Market Overview

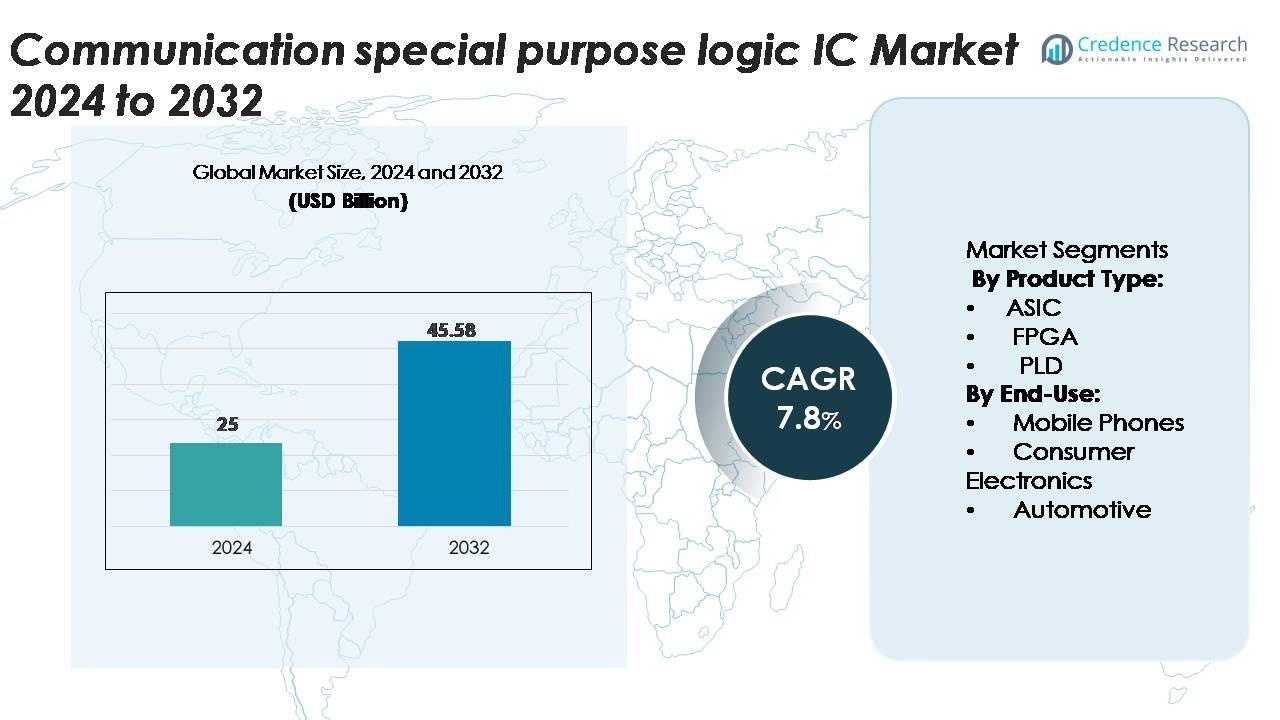

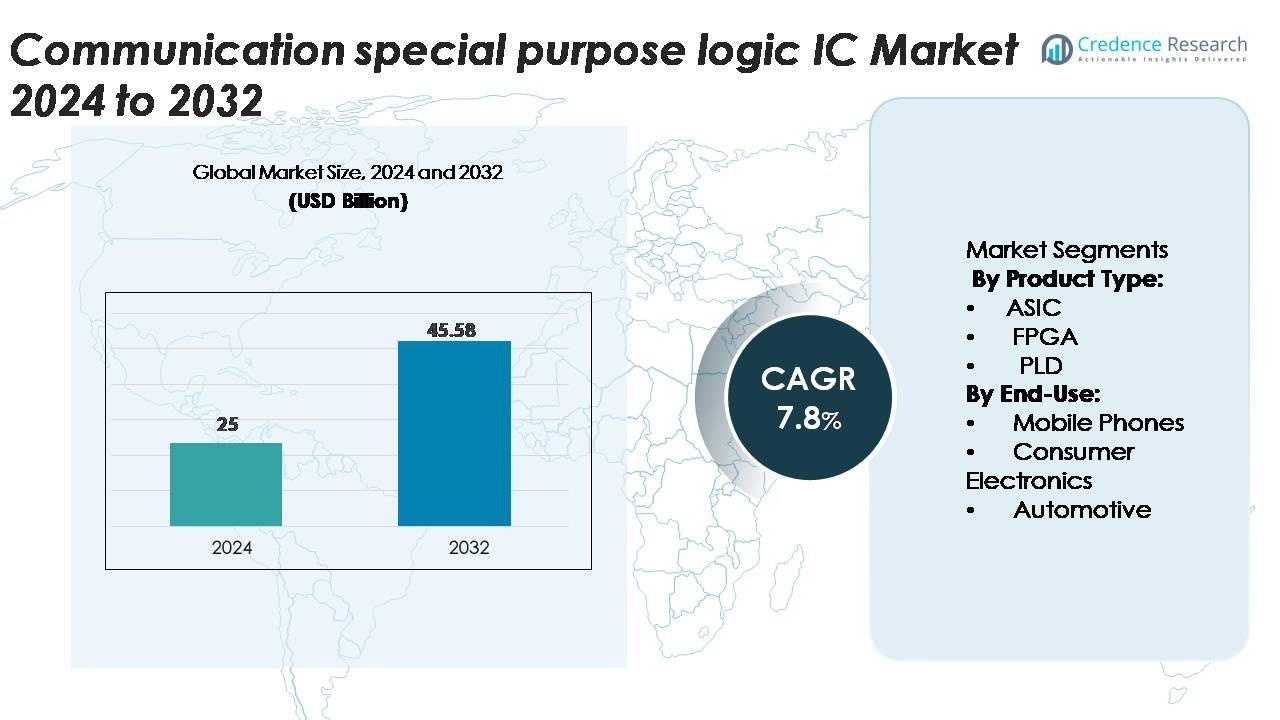

Communication Special Purpose Logic IC Market size was valued at USD 25 billion in 2024 and is anticipated to reach USD 45.58 billion by 2032, at a CAGR of 7.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Communication Special Purpose Logic IC Market Size 2024 |

USD 25 Billion |

| Communication Special Purpose Logic IC Market, CAGR |

7.8% |

| Communication Special Purpose Logic IC Market Size 2032 |

USD 45.58 Billion |

The communication special purpose logic IC market is led by major players such as Intel Corporation, Qualcomm Inc., Marvell Semiconductor Inc., Toshiba Corporation, Renesas Electronics, STMicroelectronics, MediaTek Inc., Broadcom Inc., Analog Devices (ADI), and NXP Semiconductors N.V. These companies dominate through continuous innovation in 5G chipsets, high-speed data processing, and AI-driven circuit design. North America remains the leading region, holding nearly 34.2% share in 2024, supported by strong semiconductor R&D and advanced communication infrastructure. Asia-Pacific follows with about 28.9% share, driven by large-scale manufacturing in China, Taiwan, and South Korea, while Europe accounts for roughly 26.8% due to robust automotive and industrial applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Communication Special Purpose Logic IC market size was valued at USD 25 billion in 2024 and is projected to reach USD 45.58 billion by 2032, registering a CAGR of 7.8% during the forecast period.

- Demand rises due to rapid 5G deployment, edge computing growth, and strong semiconductor usage in smartphones, routers, and network equipment. Mobile phones hold the highest segment share due to large-scale 4G and 5G handset production.

- Trends focus on low-power ASICs, advanced FPGA architectures, and compact logic designs for high-speed data processing. Companies integrate AI-ready logic blocks and chiplet-based architectures to improve performance and thermal efficiency.

- Competition intensifies among Intel, Qualcomm, Broadcom, MediaTek, NXP Semiconductors, and STMicroelectronics as players expand telecom and consumer electronics portfolios while navigating high design costs and supply chain risks.

- North America leads with 34.2% share, followed by Asia-Pacific with 28.9% and Europe with 26.8%; among product segments, application-specific ICs command the largest share due to their extensive use in communication infrastructure and connected devices.

Market Segmentation Analysis:

By Product Type

ASIC leads the Communication Special Purpose Logic IC market with the highest share, supported by strong adoption in high-volume communication hardware. Chipmakers use ASICs to deliver faster data processing, lower power loss, and compact board layouts. Telecom OEMs prefer custom logic designs for 5G modems, switching gear, and network processors. FPGA demand grows in base stations and edge servers due to faster reconfiguration and shorter prototyping cycles. PLDs serve low-power embedded systems and simple routing functions in networking modules, but their usage remains smaller than ASIC and FPGA.

- For instance, Broadcom Inc’s Jericho3-AI switch ASIC supports 144 SerDes lanes operating at 106 Gbps PAM4, enabling up to 18 × 800 GbE ports or 36 × 400 GbE ports in a single device.

By End-Use

Mobile phones represent the dominant end-use segment due to large-scale production of 4G and 5G devices. Advanced logic ICs support high-speed RF communication, enhanced signal modulation, and power management inside premium handsets. Consumer electronics such as routers, gaming consoles, and smart TVs create steady demand for fast networking chips. The automotive sector expands with connected cars and ADAS platforms, using custom logic ICs for communication between sensors and vehicle control units. Growing vehicle electrification and telematics systems will further boost adoption in automotive applications.

- For instance, Qualcomm Inc’s Snapdragon X80 5G Modem-RF System delivers peak download speeds of up to 10 Gbps and peak upload speeds of 3.5 Gbps, enabling ultrafast data transfers and real-time connectivity for mobile devices.

Key Growth Drivers

Rising Demand for High-Speed Communication Systems

The market grows rapidly due to the rising need for high-speed data processing in mobile networks, data centers, and consumer devices. Communication special purpose logic ICs offer faster switching, lower latency, and better error control, which support 4G and 5G rollouts worldwide. Telecom operators integrate custom logic chips in base stations and routers to manage dense traffic loads and high-frequency communication. Growing cloud-based applications, streaming services, and online gaming increase data flow across networks, pushing device manufacturers to adopt advanced ICs with low power consumption and compact design. This momentum continues as enterprises deploy edge servers and private 5G networks for industrial automation, making high-speed custom logic ICs a core requirement for communication infrastructure.

- For instance, Marvell’s Prestera DX 7321 Ethernet switch IC delivers an aggregate switching capacity of up to 1.6 terabits per second (Tbps) and supports port speeds ranging from 1 Gbps to 400 Gbps, enabling rapid packet forwarding in telecom backbones and cloud data routes, particularly for 5G carrier and metro edge networks.

Expansion of Smartphones and Connected Consumer Devices

Smartphone shipment volumes and connected home devices drive strong demand for high-performance logic ICs. Advanced ICs in mobile phones help manage signal integrity, power efficiency, and wireless communication standards. Consumer electronics such as smart TVs, gaming consoles, wearables, and Wi-Fi routers rely on programmable and custom logic chips to deliver smooth connectivity and real-time communication. Growing use of cloud gaming, video streaming, and AI-based voice assistants increases the load on wireless networks, encouraging device makers to upgrade chipsets. Feature-rich consumer devices with faster processing, compact form factors, and low heat generation further support IC integration. The rapid shift toward 5G-enabled smartphones and IoT ecosystems strengthens future demand.

- For instance, MediaTek confirmed that its Dimensity 9300 platform integrates a 5G Release-16 modem supporting peak downlink speeds of up to 7,900 Mbps (7.9 Gbps) and uplink speeds of up to 4,200 Mbps (4.2 Gbps), enabling faster data transmission for streaming and cloud gaming.

Automotive Connectivity and ADAS Growth

The automotive sector becomes a strong contributor as vehicles adopt telematics, V2X systems, and driver assistance platforms. Communication special purpose logic ICs manage data links between sensors, cameras, control systems, and cloud platforms. Connected cars require faster data routing for real-time navigation, vehicle health monitoring, and infotainment. ADAS features such as lane detection, collision alerts, and autonomous braking demand reliable, low-latency communication chips. Carmakers also integrate communication logic into electric vehicles for battery management and charging communication. As global regulations push for advanced safety electronics and intelligent mobility, automotive OEMs and Tier-1 suppliers continue investing in custom communication logic ICs, creating long-term market momentum.

Key Trends & Opportunities

Rising Adoption of IoT, Smart Devices, and Connected Infrastructure

IoT devices in healthcare, industrial automation, smart homes, and wearables create large-scale demand for programmable logic ICs. Smart appliances rely on low-power communication chips to support Wi-Fi, Bluetooth, and cellular connectivity. Cities and enterprises deploy connected lighting, surveillance, and energy grids, opening a broad opportunity for custom logic designs. Manufacturers develop smaller, faster, and power-efficient chips to support battery-operated IoT nodes. As global IoT installations rise into billions of devices, chipmakers gain strong recurring opportunities across edge sensors, gateways, consumer devices, and industrial controllers.

- For instance, STMicroelectronics confirmed that its STM32U5 microcontroller integrates an Arm Cortex-M33 core running at 160 MHz and achieves a 651 CoreMark score, enabling secure, battery-efficient operation in IoT sensors and smart metering systems.

Shift Toward 5G, Edge Computing, and Cloud-Native Networks

A major market trend is the rapid shift toward 5G deployment, low-latency edge networks, and cloud-native telecom operations. This requires communication ICs capable of handling high bandwidth, multi-antenna processing, and real-time switching. FPGA-based and ASIC-based logic architectures find opportunities in base stations, small-cell networks, and C-RAN architecture. Edge data centers also demand custom logic ICs to support high-speed analysis closer to the user. Telecom operators deploy virtualized network functions which increase reliance on programmable logic platforms. Countries expanding 5G infrastructure, smart factories, and IoT connectivity offer strong long-term growth potential.

Key Challenges

High Design Cost and Complex Manufacturing

Communication special purpose logic ICs require complex architectures and large investments in R&D and fabrication. ASIC development demands expensive design cycles, testing, and tooling, which limit adoption among small manufacturers. Any design change requires a complete re-fabrication process, adding cost and time delays. Advanced nodes used for high-speed communication chips face supply constraints and high wafer costs. Limited skilled professionals in chip architecture and verification increase development burdens. These factors restrict market entry and slow product diversification for new players.

Supply Chain Disruptions and Semiconductor Shortages

Global semiconductor shortages and geopolitical trade restrictions affect the availability of key components and fabrication capacity. Communication chips require advanced foundry processes that only a few vendors offer, creating production bottlenecks. Long lead times, shipping delays, and raw material supply gaps increase costs for OEMs and telecom manufacturers. Rapid demand for chips in automotive and electronics intensifies competition for foundry slots. These challenges impact pricing, shipment schedules, and market expansion efforts. Companies with strong supplier networks and multi-fab partnerships manage risks better, while smaller players face higher uncertainty.

Regional Analysis

North America

North America holds the largest share of the communication special purpose logic IC market, accounting for nearly 34.2% in 2024. The region benefits from strong demand across data centers, 5G infrastructure, and networking equipment manufacturers. The U.S. dominates due to the presence of key semiconductor firms and early adoption of advanced communication technologies. Growth is further supported by heavy investments in AI-driven chip design and cloud computing infrastructure. Canada contributes through innovation in telecommunication components and IoT systems integration. Expanding broadband connectivity and ongoing 6G R&D initiatives ensure continued leadership for North America in this market.

Europe

Europe captures about 26.8% share of the communication special purpose logic IC market in 2024. The region’s growth is driven by increased demand for high-performance integrated circuits in automotive communication and industrial automation applications. Germany, France, and the U.K. lead due to strong electronics manufacturing bases and innovation in low-power chip architecture. European Union initiatives supporting semiconductor independence and green technology development also boost regional production. Rising adoption of edge computing and smart factory solutions expands market opportunities. Continued investment in semiconductor R&D and partnerships with global foundries sustain Europe’s competitive position in the market.

Asia-Pacific

Asia-Pacific accounts for approximately 28.9% share of the global communication special purpose logic IC market in 2024. The region’s dominance stems from large-scale production in China, Taiwan, South Korea, and Japan, supported by robust electronic component manufacturing ecosystems. High adoption of 5G networks, AI-enabled devices, and IoT infrastructure accelerates demand for specialized logic ICs. Strong government support for semiconductor self-reliance in China and India enhances local fabrication capacity. Expanding consumer electronics and data center infrastructure further fuel market expansion. With its strong supply chain and cost-effective manufacturing, Asia-Pacific remains the fastest-growing region globally.

Latin America

Latin America represents around 6.1% share of the communication special purpose logic IC market in 2024. Growth is driven by increasing digital transformation across telecom and enterprise sectors. Brazil and Mexico lead adoption, supported by government initiatives to expand broadband and 5G connectivity. Local demand for cloud services, smart devices, and industrial IoT systems continues to grow. The region’s reliance on imports creates opportunities for partnerships with global semiconductor manufacturers. Rising investments in network modernization and data infrastructure projects are expected to strengthen Latin America’s contribution to the overall market in the coming years.

Middle East & Africa

The Middle East and Africa hold nearly 4% share of the communication special purpose logic IC market in 2024. Demand is expanding due to rapid digitization and deployment of 4G and 5G networks across key economies such as the UAE, Saudi Arabia, and South Africa. Increasing use of smart city platforms and cloud-based communication services drives adoption of specialized logic ICs. Regional governments are investing heavily in ICT infrastructure and semiconductor-related R&D. The growing presence of international technology firms and local assembly operations supports gradual market development across the Middle East and Africa.

Market Segmentations:

By Product Type:

By End-Use:

- Mobile Phones

- Consumer Electronics

- Automotive

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the communication special purpose logic IC market is highly consolidated, with global semiconductor leaders focusing on advanced design, performance optimization, and scalability for next-generation communication systems. Companies such as Intel Corporation, Qualcomm Inc., Broadcom Inc., and MediaTek Inc. maintain strong market positions through continuous product innovation and integration of AI and 5G capabilities. Marvell Semiconductor, NXP Semiconductors, and STMicroelectronics are expanding their portfolios to meet growing demand from data centers, automotive connectivity, and IoT devices. Strategic collaborations, foundry partnerships, and acquisitions remain central to strengthening production capacity and technological depth. Asian manufacturers are leveraging cost efficiency and rapid production cycles to capture emerging opportunities. Meanwhile, U.S. and European players are emphasizing chip architecture innovation and energy-efficient processing solutions. Overall, competition is intensifying as companies pursue differentiation through high-performance logic designs tailored to advanced communication, cloud computing, and edge processing environments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Intel Corporation

- Qualcomm Inc

- Marvell Semiconductor Inc

- Toshiba Corporation

- Renesas Electronics

- STMicroelectronics

- MediaTek Inc

- Broadcom Inc

- ADI

- NXP Semiconductors N.V

Recent Developments

- In October 2025, Qualcomm publicly introduced its AI200 and AI250 rack-scale AI inference accelerator platforms, marking a move into data centre and communication logic segments beyond mobile.

- In 2025, at its Vision 2025 event in Las Vegas, Intel revealed a new product strategy focused on enterprise workloads, AI acceleration, edge and networking solutions.

- In March 2025 the company launched its RZ/V2N vision-AI microprocessor, integrating a DRP-AI3 accelerator achieving 15 TOPS of AI inference performance and delivering size reduction of about 38 % compared to the prior generation.

Report Coverage

The research report offers an in-depth analysis based on Product type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for custom logic ICs will rise with large-scale 5G rollouts.

- Smartphone makers will adopt advanced logic chips for faster data handling.

- AI-driven network equipment will push growth in programmable logic platforms.

- Edge computing will increase the need for low-latency, high-bandwidth ICs.

- Automotive communication systems will create new opportunities for custom designs.

- IoT growth will expand usage in smart home and industrial devices.

- Energy-efficient and compact chip designs will gain stronger market preference.

- Supply chain diversification will become a priority for semiconductor vendors.

- Chiplet-based architectures will improve processing speeds and reduce heat.

- Collaboration between telecom companies and chip makers will strengthen product development.