Market Overview

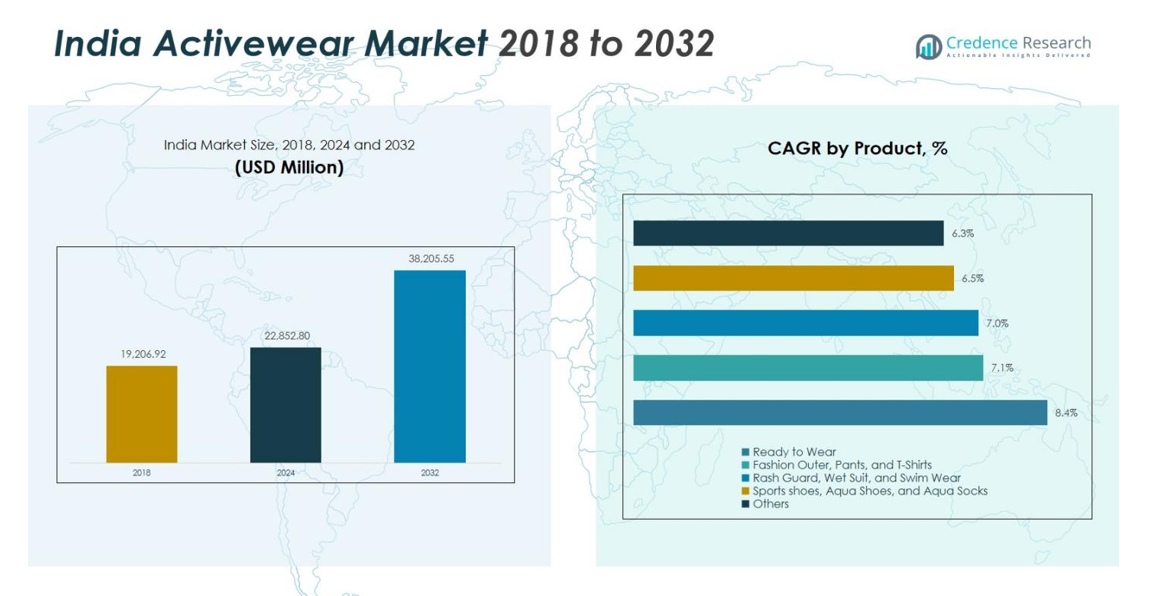

The India Activewear Market size was valued at USD 19,206.92 Million in 2018, reaching USD 22,852.80 Million in 2024. It is anticipated to grow to USD 38,205.55 Million by 2032, at a CAGR of 6.63% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Activewear Market Size 2024 |

USD 22,852.80 Million |

| India Activewear Market, CAGR |

6.63% |

| India Activewear Market Size 2032 |

USD 38,205.55 Million |

The India Activewear Market is led by major players such as Puma, Nike, Adidas, Reebok, and Decathlon, which dominate through strong brand recognition and extensive distribution channels. Puma, Nike, and Adidas focus on premium offerings, catering to urban, high-income consumers, while Decathlon captures a broader market with its affordable and diverse product range. Local brands like HRX and Nivia Sports also play a significant role by meeting the growing demand for functional and affordable activewear. Regionally, North India holds the largest market share at 35%, driven by rising urbanization and fitness trends in cities like Delhi and Chandigarh. South India follows with a 30% share, and West India contributes 25%, with East India representing a smaller but steadily growing 10% market share. These regions continue to see growing demand for activewear driven by fitness awareness and athleisure trends.

Market Insights

- USD 22,852.80 Million market size in 2024 and a CAGR of 6.63% set the stage for the India Activewear Market.

- The popularity of athleisure and expanding fitness awareness propel performance‑wear and casual‑wear alike, making consumers buy activewear for both gym and daily use.

- Growth in segment share is apparent: synthetic materials dominate with 70% share in materials, while polyester leads fabrics with over 40% share, reflecting functionality and design shifts.

- Intense brand rivalry and regional leadership mark the landscape: North India holds 35% share, South India 30%, West India 25%, and East India 10%, spotlighting where demand concentrates.

- Consumer price sensitivity and raw‑material cost volatility restrain growth as brands strive to balance quality, innovation and affordability across segments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

The By Material segment is divided into natural and synthetic materials, with synthetic materials holding a dominant share of 70%. Synthetic fabrics such as polyester, spandex, and nylon are preferred for their durability, moisture-wicking properties, and elasticity, making them ideal for high-performance activewear. Natural materials like cotton hold a smaller share of about 30% due to their comfort and breathability but are less suitable for intense physical activities due to moisture retention. The shift towards functionality and performance is driving the preference for synthetic materials.

