Market Overview

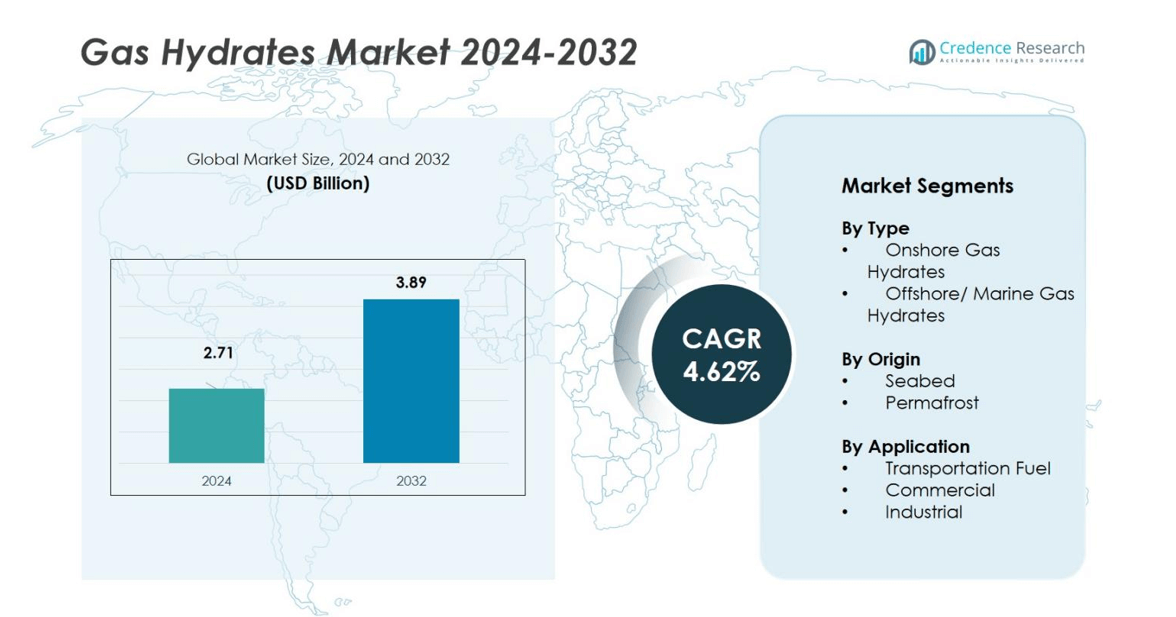

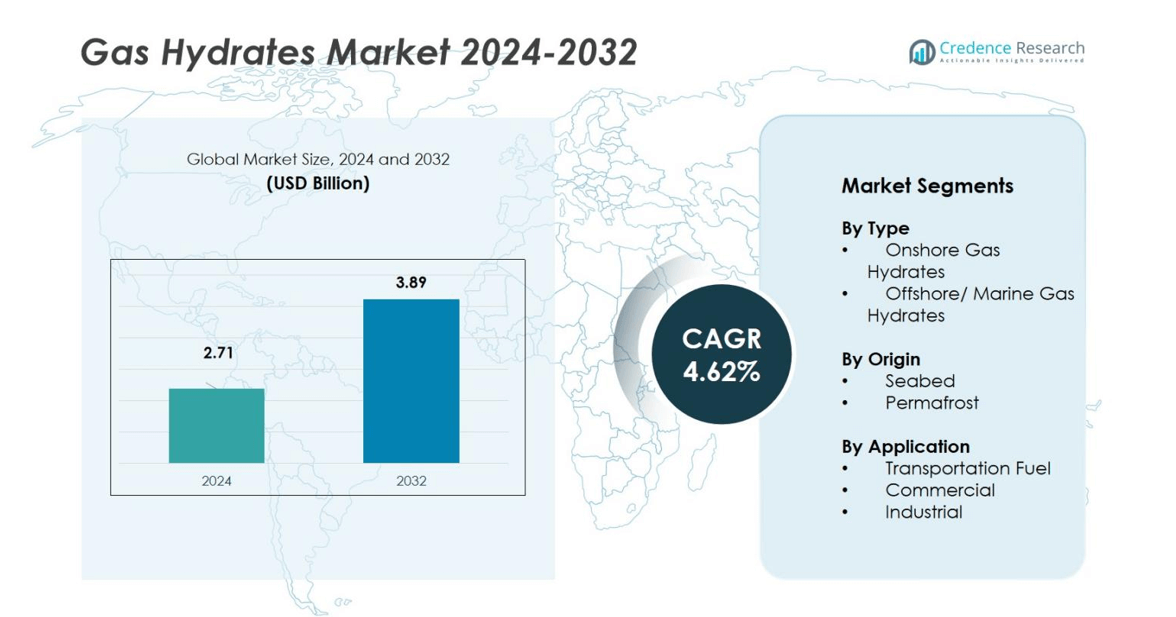

The Gas Hydrates Market size was valued at USD 2.71 billion in 2024 and is anticipated to reach USD 3.89 billion by 2032, growing at a CAGR of 4.62% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gas Hydrates Market Size 2024 |

USD 2.71 billion |

| Gas Hydrates Market, CAGR |

4.62% |

| Gas Hydrates Market Size 2032 |

USD 3.89 billion |

The Gas Hydrates Market is led by major players such as Shell Plc, BP plc, TotalEnergies S.E., Chevron Corporation, Equinor ASA, PetroChina Company Limited, Sinopec, Indian Oil Corporation (IOC), Oil and Natural Gas Corporation (ONGC), and Japan Oil, Gas and Metals National Corporation (JOGMEC). These companies focus on strategic partnerships, offshore exploration, and technological advancements to enhance gas hydrate extraction. Asia-Pacific dominates the global market with a 41% share in 2024, driven by strong government-backed projects in Japan, China, and India. North America follows with a 29% share, supported by large offshore reserves and advanced drilling initiatives in the U.S. and Canada.

Market Insights

- The Gas Hydrates Market was valued at USD 2.71 billion in 2024 and is projected to reach USD 3.89 billion by 2032, growing at a CAGR of 4.62% during the forecast period.

- Rising global energy demand and government-backed offshore exploration projects drive market growth, with strong investments in advanced drilling and depressurization technologies.

- Offshore or marine gas hydrates dominate with a 72% share, supported by rapid adoption of subsea recovery techniques and environmental sustainability initiatives.

- The market is moderately competitive, with key players such as Shell, BP, Chevron, PetroChina, and ONGC focusing on pilot production, AI-based reservoir monitoring, and joint exploration programs.

- Asia-Pacific leads with a 41% regional share, followed by North America at 29%, as Japan, China, India, and the U.S. expand offshore projects and enhance methane recovery capabilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Offshore or marine gas hydrates dominate the Gas Hydrates Market with a share of 72% in 2024. This dominance is driven by the extensive presence of hydrate reserves in continental margins and deep-sea sediments. Offshore extraction technologies, such as depressurization and thermal stimulation, are improving efficiency and safety in production. Government-funded exploration projects in Japan, China, and the U.S. further boost offshore development. In contrast, onshore hydrates, holding 28% share, face limitations due to lower reserves and complex permafrost extraction conditions.

- For instance, Japan Petroleum Exploration Company Limited (JAPEX) has led multiple offshore production tests at the Daini-Atsumi Knoll, demonstrating sustained gas recovery and operational learning since early trials.

By Origin

Seabed-origin gas hydrates lead the market, accounting for 68% share in 2024, supported by rich methane reserves in marine sediments and large-scale exploration efforts. Advances in drilling and subsea recovery technologies enhance the economic feasibility of seabed hydrate extraction. Growing investments in offshore energy diversification strengthen segment growth. The permafrost-origin segment, holding 32% share, is expanding steadily due to its potential in Arctic regions, though environmental challenges and logistical issues constrain its commercial development.

- For instance, the Prudhoe Bay trial on Alaska’s North Slope, conducted by JOGMEC with US Department of Energy support, targets methane hydrate production from onshore permafrost layers.

By Application

The transportation fuel segment dominates the market with a 59% share in 2024, driven by the global shift toward clean and efficient energy sources. Methane extracted from hydrates serves as a promising alternative to conventional fossil fuels. Governments are supporting pilot projects to use hydrate-derived gas in LNG and vehicular fuel applications. The industrial segment, with a 25% share, benefits from rising use in power generation, while the commercial segment holds 16%, mainly used for research, heating, and localized energy applications.

Key Growth Drivers

Rising Global Energy Demand

Increasing global energy consumption drives exploration of alternative energy resources like gas hydrates. With natural gas demand surging across Asia-Pacific and Europe, hydrates offer a vast and untapped energy reserve. The abundance of methane hydrates in seabed deposits provides a potential solution to reduce dependency on conventional fossil fuels. Nations such as Japan, China, and India are investing in pilot extraction projects to secure long-term energy supplies, creating strong growth momentum for the gas hydrates market.

- For instance, Japan’s MH21 research program, launched in 2001, has successfully conducted two experimental offshore production tests in the Nankai Trough (in 2013 and 2017), demonstrating methane gas extraction through depressurization.

Advancements in Extraction and Drilling Technologies

Technological innovations in subsea drilling and depressurization techniques are improving the commercial viability of gas hydrate recovery. Modern tools, including remotely operated vehicles (ROVs) and high-pressure coring systems, enhance precision and reduce environmental risks. These advancements lower operational costs and make large-scale hydrate extraction more feasible. Government-supported R&D initiatives, particularly in Japan and South Korea, further accelerate the adoption of advanced methods, enabling safer and more sustainable energy production from marine deposits.

- For instance, Indian startup EyeROV secured a multi-million dollar contract to supply remotely operated vehicles (ROVs) with advanced 4K imaging and deepwater capabilities to the Indian Navy, exemplifying progress in subsea inspection and operational technology crucial for underwater energy resources.

Supportive Government Policies and Investments

Government support through funding, partnerships, and exploration programs is a key growth enabler. Energy ministries and research institutions worldwide are actively promoting hydrate development to ensure energy diversification. Strategic collaborations among oil and gas majors like Shell, Chevron, and ONGC with national agencies drive pilot production projects. Policy incentives focusing on methane emission reduction and resource sustainability also encourage private investment. This policy-driven momentum is positioning gas hydrates as a key component of future clean energy strategies.

Key Trends and Opportunities

Integration into Clean Energy Transition

Gas hydrates are gaining prominence as part of the global clean energy transition. Methane extracted from hydrates emits fewer pollutants than coal or oil, aligning with carbon reduction goals. The transition to low-carbon fuels increases interest in gas hydrates as an interim solution before achieving full renewable adoption. Companies are integrating hydrate research into broader natural gas portfolios to balance sustainability and profitability, positioning the resource as a future-ready energy source.

- For instance, Chevron Corporation is actively involved in gas hydrate research, focusing on technologies for safe and efficient methane recovery as part of its broader natural gas portfolio to ensure environmental sustainability alongside profitability.

Growing Offshore Exploration Initiatives

Expanding offshore drilling programs in Asia-Pacific, especially in Japan, China, and India, present significant opportunities. Successful offshore production tests have proven the technical feasibility of large-scale hydrate recovery. Partnerships between national governments and energy corporations support advanced research on deep-sea methane extraction. Increasing investment in marine technologies and data-driven reservoir mapping helps identify new reserves, establishing offshore regions as the primary growth frontier for the gas hydrates market.

- For instance, JX Nippon Oil & Gas Exploration Corporation recently acquired Japan’s only offshore drilling company, Japan Drilling Co., to strengthen its offshore exploration capabilities and support the country’s deepwater gas development efforts.

Key Challenges

High Extraction and Production Costs

The commercial development of gas hydrates faces major cost challenges. Extraction requires complex technologies and specialized infrastructure, increasing operational expenses. Compared to conventional natural gas, hydrate extraction remains economically less viable. Uncertainties in long-term profitability and fluctuating energy prices discourage private sector investments. Without technological breakthroughs to reduce costs, widespread adoption of hydrate-based energy production remains limited to government-backed pilot projects.

Environmental and Safety Concerns

Environmental risks associated with hydrate extraction pose critical challenges. Methane release during drilling can contribute to greenhouse gas emissions and climate change. Disturbance of seabed ecosystems and potential underwater landslides add to environmental concerns. Regulators are tightening standards to mitigate ecological damage, increasing compliance costs. Developing safe and environmentally sustainable extraction processes is essential for gaining public and regulatory acceptance, making environmental management a key obstacle in the market’s expansion.

Regional Analysis

North America

North America holds a 29% market share in the global gas hydrates market, driven by extensive offshore reserves in the Gulf of Mexico and the Arctic. The U.S. and Canada lead exploration initiatives supported by strong government funding and R&D activities. The U.S. Department of Energy’s methane hydrate program continues to advance extraction technologies and environmental safety measures. Growing energy security concerns and technological readiness position North America as a strategic hub for future large-scale gas hydrate production and commercialization.

Asia-Pacific

Asia-Pacific dominates the gas hydrates market with a 41% share in 2024, supported by large offshore deposits across Japan, China, and India. Japan’s successful pilot production tests and China’s exploration projects in the South China Sea drive regional growth. India’s National Gas Hydrate Program (NGHP) further strengthens its position in marine energy exploration. Rapid industrialization and surging energy demand increase reliance on unconventional gas resources. The region’s proactive government policies and expanding energy infrastructure make it the most dynamic market globally.

Europe

Europe accounts for 14% of the global market, led by initiatives in Norway and the United Kingdom. The region’s focus on low-carbon energy and sustainable fuel alternatives supports hydrate research and development. Equinor ASA and TotalEnergies are investing in feasibility studies for methane hydrate recovery in the North Atlantic. Environmental regulations encourage safe exploration methods while balancing energy diversification goals. Europe’s strong policy support and innovation-driven approach create opportunities for advanced hydrate extraction technologies.

Latin America

Latin America represents a 9% market share, driven by untapped hydrate reserves in Brazil and Chile’s offshore basins. Growing collaboration between regional energy companies and global oil majors fuels exploration programs. Government-backed initiatives promoting energy diversification are fostering investments in alternative resources like hydrates. Although infrastructure limitations and technical barriers persist, rising energy demand and resource-rich coastal zones position the region as a potential growth frontier for hydrate development projects in the coming years.

Middle East & Africa

The Middle East & Africa hold a 7% share in the global gas hydrates market, primarily led by exploratory studies in South Africa and Oman. The region’s interest in methane hydrates is increasing as part of long-term strategies for energy security and diversification. Ongoing research partnerships with international energy firms support early-stage feasibility assessments. However, limited technological readiness and high exploration costs restrict widespread adoption. With growing energy demand, gradual advancements in offshore exploration are expected to strengthen the region’s role in future market expansion.

Market Segmentations:

By Type

- Onshore Gas Hydrates

- Offshore/ Marine Gas Hydrates

By Origin

By Application

- Transportation Fuel

- Commercial

- Industrial

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Gas Hydrates Market features major players such as Shell Plc, BP plc, TotalEnergies S.E., Chevron Corporation, Equinor ASA, PetroChina Company Limited, Sinopec, Indian Oil Corporation (IOC), Oil and Natural Gas Corporation (ONGC), and Japan Oil, Gas and Metals National Corporation (JOGMEC). These companies focus on strategic collaborations, technological innovation, and pilot exploration programs to enhance hydrate extraction efficiency. Multinational energy firms are partnering with government agencies to develop sustainable offshore recovery technologies, particularly in Asia-Pacific and North America. Companies like Shell and Chevron are advancing deep-sea drilling techniques, while PetroChina and ONGC lead regional exploration initiatives. Increasing R&D investments, coupled with environmental compliance strategies, are driving competitive differentiation. Market players are also pursuing digitalization through AI-based reservoir analysis and real-time monitoring to optimize production. The competition is characterized by long-term exploration contracts, joint ventures, and technology-sharing agreements shaping the future of the gas hydrates industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Shell Plc

- BP plc

- TotalEnergies S.E.

- Chevron Corporation

- Equinor ASA

- PetroChina Company Limited

- Sinopec

- Indian Oil Corporation (IOC)

- Oil and Natural Gas Corporation (ONGC)

- Japan Oil, Gas and Metals National Corporation (JOGMEC)

Recent Developments

- In October 2025, Japan Oil, Gas and Metals National Corporation (JOGMEC) signed a memorandum of understanding with PetroVietnam, ENEOS Xplora, and Nghi Son 2 Power LLC. The collaboration aims to advance carbon capture and storage (CCS) technologies and strengthen Japan’s broader gas hydrate development initiatives across Asia.

- In August 2025, Abu Dhabi National Oil Company (ADNOC) entered a 15-year LNG sale and purchase agreement with Indian Oil Corporation Limited (IOCL). The deal supports India’s growing natural gas demand while indirectly boosting long-term prospects for gas hydrate exploration and supply chain integration.

- In February 2025, Oil and Natural Gas Corporation Limited (ONGC) formed a three-year strategic partnership with bp p.l.c. to enhance exploration and production initiatives. The partnership also emphasizes low-carbon technology exchange, trading cooperation, and offshore gas development in India and global markets.

- In August 2024, the U.S. Department of Energy (DOE) and its international partners successfully completed a long-term gas hydrate production test at Alaska’s North Slope. This milestone demonstrates significant progress in advancing gas hydrate extraction and production technologies

Report Coverage

The research report offers an in-depth analysis based on Type, Origin, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Offshore gas hydrate exploration will expand with improved subsea drilling and production technologies.

- Governments will increase funding for methane hydrate research and pilot extraction projects.

- Asia-Pacific will remain the leading region due to strong national exploration programs.

- Technological innovation will reduce extraction costs, improving commercial viability.

- Collaboration between oil majors and research institutions will accelerate field testing.

- Environmental regulations will shape sustainable and safe hydrate extraction practices.

- Digital tools like AI and data analytics will enhance reservoir identification and monitoring.

- Gas hydrates will gain importance as a transitional clean energy source.

- New partnerships will emerge to develop global supply chains for methane-based fuels.

- Continued investment in marine infrastructure will drive large-scale hydrate production by 2032.