Market Overview

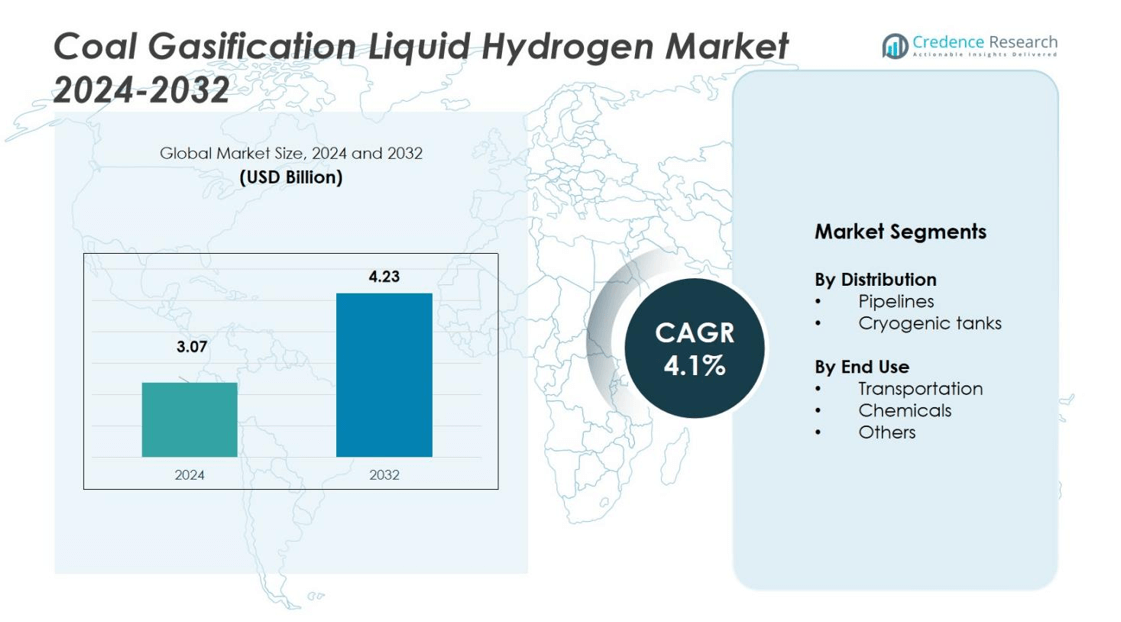

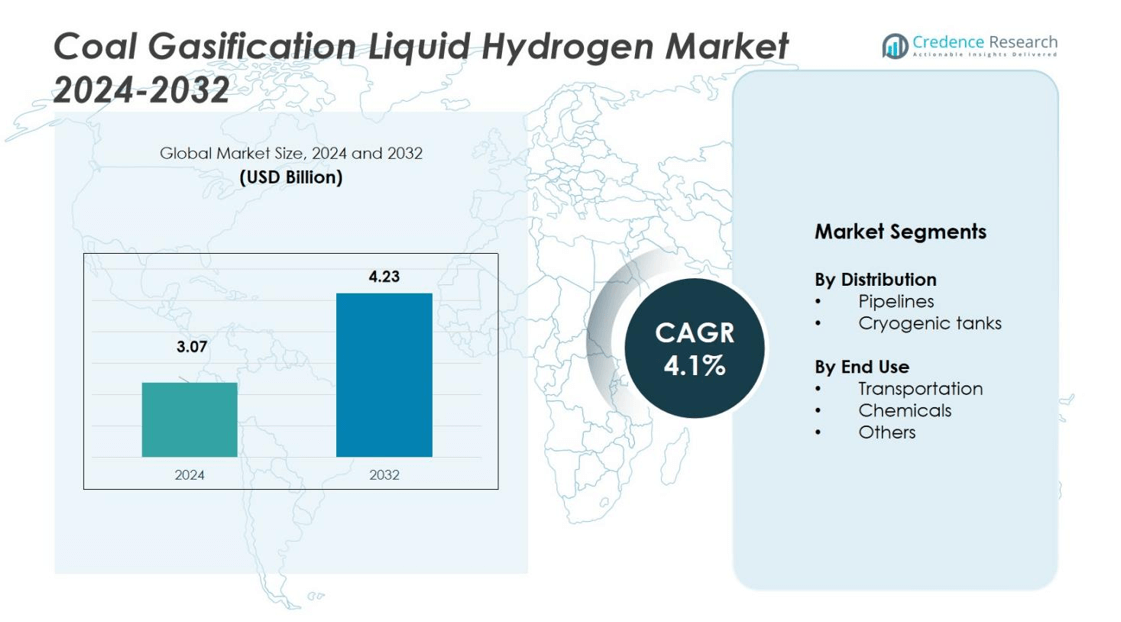

The Coal Gasification Liquid Hydrogen Market size was valued at USD 3.07 billion in 2024 and is anticipated to reach USD 4.23 billion by 2032, growing at a CAGR of 4.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Coal Gasification Liquid Hydrogen Market Size 2024 |

USD 3.07 billion |

| Coal Gasification Liquid Hydrogen Market, CAGR |

4.1% |

| Coal Gasification Liquid Hydrogen Market Size 2032 |

USD 4.23 billion |

The Coal Gasification Liquid Hydrogen Market is led by prominent companies including Linde Plc, Air Liquide, Air Products and Chemicals, Inc., KBR, Inc., J-Power, Iwatani Corporation, Kawasaki Heavy Industries, Ltd., General Electric Power, Messer, and Loy Yang Power. These players focus on technological innovation, strategic alliances, and large-scale infrastructure projects to strengthen their market presence. Linde and Air Liquide dominate hydrogen liquefaction and distribution technologies, while KBR and GE Power specialize in advanced gasification systems. Asia Pacific leads the market with a 37% share in 2024, driven by extensive hydrogen initiatives, growing infrastructure investments, and strong government support for clean energy transition.

Market Insights

- The Coal Gasification Liquid Hydrogen Market was valued at USD 3.07 billion in 2024 and is projected to reach USD 4.23 billion by 2032, growing at a CAGR of 4.1%.

- Rising demand for clean hydrogen fuels and government-backed decarbonization programs are driving market expansion across industrial and transportation sectors.

- Integration of carbon capture and storage technologies and advancements in gasification systems are shaping major market trends.

- The market is moderately consolidated, with key players such as Linde Plc, Air Liquide, and KBR, Inc. focusing on technology partnerships and infrastructure development.

- Asia Pacific leads with a 37% regional share, while the pipelines segment holds 58% and transportation end use accounts for 46%, supported by large-scale hydrogen infrastructure projects and growing zero-emission mobility initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Distribution

The pipelines segment dominates the Coal Gasification Liquid Hydrogen Market with a 58% share in 2024. Pipelines remain the preferred distribution mode due to their efficiency in large-scale hydrogen transfer and lower operational costs compared to cryogenic tanks. The infrastructure expansion for hydrogen transport networks, especially in industrial clusters, strengthens this segment’s position. Cryogenic tanks account for the remaining 42% share, catering to decentralized facilities and short-distance logistics. The rising demand for flexible and mobile hydrogen storage systems continues to support steady growth in cryogenic tank adoption.

- For instance, the SoutH2 Corridor project plans a 3,000 km hydrogen pipeline connecting North Africa to Europe, repurposing natural gas pipelines to transport up to 4 million tons of hydrogen annually by 2030.

By End Use

The transportation segment leads the market with a 46% share in 2024, driven by the rising adoption of hydrogen-fueled vehicles and government initiatives for zero-emission mobility. The growing network of hydrogen refueling stations across major economies further supports this dominance. The chemicals segment follows with a 38% share, driven by its extensive use of hydrogen in ammonia and methanol production. The “others” category, holding 16% share, includes applications in power generation and metal refining, where hydrogen’s role in decarbonization is steadily expanding.

- For instance, BASF has begun producing green hydrogen-based ammonia at its Ludwigshafen site, utilizing renewable hydrogen to lower fossil fuel consumption.

Key Growth Drivers

Rising Demand for Clean Hydrogen Production

The transition toward low-carbon energy sources strongly drives the Coal Gasification Liquid Hydrogen Market. Hydrogen derived from coal gasification, combined with carbon capture technology, offers a cost-effective way to meet clean fuel needs. Governments in major economies are investing in hydrogen hubs and decarbonization programs to support large-scale deployment. The integration of gasification plants with renewable energy storage systems enhances energy efficiency. This rising focus on sustainable hydrogen production significantly boosts demand across transportation, power, and industrial applications.

- For instance, ExxonMobil is scaling up low-carbon hydrogen production at its Baytown, Texas facility, aiming to produce 1 billion cubic feet of hydrogen daily while capturing more than 98% of associated CO2 emissions, potentially reducing site-wide emissions by 30%.

Technological Advancements in Gasification Processes

Ongoing innovations in gasification and carbon capture technologies fuel market growth. Modern gasification systems improve hydrogen yield and reduce emissions through optimized temperature and pressure control. Companies are introducing integrated gasification combined cycle (IGCC) systems to achieve higher efficiency. The development of advanced catalysts and membrane separation techniques further enhances hydrogen purity. These technological improvements reduce operational costs and strengthen the competitiveness of coal-based hydrogen against other low-carbon alternatives.

- For instance, the Osaki CoolGen Project in Japan integrates coal gasification with combined cycle power generation, aiming to reduce CO2 emissions significantly through advanced oxygen-blown gasifiers and carbon capture units.

Government Incentives and Infrastructure Expansion

Strong policy support from governments accelerates the growth of coal gasification-based hydrogen projects. Subsidies, carbon credits, and tax incentives encourage private investments in hydrogen infrastructure. Countries such as Japan, China, and the United States have launched national hydrogen roadmaps to boost production capacity. Expansion of transportation pipelines and refueling networks ensures stable supply for end users. This policy-driven approach creates a favorable environment for scaling up commercial operations and attracting industrial collaboration.

Key Trends & Opportunities

Integration of Carbon Capture and Storage (CCS)

The integration of carbon capture and storage (CCS) systems is becoming a major trend in coal-based hydrogen projects. CCS technology allows producers to trap up to 90% of carbon emissions generated during gasification. This approach helps countries meet their net-zero commitments and attract green financing. The growing emphasis on low-carbon hydrogen certification also creates new investment opportunities. Companies adopting CCS-integrated hydrogen systems gain a competitive edge by aligning with global sustainability standards.

- For instance, for the Tokyo 2020 Olympics, Toyota and Hino deployed approximately 100 hydrogen fuel-cell buses, known as the Sora, with each powered by two Mirai-derived fuel cell stacks, each producing 114 kW of output.

Emerging Opportunities in Transportation Sector

The transportation sector presents vast growth potential for liquid hydrogen produced from coal gasification. The expansion of hydrogen-powered vehicle fleets and refueling networks supports this trend. Governments are investing heavily in fuel cell electric buses, trucks, and trains to reduce fossil fuel reliance. Hydrogen’s high energy density makes it a preferred fuel for long-range and heavy-duty transport. This emerging demand from mobility applications is expected to reshape supply chains and stimulate new partnerships in logistics.

- For instance, the Hyundai XCIENT Fuel Cell heavy-duty truck fleet has logged over 15 million kilometres in commercial service across Europe, highlighting hydrogen mobility’s real-world deployment.

Key Challenges

High Production and Infrastructure Costs

One of the main challenges for the Coal Gasification Liquid Hydrogen Market is high production and infrastructure costs. Establishing gasification and liquefaction plants requires large capital investments and advanced equipment. Transporting and storing liquid hydrogen also demand expensive cryogenic facilities. Limited pipeline networks and refueling stations further increase distribution costs. These factors restrict large-scale adoption, particularly in emerging economies with lower investment capacity and fewer hydrogen-ready assets.

Environmental and Regulatory Concerns

Despite emission control technologies, coal-based hydrogen production still faces environmental scrutiny. Regulatory frameworks in developed regions are tightening to limit carbon footprints and encourage renewable hydrogen alternatives. The dependence on coal feedstock raises sustainability concerns, making compliance with international emission standards challenging. Delays in obtaining environmental clearances can also slow project implementation. Addressing these challenges requires stronger integration of carbon capture systems and cleaner feedstock strategies.

Regional Analysis

North America

North America holds a 29% share of the Coal Gasification Liquid Hydrogen Market in 2024. The region benefits from strong investments in hydrogen infrastructure, particularly in the United States, where federal incentives and clean energy policies drive adoption. Integration of carbon capture systems with coal gasification plants supports low-emission hydrogen production. Canada’s growing interest in clean fuel technologies further strengthens regional demand. The presence of major players and advanced R&D activities enhances the region’s competitive advantage in the global market.

Europe

Europe accounts for a 24% market share in 2024, supported by its commitment to carbon neutrality and strong environmental regulations. Countries such as Germany and the U.K. are promoting hydrogen as part of their decarbonization strategies. Investments in pilot projects using coal gasification with carbon capture improve regional hydrogen supply chains. The European Union’s Hydrogen Strategy and funding programs encourage private sector participation. Continuous advancements in clean technology and the rise of industrial hydrogen clusters position Europe as a key contributor to global hydrogen development.

Asia Pacific

Asia Pacific leads the global market with a 37% share in 2024, driven by large-scale hydrogen initiatives in China, Japan, and South Korea. China’s national hydrogen roadmap and heavy investments in coal gasification projects enhance domestic supply. Japan’s focus on hydrogen-fueled mobility and power generation further accelerates market growth. The region’s abundance of coal resources, combined with ongoing infrastructure development, supports cost-effective hydrogen production. Rising energy demand and government-backed clean fuel programs make Asia Pacific the fastest-growing regional segment.

Latin America

Latin America holds a 6% share of the Coal Gasification Liquid Hydrogen Market in 2024. The region is gradually exploring hydrogen potential through industrial partnerships and pilot-scale gasification projects. Brazil and Chile lead regional initiatives by integrating hydrogen technologies into existing energy systems. Limited infrastructure and investment constraints remain challenges, yet growing international collaboration supports technology transfer. The increasing focus on decarbonizing heavy industries and exports strengthens long-term market prospects for hydrogen development in the region.

Middle East & Africa

The Middle East & Africa region captures a 4% market share in 2024, driven by emerging hydrogen projects in the Gulf Cooperation Council (GCC) countries. The availability of natural resources and growing diversification of energy portfolios fuel regional interest. Saudi Arabia and the UAE are investing in hydrogen-based industrial zones and carbon capture projects. Africa’s coal reserves in South Africa present opportunities for local hydrogen generation. Despite infrastructure limitations, rising global partnerships and clean energy ambitions are fostering gradual growth across the region.

Market Segmentations:

By Distribution

- Pipelines

- Cryogenic tanks

By End Use

- Transportation

- Chemicals

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Coal Gasification Liquid Hydrogen Market features major players such as Linde Plc, Air Liquide, Air Products and Chemicals, Inc., KBR, Inc., J-Power, Iwatani Corporation, Kawasaki Heavy Industries, Ltd., General Electric Power, Messer, and Loy Yang Power. These companies compete through technological innovation, strategic partnerships, and large-scale project developments. Linde and Air Liquide lead in hydrogen liquefaction and storage technologies, while KBR and GE Power focus on gasification plant design and engineering solutions. Iwatani Corporation and Kawasaki Heavy Industries drive advancements in hydrogen transport and mobility applications. Continuous investments in carbon capture and storage (CCS) integration are a key differentiator among top players. Companies are also expanding regional collaborations, particularly in Asia Pacific, to strengthen production capacity and supply networks. The market remains moderately consolidated, with leading firms holding strong technological and financial capabilities that influence global industry direction.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Air Liquide

- KBR, Inc.

- Linde Plc

- J-Power

- Messer

- Iwatani Corporation

- Air Products and Chemicals, Inc.

- Kawasaki Heavy Industries, Ltd.

- General Electric Power

- Loy Yang Power

Recent Developments

- In March 2025, Aramco completed acquisition of a 50% stake in the “Blue Hydrogen Industrial Gases Company” (BHIG) alongside Air Products Qudra in Jubail, Saudi Arabia aimed at scaling hydrogen (including coal-derived pathways) with carbon capture.

- In June 2024, ExxonMobil announced an agreement with Air Liquide to collaborate on a low-carbon hydrogen and ammonia production project in Baytown, Texas.

- In March 2023, Electric Power Development Co., Ltd. (J-Power) and Sumitomo Corporation signed a memorandum of understanding to jointly study a clean hydrogen production project using gasified Latrobe Valley coal integrated with carbon capture and storage technology.

Report Coverage

The research report offers an in-depth analysis based on Distribution, End Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily driven by increasing adoption of clean hydrogen solutions.

- Integration of carbon capture and storage will become standard in new gasification plants.

- Asia Pacific will continue to dominate due to large-scale investments in hydrogen infrastructure.

- Technological innovation will improve conversion efficiency and lower production costs.

- Governments will strengthen hydrogen roadmaps supporting long-term energy transition goals.

- Transportation and industrial sectors will drive consistent demand for liquid hydrogen.

- Strategic alliances between technology providers and energy companies will increase.

- Expansion of hydrogen pipelines and refueling networks will enhance market accessibility.

- Environmental regulations will encourage coal-based hydrogen producers to adopt greener methods.

- Research in hybrid gasification using biomass and coal will open new sustainability pathways.