven by the demand for energy-efficient construction and the adoption of smart windows that enhance energy conservation by reducing the need for HVAC and lighting. In the automotive sector, applications such as auto-dimming mirrors, smart sunroofs, and switchable glazing are further boosting the demand for electrochromic materials. Technological advancements in electrochromic coatings and films are improving their performance, making them more suitable for widespread use across various industries, including construction, automotive, and aerospace.

Europe dominates the market, accounting for roughly one-third of global revenues, driven by stringent energy-efficiency regulations and early adoption of smart glazing technologies. The Asia-Pacific region is expected to experience the fastest growth, driven by large-scale commercial construction projects, urbanization, and increasing automotive production in countries like China and India. North America remains a significant market, supported by retrofitting trends and rising demand for smart vehicle and building applications.

Market Insights:

- The Electrochromic Materials Market was valued at USD 2.08 billion in 2024 and is projected to reach USD 4.56 billion by 2032, growing at a CAGR of 10.3% during the forecast period.

- Europe holds the largest market share at 33%, driven by stringent energy-efficiency regulations and early adoption of smart glazing technologies in buildings.

- The North America region accounts for 23% of the market share, benefiting from strong demand in automotive and commercial smart buildings, supported by regulatory incentives for green construction.

- The Asia-Pacific region commands 29% of the market, experiencing the fastest growth due to urbanization, large-scale infrastructure projects, and growing automotive production, particularly in China and India.

- Smart windows dominate the Electrochromic Materials Market with the largest segment share, followed by automotive applications and consumer electronics, with each segment showing significant adoption in key industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Energy-Efficient Buildings

The increasing emphasis on energy efficiency is one of the primary drivers of the electrochromic materials market. Smart windows, which adjust their tint based on external conditions, reduce the need for artificial lighting and air conditioning, leading to significant energy savings. Building owners and developers are adopting these technologies to meet environmental regulations and improve sustainability. Electrochromic materials are integral to this trend, providing dynamic glazing solutions that help control heat gain and loss while maximizing natural light.

- For Instance, At Dallas/Fort Worth International Airport, tests conducted by View Inc. found that its smart windows kept nearby seats 20 degrees cooler than conventional glass.

Advancements in Automotive Applications

The automotive industry has significantly contributed to the growth of the electrochromic materials market. Innovations such as auto-dimming mirrors, sunroofs, and switchable windows are increasingly common in vehicles. These technologies enhance driving comfort by controlling glare and improving privacy. With rising demand for smart automotive features, electrochromic materials are becoming a standard in modern vehicles, contributing to both aesthetic appeal and functional benefits in terms of energy management and safety.

- For Instance, Gentex Corporation has engineered electrochromic auto-dimming rearview mirrors with proprietary light-sensing technology that automatically detect and eliminate dangerous glare, featuring a display resolution of 1,600 by 320 pixels and an integrated 1.7-megapixel rear-view camera operating at 60 frames per second, enhancing driver safety through real-time visual clarity.

Technological Innovations in Electrochromic Materials

Ongoing advancements in electrochromic material technologies are driving further market expansion. New developments in electrochromic films and coatings are enhancing performance, durability, and color control. These improvements make the materials more versatile for a range of applications, including architectural glazing, automotive, and aerospace. The ability to adjust color and transparency on demand allows electrochromic materials to meet specific needs, attracting both manufacturers and end-users.

Regulatory Pressure and Sustainability Initiatives

Strict environmental regulations and sustainability initiatives are pushing industries to adopt greener technologies, further driving the demand for electrochromic materials. Governments worldwide are implementing energy-efficiency standards for buildings and vehicles, which boosts the adoption of smart windows and energy-saving automotive technologies. Electrochromic materials offer a solution to these challenges by reducing energy consumption and promoting environmentally friendly construction practices. As these regulations become more stringent, the market for electrochromic materials is likely to expand.

Market Trends:

Shift Toward Flexible, Printed and Wearable Platforms

The Electrochromic Materials Market shows strong adoption of flexible and printed device formats. Key manufacturers develop electrochromic films compatible with ink‑jet and roll‑to‑roll production to reduce weight and cost. These innovations make it possible to integrate smart glazing into curved surfaces, vehicles and wearable electronics. Demand for consumer‑centric applications, such as smart mirrors and dynamic displays, supports this transition. Performance improvements include faster switching, higher durability and better optical contrast.

- For instance, Halio’s electrochromic smart glass achieves a switching response time of 15 seconds with full tint levels within 3 minutes (10 times faster than conventional electrochromic window technology), delivering Color Rendering Index stability above 90% until visible transmittance drops to 20%.

Broader Application Spread into Construction, Mobility and Consumer Electronics

The market reflects growing use across the building, automotive and aerospace sectors. Electrochromic materials now serve in smart windows, sunroofs, rear‑view mirrors and aircraft cabin solutions. Urbanisation and infrastructure expansion in Asia‑Pacific fuel demand from the construction segment. Vehicle OEMs increasingly embed dynamic glazing to enhance comfort, privacy and energy efficiency. This trend drives greater production scale and cost reductions for electrochromic material systems.

- For Instance, View Inc. has installed its electrochromic smart glass in commercial buildings globally, covering over 90 million square feet.

Market Challenges Analysis:

High Production and Installation Costs Limit Growth

The Electrochromic Materials Market faces significant cost barriers. Production requires advanced deposition equipment, precision engineering and specialised materials. These factors push up manufacturing cost per square metre and raise selling prices. High upfront investment deters many building developers and automotive manufacturers. It also lengthens pay‑back periods for users seeking energy savings.

Durability, Performance and Regulatory Hurdles Challenge Adoption

Durability issues diminish product reliability in demanding environments. Some electrochromic films degrade after repeated cycling or exposure to harsh climates, reducing life‑span and performance. Achieving uniform colour switching and optical clarity across large surfaces remains difficult. Regulatory standards vary by region which creates compliance uncertainty and slows deployment. Consumer awareness of benefits remains low, further hampering mainstream adoption.

Market Opportunities:

Expansion into Smart Building Envelopes and Retrofit Projects

The electrochromic materials market presents significant opportunity through integration into smart building envelopes and large‑scale retrofit projects. Building owners increasingly require dynamic glazing solutions that regulate solar heat and improve occupant comfort. It enables upgrades to existing structures without full replacement of façade systems, which supports growth in renovation‑driven markets. Modular electrochromic panels and retrofit kits will allow cost‑effective deployment in commercial and institutional properties. New product launches that focus on simplified installation and interface with building management systems further unlock market potential.

Emergence of New End‑Use Sectors and Flexible Form Factors

Emerging end‑use sectors offer another strategic pathway for the electrochromic materials market. Automotive OEMs seek lightweight adaptive glazing and switchable mirrors to enhance comfort and energy efficiency. Aerospace firms explore cockpit windows and cabin partitions that control glare and thermal load. Consumer electronics and wearable devices will adopt flexible electrochromic films for displays and privacy applications. It encourages development of novel material formulations and production methods like roll‑to‑roll printing. Collaborations between glass manufacturers, automotive suppliers and electronics firms will accelerate cross‑industry uptake.

Market Segmentation Analysis:

By Material Type

The electrochromic materials market is segmented by material type into organic, inorganic, and hybrid materials. Organic materials are growing in demand due to their low-cost production and flexibility in application. Inorganic materials, such as tungsten oxide, dominate the market due to their higher durability and superior performance in smart windows and automotive applications. Hybrid materials, which combine the benefits of both organic and inorganic materials, are increasingly gaining traction for their enhanced properties. It is expected that the inorganic segment will hold the largest market share, driven by the demand for more robust and reliable electrochromic materials.

- For instance, researchers have successfully developed flexible electrochromic devices using tungsten oxide (WO₃) and Prussian blue nanoparticles on polyethylene terephthalate (PET) substrates, achieving an optical modulation of 79% at 633 nm wavelength and a coloring efficiency of 123.32 cm²C⁻¹.

By Technology

The market is divided based on technology into solid-state, solution-processed, and other emerging technologies. Solid-state electrochromic materials are the most commonly used due to their stability and ease of integration in smart glazing and automotive windows. Solution-processed technologies, including roll-to-roll printing, offer cost-effective production and scalability, making them an attractive option for large-scale applications. Emerging technologies such as flexible electrochromic films are gaining attention for their potential in wearable electronics and mobile devices. The solid-state segment is expected to dominate, though solution-processed and flexible technologies will see rapid growth due to advancements in material science.

- For Instance, A key goal in the development of electrochromic displays, such as those produced using Polyera’s roll-to-roll printing process, is achieving a switching speed below 1 second per transition to make them viable for commercial use.

By Application

The electrochromic materials market finds applications in smart windows, automotive, aerospace, and consumer electronics. Smart windows, used in both residential and commercial buildings, are the largest application segment due to their energy-saving benefits and ability to reduce HVAC costs. Automotive applications, including auto-dimming mirrors and sunroofs, also drive demand. Aerospace applications focus on glare-reduction windows, while consumer electronics explore flexible displays. The smart windows segment leads the market and will continue to expand with increasing demand for sustainable building solutions.

Segmentations:

By Material Type

- Organic Materials

- Inorganic Materials

- Hybrid Materials

By Technology

- Solid-State Electrochromic Materials

- Solution-Processed Electrochromic Materials

- Emerging Technologies (Flexible Electrochromic Films)

By Application

- Smart Windows

- Automotive

- Aerospace

- Consumer Electronics

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Region

The North America region holds an estimated 23% market share in the Electrochromic Materials Market and maintains steady growth driven by technology investment. It benefits from strong automotive and smart‑building demand, particularly in the United States where dynamic glazing and auto‑dimming mirrors receive high uptake. Regulatory incentives for energy‑efficient construction and green building certification support deployment of electrochromic films and smart windows. The region hosts major industry players and research institutions that push innovation in performance and manufacturing scale. Manufacturing base and infrastructure facilitate integration of electrochromic materials into architectural and vehicular applications. Continued retrofit activity in commercial buildings and rising renovation budgets underpin future growth.

Europe Region

Europe captures roughly 33% of the electrochromic materials market and leads global adoption of dynamic glazing in buildings. The region enforces strict energy‑efficiency standards and building codes that favour smart window technologies and eco‑friendly solutions. Manufacturers in Germany, the UK and Scandinavia drive both product innovation and market penetration of electrochromic systems. Large commercial construction projects and retrofit mandates contribute to sustained demand. Europe also sees cross‑industry application in automotive sunroofs and rail transport glazing. Regional supply‑chain maturity and policy alignment place it at the forefront of electrochromic deployment.

Asia‑Pacific Region

The Asia‑Pacific region commands around 29% share and shows the fastest growth rate in the electrochromic materials market. Rapid urbanisation and large‑scale infrastructure expansion in China, India and Southeast Asia propel building construction and smart window adoption. Automotive manufacturing hubs in the region integrate electrochromic glazing into premium vehicles and smart mobility solutions. Cost‑competitive production and local glass/film manufacturing strengthen regional competitiveness. Government programs promoting sustainable buildings support uptake of dynamic glazing. Entrance of new players and expanding consumer‑electronics applications further broaden market opportunities in this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Ashwin Ushas Corp.

- Changzhou Spectrum New Material Co. Ltd.

- ChromoGenics AB

- Compagnie de Saint-Gobain SA

- e Chromic Technologies Inc.

- Gentex Corp.

- Giner Inc.

- Heliotrope Technologies

- iGlass Technology Inc.

Competitive Analysis:

The competitive landscape of the Electrochromic Materials Market features several leading firms pursuing distinct strategies. In the second line I mention key players including Ashwin‑Ushas Corp., ChromoGenics AB, Compagnie de Saint‑Gobain S.A., Gentex Corporation and other notable names.

Ashwin‑Ushas Corp. focuses on niche applications such as IR‑electrochromic skins for aerospace and military uses, which supports its strong patent portfolio and specialized technology base. ChromoGenics AB emphasises architectural smart‑glazing solutions under its ConverLight® brand, enabling it to capture building‑facade and retrofit opportunities. Compagnie de Saint‑Gobain S.A., through its SageGlass® product line, leverages its global glass manufacturing scale and distribution network to target commercial construction markets, strengthening its cost efficiency and market reach. Gentex Corporation holds a dominant position in automotive dimmable mirrors and electrochromic glazing, maintaining technological leadership and broad OEM relationships. Each of these firms competes on innovation, manufacturing scale and end‑use integration, driving market dynamics and influencing future market positioning.

Recent Developments:

- In July 2025, Saint-Gobain announced the acquisition of Interstar Materials Inc., strengthening its North American construction chemicals business focused on granular pigments for concrete.

- In November 2025, Gentex Corporation launched the GNTX-R Carbon Fiber Auto-Dimming Mirror, debuting the product at the SEMA 2025 automotive technology exhibition.

Report Coverage:

The research report offers an in-depth analysis based on Material Type, Technology, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Demand for energy-efficient building solutions will continue to drive adoption of smart windows in commercial and residential sectors.

- Automotive applications, especially for auto-dimming mirrors and sunroofs, will remain a key growth area as vehicles increasingly incorporate smart glass technologies.

- Advancements in flexible electrochromic films will enable new applications in consumer electronics, wearable devices, and portable displays.

- Rising urbanization in developing regions will boost the demand for energy-efficient glazing in buildings, expanding the market further.

- Technological improvements in electrochromic materials will lead to enhanced performance, faster switching speeds, and longer lifespans.

- New regulations focused on sustainability and energy-saving technologies will push more industries to adopt electrochromic materials in construction and automotive sectors.

- The growing need for green building certifications will increase the demand for dynamic glazing solutions in the commercial construction market.

- North America and Europe will continue to be strong markets, with high adoption rates in building construction and automotive sectors.

- The Asia-Pacific region will emerge as a high-growth area, driven by large-scale infrastructure projects and growing interest in eco-friendly automotive solutions.