Market Overview

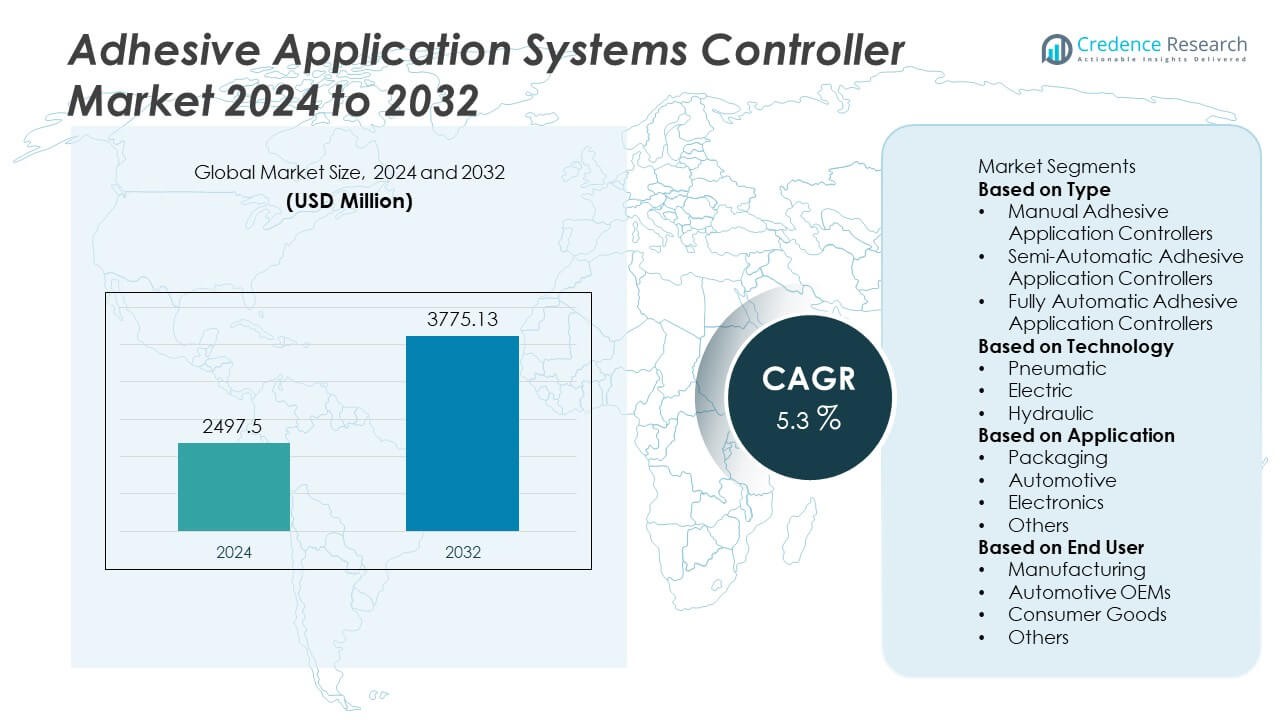

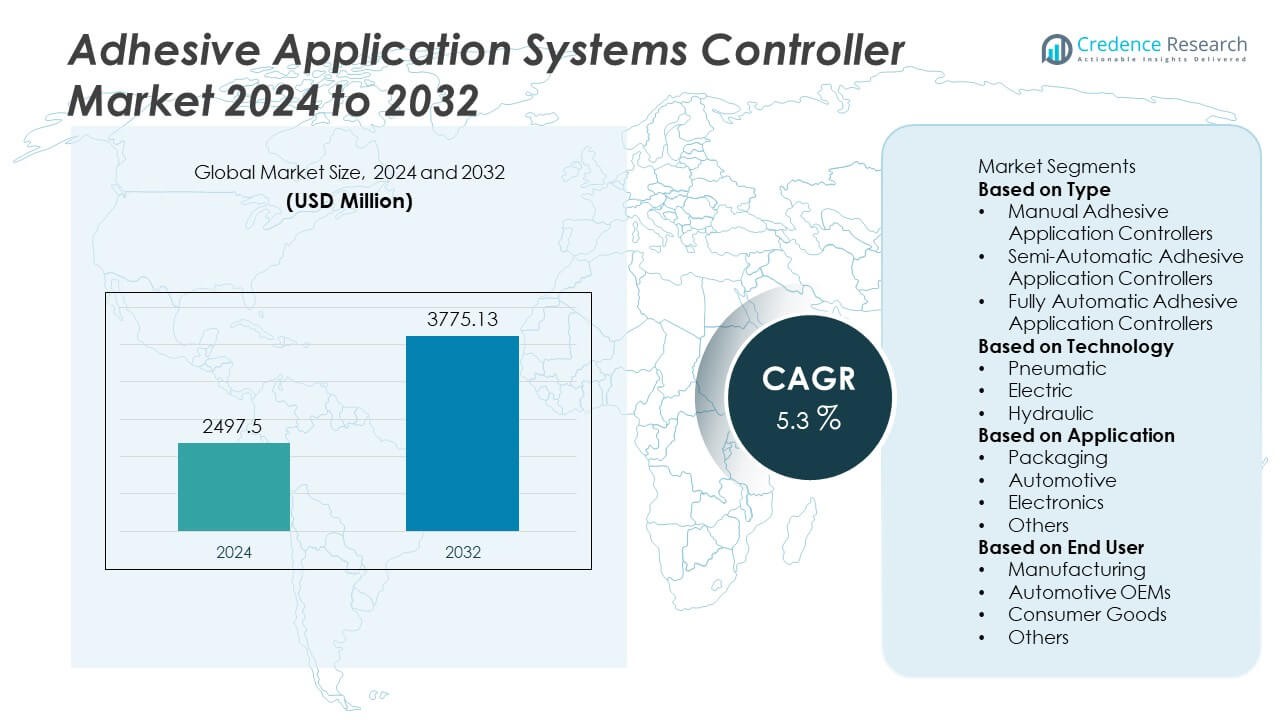

The Adhesive Application Systems Controller Market reached USD 2,497.5 million in 2024 and is projected to rise to USD 3,775.13 million by 2032, reflecting a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Adhesive Application Systems Controller Market Size 2024 |

USD 2,497.5 Million |

| Adhesive Application Systems Controller Market, CAGR |

5.3% |

| Adhesive Application Systems Controller Market Size 2032 |

USD 3,775.13 Million |

The Adhesive Application Systems Controller market is shaped by leading players such as Nordson Corporation, Henkel AG & Co. KGaA, Robatech AG, Valco Melton, H.B. Fuller Company, Graco Inc., ITW Dynatec, Glue Machinery Corporation, Meler Gluing Solutions, and SCA Schucker. These companies expand their market presence through advanced dispensing technologies, automation-focused solutions, and real-time monitoring capabilities that enhance production efficiency. Asia Pacific leads the market with a 31% share driven by strong manufacturing growth and rapid automation adoption. North America follows with a 33% share supported by high investment in industrial automation, while Europe holds a 29% share due to stringent quality standards and advanced production technologies across automotive, packaging, and electronics industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Adhesive Application Systems Controller market reached USD 2,497.5 million in 2024 and will grow at a CAGR of 5.3% through 2032.

- Demand increases as industries adopt automation and precision dispensing, with fully automatic controllers holding a 49% share and electric technology leading with a 46% share.

- Key trends include rising integration of IoT-enabled monitoring, energy-efficient systems, and advanced digital controls that enhance accuracy, reduce waste, and improve production speed.

- Competition strengthens among Nordson, Henkel, Robatech, Valco Melton, H.B. Fuller, Graco, ITW Dynatec, and others as they expand automated solutions despite restraints tied to high installation costs and technical workforce requirements.

