Market Overview:

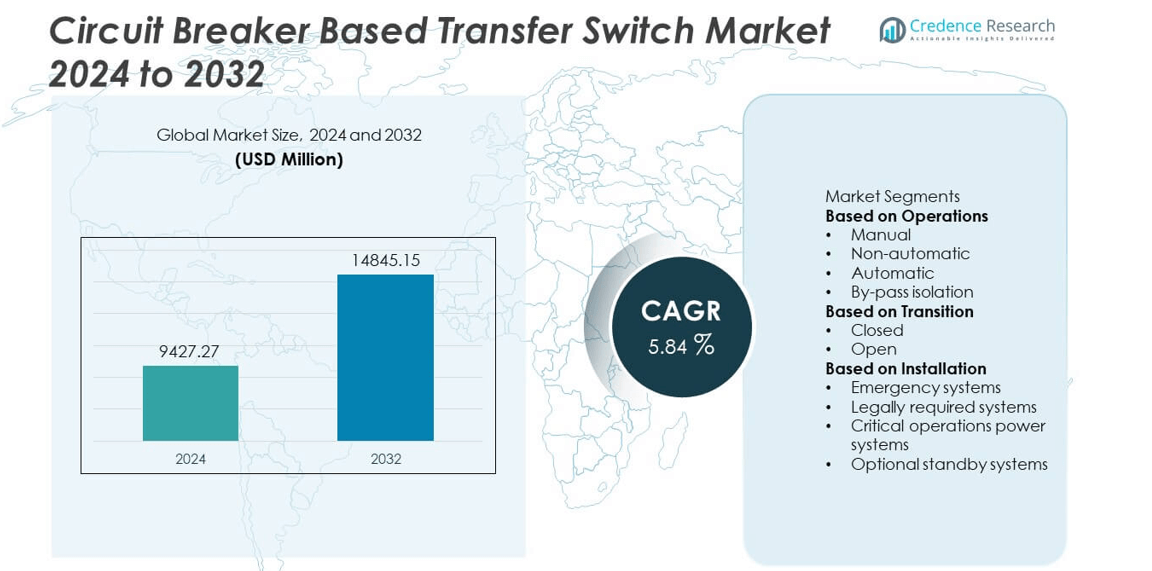

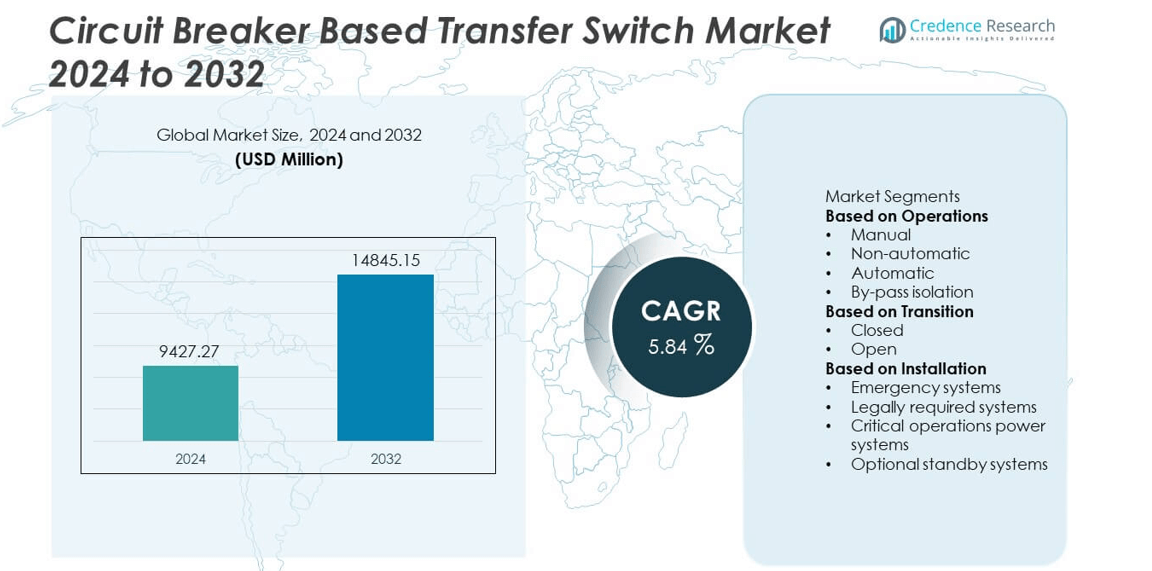

The Circuit Breaker Based Transfer Switch market was valued at USD 9427.27 million in 2024 and is projected to reach USD 14845.15 million by 2032, expanding at a CAGR of 5.84% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Circuit Breaker Based Transfer Switch Market Size 2024 |

USD 9427.27 million |

| Circuit Breaker Based Transfer Switch Market, CAGR |

5.84% |

| Circuit Breaker Based Transfer Switch Market Size 2032 |

USD 14845.15 million |

The Circuit Breaker Based Transfer Switch market is led by key players such as Eaton, ABB, Caterpillar, Generac Power Systems, Kohler, Cummins, AEG Power Solutions, General Electric, DAIER, and Briggs & Stratton. These companies dominate through advanced switchgear technologies, strong service networks, and integration of smart monitoring systems for enhanced reliability and automation. North America accounted for 38.6% of the global market share in 2024, driven by high investments in backup power and industrial infrastructure. Europe followed with a 27.4% share, while Asia-Pacific emerged as the fastest-growing region, supported by rapid urbanization, manufacturing expansion, and growing demand for uninterrupted power supply solutions.

Market Insights

- The Circuit Breaker Based Transfer Switch market was valued at USD 9427.27 million in 2024 and is projected to reach USD 14845.15 million by 2032, growing at a CAGR of 5.84%.

- Rising demand for reliable and automated power transfer solutions in commercial, industrial, and residential sectors is driving market growth.

- The market is witnessing a trend toward smart and IoT-enabled transfer switches that improve operational efficiency and real-time monitoring.

- Leading players such as Eaton, ABB, Caterpillar, and Generac Power Systems focus on product innovation, safety compliance, and expansion in emerging markets.

- North America led with a 38.6% market share in 2024, followed by Europe at 27.4%, while the automatic operation segment held the largest share at 42.1%, supported by increased adoption in critical power systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Operations

Automatic transfer switches dominated the Circuit Breaker Based Transfer Switch market in 2024, accounting for 46.8% of the total share. Their widespread adoption is driven by the increasing need for uninterrupted power in industrial and commercial facilities. Automatic systems ensure seamless transition between power sources without human intervention, enhancing safety and efficiency. The rise in smart grid integration and advanced automation technologies has further boosted demand. Growing deployment across hospitals, data centers, and manufacturing units underscores the segment’s dominance in ensuring operational reliability and continuity.

- For instance, Generac Power Systems introduced an automatic transfer switch series rated at 100 A with a 10,000 A withstand rating, equipped with a microprocessor-based controller capable of transferring loads within 150 milliseconds. This system ensures smooth transitions between generator and utility power, enhancing reliability in mission-critical facilities.

By Transition

The closed transition segment led the Circuit Breaker Based Transfer Switch market in 2024 with a 57.3% share. This dominance is attributed to its ability to provide continuous power supply during the transfer process, minimizing downtime and equipment damage. Closed transition switches are increasingly used in critical applications such as data centers, healthcare facilities, and utility plants where uninterrupted power is essential. The segment’s growth is further supported by the expansion of distributed energy systems and the rising emphasis on high-performance power management infrastructure.

- For instance, Eaton developed its ATC-900 closed transition breaker-based transfer switch rated up to 1,000 A, featuring a maximum transfer overlap of 100 milliseconds to maintain load continuity. The system integrates digital metering and communication protocols for monitoring transfer events in real time, ensuring stable operation in high-load environments.

By Installation

Emergency systems accounted for 41.6% of the Circuit Breaker Based Transfer Switch market share in 2024, driven by their critical role in maintaining power continuity during outages. These systems are widely used in hospitals, airports, and public safety facilities that demand instant power restoration. Increasing regulatory mandates on backup power infrastructure and growing investments in resilient energy systems are propelling market growth. The expansion of infrastructure projects and the adoption of advanced electrical safety systems also support the rising use of transfer switches in emergency installations globally.

Key Growth Drivers

Rising Demand for Reliable Power Backup Solutions

Growing dependence on continuous electricity supply in industrial, commercial, and residential sectors is a major driver of the Circuit Breaker Based Transfer Switch market. Frequent power fluctuations and grid instability have increased demand for efficient power transfer systems. These switches ensure seamless transition between primary and secondary power sources, minimizing downtime and operational losses. Expanding data centers, hospitals, and manufacturing facilities further boost installation rates. The global shift toward energy reliability and uninterrupted operations continues to reinforce adoption across developed and emerging markets.

- For instance, Kohler Co. introduced its RXT-JFNC automatic transfer switch rated at 100 A and compliant with UL 1008 standards. The unit supports a transfer time of less than 100 milliseconds and ensures compatibility with both standby and prime power generators used in healthcare and critical infrastructure applications.

Expansion of Smart Grid and Automation Technologies

The integration of smart grid technologies and digital automation is accelerating the use of circuit breaker-based transfer switches. Modern systems incorporate intelligent control features for real-time monitoring, fault detection, and remote operation. Automation enhances response time and improves system safety in high-demand environments. Utilities and industrial facilities are increasingly adopting these technologies to optimize power efficiency. The development of IoT-enabled and cloud-connected transfer switches supports predictive maintenance, enabling users to reduce energy wastage and improve grid management performance.

- For instance, ABB launched its TruONE automatic transfer switch with built-in monitoring, communication ports, and motorized mechanisms supporting ratings up to 1,600 A (for IEC standards).

Increasing Infrastructure and Industrial Investments

Rapid urbanization and industrialization are fueling large-scale infrastructure projects that require reliable power distribution systems. Transfer switches play a critical role in ensuring electrical stability across critical applications, including energy, telecom, and manufacturing. Government-led investments in renewable energy, smart cities, and public infrastructure are boosting product demand. Additionally, growing electrification in developing economies such as India and China drives adoption across both commercial and utility sectors. These expanding infrastructure networks are strengthening global market growth for circuit breaker-based transfer switches.

Key Trends & Opportunities

Adoption of IoT-Enabled and Remote Monitoring Solutions

The rising trend toward smart energy management is driving the adoption of IoT-integrated transfer switches. Remote monitoring capabilities allow operators to track performance metrics, identify faults, and initiate corrective actions instantly. The integration of cloud platforms enables predictive maintenance and enhanced energy optimization. As end-users prioritize automation and data-driven insights, manufacturers are investing in intelligent switchgear technologies. This trend provides major opportunities for innovation and market differentiation, particularly in energy-intensive industries and mission-critical operations.

- For instance, Eaton provides power management solutions featuring Power Defense breakers equipped with built-in PXR electronic trip units and robust communication options, including Ethernet connectivity.

Growing Integration with Renewable Energy Systems

The expansion of renewable energy installations, such as solar and wind, is creating new opportunities for circuit breaker-based transfer switches. These switches play a key role in managing the transition between grid and renewable power sources. The growing adoption of hybrid energy systems and microgrids is further accelerating demand. Manufacturers are focusing on designing transfer switches capable of handling variable power loads and improving synchronization efficiency. As the global energy landscape shifts toward sustainability, this integration will remain a major growth driver.

- For instance, Cummins developed its OTEC Series transfer switches supporting current ratings up to 1200 A, designed for reliable open-transition switching between utility and generator power.

Key Challenges

High Installation and Maintenance Costs

The significant initial investment required for circuit breaker-based transfer switch systems presents a challenge, particularly for small and medium enterprises. Complex installation procedures and the need for skilled labor add to overall project costs. Ongoing maintenance, calibration, and system testing further increase expenditure. Although automation reduces operational inefficiencies, budget limitations may slow adoption in cost-sensitive markets. Manufacturers are focusing on modular designs and cost-efficient production methods to make systems more accessible to a broader range of end-users.

Regulatory Compliance and Safety Standards

Compliance with strict international electrical standards and safety regulations remains a key hurdle. Manufacturers must meet certifications such as IEC, UL, and IEEE, which vary across regions and applications. Non-compliance can lead to operational hazards, equipment failures, or legal liabilities. The complexity of evolving standards related to smart grid integration and renewable energy synchronization adds further challenges. Continuous investment in product testing and certification is essential to ensure reliability, increasing both time-to-market and development costs for manufacturers.

Regional Analysis

North America

North America dominated the Circuit Breaker Based Transfer Switch market in 2024, accounting for 38.6% of the total share. The region’s leadership is driven by increasing investments in data centers, renewable energy integration, and smart grid modernization. The United States remains the key contributor due to rising demand for advanced power continuity solutions across commercial and industrial sectors. Strict regulatory standards for energy reliability and safety also support market expansion. Continuous infrastructure upgrades and widespread adoption of automated and IoT-enabled switching systems further strengthen North America’s position in the global market.

