Market Overview:

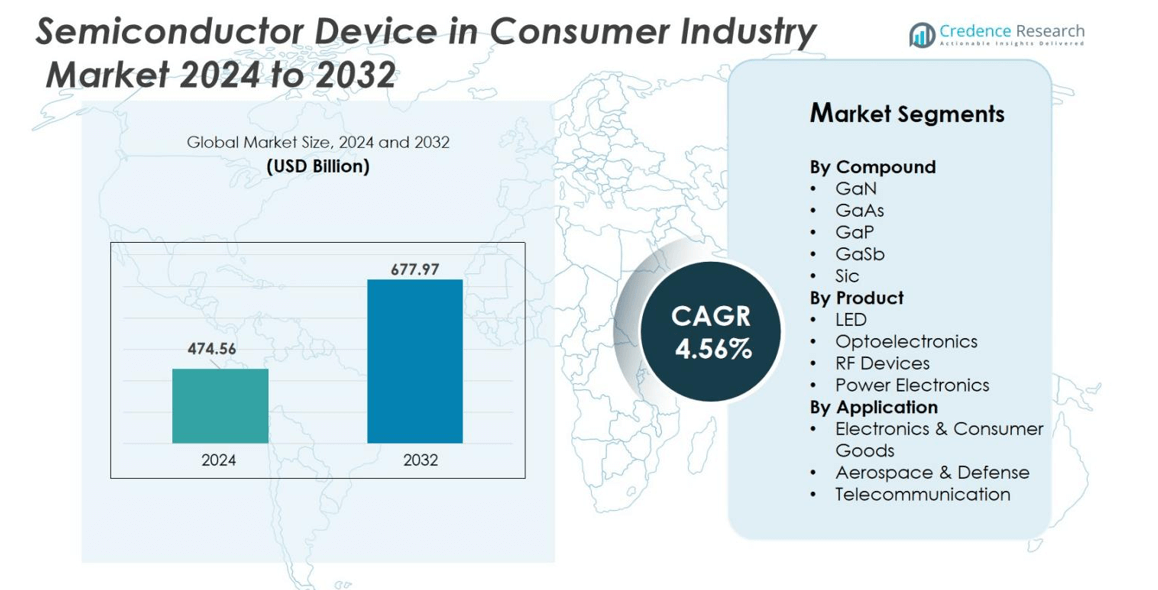

Semiconductor Device in Consumer Industry market size was valued at USD 474.56 Billion in 2024 and is anticipated to reach USD 677.97 Billion by 2032, at a CAGR of 4.56% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Semiconductor Device in Consumer Industry Market Size 2024 |

USD 474.56 Billion |

| Semiconductor Device in Consumer Industry Market, CAGR |

4.56% |

| Semiconductor Device in Consumer Industry Market Size 2032 |

USD 677.97 Billion |

The Semiconductor Device in Consumer Industry market includes major players such as Samsung Semiconductor, Intel Corporation, Texas Instruments, Broadcom, Analog Devices, Skyworks Solutions, Qorvo, Microchip Technology, WOLFSPEED, and MACOM. These companies focus on advanced chipsets, power modules, RF devices, and sensor-integrated components for smartphones, laptops, wearables, and smart home systems. Asia Pacific leads the global market with over 40% share, supported by large-scale electronics manufacturing, rapid 5G deployment, and high consumer demand for connected devices. North America and Europe remain strong adopters of premium consumer electronics, driven by heavy investments in AI, connectivity, and compact semiconductor solutions.

Market Insights

- The Semiconductor Device in Consumer Industry market was valued at USD 474.56 Billion in 2024 and is set to reach USD 677.97 Billion by 2032, growing at a CAGR of 4.56%.

- Strong demand for smartphones, laptops, gaming devices, and household automation systems drives continuous adoption of advanced chips, power modules, and RF components.

- GaN dominates the compound segment with 38% share, while optoelectronics leads the product category with over 40% share, supported by rising use in displays, sensors, and smart lighting systems.

- Asia Pacific holds over 40% share, followed by North America with 32% share, driven by high semiconductor consumption, 5G rollout, and strong electronics manufacturing capacity.

