Market Overview:

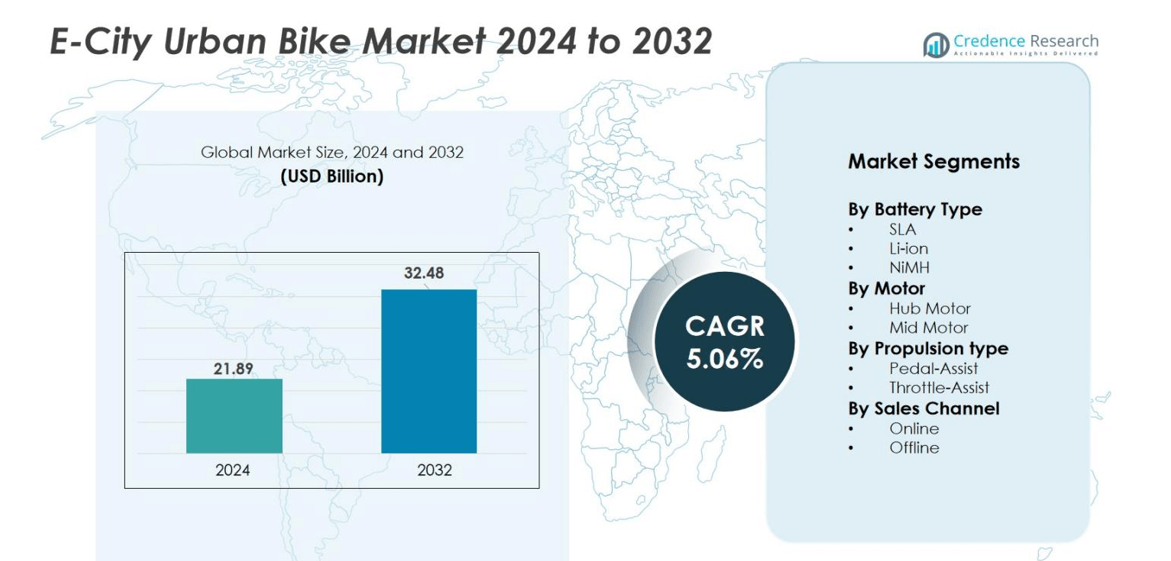

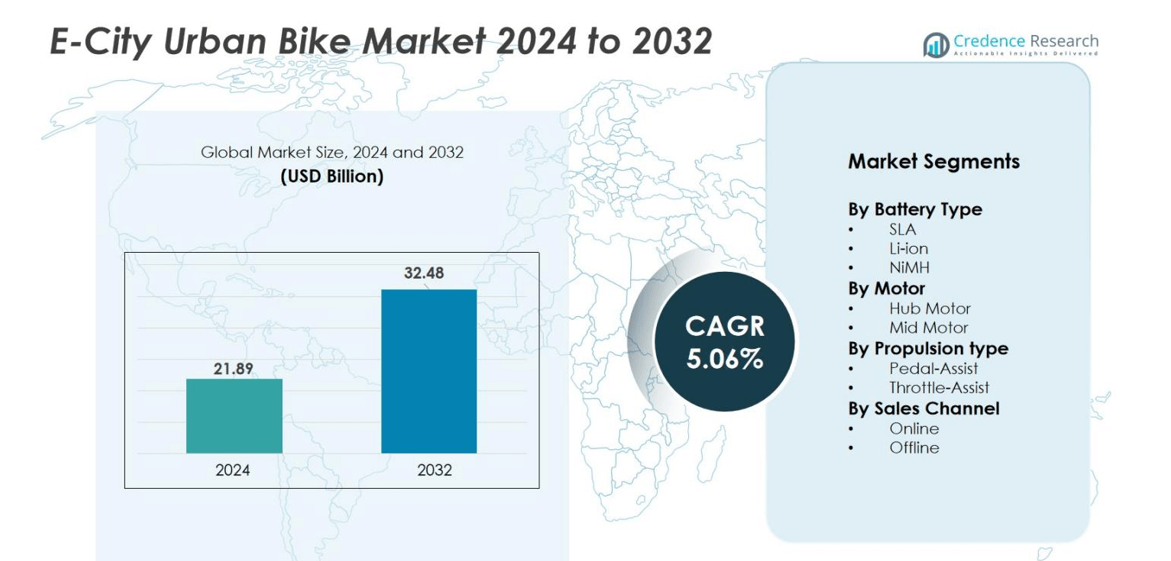

E-City Urban Bike market size was valued USD 21.89 billion in 2024 and is anticipated to reach USD 32.48 billion by 2032, at a CAGR of 5.06% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| E-City Urban Bike Market Size 2024 |

USD 21.89 billion |

| E-City Urban Bike Market, CAGR |

5.06% |

| E-City Urban Bike Market Size 2032 |

USD 32.48 billion |

E-City Urban Bike Market features key players such as Accell Group, Giant Bicycles, Merida, Brompton Bicycle Ltd., Trek Bicycles, Scott Sports SA, Specialized Bicycle Components, Tern, Polygon Bikes, and Rad Power Bikes. These companies compete through lightweight frames, Li-ion batteries, smart dashboards, and commuter-friendly designs. Europe remains the leading region with 39% market share, supported by strong cycling infrastructure, emission-free mobility policies, and high consumer spending power. North America follows with 31% share, driven by growing adoption among commuters and delivery fleets, while Asia Pacific expands rapidly due to large manufacturing bases and rising urban congestion.

Market Insights

- The market reached USD 21.89 billion in 2024 and will grow at 5.06% CAGR to hit USD 32.48 billion by 2032.

- Rising cycling lanes, fuel cost reduction, and eco-friendly commuting push demand, with pedal-assist bikes holding 71% share as the leading propulsion mode.

- Smart dashboards, GPS tracking, removable batteries, and lightweight frames shape new product trends while rental platforms and delivery fleets increase bulk adoption.

- Key players include Accell Group, Trek, Specialized, and Giant, focusing on Li-ion batteries, which dominate with 78% market share, while hub motors lead the motor segment with 63% share.

- Europe leads the global market with 39% share, followed by North America at 31%, Asia Pacific at 22%, Latin America at 5%, and Middle East & Africa at 3%, supported by urban mobility policies and clean transport initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Battery Type

Li-ion batteries hold the dominant position with nearly 78% market share due to high energy density, longer lifecycle, and lightweight design. These packs support longer range per charge, which suits daily city commuting and rental fleets. Leading manufacturers continue shifting from SLA and NiMH to Li-ion to improve efficiency and cut maintenance. SLA batteries account for about 14% because of heavy weight and short life, while NiMH holds close to 8% in a few mid-range models. Strong demand for long-range, fast-charging bikes keeps Li-ion in the lead.

- For instance, Exide Industries offers VRLA/SLA batteries with capacities up to 20,600 Ah for industrial applications.

By Motor Type

The hub-motor segment maintains roughly 63% share in the e-city urban bike market, driven by simple construction, reduced servicing needs, and lower upfront cost. These motors work well for short-distance commuting and city rentals, making them ideal for budget-friendly models. Mid-motor systems represent around 37%, gaining traction in premium categories due to stronger torque and better weight balance. However, higher pricing limits wider adoption. Hub motors stay dominant because commuters and fleet buyers prioritize reliability and cost efficiency.

- For instance, Bafang’s mid-drive M620 motor delivers a maximum torque of 170 Nm along with a rated power output of 750 W, underlining why mid-motors appeal for more demanding applications.

By Propulsion Type

Pedal-assist bikes dominate with about 71% market share, supported by longer riding range, smoother power delivery, and compliance with urban mobility regulations. These models are widely used by students, office commuters, and shared mobility platforms. Throttle-assist bikes hold close to 29% and attract users who prefer full-electric convenience, but stricter rules in many cities slow expansion. Delivery services and rental operators prefer pedal-assist for better battery performance and speed control, keeping this segment in the leading position.

Key Growth Drivers

Rising Urban Congestion and Shift Toward Sustainable Transport

Growing traffic congestion and fuel costs push commuters toward cleaner and compact mobility solutions. E-city bikes allow faster movement through crowded areas, affordable transportation, and easy parking compared to cars and two-wheelers. Many cities promote cycling lanes and low-emission mobility zones, encouraging electric bike adoption. Government subsidies, tax credits, and scrappage incentives also lower upfront purchase cost and make premium models more accessible. Delivery and courier services prefer e-bikes for last-mile logistics because they reduce fuel spending and maintenance. The combination of environmental goals, cost savings, and improved cycling infrastructure continues to accelerate the demand for urban e-bikes.

- For instance, in San Francisco, DoorDash reported that 76% of its deliveries were made using bikes, e-bikes and scooters in the city.

