Market Overviews

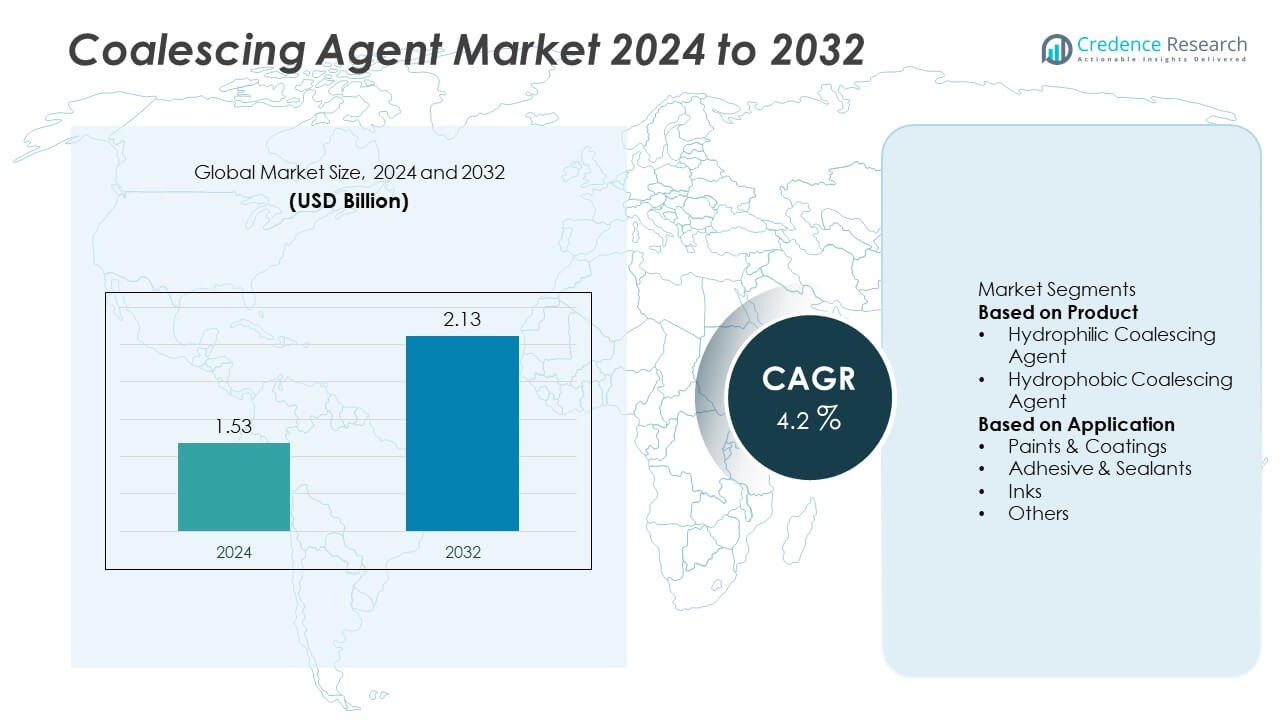

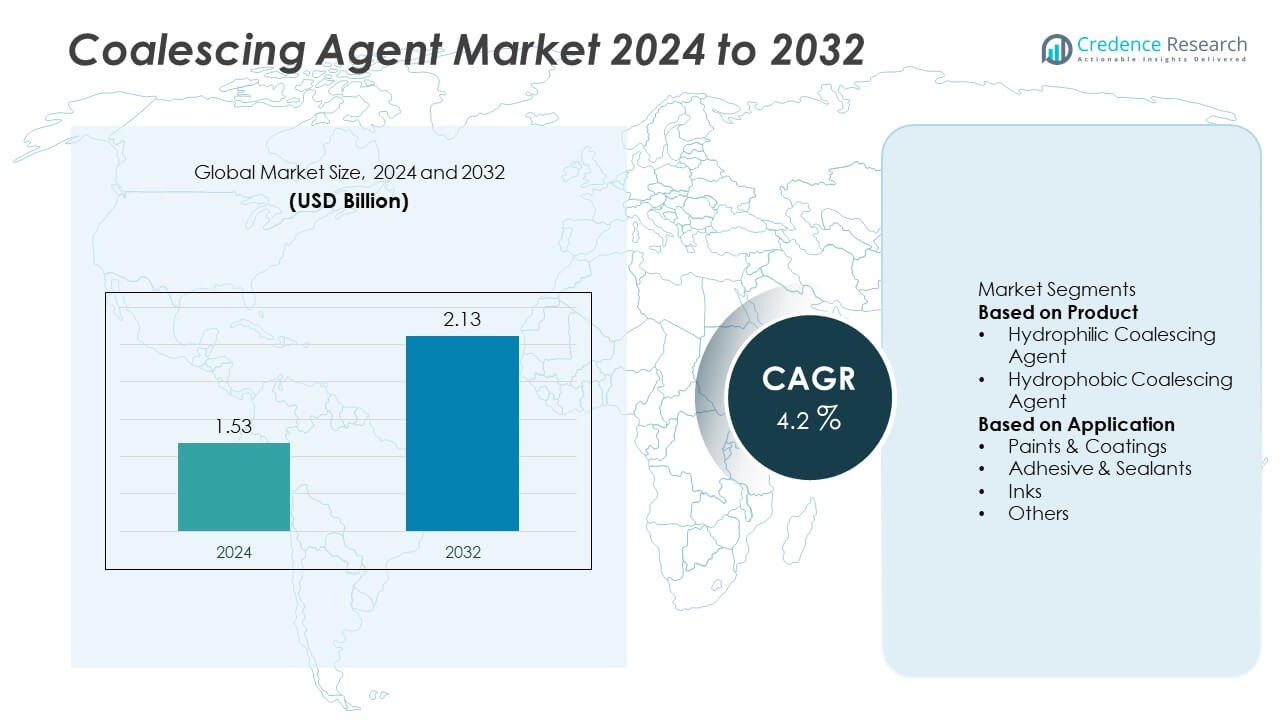

The Coalescing Agent market was valued at USD 1.53 billion in 2024 and is projected to reach USD 2.13 billion by 2032, growing at a CAGR of 4.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Coalescing Agent Market Size 2024 |

USD 1.53 Billion |

| Coalescing Agent Market, CAGR |

4.2% |

| Coalescing Agent Market Size 2032 |

USD 2.13 Billion |

The leading companies in the coalescing agent market—Stepan Company, Runtai New Material Co., Ltd., ADDAPT Chemicals B.V., PATCHAM(FZC), Chemoxy International Ltd, Hallstar, Krishna Antioxidants Pvt. Ltd. (Cristol), Cargill, Incorporated, Dow and Deborn—operate globally with strong presence across major regional markets. The Asia‑Pacific region leads the market with a share of 38.76% in 2024, supported by rapid industrialisation and infrastructure development across China and India. The North America and Europe regions follow, driven by mature coatings and adhesives industries demanding low‑VOC and high‑performance formulations. These companies leverage their expansive R&D capabilities and supply chains to capture emerging opportunities in the coatings, adhesives and inks segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Insights

- The global coalescing agent market size stood at USD 1.45 billion in 2024 and is projected to grow at a CAGR of 6.8% through 2030.

- Accelerated demand for eco‑friendly waterborne coatings and adhesives drives market growth, as formulators seek additives that improve film formation while meeting low‑VOC norms.

- Sustainability and innovation emerge as key trends, with hydrophobic types holding a leading share (35%) and paint & coatings applications dominating (39%), while solutions for adhesives and ink sectors gain traction.

- Strong competitive pressure and raw‑material price volatility restrict expansion, particularly given reliance on petrochemical feedstocks and evolving regulatory landscapes.

- Asia‑Pacific leads regional growth with a share around 45% by value, supported by robust construction and automotive activity, while North America and Europe follow with mature specialty‑chemicals markets and growing waterborne system adoption.

Market Segmentation Analysis:

By Product Type

In the coalescing agent market, the hydrophobic sub‑segment held the dominant share of 60.66% in 2024, driven by its strong performance attributes such as enhanced water resistance and durability in demanding applications. Manufacturers favour hydrophobic agents for heavy‑duty coatings, automotive finishes, and industrial sealants, where exposure to harsh environments is common. The hydrophilic segment, despite its smaller share, is gaining traction due to its compatibility with water‑based systems and low‑VOC formulations, aligning with increasing regulatory pressure for sustainable coatings.

- For instance, Dow’s DOWSIL™ brand introduced new water resistance additives for waterborne architectural and general industrial paints which achieved significant water absorption reduction in internal testing, allowing for improved performance in challenging weather conditions.

By Application

The paints & coatings application led the market with 46.29% share in 2024, reflecting the widespread use of coalescing agents to improve film formation and durability in architectural, automotive, and industrial coatings. Adhesives & sealants and inks follow but hold smaller shares. Demand in the paints & coatings segment is supported by growth in construction and infrastructure spending globally, coupled with a shift towards eco‑friendly, waterborne formulations that require efficient coalescing agents to achieve optimal film properties.

- For instance, AkzoNobel’s Sikkens automotive coatings leverage advanced technology and perform benchmark testing to enhance film durability, leading to strong performance and long-lasting finishes in harsh automotive environments

Key Growth Drivers

Key Growth Drivers

Rising Demand for Eco-Friendly Coatings

The increasing demand for eco-friendly coatings is a significant growth driver for the coalescing agent market. As regulations around volatile organic compounds (VOCs) become stricter globally, manufacturers are shifting towards waterborne and low-VOC formulations. Coalescing agents play a crucial role in these formulations, improving film formation without compromising performance. This trend towards sustainability in paints and coatings is expanding the market for coalescing agents, as both industrial and consumer sectors prioritize environmentally friendly products.

- For instance, Sherwin-Williams has developed several eco-friendly product lines, such as its ProMar® 200 Zero VOC Interior Latex Paint which meets stringent indoor air quality requirements, and the Powdura® ECO line of powder coatings made with post-consumer recycled plastic.

Expansion of the Construction and Infrastructure Sectors

The rapid growth in the construction and infrastructure sectors globally is driving demand for coalescing agents, particularly in paints and coatings. Coalescing agents are essential for achieving durable, high-performance coatings that meet the specific needs of the construction industry, including resistance to weather, abrasion, and chemicals. As the demand for residential, commercial, and industrial properties rises, the need for coatings with superior performance characteristics, facilitated by coalescing agents, is also growing.

- For instance, PPG Industries offers a range of high-performance industrial coatings, such as the PPG BRIDGE DECK MEMBRANE system which provides permanent waterproofing for railroad bridge decks, and other advanced systems that offer proven protection against corrosion, high-temperatures, and fire to extend the service life of assets like bridges and roads.

Increased Use of Coalescing Agents in Adhesives and Sealants

The growing adoption of coalescing agents in adhesives and sealants is contributing to the market’s expansion. Coalescing agents help improve the film-forming ability and enhance the performance of these products, which are widely used in the automotive, construction, and packaging industries. As these industries grow and innovate, the demand for high-quality adhesives and sealants, which rely on coalescing agents for better consistency and durability, continues to increase.

Key Trends & Opportunities

Shift Towards Water-Based Systems

One of the key trends in the coalescing agent market is the shift towards water-based systems. As environmental concerns continue to rise and regulatory pressures increase, industries are moving away from solvent-based systems in favor of water-based solutions. Coalescing agents that are specifically designed for waterborne coatings are seeing higher demand due to their lower environmental impact. This shift is expected to provide significant growth opportunities for manufacturers focused on developing sustainable and high-performance water-based coalescing agents.

- For instance, Arkema developed a water-based coalescing agent that met stringent low-VOC regulatory standards in Europe, resulting in the successful launch of a new environmentally friendly line of industrial coatings.

Increasing Focus on Sustainable and Biodegradable Products

Sustainability is becoming a core focus for industries using coalescing agents, particularly in paints, coatings, and adhesives. There is a growing preference for biodegradable and sustainable coalescing agents that can help reduce environmental footprints. Manufacturers are innovating by developing coalescing agents derived from renewable resources, which align with global trends towards cleaner, more eco-friendly solutions. This trend presents opportunities for companies to cater to the increasing demand for sustainable products and gain a competitive edge in the market.

- For instance, Evonik’s development of bio-based coalescing agents, derived from sustainable raw materials, was a key factor in its new product line, which resulted in significant adoption by customers looking to meet eco-friendly certification requirements for their coatings.

Key Challenges

Price Volatility of Raw Materials

One of the main challenges facing the coalescing agent market is the price volatility of raw materials. The fluctuation in the prices of petroleum-based chemicals and renewable raw materials can significantly impact the production cost of coalescing agents. This unpredictability poses a challenge for manufacturers who must balance production costs with competitive pricing, especially in a price-sensitive market. Additionally, supply chain disruptions can exacerbate these challenges, leading to potential delays and increased operational costs.

Intense Market Competition

The coalescing agent market is highly competitive, with numerous global players offering similar products. This intense competition puts pressure on manufacturers to innovate continuously, maintain product quality, and keep prices competitive. Smaller companies face challenges in establishing themselves in the market, especially when competing with established players that have significant resources and brand recognition. Additionally, price wars and the pressure to develop cutting-edge products create further challenges for companies striving to maintain profitability while meeting customer demands.

Regional Analysis

North America

North America captured a market share of around 25% in the coalescing agent market in 2024. The region benefits from mature coatings, adhesives, and sealants industries as well as strict low‑VOC regulations driving demand for high‑performance additives. Manufacturers leverage strong R&D infrastructure to introduce advanced coalescing agents tailored for waterborne systems and sustainable formulations. While growth remains steady, the region faces cost pressures from raw material volatility and stringent environmental compliance impacting formulation dynamics.

Europe

Europe held nearly 22% market share in 2024 in the coalescing agent market. Demand is bolstered by robust automotive, construction, and industrial sectors coupled with strong regulatory mandates on volatile organic compounds (VOCs). Suppliers in this region focus heavily on bio‑based and low‑VOC solutions to meet European sustainable chemistry targets. However, higher feedstock and energy costs weigh on margin expansion and challenge pricing strategies as formulators adapt to stringent environmental and circular‑economy standards.

Asia‑Pacific

Asia‑Pacific dominated the coalescing agent market with a share of 38% in 2024. Rapid industrialisation, infrastructure build‑out, and strong growth in paints, coatings, and adhesives demand drive the region’s performance. Countries such as China and India lead due to expanding construction and manufacturing sectors. Local production advantages and rising demand for waterborne systems further strengthen the region’s position. Manufacturers are increasing capacity and launching formulations suited to regional needs such as high humidity and diverse substrates.

Latin America

Latin America accounted for about 8% of the coalescing agent market in 2024. Growth in this region is supported by rising urbanisation, recovery in construction activity, and increased use of coatings and adhesives in sectors like packaging and automotive. However, economic volatility, fluctuating currency values, and supply‑chain limitations create challenges for consistent growth. Despite these constraints, manufacturers see potential in Brazil and Mexico where housing and industrial investments are gaining momentum.

Middle East & Africa

The Middle East & Africa region held approximately 7% share of the global coalescing agent market in 2024. The demand is driven by expanding infrastructure projects, rising oil and gas sector activity, and growing construction of residential and commercial buildings. Regulatory mandates around low‑VOC products in major Gulf countries also support adoption of high‑performance coalescing agents. Nevertheless, the region faces infrastructure and logistical hurdles along with uneven regulatory frameworks that can impact investment and supply‑chain stability.

Market Segmentations:

By Product

- Hydrophilic Coalescing Agent

- Hydrophobic Coalescing Agent

By Application

- Paints & Coatings

- Adhesive & Sealants

- Inks

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive analysis of the coalescing agent market includes key players such as Dow, Eastman Chemical Company, BASF SE, Cargill, Incorporated and Stepan Company. These firms maintain their leadership through strong R&D pipelines, global production footprints and a wide portfolio of high‑performance and eco‑friendly formulations. They frequently engage in strategic partnerships, capacity expansions and product launches tailored for low‑VOC coatings and adhesives to match evolving regulatory and market demands. Market entrants face steep barriers including scale advantages, raw‑material access and regulatory compliance costs. High competition compels players to differentiate via formulation efficiency, customization capabilities and sustainability credentials, making market positioning increasingly dependent on innovation and supply‑chain resilience.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Krishna Antioxidants Pvt. Ltd. (Cristol)

- Cargill, Incorporated

- ADDAPT Chemicals B.V.

- Hallstar

- Stepan Company

- Dow

- PATCHAM(FZC)

- Chemoxy International Ltd

- Runtai New Material Co., Ltd.

- Deborn

Recent Developments

- In October 2024, Evonik Oxeno expanded its production of INA‑based plasticizers and related coalescing agents (ELATUR® CH / DINCH) at its Marl site to support reliable supply in Europe.

- In November 2023, IMCD declared that its Indian subsidiary, IMCD India, had entered into an agreement to acquire two business lines from CJ Shah & Company. These business lines specialize in offering Cellulose Acetate Butyrate, Coalescing Agent, Polyolefin Polymers, and various other chemicals, mainly catering to applications in Paints, Coatings, Adhesives, and Lifesciences.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for low‑VOC and water‑based coatings will drive consumption of coalescing agents globally.

- Increased infrastructure and automotive industrialization in Asia‑Pacific will boost regional demand for coalescing agents.

- Technological advancements will enable development of biodegradable and bio‑based coalescing agents, meeting sustainability criteria.

- Growth in adhesives and sealants applications will expand opportunities for coalescing agents beyond paints and coatings.

- E‑commerce packaging and UV‑curable coatings will create new requirements for specialised coalescing agents with tailored film‑forming performance.

- Manufacturers will invest in large‑scale regional production to reduce supply‑chain risk and gain cost advantages in emerging markets.

- Regulatory pressure on emissions and chemical safety will force reformulation, accelerating adoption of high‑performance coalescing agents.

- Raw‑material volatility and tight feedstock supply will challenge cost control and profit margins for coalescing agent makers.

- Consolidation and strategic partnerships will increase as players seek to expand portfolios and geographic footprint.

- Growth in renewable and sustainable raw materials will open pathways for next‑generation coalescing agents aligned with circular economy goals.

Key Growth Drivers

Key Growth Drivers