- The market faces restraints from supply chain disruptions and high manufacturing costs of advanced semiconductor nodes, while leading players such as Samsung Semiconductor, Intel, Broadcom, and Texas Instruments invest in capacity expansion and technological innovation to maintain competitive advantage.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Compound

Gallium Nitride (GaN) leads this segment with 38% share, driven by rising adoption in high-power and high-frequency devices. Electronics manufacturers prefer GaN because it delivers faster switching, higher thermal efficiency, and compact device size. GaN-based semiconductor devices support fast charging, 5G connectivity, and smart home appliances. Gallium Arsenide (GaAs) and Silicon Carbide (SiC) also gain traction due to demand in RF components and electric vehicle power modules. The shift toward energy-efficient consumer electronics and rapid 5G rollout keeps GaN dominant in the Semiconductor Device in Consumer Industry market.

- For instance, Navitas Semiconductor specializes in high-efficiency GaN power ICs that significantly improve charging performance in consumer electronics and electric vehicles.

By Product

Optoelectronics holds the largest share at over 40%, supported by strong usage in displays, smart lighting, camera flash modules, and biometric sensors in smartphones. LED technology continues to expand due to reduced heat output, longer lifespan, and energy savings in consumer lighting. Power electronics also rise with increased demand for efficient power conversion in laptops, smart wearables, and portable chargers. RF devices gain momentum in Wi-Fi routers, Bluetooth systems, and 5G smartphones. The continuous shift toward miniaturized and power-efficient semiconductor devices supports optoelectronics dominance.

- For instance, Samsung Electronics powers imaging systems in smartphones and other devices with its advanced ISOCELL image sensors and OLED displays, focusing on miniaturization and low-light imaging.

By Application

Electronics & Consumer Goods dominates this segment with more than 55% share, fueled by growing use of semiconductor devices in smartphones, smart TVs, gaming consoles, and home automation systems. High-performance chips, sensors, and power modules enhance device speed and energy efficiency. Telecommunication also expands due to 5G adoption, RF components, and optical modules in network infrastructure. Aerospace & Defense uses compound semiconductors for radar, satellite links, and secure communication equipment. Rising consumer inclination toward connected and AI-enabled devices sustains the leading position of Electronics & Consumer Goods in the Semiconductor Device in Consumer Industry market.

Key Growth Drivers

Proliferation of Smart Consumer Electronics and IoT Devices

The rapid growth of smart consumer electronics remains a major catalyst for the Semiconductor Device in Consumer Industry market. Smartphones, smart TVs, wearables, and home automation systems use advanced chips, power modules, and RF components for better performance and energy efficiency. IoT integration in household appliances, lighting systems, and personal devices requires high-speed processing, enhanced connectivity, and compact chip designs. Semiconductor manufacturers also increase production of AI-enabled processors for voice assistants, facial recognition, and gesture sensors. The surge in remote work and digital entertainment increases demand for laptops, gaming consoles, and high-resolution display panels.

- For instance, Samsung’s Exynos 2400 chip delivers a 14.7-fold performance increase over the previous generation, enabling always-on voice and vision AI workloads in smartphones with enhanced energy efficiency.

Expansion of 5G Connectivity and High-Speed Communication Systems

The rollout of 5G networks significantly accelerates semiconductor usage in consumer applications. 5G-enabled smartphones, routers, smart home hubs, and connected vehicles demand high-frequency RF components, power amplifiers, and mmWave chipsets. Compound semiconductors like GaN and GaAs gain importance because they support high data transmission speeds, low signal loss, and strong thermal performance. Consumer brands also integrate 5G into AR/VR headsets, smart cameras, and wearable health devices to enable real-time analytics and cloud-based processing. Telecom operators boost network capacity with optical modules, signal amplifiers, and switching chips, strengthening market growth.

- For instance, Apple integrated Qualcomm’s Snapdragon X70 5G modem in its iPhone 15 lineup in 2023, enabling faster mmWave performance and improved signal reliability for global users.

Rising Adoption of Energy-Efficient and Miniaturized Chip Designs

Consumer electronics require smaller, faster, and more power-efficient chips, driving strong adoption in the semiconductor sector. Shrinking semiconductor architecture allows manufacturers to add more transistors into smaller spaces, enhancing device speed without increasing power use. Compact power modules support fast charging, longer battery life, and low heat generation in premium smartphones, laptops, and wearables. Energy-efficient semiconductors also support sustainable electronics manufacturing as brands focus on reducing carbon footprints. GaN-based power electronics replace traditional silicon components to improve thermal handling and reduce size. The push toward lightweight consumer electronics fuels the need for miniaturized components in smartwatches, earbuds, drones, and digital cameras.

