Market Overview:

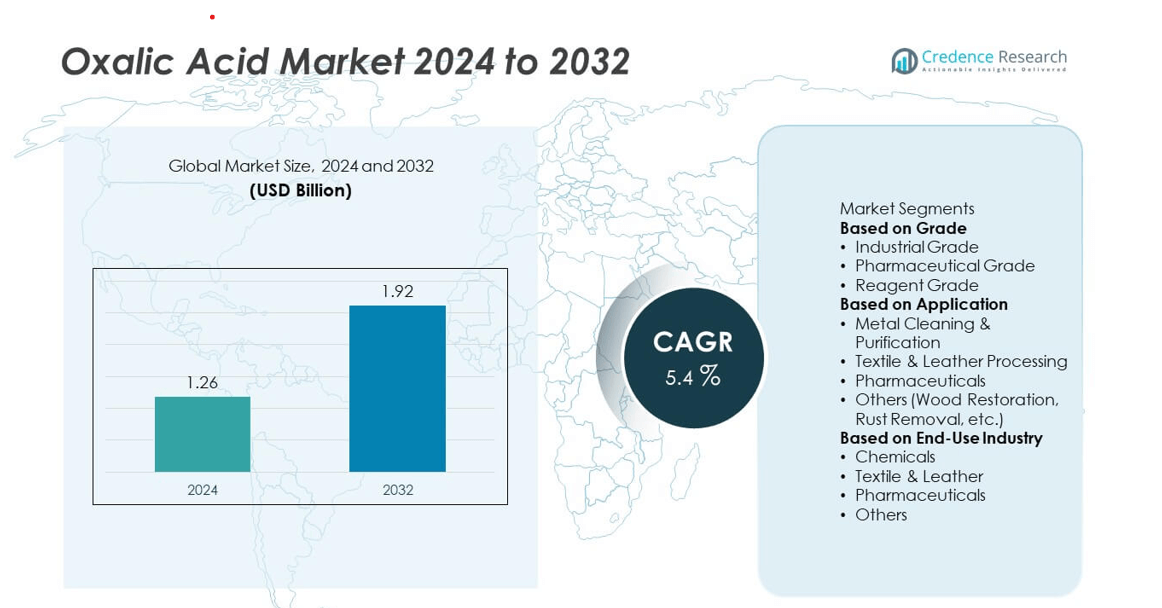

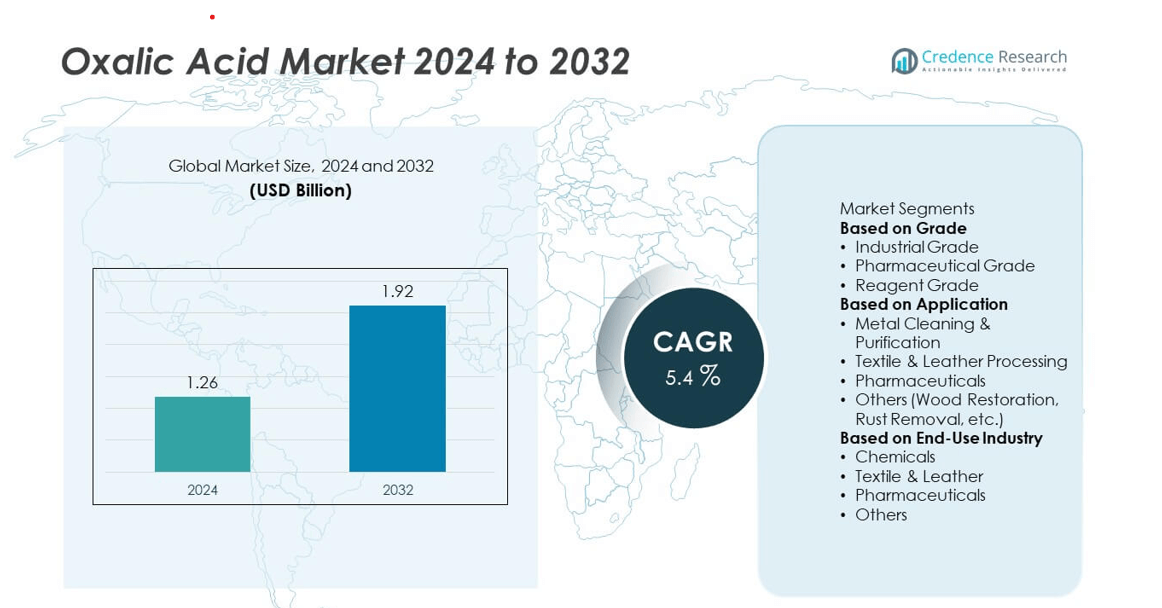

The oxalic acid market was valued at USD 1.26 billion in 2024 and is projected to reach USD 1.92 billion by 2032, registering a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Oxalic Acid Market Size 2024 |

USD 1.26 billion |

| Oxalic Acid Market, CAGR |

5.4% |

| Oxalic Acid Market Size 2032 |

USD 1.92 billion |

The oxalic acid market is led by major players including Oxaquim S.A., Ube Industries Ltd., Indian Oxalate Ltd., Star Oxochem Pvt. Ltd., Radiant Indus Chem Pvt. Ltd., Punjab Chemicals & Crop Protection Ltd., Alta Laboratories Ltd., Shandong Fengyuan Chemical Co., Ltd., Clariant AG, and OxoChem India Pvt. Ltd. These companies emphasize sustainable production, capacity expansion, and high-purity formulations to meet growing industrial and pharmaceutical demand. Regionally, Asia-Pacific dominated the global market in 2024 with a 37.8% share, driven by strong demand from textile, metal processing, and chemical industries, followed by North America with 26.4% and Europe with 24.1%, supported by advancements in green chemistry and growing adoption in specialty chemical manufacturing.

Market Insights

- The oxalic acid market was valued at USD 1.26 billion in 2024 and is projected to reach USD 1.92 billion by 2032, growing at a CAGR of 5.4%.

- Rising demand from metal cleaning, textile processing, and pharmaceutical industries drives market growth, with the industrial-grade segment holding a 58.7% share in 2024.

- Increasing adoption of eco-friendly production processes and applications in rare earth extraction are key market trends enhancing sustainability and efficiency.

- Leading players such as Oxaquim S.A., Ube Industries Ltd., Indian Oxalate Ltd., and Clariant AG focus on product quality, technological innovation, and regional expansion to strengthen competitiveness.

- Asia-Pacific dominated the global market with a 37.8% share, followed by North America at 26.4% and Europe at 24.1%, supported by rapid industrialization, growing chemical production, and regulatory emphasis on green manufacturing practices.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Grade

The industrial-grade segment dominated the oxalic acid market in 2024 with a 58.7% share. Its wide use across industries such as metal cleaning, textile processing, and chemical synthesis drives this leadership. Industrial-grade oxalic acid is preferred for its strong reducing and bleaching properties, making it essential for rust removal and surface treatment applications. The segment also benefits from large-scale availability and cost efficiency compared to other grades. Pharmaceutical-grade oxalic acid continues to gain momentum in drug formulation and purification, while reagent-grade is used mainly in laboratory and analytical processes.

- For instance, Shandong Fengyuan Chemical Stock Co., Ltd., supplying high-purity industrial-grade oxalic acid used in textile manufacturing to improve fabric whiteness and remove iron stains, resulting in up to 40% better stain clearance.

By Application

Metal cleaning and purification held the largest market share of 41.3% in 2024, driven by increasing use in removing rust, stains, and mineral deposits from industrial surfaces. Its high effectiveness in restoring metal luster and enhancing corrosion resistance supports demand in the automotive and machinery sectors. Textile and leather processing remains another key application area, where oxalic acid acts as a bleaching and dyeing agent. Growth in chemical synthesis and pharmaceutical applications further expands market opportunities, supported by technological advancements in production and purification.

- For instance, ZERUST® offers their AxxaClean™ line of industrial rust removers, which are widely used in automotive and machinery maintenance to rapidly eliminate heavy rust and restore metal surfaces.

By End-Use Industry

The chemical industry accounted for a dominant 43.6% share of the oxalic acid market in 2024. Its extensive use in producing various intermediates, catalysts, and cleaning compounds sustains strong demand. The textile and leather sector follows, driven by the compound’s role in bleaching and finishing processes. The pharmaceutical industry also contributes significantly as oxalic acid is increasingly used in API synthesis and rare earth element extraction. Expanding industrial manufacturing in Asia-Pacific and growing demand for high-purity chemicals further strengthen the outlook for the oxalic acid market across end-use sectors.

Key Growth Drivers

Expanding Demand in Metal Cleaning and Surface Treatment

The growing use of oxalic acid in metal cleaning and surface treatment industries is a major growth driver. Its effectiveness in removing rust, scale, and stains from metal surfaces supports applications in automotive, construction, and manufacturing sectors. The compound’s role in producing high-purity metals and enhancing corrosion resistance increases its industrial importance. Rising infrastructure development and metal fabrication activities, particularly in Asia-Pacific, further boost consumption of industrial-grade oxalic acid across various processing and maintenance operations.

- For instance, Ningbo Inno Pharmchem Co., Ltd. highlights oxalic acid dihydrate’s role in rust removal and surface preparation that improves primer adhesion and corrosion resistance for metals used in industrial coatings.

Rising Utilization in Pharmaceuticals and Chemical Synthesis

Oxalic acid’s growing application in pharmaceutical manufacturing and chemical synthesis strengthens market expansion. It serves as a key intermediate in the preparation of antibiotics, sedatives, and purification processes. Its role as a catalyst and reducing agent enhances efficiency in multiple synthesis pathways. With global pharmaceutical production increasing, especially in India and China, demand for high-purity oxalic acid continues to rise. Manufacturers are investing in purification technologies to ensure product consistency for medical and chemical-grade applications.

- For instance, Clariant has moved to supply higher-purity specialty products to the pharmaceutical sector and expanded its healthcare product offering to address demand for high-purity ingredients.

Increasing Use in Textile and Leather Processing

The textile and leather industries contribute significantly to oxalic acid demand due to its role as a bleaching and dyeing agent. It is widely used to remove stains, iron deposits, and impurities during fabric finishing processes. The compound ensures improved brightness and color uniformity in textiles, while enhancing leather softness and quality. Growing apparel manufacturing, coupled with rising exports in developing economies, supports steady market growth. Adoption of eco-friendly processing methods further promotes oxalic acid usage in sustainable textile operations.

Key Trends & Opportunities

Shift Toward Eco-Friendly and Sustainable Manufacturing

Manufacturers are focusing on developing environmentally friendly oxalic acid production processes using renewable raw materials. The shift from petrochemical-based synthesis to bio-based and green catalytic methods reduces carbon emissions and waste generation. This aligns with global sustainability goals and regulatory pressures on chemical producers. The trend offers significant opportunities for innovation and expansion, particularly in Europe and North America, where environmental compliance standards are stringent. Sustainable production is expected to enhance product acceptance among industrial and pharmaceutical end users.

- For instance, Kushtia Sugar Mills Ltd. in Bangladesh developed an eco-friendly method to produce oxalic acid by oxidizing waste cane sugar molasses, employing a novel TiO2-V2O5 catalyst and recycling nitrogen oxide gases to minimize environmental impact.

Rising Adoption in Rare Earth Element Extraction

Increasing global demand for rare earth elements in electronics and renewable energy sectors presents new opportunities for oxalic acid producers. The compound is used to precipitate rare earth oxalates, an essential step in refining and separation processes. Expanding production of electric vehicles, wind turbines, and advanced batteries drives the need for efficient extraction methods. Oxalic acid’s role in cost-effective rare earth recovery positions it as a critical chemical in high-tech material processing industries.

- For instance, Indian Rare Earths Limited (IREL) uses oxalic acid-based precipitation in their monazite sand processing, improving yields and thermal efficiency in converting oxalates to metal oxides.

Key Challenges

Health and Environmental Safety Concerns

Oxalic acid poses handling and disposal challenges due to its corrosive and toxic nature. Prolonged exposure can cause health risks, while improper waste management may lead to environmental contamination. Compliance with occupational safety and chemical disposal regulations increases operational costs for manufacturers. Companies are investing in advanced safety measures and neutralization technologies to minimize risks. However, stringent environmental regulations may limit large-scale production and hinder market growth in regions with strict chemical control policies.

Volatility in Raw Material Prices and Supply Constraints

Fluctuating prices of raw materials used in oxalic acid production, such as sugar, molasses, and carbon monoxide, affect overall manufacturing costs. Dependence on specific feedstock sources, particularly in developing countries, creates supply instability. Market participants face challenges in maintaining profit margins amid changing input costs and transportation disruptions. To address this, producers are exploring process optimization and alternative synthesis routes to ensure stable supply and cost efficiency in competitive global markets.

Regional Analysis

North America

North America held a 26.4% share of the oxalic acid market in 2024, driven by its extensive use in metal cleaning, pharmaceuticals, and industrial processing. The U.S. leads regional demand due to strong manufacturing and healthcare sectors. Growth is supported by technological advancements in purification and sustainable chemical synthesis. Increasing applications in textile finishing and rust removal further contribute to demand. The region’s stringent environmental regulations are encouraging producers to adopt eco-friendly production methods, enhancing competitiveness and product quality in both domestic and export markets.

Europe

Europe accounted for a 24.1% share of the oxalic acid market in 2024, supported by high demand from the pharmaceutical and textile industries. Countries such as Germany, France, and Italy lead regional consumption due to established chemical manufacturing bases. The market benefits from increasing adoption of oxalic acid in rare earth purification and high-grade metal polishing applications. Strict regulations promoting environmentally safe chemicals drive innovation toward sustainable production methods. Growing demand for specialty and reagent-grade oxalic acid in laboratory and analytical applications also supports market expansion across the region.

Asia-Pacific

Asia-Pacific dominated the oxalic acid market in 2024 with a 37.8% share and is projected to maintain strong growth through 2032. China, India, and Japan are the primary contributors, supported by expanding industrial, textile, and pharmaceutical sectors. Rapid urbanization and rising construction activities boost the demand for oxalic acid in metal cleaning and finishing processes. Favorable manufacturing conditions and low production costs encourage regional output growth. The increasing focus on eco-friendly chemicals and the region’s role as a global hub for textile and chemical exports further strengthen market leadership.

Latin America

Latin America represented a 6.3% share of the oxalic acid market in 2024, driven by rising industrialization and growth in the textile and leather sectors. Brazil and Mexico lead consumption due to increasing use in cleaning agents and dyeing processes. Expanding pharmaceutical manufacturing and agricultural applications also support demand. However, limited technological infrastructure and high import dependency constrain market development. Local producers are gradually adopting cost-effective production methods and expanding distribution networks, improving market accessibility and supporting steady growth across key regional industries.

Middle East & Africa

The Middle East & Africa accounted for a 5.4% share of the oxalic acid market in 2024, supported by demand from construction, chemical, and metal processing industries. Countries such as the UAE, Saudi Arabia, and South Africa are key consumers due to growing infrastructure and automotive activities. The compound’s use in surface cleaning and water treatment continues to expand across industrial applications. While high raw material costs and limited local production pose challenges, increasing investment in chemical manufacturing and import partnerships supports gradual regional market development.

Market Segmentations:

By Grade

- Industrial Grade

- Pharmaceutical Grade

- Reagent Grade

By Application

- Metal Cleaning & Purification

- Textile & Leather Processing

- Pharmaceuticals

- Others (Wood Restoration, Rust Removal, etc.)

By End-Use Industry

- Chemicals

- Textile & Leather

- Pharmaceuticals

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The oxalic acid market is characterized by strong competition among key players such as Oxaquim S.A., Ube Industries Ltd., Indian Oxalate Ltd., Star Oxochem Pvt. Ltd., Radiant Indus Chem Pvt. Ltd., Punjab Chemicals & Crop Protection Ltd., Alta Laboratories Ltd., Shandong Fengyuan Chemical Co., Ltd., Clariant AG, and OxoChem India Pvt. Ltd. These companies focus on capacity expansion, product quality improvement, and sustainable manufacturing technologies to strengthen market presence. Leading producers are investing in advanced production processes to enhance purity levels and reduce environmental impact. Strategic collaborations and regional partnerships are becoming common to optimize supply chains and expand into high-demand markets like Asia-Pacific and Europe. Furthermore, the shift toward eco-friendly and bio-based oxalic acid production presents new growth opportunities. Intense price competition and raw material volatility drive innovation and operational efficiency among established and emerging market participants.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Oxaquim S.A.

- Ube Industries Ltd.

- Indian Oxalate Ltd.

- Star Oxochem Pvt. Ltd.

- Radiant Indus Chem Pvt. Ltd.

- Punjab Chemicals & Crop Protection Ltd.

- Alta Laboratories Ltd.

- Shandong Fengyuan Chemical Co., Ltd.

- Clariant AG

- OxoChem India Pvt. Ltd.

Recent Developments

- In April 2024, Clariant also announced new bio-based additive solutions (Licocare® RBW Vita 560 & 360) for plastics, part of its sustainability push which impacts upstream chemical supply chains (including oxalic acid intermediates) for electronics and E&E industries.

- In January 2023, ADAMA Ltd. introduced a new herbicide named Acert in Brazil, featuring oxalic acid as the key active ingredient, aimed at enhancing weed control efficiency.

- In December 2022, UBE Corporation completed the acquisition of API Corporation (formerly part of Mitsubishi Chemical Group) to strengthen its specialty chemicals and CDMO segment, enhancing its oxalic acid intermediate portfolio.

Report Coverage

The research report offers an in-depth analysis based on Grade, Application, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for oxalic acid will rise across metal cleaning, textile, and pharmaceutical sectors.

- Industrial-grade oxalic acid will continue dominating due to its wide industrial applications.

- Growth in rare earth extraction will create new opportunities for oxalic acid producers.

- Sustainable and bio-based production methods will gain higher industry adoption.

- Asia-Pacific will remain the leading and fastest-growing regional market.

- Technological advancements will enhance purity and efficiency in production processes.

- Expansion of chemical manufacturing in developing economies will support long-term growth.

- Strategic collaborations will help companies strengthen supply chains and regional reach.

- Increasing environmental regulations will drive innovation toward safer production methods.

- Rising investment in R&D will lead to the development of high-performance and eco-friendly oxalic acid formulations.