Market Overview

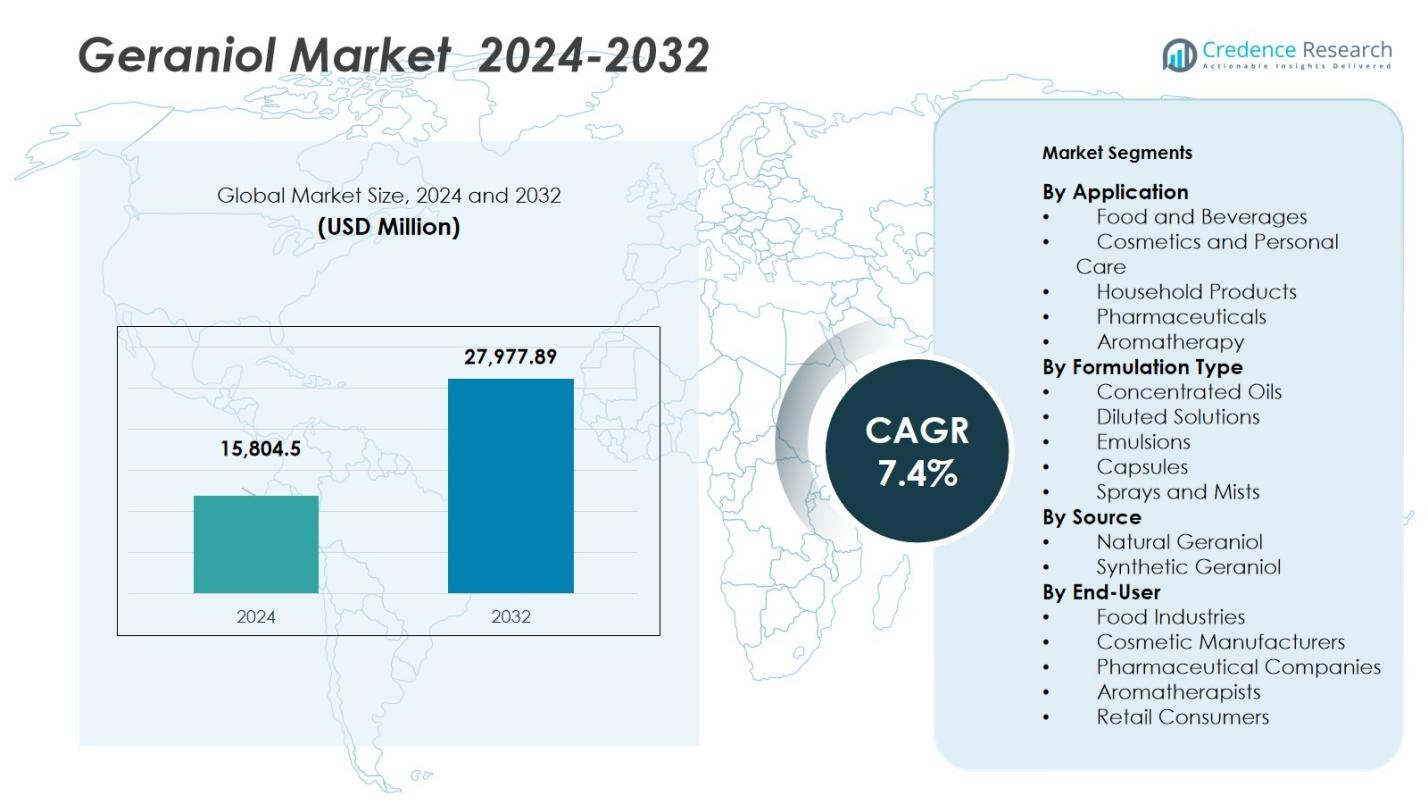

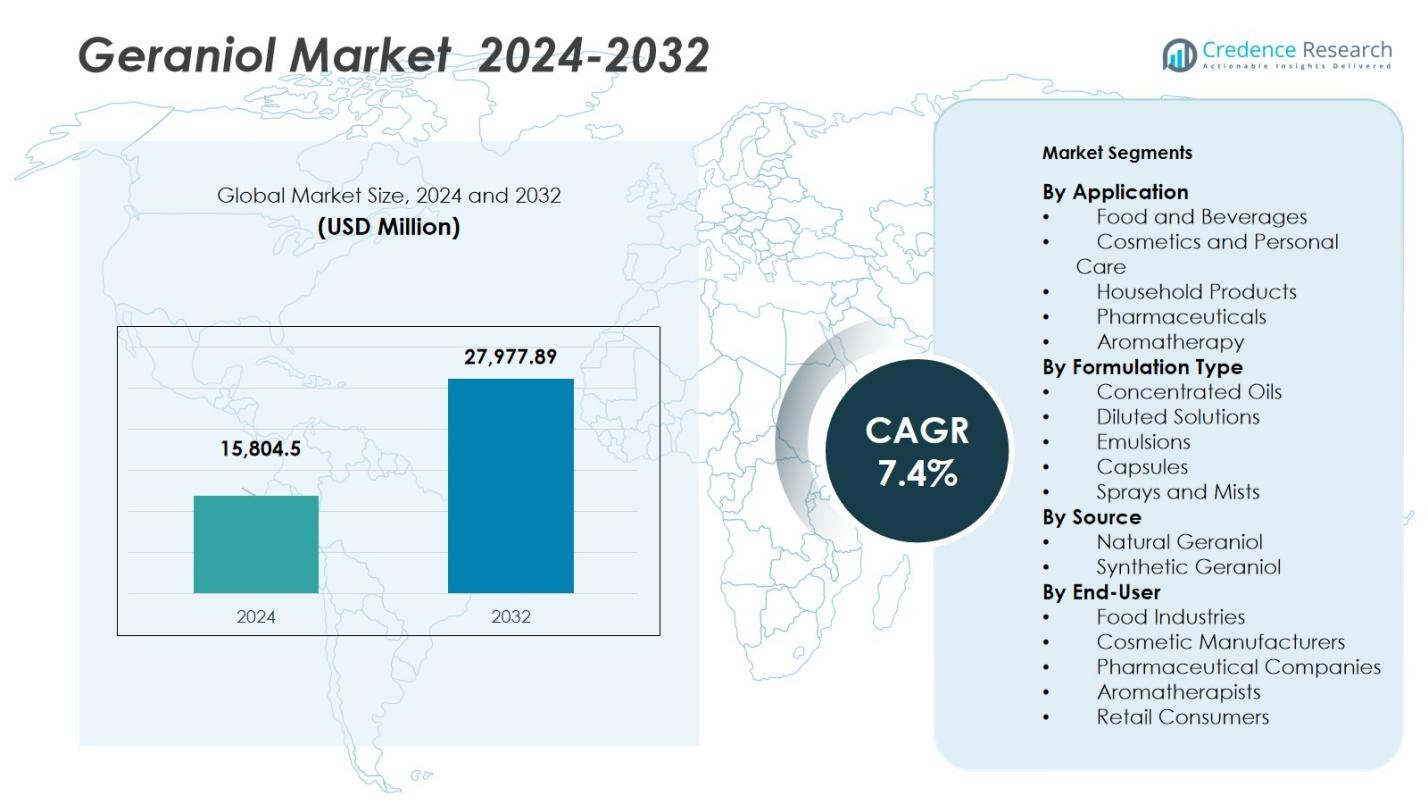

The Geraniol Market size was valued at USD 15,804.5 Million in 2024 and is anticipated to reach USD 27,977.89 Million by 2032, growing at a CAGR of 7.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Geraniol Market Size 2024 |

USD 15,804.5 Million |

| Geraniol Market, CAGR |

7.4% |

| Geraniol Market Size 2032 |

USD 27,977.89 Million |

The Geraniol Market is dominated by key players such as OC Sciences, Renessenz LLC, Global Essence Inc., CTC Organics, and Biosynth. These companies have established strong positions through a combination of high-quality product offerings, technological innovation in extraction processes, and strategic partnerships across various industries. North America holds the largest share of the Geraniol Market, accounting for 35% in 2024, driven by growing demand for natural and sustainable ingredients in personal care, food, and wellness products. Europe follows with a 30% share, supported by increasing consumer preference for clean-label products and regulatory support for natural ingredients. The Asia-Pacific region is experiencing rapid growth, capturing 25% of the market, particularly in the food, beverage, and personal care sectors. Latin America and the Middle East & Africa account for 5% each, with growing interest in natural ingredients and eco-friendly products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Geraniol Market size reached USD 15,804.5 Million in 2024 and is projected to hit USD 27,977.89 Million by 2032 at a CAGR of 7.4%.

- Demand for natural, plant‑derived ingredients in food and personal care drives the market, with the Food & Beverages segment holding a 35% share.

- Innovation in formulation formats like concentrated oils (40% share) and increased use in aromatherapy and wellness products highlight key market trends.

- Key players such as OC Sciences, Renessenz LLC, Global Essence Inc., CTC Organics and Biosynth intensify activities through premium product launches and supply‑chain enhancements.

- Regional analysis shows North America leading with a 35% share, Europe at 30%, Asia‑Pacific at 25%, and Latin America and Middle East & Africa at 5% each, while restraints include raw‑material supply volatility and stringent regulatory compliance.

Market Segmentation Analysis:

By Application

The Food & Beverages segment holds a dominant share of 35% in the Geraniol Market, driven by its use as a flavour enhancer and natural preservative in products such as beverages, confectioneries, and baked goods. Consumer demand for clean-label, plant-derived ingredients supports its growth, as Geraniol’s fruity aroma adds value to both processed foods and drinks. The segment is propelled by an increasing shift towards natural flavourings and the expansion of processed food portfolios in emerging markets.

- For instance, BASF SE’s Aroma Ingredients unit launched its “Geraniol Extra BMBcert™” product in November 2022, which is certified by the Carbon Trust as having a demonstrably lower product‑carbon footprint compared to market standard.

By Formulation Type

Concentrated Oils lead the Geraniol market’s formulation type segment with an estimated 40% market share. This format is preferred for its high purity and versatility in use, particularly in fragrances and essential oils. The growth of this sub-segment is driven by the increasing demand for high-aroma intensity and the use of concentrated oils in premium cosmetic, wellness, and flavoring applications. Furthermore, advancements in extraction methods are supporting higher-quality oil production, bolstering this segment’s dominance.

- For instance, BASF’s Geraniol Extra, which boasts > 98% purity, exemplifies high-purity concentrated oils that are used commercially for their consistency and premium quality, supporting formulations in cosmetics and personal care.

By Source

Natural Geraniol accounts for 70% of the market share in the Geraniol Source segment. This dominance is attributed to the growing consumer preference for plant-derived ingredients in the food, cosmetics, and wellness industries. Regulatory support for natural products and the premium appeal of sustainably sourced ingredients are major drivers. The segment’s expansion is supported by the rising demand for eco-friendly and non-synthetic components in consumer products, further pushing the adoption of natural Geraniol.

Key Growth Drivers

Rising Demand for Natural Ingredients

The increasing consumer preference for natural and plant-derived ingredients is a significant growth driver for the Geraniol market. As consumers become more health-conscious and eco-aware, there is a growing demand for products with clean labels and natural formulations. Geraniol, derived from plant sources such as roses and lemongrass, is widely used in food, beverages, and personal care products, thus benefiting from this shift. Regulatory support for natural ingredients further fuels this trend, as many industries seek alternatives to synthetic chemicals, boosting the adoption of Geraniol in various applications.

- For instance, Symrise, another prominent player in the flavor and fragrance sector, recently developed a line of personal care products featuring Geraniol as a core natural ingredient

Expanding Applications in Personal Care and Cosmetics

Geraniol’s versatility as a fragrance and skin-conditioning agent has led to its increased usage in personal care and cosmetics. With consumers gravitating towards premium, natural, and sustainably sourced beauty products, Geraniol is well-positioned to capitalize on these trends. It is commonly found in lotions, perfumes, hair care products, and deodorants. The rising demand for organic and plant-based beauty products, driven by growing awareness of skin sensitivities and allergies to synthetic chemicals, continues to drive Geraniol’s adoption in the cosmetics and personal care sectors.

- For instance, Kissed Earth incorporates geraniol in its Awaken Collagen Day Cream and Enzymatic Cream Cleanser, utilizing its aromatic and skin-nourishing properties to enhance the sensorial experience and provide skin conditioning benefits.

Growth in Aromatherapy and Wellness Products

The booming wellness industry has become a key driver for the Geraniol market, especially in aromatherapy and wellness products. Geraniol, with its calming floral scent and therapeutic properties, is widely used in essential oils, diffusers, and other aromatherapy products. As consumers increasingly turn to wellness products to manage stress and enhance their well-being, the demand for Geraniol-infused products is growing. This shift towards holistic health and the rising popularity of natural therapies in daily routines are expected to continue fueling the market’s growth.

Key Trends & Opportunities

Sustainable and Eco-friendly Production

As sustainability becomes a top priority across industries, the Geraniol market is witnessing a shift towards eco-friendly production methods. The demand for sustainably sourced, environmentally friendly products is on the rise, particularly in the food and personal care industries. Geraniol, being derived from natural plant sources, has a strong position in this trend, as consumers seek alternatives to synthetic chemicals with lower environmental impact. Opportunities abound for companies that focus on sustainable cultivation and extraction processes, aligning with global shifts towards greener, more responsible production practices.

- For instance, cosmetic formulators, including Korean skincare brands like Innisfree and Etude House, use naturally derived geraniol in moisturizers, serums, and haircare products to deliver floral fragrance while supporting portfolios built around plant-based ingredients.

Innovation in Product Formulations

Innovation in Geraniol product formulations presents a significant growth opportunity, especially with the introduction of new delivery forms such as emulsions, sprays, and capsules. These innovations enhance the functionality and appeal of Geraniol in various markets, including food, pharmaceuticals, and personal care. As consumer preferences evolve towards convenient and multi-functional products, manufacturers are developing novel ways to incorporate Geraniol into products that offer both health benefits and enhanced sensory experiences. This trend presents an opportunity for companies to diversify their product offerings and cater to a broader consumer base.

- For instance, Arora Aromatics Private Limited is a prominent manufacturer based in India, known for supplying high-quality Geraniol globally. They emphasize safety and purity in their formulations, catering to markets in food, pharmaceuticals, and personal care.

Key Challenges

Supply Chain and Raw Material Costs

A major challenge for the Geraniol market is the volatility in raw material supply and costs. Since Geraniol is primarily derived from natural sources such as lemongrass and rose oil, fluctuations in agricultural yields and the availability of these raw materials can affect production costs and supply chain stability. Adverse weather conditions, pests, and land use changes can disrupt the availability of these plants, leading to price increases. This unpredictability in raw material supply could pose challenges for manufacturers and increase the cost of Geraniol-based products.

Regulatory Hurdles and Standards Compliance

Another significant challenge for the Geraniol market is the complex and evolving regulatory landscape. As a natural ingredient used in food, cosmetics, and pharmaceuticals, Geraniol must comply with various regional and international regulations. These regulations often change, requiring manufacturers to stay up-to-date with new standards for safety, quality, and sustainability. Meeting these standards, especially in highly regulated industries like food and pharmaceuticals, can increase operational costs and delay product development. Navigating these regulatory hurdles is crucial for companies to maintain market access and ensure consumer safety.

Regional Analysis

North America

North America dominates the Geraniol market, accounting for 35% of the total market share in 2024. This strong market presence is driven by increasing consumer demand for natural and plant-based ingredients in food, personal care, and wellness products. The U.S. and Canada are key markets where the demand for Geraniol is growing due to its use in fragrances, cosmetics, and aromatherapy products. Furthermore, the rising trend of sustainable and eco-friendly production practices in the region continues to support Geraniol’s growth. Manufacturers in North America are also focusing on innovation, enhancing the availability of Geraniol in various product formulations.

Europe

Europe holds the second-largest share of the Geraniol market, representing 30% of the market in 2024. The region’s market growth is primarily driven by the strong demand for natural ingredients in personal care, cosmetics, and food products. Countries like Germany, France, and the U.K. are leading markets, with consumers increasingly seeking clean-label, organic, and eco-friendly products. The regulatory support for natural ingredients and sustainability also contributes to the region’s dominance. Additionally, the growth of the aromatherapy market and wellness trends in Europe further boosts the adoption of Geraniol in various consumer goods.

Asia-Pacific

The Asia-Pacific region is experiencing rapid growth in the Geraniol market, with a market share of 25% in 2024. The demand for Geraniol in countries like China, India, and Japan is being driven by the expanding food and beverage sector, as well as the rising awareness of personal care products that use natural ingredients. The increasing middle-class population and demand for luxury and wellness products are further propelling the market. Additionally, the growth of the wellness and aromatherapy industries in the region presents significant opportunities for Geraniol’s use in essential oils and therapeutic products.

Latin America

Latin America accounts for 5% of the Geraniol market in 2024, with key markets in Brazil and Mexico. The region’s growing middle class and increased consumer interest in natural and organic products are driving the demand for Geraniol, particularly in the food and beverage sector. There is also growing adoption in personal care and household products, as consumers shift toward eco-friendly and plant-based ingredients. The region’s increasing focus on sustainable production and the popularity of essential oils and natural fragrances are creating significant growth opportunities for Geraniol in the coming years.

Middle East & Africa

The Middle East & Africa region holds a 5% share of the Geraniol market in 2024. While the market is relatively smaller, it is growing steadily, especially in the Gulf Cooperation Council (GCC) countries. The demand for Geraniol is primarily driven by its use in high-end fragrances, personal care, and wellness products. The growing interest in aromatherapy and essential oils in the region is also contributing to the market’s expansion. Furthermore, the increasing emphasis on sustainability and eco-friendly products in both the personal care and food industries is expected to support the continued growth of the Geraniol market in this region.

Market Segmentations:

By Application

- Food and Beverages

- Cosmetics and Personal Care

- Household Products

- Pharmaceuticals

- Aromatherapy

By Formulation Type

- Concentrated Oils

- Diluted Solutions

- Emulsions

- Capsules

- Sprays and Mists

By Source

- Natural Geraniol

- Synthetic Geraniol

By End-User

- Food Industries

- Cosmetic Manufacturers

- Pharmaceutical Companies

- Aromatherapists

- Retail Consumers

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the geraniol market shows that key players OC Sciences, Renessenz LLC, Global Essence Inc., CTC Organics, and Biosynth are actively strengthening their positions through portfolio expansion, innovation in extraction technologies, and geographic market penetration. These firms invest in higher‑purity natural geraniol grades and secure long‑term supply contracts to differentiate in a market that prizes natural, sustainable ingredients. Strategic alliances with cosmetic, food‑flavour, and fragrance formulators are increasingly common as companies seek to embed geraniol deeper in end‑use applications. Supply‑chain resilience remains a critical competitive lever, with top firms emphasising vertical integration and robustness in raw‑material sourcing to mitigate volatility in agricultural feedstocks. Additionally, players are focusing on R&D to improve geraniol’s functionality in diverse applications, such as expanding its use in pharmaceuticals and wellness products. This trend is driving increased market competition, fostering innovation, and enhancing product offerings across various sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2025, BASF launched L-Menthol FCC rPCF as its first aroma ingredient with a reduced Product Carbon Footprint, with plans to launch Citronellol rPCF and Geraniol rPCF later in 2025, achieving a PCF reduction of 10 to 15% compared to conventional BASF products.

- In October 2024, Givaudan and Privi’s joint venture (Prigiv) commenced operations at the new Mahad Fragrance Ingredients facility in India, where Privi holds a 51% equity stake.

- In November 2022, BASF was granted Lower Carbon Footprint certification for its Geraniol Extra BMBcert by the Carbon Trust, which replaces fossil feedstock with 100% certified renewable raw materials via a biomass balance approach.

Report Coverage

The research report offers an in-depth analysis based on Application, Formulation Type, Source, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for natural and sustainable ingredients in various industries will continue to drive the growth of the geraniol market.

- As consumer preferences shift towards clean-label and eco-friendly products, the adoption of geraniol in food, personal care, and wellness products will rise.

- Technological advancements in extraction and purification processes will lead to higher-quality and more cost-effective geraniol production.

- The expansion of the aromatherapy and wellness industry will create new opportunities for geraniol in essential oils and therapeutic products.

- Regulatory support for natural and plant-based ingredients will foster a favorable environment for geraniol market expansion.

- Geraniol’s versatility in fragrances, cosmetics, food flavorings, and pharmaceuticals will ensure its continued relevance across diverse industries.

- Increasing awareness of the health benefits of natural ingredients in consumer products will further fuel geraniol’s demand.

- Growing investments in sustainable farming and responsible sourcing of raw materials will help mitigate supply chain risks in the geraniol market.

- The rise of personalized and premium skincare and beauty products will drive further adoption of geraniol in the personal care sector.

- Strategic collaborations between geraniol suppliers and end-users will enhance market penetration and accelerate innovation in product formulations.