Market Overview:

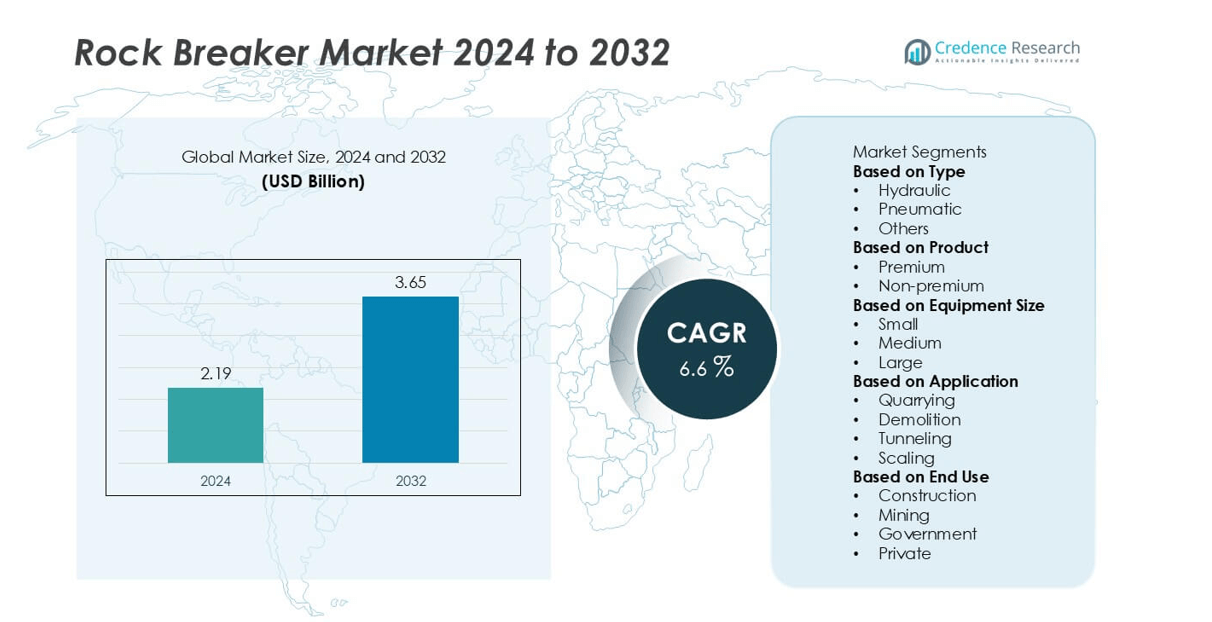

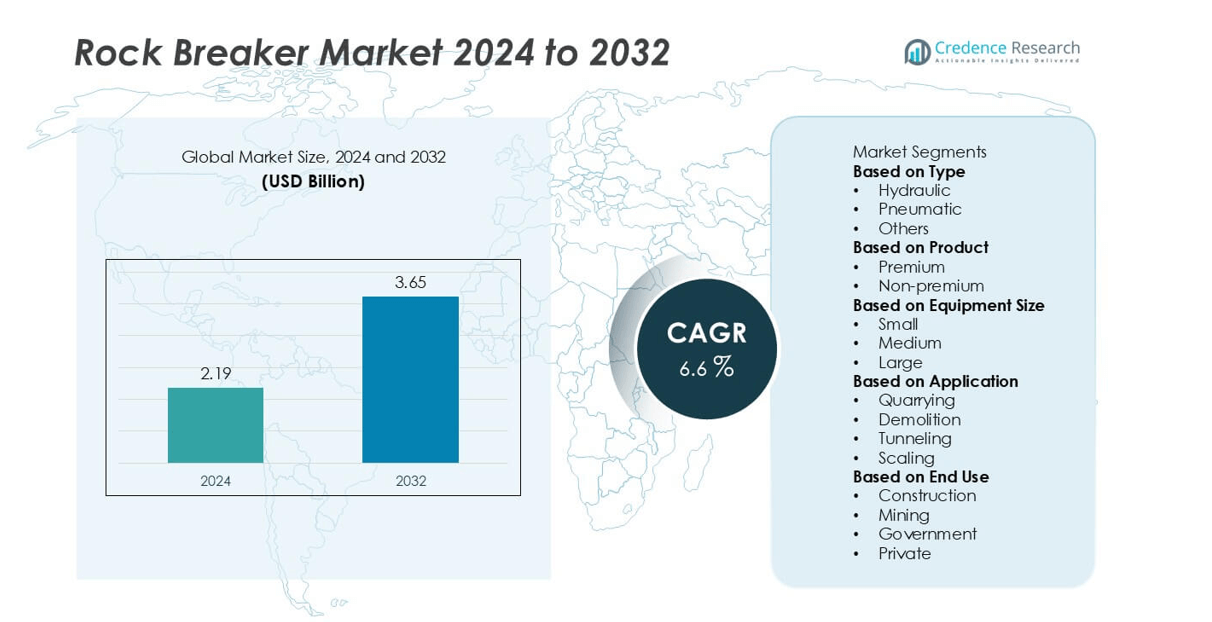

The Rock Breaker market was valued at USD 2.19 billion in 2024 and is projected to reach USD 3.65 billion by 2032, growing at a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rock Breaker Market Size 2024 |

USD 2.19 billion |

| Rock Breaker Market, CAGR |

6.6% |

| Rock Breaker Market Size 2032 |

USD 3.65 billion |

The rock breaker market is dominated by major players such as Komatsu, Furukawa Rock Drill, JCB, Epiroc, Caterpillar, Hitachi Construction Machinery, Sandvik, Atlas Copco, Doosan Infracore, and John Deere, who collectively hold a significant share of the global market. These companies focus on advanced hydraulic technologies, automation, and energy-efficient designs to strengthen their competitive positions. Asia-Pacific leads the global market with a 42% share, driven by extensive mining operations and large-scale infrastructure development in countries like China and India. North America and Europe follow, supported by steady demand for high-performance and sustainable equipment in mining, construction, and quarrying sectors.

Market Insights

- The global rock breaker market was valued at USD 2.19 billion in 2024 and is projected to reach USD 3.65 billion by 2032, growing at a CAGR of 6.6% during the forecast period.

- Market growth is driven by expanding mining and quarrying operations, rising infrastructure development projects, and increasing adoption of advanced hydraulic equipment across construction sectors.

- Key trends include the integration of automation, remote monitoring, and energy-efficient technologies, along with growing demand for durable and low-maintenance rock breakers.

- The competitive landscape features major players such as Komatsu, Caterpillar, Epiroc, Atlas Copco, Sandvik, and JCB, focusing on innovation, product diversification, and strategic expansion to strengthen their global footprint.

- Asia-Pacific leads with a 42% share, followed by North America at 24% and Europe at 20%; by segment, hydraulic rock breakers dominate with over 65%, supported by strong demand for high-performance and efficient equipment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The hydraulic segment dominated the rock breaker market in 2024, accounting for over 65% of the total market share. Hydraulic rock breakers are widely preferred due to their superior efficiency, high impact energy, and ability to handle tough rock formations in mining and construction projects. Their easy integration with modern excavators and lower maintenance requirements further enhance adoption. The growing demand for infrastructure development, particularly in emerging economies, continues to drive the use of hydraulic breakers over pneumatic and other types. Pneumatic and other variants hold smaller shares due to limited versatility and higher operational constraints.

- For instance, Epiroc introduced its HB 4100 hydraulic breaker, a model weighing approximately 4,100 kilograms. This breaker features a variable impact rate (frequency) ranging from 280 to 550 blows per minute (bpm) and incorporates an Intelligent Protection System (IPS) which optimizes performance and productivity by automatically adapting to working conditions and preventing blank firing.

By Product

The premium segment held the largest share of the rock breaker market in 2024, capturing approximately 58% of total revenue. Premium rock breakers are favored for their advanced technology, durability, and performance in demanding applications such as quarrying and large-scale mining. Their longer lifespan and lower downtime offset higher initial costs, making them the preferred choice for high-capacity operations. Increasing adoption of automated and energy-efficient equipment also supports premium segment growth. In contrast, non-premium products, while more affordable, cater mainly to small-scale construction activities and budget-sensitive markets.

- For instance, Sandvik’s Rammer Excellence Line includes the Rammer 5011E breaker, which comes standard with the RD3 remote monitoring device. The breaker’s impact rate is 370–530 blows per minute (bpm) on long stroke and 450–620 bpm on short stroke.

By Equipment Size

The large equipment size segment led the market in 2024, holding around 45% of the market share. Large rock breakers are essential for heavy-duty mining, quarrying, and major infrastructure projects that require high-impact power and efficiency. Their dominance is driven by the expansion of large-scale mining operations and the global rise in aggregate and mineral extraction activities. The medium-size segment follows closely, supported by demand in general construction and road projects. Meanwhile, small rock breakers are mainly used in urban construction and demolition tasks, contributing to a modest but growing market portion.

Key Growth Drivers

Expanding Mining and Quarrying Activities

The growing demand for minerals, metals, and aggregates has significantly boosted mining and quarrying operations worldwide, driving the adoption of rock breakers. These machines play a critical role in breaking oversized rocks, ensuring smooth material handling and higher productivity. Countries rich in mineral resources, such as Australia, China, and India, are investing heavily in mining infrastructure, further propelling equipment demand. The need for efficient, high-impact tools in open-pit and underground mining operations continues to position rock breakers as essential equipment for production efficiency.

- For instance, Caterpillar introduced its H215 S Performance Series hydraulic breaker producing an impact energy of 24,407 joules (18,000 ft-lb) and an impact frequency range of 300 to 520 blows per minute.

Rapid Infrastructure Development

Accelerated infrastructure development across emerging economies is a major driver of the rock breaker market. Increasing investments in road construction, railways, urban development, and industrial expansion are generating substantial demand for rock breakers in excavation and demolition works. Governments’ focus on improving public infrastructure and connectivity-particularly in Asia-Pacific and the Middle East-has further strengthened market growth. The equipment’s ability to handle diverse rock formations efficiently makes it indispensable for large-scale civil engineering and construction projects worldwide.

- For instance, Komatsu supplied its JTHB210-3 hydraulic breaker, delivering approximately 6,100 joules (6.1 kJ) per strike, for use in various infrastructure projects in India, including those potentially related to national highway development.

Technological Advancements and Product Innovation

Continuous technological advancements in hydraulic systems, energy efficiency, and noise reduction are driving product innovation in the rock breaker market. Manufacturers are focusing on developing smart, automated, and environmentally friendly breakers that offer superior performance with minimal maintenance. Features such as real-time monitoring, automatic lubrication, and improved material strength enhance operational reliability and productivity. These innovations not only extend equipment lifespan but also cater to sustainability goals, aligning with global trends toward eco-efficient construction and mining practices.

Key Trends & Opportunities

Rising Adoption of Automated and Remote-Controlled Equipment

The integration of automation and remote-control technologies presents a significant trend in the rock breaker market. Modern rock breakers equipped with sensors and telematics allow operators to monitor performance, detect faults, and ensure safety from a distance. This trend improves operational efficiency while reducing labor risks in hazardous environments such as mines and quarries. As digital transformation accelerates in the construction and mining sectors, manufacturers are capitalizing on the growing demand for intelligent, connected equipment to enhance productivity and operational precision.

- For instance, Epiroc provides remote-control solutions like the BenchREMOTE system for its SmartROC D65 drilling rigs, which enhance safety by removing the operator from the immediate hazard zone and improve operational efficiency and consistency through automation features.

Growing Demand in Emerging Economies

Emerging economies in Asia-Pacific, Africa, and Latin America are offering lucrative opportunities for rock breaker manufacturers. Rapid urbanization, industrial growth, and expanding mining operations are fueling the need for heavy-duty equipment. Governments’ infrastructure development initiatives, including smart city projects and road expansion, are creating consistent demand for rock breakers across varied applications. Additionally, the availability of low-cost labor and favorable investment policies attract global players to set up manufacturing bases, further strengthening regional market growth potential.

- For instance, Doosan Bobcat established an 85,000 m² manufacturing facility in Chennai, India, with an annual production capacity of 8,000 machines, including backhoe loaders and skid-steer loaders, which are exported to Southeast Asia, Africa, and the Middle East.

Key Challenges

High Initial and Maintenance Costs

One of the major challenges hindering rock breaker market growth is the high initial investment and ongoing maintenance costs. Advanced hydraulic systems, durable components, and specialized parts increase the equipment’s overall price, making it less accessible for small and medium contractors. Moreover, regular servicing and replacement of wear components add to operational expenses. These cost barriers often encourage rental equipment usage over ownership, limiting long-term market penetration, particularly in developing regions with constrained capital budgets.

Environmental Regulations and Noise Concerns

Stringent environmental and noise control regulations pose a significant challenge for rock breaker manufacturers and users. Rock-breaking operations generate considerable noise and vibration, which can affect surrounding environments and communities. Increasing enforcement of environmental standards requires companies to invest in noise-suppression technologies and eco-friendly hydraulic systems, leading to higher production costs. Compliance with these regulations, while essential for sustainability, can slow down operational efficiency and limit the widespread use of traditional rock breakers in urban or environmentally sensitive zones.

Regional Analysis

North America

North America held a market share of 24% in 2024, driven by strong demand from the mining, quarrying, and construction sectors. The United States leads the region due to ongoing infrastructure modernization projects and the presence of established mining operations. Canada’s extensive mineral exploration and resource extraction activities further support market growth. Increasing investments in automation and advanced hydraulic equipment have encouraged the adoption of premium rock breakers. Moreover, the region’s stringent safety and performance standards promote the use of durable, energy-efficient models, sustaining steady growth through 2032.

Europe

Europe accounted for a market share of 20% in 2024, supported by expanding construction, demolition, and infrastructure renewal projects. Countries such as Germany, the United Kingdom, and France are driving demand through urban redevelopment initiatives and quarrying activities. The region’s focus on sustainable construction equipment, driven by stringent environmental regulations, has accelerated the shift toward low-noise and energy-efficient hydraulic breakers. Continuous innovation and integration of automation technologies are further strengthening the market. Although the mature nature of Europe’s mining industry limits rapid expansion, steady replacement demand ensures consistent revenue growth.

Asia-Pacific

Asia-Pacific dominated the global market with a market share of 42% in 2024, making it the leading regional segment. Rapid industrialization, urbanization, and large-scale infrastructure projects in China, India, and Southeast Asia are major growth drivers. Expanding mining operations, supported by favorable government initiatives, have significantly increased the use of heavy-duty rock breakers. The presence of numerous local manufacturers enhances equipment accessibility and cost competitiveness. Furthermore, rising investments in road construction, housing, and smart city projects continue to boost demand, positioning Asia-Pacific as the fastest-growing market through 2032.

Latin America

Latin America captured a market share of 8% in 2024, primarily fueled by expanding mining and quarrying operations in Brazil, Chile, and Peru. The region’s rich mineral resources and increasing foreign investments in mining infrastructure are driving rock breaker adoption. Construction and road development initiatives also contribute to regional growth. However, limited availability of advanced equipment and economic fluctuations in some countries pose moderate challenges. Despite these constraints, modernization efforts in mining operations and government-backed infrastructure programs are expected to sustain steady market growth during the forecast period.

Middle East & Africa

The Middle East & Africa region accounted for a market share of 6% in 2024, driven by ongoing infrastructure development and mining expansion. Gulf countries such as Saudi Arabia and the UAE are investing heavily in megaprojects and urban construction, stimulating demand for high-performance rock breakers. In Africa, abundant mineral reserves in South Africa and Botswana are encouraging mining exploration, further supporting equipment sales. However, limited local manufacturing capacity and fluctuating raw material costs slightly restrain growth. Increasing foreign investment and industrial development initiatives are expected to strengthen market potential by 2032.

Market Segmentations:

By Type

- Hydraulic

- Pneumatic

- Others

By Product

By Equipment Size

By Application

- Quarrying

- Demolition

- Tunneling

- Scaling

- Others

By End Use

- Construction

- Mining

- Government

- Private

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the rock breaker market is characterized by the presence of leading global manufacturers such as Komatsu, Furukawa Rock Drill, JCB, Epiroc, Caterpillar, Hitachi Construction Machinery, Sandvik, Atlas Copco, Doosan Infracore, and John Deere. These companies compete through product innovation, technological advancements, and strategic partnerships to strengthen their market presence. Manufacturers focus on developing durable, energy-efficient, and low-maintenance rock breakers to meet the growing demand from mining and construction sectors. Continuous investment in research and development, along with the integration of automation and smart technologies, enhances product performance and operational safety. Strategic mergers, acquisitions, and regional expansions further help these players expand their global footprint and customer base. The competition remains intense, with established brands emphasizing aftersales services, customized solutions, and equipment reliability to gain a competitive edge in both developed and emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Komatsu

- Furukawa Rock Drill

- JCB

- Epiroc

- Caterpillar

- Hitachi Construction Machinery

- Sandvik

- Atlas Copco

- Doosan Infracore

- John Deere

Recent Developments

- In April 2025, Epiroc inaugurated an expanded manufacturing facility in India for rock-drilling tools and attachments, including hydraulic breakers.

- In September 2023, Epiroc marked the 60-year milestone of its hydraulic breaker business, highlighting legacy and ongoing attachment tool leadership.

- In May 2023, Sandvik AB launched a new “Rammer” compact range of hydraulic hammers (attachments similar to rock breakers) for excavators from 0.6 to 6 ton.

Report Coverage

The research report offers an in-depth analysis based on Type, Product, Equipment Size, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The rock breaker market is expected to witness steady growth driven by rising demand from the mining and construction industries.

- Increasing infrastructure development projects across emerging economies will continue to boost equipment adoption.

- Advancements in hydraulic and automated technologies will enhance operational efficiency and product performance.

- The integration of IoT and remote monitoring systems will improve equipment management and predictive maintenance.

- Manufacturers will focus on developing energy-efficient and low-noise breakers to meet environmental standards.

- The Asia-Pacific region will remain the leading market due to ongoing urbanization and industrial expansion.

- North America and Europe will experience stable growth supported by equipment modernization and replacement demand.

- Strategic mergers, acquisitions, and partnerships will help companies expand their global footprint and product portfolios.

- Growing emphasis on safety and productivity will drive innovation in design and control systems.

- Rental and leasing services will gain traction among small and medium construction firms seeking cost-effective solutions.