- Asia Pacific holds a 31% share, North America leads with 33%, Europe follows at 29%, Latin America accounts for 4%, and the Middle East & Africa holds 3%, supported by strong demand across packaging, automotive, and electronics industries.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Type

Fully automatic adhesive application controllers lead the market with a 49% share, driven by rising demand for precision, consistency, and high-speed production in packaging, automotive, and electronics manufacturing. These systems reduce manual errors, optimize adhesive usage, and improve overall operational efficiency. Semi-automatic controllers hold a notable portion of the market as mid-sized manufacturers adopt automation at a controlled cost. Manual controllers remain relevant in small-scale operations where flexibility and low investment requirements matter. Advancements in automated dispensing technologies and growing adoption of Industry 4.0 systems continue to strengthen the dominance of fully automatic controllers.

- For instance, Nordson Corporation upgraded its ProBlue Flex system with a touchscreen module that supports 5,000 control points per second and integrates with EtherNet/IP and PROFINET networks.

By Technology

Electric adhesive application controllers dominate the segment with a 46% share due to their accuracy, energy efficiency, and compatibility with advanced automation systems. Electric controllers support real-time monitoring, digital adjustments, and improved repeatability across high-speed production lines. Pneumatic systems maintain steady demand where cost efficiency and robust performance are priorities, particularly in woodworking and general manufacturing. Hydraulic controllers serve heavy-duty industrial applications requiring higher force and durability. The increasing shift toward energy-efficient, low-maintenance, and digitally integrated solutions continues to drive the expansion of electric controller technology.

- For instance, Graco Inc. offers its InvisiPac system, which features “Plug-Free” applicators designed for high-speed operation that helps eliminate char and prevent nozzle plugs, reducing maintenance needs.

By Application

The packaging segment leads the market with a 38% share, supported by rising demand in food packaging, e-commerce logistics, and fast-moving consumer goods. Adhesive application controllers ensure consistent bonding, reduced waste, and high throughput, making them essential in automated packaging lines. The automotive sector follows as manufacturers adopt advanced controllers for interior assembly, sealing, and component bonding. Electronics production also shows strong growth as miniaturization and precision requirements increase. Other applications, including textiles and construction, expand steadily as industries prioritize enhanced adhesive control, improved safety, and streamlined manufacturing processes.

Key Growth Drivers

Increasing Demand for Automation in Manufacturing Processes

Automation adoption continues to rise across packaging, automotive, electronics, and consumer goods industries, driving strong demand for adhesive application systems controllers. Manufacturers seek greater precision, faster production cycles, and reduced material waste, all of which automated controllers deliver. Fully automatic systems enhance consistency and reduce downtime, improving overall operational efficiency. Growing deployment of robotics and smart production lines further supports controller integration. The shift toward automated bonding and sealing processes strengthens long-term market expansion as companies pursue higher productivity and stricter quality standards.

- For instance, Robatech AG deployed its SpeedStar Compact applicator that delivers up to 800 switching cycles per second, enabling high-speed carton sealing.

Rising Need for Precision and Quality in Adhesive Dispensing

Industries increasingly require accurate adhesive control to meet performance, safety, and quality benchmarks. Adhesive application controllers enable precise dispensing, consistent bonding strength, and improved product durability, making them crucial for electronics, automotive assemblies, and high-speed packaging lines. Advanced controllers reduce adhesive waste, enhance repeatability, and support complex geometries. As product miniaturization and component integration increase, demand for high-precision dispensing solutions grows. This focus on accuracy and efficiency accelerates market adoption across diverse industrial applications.

- For instance, Meler Gluing Solutions implemented a micro-dispensing unit (HS series microprecision applicator) that operates at high speeds (up to 8,500 cycles/minute in the MU series version), improving accuracy in high-speed machines.

Expansion of Packaging and E-Commerce Industries

Booming e-commerce and rising demand for secure, efficient packaging drive strong growth for adhesive application systems controllers. Automated adhesive systems ensure reliable sealing, carton closing, and labeling operations essential for high-volume packaging facilities. As consumer goods production expands, manufacturers invest in advanced controllers to improve speed, reduce defects, and support sustainable packaging practices. Growth in food and beverage, pharmaceuticals, and logistics strengthens adoption. Increased emphasis on packaging customization and fast turnaround times further boosts market demand.

