Market Overview:

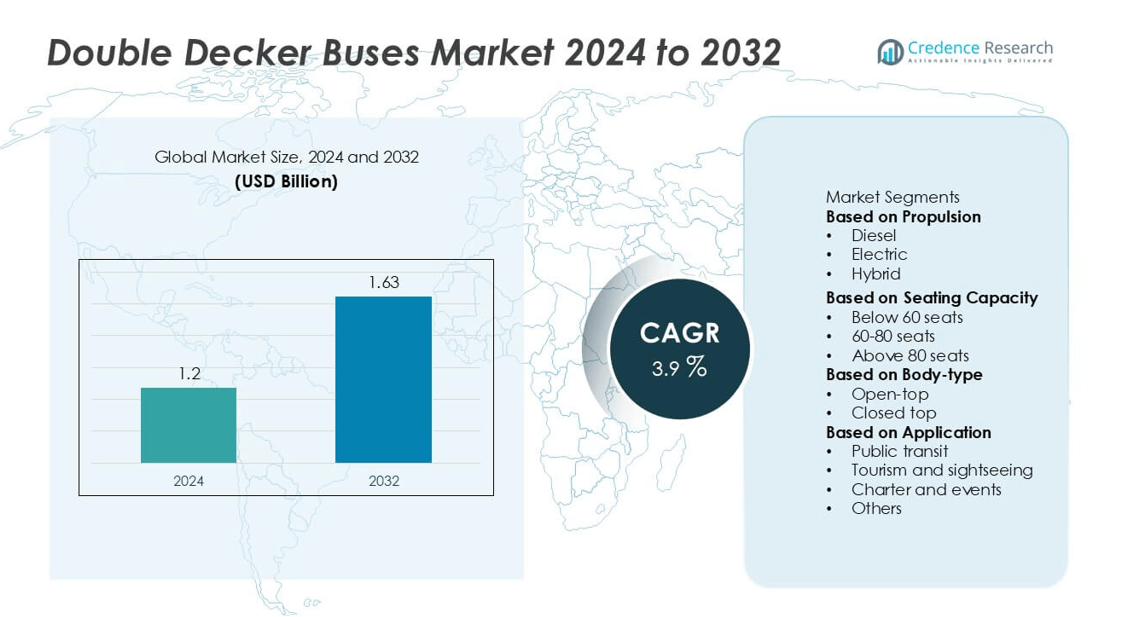

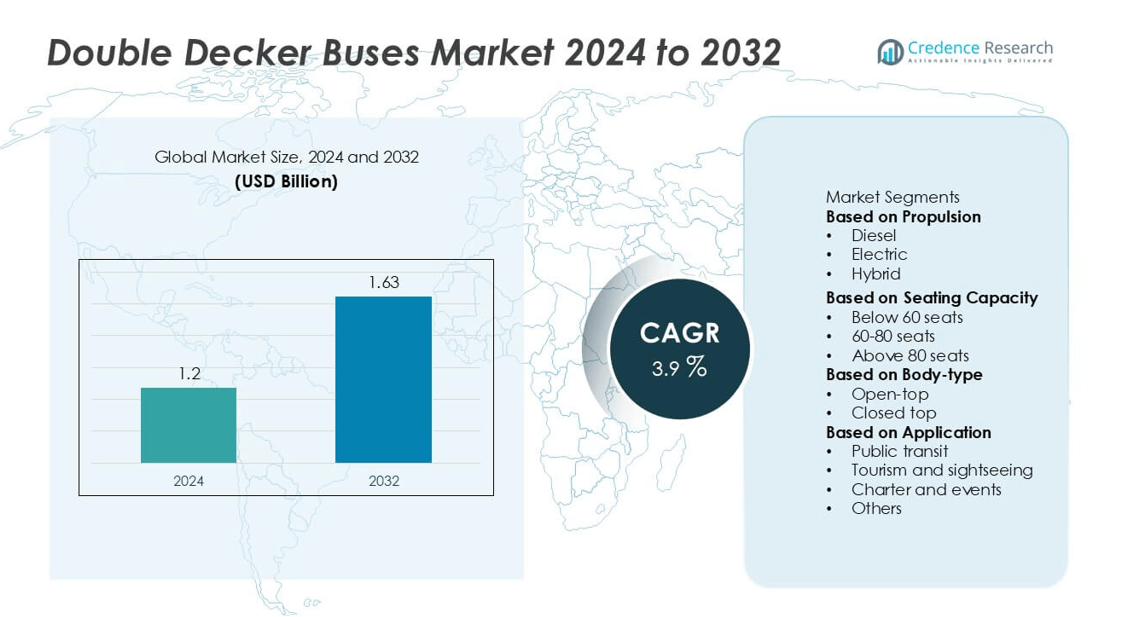

The global Double Decker Buses market was valued at USD 1.2 billion in 2024 and is projected to reach USD 1.63 billion by 2032, growing at a CAGR of 3.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Double Decker Buses Market Size 2024 |