Advancement in Lithium-Ion Batteries and Motor Efficiency

Better battery chemistry, lightweight frames, and efficient motors help riders travel longer distances on a single charge. Li-ion and smart battery management systems extend battery life and support fast charging. Hub motors and mid-drive systems now deliver smoother torque and silent operation, making rides more comfortable in city traffic. Integration of regenerative braking adds more range, reducing charging frequency for daily commuters. Technology improvements make e-bikes suitable for wider rider age groups, including seniors and office workers. As performance improves and charging technology expands in public places, consumer acceptance continues to rise, helping the market grow at a steady pace.

- For instance, modern lithium-ion battery systems are reported to achieve cycle lives exceeding 1,000 cycles. Hub motors and mid-drive systems now deliver smoother torque and silent operation, making rides more comfortable in city traffic.

Growth of Online Sales and E-Bike Rental Platforms

E-commerce platforms expand buyer reach with home delivery, digital financing, and easy comparison of specifications. Online channels help new brands enter the market and offer competitive pricing. Subscription-based rental and shared mobility services increase awareness and allow riders to test products before buying. Delivery fleets and food-service companies adopt e-bikes to cut fuel usage and move quickly within urban centers. Many operators deploy large connected fleets with GPS tracking, remote battery monitoring, and maintenance alerts. The combined rise of online retail and shared mobility solutions creates a strong demand pipeline for smart and reliable city e-bikes.

Key Trends & Opportunities

Expansion of Connected and App-Enabled Bikes

Smart dashboards, GPS navigation, remote locking, and theft tracking now come standard in many models. App integration lets riders check distance, battery status, and service schedules from a smartphone. Fleet operators and rental platforms use analytics to track battery health and optimize routes. Manufacturers introduce IoT-based solutions to improve commuter safety through geofencing, fall detection, and emergency alerts. Growing demand for smart urban mobility presents opportunities for tech-focused brands, component suppliers, and service providers. As connectivity becomes a key buying factor, companies investing in intelligent features gain a competitive edge.

- For instance, Bosch’ SmartphoneHub and COBI.Bike app give e-bike riders real-time route data and display battery-capacity on the handlebar screen.

Rise of Lightweight Frames and Modular Design

Manufacturers shift to aluminum, magnesium alloys, and carbon fiber to reduce weight and improve handling. Foldable and modular bikes attract office workers, apartment residents, and public transport users who need compact vehicles for short travel. Swappable battery packs help riders extend travel distance without long charging breaks, making the product ideal for busy commuters and delivery services. Brands offering ergonomic seats, shock-absorbing forks, and cargo attachments capture demand from family riders and utility users. Lightweight and modular design opens strong growth opportunities for premium bike makers and aftermarket accessories.

- For instance, Gogoro introduced swappable traction-battery packs that increased storage capacity from 1,374 Wh in their first generation to 1,742 Wh in the third generation.

Key Challenges

High Purchase Cost and Limited Charging Access

E-city bikes cost more than regular bicycles because of batteries, motors, controllers, and smart systems. Entry-level pricing still restricts adoption among students and low-income commuters. Although charging at home is common, many urban areas lack public e-bike charging points, especially in developing regions. Rental and fleet operators need centralized charging hubs, which involve high setup costs. Without wider charging access, long-distance commuters hesitate to buy. Reducing battery cost, improving charging infrastructure, and offering financial subsidies are essential to overcome this barrier.

Maintenance Complexity and Component Availability

Unlike regular bicycles, e-city models require skilled technicians for battery checks, motor servicing, and electronics repairs. In many regions, service shops lack trained staff or diagnostic tools, causing delays and higher repair costs. Imported batteries and electronic parts create long wait times when replacements are needed. Weather factors like rain and heat also affect battery performance and require protective design. Limited aftermarket availability and service networks discourage some buyers. Expanding authorized service centers, localizing battery production, and offering longer warranties can help solve this challenge.

Regional Analysis

North America

North America holds around 31% market share, driven by rising adoption of eco-friendly commuting and strong cycling infrastructure in the U.S. and Canada. Cities promote bike lanes and emission-free travel, encouraging commuters to switch from fuel vehicles to e-city bikes. Delivery and courier services also use e-bikes for last-mile transport. Government incentives, tax credits, and fleet electrification programs support market growth. Key brands expand sales through online retail, rental platforms, and subscription services. Increasing demand for lightweight, connected models with smart tracking features continues to push product upgrades across major cities.

Europe

Europe leads the market with nearly 39% market share, supported by high environmental awareness, strict emission norms, and strong cycling culture. Countries such as Germany, the Netherlands, Denmark, and France invest heavily in bike-friendly infrastructure, charging points, and smart mobility programs. Subsidies, public leasing schemes, and scrappage incentives boost e-bike sales, especially among daily commuters. Shared mobility fleets also drive adoption in urban centers. Lightweight, pedal-assist bikes dominate due to favorable regulations and long-distance utility. The region remains the strongest revenue contributor because of established brands and high consumer spending power.

