Market Overview:

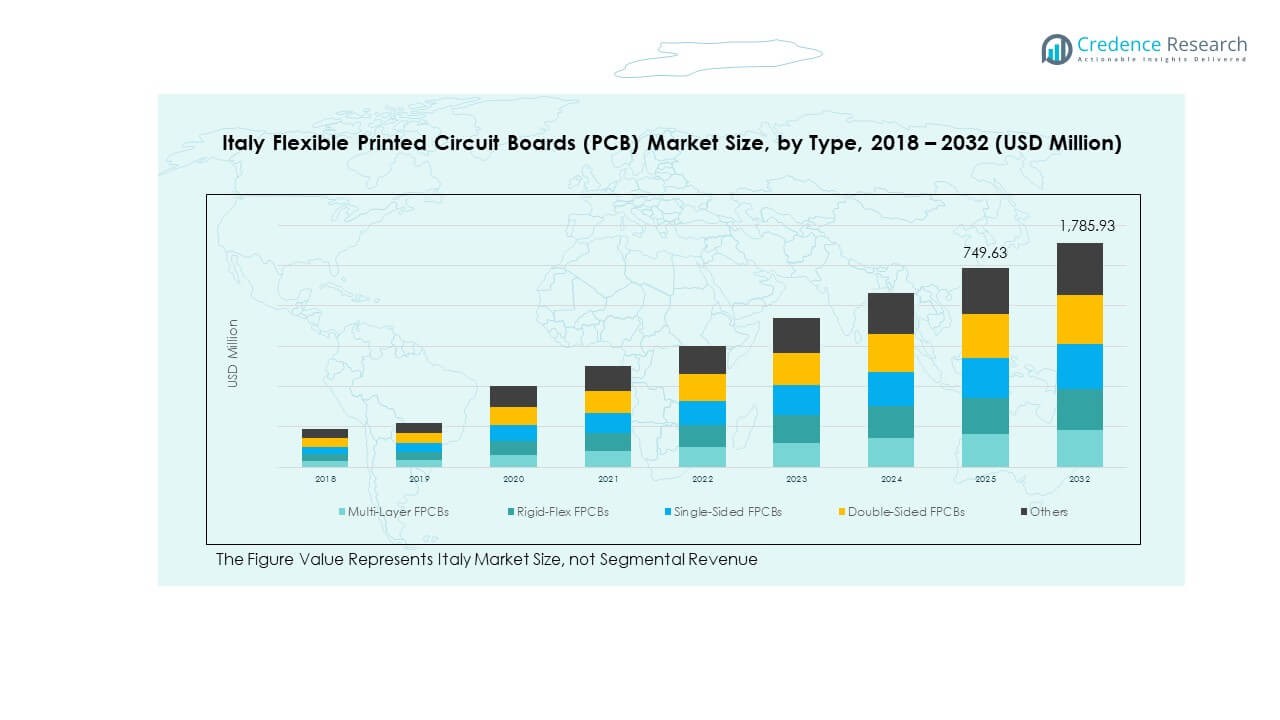

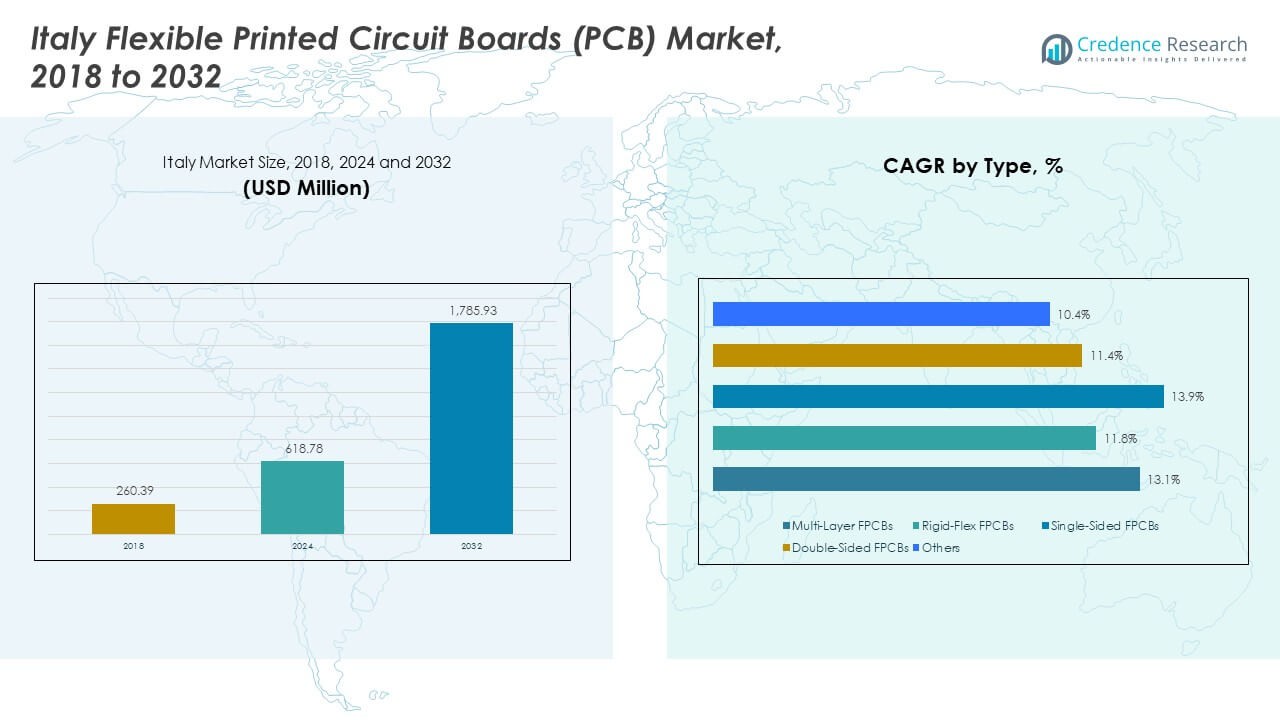

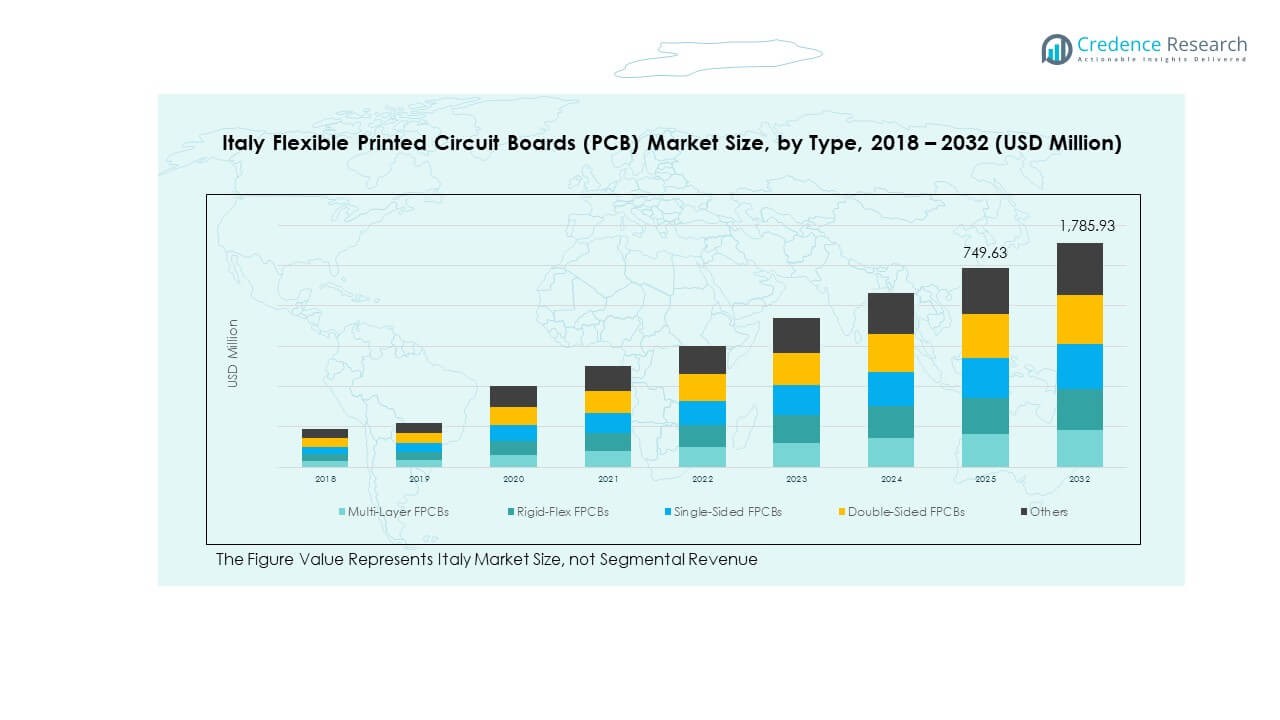

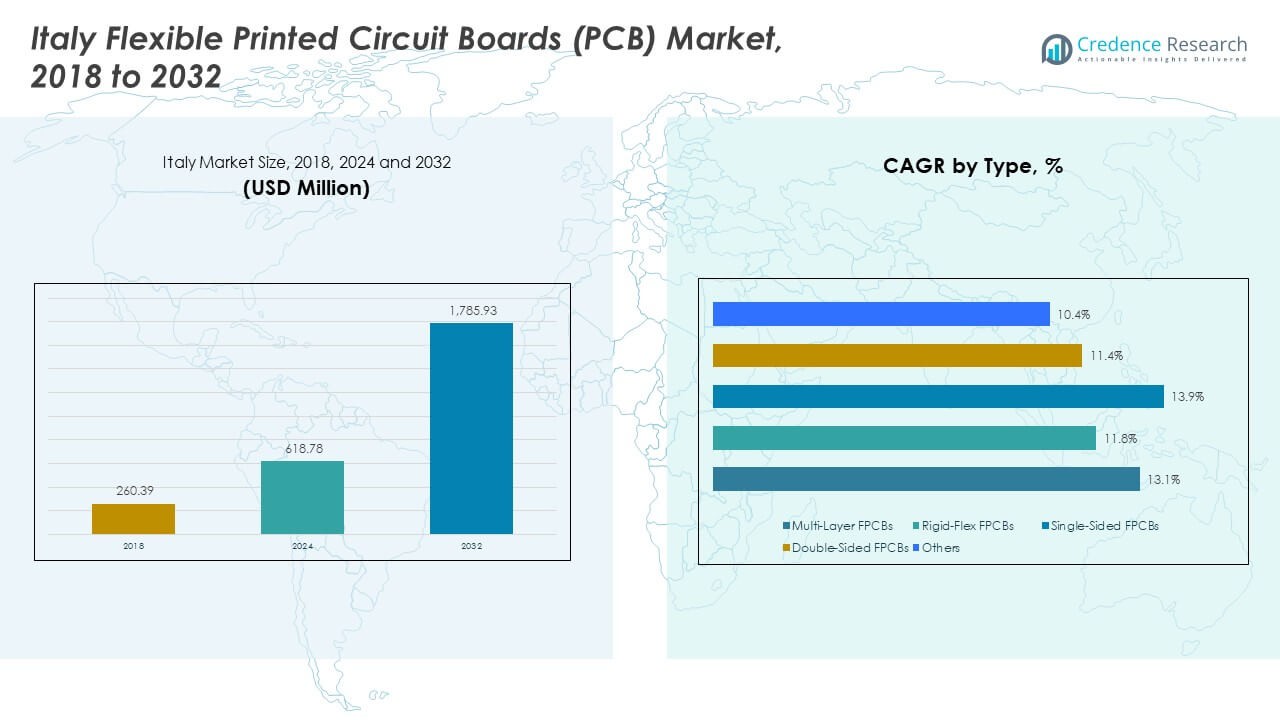

The Italy Flexible Printed Circuit Boards (PCB) Market size was valued at USD 260.39 million in 2018, increased to USD 618.78 million in 2024, and is anticipated to reach USD 1,785.93 million by 2032, at a CAGR of 13.20% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Flexible Printed Circuit Boards (PCB) Market Size 2024 |

USD 618.78 Million |

| Italy Flexible Printed Circuit Boards (PCB) Market, CAGR |

13.20% |

| Italy Flexible Printed Circuit Boards (PCB) Market Size 2032 |

USD 1,785.93 Million |

Rising demand for compact and high-performance electronics is driving the Italian market for flexible PCBs. The growing use of wearable devices, foldable smartphones, and advanced automotive electronics has accelerated the adoption of these circuits. Manufacturers are shifting toward multilayer flexible PCBs to enhance signal integrity and thermal management. Additionally, automation and electric mobility trends have strengthened domestic production and component integration.

Regionally, northern Italy, including Lombardy and Emilia-Romagna, is leading the market due to strong industrial and electronics manufacturing clusters. Central and southern regions are emerging as growth areas supported by new investment in electronic assembly and design capabilities. Increasing collaboration between local PCB manufacturers and European automotive and medical device firms is also promoting steady market expansion across Italy.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Italy Flexible Printed Circuit Boards (PCB) Market was valued at USD 238.41 million in 2018, reached USD 749.63 million in 2024, and is projected to attain USD 1,785.93 million by 2032, expanding at a CAGR of 11.5% from 2024 to 2032.

- Northern Italy dominated with 3% share, driven by strong industrial electronics and automotive manufacturing hubs in Lombardy and Emilia-Romagna. Central Italy followed with 29.6%, supported by expanding aerospace and defense applications. Southern Italy accounted for 18.7%, reflecting growing investments in consumer electronics assembly.

- The fastest-growing region is Southern Italy, expected to expand rapidly due to increasing adoption of flexible PCB technologies in emerging electronics clusters and government incentives promoting localized manufacturing.

- By type, Multi-Layer FPCBs held the largest share at 8%, reflecting strong demand in complex automotive and telecom circuitry.

- Rigid-Flex FPCBs captured 5% of the market, supported by rising integration in defense systems and miniaturized industrial equipment.

Market Drivers:

Rising Demand for Compact and Lightweight Electronic Devices Across Consumer Applications

The Italy Flexible Printed Circuit Boards (PCB) Market is experiencing strong growth due to the widespread use of compact electronics. Consumer demand for thinner, foldable, and energy-efficient devices pushes manufacturers to adopt flexible PCB solutions. These circuits enable lightweight structures while maintaining high connectivity and reliability. Smartphone makers are using flexible PCBs to achieve space efficiency and improved performance. Wearables, tablets, and medical monitors also integrate these boards for enhanced flexibility. Manufacturers are focusing on higher signal density and flexibility for compact electronic layouts. The increasing miniaturization trend continues to fuel steady market expansion.

- For instance, HilPCB manufactures flexible PCBs on polyimide with fine-line 50/50 µm capability and dynamic bend performance exceeding one million cycles. Consumer demand for thinner, foldable, and energy-efficient devices pushes manufacturers to adopt these flexible circuits. These boards enable lightweight structures while maintaining high connectivity and reliability.

Growth in Automotive Electronics and Electric Vehicle Integration

Automotive advancements have created significant demand for flexible PCBs in Italy. Vehicles now rely on compact, heat-resistant circuits for infotainment, safety systems, and power control. It supports advanced driver-assistance features that depend on flexible and durable circuit design. The expansion of electric and hybrid vehicles raises the need for lightweight electronic architectures. Manufacturers are introducing high-temperature polyimide materials to improve durability. Growing EV infrastructure also strengthens PCB adoption for battery and control units. The integration of flexible PCBs enhances energy efficiency and improves in-vehicle performance standards.

- For instance, manufacturers using pure polyimide substrates claim material stability at continuous operating temperatures up to 400 °C and dimension stability within ±25 µm. Vehicles now rely on compact, heat-resistant circuits for infotainment, safety systems, and power control. It supports advanced driver-assistance features that depend on flexible and durable circuit design.

Expanding Medical Device Manufacturing and Diagnostic Equipment Demand

The healthcare sector is becoming a key driver for flexible PCB adoption. Increasing demand for compact and portable diagnostic tools enhances the use of these circuits. It supports precision-driven medical devices like imaging scanners and wearable sensors. The miniaturized structure allows more advanced, patient-friendly designs in hospitals and labs. Italian firms are investing in PCB designs for bio-compatible and sterilization-resistant applications. Rising healthcare spending accelerates innovation in flexible designs for critical systems. This shift supports better reliability and operational performance in life-saving devices.

Technological Innovation in Materials and Manufacturing Processes

Continuous improvement in flexible PCB materials drives market performance. Polyimide and polyester substrates allow stronger flexibility and temperature resistance. The Italy Flexible Printed Circuit Boards (PCB) Market benefits from domestic R&D and material science progress. Automation and laser etching enhance manufacturing precision while reducing costs. Advanced layering processes improve circuit density and signal integrity. Local suppliers are focusing on environment-friendly materials to meet sustainability goals. These innovations expand industrial applications and improve circuit functionality across sectors.

Market Trends:

Market Trends:

Adoption of Multilayer and Rigid-Flex PCB Designs in Advanced Electronics

The Italy Flexible Printed Circuit Boards (PCB) Market is shifting toward multilayer and rigid-flex architectures. This trend allows manufacturers to build more complex, space-saving electronic modules. It improves mechanical stability and ensures higher circuit reliability in compact devices. Smartphones, sensors, and wearables now employ these hybrid structures for better connectivity. Design innovation supports higher data transmission rates for advanced consumer products. Companies are investing in CAD software and simulation tools for accuracy. The rising complexity of devices continues to push multilayer PCB usage.

- For instance, Flexium Interconnect develops 12+-layer flex and rigid-flex PCBs with line/space down to 8 µm to support miniaturized consumer and automotive modules. This trend allows manufacturers to build more complex, space-saving electronic modules. It improves mechanical stability and ensures higher circuit reliability in compact devices. Smartphones, sensors, and wearables now employ these hybrid structures for better connectivity.

Increased Focus on Sustainability and Eco-Friendly Production Methods

Manufacturers are integrating sustainable production techniques into flexible PCB manufacturing. It reduces waste, lowers emissions, and aligns with EU environmental regulations. The Italy Flexible Printed Circuit Boards (PCB) Market is seeing adoption of recyclable substrates and lead-free soldering. Water-based cleaning and chemical recycling are becoming standard practices. Local firms are developing eco-friendly laminates and adhesives for green electronics. This approach enhances brand reputation and strengthens export competitiveness. Sustainability now influences design, supply chain, and procurement strategies in PCB production.

- For instance, firms using polyimide flex circuits highlight reuse of process chemicals and reduction of solder waste, with typical substrates enduring over several hundred thousand flex cycles before failure. It reduces waste, lowers emissions, and aligns with EU environmental regulations. The Italy Flexible Printed Circuit Boards (PCB) Market is seeing adoption of recyclable substrates and lead-free soldering.

Integration of Flexible PCBs in IoT and Smart Infrastructure Projects

Internet of Things applications are driving new PCB integration opportunities. Flexible boards are vital for compact sensors and data transmission devices in smart cities. The Italy Flexible Printed Circuit Boards (PCB) Market benefits from IoT adoption in homes, industries, and transportation. It supports reliable power and communication modules for connected devices. PCB manufacturers are enhancing durability to withstand outdoor and industrial conditions. The rise of connected manufacturing systems increases demand for flexible circuits. Expanding IoT infrastructure strengthens local production and innovation capacity.

Rising Automation and Digitalization in PCB Production Facilities

Italian PCB manufacturers are implementing advanced automation for precision and productivity. Robotics, machine vision, and AI-driven inspection reduce production defects and waste. It shortens development cycles and ensures consistency across high-volume batches. The Italy Flexible Printed Circuit Boards (PCB) Market benefits from digital manufacturing platforms. Cloud integration enables better design management and real-time monitoring. Smart factories improve traceability and material control throughout the process. Automation supports cost efficiency and meets global quality standards.

Market Challenges Analysis:

High Material Costs and Complex Manufacturing Requirements Limiting Scalability

The Italy Flexible Printed Circuit Boards (PCB) Market faces rising costs due to advanced substrate and adhesive materials. Polyimide and polyester films remain expensive and difficult to process. It requires precise temperature control, cleanroom environments, and specialized machinery. Small and medium manufacturers struggle to balance cost and quality. The intricate layering and etching processes increase error rates during production. Dependence on imported raw materials also exposes the market to price volatility. These challenges hinder scalability and affect profit margins across domestic firms.

Skilled Workforce Shortage and Limited Domestic Supply Chain Capacity

Italy’s PCB industry experiences a shortage of trained engineers and technicians. It restricts large-scale implementation of advanced fabrication technologies. The Italy Flexible Printed Circuit Boards (PCB) Market must invest in technical training to maintain quality output. Limited domestic suppliers for specialty chemicals and laminates slow production. Global supply chain disruptions have created delays and cost surges. Many firms rely on Asian imports for critical components. Weak local supply networks impact delivery timelines and reduce export competitiveness.

Market Opportunities:

Emerging Applications in Wearable Electronics and Smart Medical Devices

The Italy Flexible Printed Circuit Boards (PCB) Market presents growth opportunities in healthcare and wearable technology. The compact size and flexibility suit next-generation sensors, patches, and diagnostic tools. It supports seamless integration with textiles and body-adapted designs. Start-ups are collaborating with medical device companies to produce custom flexible circuits. The rise in remote monitoring systems fuels long-term demand. Investment in flexible electronics research enhances Italy’s competitiveness in global markets.