USD 1.2 billion |

| Double Decker Buses Market, CAGR |

3.9% |

| Double Decker Buses Market Size 2032 |

USD 1.63 billion |

The global double-decker buses market is led by key players such as Yutong Group Co., Ltd., Wrightbus, MAN Truck & Bus AG, Volvo Buses, Alexander Dennis Limited (ADL), Zhongtong Bus Holding Co., Ltd., Scania AB, BYD Company Limited, Daimler AG, and New Flyer Industries. These companies dominate through innovation in electric and hybrid propulsion technologies, expanding production capabilities, and strategic partnerships with transit authorities. Europe remains the leading region, holding 31% of the global market share, driven by established urban transport systems and strong environmental regulations promoting low-emission fleets. Asia-Pacific, with a 28% share, follows closely, fueled by large-scale infrastructure development, population growth, and government initiatives supporting electric mobility.

Market Insights

- The global double-decker buses market was valued at USD 1.2 billion in 2024 and is projected to reach USD 1.63 billion by 2032, growing at a CAGR of 3.9% during the forecast period.

- Market growth is driven by rising urbanization, increasing public transport demand, and government initiatives promoting sustainable and high-capacity mobility solutions.

- Key trends include the adoption of electric and hybrid propulsion systems, integration of smart connectivity features, and expanding applications in tourism and intercity travel.

- The competitive landscape is characterized by leading players such as Yutong Group, Volvo Buses, ADL, BYD, Daimler, and Scania, focusing on innovation, fleet electrification, and global expansion.

- Europe holds the largest regional share at 31%, followed by Asia-Pacific with 28%; the diesel segment leads propulsion with 80%, while the 60–80 seats category dominates by capacity with 45%, and closed-top buses account for 72% of the market by body type.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Propulsion

In the propulsion segment of the double-decker buses market, the diesel sub-segment retains dominance, capturing about 80% of the market share in 2023. The strong share stems from the mature infrastructure supporting diesel fleets, including established fueling networks, reliable performance, and cost-effective maintenance. While electric and hybrid variants are gaining traction due to stricter emission regulations and the shift toward sustainable mobility, their relatively smaller base means diesel continues to be the cornerstone of the market, particularly in regions with extensive intercity transport networks.

- For instance, MAN Truck & Bus AG has a long-standing relationship with the Berlin Transport Authority (BVG), having supplied numerous double-decker buses, including the 400th MAN Lion’s City DD delivered in 2010.

By Seating Capacity

Based on seating capacity, the 60–80 seats segment dominates the market, accounting for the largest share of around 45% in 2024. This range offers the optimal balance between passenger load and operational flexibility, making it ideal for urban and suburban routes. The segment’s growth is driven by the increasing demand for efficient public transportation, rising urbanization, and the need for high-capacity vehicles that maintain maneuverability in congested city environments. Operators favor these models for their ability to maximize ridership while minimizing infrastructure strain.

- For instance, Alexander Dennis Limited (ADL) manufactures its Enviro400 model which typically accommodates around 86 passengers in high-capacity configurations. The design utilizes a lightweight aluminum frame to optimize fuel efficiency and passenger capacity, which generally leads to improvements in operational performance and reductions in maintenance requirements across various urban deployments.

By Body-Type

In terms of body type, the closed-top double-decker bus segment leads the market, representing about 72% of global revenue in 2024. This dominance is attributed to its year-round operational capability, enhanced passenger safety, and suitability for both city and intercity routes. Closed-top buses are preferred by public transit authorities and commercial fleet

Key Growth Drivers

Rising Urbanization and Public Transit Expansion

Rapid urbanization and population growth are driving increased investment in high-capacity public transport solutions, fueling demand for double-decker buses. Cities worldwide are prioritizing efficient, space-optimized mobility options to reduce congestion and emissions. Double-decker buses enable higher passenger throughput on existing road networks, making them an ideal choice for busy urban corridors. Government-backed infrastructure programs and smart city initiatives further support fleet modernization, reinforcing adoption across metropolitan areas and strengthening the long-term growth prospects of the global double-decker bus market.

- For instance, Volvo Buses delivered numerous B9TL double-decker units for operation in Singapore, and also trialled one B8L double-decker unit featuring a 350 horsepower Euro VI engine and optimized emission systems.

