Market Overview

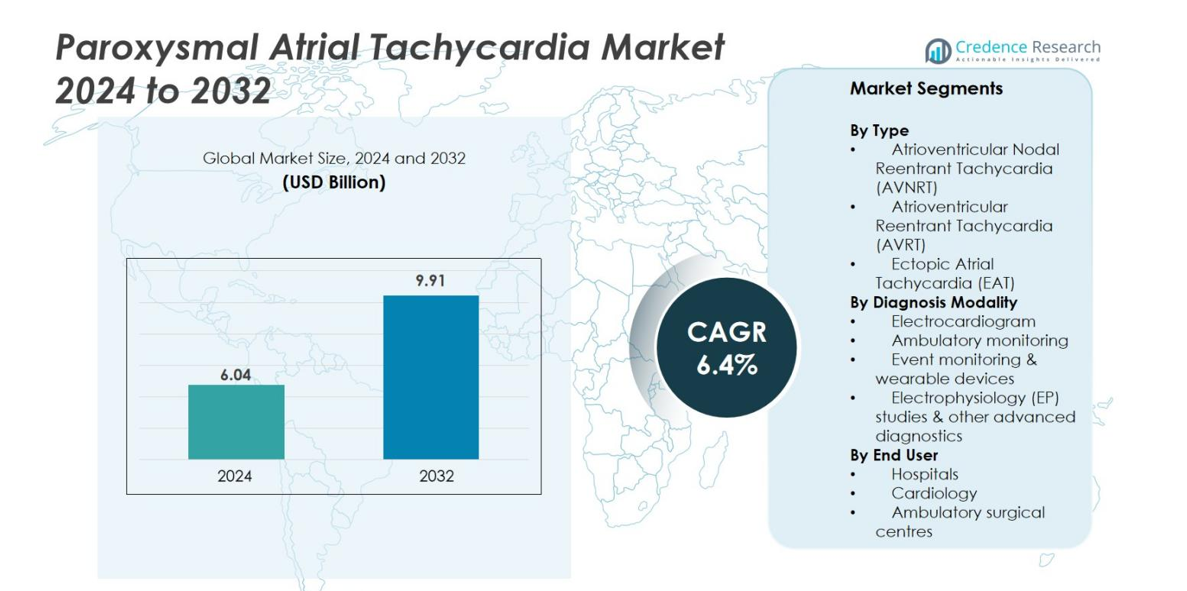

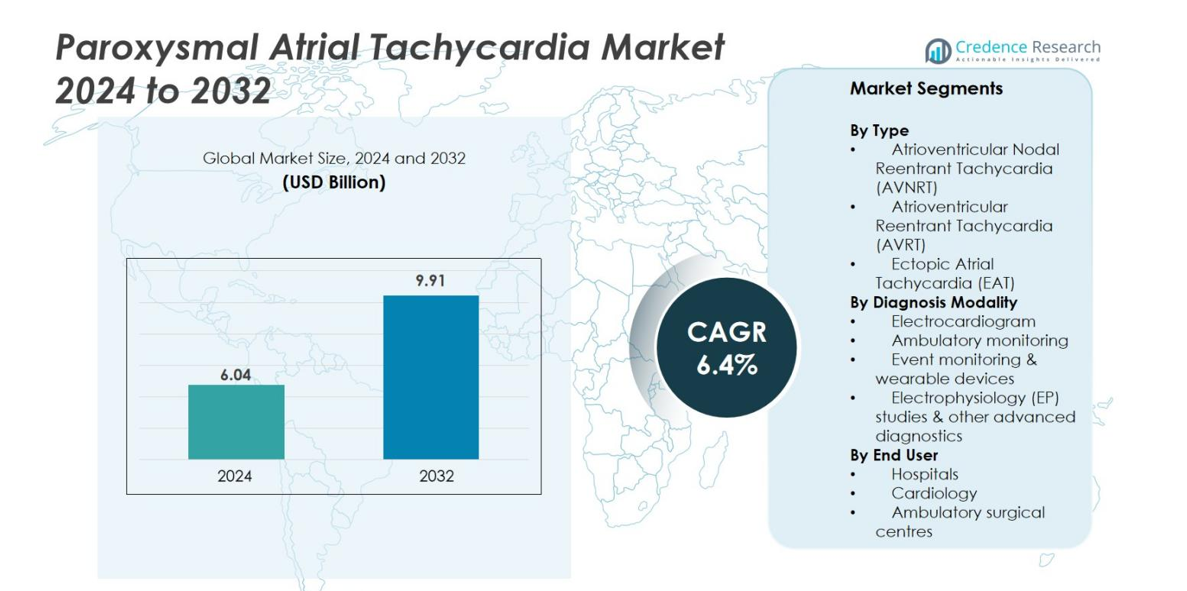

The Paroxysmal Atrial Tachycardia market size was valued at USD 6.04 Billion in 2024 and is anticipated to reach USD 9.91 Billion by 2032, at a CAGR of 6.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Paroxysmal Atrial Tachycardia Market Size 2024 |

USD 6.04 Billion |

| Paroxysmal Atrial Tachycardia Market, CAGR |

6.4% |

| Paroxysmal Atrial Tachycardia Market Size 2032 |

USD 9.91 Billion |

Key players in the global Paroxysmal Atrial Tachycardia (PAT) market include Abbott Laboratories, Boston Scientific Corporation, Medtronic plc, and Biotronik SE & Co. KG together commanding approximately 80 % of the market. Regional leadership lies with North America, which holds around 37 % – 40 % of global market share, driven by strong electrophysiology infrastructure, high treatment adoption and favorable reimbursement. These companies leverage their broad portfolios and global reach to consolidate their positions, while the North American region provides a stable hub for innovation, procedural volumes and early adoption.

Market Insights

- The global Paroxysmal Atrial Tachycardia market was valued at USD 6.04 Billion in 2024 and is projected to reach USD 9.91 Billion by 2032, growing at a CAGR of 6.4 % during the forecast period.

- Rising prevalence of cardiac arrhythmias, aging populations, and lifestyle-related risk factors drive demand for diagnostics, monitoring devices, and catheter ablation therapies across hospitals and cardiology clinics.

- Adoption of wearable ECG devices, ambulatory monitors, and AI-integrated remote monitoring platforms is increasing, while minimally invasive ablation technologies enhance procedural efficiency and patient outcomes globally.

- Key players, including Abbott Laboratories, Boston Scientific, Medtronic, and Biotronik, dominate the market, leveraging strategic partnerships, product innovation, and training programs to strengthen competitive positioning and expand reach.

- North America leads with 42 % market share, followed by Europe at 28 %, Asia Pacific 22 %, Latin America 7 %, and MEA 5 %; AVNRT remains the dominant type segment with 42 % share, driving regional and global growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Type

Atrioventricular Nodal Re‑entrant Tachycardia (AVNRT) dominates the type segment, accounting for 42% of the market share in 2024. Its prevalence among adults and higher recurrence rate drive demand for effective interventions. Atrioventricular Re‑entrant Tachycardia (AVRT) holds 28% share, supported by advancements in ablation techniques. Ectopic Atrial Tachycardia (EAT) represents 30%, driven by increasing diagnosis in pediatric and young adult populations. Rising awareness of arrhythmia management, coupled with innovations in minimally invasive procedures, supports market growth across all type categories.

- For instance, cryoablation has been demonstrated to offer a safe, effective alternative to radiofrequency ablation, with lower risks of atrioventricular block and less fluoroscopy time in young and active patients.

By Diagnosis Modality

Electrocardiogram (ECG) leads the diagnosis segment with 38% market share, owing to its ease of use, low cost, and high adoption in hospitals. Ambulatory monitoring captures 25%, fueled by continuous heart rhythm tracking for early detection. Event monitoring and wearable devices hold 20%, driven by growing consumer preference for home-based monitoring. Electrophysiology (EP) studies and advanced diagnostics account for 17%, supported by precise mapping of arrhythmic foci and increased procedural adoption in specialized clinics. Digital integration and real-time monitoring enhance the segment’s expansion.

