Market Overview

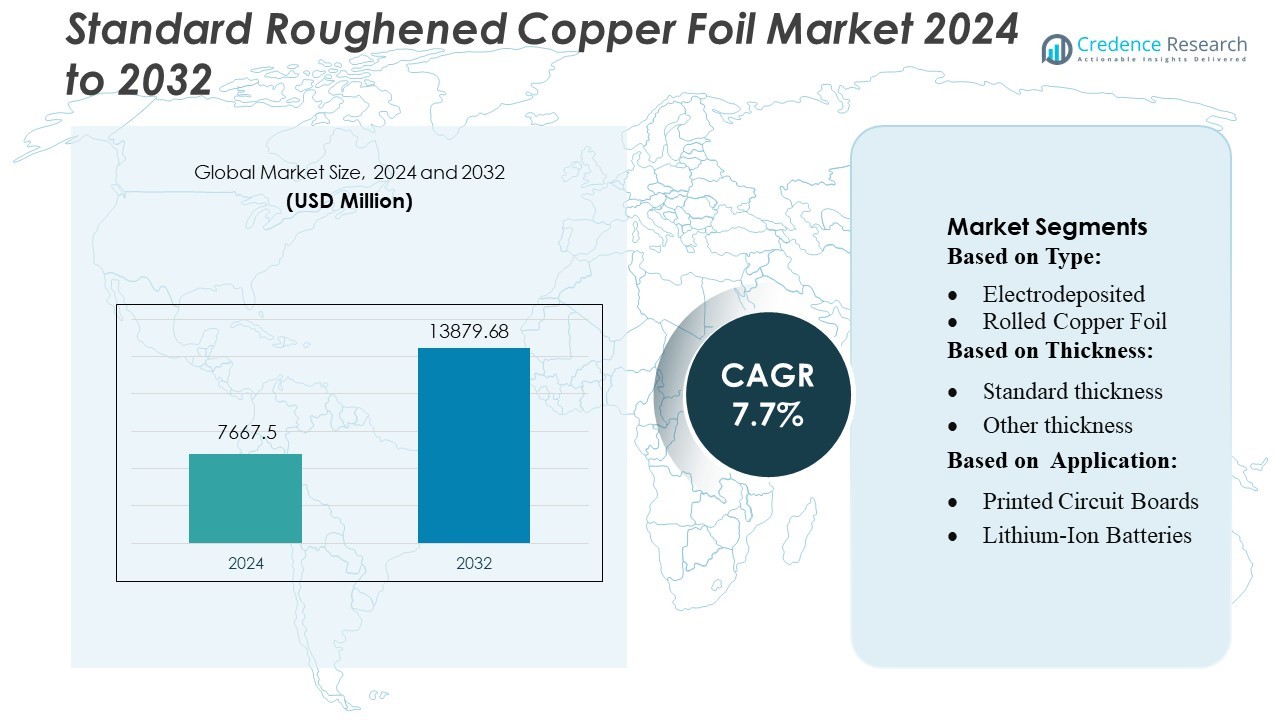

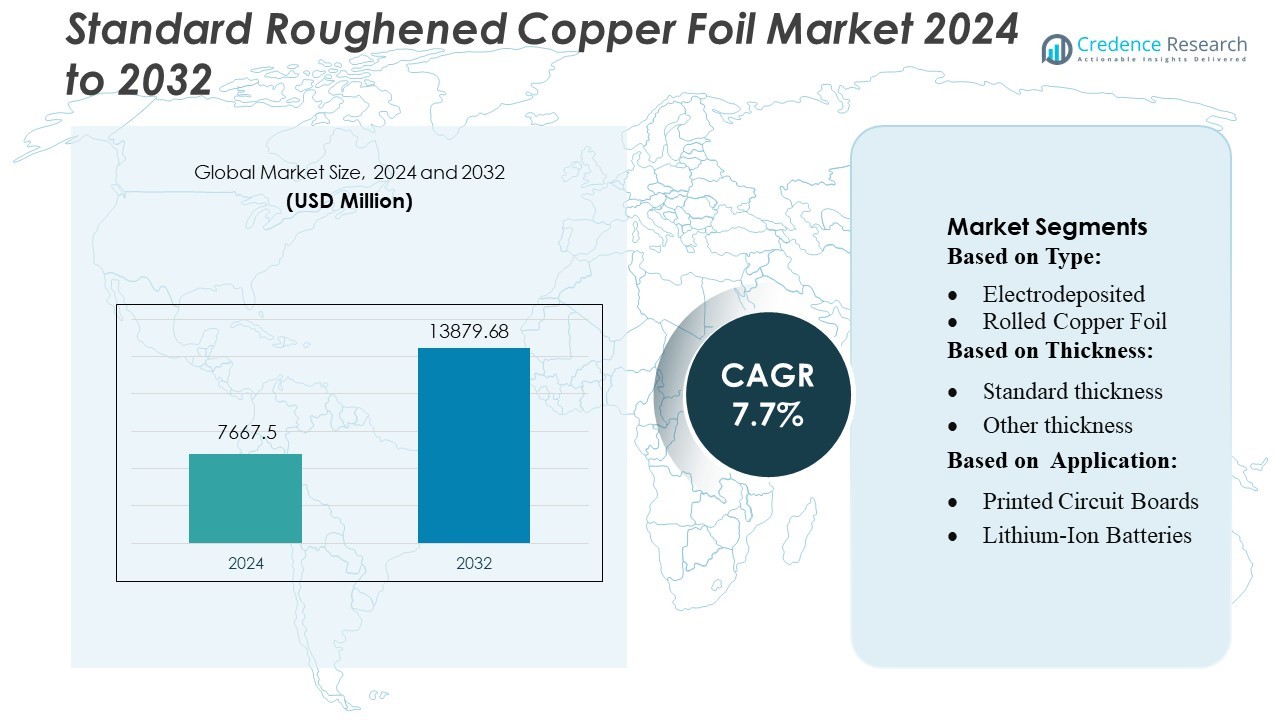

Standard Roughened Copper Foil Market size was valued USD 7667.5 million in 2024 and is anticipated to reach USD 13879.68 million by 2032, at a CAGR of 7.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Standard Roughened Copper Foil Market Size 2024 |

USD 7667.5 Million |

| Standard Roughened Copper Foil Market , CAGR |

7.7% |

| Standard Roughened Copper Foil Market Size 2032 |

USD 13879.68 Million |

The Standard Roughened Copper Foil Market—including Lingbao, Circuit Foils, SKC, LS Mtron, Doosan Electro-Materials, UACJ Foil, Lotte Energy Materials, Chang Chun, Nippon Denkai, and Furukawa Electric—are leading technological innovation and capacity expansion to cater to rising demand in automotive, electronics, and advanced packaging sectors. Their strategies emphasize high-adhesion, ultra-thin foils and sustainable refining processes. Geographically, North America emerges as the dominant region, capturing approximately 34.1 % of global market share, driven by its mature electronics industry, strong EV investments, and advanced PCB manufacturing capabilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Standard Roughened Copper Foil Market was valued at USD 7,667.5 million in 2024 and is projected to reach USD 13,879.68 million by 2032, registering a CAGR of 7.7%, supported by expanding electronics manufacturing and growing PCB adoption.

- Rising demand for high-adhesion, ultra-thin foils in EV batteries, 5G infrastructure, and advanced semiconductor packaging continues to drive market growth, strengthening requirements for durability and precision treatment.

- The market experiences strong competitive activity as leading players invest in capacity expansion, sustainable refining technologies, and next-generation surface-treatment processes to maintain technological leadership.

- Supply chain constraints, fluctuations in copper prices, and high production energy requirements act as restraints, challenging manufacturers to optimize operational efficiency and material sourcing.

- North America leads with 34.1% regional share, while the electronics segment dominates overall consumption, driven by PCB applications contributing the highest share among end-use segments.

Market Segmentation Analysis:

By Type

Electrodeposited (ED) copper foil dominates the Standard Roughened Copper Foil Market, accounting for an estimated around 65% share due to its cost-efficiency, uniform grain structure, and strong adhesion performance required for high-frequency circuit and battery applications. Its wide adoption is driven by rising demand for multilayer PCBs and improved thermal stability in power electronics. Rolled copper foil continues to grow in niche segments requiring superior flexibility, but ED foil remains the leading category as manufacturers prioritize scalable production capacity and consistent surface roughness suited for advanced electronic components.

- For instance, Lingbao Huaxin Copper Foil Technology operates an ED copper-foil production line with a verified annual capacity of 10,000 tons, enabling stable grain-orientation control essential for high-reliability PCB fabrication.

By Thickness

The Standard Thickness segment holds the dominant position with approximately 70% market share, supported by its compatibility with mainstream PCB manufacturing and lithium-ion battery current collectors. Its reliability in achieving stable peel strength and controlled roughness enhances process efficiency for large-volume production across automotive and consumer electronics applications. Other Thickness variants serve specialized uses requiring ultra-thin or reinforced structures, yet the industry continues to prefer standard profiles for their balanced electrical performance, ease of handling, and ability to meet evolving design needs in high-density interconnect substrates.

- For instance, Circuit Foil Luxembourg offers advanced, low-roughness copper foils, such as those in their ultrathin ranges, with a nominal roughness (Rz ISO) of ≤ 1.5 µm. This low roughness enables consistent adhesion and electrical performance essential for high-density and advanced PCB applications.

By Application

Printed Circuit Boards (PCBs) represent the leading application segment, capturing nearly 60% market share, driven by rapid proliferation of communication devices, servers, and automotive electronics. Demand for high-reliability interconnects, enhanced thermal dissipation, and stable adhesion properties reinforces the adoption of standard roughened copper foils in multilayer PCB architectures. Lithium-ion batteries exhibit strong growth momentum, particularly in EV and energy-storage systems, while electromagnetic shielding applications benefit from rising EMI concerns—but PCBs remain dominant due to their extensive consumption base and continuous product innovation cycles.

Key Growth Drivers

1. Rising Adoption in High-Frequency and High-Speed PCBs

The increasing use of high-frequency and high-speed printed circuit boards in telecommunications, automotive electronics, and industrial automation significantly drives demand for standard roughened copper foil. Manufacturers prefer this foil type because its optimized surface profile enhances adhesion strength, signal integrity, and thermal stability, which are essential for 5G base stations, radar systems, and advanced control modules. As electronic devices become increasingly compact and performance-intensive, the industry requires copper foils with stable electrical conductivity and improved interlaminar bonding, reinforcing its market expansion.

- For instance, SKC’s subsidiary SK Nexilis developed a V-grade copper foil with more than 30% higher elongation compared to its conventional V-foil, improving resilience to anode expansion in 4680 cylindrical EV battery cells.

2. Expansion of Electric Vehicles and Battery Technologies

The rapid scale-up of EV battery production accelerates the adoption of standard roughened copper foil for current collectors and battery management systems. Its uniform roughness, high mechanical strength, and durability enable efficient charge transfer and stable cycling performance, which are critical for lithium-ion and solid-state battery designs. As OEMs increase investments in gigafactories and high-power battery architectures, the need for reliable copper foils for anode current collectors rises sharply. This shift toward large-volume electric mobility strengthens long-term market growth for roughened foil producers.

- For instance, LS Mtron—through its former battery-foil business now carried on by KCFT—achieved mass production of 4 µm-thick copper foil, producing 30 km long rolls that are 1,400 mm wide.

3. Growth in Consumer Electronics Miniaturization

Consumer device manufacturers increasingly rely on standard roughened copper foil to support miniaturized PCBs with improved thermal dissipation and connectivity. Smartphones, wearables, and IoT devices require ultra-thin, high-adhesion foil grades that maintain conductivity despite reduced thickness. The ongoing push toward multi-layer boards, flexible circuits, and more compact assemblies boosts the need for foils with controlled roughness and enhanced peel strength. This trend, combined with accelerating production of smart home and portable electronics, expands the application scope and market demand for roughened copper foil.

Key Trends & Opportunities

1. Growing Shift Toward Low-Profile and Ultra-Low-Profile Foils

As signal loss becomes a critical challenge in high-frequency applications, manufacturers are increasingly investing in low-profile and ultra-low-profile roughened foils. These advanced variants reduce conductor surface roughness while preserving adhesion performance, enabling superior signal transmission for 5G networks and advanced data centers. The shift opens opportunities for producers to enhance manufacturing technologies such as controlled electro-deposition and micro-etching. Companies capable of supplying low-loss foil grades aligned with global digital infrastructure expansion stand to secure strong growth prospects.

- For instance, Doosan Corporation Electro-Materials offers the DS-9000 CCL which supports an ultra-low-profile ED copper layer and features ultra-low dielectric loss, making it suitable for 5G, 6G, and mmWave applications.

2. Increasing Automation and Process Optimization in Foil Manufacturing

Production lines are rapidly integrating automation, AI-driven quality monitoring, and chemical surface treatment advancements to improve foil consistency and performance. Automated profiling and inspection systems allow manufacturers to maintain stable roughness parameters while minimizing defects. This technological shift improves yield rates and supports the development of customized foil grades tailored to advanced electronics, EV batteries, and high-power systems. Companies that adopt smart manufacturing capabilities are well positioned to capture opportunities in emerging electronics and energy-storage applications.

- For instance, UACJ Foil Corporation uses CCD-camera-based surface lithium-ion battery aluminum foil, the company specifically mentions a rolling technology precise to within ±0.5 µm during production, ensuring defect-free shape and consistent thickness.

3. Rising Opportunity in Flexible and Wearable Electronics

Standard roughened copper foil is gaining traction in flexible printed circuits used in wearables, medical monitoring devices, and foldable consumer electronics. The opportunity emerges from rising demand for foils offering flexibility, fatigue resistance, and strong adhesion with polyimide substrates. As brands accelerate investments in next-generation flexible displays and smart textiles, suppliers can capitalize by producing thinner, bend-stable, and heat-resistant copper foil grades. The ongoing expansion of IoT-enabled wearable ecosystems strengthens prospects for specialized roughened copper foil solutions.

Key Challenges

1. Volatility in Copper Prices and Supply Chain Instability

Fluctuating global copper prices pose a major challenge for manufacturers relying heavily on stable raw material costs. Disruptions in mining output, transportation delays, and geopolitical uncertainties introduce variability in procurement cycles, affecting production planning and pricing strategies. These fluctuations pressure profit margins and create cost-management difficulties for suppliers aiming to maintain competitiveness. Companies must adopt diversified sourcing, long-term supply contracts, and improved recycling practices to mitigate the risks associated with raw material volatility.

2. Complex Production Requirements and High Quality-Control Standards

Producing standard roughened copper foil requires precise surface-profiling control, stringent material purity, and consistent mechanical properties. Even minor deviations in roughness, thickness uniformity, or peel strength can lead to PCB defects, product recalls, or customer rejections. Maintaining these quality standards demands significant investment in advanced surface-treatment lines, analytical instruments, and skilled personnel. Smaller manufacturers may struggle to keep pace with increasingly demanding electronics and battery industry specifications, creating barriers to entry and competitive pressure.

Regional Analysis

North America:

North America is the leading region in the standard roughened copper foil market, commanding approximately 34.1 % of global revenue. This dominance is driven by strong demand in high-technology electronics, especially printed circuit boards (PCBs) and advanced packaging, as well as rising investment in electric vehicle (EV) battery manufacturing. The U.S. and Canada benefit from well-established infrastructure, technological innovation, and proximity to major end-users. Growth is further supported by increased R&D in surface-modified foils and integration of copper in high-frequency and high-reliability applications.

Asia-Pacific:

The Asia-Pacific region holds roughly 30.5 % of the standard roughened copper foil market, making it the second-largest regional contributor. Rapid industrialization, mass production of consumer electronics, and surging EV penetration in countries such as China, Japan, South Korea, and India boost usage. In particular, China’s strong manufacturing ecosystem — spanning PCBs, lithium-ion batteries, and 5G infrastructure — underpins regional demand. Moreover, Asia-Pacific is projected to register the fastest CAGR over the forecast period, supported by low-cost production and aggressive capacity expansion.

Europe:

Europe accounts for about 25.3 % of the standard roughened copper foil market. The region benefits from mature electronics and automotive sectors, with stringent environmental regulations accelerating green mobility and renewable energy adoption. Germany, France, and the UK lead in consumer-electronics and EV battery applications. European demand is also supported by local production and a focus on high-quality, treated copper foils for advanced packaging and industrial systems. This steady market share reflects both stable demand and technological sophistication in foil manufacturing.

Latin America:

Latin America holds approximately 4.9 % of the global standard roughened copper foil market. The region is gaining traction as infrastructure and industrialization accelerate in Brazil, Mexico, and Argentina. Demand is particularly driven by telecommunications, solar energy installations, and flexible electronics. Although the region’s manufacturing base is less developed relative to North America or Asia, growing local capacity and foreign investment are contributing to a consistent increase in copper foil consumption. Latin America’s share reflects its emerging yet promising role in the broader global market.

Middle East & Africa:

The Middle East & Africa (MEA) region represents around 5.2 % of the standard roughened copper foil market. Though smaller in scale compared to other regions, MEA is experiencing increasing copper-foil demand due to infrastructure development, renewable energy projects, and expanding telecommunication networks. Countries such as the UAE, Saudi Arabia, and South Africa are investing in electronics manufacturing and energy storage, gradually increasing regional foil consumption. The region’s growth is expected to be driven by strategic investments in local production capabilities and green technology deployment.

Market Segmentations:

By Type:

- Electrodeposited

- Rolled Copper Foil

By Thickness:

- Standard thickness

- Other thickness

By Application:

- Printed Circuit Boards

- Lithium-Ion Batteries

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Standard Roughened Copper Foil Market features a competitive landscape shaped by leading manufacturers such as Lingbao, Circuit Foils, SKC, LS Mtron Ltd., Doosan Corporation Electro-Materials, UACJ Foil Corporation, Lotte Energy Materials, Chang Chun Group, Nippon Denkai, Ltd., and Furukawa Electric Co., Ltd. The Standard Roughened Copper Foil Market remains moderately consolidated, characterized by continuous technological upgrades, capacity expansion, and material innovation. Companies focus on enhancing foil adhesion, improving uniformity, and developing ultra-thin variants suitable for high-frequency PCBs, advanced semiconductor packaging, and next-generation EV batteries. The industry is witnessing increased investment in automation, energy-efficient refining processes, and precision surface-treatment technologies to meet stringent performance requirements. Strategic collaborations with PCB manufacturers and battery producers are becoming essential for strengthening market positioning. Additionally, firms emphasize global supply-chain resilience, regional diversification, and high-purity production standards to maintain a competitive edge in this evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Lingbao

- Circuit Foils

- SKC

- LS Mtron Ltd.

- Doosan Corporation Electro-Materials

- UACJ Foil Corporation

- Lotte Energy Materials

- Chang Chun Group

- Nippon Denkai, Ltd.

- Furukawa Electric Co., Ltd.

Recent Developments

- In April 2025, Destiny Copper, an innovative cleantech mineral recovery and processing company, announced a strategic partnership with BMI Group. BMI Group, a real-estate investment and value acceleration company, has purchased a minority stake in Destiny Copper.

- In February 2025, Anglo American announced that it had signed a memorandum of understanding (MoU) with Codelco, a Chilean mining company. The agreement involves Anglo American’s subsidiary, Anglo American Sur SA (AAS), which owns 50.1% of the company.

- In November 2024, Vedanta announced its plan to invest in copper production facilities in Saudi Arabia. This initiative is a part of nine investment agreements worth over signed by Saudi Arabia during the World Investment Conference in Riyadh.

- In January 2024, Volta Energy Solutions (VES) reinforced its commitment to the North American market, confirming it had started construction on a new battery copper foil plant in Granby, Quebec, to help fill a supply chain gap.

Report Coverage

The research report offers an in-depth analysis based on Type, Thickness, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to experience steady demand growth as PCB manufacturers adopt higher-performance substrates for advanced electronics.

- Increasing EV battery production will continue to strengthen the need for enhanced-adhesion copper foils with improved durability.

- Technological innovation will focus on ultra-thin, low-profile, and high-reliability foils suited for high-frequency and 5G applications.

- Manufacturers will expand production capacity and modernize facilities to meet rising global requirements.

- Sustainability initiatives will drive the adoption of energy-efficient and low-emission foil processing technologies.

- Supply-chain optimization will remain a priority as companies aim to mitigate volatility in raw material availability.

- Regional expansion in Asia, Europe, and North America will shape competitive positioning over the forecast period.

- Collaboration between foil producers and PCB or battery manufacturers will increase to support customized performance needs.

- Quality certification and compliance with stricter industry standards will influence procurement decisions.

- Digital manufacturing and automation will enhance operational efficiency and output consistency across production lines.