Asia Pacific

Asia Pacific accounts for around 22% market share, with rapid growth in China, Japan, South Korea, and India. Rising urban congestion and fuel prices encourage citizens to adopt electric mobility solutions. China leads production and exports due to large manufacturing bases and cost-efficient components. Delivery and e-commerce companies use e-bikes for city logistics, increasing bulk demand. Governments promote EV adoption with charging subsidies and cycling infrastructure. Affordable pricing helps mass-market penetration, while connected and foldable models gain popularity among younger commuters. Expanding retail networks and digital financing support steady growth across key economies.

Latin America

Latin America holds close to 5% market share, driven by growing interest in cost-effective commuting and fuel savings. Brazil, Mexico, and Chile show rising adoption as cities introduce low-emission transport policies. Delivery platforms and courier services are major buyers, using e-bikes for short-distance logistics in crowded streets. Limited charging networks and higher product cost remain restraints, but online retail and financing options improve accessibility. Import-driven supply chains still dominate the region, though local assembly is slowly expanding. Increasing awareness of environmental benefits supports future market potential.

Middle East & Africa

Middle East & Africa represent nearly 3% market share, with emerging adoption in the UAE, Saudi Arabia, and South Africa. Smart city development, e-mobility initiatives, and bike-sharing pilots encourage early growth. Hot climate and limited cycling infrastructure restrict widespread usage, but recreational and tourist zones show rising demand. Delivery companies in dense urban areas also test e-bike usage to reduce fuel costs. Import dependency results in higher pricing, slowing mass adoption. However, rising sustainability goals and government mobility reforms create long-term opportunities for urban electric bike manufacturers and rental operators.

Market Segmentations:

By Battery Type

By Motor

By Propulsion type

- Pedal-Assist

- Throttle-Assist

By Sales Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the E-City Urban Bike market includes established manufacturers such as Trek Bicycles, Scott Sports SA, Accell Group, Brompton Bicycle Ltd, Tern, Polygon Bikes, and Rad Power Bikes, LLC, along with emerging technology-driven startups. These companies compete based on design innovation, smart connectivity, and pricing efficiency. Leading brands expand product portfolios with lightweight aluminum or carbon frames, removable high-capacity lithium-ion batteries, and GPS-enabled anti-theft systems to appeal to urban commuters and fleet operators.Partnerships with logistics providers and shared-mobility platforms help manufacturers increase deployment in dense urban areas. Many companies, including Trek and Rad Power Bikes, focus on integrating regenerative braking, IoT-enabled dashboards, and smartphone app control to improve the riding experience. Online channels boost direct-to-consumer reach, while subscription and financing options introduced by Accell Group and Tern enhance affordability. Overall, government incentives for eco-friendly mobility continue to attract new entrants and intensify competition across the e-city urban bike sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Tern

- Scott Sports SA

- Polygon Bikes

- Rad Power Bikes, LLC

- Trek Bicycles

- Accell Group

- Brompton Bicycle Ltd

- Specialized Bicycle Components

- Merida Bikes

- Giant Bicycles

Recent Developments

- In August 2023, Trek’s e-bike brand Electra introduced the Ponto Go!, featuring a long cargo rack and an extended bench saddle for improved passenger comfort and load capacity.

- In November 2022, Giant Bicycles launched the Stormguard E+, a full-suspension urban e-bike built for daily commutes, shopping trips, and light off-road use, offering enhanced comfort and durability.

- In January 2022, a consortium led by KKR acquired Accell Group in a $1.8 billion (€1.56 billion) deal aimed at capitalizing on the growing global e-bike demand.

Report Coverage

The research report offers an in-depth analysis based on Battery Type, Motor, Propulsion Type, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Battery technology will improve range, charging speed, and overall riding efficiency.

- Foldable and lightweight models will attract apartment residents and office commuters.

- Connected bikes with GPS, anti-theft locks, and app control will gain popularity.

- Rental platforms and subscription services will expand in major cities.

- Delivery companies will increase e-bike fleets for low-cost last-mile logistics.

- Public charging stations and swapping networks will support long-distance use.

- Government subsidies and cycling infrastructure will boost adoption in developing regions.

- More brands will offer modular designs with swappable battery packs.

- Premium models will feature advanced suspension, ergonomic seats, and smart displays.

- Local assembly and component production will reduce costs and strengthen supply chains.