Key Trends & Opportunities

Expansion of AI-Enabled and Edge Computing Devices

The rise of AI-powered consumer electronics offers major opportunities for semiconductor manufacturers. Smart speakers, robotic cleaners, voice-controlled appliances, and biometric security devices depend on powerful AI chips, microcontrollers, and embedded sensors. Edge computing allows these devices to process data locally rather than relying on cloud servers, improving speed and privacy. This trend boosts demand for low-latency processors, neuromorphic chips, and advanced GPUs designed for home intelligence systems. Consumer electronics brands invest in semiconductor architectures that support AI functions such as motion tracking, speech processing, image detection, and predictive automation.

- For instance, Qualcomm’s QCS400 series SoCs integrate an AI engine and multiple processors to deliver power-efficient AI acceleration specifically for smart speakers and soundbars, enhancing voice UI and connected experiences.

Growing Market for AR/VR, Gaming, and High-Resolution Displays

The consumer market is shifting toward immersive entertainment, creating strong demand for AR/VR headsets, high-refresh-rate displays, and advanced gaming consoles. These devices rely on high-performance GPUs, image sensors, micro-LED displays, and power electronics capable of handling intensive graphics workloads. Semiconductor companies are developing custom processors that reduce latency, enhance visual clarity, and support realistic graphics performance. Growth in metaverse applications, virtual training, and online gaming boosts adoption of advanced optoelectronic components. The movement toward ultrathin display panels and flexible OLED screens offers new opportunities for miniaturized semiconductor devices.

- For instance, NVIDIA has developed lightweight XR glasses using holographic near-eye displays and AI algorithms to reduce device bulk while enhancing visual performance, aiming for AR glasses as thin as 2.5 mm lenses.

Key Challenges

Supply Chain Disruptions and Raw Material Constraints

Global semiconductor supply chains face volatility due to shortages in silicon wafers, advanced chip manufacturing equipment, and rare compound materials like gallium and silicon carbide. Consumer electronic brands rely on just-in-time production strategies, making any disruption highly impactful. High dependency on limited foundries and fabrication plants increases lead times and raises production costs. Geopolitical tensions, trade restrictions, and logistical delays further intensify component shortages. As demand rises from both consumer electronics and automotive industries, competition for semiconductor capacity becomes stronger. These constraints affect product launch timelines, pricing strategies, and manufacturing scalability.

High Manufacturing Complexity and Cost of Advanced Nodes

Modern consumer devices demand small, fast, and efficient chipsets, which require advanced lithography and packaging technologies. Fabricating semiconductors below 10nm node sizes is expensive and requires massive capital investment. Small-scale manufacturers struggle to compete with large players who dominate fabrication capabilities. Producing compound semiconductors like GaN and GaAs involves complex processing, specialized equipment, and higher operational costs than traditional silicon. The need for constant technological upgrades raises R&D spending and increases risk for new entrants. As a result, cost pressure and technological complexity remain major barriers in the Semiconductor Device in Consumer Industry market.

Regional Analysis

North America

North America holds around 32% share of the Semiconductor Device in Consumer Industry market, driven by high adoption of smart consumer electronics, gaming consoles, and advanced computing devices. Major chipmakers expand investments in AI processors, GPUs, and power modules to support wearables, VR headsets, and 5G-enabled devices. The United States leads due to strong semiconductor R&D, advanced fabrication facilities, and rapid shift toward high-performance consumer products. Growth in smart homes and connected appliances strengthens demand for RF devices and sensor-integrated chips. Continuous spending on premium smartphones and laptops keeps North America a leading market.

Europe

Europe accounts for nearly 22% share, supported by strong consumer electronics manufacturing and rising adoption of smart home technologies. The region’s demand for energy-efficient devices increases use of GaN and SiC-based power modules in home appliances and electric mobility products. Germany, the U.K., and France lead semiconductor consumption due to high usage of smart wearables, gaming hardware, and connected household devices. Expansion of 5G infrastructure and IoT-enabled consumer goods fuels additional chip requirements. Sustainability regulations also push brands to adopt low-power semiconductor designs, keeping Europe an attractive market for advanced device manufacturers.

Asia Pacific

Asia Pacific dominates the market with over 40% share, driven by large-scale smartphone production, rising disposable income, and expansion of consumer electronics manufacturing hubs. China, South Korea, Japan, and Taiwan house major semiconductor fabs and consumer device brands, supporting high demand for RF components, LEDs, camera sensors, and display drivers. Rapid urbanization and booming e-commerce accelerate purchases of smart appliances, laptops, and wearables. Governments also support semiconductor self-sufficiency through incentives and capacity expansion. Strong 5G rollout, growing IoT adoption, and high-volume electronics exports keep Asia Pacific the leading regional contributor.

Latin America

Latin America holds around 4% share, influenced by rising adoption of affordable smartphones, smart TVs, and home electronics. Brazil and Mexico lead demand due to large consumer populations and expanding retail electronics channels. Growth in digital payments, online streaming, and e-learning increases semiconductor use in tablets, routers, and smart devices. Local manufacturing remains limited, so brands rely heavily on imported chips and assembled electronics. Despite slower technology penetration compared to major regions, increasing interest in smart appliances and improved connectivity infrastructure provide growth opportunities for semiconductor suppliers.

Middle East & Africa

The Middle East & Africa represent nearly 2% share, with gradual adoption of smart consumer electronics and connected home devices. Countries such as the UAE, Saudi Arabia, and South Africa show growing demand for premium smartphones, smart TVs, and advanced home appliances. Investments in telecom modernization and 5G networks boost RF and optoelectronic semiconductor consumption. Limited manufacturing infrastructure keeps reliance on imported devices high, but rising digital lifestyles and smart city initiatives create opportunities for market expansion. As consumer income levels improve, semiconductor-powered devices gain wider acceptance across urban households.

Market Segmentations:

By Compound

By Product

- LED

- Optoelectronics

- RF Devices

- Power Electronics

By Application

- Electronics & Consumer Goods

- Aerospace & Defense

- Telecommunication

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Semiconductor Device in Consumer Industry market features global chipmakers, integrated device manufacturers, and foundry operators focusing on high-performance processing, miniaturization, and energy efficiency. Leading companies such as Samsung Semiconductor, Intel Corporation, Texas Instruments, Broadcom, and Analog Devices invest heavily in R&D to develop compact power modules, AI-enabled processors, and advanced RF semiconductors for consumer devices. Compound semiconductor specialists including WOLFSPEED and Qorvo strengthen their presence in 5G smartphones, Wi-Fi systems, and smart home technologies. Many players expand capacity and partnerships with consumer electronics brands to secure long-term supply agreements. Investments in GaN and SiC power devices rise as manufacturers prioritize fast charging, longer battery life, and heat-efficient designs in laptops, smartphones, wearables, and gaming consoles. Competition also intensifies in sensor-integrated systems for smart appliances, AR/VR headsets, and biometric authentication. Overall, innovation, pricing strategies, manufacturing efficiency, and technology differentiation shape market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2024, Intel Corporation and the U.S. Department of Commerce signed a non-binding memorandum of terms for approximately USD 8.5 billion in funding under the CHIPS and Science Act.

- In February 2024, Analog Devices, Inc. entered a collaboration with TSMC to secure long-term wafer capacity through Japan Advanced Semiconductor Manufacturing, Inc. (JASM) in Kumamoto Prefecture, Japan.

- In February 2024, Qorvo, Inc. launched four 1200V SiC modules—two full-bridge and two half-bridges within a compact E1B package featuring RDS (on) as low as 9.4mΩ, designed for EV charging, energy storage, industrial, and solar applications

Report Coverage

The research report offers an in-depth analysis based on Compound, Product, Application, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for smart consumer electronics will continue to boost semiconductor adoption.

- 5G expansion will increase usage of RF devices, power amplifiers, and high-frequency chips.

- AI-enabled processors and edge chips will gain traction in home automation and wearables.

- GaN and SiC power devices will replace traditional silicon for faster and energy-efficient performance.

- Miniaturized chipsets will support slim smartphones, lightweight laptops, and compact wearables.

- Optoelectronics will advance with micro-LED and OLED display technologies.

- AR/VR devices and gaming hardware will create new demand for high-performance GPUs and sensors.

- Smart home ecosystems will expand chip requirements across lighting, appliances, and security devices.

- Major players will invest in advanced packaging and high-capacity fabs to scale production.

- Supply chain localization and government incentives will strengthen semiconductor manufacturing capabilities.