Market Overview:

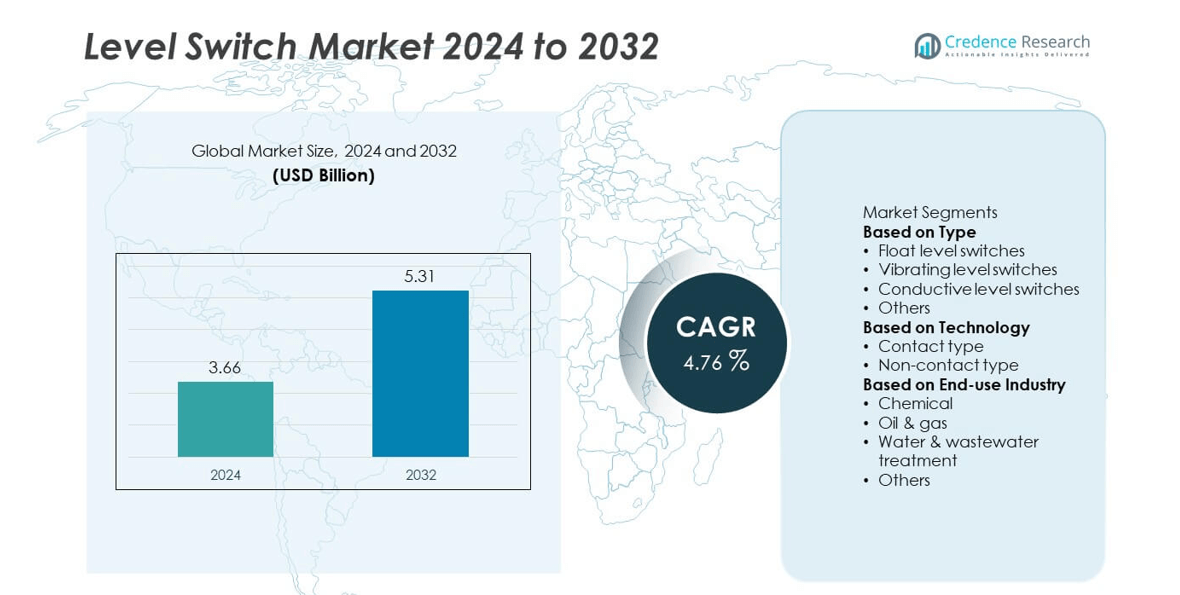

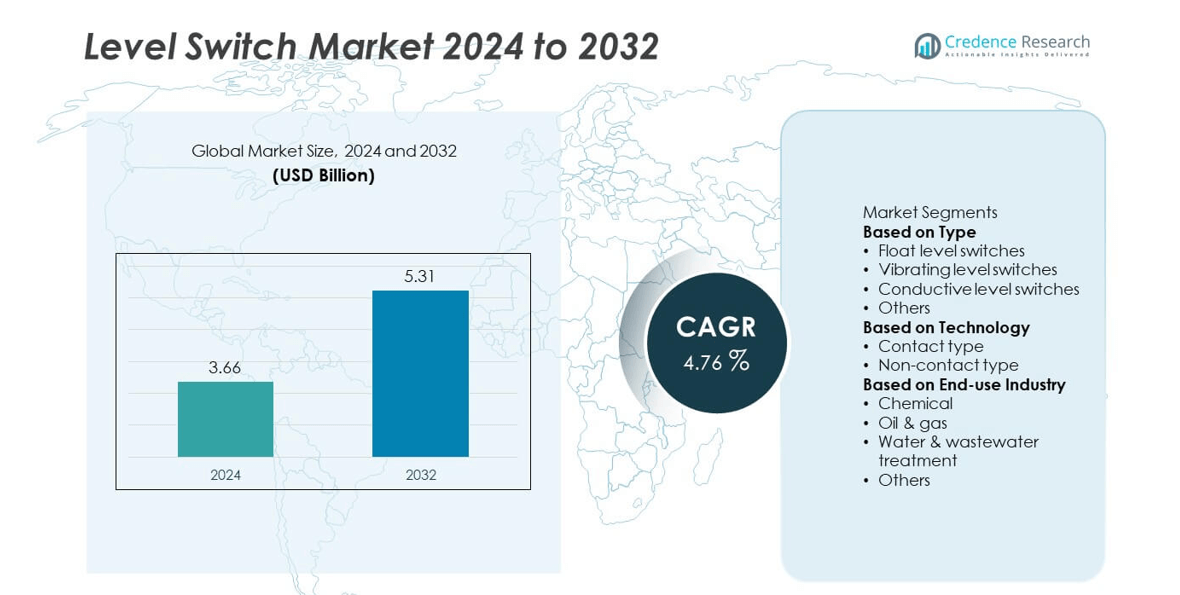

The Level Switch market was valued at USD 3.66 billion in 2024 and is projected to reach USD 5.31 billion by 2032, expanding at a CAGR of 4.76% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Level Switch Market Size 2024 |

USD 3.66 billion |

| Level Switch Market, CAGR |

4.76% |

| Level Switch Market Size 2032 |

USD 5.31 billion |

The Level Switch market is dominated by key players including Emerson Electric Co., Siemens AG, ABB Ltd., Endress+Hauser Group Services AG, VEGA Grieshaber KG, KROHNE Messtechnik GmbH, Honeywell International Inc., AMETEK Inc., Schneider Electric SE, and WIKA Alexander Wiegand SE & Co. KG. These companies lead through advanced automation technologies, digital integration, and durable sensor designs suited for diverse industrial environments. North America held the largest 36.7% share in 2024, driven by strong industrial automation adoption and strict safety standards. Europe followed with 31.2% share, supported by established manufacturing bases and sustainability-focused process industries. Asia Pacific, with 24.5% share, remains the fastest-growing region due to rapid industrialization and expansion of the oil & gas and chemical sectors.

Market Insights

- The Level Switch market was valued at USD 3.66 billion in 2024 and is projected to reach USD 5.31 billion by 2032, expanding at a CAGR of 4.76%.

- Market growth is driven by rising demand for precise level monitoring and automation in industries such as oil & gas, chemical, and water treatment.

- Key trends include increasing adoption of non-contact technologies, integration of IoT-enabled sensors, and demand for corrosion-resistant materials.

- Leading players like Emerson, Siemens, and ABB focus on product innovation, partnerships, and smart process control solutions to enhance competitiveness.

- Regionally, North America leads with 36.7% share, followed by Europe at 31.2%, while the float level switch segment dominates with 42.6% share supported by its reliability in chemical and wastewater applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The float level switches segment dominated the Level Switch market in 2024, holding a 41.6% share. Its dominance is driven by reliability, cost-effectiveness, and ease of installation across various liquid level monitoring applications. Float switches are widely used in water treatment, oil storage, and chemical tanks due to their mechanical simplicity and compatibility with different liquid types. Their robust design and minimal maintenance requirements make them suitable for harsh industrial environments. Growing investments in water infrastructure and industrial automation continue to strengthen demand for float-based level detection systems.

- For instance, KROHNE Messtechnik GmbH developed the BM26A float-based magnetic level indicator with a measurement range from 0.3 m to 5.5 m and switch accuracy within ±2 mm. The model integrates up to two reed-switch modules for independent level alarms and operates under pressures up to 40 bar, supporting continuous monitoring in refinery and chemical storage tanks.

By Technology

The non-contact type segment led the Level Switch market in 2024 with a 54.8% share, driven by its superior accuracy, safety, and suitability for corrosive or high-temperature liquids. Non-contact switches, including ultrasonic and radar-based designs, eliminate direct exposure to liquids, reducing maintenance and contamination risks. These systems are increasingly adopted in industries where hygiene and safety are critical, such as food processing, pharmaceuticals, and chemicals. The rising shift toward smart sensors with digital connectivity and predictive maintenance capabilities further enhances adoption of non-contact level switch technology worldwide.

- For instance, VEGA Grieshaber KG launched the VEGAPOINT 31 compact capacitive point level switch which is optimized for the detection of light bulk solids and has a process temperature tolerance up to +115 °C.

By End-use Industry

The oil & gas segment accounted for the largest 37.4% share of the Level Switch market in 2024. This segment’s dominance is attributed to stringent safety requirements and the need for reliable liquid level monitoring in storage tanks, pipelines, and refineries. Level switches help prevent overflows, leaks, and equipment failures in critical operations. Increasing exploration activities, along with the modernization of refining infrastructure, continue to drive demand. Additionally, the chemical and water treatment sectors are expanding adoption of advanced level sensing systems to improve process control, efficiency, and environmental compliance.

Key Growth Drivers

Rising Demand for Process Automation and Industrial Safety

The growing adoption of automation across industries such as oil & gas, chemicals, and water treatment is a major driver of the Level Switch market. These switches play a crucial role in ensuring operational safety by providing accurate liquid level monitoring and preventing overflow or dry-run conditions. The need for continuous and reliable measurement in automated systems supports their integration into industrial control networks. Increasing regulatory emphasis on process safety and efficiency further accelerates the deployment of advanced level switch technologies.

- For instance, Emerson Electric Co. introduced its Rosemount 2140 vibrating fork level switch equipped with a self-diagnostics system that performs over 300 internal health checks per second. The device features a SIL 2 certification and operates under pressures up to 100 bar and temperatures from –70 °C to +260 °C, ensuring reliable performance in critical oil and gas applications.

Expansion of Water and Wastewater Treatment Facilities

Rapid industrialization and urbanization are fueling the demand for efficient water management systems, boosting the adoption of level switches. Governments and municipalities are investing in modern water and wastewater treatment infrastructure to support sustainability goals. Level switches are essential for maintaining fluid levels, controlling pumps, and ensuring process reliability in these facilities. Their compatibility with harsh and variable water conditions makes them ideal for long-term monitoring applications. This trend is particularly strong in developing regions focusing on clean water initiatives.

- For instance, Siemens AG supplied its SITRANS LVS100 vibrating point level switch to a facility, for point level detection in dry bulk solids such as grain or flour. The device features a compact design, a process pressure limit up to 10 bar, and a vibrating fork mechanism that ensures a self-cleaning effect for reliable operation in fine or coarse materials.

Growing Use of Non-Contact and Smart Sensor Technologies

The market is witnessing strong growth due to the increasing adoption of non-contact and smart sensing technologies. Non-contact level switches, such as radar and ultrasonic types, offer high accuracy and maintenance-free operation, making them ideal for corrosive and high-temperature environments. Integration with IoT and predictive maintenance platforms enables real-time data analysis and remote monitoring. These innovations reduce operational costs and improve process visibility, encouraging wider adoption across industries seeking efficient and connected automation systems.

Key Trends & Opportunities

Integration of Wireless and IoT-Enabled Solutions

The growing implementation of wireless and IoT-enabled level switch systems presents new opportunities for manufacturers. These smart devices enhance data collection, improve communication between field instruments, and enable remote control in hazardous or hard-to-access locations. The combination of wireless technology and cloud-based analytics supports predictive maintenance and reduces downtime. As industries shift toward digital transformation, IoT integration in level monitoring systems is expected to become a standard feature in industrial automation solutions.

- For instance, ABB Ltd. introduced its LST400 ultrasonic level transmitter, which uses non-contact technology with a standard measurement range up to 15 meters (50 ft) or an optional long-range sensor for up to 30 meters (100 ft).

Increased Adoption in Renewable Energy and Green Infrastructure

The expanding renewable energy sector and eco-friendly infrastructure projects are creating opportunities for level switch manufacturers. Applications in biofuel production, hydropower plants, and sustainable wastewater systems are rising. These systems require precise liquid level management to ensure safe and efficient operation. Manufacturers are developing eco-efficient, low-power switches compatible with renewable systems. The push toward energy-efficient industrial equipment and environmentally responsible technologies further promotes the adoption of smart, sustainable level switch solutions.

- For instance, Endress+Hauser developed the Liquiphant FTL51B point level switch for liquids in general process industries and hazardous areas. The unit supports various power inputs, including a 10-55 V DC (3-wire) or 9-20 V DC (with relay) supply, and is designed for reliable level detection under temperatures up to 150 °C and pressures up to 100 bar, regardless of changing media properties or flow.

Key Challenges

High Installation and Calibration Costs

The initial cost of advanced level switch systems, particularly non-contact and smart variants, remains a challenge for small and medium-sized enterprises. Installation in complex industrial environments often requires specialized equipment and skilled labor, increasing total project expenses. Additionally, periodic calibration is necessary to maintain accuracy in demanding applications, adding to maintenance costs. This price sensitivity can hinder adoption, especially in emerging economies where budget constraints and lack of technical expertise limit investments in modern sensing technologies.

Performance Limitations in Harsh Conditions

Despite technological advancements, level switches face performance challenges in extreme environmental conditions. Factors such as high viscosity, foam formation, turbulence, or temperature fluctuations can affect accuracy and reliability. In industries like oil & gas and chemicals, exposure to corrosive fluids and high pressure can shorten equipment lifespan. Manufacturers are investing in materials like stainless steel and advanced coatings to enhance durability, but ensuring consistent performance under variable conditions remains a significant operational challenge for end-users.

Regional Analysis

North America

North America held the largest share of 37.6% in the Level Switch market in 2024. The region’s growth is driven by strong adoption across the oil & gas, water treatment, and chemical sectors. The U.S. leads with widespread use of advanced level detection technologies for industrial safety and automation. Investments in shale gas exploration and modernization of wastewater infrastructure further fuel demand. The presence of leading manufacturers and strict safety regulations promote continuous technological innovation. Increasing emphasis on energy efficiency and predictive maintenance also supports the growing adoption of smart and non-contact level switches.

Europe

Europe accounted for 31.8% share of the Level Switch market in 2024. The region’s growth is supported by stringent environmental regulations and strong demand from chemical, food, and process industries. Germany, the U.K., and France are major contributors due to their advanced manufacturing and industrial automation infrastructure. Rising focus on sustainable operations and water conservation drives demand for precision level control technologies. Adoption of digital and wireless monitoring systems is increasing across industrial plants. Supportive government policies for energy-efficient automation equipment continue to boost market expansion throughout Europe.

Asia Pacific

Asia Pacific captured 22.9% share of the Level Switch market in 2024. Rapid industrialization and expanding manufacturing sectors in China, India, and Japan are key drivers. The region’s growing investments in water management, power generation, and oil refining projects accelerate adoption. Local industries are increasingly implementing non-contact and IoT-enabled switches to enhance safety and reduce maintenance costs. Government initiatives promoting industrial automation and environmental compliance support steady market growth. Expanding infrastructure development and the presence of low-cost manufacturers further strengthen Asia Pacific’s position in the global market.

Latin America

Latin America represented 4.8% share of the Level Switch market in 2024. The region’s growth is driven by increasing adoption in oil & gas, mining, and water treatment sectors. Countries such as Brazil and Mexico are witnessing rising investments in industrial modernization and environmental sustainability projects. The growing demand for efficient liquid level control in chemical and food industries also contributes to expansion. However, budget constraints and limited technical expertise hinder faster adoption of advanced technologies. Strategic collaborations and regional manufacturing partnerships are helping improve accessibility and market presence.

Middle East & Africa

The Middle East & Africa accounted for 2.9% share of the Level Switch market in 2024. Strong demand from oil & gas, petrochemical, and water desalination industries drives market growth. The UAE and Saudi Arabia lead in deploying advanced process control equipment to enhance operational safety and efficiency. Rising investments in industrial automation and smart infrastructure projects further stimulate adoption. However, reliance on imported technologies and higher maintenance costs pose challenges. Growing focus on industrial diversification and renewable energy initiatives is expected to support long-term market development across the region.

Market Segmentations:

By Type

- Float level switches

- Vibrating level switches

- Conductive level switches

- Others

By Technology

- Contact type

- Non-contact type

By End-use Industry

- Chemical

- Oil & gas

- Water & wastewater treatment

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Level Switch market features major players such as Emerson Electric Co., Siemens AG, ABB Ltd., Endress+Hauser Group Services AG, VEGA Grieshaber KG, KROHNE Messtechnik GmbH, Honeywell International Inc., AMETEK Inc., Schneider Electric SE, and WIKA Alexander Wiegand SE & Co. KG. These companies compete through continuous innovation, product differentiation, and global service networks. Leading manufacturers focus on expanding smart sensing technologies, including IoT-enabled and wireless level switches, to improve accuracy and remote monitoring capabilities. Strategic mergers, partnerships, and acquisitions are strengthening their regional presence and technological portfolios. Many vendors are emphasizing compact, corrosion-resistant designs suitable for harsh industrial environments. Additionally, investment in R&D for advanced materials and safety-compliant designs supports long-term competitiveness. Increasing focus on energy efficiency and predictive maintenance solutions further drives differentiation among key market participants.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Emerson Electric Co.

- Siemens AG

- ABB Ltd.

- Endress+Hauser Group Services AG

- VEGA Grieshaber KG

- KROHNE Messtechnik GmbH

- Honeywell International Inc.

- AMETEK Inc.

- Schneider Electric SE

- WIKA Alexander Wiegand SE & Co. KG

Recent Developments

- In 2024, Endress+Hauser continued to offer its Soliphant vibratory point level switches for solids, which are suitable for safety-critical silo applications with SIL 2 certification and, for some models like the FTM52, are available with a rope extension probe length up to 20 m.

- In 2024, WIKA Alexander Wiegand SE & Co. KG released a vibrating fork level switch variant using 316L stainless steel and rated to operate at temperatures up to +150 °C and pressures up to 16 bar, targeting food & beverage stainless-steel tanks.

- In July 2023, KROHNE Messtechnik GmbH announced the launch of the BM26A-8000 series magnetic level indicators with measuring ranges from 0.3 m to 5.5 m and integrated limit-switch options for liquids and solids applications.

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, End-use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with increasing automation in process industries.

- Adoption of smart and IoT-enabled level switches will enhance operational efficiency.

- Demand for non-contact technologies will grow due to safety and maintenance benefits.

- The oil and gas sector will remain a major contributor to global market revenue.

- Manufacturers will focus on durable and corrosion-resistant materials for harsh environments.

- Integration with digital control systems will improve real-time monitoring and data accuracy.

- Asia Pacific will emerge as the fastest-growing region driven by industrial expansion.

- Energy-efficient and low-maintenance level switches will gain traction across end-user sectors.

- Partnerships and product innovations will strengthen competition among leading manufacturers.

- Increasing focus on sustainability and safety compliance will guide future product development.