Market Overview

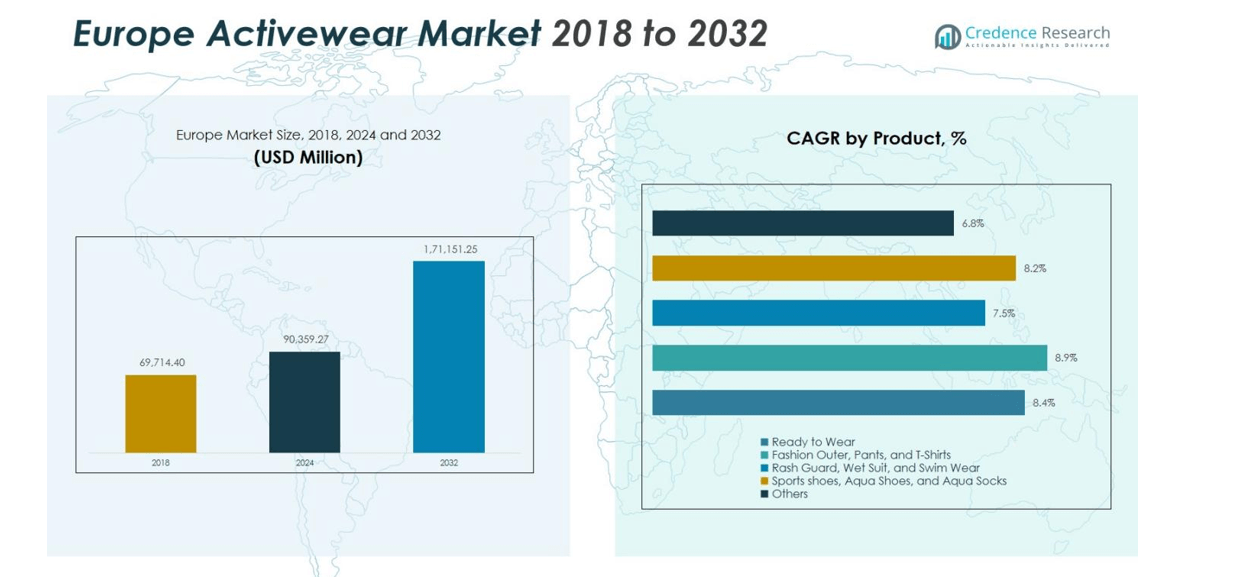

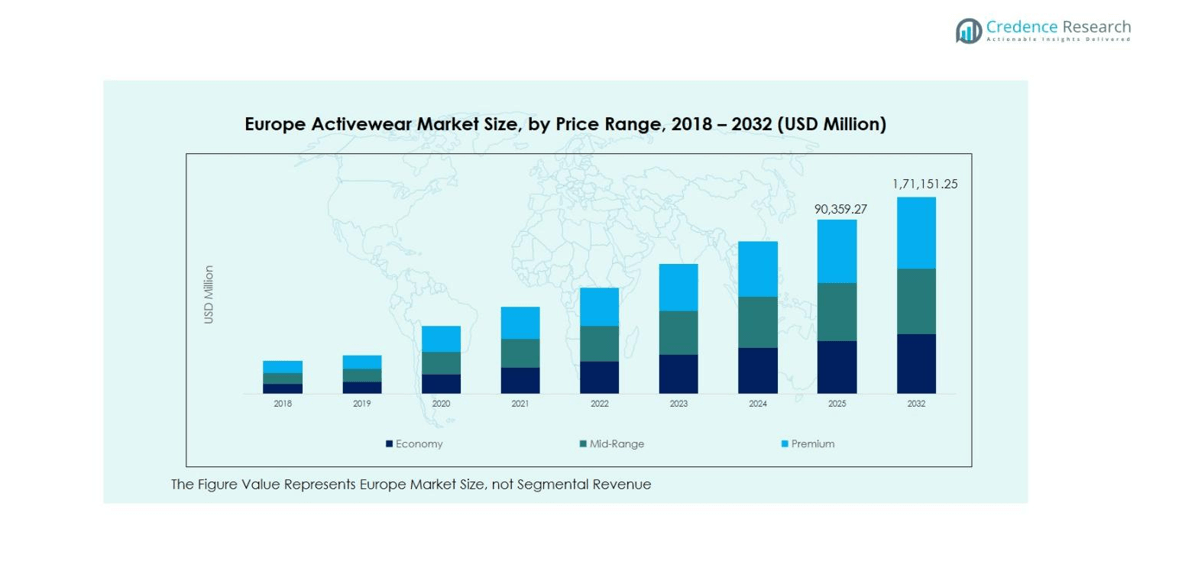

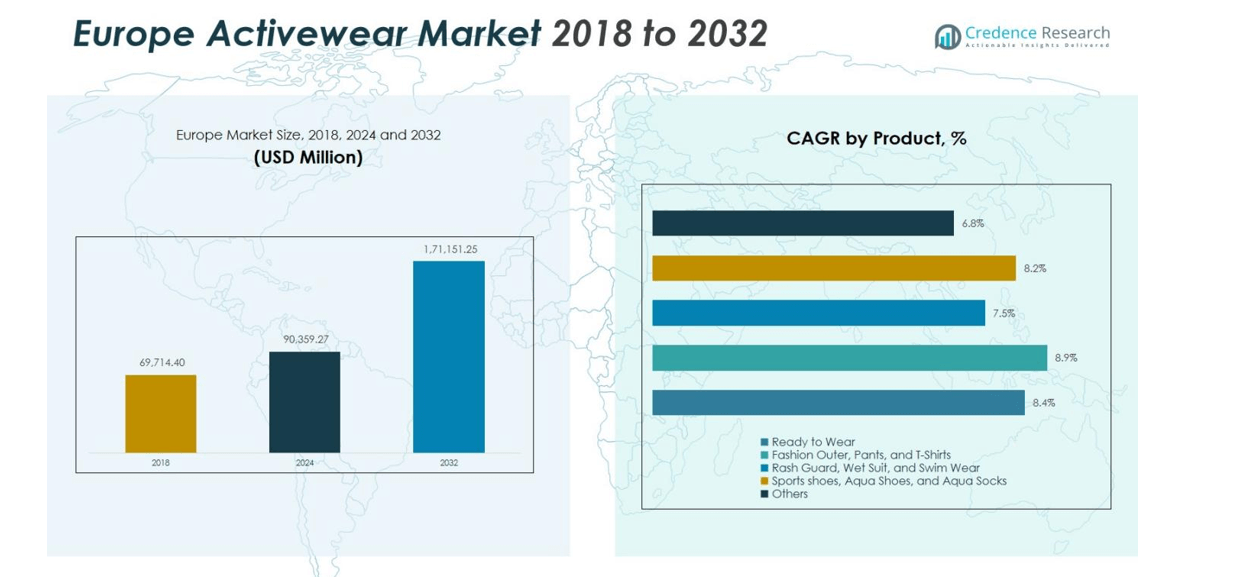

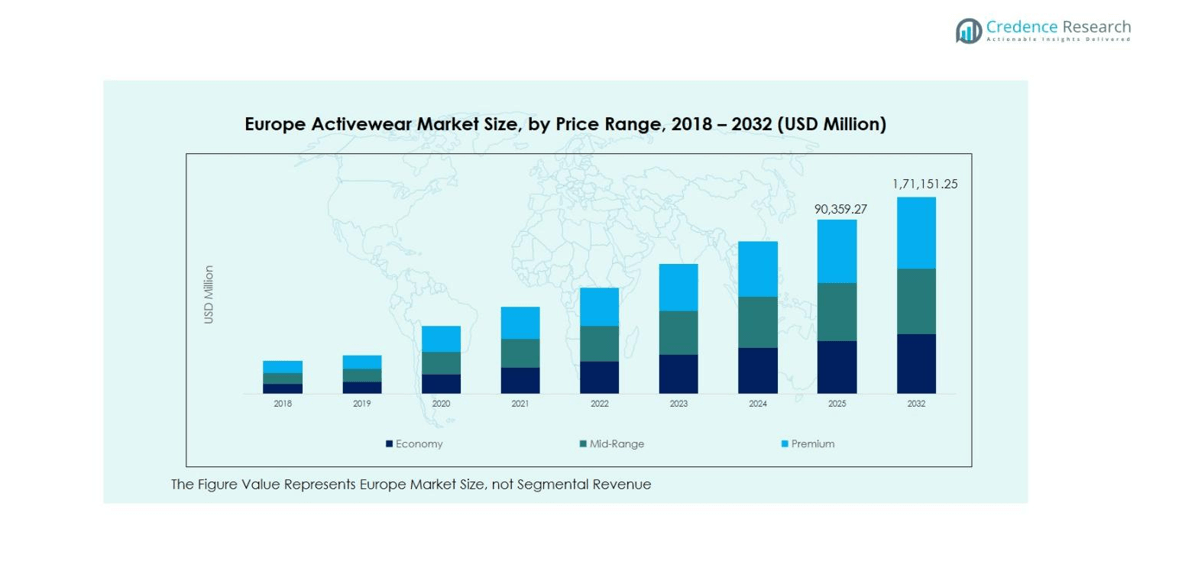

The Europe Activewear Market size was valued at USD 69,714.40 Million in 2018, increased to USD 90,359.27 Million in 2024, and is anticipated to reach USD 171,151.25 Million by 2032, at a CAGR of 8.51% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Activewear Market Size 2024 |

USD 90,359.27 Million |

| Europe Activewear Market, CAGR |

8.51% |

| Europe Activewear Market Size 2032 |

USD 171,151.25 Million |

The Europe Activewear Market is led by prominent companies such as Adidas AG, Nike, Inc., Puma SE, Lululemon Athletica Inc., and Under Armour Inc. These companies dominate the market through their extensive product portfolios, innovation in high-performance fabrics, and strong brand recognition. Adidas and Nike hold substantial shares due to their global presence, technological advancements, and sustainability initiatives, while Puma and Under Armour continue to expand their influence with a focus on performance-oriented activewear. The leading region in the market is Germany, commanding a 19.8% share, supported by a strong fitness culture and high consumer spending on activewear. The United Kingdom follows with an 18% share, benefiting from athleisure trends and advanced e-commerce infrastructure. France, with a 10% market share, also plays a key role, driven by a blend of style-conscious and health-conscious consumers. These markets show steady growth across key product segments.

Market Insights

- The Europe Activewear Market size stood at USD 90,359.27 Million in 2024 and is projected to reach USD 171,151.25 Million by 2032 at a CAGR of 8.51%.

- The rising health and fitness consciousness among European consumers fuels greater demand for performance‑oriented apparel, particularly in the Ready‑to‑Wear segment which holds around 35% share.

- The growing athleisure trend and emphasis on versatile apparel drive activewear usage beyond the gym; in the fabric segment, Polyester leads with a 45% share as consumers favour durable, moisture‑wicking materials.

- Major players such as Adidas AG, Nike, Inc., Puma SE and Lululemon Athletica Inc. strengthen market competitiveness through innovation and global brand presence, while Germany remains the leading regional market with a share of 19.8%.

- Rising production and material costs alongside pressure on margins act as key restraints, and slower growth in less‑mature regional markets presents further challenge to widespread expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The Europe Activewear Market’s product segments are diverse, with Ready to Wear emerging as the dominant sub-segment, holding around 35% of the market share. Ready-to-wear activewear is favored for its versatility and comfort, contributing to its widespread popularity across various age groups and demographics. Fashion Outer, Pants, and T-Shirts follow closely, capturing 30% of the market share, as consumers prioritize multifunctionality and style in their activewear. The growth of Sports Shoes, Aqua Shoes, and Aqua Socks is driven by rising participation in fitness activities and aquatic sports, contributing to roughly 20% of the market share. The Others category, including accessories like bags and hats, continues to cater to niche consumer needs, accounting for about 15% of the market share.

- For instance, in the sports shoe segment, Nike and Adidas continue to dominate by launching technologically advanced running shoes tailored for both fitness enthusiasts and casual wearers, driving growth in this product category.

By Fabric

Among the fabric types, Polyester remains the leading sub-segment, holding the largest share of 45% in the Europe Activewear Market due to its durability, moisture-wicking properties, and cost-effectiveness. Polyester is widely used in activewear due to its suitability for various activities, from gym workouts to outdoor sports. Spandex follows closely with a share of 25%, especially in performance-oriented activewear like leggings and compression wear. Nylon and Neoprene also hold significant shares, accounting for 15% and 10%, respectively, favored for their elasticity and water-resistant properties in swimwear and wetsuits. Cotton holds the smallest share at 5%, as its moisture management properties are less effective compared to synthetic fabrics.

- For instance, Nike’s Dri-FIT line uses polyester as the foundation fabric for its lightweight, breathable, and moisture-wicking performance, helping athletes stay dry during workouts.

By Material

In the material segment, Synthetic materials dominate the Europe Activewear Market with a significant share of 70%, driven by their lightweight, flexible, and moisture-wicking characteristics. Synthetic fabrics like polyester and spandex are preferred for their performance-oriented qualities, especially in athletic wear. Natural materials hold a smaller share at 30% due to their higher cost and reduced moisture management capabilities. However, the demand for Natural materials is expected to grow with the rise of sustainable and eco-conscious consumer trends, pushing brands to explore innovative blends of natural fibers in activewear designs.

Key Growth Drivers

Rising Health and Fitness Consciousness

The growing awareness around health and fitness has been a key driver for the Europe Activewear Market. As consumers prioritize health, wellness, and active lifestyles, the demand for comfortable, performance-oriented activewear has surged. Fitness trends, such as gym memberships, outdoor activities, and sports participation, have contributed significantly to this market growth. The increasing adoption of fitness tracking devices and mobile health apps further enhances consumer engagement with physical activities, driving the demand for specialized activewear that combines functionality with style.

- For instance, Swedish brand AIM’N, which launched its Shape Seamless Collection featuring ultra-flattering, performance-enhancing leggings in 2024, attracting substantial attention through celebrity collaborations.

Growing Adoption of Athleisure Trend

The athleisure trend has become a dominant factor in driving the Europe Activewear Market. Consumers are increasingly looking for activewear that is not only suitable for workouts but also fashionable enough for everyday wear. This shift towards athleisure is fueled by lifestyle changes, where comfort and versatility are prioritized. Brands are capitalizing on this trend by offering stylish and multi-functional activewear that can be worn in casual settings, helping to bridge the gap between athletic gear and casual fashion, thus expanding the market’s potential.

- For instance, Athleta, a Gap Inc. brand, launched its high-performance Train Collection in early 2024. The eight-piece line features PowerMove fabric, a proprietary material made from recycled polyester sourced from post-consumer plastic bottles.

Expansion of E-commerce and Online Retail

The rapid expansion of e-commerce and online retail platforms is a significant growth driver for the Europe Activewear Market. With the increasing preference for online shopping, activewear brands are leveraging digital channels to reach a broader audience. The convenience of online shopping, coupled with targeted marketing, personalized recommendations, and home delivery, has led to a surge in online purchases of activewear. E-commerce also enables brands to reach niche markets and expand their customer base, boosting the overall market growth in Europe.

Key Trends & Opportunities

Sustainable and Eco-Friendly Activewear

Sustainability has emerged as a critical trend in the Europe Activewear Market, with consumers increasingly demanding eco-friendly products. Brands are responding by developing activewear made from recycled materials, organic fabrics, and sustainable production processes. This growing focus on environmental impact presents significant opportunities for companies to differentiate themselves in a competitive market. Additionally, the rise of circular economy practices, including product take-back and recycling programs, provides brands with innovative ways to engage eco-conscious consumers while reducing waste.

- For instance, Nike has introduced its “Nike Forward” material made from recycled polyester, which reduces the carbon footprint of their knit fleece by 75% compared to traditional materials.

Innovation in Smart and Performance-Enhancing Fabrics

There is a growing demand for activewear that incorporates advanced technologies to enhance performance and comfort. Smart fabrics, such as moisture-wicking materials, heat-regulating textiles, and anti-odor coatings, are gaining traction in the market. These innovations improve the overall user experience, making activewear more functional for athletes and fitness enthusiasts. As performance-enhancing fabrics continue to evolve, there are significant opportunities for brands to develop high-tech activewear that provides tangible benefits, appealing to a tech-savvy consumer base seeking more than just basic comfort and style.

- For instance, Hexoskin’s smart shirts are embedded with ECG sensors that continuously monitor heart rate, heart rate variability, and breathing patterns during workouts.

Key Challenges

Intense Market Competition

The Europe Activewear Market is highly competitive, with numerous global and regional players vying for market share. This intense competition places significant pressure on brands to continuously innovate and differentiate themselves. Price sensitivity among consumers further complicates the market dynamics, as brands must balance quality, performance, and affordability. Small and emerging players face challenges in establishing their presence against well-established brands like Adidas, Nike, and Puma, making it crucial for new entrants to offer unique value propositions or target niche segments to succeed.

Rising Production and Material Costs

The Europe Activewear Market is also grappling with rising production and material costs. The increasing cost of raw materials, including high-performance fabrics and eco-friendly textiles, has put pressure on manufacturers to maintain profitability. Additionally, labor costs and transportation expenses are rising, further impacting the production cost structure. While many consumers are willing to pay a premium for high-quality and sustainable products, the overall cost increase challenges brands in managing their margins while keeping products affordable for a broader consumer base.

Regional Analysis

United Kingdom

The UK market segment of the European activewear market holds a notable share of 18% in 2024, reflecting its position as the second‑largest national market in the region. Strong consumer demand is driven by an entrenched athleisure culture, high online penetration, and mature e‑commerce infrastructure. UK consumers favour performance apparel that doubles as everyday wear, supported by advanced logistics and direct‑to‑consumer models. Retailers in major cities like London increasingly integrate experiential flagship stores with digital channels. These dynamics reinforce the UK’s role as a key growth hub in the Europe activewear market.

France

France contributes 10% to the Europe activewear market in 2024, underlining its importance as a fashion‑forward and health‑conscious market. French consumers demand activewear that blends technical performance with aesthetic elegance, reflecting Paris’s influence on global style. Government wellness initiatives and rising female fitness participation elevate product demand. Domestic and international brands focus on premium and sustainable activewear lines to meet local preferences. This combination of public health policy, fashion sensibility and rising disposable income supports steady growth in France’s activewear segment.

Germany

Germany leads the European activewear market with a share of about 19.8% in 2024, making it the largest national market in the region. Robust fitness culture, substantial disposable income and strong brand presence underpin its market dominance. Urban infrastructure supports cycling and outdoor activity participation, which in turn drives demand for performance‑oriented activewear. German consumers show willingness to invest in sustainability and advanced fabric technologies, encouraging manufacturers to tailor products accordingly. As a result, Germany remains the most significant individual contributor to Europe’s activewear market.

Italy

Italy accounts for 8% of the European activewear market in 2024, reflecting its steady but smaller scale relative to northern peers. The nation leverages its design heritage and technical textile manufacturing base to create premium activewear lines. Consumer interest blends sport and style, and collaboration between fashion and sportswear brands supports innovation. Public programs promoting sports in schools also contribute incremental volume. While growth is moderate, Italy remains an important production and trend‑setting hub within the European activewear landscape.

Spain

Spain holds 7% of the Europe activewear market share in 2024, driven by a strong outdoor lifestyle, warm climate and growing interest in fitness activities such as running and padel. Retail expansion in cities such as Madrid and Barcelona, along with tourism‑related seasonal demand, further supports the sector. Spanish consumers increasingly embrace multifunctional activewear that suits both training and leisure. Although economic constraints limit spending relative to some peers, the trend toward active living positions Spain as a valuable growth market in Southern Europe.

Russia

Russia represents 5% of the Europe activewear market in 2024, identified as one of the fastest‑growing regional markets within Europe. Rising fitness club memberships, urbanisation and increasing brand awareness are key growth drivers. Retail infrastructure is expanding and international activewear brands are establishing presence. Accessibility and affordability remain constraints, but the trend toward healthier lifestyles and greater physical activity is fueling demand for both performance and athleisure activewear. Russia therefore offers strong potential for future growth within the European region.

Rest of Europe

The ‘Rest of Europe’ segment – covering countries outside the major Western markets – collectively accounts for the remaining 30% of the regional activewear market in 2024. Growth in these markets is supported by rising disposable income, expanding urban middle classes, increasing sport participation and rapid digital retail adoption. While individual country shares remain smaller, cumulative momentum is significant. Brands that tailor offerings to local consumer behaviour and leverage e‑commerce stand to gain in these emerging European markets.

Market Segmentations:

By Product

- Ready to Wear

- Fashion Outer, Pants, and T-Shirts

- Rash Guard, Wet Suit, and Swim Wear

- Sports Shoes, Aqua Shoes, and Aqua Socks

- Others

By Fabric

- Polyester

- Nylon

- Neoprene

- Polypropylene

- Spandex

- Cotton

- Others

By Material :

By Price Range :

- Economy

- Mid-Range

- Premium

By Distribution Channel

By Region

- K.

- France

- Germnay

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

Competitive analysis in the Europe Activewear Market reveals a dynamic environment driven by leading global brands such as Adidas, Nike, Puma, and Lululemon Athletica, along with regional players that continue to challenge the market. These established brands dominate with comprehensive product portfolios, innovative technologies, and strong brand recognition. Adidas and Nike, in particular, leverage their global reach, extensive retail networks, and deep investment in sustainable products to capture significant market share. Additionally, brands like Puma and Under Armour focus on performance-oriented activewear, enhancing their offerings with advanced fabric technologies and athleisure designs. Regional players are increasingly emphasizing online platforms to reach niche markets and eco-conscious consumers, as digital transformation reshapes retail strategies. The competitive landscape is marked by intense rivalry, requiring brands to innovate continuously and adapt to changing consumer preferences, including the growing demand for sustainability, performance, and fashion-forward designs, driving both competition and growth in the European market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Adidas AG

- Nike, Inc.

- Puma SE

- Lululemon Athletica Inc.

- The Columbia Sportswear Company

- VF Corporation

- ASICS Corporation

- Skechers USA, Inc.

- Under Armour, Inc.

- Hanesbrands Inc.

Recent Developments

- In October 2025, Ted Baker announced the launch of its first activewear collection for men and women, covering activities such as yoga, training and tennis.

- In September 2025, Under Armour partnered with Incubeta to accelerate its European growth on Amazon, targeting young team‑sports athletes and Gen Z lifestyle shoppers.

- In November 2025, BasicNet S.p.A. announced the acquisition of the European rights and distribution business of Woolrich Europe (100% of Woolrich Europe S.p.A.) for c. €90 million, with completion expected December 2025

Report Coverage

The research report offers an in-depth analysis based on Product, Fabric, Material, Price Range, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Europe Activewear Market is expected to continue its strong growth driven by increasing health and fitness awareness.

- Athleisure will remain a dominant trend, with consumers seeking multifunctional apparel for both exercise and casual wear.

- Sustainability will play a pivotal role, with more brands adopting eco-friendly materials and production methods to meet consumer demand.

- The rise of digital retail channels and e-commerce platforms will enhance accessibility and convenience for consumers.

- Innovations in performance-enhancing fabrics, such as moisture-wicking, temperature-regulating, and smart textiles, will drive product differentiation.

- Increasing female participation in fitness activities will fuel demand for specialized activewear, contributing to market expansion.

- Stronger growth is anticipated in Eastern European countries as disposable incomes rise and fitness culture gains momentum.

- The demand for sustainable and ethical production practices will lead to more transparency in supply chains.

- Key brands will continue to expand their presence in online marketplaces to capture the growing digital shopper base.

- Collaboration between fashion and sportswear brands will result in more stylish, high-performance activewear, attracting fashion-forward consumers.