Key Trends & Opportunities

Integration of Industry 4.0 and Smart Monitoring Technologies

Adhesive application systems increasingly incorporate IoT-based monitoring, data analytics, and predictive maintenance features. Smart controllers offer real-time visibility into adhesive flow, temperature, pressure, and usage patterns, improving process control and reducing downtime. Industry 4.0 integration enables remote adjustments, automated reporting, and enhanced quality assurance. Cloud connectivity also supports centralized monitoring across multiple production sites. This digital shift creates opportunities for manufacturers to offer advanced, software-driven adhesive dispensing solutions.

- For instance, Valco Melton introduced its ClearVision module, which inspects adhesive beads in real-time at full production speeds for high-speed packaging lines.

Growth of Eco-Friendly and Energy-Efficient Adhesive Systems

Sustainability trends create new opportunities as industries adopt low-energy and eco-friendly adhesive application systems. Electric controllers gain traction due to reduced power consumption and lower maintenance needs. Manufacturers develop systems that minimize adhesive waste and support water-based or bio-based adhesives. Demand for sustainable packaging fuels adoption of optimized adhesive control features. Environmental regulations and corporate sustainability goals accelerate the shift toward efficient, resource-conscious adhesive dispensing technologies.

- For instance, ITW Dynatec developed a “melt-on-demand” system that ensures a stable flow at pressures typically up to 1,000 psi (approximately 68 bar), which helps reduce adhesive waste and charring when processing hot melt adhesives.

Key Challenges

High Initial Installation and Maintenance Costs

Advanced adhesive application controllers require significant investment in equipment, integration, and operator training. Small and mid-sized manufacturers struggle with the upfront cost of adopting automated systems, slowing market penetration. Maintenance of complex controllers adds ongoing expenses, especially for systems integrated into high-speed production lines. Manufacturers must justify costs with long-term productivity gains, but budget constraints remain a challenge in emerging markets. These financial barriers limit rapid adoption across cost-sensitive industries.

Technical Complexity and Need for Skilled Workforce

Adhesive application systems controllers involve intricate mechanical, electronic, and software components that require skilled technicians for installation, calibration, and troubleshooting. Limited availability of trained personnel affects adoption, particularly in developing regions. As automation and digitalization increase, the complexity of system integration also rises. Inadequate training can result in operational errors, downtime, and inconsistent adhesive application. Manufacturers must invest in workforce development and simplified system interfaces to overcome this challenge.

Regional Analysis

North America

North America holds a 33% share of the Adhesive Application Systems Controller market, driven by strong adoption of automation across packaging, automotive, and electronics manufacturing. The United States leads demand as companies prioritize precision bonding, reduced waste, and consistent production quality. Investments in advanced assembly technologies and Industry 4.0 integration strengthen the need for intelligent controllers. The region’s mature manufacturing base and widespread use of high-speed production lines support continuous growth. Favorable adoption of energy-efficient electric controllers and rising demand for smart monitoring systems further reinforce North America’s leadership in the market.

Europe

Europe accounts for a 29% share, supported by strong industrial automation, rigid manufacturing standards, and robust presence of automotive and machinery producers. Germany, Italy, and France drive adoption as manufacturers seek high-precision adhesive control for assembly and electronic applications. Sustainability regulations encourage the use of energy-efficient controllers and optimized adhesive usage. European packaging and consumer goods industries increasingly integrate automated dispensing solutions to maintain high output quality. Growing investments in digital manufacturing and predictive maintenance technologies continue to boost demand for advanced adhesive application controllers across the region.

Asia Pacific

Asia Pacific leads growth momentum with a 31% share driven by expanding manufacturing capacity in China, Japan, South Korea, and India. Rapid industrialization and strong demand in packaging, automotive, and electronics production significantly increase the adoption of automated adhesive controllers. Manufacturers in the region invest heavily in high-speed assembly lines and robotics, accelerating market penetration. Rising consumer goods and e-commerce activities boost packaging automation further. Government support for manufacturing modernization and the expansion of export-oriented production strengthen Asia Pacific’s position as the fastest-growing regional market.

Latin America

Latin America holds a 4% share, with growth concentrated in Brazil and Mexico as manufacturers upgrade production lines to improve efficiency and product quality. Packaging, automotive, and food processing industries drive demand for adhesive application controllers in the region. Companies gradually adopt semi-automatic and automatic systems to reduce material waste and meet rising production requirements. Limited capital investment capabilities slow high-end technology adoption, but growing awareness of automation benefits supports steady expansion. Regional manufacturing development and rising industrial activity contribute to long-term market potential.

Middle East & Africa

The Middle East & Africa region accounts for a 3% share, supported by gradual growth in manufacturing, construction, and packaging industries. Countries such as the UAE, Saudi Arabia, and South Africa increasingly adopt automated adhesive controllers to enhance production consistency and reduce operational costs. Investments in industrial modernization and expansion of consumer goods manufacturing support demand for precise dispensing systems. Limited local production encourages imports of advanced controllers from global suppliers. Improving industrial automation infrastructure and rising demand for durable, consistent bonding solutions support steady regional market growth.

Market Segmentations:

By Type

- Manual Adhesive Application Controllers

- Semi-Automatic Adhesive Application Controllers

- Fully Automatic Adhesive Application Controllers

By Technology

- Pneumatic

- Electric

- Hydraulic

By Application

- Packaging

- Automotive

- Electronics

- Others

By End User

- Manufacturing

- Automotive OEMs

- Consumer Goods

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape or analysis of the Adhesive Application Systems Controller market features major players such as Nordson Corporation, Henkel AG & Co. KGaA, Robatech AG, Valco Melton, H.B. Fuller Company, Graco Inc., ITW Dynatec, Glue Machinery Corporation, Meler Gluing Solutions, and SCA Schucker. These companies compete by advancing precision dispensing technologies, automation capabilities, and energy-efficient control systems. Market leaders invest in intelligent controllers with real-time monitoring, IoT connectivity, and predictive maintenance functions to support high-speed manufacturing environments. Strong partnerships with packaging, automotive, electronics, and woodworking industries enhance product integration and global reach. Many players focus on sustainability by developing systems that reduce adhesive waste and improve production efficiency. Continuous R&D investment, expansion of product portfolios, and strategic acquisitions further intensify competition as companies aim to deliver superior accuracy, reliability, and cost-effective adhesive application solutions.

Key Player Analysis

- Nordson Corporation

- Henkel AG & Co. KGaA

- Robatech AG

- Valco Melton

- B. Fuller Company

- Graco Inc.

- ITW Dynatec

- Glue Machinery Corporation

- Meler Gluing Solutions

- SCA Schucker (SCA Packaging)

Recent Developments

- In July 2025, Henkel launched a solvent-free adhesive system (Loctite Liofol LA 7837/LA 6265) for high-performance packaging, emphasising processing reliability and sustainability.

- In February 2025, Henkel announced investments in an Application Engineering Center in Chennai and a separate manufacturing plant expansion in Kurkumbh.

- In September 2023, Valco Melton showcased its existing EcoStitch™ all-electric gluing technology, including its integrated intelligent adhesive dispensing control (Ethernet IP integration, digital pressure control, usage data), at PPMA 2023.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of automated adhesive dispensing will grow as industries pursue higher production efficiency.

- Fully automatic controllers will expand rapidly with rising demand for precision bonding.

- IoT-enabled monitoring and predictive maintenance will become standard in new installations.

- Electric adhesive controllers will gain traction due to energy efficiency and reduced maintenance needs.

- Integration with robotics and smart manufacturing systems will strengthen across industrial sectors.

- Packaging and e-commerce growth will drive increased deployment of high-speed adhesive controllers.

- Automotive lightweighting and EV production will boost demand for advanced adhesive application solutions.

- Digital calibration and real-time control features will improve accuracy and reduce adhesive waste.

- Emerging markets will adopt automated systems as manufacturing modernization accelerates.

- Sustainability goals will push companies toward optimized adhesive usage and eco-efficient controller technologies.

Market Segmentation Analysis:

Market Segmentation Analysis: