Market Overview:

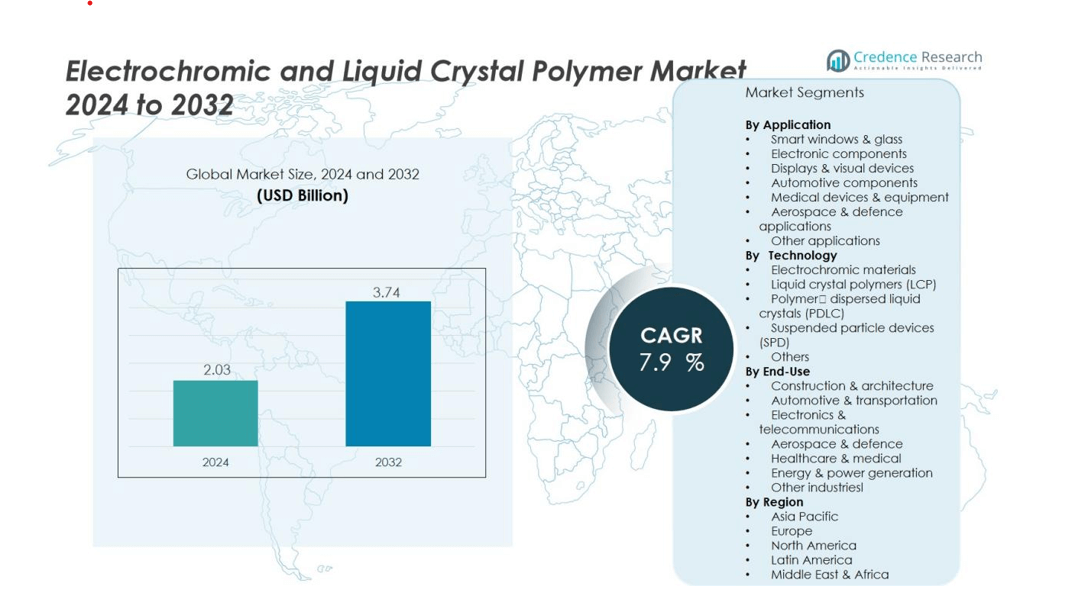

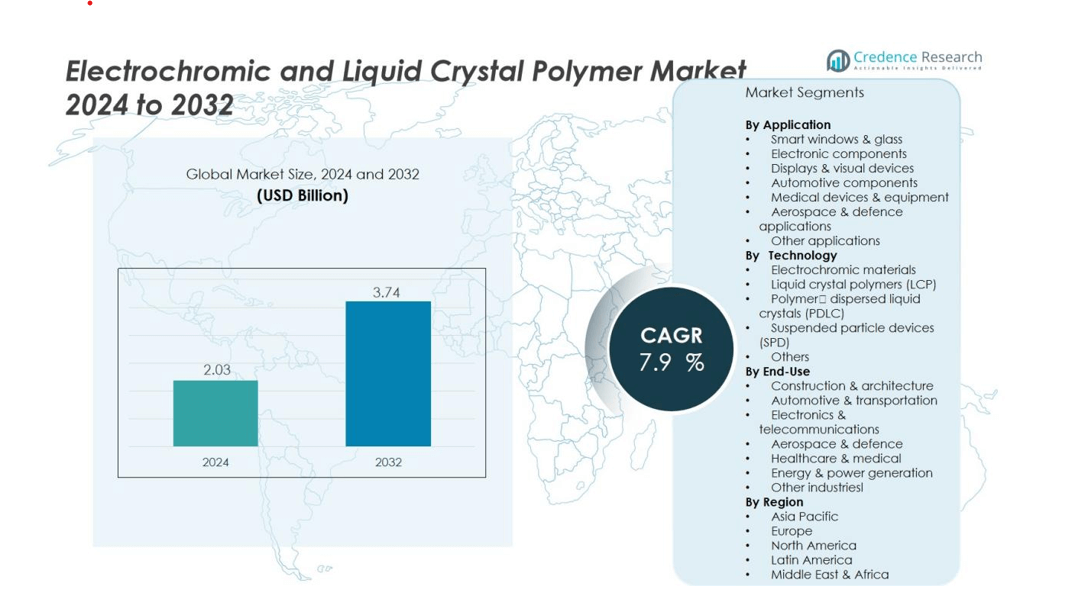

The Electrochromic and Liquid Crystal Polymer Market size was valued at USD 2.03 billion in 2024 and is anticipated to reach USD 3.74 billion by 2032, at a CAGR of 7.9 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electrochromic and Liquid Crystal Polymer Market Size 2024 |