- For instance, Lululemon’s Everlux fabric, made of 77% nylon and 23% Lycra elastane, is designed for high-intensity workouts with quick-drying and sweat-wicking capabilities, providing comfort and breathability during intense exercise.

By Fabric

The By Fabric segment is heavily influenced by polyester, which leads with over 40% market share due to its durability, affordability, and moisture-wicking properties. Other fabrics like nylon (25%), spandex (12%), and neoprene (10%) are also growing in popularity, particularly for performance apparel. While polyester remains the most commonly used fabric, the demand for specialized materials such as spandex for flexibility and neoprene for water sports is increasing. This diversity in fabric choices is fueling market expansion in various activewear categories.

- For instance, Nike’s recycled polyester fabrics, such as those used in their Dri-FIT line, combine quick-drying and moisture-wicking properties with sustainability by using plastic bottles converted into high-quality yarn.

By Material

The By Material segment, with synthetic materials accounting for 70% of the market share, is dominated by polyester, spandex, and nylon. These materials are favored for their performance-driven qualities like moisture resistance, elasticity, and durability, making them ideal for sports and high-intensity activities. Natural materials such as cotton hold a smaller share of around 30%, primarily used in casual activewear, as they are less suitable for performance-oriented clothing due to their moisture retention properties.

Key Growth Drivers

Growing Popularity of Athleisure

The rising popularity of athleisure is a key growth driver in the India Activewear Market. Consumers are increasingly seeking activewear that offers both performance and style, suitable for a wide range of activities, from fitness to casual wear. This shift is being fueled by the demand for comfortable, versatile clothing that can be worn throughout the day. With increasing awareness about health and wellness, athleisure is becoming a staple in daily wardrobes, driving growth in both urban and semi-urban regions across India.

- For instance, Adidas partnered with fitness brand Cult in 2024 to launch adidas Strength+, a strength training workout program available across 150 gyms in India, while innovating with recyclable and plant-based materials in its products.

Increase in Health and Fitness Awareness

The growing focus on health and fitness in India has significantly contributed to the demand for activewear. With rising disposable incomes and more people adopting fitness regimes, there is an increasing need for high-quality sportswear. The surge in fitness activities like yoga, running, and gym workouts has propelled the demand for specialized activewear products that enhance performance and comfort. Health-conscious consumers are increasingly willing to invest in premium activewear, further propelling the market growth in both urban and rural areas.

- For instance, Shahi Exports, known for supplying premium sportswear to global brands like Nike and Adidas, incorporates advanced fabric technologies for moisture management and flexibility, catering to the needs of health-conscious consumers.

Expansion of Online Retail and E-commerce Platforms

The rapid expansion of online retail and e-commerce platforms has been a significant driver for the India Activewear Market. Online shopping offers convenience, wider product selection, and competitive pricing, which attracts a growing number of consumers. Additionally, e-commerce platforms provide easy access to a variety of international and local brands, allowing consumers to explore products that may not be available in physical stores. The increasing use of smartphones and digital payments has further facilitated the growth of online retail, driving sales in the activewear segment.

Key Trends & Opportunities

Rise of Sustainable and Eco-Friendly Activewear

There is a growing demand for sustainable and eco-friendly activewear in India, driven by the increasing consumer awareness regarding environmental concerns. Brands are responding by using recycled materials, eco-friendly fabrics, and ethical manufacturing processes. As more consumers seek sustainable options, there is a clear opportunity for activewear brands to innovate and position themselves as environmentally responsible. The growing preference for sustainable products is expected to drive new product development and create a niche market within the activewear segment.

- For instance, Satva partners with Suminter India Organics to source certified organic cotton, supporting rural farming communities while producing stylish sustainable activewear.

Integration of Technology in Activewear

Technological advancements in activewear are becoming a significant trend, with smart fabrics and wearables gaining traction in the market. Innovations such as temperature-regulating fabrics, moisture-wicking materials, and performance-tracking clothing are transforming the activewear sector. These products are designed to enhance the overall fitness experience by improving performance, comfort, and monitoring health metrics. As technology continues to evolve, there is an opportunity for brands to develop high-tech activewear that appeals to fitness enthusiasts and tech-savvy consumers.

- For instance, HeiQ’s Smart Temp thermoregulating fabric technology actively cools the body by up to 2.5°C when hot and stops cooling once temperature normalizes, enhancing comfort and performance in sportswear.

Key Challenges

Price Sensitivity Among Consumers

A major challenge in the India Activewear Market is the price sensitivity of consumers. While the demand for premium activewear is growing, many consumers remain hesitant to invest in high-priced sportswear due to affordability concerns. This is particularly true in smaller cities and rural areas where price-conscious consumers dominate the market. Brands must strike a balance between offering high-quality products and ensuring that their pricing aligns with the purchasing power of various consumer segments, especially as the demand for affordable options continues to rise.

Intense Competition and Brand Loyalty

The India Activewear Market is highly competitive, with both local and international brands vying for market share. The presence of well-established global players such as Nike, Adidas, and Puma intensifies competition, making it challenging for smaller or emerging brands to differentiate themselves. Building strong brand loyalty and consumer trust is crucial for long-term success, but achieving this amidst intense competition can be difficult. Brands need to continuously innovate, offer unique value propositions, and enhance customer engagement to stay ahead of competitors.

Regional Analysis

North India

North India holds a significant share of the India Activewear Market, accounting for 35% of the overall market in 2024. The region is driven by a growing urban population with increased disposable income, particularly in cities like Delhi, Chandigarh, and Jaipur. As the health and fitness trend becomes more mainstream, there is an increased demand for activewear, especially among the young, health-conscious population. The rising popularity of fitness centers, yoga, and outdoor activities like running further fuels the demand for high-quality activewear in the region.

South India

South India contributes 30% to the India Activewear Market, with major markets in cities such as Bangalore, Chennai, and Hyderabad. The region benefits from a strong inclination toward fitness activities and a higher adoption of activewear among both men and women. With a growing number of gyms, fitness clubs, and yoga centers, South India has seen a steady rise in the demand for performance-driven activewear. The region’s increasing focus on healthy lifestyles, coupled with an expanding middle class, continues to drive the growth of activewear brands in this area.

West India

West India holds a 25% share of the India Activewear Market, with Mumbai, Pune, and Ahmedabad acting as key hubs. The region’s activewear demand is fueled by a vibrant, fashion-conscious population that frequently participates in fitness activities. Urbanization, coupled with increasing disposable incomes, has led to greater spending on sports and activewear, particularly in the metropolitan areas. The region’s fitness culture, along with the growing preference for athleisure, has been a major driver for both high-performance and casual activewear products in the market.

East India

East India represents 10% of the India Activewear Market. While the market is relatively smaller compared to other regions, it is growing steadily due to increasing awareness about fitness and wellness. Cities like Kolkata, Bhubaneswar, and Patna have witnessed a rise in gyms, fitness centers, and yoga studios, contributing to the demand for activewear. The region’s youth, along with rising urbanization and improving disposable income, are expected to boost the activewear market in the coming years. As more brands penetrate the region, growth prospects remain positive.

Market Segmentations:

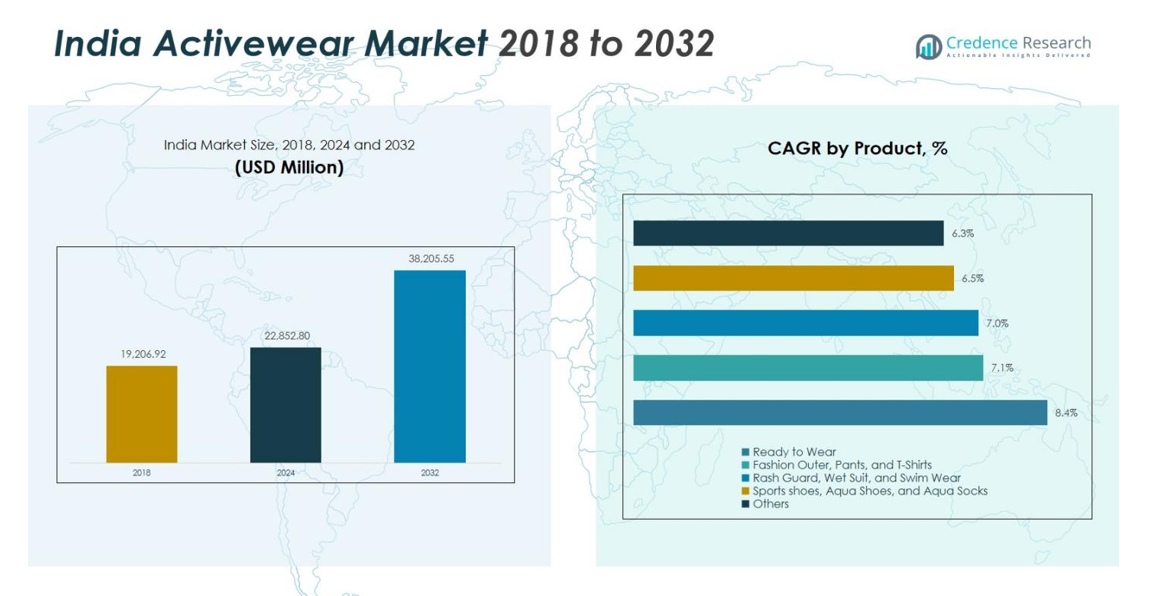

By Product

- Ready to Wear

- Fashion Outer, Pants, and T-Shirts

- Rash Guard, Wet Suit, and Swim Wear

- Sports Shoes, Aqua Shoes, and Aqua Socks

- Others

By Fabric

- Polyester

- Nylon

- Neoprene

- Polypropylene

- Spandex

- Cotton

- Others

By Material :

By Price Range :

- Economy

- Mid-Range

- Premium

By Distribution Channel

By Region

- North India

- South India

- West India

- East India

Competitive Landscape

Competitive analysis of the India Activewear Market reveals a highly fragmented and dynamic environment, with key players such as Puma, Nike, Adidas, Reebok, and Decathlon leading the market. These companies have established strong brand recognition and extensive distribution networks across the country. Puma, Nike, and Adidas continue to dominate with their premium product offerings, targeting urban, middle to high-income consumers. Decathlon, on the other hand, stands out with its diverse range of affordable and quality products, catering to the mass market. Local players like Nivia Sports and HRX have also gained traction by focusing on the growing demand for affordable, functional, and stylish activewear. The competition is intense, with brands continuously innovating to offer enhanced features such as moisture-wicking fabrics, ergonomic designs, and eco-friendly materials. E-commerce platforms play a significant role in reaching a wider audience, while retail stores remain vital for brand visibility and customer engagement.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Puma Sports India Pvt Ltd

- Adidas India Marketing Pvt. Ltd.

- Nike India Pvt. Ltd.

- Under Armour India Trading Pvt. Ltd.

- ASICS India Pvt. Ltd.

- Decathlon Sports India Pvt. Ltd.

- Reebok India Company

- Nivia Sports (Freewill Sports Pvt. Ltd.)

- HRX (Exceed Entertainment Pvt. Ltd.)

- Tyka Sports (TK Sports Pvt. Ltd.)

- Skechers India Pvt. Ltd.

- Monte Carlo Sports

- Alcis Sports Pvt. Ltd.

Recent Developments

- In August 2025, ATHLETIFREAK launched its first Indian store in New Delhi in partnership with investors and brand ambassadors Mira Kapoor and Shahid Kapoor.

- In October 2025, TechnoSport (an Indian activewear brand) announced the launch of its kids’ activewear collection on FirstCry (India’s leading kids‑commerce platform).

- In November 2025, A29 Wellbeing, a new activewear brand by entrepreneur Isha Jain, was launched in India.

- In July 2025, Lululemon announced its strategic partnership with Tata CLiQ to enter India, with plans to open its first store and e‑commerce presence in India in the second half of 2026.

- In July 2025, HRX launched a new campaign titled “Built for Sweat, Designed for Life,” onboarding actress Triptii Dimri as its female brand ambassador alongside Hrithik Roshan.

Report Coverage

The research report offers an in-depth analysis based on Product, Fabric, Material, Price Range, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The India Activewear Market is expected to continue growing at a steady pace, driven by increasing health and fitness awareness.

- Athleisure will remain a dominant trend, with consumers seeking versatile activewear for both fitness and casual wear.

- The demand for eco-friendly and sustainable activewear will increase as consumers become more environmentally conscious.

- Technological innovations in activewear, such as moisture-wicking and performance-enhancing fabrics, will shape product offerings.

- E-commerce will play an increasingly important role, with online sales accounting for a significant portion of total market revenue.

- The growing fitness culture in tier 2 and tier 3 cities will create new opportunities for activewear brands.

- Women’s activewear will see strong growth, as more women participate in fitness activities and sports.

- The demand for premium activewear will rise as consumers focus more on quality and performance over price.

- Brands will continue to invest in celebrity endorsements and influencer marketing to drive consumer interest and engagement.

- The market will become more competitive, with both international and local brands striving to differentiate themselves through innovation and pricing strategies.