Shift Toward Sustainable and Electric Mobility

The growing emphasis on sustainability and emission reduction is accelerating the transition from diesel to electric and hybrid double-decker buses. Governments are offering subsidies, incentives, and stricter emission norms to encourage fleet electrification. Advancements in battery technology and charging infrastructure have improved the operational range and efficiency of electric double-decker buses, making them more viable for urban and intercity applications. This shift aligns with global efforts to achieve carbon neutrality, positioning electric propulsion as a key driver of future market expansion.

- For instance, BYD Company Limited introduced its BD11 electric double-decker model equipped with a 532 kWh lithium-iron phosphate battery, offering a range of up to 400 miles (approximately 640 kilometers) per charge.

Tourism and Sightseeing Industry Growth

The expansion of the global tourism and leisure industry significantly contributes to the demand for open-top and luxury double-decker buses. Major cities and heritage destinations increasingly use these buses for guided tours, enhancing the tourist experience while boosting local economies. Rising disposable incomes and post-pandemic travel recovery have spurred investments in premium sightseeing fleets. The demand for customized, comfortable, and visually engaging transport experiences continues to elevate the adoption of double-decker buses in the tourism and hospitality sectors.

Key Trends & Opportunities

Integration of Smart Technologies

Manufacturers are integrating advanced technologies such as GPS tracking, passenger information systems, Wi-Fi connectivity, and real-time monitoring into double-decker buses. These smart features enhance passenger convenience, operational efficiency, and safety. Fleet operators benefit from improved route optimization and predictive maintenance, reducing downtime and operational costs. The growing trend toward connected and data-driven public transport systems presents significant opportunities for technology providers and bus manufacturers to deliver digitally enhanced mobility solutions.

- For instance, Wrightbus equipped its StreetDeck model with a telematics suite that integrates GPS tracking, predictive diagnostics, and onboard Wi-Fi. The AI-based system monitors thousands of sensor thresholds, enabling operators to achieve significant reductions in unscheduled maintenance incidents across their active fleets

Expansion in Emerging Economies

Emerging economies in Asia-Pacific, Latin America, and Africa are witnessing rapid urbanization, creating new opportunities for mass transit development. Governments in these regions are investing in sustainable transport solutions to address traffic congestion and pollution. Double-decker buses, with their high passenger capacity and efficient land use, are gaining traction as cost-effective alternatives to metro and tram systems. Local manufacturing initiatives and public-private partnerships are further propelling market penetration, particularly in India, China, and Brazil.

- For instance, Ashok Leyland launched its 9.5-meter electric double-decker model powered by a 231 kWh battery pack, developed under India’s FAME-II public transport program. The company supplied 200 units to the Mumbai Metropolitan Region Transport Authority, expanding urban capacity by 18,000 passengers per day while cutting annual fuel consumption by 1.1 million liters.

Key Challenges

High Initial and Maintenance Costs

The substantial upfront investment required for purchasing and maintaining double-decker buses remains a key market challenge. High production costs, driven by complex designs, advanced components, and safety features, limit adoption among smaller operators. Additionally, maintenance and repair expenses are higher than those of standard single-deck buses due to specialized parts and structural complexity. These financial barriers can restrict market growth, especially in cost-sensitive regions lacking government subsidies or dedicated public transport funding.

Infrastructure and Operational Limitations

The operation of double-decker buses requires suitable infrastructure, including roads, depots, and bridges with sufficient height clearance. In many cities, existing infrastructure is not designed to accommodate taller vehicles, restricting route flexibility and operational efficiency. Additionally, challenges such as limited maneuverability in narrow urban streets and longer boarding times can affect service reliability. Overcoming these limitations will require coordinated planning and investment in supportive infrastructure to enable smooth integration of double-decker fleets into public transport networks.

Regional Analysis

North America

North America holds a market share of 22% in the global double-decker buses market, driven by strong adoption in the United States and Canada for intercity transport and sightseeing services. The region’s emphasis on sustainable mobility and tourism infrastructure supports consistent demand for both closed-top and open-top models. Electric double-decker buses are gaining traction, particularly in cities such as Los Angeles and Toronto, due to environmental regulations and public transport electrification initiatives. Continuous investment in smart public transit and fleet modernization is expected to strengthen the region’s position during the forecast period.

Europe

Europe accounts for 31% of the global double-decker buses market, maintaining dominance due to its long-standing public transportation culture and extensive urban transit networks. The United Kingdom, Germany, and France lead adoption, supported by government initiatives for low-emission and electric bus deployment. Heritage and sightseeing applications also drive significant demand for open-top models across major tourist destinations. Increasing investments in green transport infrastructure and strong regulatory support for zero-emission mobility are reinforcing Europe’s leadership in the double-decker bus industry.

Asia-Pacific

Asia-Pacific captures 28% of the global double-decker buses market, fueled by rapid urbanization, population growth, and expanding public transportation systems. China, India, and Japan are key contributors, driven by government investments in mass transit and sustainable mobility solutions. The region is also witnessing increasing production of electric and hybrid double-decker buses, supported by local manufacturing and technology advancements. Rising tourism in countries such as Thailand and Indonesia further supports market expansion. The combination of infrastructure growth and economic development positions Asia-Pacific as a high-growth region for the coming years.

Latin America

Latin America holds a 10% market share in the global double-decker buses market, with demand primarily concentrated in Brazil, Mexico, and Argentina. Growing urban populations and the need for efficient, high-capacity public transport systems are driving adoption across major metropolitan areas. Tourism activities, especially in iconic cities such as Rio de Janeiro and Mexico City, further support open-top bus utilization. Although high operational costs and infrastructure limitations present challenges, government initiatives for fleet modernization and emission reduction are gradually improving market prospects in the region.

Middle East & Africa

The Middle East & Africa region accounts for 9% of the global double-decker buses market, supported by investments in tourism and expanding urban transport networks. Countries such as the United Arab Emirates, Saudi Arabia, and South Africa are leading adoption, particularly for premium and sightseeing fleets. The region’s focus on sustainable mobility and smart city projects, including electric bus integration, is enhancing future growth potential. While infrastructure and maintenance challenges persist in certain areas, rising tourism and public transport development initiatives continue to create new market opportunities.

Market Segmentations:

By Propulsion

By Seating Capacity

- Below 60 seats

- 60-80 seats

- Above 80 seats

By Body-type

By Application

- Public transit

- Tourism and sightseeing

- Charter and events

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the double-decker buses market features key players such as Yutong Group Co., Ltd., Wrightbus, MAN Truck & Bus AG, Volvo Buses, Alexander Dennis Limited (ADL), Zhongtong Bus Holding Co., Ltd., Scania AB, BYD Company Limited, Daimler AG, and New Flyer Industries. These companies compete through innovations in electric and hybrid propulsion technologies, design efficiency, and passenger comfort. Strategic collaborations, government partnerships, and global expansion initiatives are central to maintaining market presence. Manufacturers are increasingly focusing on sustainable mobility solutions, leveraging electric and hydrogen fuel cell technologies to meet emission standards. Additionally, investments in digital integration-such as fleet monitoring and connectivity systems-are enhancing operational performance. Product differentiation, aftersales service, and cost competitiveness remain vital strategies as companies strengthen their foothold across developed and emerging markets. The overall competition is intensifying as technological advancements and public transit modernization drive the next phase of industry growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Yutong Group Co., Ltd.

- Wrightbus

- MAN Truck & Bus AG

- Volvo Buses

- Alexander Dennis Limited (ADL)

- Zhongtong Bus Holding Co., Ltd.

- Scania AB

- BYD Company Limited

- Daimler AG

- New Flyer Industries

Recent Developments

- In July 2025, Volvo Buses secured an order for 76 B13RLE 6×2 Euro 6 double-deck coaches to be delivered in 2026 to Dubai’s Roads & Transport Authority, featuring advanced ITS and predictive-maintenance technologies.

- In May 2025, Yutong Group Co., Ltd. held the roll-off ceremony of its new-generation U12DD battery-electric double-deck bus at its Zhengzhou factory, marking a strategic shift toward premium new-energy double-deckers.

- In November 2024, Wrightbus received an order from First Bus for 24 new electric double-deck buses (plus 12 conversions) for deployment from early 2025 in Aberdeen.

- In May 2024, BYD Company Limited launched the BD11 electric double-deck bus for the UK market, featuring a 532 kWh blade battery and a 10.9-metre length (capacity up to 90 passengers)

Report Coverage

The research report offers an in-depth analysis based on Propulsion, Seating Capacity, Body-type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The double-decker buses market will continue expanding steadily due to rising demand for high-capacity public transport in urban areas.

- Electric and hybrid models will gain a larger market share as governments enforce stricter emission standards worldwide.

- Technological advancements in battery performance and charging infrastructure will enhance the operational efficiency of electric double-decker buses.

- Tourism and sightseeing applications will remain key growth areas, especially in major global cities and heritage destinations.

- Manufacturers will increasingly focus on lightweight materials and aerodynamic designs to improve fuel efficiency.

- Integration of smart technologies such as telematics, Wi-Fi, and real-time monitoring will enhance passenger experience and fleet management.

- Asia-Pacific will emerge as the fastest-growing region, supported by infrastructure investments and public transport modernization.

- Strategic collaborations between manufacturers and transit authorities will accelerate the adoption of sustainable bus fleets.

- High manufacturing and maintenance costs will continue to challenge small and mid-sized operators.

- Continued emphasis on carbon-neutral mobility and green transportation policies will shape long-term industry evolution.