Europe

Europe held a 27.3% share of the Circuit Breaker Based Transfer Switch market in 2024, supported by strong demand from manufacturing, healthcare, and utility sectors. The region benefits from stringent energy efficiency regulations and increasing adoption of renewable energy systems. Countries such as Germany, the United Kingdom, and France are leading adopters of automatic transfer switches to ensure power reliability in critical applications. Ongoing investment in smart grid infrastructure and industrial automation enhances market penetration. The focus on sustainability and technological innovation continues to drive the region’s steady growth.

Asia-Pacific

Asia-Pacific accounted for 24.1% of the Circuit Breaker Based Transfer Switch market share in 2024 and is expected to register the fastest growth through 2032. Rapid industrialization, expanding construction activities, and growing demand for uninterrupted power in emerging economies such as China, India, and Japan fuel regional demand. Increasing adoption of renewable energy sources and microgrid systems further supports market expansion. The presence of major manufacturing facilities and favorable government initiatives promoting energy infrastructure modernization strengthen Asia-Pacific’s competitive position in the global market.

Latin America

Latin America captured a 6.1% share of the Circuit Breaker Based Transfer Switch market in 2024, driven by the growing need for reliable power solutions across commercial and residential sectors. Brazil and Mexico lead regional demand, supported by expanding energy infrastructure and increasing industrialization. Rising investments in renewable energy projects and grid modernization initiatives are enhancing market adoption. The growing emphasis on energy efficiency and the gradual digitalization of power systems are expected to create favorable conditions for continued market growth throughout the region.

Middle East & Africa

The Middle East & Africa held a 3.9% share of the Circuit Breaker Based Transfer Switch market in 2024, supported by expanding infrastructure projects and rising demand for backup power systems. The Gulf Cooperation Council (GCC) countries dominate regional growth due to large-scale industrial developments and investments in smart cities. Increasing reliance on continuous power in oil and gas, healthcare, and commercial sectors further drives demand. However, limited grid connectivity and high installation costs remain challenges. Ongoing diversification into renewable energy and technological modernization initiatives are expected to strengthen future market performance.

Market Segmentations:

By Operations

- Manual

- Non-automatic

- Automatic

- By-pass isolation

By Transition

By Installation

- Emergency systems

- Legally required systems

- Critical operations power systems

- Optional standby systems

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Circuit Breaker Based Transfer Switch market is highly competitive, featuring major players such as Generac Power Systems, Eaton, Caterpillar, Kohler, Cummins, ABB, AEG Power Solutions, General Electric, DAIER, and Briggs & Stratton. These companies focus on technological innovation, product reliability, and automation to strengthen their market presence across industrial, commercial, and residential sectors. Strategic collaborations, capacity expansions, and product advancements in intelligent transfer systems are driving market differentiation. Leading players are emphasizing digital monitoring and IoT-based control solutions to enhance operational efficiency and safety. Moreover, the growing adoption of renewable energy and microgrid systems is encouraging manufacturers to develop advanced, energy-efficient switching technologies that ensure seamless power continuity in dynamic grid environments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Elmeasure acquired a minority stake in Static Power (Australia) and initiated a five-year collaboration to advance innovation in static transfer switch technologies closely aligned with circuit breaker-based systems.

- In May 2025, Schneider Electric introduced new transfer switch solutions, including the Acti9 Incoming Automatic Transfer Switch Kit and a single-way bypass transfer switch (32 A–400 A) under its ASCO brand, enhancing power reliability and safety.

- In April 2024, Siemens’ RUSSELL Electric released the RTS-30 Series transfer switches for water treatment facilities. These switches maintain uninterrupted power supply during outages, meeting the critical power backup needs of water infrastructure.

- In March 2023, Cummins launched its PowerCommand B-Series transfer switches in North America. The switches offer bypass-isolation features and operate between 1200-3000 amps, expanding Cummins’ power solutions range

Report Coverage

The research report offers an in-depth analysis based on Operations, Transition, Installation and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising investments in reliable power infrastructure.

- Growing adoption of automation and smart grid systems will boost product demand.

- Integration of IoT and digital monitoring will enhance switch performance and safety.

- Manufacturers will focus on developing energy-efficient and low-maintenance transfer switches.

- The automatic operation segment will continue to dominate due to increasing preference for uninterrupted power.

- Rising industrialization and commercial building projects will strengthen global demand.

- Renewable energy integration will create new opportunities for advanced switching systems.

- Asia-Pacific will emerge as the fastest-growing region with strong manufacturing expansion.

- Strategic partnerships and mergers will drive innovation and market competitiveness.

- Continuous R&D in fault detection and circuit protection will improve reliability and product lifespan.