Market Overview:

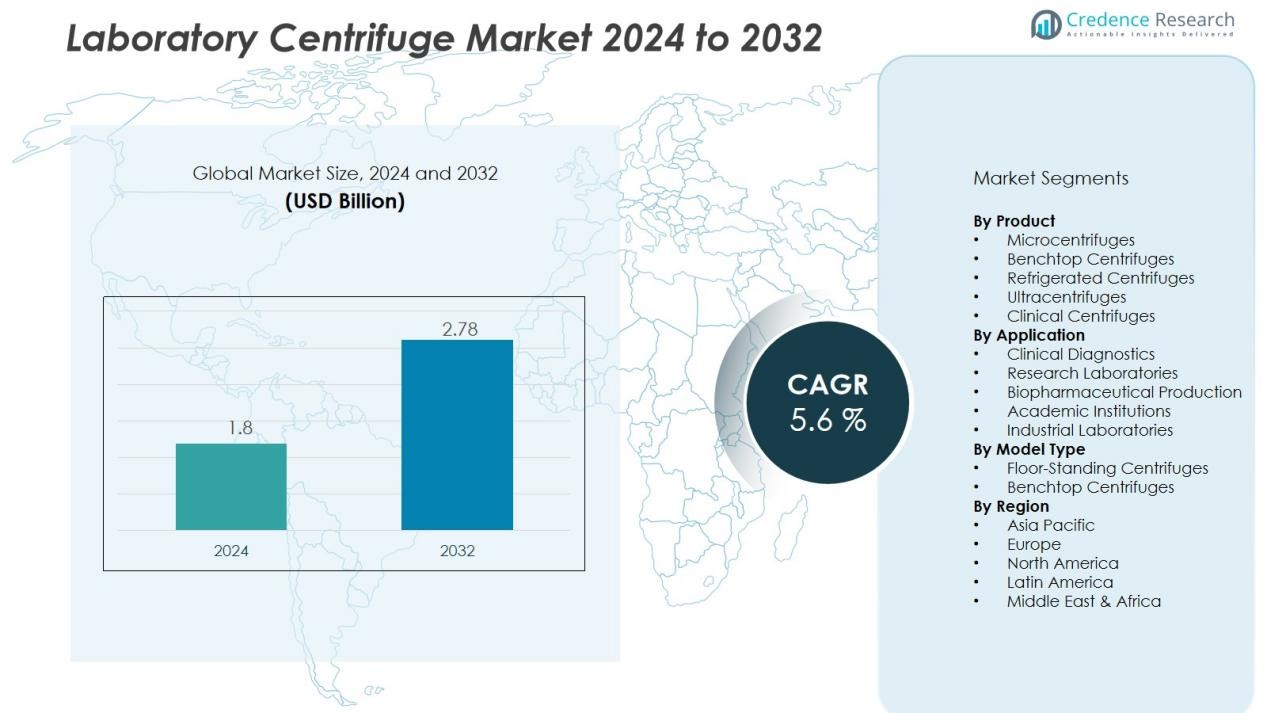

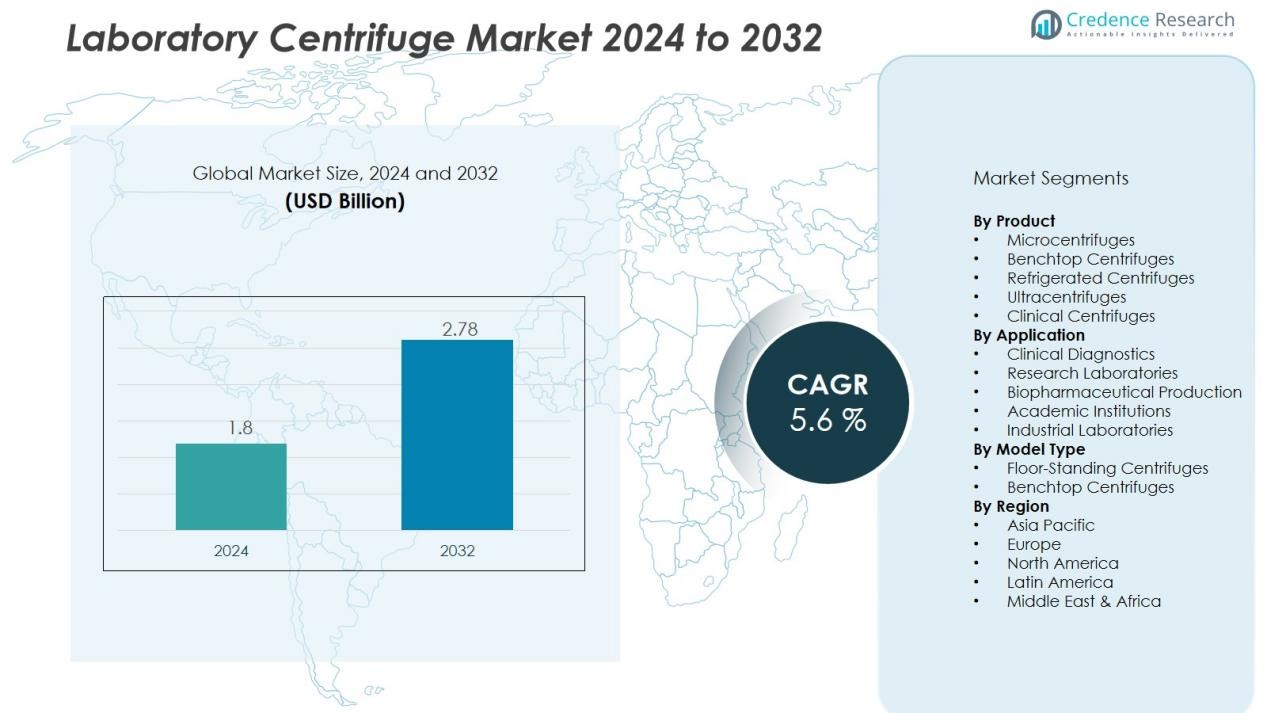

The Laboratory Centrifuge Market size was valued at USD 1.8 billion in 2024 and is anticipated to reach USD 2.78 billion by 2032, at a CAGR of 5.6 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Laboratory Centrifuge Market Size 2024 |

USD 1.8 Billion |

| Laboratory Centrifuge Market, CAGR |

5.6% |

| Laboratory Centrifuge Market Size 2032 |

USD 2.78 Billion |

The market experiences sustained demand due to several drivers, including the global rise in chronic and infectious diseases, which accelerates diagnostic testing requirements. Growth in biopharmaceutical R&D further boosts centrifuge usage, particularly in cell culture, protein purification, and molecular biology workflows. Advancements such as refrigerated centrifuges for heat-sensitive samples, high-speed ultracentrifuges for molecular analysis, and digital interfaces that enhance operational precision also drive adoption. Increasing automation and compliance with stringent quality and safety standards strengthen the market’s long-term outlook.

Regionally, North America leads due to strong healthcare infrastructure, significant R&D investments, and the presence of major biotechnology and pharmaceutical firms. Europe follows with robust academic research networks and clinical testing capacities. Asia-Pacific emerges as the fastest-growing region, driven by expanding diagnostic laboratories, large patient populations, and continued investment in biomedical research, particularly in China, India, and Southeast Asian countries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Laboratory Centrifuge Market was valued at USD 1.8 billion in 2024 and is projected to reach USD 2.78 billion by 2032, advancing at a CAGR of 5.6% as rising diagnostic workloads, biopharmaceutical R&D, and advanced centrifugation technologies continue to support global demand.

- North America leads with 38% share due to strong diagnostic infrastructure, high test volumes, and sustained biopharmaceutical investments that drive adoption of advanced and automated centrifuge platforms.

- Europe holds 28% share, supported by its robust academic research ecosystem, extensive molecular testing programs, and strict regulatory standards that require high-performance centrifugation systems.

- Asia-Pacific commands 24% share and ranks as the fastest-growing region, driven by expanding diagnostic labs, rising chronic disease burdens, and strong government support for biomedical and genomics research.

Market Drivers:

Market Drivers:

Strong Growth in Diagnostic Testing Driving Demand for Advanced Centrifugation

The Laboratory Centrifuge Market expands due to higher diagnostic test volumes worldwide. Healthcare providers increase sample processing needs for infectious disease detection, oncology screening, and chronic disorder monitoring. Laboratories seek reliable centrifugation tools that support faster turnaround times. The market benefits from rising investments in automated sample preparation. These factors create steady procurement momentum across hospital and clinical labs.

- For Instance, Hettich does market these systems, including the ROTANTA 460 Robotic and SBS 300 Robotic, as designed for high-throughput environments in clinical and research laboratories to increase efficiency and minimize manual intervention.

Rising Biopharmaceutical Research Activity Supporting High-Performance Equipment Adoption

Biopharmaceutical firms elevate demand for precision centrifugation to improve workflows in cell culture, protein purification, and molecular assays. The Laboratory Centrifuge Market gains from higher R&D spending in biologics and gene therapies. Research teams rely on ultracentrifuges and refrigerated models to manage sensitive materials. These systems deliver controlled temperature settings and stable rotational forces. The industry values consistent performance for regulated manufacturing and discovery work.

- For Instance, Thermo Fisher Scientific, the CTS Rotea system can achieve over 95% cell recovery in specific applications, such as T cell processing. The system also demonstrates efficient processing of large input volumes, with sample data showing concentration of 1,000 mL down to 5 mL with 97% recovery.

Advancements in Rotor Technology and Automation Enhancing Laboratory Productivity

Innovations in rotor material, digital control systems, and safety features improve laboratory throughput. The Laboratory Centrifuge Market benefits when users shift to automated interfaces that reduce manual effort. These upgrades help laboratories manage complex sample loads with greater accuracy. Engineers refine instrument designs to minimize vibration and noise. Productivity improves when staff operate safer and more intuitive equipment.

Expansion of Healthcare Infrastructure Across Emerging Regions Strengthening Equipment Uptake

Healthcare systems in Asia-Pacific, Latin America, and the Middle East expand diagnostic and research capacity. The Laboratory Centrifuge Market experiences stronger demand in these regions due to government investment in laboratory modernization. New diagnostic labs and academic research centers require scalable centrifugation platforms. Local manufacturers introduce cost-effective units that support basic and advanced applications. Growing healthcare access increases procurement of essential laboratory instruments.

Market Trends:

Increasing Shift Toward Automation, Digital Control, and Smart Workflow Integration

The Laboratory Centrifuge Market sees strong momentum toward automated and digitally controlled systems. Laboratories adopt touchscreen interfaces and software-driven control panels to improve precision and user safety. It supports real-time performance monitoring and reduces manual errors across routine workflows. Integrated data logging features help institutions meet compliance standards and audit requirements. Remote monitoring functions gain traction in high-volume research and diagnostic settings. Users adopt connected centrifuges that align with broader laboratory information systems. These trends strengthen operational efficiency and equipment consistency.

- For Instance, Adopting remote monitoring and predictive maintenance for laboratory equipment, such as centrifuges and freezers, enables biobanks to improve equipment reliability and optimize maintenance schedules.

Rising Preference for High-Capacity, Energy-Efficient, and Versatile Centrifuge Platforms

High-capacity centrifuge models attract demand due to increased sample loads in clinical and biopharmaceutical environments. The Laboratory Centrifuge Market benefits from a stronger focus on energy-efficient designs that reduce operational costs. It includes innovations in rotor materials that deliver higher durability and stable performance. Laboratories favor models that support multiple tube formats, specialty rotors, and temperature-controlled workflows. Compact benchtop designs gain attention in space-constrained facilities. Users prefer quieter systems that reduce workplace fatigue and support longer operating hours. These preferences guide product development toward flexible and sustainable equipment choices.

- For instance, Eppendorf’s 5910 Ri centrifuge features a maximum capacity of 4 × 1,000 mL and integrates a new cooling system that reduces energy consumption by up to 18%, offering quiet operation at <59 dB(A) during maximum speed, which enhances operator comfort and sustainability.

Market Challenges Analysis:

High Maintenance Requirements and Operational Complexities Limiting Equipment Efficiency

The Laboratory Centrifuge Market faces challenges linked to frequent maintenance demands and operational complexity. Laboratories manage rotor balancing, temperature control, and calibration to prevent equipment failures. It increases downtime when parts wear out under high-speed conditions. Users require skilled staff to handle setup and troubleshooting, which strains smaller facilities. Safety concerns rise when operators manage hazardous samples under strict protocols. Compliance with regulatory standards adds more operational pressure. These issues slow adoption in budget-limited environments.

Rising Cost Pressures and Limited Access to Advanced Models in Developing Regions

High procurement and maintenance costs restrict access to advanced centrifuge platforms in emerging markets. The Laboratory Centrifuge Market encounters barriers when institutions prioritize lower-cost instruments over high-performance units. It creates a performance gap between advanced research centers and smaller diagnostic labs. Import duties and supply delays increase the total cost of ownership. Service networks remain limited in rural or underserved areas. Users struggle to replace parts quickly, which reduces uptime. These constraints limit wider modernization efforts across developing regions.

Market Opportunities:

Expansion of Molecular Diagnostics, Genomics, and Biopharmaceutical R&D Creating Strong Growth Paths

The Laboratory Centrifuge Market gains opportunities from the rapid rise of molecular diagnostics and genomics programs. Research teams expand nucleic acid extraction, cell separation, and biomarker analysis, which increases demand for advanced centrifugation tools. It supports broader adoption of high-speed, refrigerated, and ultracentrifuge models across research institutes. Biopharmaceutical firms invest in new facilities that require standardized sample preparation systems. Clinical laboratories upgrade equipment to meet higher testing volumes for infectious and chronic diseases. These developments strengthen market penetration across high-growth scientific domains. The opportunity widens when institutions pursue large-scale research funding.

Rising Need for Automation, Smart Connectivity, and Energy-Efficient Laboratory Equipment

Automation and digital connectivity create strong opportunities for next-generation centrifuge platforms. The Laboratory Centrifuge Market benefits when users seek instruments that integrate with laboratory information systems and support remote monitoring. It helps laboratories optimize workflows, reduce manual errors, and improve traceability. Energy-efficient designs attract attention in facilities that target lower operational costs and sustainability goals. Compact and versatile models appeal to decentralized testing centers and mobile laboratory units. Strong demand for safer, quieter, and user-friendly instruments drives product innovation. These trends open pathways for manufacturers to expand into new customer segments.

Market Segmentation Analysis:

By Product

The segment in the Laboratory Centrifuge Market covers microcentrifuges, refrigerated centrifuges, ultracentrifuges, and benchtop models. Microcentrifuges remain widely used in molecular biology and routine clinical workflows. Refrigerated units support temperature-sensitive samples in genomics, proteomics, and cell research. Ultracentrifuges serve advanced biopharmaceutical and academic programs that require high-speed separation. Benchtop centrifuges appeal to diagnostic labs that prefer compact and versatile instruments. The market sees higher adoption when users seek reliable performance across varied sample types.

- For instance, the Eppendorf Centrifuge 5425 delivers maximum rotational speeds of 15,060 RPM generating 21,300 x g relative centrifugal force, enabling efficient separation of DNA/RNA and protein purification in molecular biology applications across 0.2 to 5 mL tube formats.

By Application

The segment spans clinical diagnostics, research laboratories, biopharmaceutical production, and academic institutions. Clinical diagnostics hold strong demand due to higher sample loads in disease testing. Research laboratories prefer advanced speed control and temperature stability for cell analysis and molecular assays. Biopharmaceutical facilities depend on centrifuges for upstream and downstream workflows. Academic institutions use centrifuges to support a wide range of teaching and research needs. The Laboratory Centrifuge Market strengthens its position when each application area expands testing capacity.

By Model Type

The segment includes floor-standing centrifuges and benchtop centrifuges. Floor-standing units provide higher capacity and stronger performance for large laboratories and bioprocess settings. Benchtop models serve small to mid-sized labs that require space-saving solutions. It supports routine processing for blood samples, microtubes, and culture materials. Demand rises for energy-efficient and low-noise variants in both categories. Manufacturers refine designs to increase safety, durability, and workflow precision across model types.

- For instance, other high-performance Thermo Scientific ultracentrifuges, such as models in the Sorvall MTX/MX+ micro-ultracentrifuge series, are capable of producing over 1,000,000 x g, providing an example of a centrifuge category that reaches this force.

Segmentations:

By Product

- Microcentrifuges

- Benchtop Centrifuges

- Refrigerated Centrifuges

- Ultracentrifuges

- Clinical Centrifuges

By Application

- Clinical Diagnostics

- Research Laboratories

- Biopharmaceutical Production

- Academic Institutions

- Industrial Laboratories

By Model Type

- Floor-Standing Centrifuges

- Benchtop Centrifuges

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Leading with Strong Institutional Demand

North America holds 38% share of the Laboratory Centrifuge Market and maintains a dominant position. The region benefits from strong diagnostic infrastructure and high testing volumes. Research institutions and biopharmaceutical firms drive consistent procurement of advanced centrifuge platforms. It supports rapid adoption of automated and high-capacity systems that improve workflow precision. Hospitals upgrade equipment to meet rising chronic disease testing needs. Favorable funding for research strengthens long-term growth. The region continues to lead due to strong innovation and steady replacement cycles.

Europe Strengthening Presence Through Research Excellence

Europe captures 28% share supported by an extensive network of academic research centers and clinical laboratories. The region benefits from strong investments in biotechnology, genomics, and precision medicine programs. Laboratories adopt advanced refrigerated and ultracentrifuge systems for molecular and proteomic studies. It helps institutions meet strict regulatory standards for sample processing and safety. Demand rises in diagnostic laboratories due to higher testing complexity. Universities expand their use of high-performance centrifuges to support scientific programs. Strong collaboration across public and private sectors reinforces market growth.

Asia-Pacific Emerging Fast with Expanding Healthcare and Research Ecosystems

Asia-Pacific holds 24% share and ranks as the fastest-growing regional market. Countries expand diagnostic capacity to support higher testing volumes for infectious and chronic diseases. Research institutes invest in centrifuges for genomics, cell culture, and vaccine development. It attracts global manufacturers that introduce cost-efficient and high-performance models. Local production capabilities grow in China, India, and South Korea. Hospitals improve laboratory infrastructure to meet rising patient loads. Strong government support for biomedical research accelerates regional adoption.

Key Player Analysis:

- Andreas Hettich GmbH & Co. KG

- Danaher Corporation (Beckman Coulter, Inc.)

- Eppendorf AG

- Thermo Fisher Scientific Inc.

- HERMLE Labortechnik GmbH

- KUBOTA Corporation

- Sartorius AG

- Cardinal Health

- Sigma Laborzentrifugen GmbH

- QIAGEN

Competitive Analysis:

The Laboratory Centrifuge Market features strong competition driven by innovation, product range depth, and global distribution strength. Key participants include Andreas Hettich GmbH & Co. KG, Danaher Corporation (Beckman Coulter, Inc.), Eppendorf AG, Thermo Fisher Scientific Inc., and HERMLE Labortechnik GmbH. Each company invests in advanced rotor technology, digital controls, and safety systems to strengthen product reliability. It supports higher adoption in clinical diagnostics, research laboratories, and biopharmaceutical facilities.

Leading players expand portfolios with high-capacity models, refrigerated systems, and benchtop units that address diverse workflow needs. Companies focus on automation, improved ergonomics, and quieter designs to improve operator experience. Strategic partnerships with laboratories and academic institutions help widen market reach. Manufacturers also target emerging regions with cost-efficient models and focused service networks. Competitive intensity increases as firms refine technologies to support precision workflows and growing diagnostic demand.

Recent Developments:

- In November 2025, Andreas Hettich GmbH & Co. KG showcased new product innovations at Interzum 2025, reinforcing its commitment to market-oriented research and development.

- In May 2025, Danaher Corporation announced a partnership with AstraZeneca to develop next-generation AI-powered diagnostic tools for precision medicine, leveraging technology from Danaher and subsidiary Leica Biosystems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Product, Application, Model Type and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- High-precision and automated centrifuge systems will gain wider use in clinical and research labs.

- Digital connectivity will expand, enabling real-time monitoring and integration with laboratory information systems.

- Energy-efficient centrifuge models will attract stronger demand in sustainability-focused facilities.

- Manufacturers will introduce compact designs that support decentralized and point-of-care testing.

- High-capacity platforms will see stronger adoption in biopharmaceutical manufacturing and cell therapy workflows.

- Advanced rotor materials will improve durability, speed stability, and long-term safety performance.

- Global research growth in genomics and molecular diagnostics will elevate demand for high-speed units.

- AI-driven maintenance alerts will improve uptime and reduce operational disruptions in busy laboratories.

- Training tools and user-friendly interfaces will support safer and more efficient operation.

- Emerging markets will adopt a broader mix of benchtop and refrigerated centrifuges as healthcare infrastructure expands.

Market Drivers:

Market Drivers: