Market Overview:

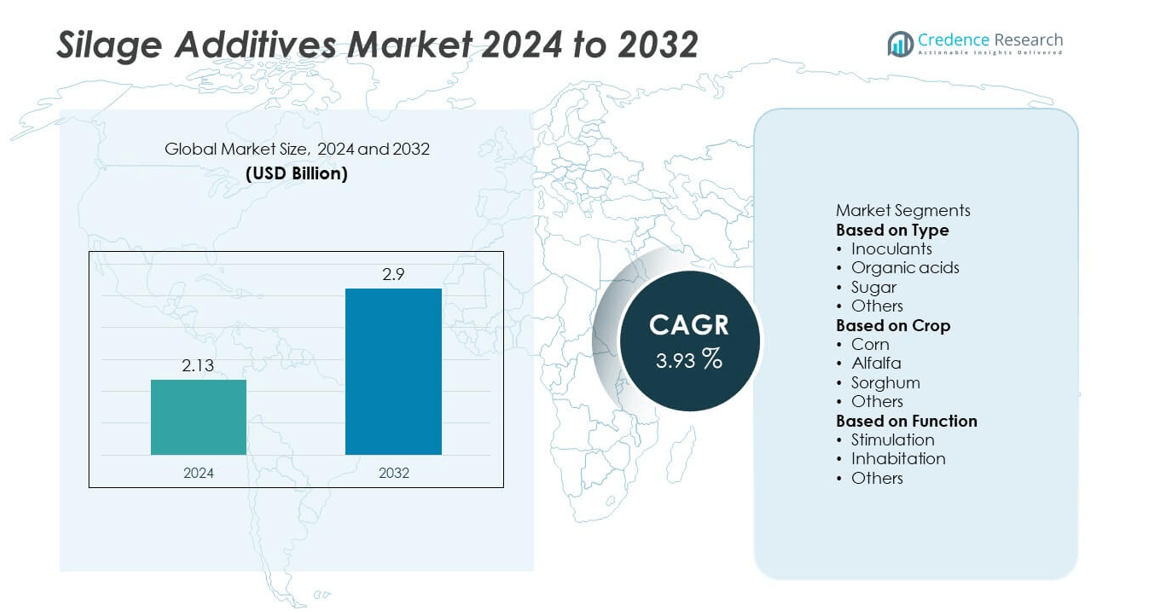

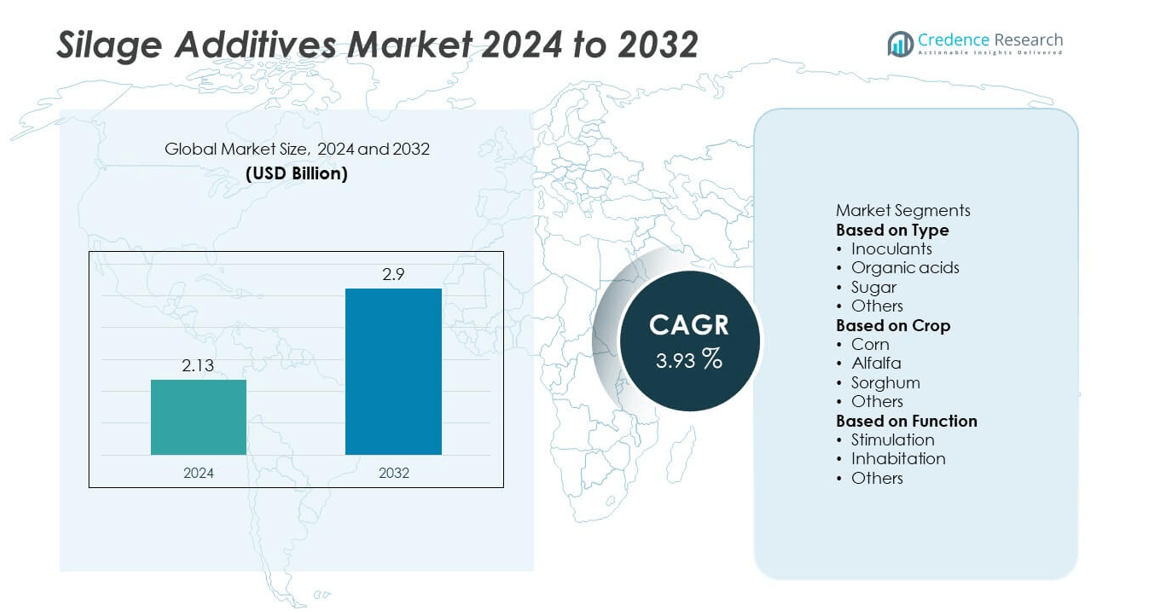

The Silage Additives Market was valued at USD 2.13 billion in 2024 and is projected to reach USD 2.9 billion by 2032, growing at a CAGR of 3.93% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Silage Additives Market Size 2024 |

USD 2.13 billion |

| Silage Additives Market, CAGR |

3.93% |

| Silage Additives Market Size 2032 |

USD 2.9 billion |

The Silage Additives market is led by prominent companies such as Lallemand, Inc., ForFarmers N.V., BASF SE, Kemin Industries, Inc., American Farm Products, Inc., Dupont de Nemours, Inc. (DuPont), Biomin Holding GmbH, Cargill, Incorporated, ADM Animal Nutrition, and Chr. Hansen Holding A/S. These players emphasize microbial and enzyme-based innovations to enhance fermentation efficiency and feed preservation. Strategic investments in sustainable and high-performance additive solutions are strengthening their global reach. Asia-Pacific dominated the market with a 33.7% share in 2024, driven by livestock expansion and improved feed practices, followed by Europe with 31.5% and North America with 27.8%, supported by advanced dairy and beef industries.

Market Insights

- The Silage Additives market was valued at USD 2.13 billion in 2024 and is projected to reach USD 2.9 billion by 2032, growing at a CAGR of 3.93% during the forecast period.

- Rising demand for high-quality livestock feed and improved silage preservation is driving adoption across dairy and beef farming sectors worldwide.

- Key trends include increased use of microbial inoculants and enzyme-based additives that enhance fermentation, reduce spoilage, and align with sustainable farming practices.

- The market is competitive, with major players such as Lallemand, BASF, Cargill, DuPont, and ADM focusing on biological innovations, regional expansion, and partnerships with feed producers.

- Asia-Pacific held 33.7%, followed by Europe with 31.5% and North America with 27.8%, while the inoculants segment led with 46.7% share, reflecting growing preference for efficient, eco-friendly solutions in silage preservation and animal nutrition management.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The inoculants segment dominated the Silage Additives market in 2024 with a 46.7% share. Its strong position is driven by its ability to enhance fermentation, improve nutrient retention, and prevent spoilage. Inoculants containing lactic acid bacteria accelerate pH reduction and increase feed digestibility, supporting livestock performance. Growing use in dairy and beef farming to maintain silage stability during long storage periods further boosts adoption. Organic acids are also gaining traction as chemical preservatives for moisture control, while sugars serve as fermentation enhancers in low-sugar crops.

- For instance, Chr. Hansen Holding A/S introduced its SiloSolve® FC inoculant combining Lactobacillus buchneri and Lactococcus lactis strains at a target application concentration of 1.5 × 10⁵ CFU per gram of fresh forage.

By Crop

The corn segment accounted for the largest 51.3% share of the market in 2024, reflecting its wide use in livestock feed production due to high starch and energy content. Silage additives improve fermentation efficiency and minimize nutrient loss in corn-based silage, which supports milk yield and animal growth. Rising demand for energy-dense feed in dairy and beef farms sustains corn’s dominance. Alfalfa and sorghum follow, as producers increasingly use additives to maintain protein levels and reduce spoilage under humid storage conditions.

- For instance, Lallemand, Inc. evaluated its Magniva® Platinum inoculant on corn silage in a 160-day storage trial, achieving a 5.4 percentage-point increase in Neutral Detergent Fibre digestibility (NDFd) and 1.23 kg higher daily milk yield per cow. The product’s multi-strain formula stabilized lactic acid concentration at 8.7 g/kg of dry matter, ensuring superior aerobic stability during long-term storage.

By Function

The stimulation segment led the market with a 54.2% share in 2024, supported by its role in promoting lactic acid fermentation and rapid pH stabilization. These additives help enhance microbial activity, ensuring better preservation and higher-quality silage. The use of enzyme-based and microbial stimulants is expanding, particularly in high-moisture crops, to boost feed conversion efficiency. The inhabitation segment, which includes preservatives and antifungal agents, continues to grow steadily as farms prioritize longer storage life and reduced mold contamination in silage.

Key Growth Drivers

Rising Demand for High-Quality Animal Feed

The growing focus on livestock productivity is driving demand for high-quality silage. Silage additives enhance fermentation efficiency, improve nutrient preservation, and extend storage stability. Farmers are adopting these products to maintain consistent feed quality throughout the year. Expanding dairy and beef industries, particularly in developing regions, are fueling wider additive use. With increasing awareness of feed efficiency and animal health, the adoption of inoculants and organic acids continues to strengthen across global livestock operations.

- For instance, Kemin Industries, Inc. introduced its Silage SAVOR® Plus Liquid additive formulated with 70% propionic and acetic acid. Applied at 2.0 lb per 10 ft² of silo surface, it achieved yeast reduction levels below 10³ CFU/g in maize silage, improving aerobic stability and preventing visible mold growth during 21 days of open storage.

