Market Overview

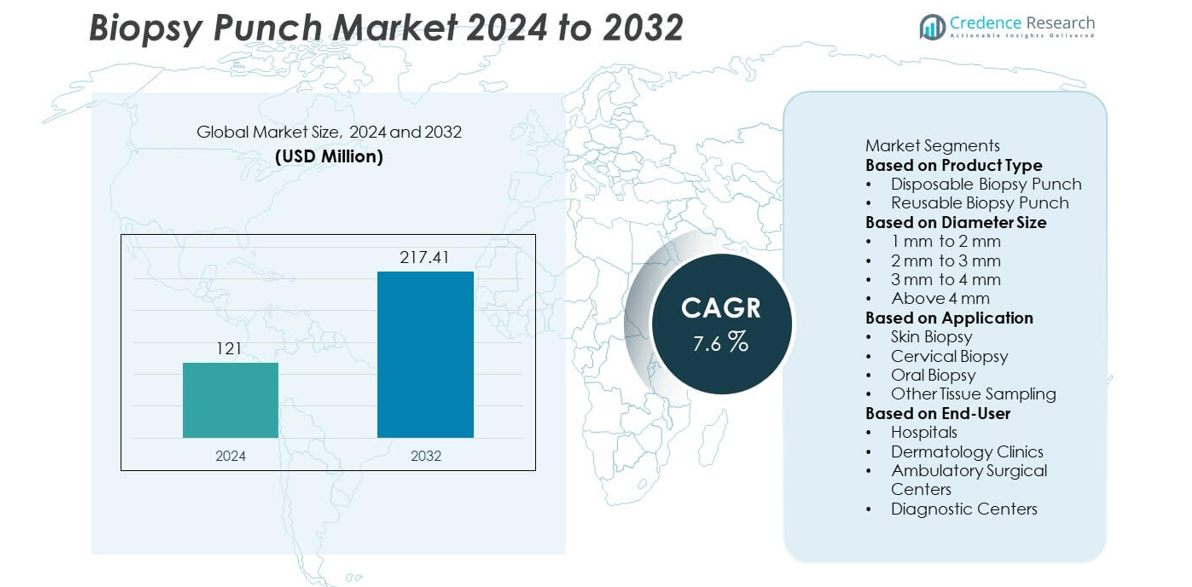

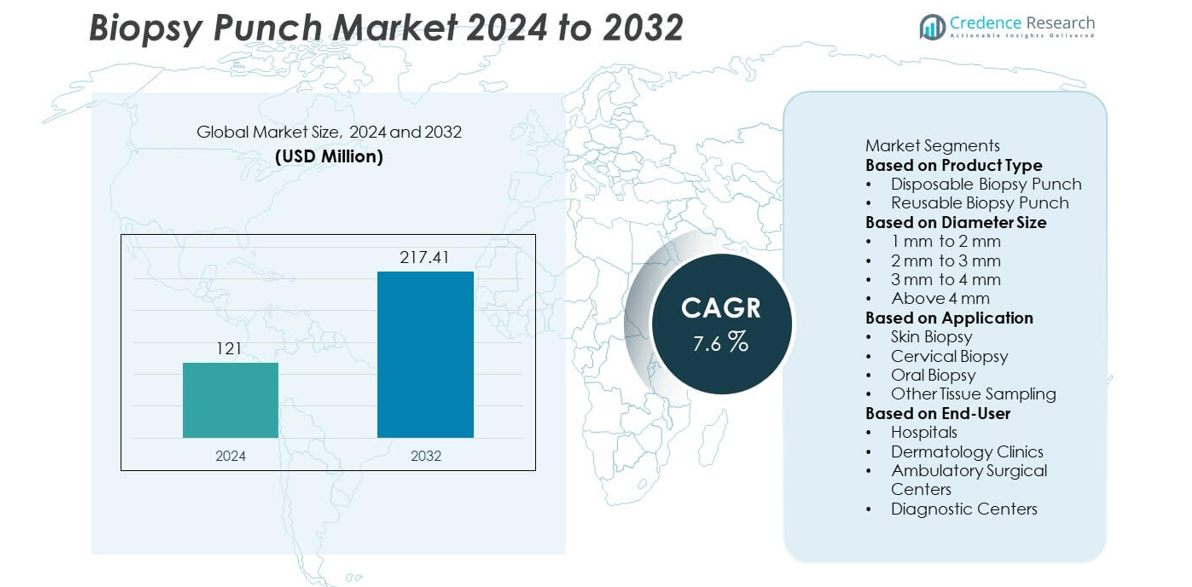

The Biopsy Punch market reached USD 121 million in 2024 and is expected to grow to USD 217.41 million by 2032, with a CAGR of 7.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Biopsy Punch Market Size 2024 |

USD 121 million |

| Biopsy Punch Market, CAGR |

7.6% |

| Biopsy Punch Market Size 2032 |

USD 217.41 million |

The Biopsy Punch market includes major players such as Integra LifeSciences, Kai Medical, Sklar Surgical Instruments, Medline Industries, Aspen Surgical, AccuTec Blades, Robbins Instruments, Premier Surgical, Miltex, and Henry Schein. These companies compete through product innovation, single-use sterile punch designs, and expanded distribution across dermatology and outpatient surgical centers. North America leads the market with a 38% share due to strong screening programs for skin cancer and advanced clinical infrastructure. Europe follows with 27% supported by established dermatology networks and early diagnosis policies, while Asia Pacific holds 22% and continues to grow rapidly with rising healthcare investments and increased awareness of early lesion evaluation.

Market Insights

- The Biopsy Punch market reached USD 121 million in 2024 and is projected to grow at a 7.6% CAGR through 2032, driven by rising biopsy procedures across dermatology and women’s health.

- Growth is supported by increased demand for minimally invasive diagnostics, stronger skin cancer screening programs, and wider access to outpatient surgical care, boosting usage in hospitals, dermatology clinics, and ambulatory surgery centers.

- Key trends include the dominance of disposable biopsy punches with a 67% segment share, strong adoption of ergonomic and color-coded punch designs, and expanding development of recyclable single-use instruments to reduce medical waste.

- Competition intensifies as leading manufacturers invest in sharper cutting edges and improved tissue sample integrity, while distributors leverage digital procurement platforms to improve inventory efficiency and supply continuity across clinical facilities.

- North America leads with 38% regional share, followed by Europe at 27% and Asia Pacific at 22%, supported by growing diagnostic awareness and healthcare investments; Latin America holds 7% and Middle East & Africa 6%, reflecting developing clinical infrastructure and gradual screening expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type:

Disposable biopsy punches hold a market share of 67%, making them the dominant product type. Healthcare facilities favor single-use designs to reduce cross-contamination risk and improve infection control compliance. These punches support faster clinical workflows and eliminate the need for sterilization cycles. Rising outpatient dermatology procedures and expanded use in ambulatory surgical centers strengthen demand. Reusable biopsy punches maintain a smaller share due to higher upfront cost and sterilization requirements, yet remain relevant for cost-sensitive settings with controlled patient volumes. Environmental considerations continue to influence research toward recyclable disposable instruments, supporting innovation across leading manufacturers.

- For instance, Medline Industries provides medical products to healthcare networks, which can assist facilities in optimizing instrument reprocessing workloads.

By Diameter Size:

The 2 mm to 3 mm diameter segment leads with a 42% share due to strong adoption in routine dermatology sampling. Physicians prefer these devices for lesion removal and diagnostic skin evaluation, offering adequate tissue extraction while minimizing scarring. The 3 mm to 4 mm range remains significant for deeper biopsies in suspected melanoma or atypical growths. Smaller 1 mm to 2 mm instruments support cosmetic procedures and pediatric use, though they represent a smaller share. Demand for sizes above 4 mm grows in specialized oncology and oral pathology, where larger samples improve diagnostic accuracy. Product availability across sterile, color-coded sizing supports clinical precision.

- For instance, Kai Medical produces precision-ground biopsy punches, which are widely used in dermatological procedures. Skin biopsy is a common diagnostic procedure in North America, with the region accounting for a significant share of the global skin biopsy market.

By Application:

Skin biopsy accounts for the largest market share at 58%, driven by rising melanoma screening and higher rates of chronic dermatological conditions. Clinicians rely on punch devices to obtain full-thickness skin samples with minimal trauma and quick healing, supporting adoption in hospitals and dermatology clinics. Cervical biopsy usage is growing as women’s health programs expand diagnostics for cervical dysplasia. Oral biopsy plays a role in detecting mucosal lesions and pre-cancerous changes, supported by dental and ENT specialists. Other tissue sampling applications continue to develop in rheumatology and transplant medicine, reflecting broader clinical usage and improved device ergonomics.

Key Growth Drivers

Rising Skin Cancer and Dermatological Disorder Cases

Growing incidence of skin cancer and chronic dermatological conditions drives the use of biopsy punches in clinical diagnosis. Early detection programs support higher biopsy volumes in hospitals and dermatology clinics. The rise in cosmetic dermatology also encourages biopsies for mole evaluation and lesion margin assessment. Increased awareness and screening campaigns help physicians detect abnormalities at early stages, increasing procedure frequency. The expansion of ambulatory care centers and better access to dermatology services further strengthens product demand across developed and emerging healthcare markets.

- For instance, the American Academy of Dermatology (AAD) has a long-standing free skin cancer screening program (known as SPOTme™) that has detected thousands of skin cancers over decades.

Shift Toward Minimally Invasive and Outpatient Procedures

Biopsy punches enable minimally invasive tissue sampling with shorter healing times and reduced scarring, making them suitable for outpatient care settings. Hospitals and clinics adopt these devices to improve patient comfort and reduce surgical overhead. Growth in ambulatory surgical centers supports higher procedure volumes due to faster appointment turnover and cost efficiency. Physicians choose punch biopsy over excisional biopsy when appropriate, reducing suturing needs. This shift aligns with broader healthcare trends focused on reducing hospital stays and enhancing procedural safety.

- For instance, while technological advancements in surgical tools, such as the use of ultrasonic or specialized cutting instruments, have shown potential for benefits like reduced blood loss, minimal tissue damage, and improved healing outcomes, these results are generally associated with specific surgical contexts and different technologies.

Increasing Adoption of Disposable Biopsy Instruments

Healthcare providers prefer disposable biopsy punches to reduce cross-contamination risk and meet strict infection control standards. Single-use punches eliminate sterilization requirements and support higher patient throughput in busy dermatology practices. Manufacturers introduce ergonomic, color-coded, and sharper cutting-edge designs that improve sampling precision. Expanding use in community clinics and tele-dermatology referral workflows increases procurement volumes. Sustainability initiatives also influence the development of recyclable and lower-waste disposable options, supporting long-term usage growth.

Key Trends & Opportunities

Advancements in Ergonomic and Precision-Engineered Biopsy Punches

Manufacturers develop biopsy punches with improved grip control, sharper cutting cylinders, and reduced tissue trauma. Enhanced blade geometry increases sample integrity for histopathology review. Color-coded sizing systems help clinicians select appropriate diameter options more quickly, improving procedural accuracy. These advancements support broader use in dermatology, oral care, and women’s health. Integration with digital imaging and biopsy tracking platforms presents a further opportunity for workflow optimization and diagnostic consistency across care networks.

- For instance, using a robust Laboratory Information Management System (LIMS) with biopsy punch ID tracking can significantly reduce specimen mismatch events, which have been reported in studies to occur at rates ranging from 0.1% to 5% in clinical and anatomical pathology settings.

Expansion of Dermatology Services in Emerging Markets

Rising healthcare investment in Asia-Pacific, Latin America, and the Middle East creates strong demand for biopsy punches. Increasing access to dermatologists, cancer screening programs, and training initiatives enhances diagnostic capabilities. Medical tourism growth in cosmetic and reconstructive procedures also drives biopsy utilization. Partnerships between device manufacturers and regional distributors expand market reach and lower product supply costs. As awareness of skin health improves, more patients seek early evaluation for suspicious lesions, supporting continued volume growth.

- For instance, Henry Schein, Inc. has expanded its presence in Latin America through various agreements, including an agreement to acquire S.I.N. Implant System, one of Brazil’s leading manufacturers of dental implants, in 2023, and a distribution agreement with Carrizo Dental in Argentina.

Key Challenges

Waste Management and Environmental Impact of Disposable Punches

High use of single-use biopsy punches raises concerns about medical waste volume and environmental impact. Hospitals face compliance requirements for hazardous waste handling, increasing disposal costs. Regulatory pressure encourages the development of recyclable materials and circular-use programs, yet cost and material performance remain barriers. Some healthcare systems reconsider reusable instruments, but sterilization infrastructure limits adoption in small clinics. Manufacturers must balance infection control needs with sustainability targets to maintain market competitiveness.

Price Sensitivity in Low-Resource Healthcare Settings

Budget constraints in low-income regions limit the adoption of premium biopsy punch designs. Healthcare providers may rely on lower-cost alternatives or reduce biopsy frequency due to procurement challenges. Limited reimbursement support affects diagnostic access and delays treatment decisions. Training gaps in rural and community healthcare settings reduce appropriate usage. Market participants must offer cost-effective product lines and support clinician education programs to ensure broader adoption and improved diagnostic outcomes.

Regional Analysis

North America

North America holds a market share of 38%, driven by high skin cancer screening rates and strong access to dermatology services. The United States leads due to advanced diagnostic infrastructure and a large base of ambulatory surgical centers that perform frequent punch biopsy procedures. Reimbursement support and widespread use of disposable biopsy punches improve procurement. Canada shows steady growth as awareness of early skin lesion evaluation increases. The presence of leading medical device suppliers, strong clinician training programs, and quick adoption of ergonomic punch designs continue to support market expansion across dermatology clinics, hospitals, and outpatient care networks.

Europe

Europe accounts for a market share of 27%, supported by strong public health systems and established cancer screening programs. Germany, the United Kingdom, and France lead demand as dermatology clinics adopt disposable punches to meet infection control requirements. Growth in Eastern Europe also adds new revenue potential due to improved hospital equipment funding. The region benefits from high awareness of melanoma and non-melanoma skin cancers, encouraging early biopsy. Regulatory focus on medical waste reduction drives research in recyclable biopsy punch materials. Increased training in minimally invasive dermatology strengthens the use of skin biopsy punches across diverse care settings.

Asia Pacific

Asia Pacific holds a market share of 22%, making it the fastest-growing regional segment. Rising investment in healthcare, especially in China, India, and South Korea, increases access to dermatology and women’s health diagnostics. Expanding medical tourism and improved health insurance coverage support higher biopsy procedure volumes. Regional hospitals and specialty clinics adopt disposable biopsy punches to improve patient safety and reduce sterilization needs. Awareness campaigns for skin cancer and oral precancerous lesions drive early evaluation. Local manufacturing capabilities reduce product cost and strengthen market penetration across both urban and semi-urban healthcare facilities.

Latin America

Latin America represents a market share of 7%, supported by growing dermatology and cervical cancer screening programs. Brazil and Mexico lead demand as healthcare systems increase diagnostic capacity and training for biopsy-based evaluations. Adoption of biopsy punches rises in both public and private hospitals, especially for skin lesion assessment. Economic constraints encourage the use of cost-effective disposable instruments in community clinics. Expansion of medical device distributors improves supply chain efficiency across the region. Rising ultraviolet exposure concerns and higher cases of chronic skin disorders contribute to gradual growth in biopsy procedures.

Middle East & Africa

The Middle East & Africa region holds a market share of 6%, driven by improving access to dermatology services in Gulf countries and selected African markets. The United Arab Emirates and Saudi Arabia lead as private healthcare investments support advanced diagnostic tools. Skin cancer awareness campaigns encourage early biopsy referrals, while medical tourism supports growth in specialized clinics. Limited dermatology infrastructure in parts of Africa slows adoption, yet international health programs improve training and device availability. Partnerships with global medical suppliers improve access to disposable biopsy punches. Market expansion continues as screening initiatives and healthcare modernization progress.

Market Segmentations:

By Product Type

- Disposable Biopsy Punch

- Reusable Biopsy Punch

By Diameter Size

- 1 mm to 2 mm

- 2 mm to 3 mm

- 3 mm to 4 mm

- Above 4 mm

By Application

- Skin Biopsy

- Cervical Biopsy

- Oral Biopsy

- Other Tissue Sampling

By End-User

- Hospitals

- Dermatology Clinics

- Ambulatory Surgical Centers

- Diagnostic Centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape or analysis of the Biopsy Punch market features key players such as Integra LifeSciences, Kai Medical, Sklar Surgical Instruments, Medline Industries, Aspen Surgical, AccuTec Blades, Robbins Instruments, Premier Surgical, Miltex, and Henry Schein. Companies focus on design precision, sharper cutting edges, and better ergonomic grip to support safer tissue sampling. Leading suppliers strengthen portfolios through sterile, color-coded, and disposable biopsy punch lines for dermatology and women’s health. Partnerships with hospitals and dermatology clinics improve distribution reach and procurement efficiency. Manufacturers invest in recyclable materials and reduced-waste packaging to address sustainability expectations. Digital ordering platforms help clinics manage inventory and reduce supply delays. Training programs support clinicians in selecting accurate punch diameters for diagnostic needs. Research and development efforts target enhanced sample quality for histopathology review. Regional players offer cost-efficient models for community care usage. Competition intensifies as healthcare systems expand screening programs for skin cancer and oral precancerous lesions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Integra LifeSciences

- Kai Medical

- Sklar Surgical Instruments

- Medline Industries

- Aspen Surgical

- AccuTec Blades

- Robbins Instruments

- Premier Surgical

- Miltex (A Integra LifeSciences Brand)

- Henry Schein, Inc.

Recent Developments

- In May 2024, Integra LifeSciences reported a first-quarter net loss and mentioned a product relaunch in the second half of the year, signalling operational developments in their device manufacturing business.

- In April 2024, the Paula Fox Melanoma and Cancer Centre was officially opened at The Alfred in Australia, a world-class facility that integrates clinical care with pioneering research and a hub for clinical trials.

- In February 2023, INNOVIA MEDICAL launched the oral rotating biopsy punch at BACO International 2023. This launch included two variants of the product: the Oral Rotating Biopsy Punch 120 mm and the Oral Rotating Biopsy Punch Long 180 mm

Report Coverage

The research report offers an in-depth analysis based on Product Type, Diameter Size, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for biopsy punches will grow as skin cancer screening expands.

- Disposable biopsy punches will gain higher preference due to infection control needs.

- Recyclable and reduced-waste products will become a key development focus.

- Ergonomic and precision-engineered punch designs will improve clinical outcomes.

- Diagnostic networks and tele-dermatology referrals will increase biopsy volumes.

- Training initiatives will enhance biopsy capabilities in emerging healthcare markets.

- Online procurement platforms will streamline product availability for clinics.

- Larger diameter punches will support more complex oncology and oral pathology cases.

- Research in advanced blade coatings will improve sample quality for pathology.

- Adoption will strengthen across ambulatory care centers and outpatient surgery facilities.