Expansion Potential in Aerospace, Defense, and Industrial Automation Sectors

Flexible PCBs are gaining attention across aerospace and industrial automation domains. Their durability and lightweight structure align with performance needs in harsh environments. The Italy Flexible Printed Circuit Boards (PCB) Market benefits from EU-backed innovation programs. It offers design flexibility for high-reliability communication, control, and power systems. Aerospace and defense modernization efforts create new contract opportunities for local manufacturers. The shift toward automation and robotics further broadens market scope.

Market Segmentation Analysis:

By Type

The Italy Flexible Printed Circuit Boards (PCB) Market includes single-sided, double-sided, multi-layer, rigid-flex, and other PCB types. Single-sided FPCBs remain popular for cost-effective consumer devices and basic circuitry needs. Double-sided variants provide improved connectivity for compact electronic layouts and moderate power applications. Multi-layer FPCBs dominate advanced electronics and automotive systems where high density and signal integrity are essential. Rigid-flex designs are gaining traction in aerospace and medical devices for their durability and reliability. It benefits from rising adoption of flexible hybrid electronics supporting lightweight and high-performance architectures. The “others” segment covers specialty circuits for custom and low-volume industrial use.

- For instance, rigid-flex manufacturer Rigiflex Technology produces flex boards with copper thickness from 0.5 oz to 6.0 oz and layer counts from 1 to 20. Rigid-flex designs are gaining traction in aerospace and medical devices for their durability and reliability. The “others” segment covers specialty circuits for custom and low-volume industrial use.

By End Use

The market serves diverse end-use sectors including consumer electronics, automotive, industrial electronics, IT and telecom, aerospace and defense, and others. Consumer electronics lead due to growing production of smartphones, wearables, and display modules. Automotive applications continue expanding with demand for advanced driver assistance, infotainment, and EV power systems. Industrial electronics use flexible PCBs for automation and precision control systems requiring compact configurations. IT and telecom industries rely on flexible PCBs for routers, servers, and optical communication devices. Aerospace and defense sectors employ them for ruggedized equipment needing reliability under stress. It reflects broad industrial adoption and innovation across multiple verticals driving steady market growth.

- For instance, Sierra Circuits manufactures flexible PCBs that endure up to 200,000 bending cycles for wearable and consumer devices. Consumer electronics lead due to growing smartphones, wearables and display modules demand. Automotive applications continue expanding with advanced driver assistance, infotainment and EV power systems driving adoption. Industrial electronics use flexible PCBs for automation and precision control systems requiring compact configurations.

Segmentation:

By Type

- Single-Sided Flexible Printed Circuit Boards (FPCBs)

- Double-Sided Flexible Printed Circuit Boards (FPCBs)

- Multi-Layer Flexible Printed Circuit Boards (FPCBs)

- Rigid-Flex Flexible Printed Circuit Boards (FPCBs)

- Others

By End Use

- Consumer Electronics

- Automotive

- Industrial Electronics

- IT & Telecom

- Aerospace & Defense

- Others

By Country

Regional Analysis:

Northern Italy – Manufacturing and Innovation Hub

Northern Italy holds around 45% market share in the Italy Flexible Printed Circuit Boards (PCB) Market. The region is home to key industrial zones in Lombardy, Veneto, and Emilia-Romagna, which drive large-scale production and innovation in PCB technology. Strong automotive, industrial electronics, and machinery sectors fuel continuous demand for advanced flexible circuits. It benefits from established R&D infrastructure, skilled labor, and supplier networks that enhance product quality and output efficiency. Local companies are investing in high-density interconnect and multilayer PCB manufacturing for next-generation electronics. Access to export routes and advanced logistics further strengthens the region’s competitive advantage in production and distribution.

Central Italy – Expanding Technology and Design Ecosystem

Central Italy contributes nearly 30% of the market share, supported by its growing electronics and IT ecosystem. Regions such as Lazio, Tuscany, and Marche are advancing in flexible PCB design, prototyping, and system integration. It supports strong demand from IT, telecom, and healthcare device manufacturers that depend on compact and reliable circuit solutions. Local universities and research institutions foster collaboration between academia and industry, accelerating product development cycles. The region is also witnessing a rise in digital manufacturing and automation investments that improve operational precision. Government-led technology clusters are encouraging SMEs to adopt advanced PCB fabrication technologies to strengthen domestic supply chains.

Southern Italy and Islands – Emerging Production and Export Center

Southern Italy and the islands account for about 25% of the market share, reflecting growing industrialization and technological investments. The regions of Campania, Puglia, and Sicily are expanding electronic component manufacturing capacities through public-private partnerships. It supports new opportunities in renewable energy systems, defense electronics, and industrial automation equipment. Local firms are focusing on low-cost, high-performance PCB production to serve regional and export markets. Infrastructure developments, including improved logistics and port access, are boosting trade efficiency. The area’s emphasis on industrial diversification and workforce training continues to position it as a competitive production hub within Italy’s broader electronics value chain.

Key Player Analysis:

- Cicor Italy

- Eurocircuits Italy

- PCB Industries S.p.A.

- Printed Circuits S.p.A.

- Silicon Box

- Aemme Line S.p.A.

- SEI S.r.l.

- MCM Italy

- Telbios S.r.l.

- Finmek S.p.A.

Competitive Analysis:

The Italy Flexible Printed Circuit Boards (PCB) Market is characterized by moderate competition among domestic and international manufacturers. Leading players such as Flex Ltd., NOK Corporation, Interconnect Systems, and AT&S drive innovation through R&D and strategic partnerships. It emphasizes product miniaturization, material efficiency, and environmental compliance to gain a technological edge. Local firms focus on customized solutions for automotive, medical, and industrial electronics to retain clients. Market consolidation and vertical integration strategies are enhancing production agility and reducing costs. Growing collaboration between design houses and PCB manufacturers continues to strengthen Italy’s electronic manufacturing base.

Recent Developments:

- In October 2025, Cicor Group signed an agreement to acquire two production sites from Valtronic, a Western Switzerland electronics supplier, on October 27, 2025. This strategic move strengthened Cicor’s medical technology business, secured a strategic location in the United States, and enabled a much-needed capacity expansion in Morocco. The transaction added around 220 employees and generated additional revenue of at least CHF 20 million to the Cicor Group. The acquisition of Valtronic’s site in Morocco, located in the same shared building with Éolane Morocco (acquired by Cicor in spring 2025), doubled Cicor’s capacity at this existing location.

- In April 2025, Cicor Group announced a significant strategic acquisition that expands its European presence. The Paris Commercial Court accepted Cicor’s offer to acquire substantial business activities of the French Éolane Group. The business transfer was concluded on April 22, 2025, with integration beginning immediately thereafter, including rebranding of all sites. As part of this acquisition, Cicor integrated five engineering and production sites in France and two additional sites in Morocco into its existing Electronic Manufacturing Services (EMS) business. This transaction added approximately 890 employees and CHF 125 million in profitable sales to the Cicor Group, marking a milestone in executing Cicor’s pan-European growth strategy and further strengthening its market leadership in the aerospace and defence sectors.

- In March 2024, Silicon Box announced a major investment plan for expansion into Italy. The cutting-edge advanced panel-level packaging foundry announced an investment of up to $3.6 billion (€3.2 billion) in Northern Italy for a new state-of-the-art semiconductor assembly and test facility. This multi-year investment was designed to replicate Silicon Box’s flagship foundry in Singapore and expand further into 3D integration and testing. When completed, the new facility was expected to support approximately 1,600 Silicon Box employees in Italy, with construction anticipated to create several thousand additional jobs. The investment aligned with the Italian government and European Commission’s goal of achieving a more resilient semiconductor supply chain.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on type and end use segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will witness rising demand from automotive and industrial electronics sectors.

- Advancements in flexible materials will improve performance and design flexibility.

- Growing adoption of IoT devices will expand PCB usage across connected applications.

- Integration of automation and robotics will enhance PCB manufacturing precision.

- Increased investment in R&D will foster miniaturized and high-density PCB innovations.

- Local suppliers will form alliances with OEMs to boost production efficiency.

- Sustainability efforts will drive the shift toward recyclable and eco-friendly substrates.

- The expansion of 5G infrastructure will accelerate demand for flexible PCBs in telecom.

- Enhanced export opportunities within Europe will strengthen Italy’s production base.

- Ongoing digital transformation will position Italy as a competitive hub for advanced electronics manufacturing.

Market Trends:

Market Trends: