Market overview

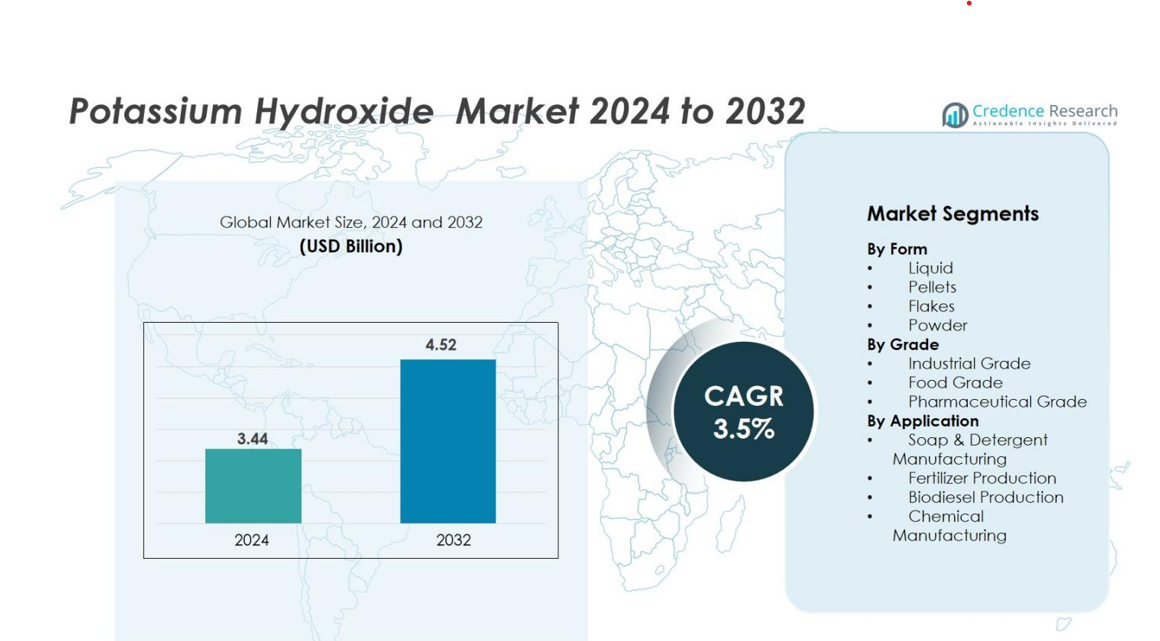

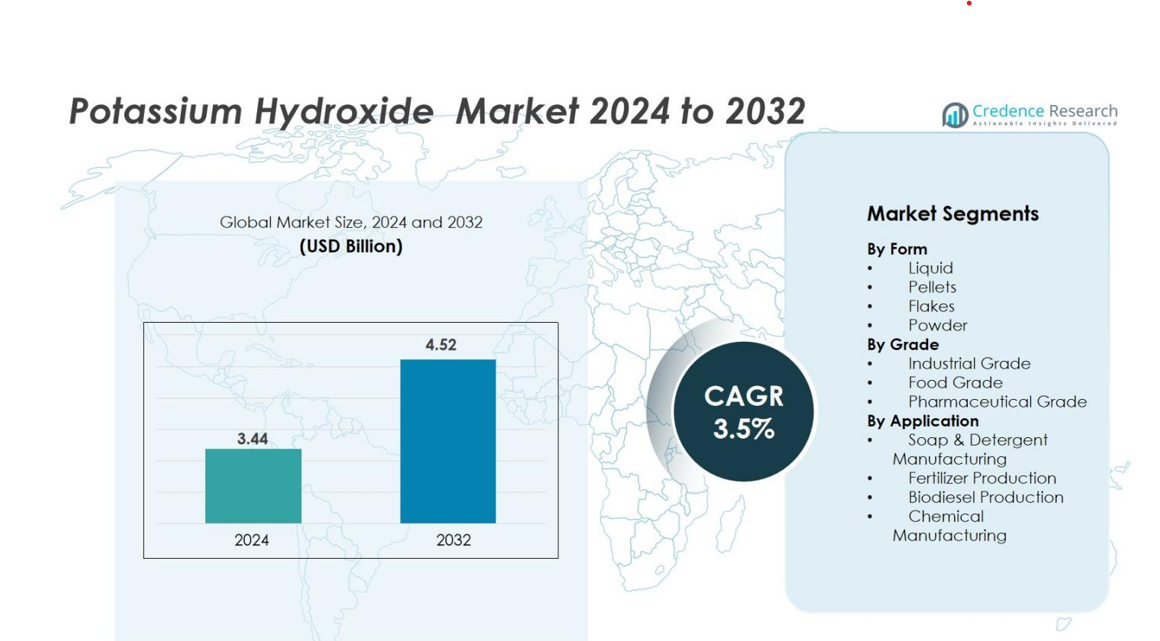

The Potassium Hydroxide market size was valued at USD 3.44 billion in 2024 and is anticipated to reach USD 4.52 billion by 2032, at a CAGR of 3.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Potassium Hydroxide Market Size 2024 |

USD 3.44 billion |

| Potassium Hydroxide Market, CAGR |

3.5% |

| Potassium Hydroxide Market Size 2032 |

USD 4.52 billion |

The global Potassium Hydroxide market features prominent players including Solvay S.A., BASF SE, Dow Inc., Occidental Petroleum Corporation (OxyChem), Olin Corporation, UNID Co., Ltd., Merck KGaA, Airedale Chemical Company Limited, American Elements and Altair Chemical S.r.l.. These firms dominate through integrated production, broad geographic reach and diverse grade portfolios. Regionally, Asia‑Pacific leads the market with a 39.8% share, North America holds about 29.9%, and Europe captures roughly 25% of global revenue. Their strategic investments in high‑purity grades, sustainable manufacturing and regional expansion drive competitive strength.

Market Insights

- The Potassium Hydroxide market was valued at USD 3.44 billion in 2024 and is projected to reach USD 4.52 billion by 2032, growing at a CAGR of 3.5% during the forecast period.

- Rising demand for fertilizers, biodiesel production, and detergent manufacturing are key drivers for market growth, with agricultural expansion being the major contributing factor.

- The market is witnessing a trend toward higher-grade KOH for pharmaceutical and food applications, alongside the adoption of sustainable production technologies.

- Competitive landscape includes key players like Solvay, BASF, Dow, and Occidental Petroleum, with Asia-Pacific leading the market share at 39.8%, followed by North America at 29.9% and Europe at 25%.

- Key restraints include regulatory challenges, raw material price fluctuations, and competition from substitutes like Sodium Hydroxide, which may limit market potential.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Form

The liquid form dominates the Potassium Hydroxide market with an estimated 55.6% share in 2024. Its strong performance stems from ease of handling, high solubility, and suitability for large‑scale chemical, biodiesel and water‑treatment operations. Pellets, flakes and powder forms are growing, but liquid remains preferred for high‑volume industrial applications given its operational advantages and process adaptability.

- For instance, sodium hydroxide is available in pellets, flakes, or as a liquid solution. The solid forms (pellets and flakes) are often preferred for applications requiring high purity and specific dosing, like in pharmaceuticals and laboratories.

By Grade

In 2024 the industrial‑grade segment held around 66.7% of the market. This grade sees vast usage across detergent manufacture, fertilizers, chemical processing and petroleum refining because of its cost efficiency and suitability for bulk applications. Food and pharmaceutical grades are growing faster, yet industrial grade continues to dominate thanks to its broad base of end‑use industries and established supply chains.

- For instance, BASF SE utilizes industrial-grade ammonia in fertilizer synthesis (e.g., to produce urea and ammonium nitrate) and a wide range of chemical manufacturing applications, capitalizing on its integrated production (Verbund) system to ensure a reliable supply chain and consistent performance.

By Application

The fertilizer‑production segment led the market in 2024 with an estimated 34.6% share, driven by rising agriculture demand and the essential role of potassium hydroxide in potassium‑based fertilizers. Soap & detergent manufacturing holds a strong position as well and biodiesel production is projected to grow fastest. Chemical manufacturing remains a key contributor, underlining the compound’s importance across industrial value chains.

Key Growth Drivers

Rising Demand in Agriculture

The global population growth and increasing need for higher crop yields drive strong demand for fertilizers, where Potassium Hydroxide (KOH) plays a critical role in producing potassium‑based compounds. Manufacturers leverage KOH’s alkaline properties to formulate efficient and soil‑enhancing fertilizer blends. As intensive agricultural practices expand in regions such as Asia‑Pacific, KOH use in fertilizers becomes a consistent and growing contributor to market volume and value.

- For instance, Vynova produces liquid potassium hydroxide used in complex fertilizers to help plants grow stronger and larger, highlighting KOH’s direct contribution to agricultural productivity.

Expansion of Chemical Manufacturing

An accelerating chemical processing industry drives KOH consumption across soaps, detergents, biodiesel, and specialty chemicals. With chemical manufacturers seeking strong alkalis for synthesis, pH regulation, and cleaning agent production, KOH becomes a preferred base material. The growth of industrial infrastructure, especially in developing economies, supports increasing volumes of KOH use and ultimately market expansion.

- For instance, industrial-grade KOH accounted for 67.4% of the market revenue share in 2024, driven by its widespread use in soap and detergent manufacturing, where precise alkali control is imperative for product quality.

Shift Toward Sustainable Energy and Products

The transition to cleaner energy solutions and eco‑friendly formulations presents an opportunity for KOH in biodiesel, alkaline batteries, and green cleaning agents. As regulations and consumer demand push toward lower‑impact chemicals, manufacturers turn to KOH for its versatility and lower environmental footprint compared to some alternatives. This shift strengthens KOH’s role in emerging applications and boosts its market potential.

Key Trends & Opportunities

High Purity Grades for Specialty Applications

A notable trend in the KOH market is the increasing demand for high-purity and specialty grades suited for pharmaceutical, food, and battery industries. As more end-use segments require tighter specifications, suppliers invest in purification and quality control enhancements to meet the growing standards. This trend is not only driven by stricter regulatory requirements but also by the demand for more reliable and efficient products. This creates opportunities for premium pricing, new product launches, and market differentiation, ultimately helping companies capture value in a more competitive marketplace.

- For instance, pharmaceutical companies, including major ones like Pfizer and Novartis, use extremely high-purity chemicals that meet stringent regulatory standards, such as those set by the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), in synthesizing active pharmaceutical ingredients (APIs), where minimizing impurities is critical to ensuring drug safety and efficacy.

Growth of Emerging Markets and Distribution Reach

Emerging economies in Asia-Pacific, Latin America, and Africa are expanding their industrial base and agricultural sectors, offering a strong opportunity for KOH suppliers to tap into previously under-explored regions. By extending distribution networks, establishing local production facilities, or forming strategic partnerships, companies can gain a foothold in these rapidly growing markets. The rise of middle-class consumers, as well as the growth of regional manufacturing hubs, further supports such strategic expansions. Moreover, governments are often incentivizing local production, which helps boost profitability in these regions.

- For instance, China dominates Asia Pacific with nearly 50% of the region’s KOH output, supported by large-scale chlor-alkali plants and government incentives for green chemical manufacturing.

Key Challenges

Stringent Environmental & Safety Regulations

The production and handling of KOH face strict environmental and safety regulations due to its caustic nature and potential hazards. Meeting chemical-handling standards, waste disposal regulations, and emission rules increases operational costs and complicates near-term capacity expansion, often leading to delays and added investments in compliance measures. These regulatory pressures pose a challenge, especially for new entrants and smaller producers who may lack the resources to invest in costly infrastructure. As such, companies need to stay proactive in maintaining regulatory compliance to avoid penalties or supply disruptions.

Raw Material Price Volatility and Substitutes

Volatility in raw material prices especially potassium salts, natural gas, and energy costs directly impacts manufacturing costs for KOH. Additionally, competition from substitutes such as Sodium Hydroxide (NaOH) can reduce demand or pressure pricing, especially in industries where cost efficiency is a priority. This cost unpredictability, along with substitution risk, constrains margin potential and requires producers to manage supply chains carefully to avoid production interruptions. To mitigate these challenges, some manufacturers are exploring long-term contracts or vertical integration, allowing for more control over raw material sourcing and cost stability.

Regional Analysis

Asia‑Pacific

The Asia‑Pacific region held the largest share of the global KOH market at 39.8% in 2024. Industries in China, India and South Korea drive consumption via chemicals, fertilisers, soaps and detergents. Rapid industrialisation and strong agricultural expansion underpin the demand, while low‑cost production facilities and integrated value chains reinforce regional dominance. In addition, government infrastructure initiatives and supportive policies accelerate adoption of KOH‑based applications across manufacturing and water treatment.

North America

North America accounted for 29.9% of the KOH market in 2024. A solid chemicals sector, advanced detergent and personal‑care manufacturing, and rising demand for alkaline batteries and biodiesel contribute to regional consumption. Mature production infrastructure in the U.S. and Canada supports large‑scale output, while stringent environmental standards encourage higher‑grade KOH use. Market growth is steady and driven by innovation and sustainable chemical processing.

Europe

In Europe, KOH captured 25% of global market share in 2024. The region’s strong chemical and pharmaceutical industries, combined with stringent environmental and sustainability regulations, spur demand for high‑purity grades. Growth is further aided by expanding biodiesel and battery‐electrolyte applications. Western European nations invest in clean manufacturing, which reinforces KOH usage in specialty and industrial segments.

Latin America

Latin America held an estimated 5% share of the KOH market in 2024. Growth is emerging, driven by increasing agricultural fertiliser use in Brazil and Argentina, budding biodiesel production and expansion of chemical manufacturing infrastructure. While the base is smaller compared to developed regions, rising food‑security initiatives and downstream integration of chemical value chains present meaningful upside potential for KOH demand.

Middle East & Africa (MEA)

The Middle East & Africa region accounted for 10% of the global KOH market in 2024. Key demand sources include water desalination, fertilizer blending in arid zones, and petrochemical processing expansions in Gulf states. Population growth, industrialization of petrochemicals and infrastructure investment for wastewater treatment all support KOH uptake. Though smaller in scale than other regions, MEA offers strategic growth opportunities in emerging applications.

Market Segmentations

By Form

- Liquid

- Pellets

- Flakes

- Powder

By Grade

- Industrial Grade

- Food Grade

- Pharmaceutical Grade

By Application

- Soap & Detergent Manufacturing

- Fertilizer Production

- Biodiesel Production

- Chemical Manufacturing

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the global Potassium Hydroxide (KOH) market features several major chemical producers operating on a global scale alongside regionally focused specialists. Key players such as Solvay, BASF SE, Dow Inc., Occidental Petroleum Corporation (through its OxyChem division), Olin Corporation, UNID Co., Ltd., Airedale Chemical Company Limited, American Elements and Altair Chemical S.r.l. all maintain substantial market presence. These firms hold competitive advantages in terms of production capacity, geographic reach, product‑grade diversity and downstream integration. Many invest in manufacturing technologies, sustainability initiatives and specialty grade expansions to differentiate. Smaller regional players compete by focusing on niche grades or local supply chains, leading to a moderately consolidated yet dynamic market structure.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Dow

- Solvay

- BASF

- Merck KGaA

- Occidental Petroleum Corporation (OxyChem)

- Olin Corporation

- UNID

- Airedale Chemical Company Limited

- American Elements

- Altair Chemical S.r.l.

Recent Developments

- In 2025, South Korean company Unid launched a new potassium hydroxide production plant in Yichang, China, with plans for annual production capacity of 90,000 tons of potassium hydroxide, aiming to become one of the world’s largest potassium product bases.

- In July 2024, American Industrial Partners announced it will acquire the sulfuric acid regeneration business of Veolia North America, which includes KOH regeneration as part of its service offering.

- In February 2024, INEOS Inovyn introduced a range of Ultra-Low-Carbon chlor-alkali products, including caustic potash, aimed at significantly lowering the carbon footprint of its products. This initiative utilizes renewable energy at key production sites and is certified under the ISCC PLUS scheme.

Report Coverage

The research report offers an in-depth analysis based on Form, Grade, Application, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Potassium Hydroxide market is set to grow steadily as agriculture and bio‑based sectors increase demand.

- Liquid form will continue dominating while pellets and flakes gain share in mid‑scale and niche applications.

- Industrial grade KOH will maintain its lead, but food and pharmaceutical grades will grow faster due to stricter purity demands.

- Asia‑Pacific will sustain its position as the key region, supported by strong chemical and fertilizer industries and more than 39 % market share.

- North America and Europe will together capture over 50 % of specialty and high‑purity demand in advanced applications.

- New applications in battery electrolytes and green hydrogen will open fresh pathways for KOH usage.

- Sustainable production technologies and energy‑efficient electrolysis will reduce costs and enhance competitiveness.

- Companies will expand in emerging regions like Latin America and MEA to diversify supply and access new demand.

- Raw material cost volatility and strong regulation will keep supplier margins under pressure.

- Substitute chemicals such as sodium hydroxide will remain a competitive restraint for lower‑cost applications.