Market Overview

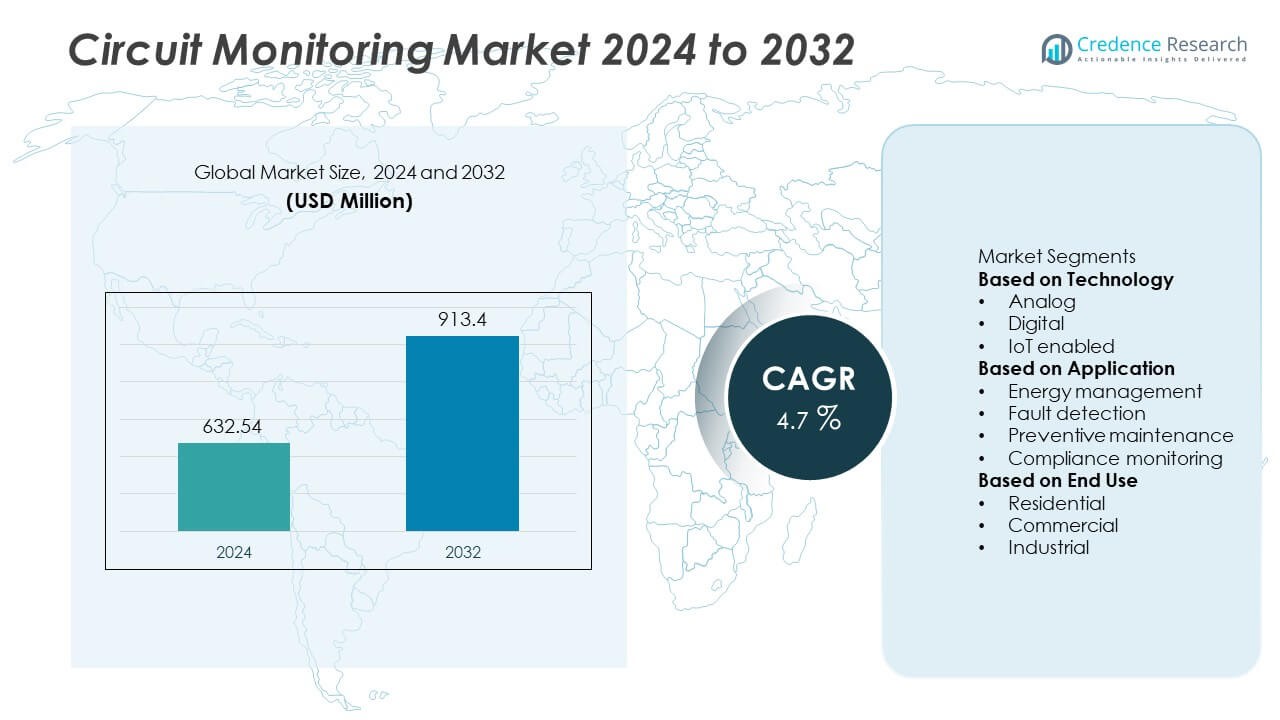

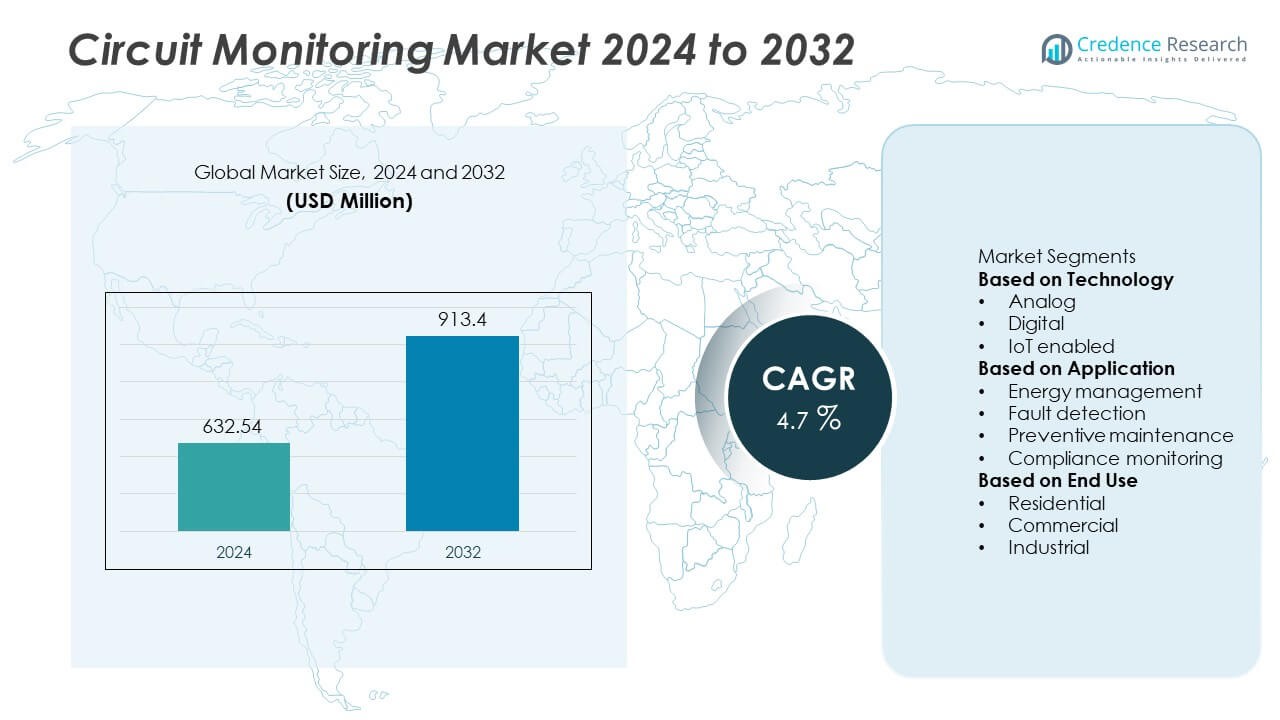

The Circuit Monitoring Market was valued at USD 632.54 million in 2024 and is projected to reach USD 913.4 million by 2032, registering a CAGR of 4.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Circuit Monitoring Market Size 2024 |

USD 632.54 Million |

| Circuit Monitoring Market, CAGR |

4.7% |

| Circuit Monitoring Market Size 2032 |

USD 913.4 Million |

The circuit monitoring market is driven by leading companies such as Omron Corporation, ABB, Eaton, Legrand, Accuenergy, MPL Technologies, Anord Mardix, NHP, Acrel Electric Co. Ltd., and Daxten. These players focus on innovation in IoT-enabled and AI-based monitoring solutions to improve energy efficiency and predictive maintenance. North America leads the global market with a 37.2% share in 2024, supported by advanced industrial automation and strong energy management regulations. Europe follows with 28.5% share, driven by sustainability goals and smart grid modernization, while Asia-Pacific is rapidly expanding with 24.6% share, fueled by industrial growth and infrastructure development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The circuit monitoring market was valued at USD 632.54 million in 2024 and is projected to reach USD 913.4 million by 2032, registering a CAGR of 4.7% during the forecast period.

- Rising demand for energy efficiency, fault detection, and predictive maintenance in industrial and commercial sectors drives market growth. The IoT-enabled segment leads with 44.6% share, supported by smart grid expansion and automation adoption.

- Growing integration of AI-based predictive analytics and cloud connectivity is shaping market trends, enhancing monitoring accuracy and real-time decision-making across manufacturing and data centers.

- Competition remains strong among players such as Omron Corporation, ABB, Eaton, Legrand, and Accuenergy, with strategic investments in digital monitoring platforms and global partnerships.

- North America holds a 37.2% share, followed by Europe with 28.5%, and Asia-Pacific with 24.6%, driven by rapid industrialization, infrastructure modernization, and sustainability initiatives.

