Market Overview:

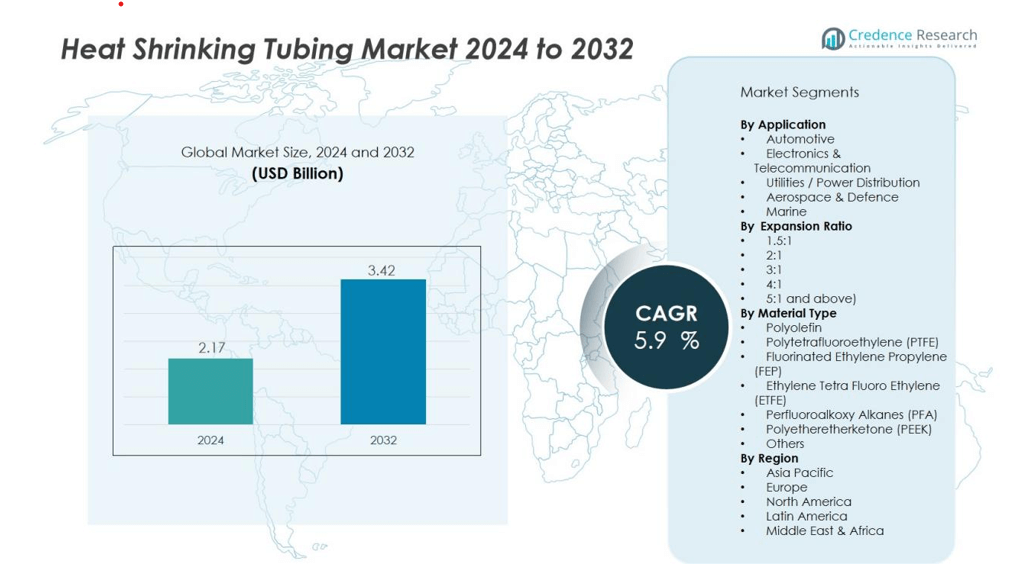

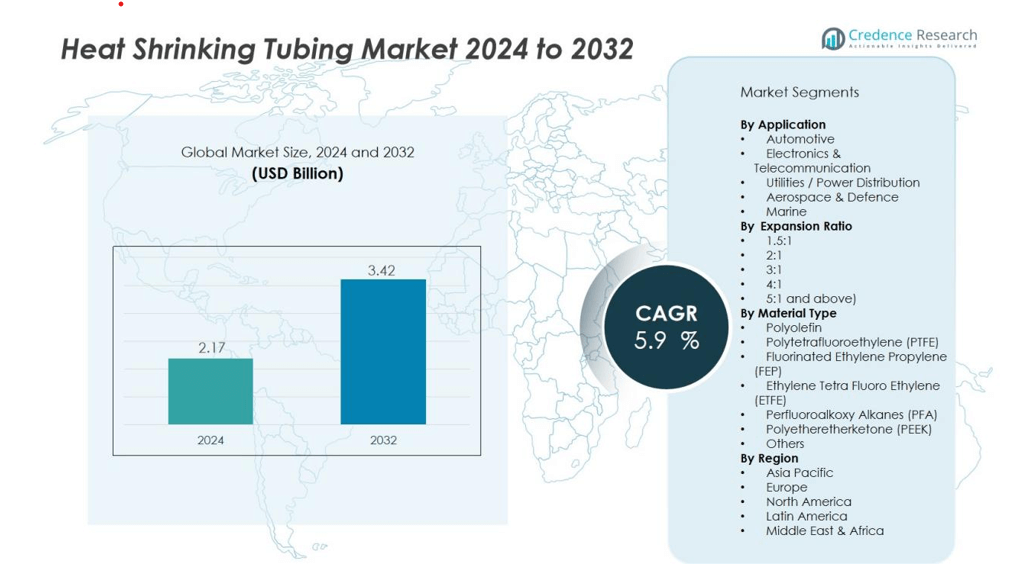

The Heat Shrinking Tubing Market size was valued at USD 2.17 billion in 2024 and is anticipated to reach USD 3.42 billion by 2032, at a CAGR of 5.9 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Heat Shrinking Tubing Market Size 2024 |

USD 2.17 billion |

| Heat Shrinking Tubing Market, CAGR |

5.9% |

| Heat Shrinking Tubing Market Size 2032 |

USD 3.42 billion |

Demand drivers include rising adoption of electric vehicles (EVs), increased global connectivity, and expansion of power and telecom infrastructure. The need for reliable wire insulation, cable protection, and environmental resistance in harsh conditions further supports uptake. Technological developments in advanced polymer materials and regulatory emphasis on safety and sustainability also play a contributory role.

Regionally, the Asia-Pacific region leads in growth thanks to large-scale industrialization, expansion of renewable energy systems, and electrification in China, India, and Southeast Asia. North America holds a strong share driven by automotive electrification, telecom rollout, and grid modernization. Europe displays moderate growth, while Latin America and the Middle East & Africa present emerging opportunities but lag behind the major regions.

Market Insights:

- The Heat Shrinking Tubing Market was valued at USD 2.17 billion in 2024 and is expected to reach USD 3.42 billion by 2032, growing at a CAGR of 5.9%.

- North America holds the largest market share at 36%, driven by strong demand in automotive electrification, telecom infrastructure, and grid modernization.

- Asia-Pacific follows with a 25% share, fueled by rapid industrialization in China, India, and Southeast Asia, along with significant investments in EV manufacturing and renewable energy.

- Europe accounts for 30% of the market, supported by automotive manufacturing and aerospace systems, though it faces slower growth compared to Asia-Pacific due to market maturity.

- The automotive segment holds the largest share in the Heat Shrinking Tubing Market due to the increased adoption of electric vehicles, while the electronics and telecommunications segments also show substantial growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand from the Automotive Industry

The automotive industry’s increasing focus on vehicle electrification is a major driver for the Heat Shrinking Tubing Market. With the rise in electric vehicles (EVs) and hybrid cars, the need for high-performance insulation materials to protect sensitive components such as wires, cables, and connectors is escalating. Heat shrink tubing is vital for ensuring the longevity and safety of these components in the harsh environments these vehicles operate in. Its ability to provide insulation, environmental protection, and mechanical strength makes it a critical material for modern automotive manufacturing.

- For instance, TE Connectivity’s Raychem heat shrink tubing, developed using radiation cross-linking technology, offers a shrink ratio of up to 7:1 and is engineered to withstand continuous operating temperatures from -67°F to 275°F (-55°C to 135°C), providing reliable protection for EV wiring harnesses and connectors in demanding automotive environments.

Expansion of Power and Telecom Infrastructure

The ongoing global expansion of power and telecommunications infrastructure is another key driver. Heat shrinking tubing is widely used for cable insulation and protection in both sectors. It provides reliable protection against harsh environmental conditions such as moisture, chemicals, and temperature fluctuations, making it ideal for use in outdoor and underground installations. The need for efficient energy transmission and the increasing number of telecom towers across the globe further stimulate demand for this versatile material.

- For instance, Prysmian’s BalWin1 and BalWin2 HVDC projects in Germany utilize ±525 kV copper cables with advanced insulation systems (XLPE for submarine sections and P-Laser for underground sections) protected with specialized thermal sealing mechanisms.

Rising Demand in Consumer Electronics

Heat shrink tubing plays a crucial role in the electronics industry, especially in consumer electronics. As devices become more compact and complex, the demand for insulation and protection solutions for wires and components is rising. Heat shrinking tubing offers a precise fit for various applications, such as wire harnesses, connectors, and sensors, making it essential for the miniaturization of electronic products. This growing demand for small, lightweight, and highly functional electronics drives the need for advanced heat shrink solutions.

Technological Advancements and Regulatory Support

Technological advancements in polymer materials and manufacturing techniques have significantly enhanced the capabilities of heat shrinking tubing. Innovations such as improved shrink ratios and multi-layer constructions have expanded its range of applications, particularly in specialized fields like aerospace and medical devices. Furthermore, increasing regulatory support for safety standards in industries such as automotive and electronics is fueling the adoption of high-performance insulation materials. As a result, heat shrinking tubing is becoming more widely used across various sectors, pushing the market’s growth.

Market Trends:

Increasing Adoption of Eco‑friendly and Bio‑based Materials

The Heat Shrink Tubing Market shows a strong shift toward eco‑friendly products derived from renewable resources. Manufacturers introduce bio‑based heat shrink tubing to meet rising sustainability demands. This trend helps firms align with stricter regulations on plastic use and waste disposal. It encourages innovation in material science and offers new revenue streams. Demand for these green solutions grows particularly within industries like automotive and electronics, where lifecycle costs matter.

- For instance, TE Connectivity’s BIOFUSE bio-based heat shrink tubing line, derived from sugarcane polymers, achieves a cradle-to-gate carbon footprint of -2.12 kg CO2/kg, significantly surpassing industry standards by capturing more carbon from the atmosphere than is emitted during production.