- For instance, GE Healthcare offers a suite of clinically accurate ECG solutions widely implemented in cardiac centers and hospitals globally, supporting real-time clinical decision-making.

By End‑User

Hospitals are the dominant end-user, representing 46% of the market, due to their capacity for advanced EP procedures and comprehensive inpatient care. Cardiology clinics hold 32%, benefiting from specialized outpatient interventions and increasing patient inflow for arrhythmia management. Ambulatory surgical centres account for 22%, driven by minimally invasive catheter ablation procedures and cost-effective service delivery. Growth is fueled by rising prevalence of PAT, improved hospital infrastructure, and adoption of advanced diagnostic and therapeutic technologies, ensuring better patient outcomes across all care settings.

Key Growth Drivers

Rising Prevalence of Cardiac Arrhythmias

The increasing global incidence of cardiac arrhythmias, particularly atrial tachycardias, significantly drives market growth. Aging populations and lifestyle-related risk factors, such as obesity, hypertension, and diabetes, contribute to higher PAT cases. Hospitals and cardiology clinics are witnessing growing patient inflows, increasing demand for diagnostic tools, monitoring devices, and treatment options like catheter ablation and anti-arrhythmic therapies. The rise in awareness among patients and healthcare providers about early diagnosis and effective management further supports market expansion. Additionally, government initiatives promoting cardiovascular health and preventive care are enhancing access to advanced therapies, creating robust growth opportunities across developed and emerging regions.

- For instance, government-sponsored programs such as the Million Hearts™ initiative in the US focus on enhancing cardiovascular disease prevention through improved access to care and awareness, which supports early diagnosis and management, further expanding market opportunities.

Advancements in Diagnostic and Monitoring Technologies

Rapid innovations in diagnostic modalities, including wearable devices, ambulatory monitors, and electrophysiology mapping systems, are fueling market expansion. Continuous heart rhythm tracking through event monitors and smart wearables enables early detection of PAT episodes, improving treatment efficacy. Integration of AI-based analytics and cloud-connected platforms allows real-time patient monitoring and remote intervention, enhancing clinical outcomes. Improved accuracy of electrocardiograms, Holter monitoring, and EP studies has increased physician confidence in diagnosis and treatment planning. These technological advancements reduce procedural risks, shorten hospital stays, and support minimally invasive interventions, driving adoption across hospitals, outpatient centers, and home care settings globally.

- For instance, Biosense Webster launched the CARTO™ 3 System Version 8, which incorporates AI-powered features like the CARTOSOUND™ FAM Module to automate 3D anatomical reconstruction and enhance precision in electrophysiology mapping for cardiac ablation procedures.

Increasing Adoption of Catheter Ablation and Minimally Invasive Therapies

The preference for catheter ablation and other minimally invasive procedures is a key growth driver in the PAT market. Ablation offers targeted treatment with lower recurrence rates compared to long-term pharmacotherapy, attracting both patients and clinicians. Rising procedural volumes in hospitals and specialized cardiac centers are supported by improved ablation technologies, including 3D mapping systems, robotic-assisted catheters, and cryoablation devices. Physicians favor these techniques for their precision and reduced recovery times, while patients benefit from improved safety and quality of life. Expanding infrastructure in emerging economies and reimbursement support for advanced interventions further fuels adoption, enhancing market revenue potential across both developed and developing regions.

Key Trends & Opportunities

Integration of Digital Health and Remote Monitoring

Digital health solutions and remote monitoring systems are transforming PAT management. Wearable ECG devices, mobile apps, and cloud-based platforms allow continuous tracking of arrhythmia events outside clinical settings. This trend supports proactive intervention, reduces hospital visits, and enables personalized therapy adjustments. Integration with telemedicine and AI-driven analytics improves predictive diagnostics and clinical decision-making. Opportunities exist for software developers and device manufacturers to innovate in user-friendly monitoring solutions. Healthcare providers increasingly leverage remote monitoring to optimize patient outcomes, creating avenues for new product launches, strategic collaborations, and expansion in home care markets globally.

- For instance, MEZOO, a Korea-based digital healthcare company, developed HiCardi, a wearable chest-worn ECG device that continuously monitors vital signs and detects 17 types of arrhythmias, transmitting real-time data to healthcare professionals for remote patient management.

Expansion of Awareness and Preventive Healthcare Programs

Awareness campaigns and preventive cardiology programs present significant market opportunities. Educational initiatives highlight early diagnosis, risk factor management, and timely intervention for PAT. Growing patient knowledge encourages routine heart monitoring and adoption of preventive therapies. Partnerships between hospitals, clinics, and government programs enhance outreach, particularly in emerging economies where underdiagnosis is common. Preventive healthcare strategies also increase demand for wearable monitors, ambulatory devices, and diagnostic services. These initiatives support sustained market growth, enabling stakeholders to address unmet needs, reduce long-term complications, and create a robust pipeline for innovative diagnostics and treatment options.

- For instance, the Rwanda Heart Foundation launched a nationwide cardiovascular risk awareness campaign supported by the World Heart Federation, focusing on lifestyle modification and early detection of heart disease.

Key Challenges

High Cost of Advanced Diagnostics and Treatment

The significant cost associated with PAT diagnostics and therapeutic interventions poses a major challenge. Advanced tools, including EP studies, 3D mapping systems, and catheter ablation devices, require substantial capital investment, limiting accessibility in cost-sensitive regions. Reimbursement policies vary globally, creating financial barriers for patients and healthcare providers. The expense of ongoing monitoring through wearables or ambulatory devices further adds to the burden, potentially slowing adoption in emerging markets. Manufacturers and healthcare providers must balance technological innovation with cost-effective solutions to expand market reach while maintaining quality care.

Limited Skilled Workforce and Infrastructure

A shortage of trained electrophysiologists, specialized technicians, and well-equipped cardiac centers constrains market growth. Complex ablation procedures and advanced diagnostics demand expert handling and robust infrastructure. Emerging economies, in particular, face gaps in clinical expertise and procedural facilities, limiting patient access to effective PAT management. Continuous training, certification programs, and infrastructure investment are required to address these constraints. Market expansion depends on increasing the availability of skilled professionals, upgrading hospitals and clinics, and enhancing awareness of advanced treatment options to ensure safe and widespread adoption of PAT interventions globally.

Regional Analysis

North America

North America holds the largest share of the Paroxysmal Atrial Tachycardia (PAT) market at approximately 42% in 2024. Advanced healthcare infrastructure, high treatment uptake, and strong reimbursement policies drive this dominance. The region benefits from rapid adoption of catheter ablation, wearable diagnostics, and remote monitoring systems. Increasing incidence of cardiac arrhythmias and rising awareness among healthcare providers further support demand. Combined with robust R&D investment and major medical device manufacturers, North America remains the key regional market for PAT therapies and diagnostics.

Europe

Europe contributes roughly 28% of the global PAT market, supported by integrated cardiology networks and comprehensive diagnostic access. The region has broad use of ECG, Holter monitors, and electrophysiology studies within national healthcare systems. Growing focus on minimally invasive treatments, like catheter ablation, and expanding tele‑cardiology services enhance growth. Aging demographics and increasing cardiovascular disease prevalence further drive demand. While reimbursement is favourable across many countries, variant national policies and variable infrastructure in Eastern Europe pose constraints. Overall, Europe serves as a stable, mature market region.

Asia Pacific

Asia Pacific records the fastest growth in the PAT market, with a current share around 22% and a projected higher CAGR over the forecast period. Rising healthcare expenditure, expanding hospital and EP‑lab infrastructure, and improving insurance access support growth in markets such as China, India, and Japan. Increasing cardiovascular disease burden and higher arrhythmia screening rates add momentum. Nonetheless, heterogeneous healthcare systems and uneven device penetration across countries pose challenges. With evolving adoption of advanced diagnostics and therapies, Asia Pacific offers significant growth potential for market players.

Latin America

Latin America accounts for about 7% of the global PAT market, reflecting moderate adoption of advanced arrhythmia diagnostics and treatment. Brazil and Mexico lead regional demand, driven by rising cardiovascular disease awareness and slowly expanding electrophysiology services. However, infrastructure gaps, limited reimbursement frameworks, and lower per‑capita device penetration restrict accelerated growth. With improving healthcare access and increased investment in cardiac care, the region offers incremental opportunities but remains less mature compared with North America and Europe.

Middle East & Africa (MEA)

The MEA region holds approximately 5% of the PAT market, reflecting early‑stage development relative to other regions. Healthcare systems in the Gulf Cooperation Council countries invest in cardiac infrastructure and diagnostics, driving growth in that sub‑region. In contrast, many African nations face significant access limitations, resource constraints, and workforce shortages. Growth hinges on improving arrhythmia awareness, deploying diagnostics, and expanding catheter‑based therapies. While potential exists, regional heterogeneity and fiscal constraints moderate near‑term market expansion.

Market Segmentations

By Type

- Atrioventricular Nodal Re‑entrant Tachycardia (AVNRT)

- Atrioventricular Re‑entrant Tachycardia (AVRT)

- Ectopic Atrial Tachycardia (EAT)

By Diagnosis Modality

- Electrocardiogram

- Ambulatory monitoring

- Event monitoring & wearable devices

- Electrophysiology (EP) studies & other advanced diagnostics

By End‑User

- Hospitals

- Cardiology

- Ambulatory surgical centres

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Paroxysmal Atrial Tachycardia (PAT) market is concentrated, with the top five companies Abbott Laboratories, Boston Scientific Corporation, Medtronic plc, Biosense Webster (a subsidiary of Johnson & Johnson), and Biotronik SE & Co. KG together commanding about 80% of the market share. These firms focus heavily on product innovation, including ablation catheters, mapping systems, and monitoring devices, as well as strategic partnerships and acquisitions to strengthen their portfolios and geographic reach. Competitive pressure remains high, particularly as newer entrants advance wearable technologies and remote diagnostics. Market players also differentiate through service support, clinical training, and reimbursement strategies to maintain leadership in this evolving field.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Johnson & Johnson (United States)

- Sanofi S.A. (France)

- Bristol-Myers Squibb (United States)

- Medtronic PLC (Ireland)

- Boston Scientific Corporation (United States)

- AbbVie Inc. (United States)

- Abbott Laboratories (United States)

- Philips Healthcare (Netherlands)

- Hansen Medical (United States)

- AtriCure, Inc. (United States)

Recent Developments

- In September 2025, Sungrow introduced its 4.8 MW SG4800UD-MV-US modular inverter for the North American market at RE+ 2025, combining central and string inverter benefits with modular architecture and grid-forming features.

- In May 2025, Huawei Technologies Co., Ltd’s Digital Power division launched its “All-Scenario Grid Forming ESS” strategy and next-generation PV+ESS products at Intersolar Europe 2025.

- In April 2025, Sungrow Power Supply Co., Ltd unveiled its 1+X 2.0 Modular Inverter at the Global Renewable Energy Summit, offering a scalable block design (800 kW–9.6 MW) with grid-forming capabilities and AI-driven diagnostics

Report Coverage

The research report offers an in-depth analysis based on Type, Diagnosis Modality, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is poised for sustained expansion driven by rising PAT diagnosis rates and broader access to care.

- Adoption of wearable ECG monitors and remote diagnostics will increasingly enable early detection and intervention.

- Demand for minimally invasive catheter‑ablation techniques and next‑generation mapping systems will accelerate treatment uptake.

- Emerging economies will record higher growth, as evolving healthcare infrastructure and arrhythmia awareness improve access.

- Strategic collaborations among device manufacturers, software firms, and care providers will create integrated care ecosystems.

- Regulatory reforms and enhanced reimbursement models will improve affordability and stimulate broader market acceptance.

- Personalized treatment protocols and AI‑augmented analytics will optimize clinical outcomes and reduce recurrence risks.

- Enhanced training programs for electrophysiologists and expansion of outpatient ablation centres will boost patient throughput.

- Cost pressures and unequal global access will prompt development of lower‑cost device variants and modular service models.

- Greater emphasis on lifestyle modification and remote monitoring will open new value‑chain opportunities in home‑based PAT management.