Market Overview:

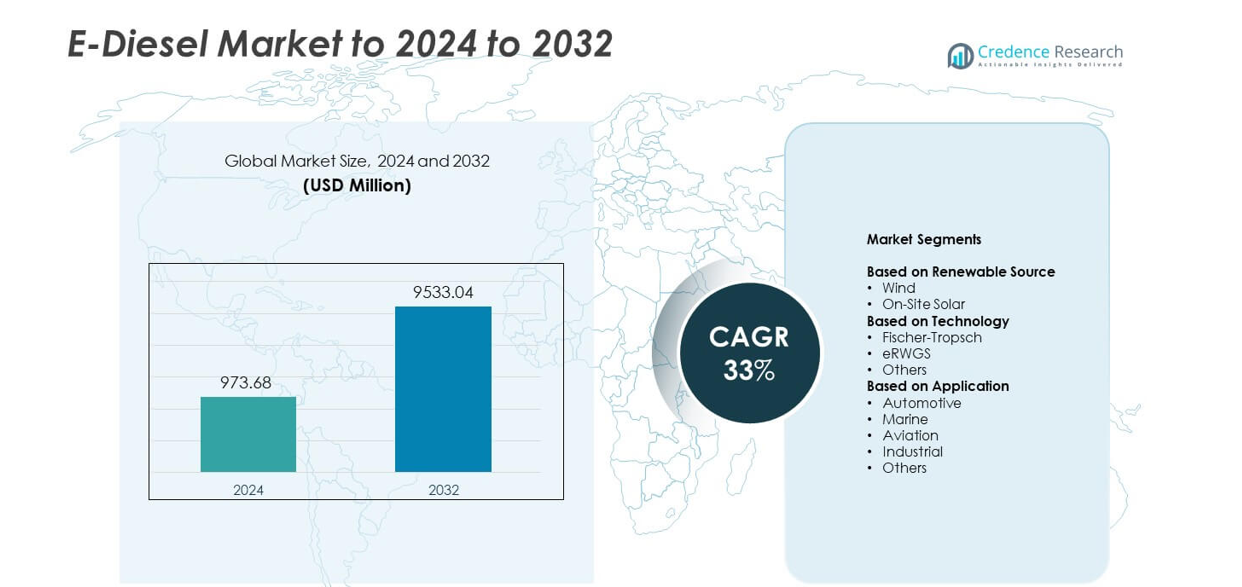

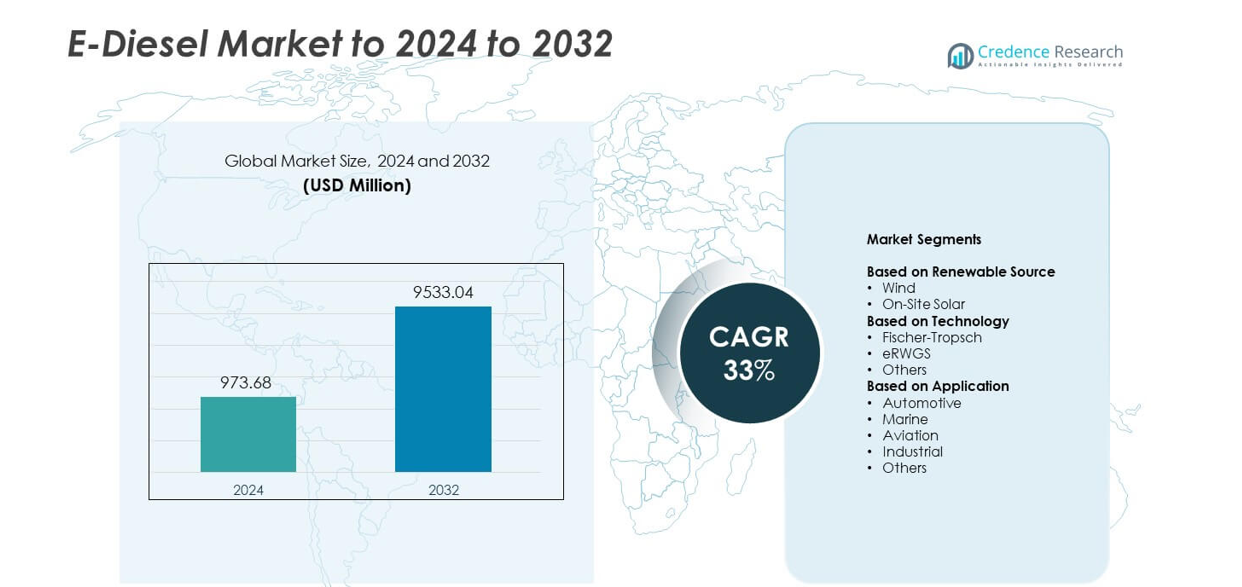

The E-Diesel Market was valued at USD 973.68 million in 2024 and is anticipated to reach USD 9533.04 million by 2032, growing at a CAGR of 33% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| E-Diesel Market Size 2024 |

USD 973.68 million |

| E-Diesel Market, CAGR |

33% |

| E-Diesel Market Size 2032 |

USD 9533.04 million |

The E-Diesel Market includes key players such as FuelCellEnergyInc., ArcadiaeFuels, LanzaJet, MANEnergySolutions, Porsche, CleanFuelsAllianceAmerica, SunfireGmbH, LiquidWind, ClimeworksAG, CeresPowerHoldingPlc, NorskE-FuelAS, BallardPowerSystemsInc., eFuelPacificLimited, ElectrochaeaGmbH, ExxonMobil, and HIFGlobal, each working to expand synthetic fuel production and accelerate large-scale commercialization. These companies invest in power-to-liquid plants, renewable hydrogen systems, and carbon-capture technologies to enhance fuel efficiency and reduce emissions. Europe leads the market with a 38% share in 2024 due to strong policy support and large renewable energy assets, followed by North America at 34% and Asia Pacific at 22%, driven by growing decarbonization commitments across transport and industry.

Market Insights

- The E-Diesel Market reached USD 973.68 million in 2024 and USD 9533.04 million in 2032 and will grow at a 33% CAGR to 2032, driven by rising adoption of renewable synthetic fuels across transport and industry.

- Demand growth comes from strict emission rules, rapid adoption of wind-powered production (60% share), and strong use of Fischer-Tropsch technology (45% share), which supports high-quality fuel output.

- Key trends include expansion of power-to-liquid plants, rising integration of renewable hydrogen, and increasing adoption in the automotive segment, which holds a 40% share.

- Competitive activity focuses on scaling commercial plants, improving catalyst efficiency, and strengthening renewable electricity partnerships to support large-volume E-Diesel production.

- Europe leads regional demand with a 38% share, followed by North America at 34% and Asia Pacific at 22%, while Latin America and the Middle East & Africa hold 4% and 2% respectively as emerging growth regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Renewable Source

The E-Diesel Market is segmented by renewable sources, with wind and on-site solar being the key contributors. The wind sub-segment holds the dominant market share of approximately 60% due to its scalability and efficiency in harnessing energy for E-Diesel production. Wind energy is widely adopted for its low environmental impact and high capacity factor, making it an ideal source for renewable E-Diesel production. The increasing shift toward cleaner energy sources and advancements in wind turbine technology are key drivers of growth in this segment.

- For instance, Siemens Gamesa secured an Engineering, Procurement, and Construction (EPC) contract in early 2021 to build the 100 MW Assela wind farm in Ethiopia for the state-owned utility Ethiopian Electric Power (EEP).

By Technology

The E-Diesel Market is driven by various technologies, with Fischer-Tropsch technology leading the market, holding around 45% of the market share. This technology dominates the segment due to its maturity and ability to produce high-quality synthetic fuels from renewable feedstocks. Fischer-Tropsch synthesis offers significant advantages in terms of efficiency and scalability, which supports its widespread adoption in commercial E-Diesel production. The demand for cleaner fuels, coupled with advancements in catalyst technologies, further strengthens the dominance of Fischer-Tropsch in this segment.

- For instance, Sasol’s Secunda CTL plant in South Africa uses the Fischer-Tropsch process and has a capacity of 160,000 barrels per day.

By Application

The application segment of the E-Diesel Market includes automotive, marine, aviation, industrial, and others, with the automotive sub-segment holding the largest market share of approximately 40%. The growing demand for clean and sustainable fuel solutions in the transportation sector drives the automotive sub-segment’s dominance. E-Diesel offers a low-carbon alternative for internal combustion engines, making it a preferred choice for automakers looking to reduce emissions. The increasing adoption of electric vehicles (EVs) and hybrid vehicles also contributes to the growing demand for E-Diesel in the automotive sector.

Key Growth Drivers

Growing Demand for Sustainable Energy Solutions

The global move toward low-carbon fuels drives strong demand for E-Diesel. Many countries enforce strict emission rules, which push industries to adopt renewable synthetic fuels. The rise of net-zero targets also increases interest in carbon-neutral diesel alternatives that work in existing engines. Transportation, industrial operations, and heavy-duty sectors use E-Diesel to reduce greenhouse gases without major equipment changes. This shift in energy policy creates steady long-term growth for the market.

- For instance, Neste increased its renewable products refinery capacity by 1.3 million tons per year at its Singapore site, helping meet rising low-carbon fuel demand.

Technological Advancements in E-Diesel Production

Advances in Fischer-Tropsch, eRWGS, and renewable hydrogen systems improve efficiency and reduce energy loss in E-Diesel production. These developments support large-scale fuel output while lowering operating costs and improving fuel purity. Better catalysts and high-temperature reactors also make the process more reliable and faster. As these technologies mature, commercial E-Diesel plants gain higher productivity, making renewable synthetic diesel more competitive. These improvements strengthen industry confidence and support wider market expansion.

- For instance, Topsoe and Sasol demonstrated conversion of biogas and CO₂ into synthetic crude (syncrude) in their FrontFuel SynFuels project in Denmark in late 2024.

Government Regulations Supporting Clean Fuel Adoption

Government climate policies and emission rules are major growth drivers for the E-Diesel Market. Many nations provide tax benefits, carbon credit programs, and incentives for renewable fuel production. Mandates for low-carbon fuels in transportation and aviation also increase demand. These policies push industries to replace fossil diesel with cleaner synthetic alternatives. As regulatory pressure continues to rise, companies accelerate investments in E-Diesel projects, supporting strong market growth across multiple sectors.

Key Trends & Opportunities

Expansion Across Automotive, Marine, and Aviation Applications

Growing decarbonization needs in automotive fleets, shipping, and aviation generate strong opportunities for E-Diesel adoption. The fuel works with existing engines, making it easier for operators to cut emissions without redesigning equipment. Aviation and marine sectors face global emission laws, driving interest in renewable synthetic fuels. Hybrid vehicle fleets and commercial transport firms also seek low-carbon fuel blends. These expanding applications position E-Diesel as a versatile replacement for conventional diesel.

- For instance, Emirates (from above) used 100 % SAF in one engine of its A380, confirming the possibility of drop-in synthetic fuels in aviation – a major segment beyond automotive.

Rising Integration of Wind and Solar in E-Diesel Production

Wind and solar are becoming primary energy sources for renewable diesel production due to falling equipment costs and wider grid integration. Wind holds a strong advantage with high output stability, while solar supports decentralized on-site generation. This trend increases production reliability and reduces carbon intensity. As renewable installations grow worldwide, E-Diesel producers gain access to cheaper and cleaner electricity, creating major opportunities for plant expansion in suitable regions.

- For instance, Siemens Gamesa’s SG 14-222 DD offshore wind turbine (14 MW class) enters series production in 2024, enabling larger renewable electricity supply for synthetic fuel plants.

Key Challenges

High Production and Infrastructure Costs

E-Diesel production remains expensive due to energy-intensive processes, advanced catalysts, and the high cost of renewable hydrogen. These costs make E-Diesel less competitive compared to fossil diesel in many regions. Large investments are also required for synthetic fuel plants, pipelines, and storage systems. Limited refueling points slow market adoption in transportation and aviation. Reducing production cost and improving infrastructure availability remain the main barriers to large-scale deployment.

Limited Large-Scale Commercial Availability

The market faces challenges due to the small number of commercial-scale E-Diesel facilities. Most projects remain in pilot or early expansion stages, which restricts supply and raises fuel prices. Industries with high fuel demand, such as marine and aviation, struggle to secure stable volumes. Limited availability also slows long-term supply contracts that many operators require. Expanding production capacity is essential for improving market stability and driving broader adoption.

Regional Analysis

North America

North America holds a market share of about 34% in 2024 in the E-Diesel Market, driven by strong adoption of low-carbon fuels and expanding renewable energy capacity. The United States leads with new synthetic fuel projects supported by clean fuel standards and rapid wind and solar growth. Canada adds demand through strict emission-reduction plans and interest in renewable diesel for transportation and industry. The region benefits from advanced technology, strong R&D activity, and early commercial pilots that improve market readiness through 2032 as decarbonization policies strengthen.

Europe

Europe accounts for roughly 38% of the E-Diesel Market in 2024, making it the leading region. Growth comes from strict emission rules, national net-zero targets for 2030 and 2050, and high demand for renewable synthetic fuels in transport, marine, and aviation sectors. Countries such as Germany, Denmark, and the Netherlands expand offshore wind and power-to-liquid projects. Carbon pricing systems and renewable fuel mandates accelerate the move away from fossil diesel. Europe’s strong regulatory framework supports commercial plant deployment through 2032.

Asia Pacific

Asia Pacific holds a market share of around 22% in 2024, supported by rising energy needs and increasing interest in low-carbon fuels. China and Japan advance synthetic fuel technologies, while South Korea and Australia invest deeply in renewable hydrogen and solar-wind capacity. Strong industrial fuel demand and rapid urbanization push governments to adopt cleaner diesel alternatives. Manufacturing strength and large renewable projects position the region for high expansion through 2032 as decarbonization policies intensify.

Latin America

Latin America represents about 4% of the E-Diesel Market in 2024, driven by expanding renewable power capacity and interest in sustainable transport fuels. Brazil leads due to its long biofuel experience and rising focus on synthetic fuel pathways. Chile and Uruguay continue to build strong wind and solar projects that support future power-to-liquid production. Commercial production remains limited in 2024, yet investment in green hydrogen improves long-term prospects through 2032. The region aims to lower fossil fuel dependence, creating future demand.

Middle East and Africa

Middle East and Africa account for nearly 2% of the E-Diesel Market in 2024, supported by early renewable hydrogen projects and growing solar investments. The United Arab Emirates and Saudi Arabia expand large-scale green energy zones that may support synthetic diesel production by 2030. Africa’s adoption remains low, although South Africa explores opportunities tied to industrial use and solar capacity. Infrastructure gaps and high project costs slow progress in 2024, but long-term diversification plans create emerging opportunities through 2032.

Market Segmentations:

By Renewable Source

By Technology

- Fischer-Tropsch

- eRWGS

- Others

By Application

- Automotive

- Marine

- Aviation

- Industrial

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the E-Diesel Market features key players such as FuelCellEnergyInc., ArcadiaeFuels, LanzaJet, MANEnergySolutions, Porsche, CleanFuelsAllianceAmerica, SunfireGmbH, LiquidWind, ClimeworksAG, CeresPowerHoldingPlc, NorskE-FuelAS, BallardPowerSystemsInc., eFuelPacificLimited, ElectrochaeaGmbH, ExxonMobil, and HIFGlobal. Companies in this market focus on expanding renewable diesel production capacity, improving conversion efficiency, and reducing overall production costs. Many firms invest in power-to-liquid technologies and renewable hydrogen projects to strengthen supply chains for large-scale synthetic fuel output. Strategic partnerships with energy producers, technology developers, and transportation sectors support faster commercialization of E-Diesel. Several participants also work on integrating wind and solar power into production systems to lower carbon intensity. Continuous innovation in reactors, catalysts, and carbon-capture systems helps improve fuel quality and operational reliability. Expansion into aviation, marine, and heavy-duty transport markets strengthens long-term growth as global decarbonization policies accelerate demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ArcadiaeFuels

- LanzaJet

- MANEnergySolutions

- Porsche

- CleanFuelsAllianceAmerica

- SunfireGmbH

- LiquidWind

- ClimeworksAG

- CeresPowerHoldingPlc

- NorskE-FuelAS

- eFuelPacificLimited

- ElectrochaeaGmbH

- ExxonMobil

- HIFGlobal

Recent Developments

- In 2025, Arcadia eFuels received an environmental permit from the Danish Environmental Protection Agency for the operation of full-scale production of electro-sustainable aviation fuel (eSAF), including eDiesel, at their facility in Vordingborg, Denmark.

- In 2025, Climeworks AG continued to lead in Direct Air Capture (DAC) technology, supplying captured CO2 for producing carbon-neutral fuels including E-Diesel.

- In 2024, Ballard announced a 15 MW order for fuel cell modules for European stationary power, supporting a shift from diesel generators toward hydrogen-based systems that complement future e-fuel use.

Report Coverage

The research report offers an in-depth analysis based on Renewable Source, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly as more countries adopt strict emission rules.

- Production capacity will rise as large power-to-liquid plants move from pilot to commercial scale.

- Renewable hydrogen development will strengthen the cost efficiency of E-Diesel.

- Automotive, marine, and aviation sectors will accelerate the shift toward low-carbon synthetic fuels.

- Wind and solar integration will improve production stability and reduce overall fuel emissions.

- Technology upgrades will lower operational costs and boost large-scale fuel output.

- Government incentives will attract new investments into synthetic diesel projects.

- Fuel blending regulations will encourage wider use of E-Diesel in transport fleets.

- Corporate net-zero commitments will increase long-term demand for renewable diesel solutions.

- Global energy diversification strategies will position E-Diesel as a key component of future clean-fuel systems.