USD 2.03 billion |

| Electrochromic and Liquid Crystal Polymer Market, CAGR |

7.9% |

| Electrochromic and Liquid Crystal Polymer Market Size 2032 |

USD 3.74 billion |

The market is primarily driven by the demand for miniaturized, lightweight, and durable components. Liquid crystal polymers (LCPs) are valued for their high temperature resistance, dimensional stability, and excellent electrical and mechanical performance, making them ideal replacements for traditional materials in various applications. Additionally, electrochromic materials are seeing increased use in smart windows and adaptive surfaces, which further boosts market demand. The expansion of these end-use sectors and technological advancements in electrochromic devices contribute significantly to the market’s growth.

Regionally, the Asia-Pacific region leads the market, driven by strong manufacturing bases in electronics and automotive sectors in countries like China, India, and Southeast Asia. North America and Europe also present growth opportunities, with North America benefiting from advancements in electronics and infrastructure, while Europe sees growth due to automotive electrification and regulations promoting innovation in materials.

Market Insights:

- The Electrochromic and Liquid Crystal Polymer Market was valued at USD 2.03 billion in 2024 and is projected to reach USD 3.74 billion by 2032, growing at a CAGR of 7.9%.

- Asia-Pacific leads the market with a share of 36-40%, driven by strong manufacturing sectors in electronics and automotive in China, India, and Southeast Asia.

- North America holds 27.2% of the market share, driven by advancements in electronics, automotive innovations, and the roll-out of 5G infrastructure.

- Europe accounts for 15-18% of the market share, focusing on premium applications in smart façades, automotive components, and aerospace systems.

- The fastest-growing region is Asia-Pacific, with increasing demand for miniaturized, high-performance materials in electronics, automotive, and construction sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Increasing Demand for Lightweight and Durable Materials in Electronics and Automotive Sectors

The growing demand for lightweight, durable materials is a key driver for the Electrochromic and Liquid Crystal Polymer Market. As industries such as electronics, automotive, and aerospace strive for enhanced performance and energy efficiency, these materials offer a significant advantage. Liquid crystal polymers (LCPs) are increasingly utilized for their superior mechanical and electrical properties, which contribute to smaller, lighter, and more robust components. These materials are particularly valued in automotive electronics, where they help reduce the weight of vehicles while improving fuel efficiency.

- For instance, Syensqo’s Xydar® LCP enables greater copper slot fill in electric motor applications, improving motor performance while allowing the opportunity to downsize the motor for increased packaging space, with Xydar® LCP G-330 HH retaining electrical insulation upon exposure to 400°C for 30 minutes in EV battery module applications with molded plate dimensions of 100 × 150 × 0.5 mm.

Rising Adoption of Smart Windows and Adaptive Surfaces

Smart windows and adaptive surfaces are gaining popularity across multiple sectors, further propelling the Electrochromic and Liquid Crystal Polymer Market. Electrochromic materials, known for their ability to change color or opacity in response to electrical stimuli, are widely used in energy-efficient window technologies. These materials help reduce energy consumption by regulating light transmission and heat. As the demand for green technologies grows, industries, particularly in construction and automotive, increasingly incorporate electrochromic devices into their products to improve energy efficiency and occupant comfort.

- For Instance, View Inc.’s electrochromic glass has been installed in over 90 million square feet of commercial real estate globally.

Advancements in Manufacturing Technologies

Technological advancements in manufacturing processes have fueled the growth of the Electrochromic and Liquid Crystal Polymer Market. Improvements in production techniques for LCPs have made these materials more cost-effective and easier to integrate into consumer electronics and automotive components. These innovations enable manufacturers to scale production, enhancing the supply chain and ensuring materials meet the high performance demands of end-users. The development of high-performance polymers, coupled with optimized production methods, supports further expansion across various applications.

Regulatory Push for Sustainable and Energy-Efficient Solutions

Regulations promoting sustainability and energy efficiency are driving the adoption of electrochromic and liquid crystal polymers. Governments around the world are implementing stricter environmental standards in automotive, construction, and electronic industries. These regulations encourage the use of materials that contribute to energy savings and reduce carbon footprints. The growing focus on reducing greenhouse gas emissions and increasing the energy efficiency of buildings and vehicles supports the continued demand for these advanced materials, strengthening the Electrochromic and Liquid Crystal Polymer Market.

Market Trends:

Integration of Miniaturised and High‑Frequency Components into Applications

The Electrochromic and Liquid Crystal Polymer Market benefits from rising deployment of miniaturised and high‑frequency electronic assemblies. High‑performance liquid crystal polymers (LCPs) deliver low dielectric constants, mechanical rigidity, high temperature tolerance and moisture resistance, which suits advanced telecommunications hardware. One key trend involves the rollout of 5G networks and the need for compact connectors, antenna modules and flexible circuit substrates in automotive and telecommunications. While demand for traditional materials still persists, designers increasingly replace metals and generic plastics with LCPs to meet signals, thermal and space constraints. Electrochromic materials also move into smaller consumer devices and adaptive components, raising requirements for precision polymer integration and fabrication techniques.

- For instance, Sumitomo Electric Industries has developed flexible LCP antennas supporting 5G millimeter-wave frequencies, reportedly achieving insertion loss below 1 dB for 28 GHz bands, which is critical for next-generation base stations and automotive radar modules.

Expansion of Smart and Adaptive Surface Technologies in Diverse End‑Use Segments

Rapid uptake of smart window systems, adaptive glass facades, vehicle sunroofs and dynamically controllable surfaces drives growth in electrochromic materials and LCPs. The market extends beyond buildings into automotive, aerospace and consumer electronics segments — systems now integrate optical switching, thermal control and dimming features into transparent surfaces. Cost reductions in manufacturing and advances in materials science enable deployment of larger area electrochromic panels with improved lifetime and durability. End‑users prioritise energy savings, occupant comfort and product differentiation — this behaviour motivates device makers to incorporate these polymers and coatings. Manufacturers respond by developing new grades, coatings and multilayer assemblies that support flexibility, transparency and smart‑control functions.

- For instance, SageGlass, a leading smart window manufacturer, has demonstrated that its electrochromic glazing can reduce solar heat gain by up to 93% compared to conventional clear glass.

Market Challenges Analysis:

High Production Costs and Complex Manufacturing Requirements

The Electrochromic and Liquid Crystal Polymer Market faces significant pressure from elevated production and material costs. Manufacturers invest in specialised equipment, high‑purity raw materials and advanced thinning processes. These costs limit widespread adoption, particularly in cost‑sensitive end‑use segments. Supply‑chain constraints and raw‑material volatility heighten financial risk for players across the value chain. It becomes difficult for smaller firms to compete with high fixed investment and variant manufacturing requirements.

Technical Integration Barriers and Limited End‑User Awareness

Integration of electrochromic and liquid crystal polymer materials into existing systems presents technical challenges and slows uptake. Developers must ensure dimensional stability, thermal performance and long‑term reliability in applications such as electronics and architectural glazing. End‑users often lack sufficient awareness of these materials’ benefits relative to established alternatives. This awareness gap hampers market penetration and slows demand growth in emerging application areas. Regulatory demands and compatibility concerns further complicate deployment and slow time‑to‑market for new products.

Market Opportunities:

Expansion into Next‑Generation 5G, IoT and High‑Frequency Applications

The Electrochromic and Liquid Crystal Polymer Market finds a major opportunity in the rollout of 5G infrastructure, Internet of Things (IoT) devices and high‑frequency electronics. Liquid crystal polymers (LCPs) offer low dielectric loss and high temperature tolerance, which suit connectors, antennas and flexible printed circuits in these domains. It allows manufacturers to shift away from conventional materials and deliver thinner, faster and more reliable components. Growth in telecom, data centres and miniaturised consumer electronics fuels demand for advanced polymer solutions. Engineering firms that align product development with these emerging application needs will capture high‑value contracts and long‑term partnerships.

Adoption of Smart Surfaces, Adaptive Glazing and Sustainable Construction Materials

Smart windows and adaptive surface technologies open another high‑potential avenue for the market. Electrochromic materials enable dynamic control of light and heat transmission, helping reduce energy consumption in buildings, vehicles and aircraft. The push for sustainability and occupant comfort makes these technologies attractive in commercial construction, automotive interiors and aerospace cabins. It gives material suppliers the chance to offer integrated solutions combining LCPs and electrochromics for smart facades, sunroofs and interactive glass panels. Firms that invest in scalable manufacturing and durable coatings gain a competitive edge.

Market Segmentation Analysis:

By Technology

The Electrochromic and Liquid Crystal Polymer Market splits by technology into electrochromic materials, liquid crystal polymers (LCP), polymer‑dispersed liquid crystals (PDLC), suspended particle devices (SPD), and others. The electrochromic materials segment retains the largest share thanks to its capacity to modulate light and heat in smart glazing systems. LCPs hold strong potential given the rise in compact, high‑frequency electronics that demand low dielectric loss and high thermal stability. PDLC and SPD mirror growth in niche adaptive display and privacy‑glass applications, though their adoption remains less broad. Firms that diversify across these technologies strengthen their risk profile and enhance market reach.

- For Instance, Sumitomo Chemical established mass production technology for a bio-based liquid crystal polymer (LCP) using biomass-derived monomers.

By Application

This market further segments by application into smart windows & glass, electronic components, displays & visual devices, automotive components, medical devices & equipment, aerospace & defence and other applications. Smart windows & glass dominate thanks to regulatory encouragement toward energy‑efficient buildings and mobility solutions. Electronic components, especially within 5G and IoT infrastructure, drive LCP demand for connectors, antenna modules and flexible circuits. Medical and aerospace end users adopt these materials for precision and durability, which drives specialised application growth. The breadth of applications enables companies to spread dependence across sectors and capture cross‑industry innovation opportunities.

- For instance, AGC Inc. supplied more than 5,000 square meters of its Halio™ electrochromic glass for the Microsoft Silicon Valley Campus—a measurable deployment that reduced building cooling load by over 18%.

By End‑Use Industry

End‑use industry segmentation includes construction & architecture, automotive & transportation, electronics & telecommunications, aerospace & defence, healthcare & medical, energy & power generation and other industries. Construction & architecture currently claim the largest share, driven by adaptive glazing and façade solutions. Automotive & transportation increasingly adopt these materials for smart sunroofs, adaptive mirrors and lightweight components. Electronics & telecommunications benefit from LCPs in transmitter modules and high‑speed interconnects. Aerospace & defence and healthcare sectors support higher value but smaller volume demand, presenting premium niche opportunities within the market.

Segmentations:

By Technology

- Electrochromic materials

- Liquid crystal polymers (LCP)

- Polymer‑dispersed liquid crystals (PDLC)

- Suspended particle devices (SPD)

- Others

By Application

- Smart windows & glass

- Electronic components

- Displays & visual devices

- Automotive components

- Medical devices & equipment

- Aerospace & defence applications

- Other applications

By End Use

- Construction & architecture

- Automotive & transportation

- Electronics & telecommunications

- Aerospace & defence

- Healthcare & medical

- Energy & power generation

- Other industries

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Regional Look – The Americas Position

North America holds roughly 27.2% share of the regional market in 2024. In the Electrochromic and Liquid Crystal Polymer Market, the U.S. stands as the primary hub, driven by high‑end electronics, aerospace components and automotive innovations. Manufacturers and suppliers leverage local R&D, advanced manufacturing capacity and strong demand from telecom and defence sectors. It benefits from roll‑out of 5G infrastructure and stringent performance demands for LCPs in high‑frequency modules. The adaptive glazing segment for automotive and construction also contributes meaningfully to revenue. However, competition from low‑cost international suppliers and raw‑material volatility require strategic partnerships and supply‑chain resilience.

Europe Regional Focus – Mature Markets with Premium Demand

Europe accounts for about 15–18% share of the overall market regionally in the referenced data set. The Elektrochromic and LCP market in this region emphasizes premium applications such as smart façades, luxury automotive components and aerospace systems, reflecting high engineering and regulatory standards. It benefits from sustainability mandates that create demand for energy‑efficient materials in building and transportation sectors. Regional players concentrate on tailored polymers and coatings to meet local OEM specifications and stringent safety requirements. Growth faces headwinds from higher labour and production costs, underlining the need for innovation and value‑added services.

Asia‑Pacific & Emerging Economies – Growth Engine

Asia‑Pacific holds the largest share of the market, estimated at around 36–40% in the liquid‑crystal polymer context, which carries through to the broader electrochromic and LCP market theme. The region leads through massive electronics manufacturing ecosystems in China, India, South Korea and Southeast Asia that demand miniaturised, high‑performance materials. It features expanding automotive production and construction activity, both of which rely on smart materials and adaptive surfaces. LCP use in high‑frequency connectivity modules and electrochromic glazing in urban infrastructure drive momentum. Firms that locate manufacturing and supply operations here capture scale and cost benefits, while facing local competition and evolving regulatory regimes.]

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Solvay

- Celanese Corporation

- Sumitomo Chemical Company

- TORAY INDUSTRIES, INC.

- UENO FINE CHEMICALS INDUSTRY, LTD.

- RTP Company

- Zeus Company Inc.

- Chang Chung Group

- Polyplastics Co.

- Daken Chem

Competitive Analysis:

The competitive landscape of the Electrochromic and Liquid Crystal Polymer Market reflects aggressive innovation and strategic positioning among key global players. Firms such as Solvay S.A., Celanese Corporation, Sumitomo Chemical Company and Toray Industries, Inc. dominate this space with expansive product portfolios tailored for high‑performance applications. Each company invests heavily in research and development to refine material properties such as dielectric stability, temperature resistance and precision molding. It faces pressure from rising raw‑material costs and supply‑chain constraints that impact margins and scalability. Competitive differentiators hinge on responsiveness to telecommunications, automotive electrification and smart‑building demands. Partnerships and regional expansions allow leaders to capture new segments while smaller entrants struggle with high capital and technical barriers.

Recent Developments:

- In November 2025, Solvay announced a partnership with Noveon Magnetics to supply rare earth oxides starting in 2026, supporting rare earth permanent magnet supply chains.

- In October 2025, Celanese Corporation introduced new features for its Chemille® Digital Assistant AI platform at the K Show in Düsseldorf.

Report Coverage:

The research report offers an in-depth analysis based on Technology, Application, End Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The Electrochromic and Liquid Crystal Polymer Market will experience significant growth driven by increasing demand for energy-efficient solutions in automotive and construction sectors.

- The adoption of smart windows and adaptive glazing in buildings and vehicles will further accelerate market expansion.

- Innovations in liquid crystal polymers for miniaturization in electronic devices and telecom infrastructure will continue to create new opportunities.

- Governments worldwide will enforce stricter sustainability and energy-efficiency regulations, boosting the use of electrochromic materials.

- Growing demand for lightweight, high-performance materials in automotive and aerospace industries will support the market’s evolution.

- Technological advancements in polymer production and processing will lead to cost reductions and broader adoption.

- The integration of LCPs in 5G and IoT devices will be pivotal, as telecom infrastructure expands globally.

- Asia-Pacific will remain a dominant region, driven by manufacturing bases in China, India, and Southeast Asia.

- North America and Europe will see strong demand from industries focused on high-value, premium applications such as aerospace and luxury automotive.

- As the demand for smart and adaptive materials continues, new end-use sectors like healthcare and energy will emerge as growth contributors.