Market Segmentation Analysis:

By Technology

The IoT-enabled segment dominates the circuit monitoring market, accounting for nearly 44.6% share in 2024. Its leadership is driven by the growing adoption of connected monitoring systems across smart grids, manufacturing plants, and data centers. IoT-based circuit monitoring offers real-time data collection, predictive alerts, and remote management, which enhance operational efficiency and reduce downtime. Integration with cloud platforms and AI analytics further boosts adoption, allowing users to analyze power usage patterns and optimize energy consumption. Analog and digital systems continue to serve legacy infrastructures but are gradually being replaced by intelligent IoT solutions.

- For instance, ABB’s CMS-700 system monitors up to 96 individual circuits simultaneously and transmits real-time data via integrated interfaces (such as Modbus TCP/IP or SNMP) for analysis and potential integration with the ABB Ability™ cloud.

By Application

The energy management segment leads the market with approximately 39.8% share in 2024, supported by increasing global focus on energy efficiency and sustainability. Circuit monitoring systems play a key role in identifying power wastage, tracking consumption, and optimizing load distribution across facilities. The need to meet energy efficiency standards and reduce operational costs has accelerated adoption in commercial and industrial environments. Fault detection and preventive maintenance segments are also growing steadily, driven by the rising demand for predictive diagnostics and safety compliance in complex electrical networks.

- For instance, Legrand’s Raritan PX4 intelligent rack PDU integrates branch-level circuit monitoring that records more than 1.2 million data samples per hour, achieving ±0.5% billing-grade accuracy. This system enables data centers to optimize load balancing and detect circuit overloads before equipment failure, supporting continuous uptime.

By End Use

The industrial segment dominates the market, capturing around 47.2% share in 2024. This dominance is attributed to the widespread use of circuit monitoring systems in manufacturing, oil and gas, and heavy engineering sectors. Industries require continuous power quality assessment and load balancing to prevent production losses and ensure equipment safety. Increased automation and the use of smart energy systems in industrial operations further strengthen demand. The commercial sector follows closely, driven by energy optimization needs in data centers, offices, and retail buildings, while residential use is expanding with the rise of smart home technologies.

Key Growth Drivers

Rising Demand for Energy Efficiency

The increasing global emphasis on energy conservation and carbon reduction is driving the adoption of circuit monitoring systems. These systems help organizations identify inefficiencies, reduce power wastage, and enhance overall energy utilization. Governments and enterprises are implementing stricter energy management standards, particularly in manufacturing and commercial buildings. As industries transition toward smart grids and renewable integration, the need for continuous monitoring of electrical performance becomes critical, further boosting demand for advanced circuit monitoring technologies.

- For instance, Eaton’s Power Xpert Branch Circuit Monitor supports monitoring across up to 84 branch circuits (and up to 100 metered points per system, including auxiliary inputs), allowing facilities to achieve verified energy savings by detecting load imbalances and inefficiencies in real time.

Expanding Industrial Automation

The rapid growth of industrial automation and Industry 4.0 initiatives has significantly increased the need for intelligent electrical monitoring. Automated manufacturing facilities rely heavily on continuous power supply and fault-free operations. Circuit monitoring systems ensure equipment protection, predictive maintenance, and operational reliability. Industries such as automotive, chemicals, and electronics are integrating IoT-enabled monitoring systems to enhance production uptime. This growing shift toward data-driven control and safety compliance continues to strengthen the market’s growth trajectory globally.

- For instance, Omron Corporation’s KM-N3 multi-circuit power monitor can measure up to four single-phase, two-wire circuits simultaneously (or one three-phase, four-wire circuit).

Integration of IoT and Smart Infrastructure

The widespread integration of IoT in smart buildings, data centers, and utilities is a major driver for the circuit monitoring market. IoT-enabled devices provide real-time insights into circuit performance, enabling predictive analytics and faster fault identification. Cloud connectivity allows remote supervision and energy optimization across multiple locations. As urban infrastructure and renewable energy systems modernize, smart monitoring solutions are becoming essential for improving system reliability, efficiency, and sustainability, supporting long-term market expansion.

Key Trends & Opportunities

Adoption of AI-Based Predictive Maintenance

Artificial intelligence is transforming circuit monitoring through predictive maintenance capabilities. AI algorithms analyze large data sets to detect early signs of electrical faults, reducing downtime and maintenance costs. Manufacturers are integrating machine learning to predict anomalies and extend equipment lifespan. This trend is particularly evident in energy-intensive sectors such as manufacturing, oil and gas, and data centers. The combination of AI and IoT is creating new opportunities for advanced monitoring solutions that enhance operational intelligence and efficiency.

- For instance, Omron Corporation’s AI Predictive Maintenance Library, when integrated into its NX/NY-Series AI Controllers, processes synchronized time-series data at high speeds and detects abnormal equipment behaviour with high accuracy.

Growing Deployment in Renewable Energy Systems

The rapid expansion of solar and wind power infrastructure has opened new opportunities for circuit monitoring technologies. Renewable systems require accurate performance tracking, voltage regulation, and grid stability management. Circuit monitoring ensures optimal power distribution and early detection of faults in decentralized energy systems. As global renewable capacity grows, the demand for smart monitoring solutions capable of managing variable power outputs and distributed generation networks is set to rise steadily.

- For instance, Accuenergy’s AcuRev 2100 series monitors up to 18 single-phase or 6 three-phase circuits with real-time data on current harmonics (up to the 31st order) and voltage imbalance, which can be integrated into energy management systems to help optimize energy dispatch.

Key Challenges

High Installation and Integration Costs

Despite strong benefits, high installation and integration costs remain a major barrier to widespread adoption. Advanced IoT-enabled and AI-driven systems require compatible infrastructure, skilled labor, and network connectivity, increasing initial investment. Small and medium enterprises often hesitate to adopt such systems due to budget limitations. Cost-effective modular solutions and scalable deployment options are essential to overcome this restraint and expand adoption across developing markets.

Cybersecurity and Data Privacy Concerns

The increasing connectivity of electrical systems through IoT and cloud platforms has heightened cybersecurity risks. Unauthorized access, data breaches, and operational disruptions pose significant challenges to system reliability. As circuit monitoring systems collect sensitive energy data, ensuring robust encryption, authentication, and compliance with data protection standards is critical. Manufacturers and service providers must prioritize secure architectures and continuous software updates to maintain trust and safeguard operational integrity in connected environments.

Regional Analysis

North America

North America dominates the circuit monitoring market with a 37.2% share in 2024, driven by advanced industrial automation, smart grid deployment, and strong energy management regulations. The United States leads the region with widespread adoption of IoT-enabled monitoring in manufacturing, data centers, and commercial facilities. Government initiatives promoting energy efficiency and carbon reduction have further strengthened market growth. Major players are investing in cloud-based and AI-integrated systems to enhance predictive maintenance and fault detection. Canada and Mexico are also expanding adoption due to increasing renewable energy integration and infrastructure modernization efforts.

Europe

Europe holds a 28.5% share in 2024, supported by stringent environmental policies and the European Union’s focus on sustainable energy consumption. Countries such as Germany, the United Kingdom, and France are leading in adopting smart monitoring solutions across industrial and commercial sectors. The transition toward digital substations and the integration of renewable energy sources create strong demand for advanced circuit monitoring systems. Manufacturers are increasingly investing in automation and grid reliability to meet carbon neutrality targets. Continuous modernization of power distribution networks further supports steady market growth across the region.

Asia-Pacific

Asia-Pacific accounts for a 24.6% share in 2024, fueled by rapid industrialization, infrastructure expansion, and smart city initiatives. China, Japan, South Korea, and India are key markets adopting IoT-based circuit monitoring for efficient energy management and equipment safety. Rising electricity demand from manufacturing and data centers is accelerating deployment. Governments across the region are supporting digital energy management programs to reduce losses and improve grid efficiency. Growing awareness of predictive maintenance and sustainability is driving further adoption across commercial and industrial sectors, particularly in emerging economies.

Latin America

Latin America represents a 6.1% share in 2024, with Brazil and Mexico leading regional adoption. Expanding industrial infrastructure, coupled with government initiatives to improve energy reliability, is fueling demand for circuit monitoring systems. Utilities and manufacturing sectors are investing in digital solutions to manage fluctuating energy loads and prevent equipment failures. Integration of renewable energy sources, particularly solar and wind, further enhances the need for continuous monitoring. Increasing foreign investments in industrial automation are expected to strengthen market penetration across the region over the forecast period.

Middle East & Africa

The Middle East & Africa region holds a 3.6% share in 2024, driven by growing investments in industrial automation and energy efficiency projects. Countries such as Saudi Arabia, the United Arab Emirates, and South Africa are focusing on smart grid modernization and real-time power monitoring solutions. The expanding oil and gas sector, along with the rise of commercial complexes and renewable projects, is boosting adoption. Government energy management programs and sustainability initiatives are supporting long-term growth. However, limited infrastructure readiness and high system costs continue to restrict faster market expansion.

Market Segmentations:

By Technology

- Analog

- Digital

- IoT enabled

By Application

- Energy management

- Fault detection

- Preventive maintenance

- Compliance monitoring

By End Use

- Residential

- Commercial

- Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis of the circuit monitoring market highlights strong participation from major players such as Omron Corporation, Accuenergy, MPL Technologies, Anord Mardix, Eaton, NHP, ABB, Legrand, Acrel Electric Co. Ltd., and Daxten. These companies compete through technological innovation, product diversification, and global distribution networks. The market is moderately consolidated, with top players focusing on expanding IoT-enabled and AI-integrated monitoring solutions for industrial and commercial applications. Strategic mergers and partnerships are enhancing product capabilities and regional presence. Continuous R&D investment in smart energy management, predictive analytics, and cybersecurity strengthens competitiveness. Emerging players are entering niche markets, offering modular and cost-effective solutions tailored to specific end-user needs. The growing demand for real-time energy data and automation integration continues to drive innovation and collaboration across the competitive landscape.

Key Player Analysis

- Omron Corporation

- Accuenergy

- MPL Technologies

- Anord Mardix

- Eaton

- NHP

- ABB

- Legrand

- Acrel Electric Co. Ltd.

- Daxten

Recent Developments

- In September 2025, Accuenergy was awarded the Supplier Specialty Award by Eaton’s Global Supplier Excellence Awards, reflecting its delivery of precision power metering instruments supporting Eaton’s supply-chain and circuit-monitoring needs.

- In August 2025, Eaton introduced “Exertherm Continuous Thermal Monitoring (CTM)” sensors for low-voltage motor control centres (MCCs). These sensors attach directly to connections, enabling real-time temperature tracking and alerting via a datacard.

- In October 2024, Legrand launched its expanded DX2 SmartSensors line, including upgraded Vibration SmartSensors and Dust/Particle SmartSensors, extending monitoring capabilities for rack power and environment in data centres.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for smart and IoT-enabled circuit monitoring systems will continue to increase across industries.

- Integration of AI and machine learning will enhance predictive maintenance and fault detection capabilities.

- Adoption of cloud-based energy management platforms will expand among commercial and industrial users.

- Renewable energy projects will create new opportunities for real-time circuit monitoring applications.

- Growing focus on carbon reduction and energy efficiency will drive modernization of electrical systems.

- Industrial automation and digital transformation will strengthen the need for advanced monitoring technologies.

- Cybersecurity solutions will become a key priority to protect connected electrical networks.

- Manufacturers will develop modular and cost-efficient systems to meet small enterprise demands.

- Government initiatives for smart grids and sustainable power distribution will accelerate deployment.

- Emerging economies will witness rapid adoption due to infrastructure growth and rising power demand.