Rise of Smart Manufacturing and Customised Solutions

The market experiences growing integration of automation, digitalisation and Industry 4.0 practices across production lines of heat shrink tubing. It benefits from advancements that allow precise control over shrink ratios, material properties and quality assurance. Customised tubing solutions for niche applications—such as aerospace, renewable energy and medical devices—gain traction. The trend toward miniaturisation and complex wire harness systems drives demand for tubing that meets tighter tolerances and higher performance standards. Manufacturers invest in R&D and flexible production systems to respond quickly to changing designs and specialised needs.

- For instance, Sumitomo Electric Industries developed ultra-thin medical-grade heat shrink tubing with wall thickness as low as 0.1 mm, which is now used in catheter manufacturing for improved flexibility and reliability.

Market Challenges Analysis:

Volatile Raw Material Prices Produce Pressure on Margins

Fluctuating costs of feedstocks impose significant strain on the Heat Shrink Tubing Market. Many raw materials derive from petroleum and reflect changes in crude oil prices, supply chain bottlenecks, and geopolitical disruptions. It forces manufacturers to either absorb higher costs or pass them on to buyers, both of which can erode competitiveness. Some firms face difficulty in maintaining steady pricing while delivering required performance levels. This challenge becomes more acute in price‑sensitive end‑use segments like consumer electronics or basic electrical wiring.

Strict Regulatory and Sustainability Requirements Limit Flexibility

The market confronts accelerating demands for compliance with safety and environmental standards. It must meet stricter rules on halogen usage, flame retardancy, and chemical emissions under frameworks like RoHS and REACH. Manufacturers need to reformulate products, validate new materials, and requalify production lines, which raises costs and time to market. Smaller players may struggle with the investment burden and certification hurdles. Strong regulatory pressure thus restricts rapid product diversification and slows the pace of innovation.

Market Opportunities:

Expansion into Renewable Energy and Infrastructure Applications

The Heat Shrink Tubing Market presents strong opportunities through rising global investment in renewable energy and infrastructure upgrades. It supports wind‑turbine cables, solar farm wiring and grid modernization projects, all of which demand robust insulation and protection. Manufacturers can target segments based on high‑need materials like thick‑wall or halogen‑free tubing suitable for harsh outdoor conditions. It also offers room for value growth via premium product variants that meet stricter safety or environmental standards. Firms that tailor packaging, service or logistics for large projects can differentiate themselves and capture more market share.

Growth via Customisation, Miniaturisation and Sector Diversification

Customised solutions and small‑scale product formats open fresh avenues in the Heat Shrink Tubing Market. It must adapt to demands in medical devices, aerospace equipment and advanced electronics where space, weight and performance matter. It invites development of tubing with enhanced shrink ratios, biocompatible materials or ultra‑thin walls. Companies can also explore under‑penetrated regions, such as Latin America or Middle East & Africa, which show infrastructure build‑out and telecommunications growth. By offering bundled services—design support, certification assistance or regional inventory—suppliers can expand revenues beyond standard product sales.

Market Segmentation Analysis:

By Material

In the Heat Shrinking Tubing Market, material segmentation plays a pivotal role. Polyolefin stands out as the dominant material type, thanks to its reliable thermal stability and cost‑effective processing. Reports highlight that this segment captures a substantial share of the market. Fluoropolymers, PVC and other specialty materials follow, each offering specific performance benefits such as chemical resistance or ultra‑high temperature tolerance. It positions companies for differentiation when targeting advanced sectors like aerospace and oil & gas. Suppliers focus on material innovation to meet tough regulations and niche requirements.

- For instance, Grayline’s SL3X polyolefin tubing has a 3:1 shrink ratio, meaning it shrinks to 33% of its original inside diameter, providing exceptional flexibility and electrical insulation.

By Application

Application segmentation divides the market according to end‐use verticals. Automotive leads due to the rapid switch to electric vehicles and the need for robust insulation. Electronics and telecommunications follow, driven by miniaturisation and data‑centre growth. Other important application areas include aerospace, marine, utilities and construction. It forces manufacturers to tailor tubing features—such as shrink ratio, wall thickness and certification—to the demands of each sector. Market players allocate resources according to growth potential in each application zone.

- For Instance, ABB invests approximately 4% to 5% of its annual revenues in R&D, focusing on software, AI, and electrification. In 2024, this investment exceeded $1.5 billion.

By Expansion Ratio

Shrink or expansion ratio defines how far tubing can contract when heated and forms a key sub‑segment of the market. The 2 : 1 ratio holds the largest share currently because of its broad utility in general‑purpose wiring and cable protection. The 3 : 1 ratio shows faster growth, especially where irregular shapes or space constraints occur (for instance in aerospace or complex wiring systems). Ratios like 4 : 1, 5 : 1 or higher cater to highly specialised applications requiring major diameter change. It gives manufacturers a means to segment product lines and capture premium pricing for complex requirements.

Segmentations:

By Material

- Polyolefin

- Polytetrafluoroethylene (PTFE)

- Fluorinated Ethylene Propylene (FEP)

- Ethylene Tetra Fluoro Ethylene (ETFE)

- Perfluoroalkoxy Alkanes (PFA)

- Polyetheretherketone (PEEK)

- Others

By Application

- Automotive

- Electronics & Telecommunication

- Utilities / Power Distribution

- Aerospace & Defence

- Marine

By Expansion Ratio

- 5:1

- 2:1

- 3:1

- 4:1

- 5:1 and above

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Regional Outlook

North America held a market share of 36 % in the Heat Shrinking Tubing Market in 2024. The United States leads based on strong demand in automotive electrification and modernisation of power grids. It benefits from high uptake in telecom infrastructure and reliable supply chains that support the region’s technology‑intensive industries. Manufacturers target this region with premium, high‑spec products that meet strict safety and regulatory standards. It faces moderate growth challenge due to mature markets and cost pressures on raw materials. The region remains a strategic priority because of stable revenues and access to leading OEMs.

Asia‑Pacific Regional Outlook

Asia‑Pacific captured roughly 25 % share of the Heat Shrinking Tubing Market in 2023. Rapid industrialisation in China, India and Southeast Asia drives the region’s demand growth. It draws significant investment in EV manufacturing, renewable‑energy infrastructure and consumer electronics production. Manufacturers focus on expanding local production and supply networks to serve this dynamic region. The region presents higher growth opportunities due to rising infrastructure build‑out and lower base. It also faces challenges of fluctuating raw‑material costs and competition from lower‑cost regional suppliers.

Europe and Other Regions Outlook

Europe accounted for an estimated market share of 30 % in the Heat Shrinking Tubing Market in 2023. Automotive manufacturing, aerospace systems and robust regulatory frameworks drive the region’s steady demand. The region demands high quality, flame‑retardant and sustainability‐compliant tubing solutions. It faces slower growth than Asia‑Pacific due to market maturity and slower infrastructure expansion. Latin America and Middle East & Africa together account for approximately 15 % share, offering emerging‐market potential driven by oil & gas, mining and utility‑upgrade projects. Manufacturers targeting those regions must deal with logistical complexity and local regulatory variation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The competitive landscape of the Heat Shrink Tubing Market features significant players such as nVent Electric, Garland Industries, Canusa, 3M, and Iljin Electric. nVent Electric leverages its global footprint and deep expertise in electrical protection systems to maintain strong presence in high‑spec applications. Garland Industries and Canusa focus on specialised product segments, offering medium‑voltage tubing and unique sealing solutions tailored to niche demands. 3M commands recognition for broad product range and consistent quality across industries from automotive to telecom, strengthening its competitive edge. Iljin Electric brings regional strength and cost efficiency, targeting growth in emerging markets and infrastructure‑upgrade segments. Companies compete on product innovation, geographic coverage, certification compliance and supply‑chain robustness to capture share in this dynamic market.

Recent Developments:

- In April 2025, TE Connectivity completed its acquisition of Richards Manufacturing Co., expanding its presence in the North American utility grid segment.

- In November 2024, TE Connectivity acquired Harger, enhancing its capabilities in lightning protection and grounding solutions for the energy sector.

Report Coverage:

The research report offers an in-depth analysis based on Material, Application, Expansion Ratio and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The Heat Shrinking Tubing Market will benefit from rising global vehicle electrification, offering strong demand for advanced insulation solutions.

- It will capture growth from expanding renewable energy investments, which require high‑performance tubing for solar farms, wind turbines and grid upgrades.

- The market will see higher adoption of bio‑based and halogen‑free materials under stricter environmental and safety regulations worldwide.

- It will gain traction through miniaturised electronics and complex wire‑harness systems, prompting demand for tubing with tighter tolerances and higher shrink ratios.

- Market participants will invest in smart manufacturing and automation, enabling faster production, lower costs and customised tubing variants.

- It will face opportunities in emerging regions such as Latin America, Middle East and Africa, where infrastructure expansion remains under‑penetrated.

- The market will expand via premium product upgrades—such as flame‑retardant, UV‑resistant and adhesive‑lined tubing—that command higher margins.

- It will benefit from supplier partnerships and value‑chain integration to address large project requirements in utilities and telecom sectors.

- The market will shift toward digital channels and aftermarket services, including design support, logistics and regional inventory, to enhance customer experience.

- It will need to contend with raw‑material volatility and regulatory compliance, demanding agile strategies and cost control to capture upscale segments.