Expansion of Livestock and Dairy Farming

The expansion of commercial livestock and dairy farms worldwide is a major growth driver. Rising meat and milk consumption in emerging economies is increasing the need for efficient feed preservation. Silage additives play a critical role in preventing spoilage, maintaining energy content, and ensuring balanced nutrition. Governments and private enterprises are investing in advanced silage management practices, supporting steady market growth. This trend is particularly strong in regions with expanding dairy production and intensive animal farming operations.

- For instance, research and field data on maize silage improvement programs in Brazil, some involving specific bacterial inoculants, have shown varied and sometimes significant results in improving forage quality. In studies evaluating the effects of different factors on maize silage quality, inoculation with Lactobacillus buchneri has been shown to increase aerobic stability.

Growing Awareness of Feed Efficiency and Sustainability

Farmers are increasingly focusing on reducing feed waste and improving sustainability in livestock systems. Silage additives help minimize nutrient losses, reduce methane emissions, and optimize fermentation processes. This aligns with environmental goals and cost-efficient farming practices. Adoption of eco-friendly microbial inoculants and biodegradable additives is growing as part of sustainable agriculture initiatives. The trend supports both productivity and environmental compliance, strengthening the market’s long-term growth prospects across the agriculture and livestock feed sectors.

Key Trends & Opportunities

Adoption of Biological and Enzyme-Based Additives

Biological and enzyme-based additives are gaining prominence due to their efficiency and eco-friendly nature. These additives enhance fiber breakdown, improve digestibility, and promote faster fermentation. Microbial inoculants containing lactic acid bacteria and enzymes are increasingly replacing chemical preservatives. Their natural composition supports clean-label livestock production and aligns with global sustainability standards. Ongoing research into multi-strain inoculants and enzyme blends is creating new opportunities for feed manufacturers targeting improved nutritional retention and higher animal performance.

- For instance, Biomin Holding GmbH developed its Biomin® BioStabil Plus inoculant containing Lactobacillus plantarum and Enterococcus faecium, a formulation of strategically selected Lactic Acid Bacteria for optimal forage preservation.

Integration of Precision Farming and Digital Monitoring

Technological advancements in precision farming are shaping the future of silage management. Digital sensors and monitoring systems now track fermentation quality, temperature, and moisture in real time. This allows farmers to optimize additive dosage and ensure consistent silage preservation. Integration of smart farming tools helps reduce feed spoilage and improve operational efficiency. The trend is supported by growing adoption of data-driven livestock management systems, especially among large-scale dairy and beef producers seeking improved productivity and cost control.

- For instance, trinamiX GmbH, a wholly-owned subsidiary of BASF SE, in collaboration with Eurofins Agro Testing, introduced the handheld NIR spectrometer trinamiX PAL Two, which can analyze various silage nutrient profiles on-farm.

Key Challenges

High Cost of Quality Additives and Equipment

The production and application of advanced silage additives involve significant costs, limiting adoption among small-scale farmers. High-quality microbial cultures, enzyme formulations, and specialized equipment increase operational expenses. Many farmers in developing regions still rely on traditional preservation methods due to budget constraints. Limited access to financial support or subsidies also restricts the use of premium additive products. Cost-effective formulations and local production could help address this challenge and expand the market’s reach among smallholder livestock producers.

Lack of Technical Knowledge and Training

Limited technical awareness among farmers remains a key barrier to wider adoption of silage additives. Many users lack understanding of optimal dosage, application timing, and crop-specific additive selection. Inadequate knowledge can lead to inconsistent results and poor fermentation outcomes. This challenge is more pronounced in developing markets with limited agricultural extension services. Training programs and awareness campaigns led by additive manufacturers and cooperatives are essential to improving user understanding and maximizing the benefits of modern silage management practices.

Regional Analysis

North America

North America held a 27.8% share of the Silage Additives market in 2024. The region’s dominance is driven by well-established dairy and beef industries in the United States and Canada. Farmers are increasingly adopting microbial inoculants and enzyme-based additives to enhance feed efficiency and reduce spoilage. Supportive government programs promoting sustainable livestock farming further encourage market growth. Growing awareness of feed preservation technologies and the presence of major feed manufacturers strengthen regional demand, while high mechanization levels in silage preparation ensure consistent adoption across large-scale farming operations.

Europe

Europe accounted for a 31.5% share of the global market in 2024, driven by the region’s advanced livestock farming systems and strict feed quality regulations. Countries such as Germany, France, and the Netherlands lead in the use of silage additives to maintain nutrient stability and fermentation quality. Farmers prioritize organic and eco-friendly additives to align with the European Union’s sustainability standards. The region’s strong dairy sector, high silage production volumes, and continuous research into biological inoculants further boost market expansion across major agricultural economies.

Asia-Pacific

Asia-Pacific dominated the Silage Additives market with a 33.7% share in 2024. The region’s growth is supported by rapid livestock expansion, increasing dairy consumption, and modernization of feed storage systems in China, India, and Japan. Rising awareness of silage preservation techniques and government efforts to improve animal nutrition practices are driving product adoption. Local manufacturers are investing in cost-effective additive formulations suited for tropical climates. Growing investments in dairy cooperatives and feed efficiency programs position Asia-Pacific as the fastest-growing region for silage additive consumption.

Latin America

Latin America captured a 4.2% share of the Silage Additives market in 2024. Brazil, Argentina, and Mexico are key contributors due to expanding beef and dairy production. Farmers are increasingly using inoculants and acid-based additives to improve silage quality under warm and humid conditions. Government-backed agricultural development programs are promoting better feed management practices. The region’s shift toward intensive livestock systems and rising export demand for meat products are encouraging wider adoption of silage additives to enhance feed preservation and animal productivity.

Middle East & Africa

The Middle East & Africa region held a 2.8% share of the global market in 2024. Growing livestock farming activities in South Africa, Saudi Arabia, and the United Arab Emirates are driving gradual adoption of silage additives. The region is witnessing rising demand for quality feed preservation solutions due to limited forage availability and harsh climatic conditions. Support from agricultural development programs and increasing focus on food security are encouraging farmers to use silage additives. The adoption of microbial inoculants is expanding as livestock producers aim to improve efficiency and reduce feed losses.

Market Segmentations:

By Type

- Inoculants

- Organic acids

- Sugar

- Others

By Crop

- Corn

- Alfalfa

- Sorghum

- Others

By Function

- Stimulation

- Inhabitation

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Silage Additives market includes key players such as Lallemand, Inc., ForFarmers N.V., BASF SE, Kemin Industries, Inc., American Farm Products, Inc., Dupont de Nemours, Inc. (DuPont), Biomin Holding GmbH, Cargill, Incorporated, ADM Animal Nutrition, and Chr. Hansen Holding A/S. These companies are focusing on product innovation, microbial strain development, and enzymatic solutions to improve silage quality and feed efficiency. Strategic partnerships with feed producers and livestock farms are enhancing distribution networks and customer reach. Leading firms are investing in eco-friendly, biological inoculants and acid-based preservatives to align with sustainability goals. Technological advancements in microbial formulation and fermentation optimization are further strengthening their market positions. Continuous R&D and regional expansion across Asia-Pacific and Europe highlight efforts to meet rising demand for high-quality animal feed additives, ensuring competitiveness through product diversification and performance-driven solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Lallemand, Inc.

- ForFarmers N.V.

- BASF SE

- Kemin Industries, Inc.

- American Farm Products, Inc.

- Dupont de Nemours, Inc. (DuPont)

- Biomin Holding GmbH

- Cargill, Incorporated

- ADM Animal Nutrition

- Hansen Holding A/S

Recent Developments

- In July 2025, BASF SE launched a handheld NIR spectrometer solution developed with trinamiX GmbH and Eurofins Agro Testing for on-farm nutritional analysis of silage; the device supports rapid measurement of maize, grass and haylage feed in-field.

- In March 2025, Lallemand, Inc. reported that use of its Magniva Platinum grass-silage inoculant increased Neutral Detergent Fibre digestibility (NDFd) by 5.4 percentage points in a 160-day trial, resulting in a daily milk yield improvement of 1.23 kg per cow.

- In January 2024, the primary focus for Chr. Hansen Holding A/S was the completion of its merger with Novozymes to form a new company named Novonesis

Report Coverage

The research report offers an in-depth analysis based on Type, Crop, Function and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for silage additives will rise with growing livestock and dairy production worldwide.

- Adoption of microbial and enzyme-based additives will continue to expand for better fermentation control.

- Farmers will increasingly prefer eco-friendly and biodegradable additive formulations.

- Advancements in biological inoculants will improve feed quality and nutrient preservation.

- Asia-Pacific will remain the leading region due to rapid livestock expansion and modernization of farming systems.

- Europe will see steady growth driven by sustainability regulations and organic farming adoption.

- Manufacturers will invest more in R&D to develop multi-strain and crop-specific additive blends.

- Integration of digital monitoring tools will optimize silage management and additive application.

- Collaborations between feed companies and livestock producers will enhance product reach and awareness.

- Continuous focus on reducing feed losses and improving animal performance will sustain long-term market growth.