Market Overview:

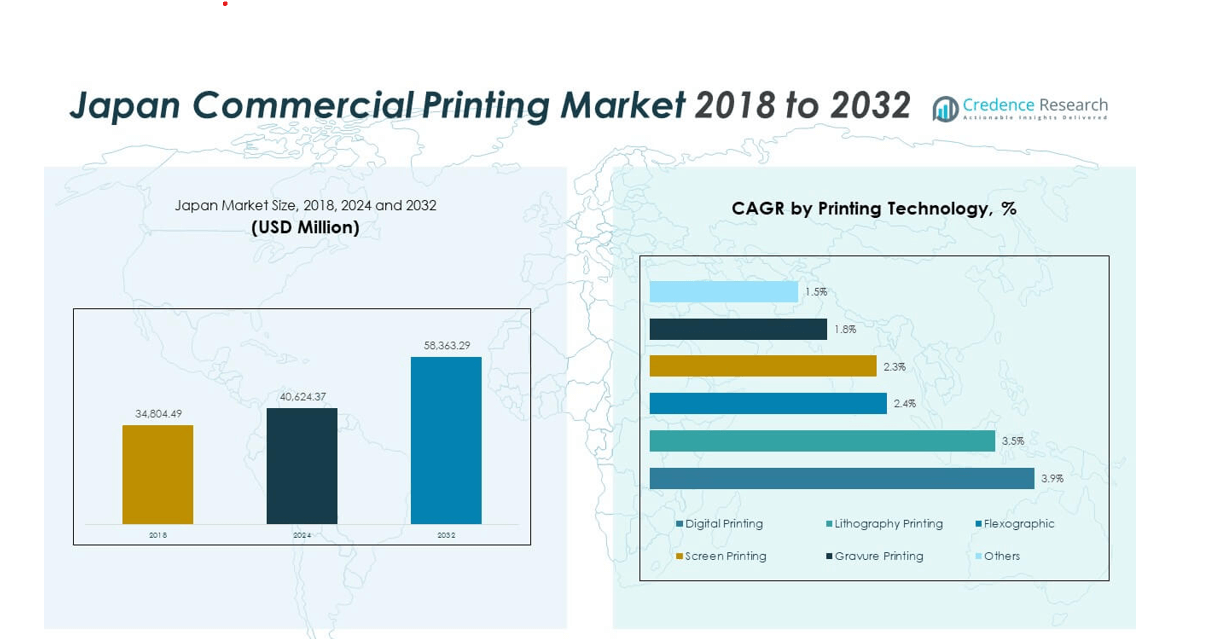

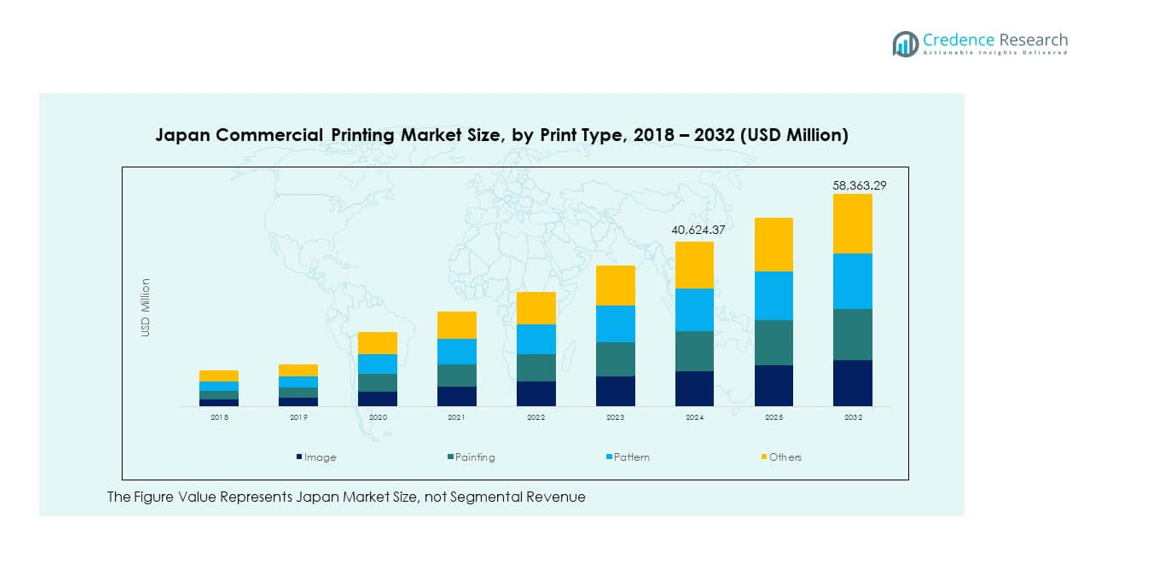

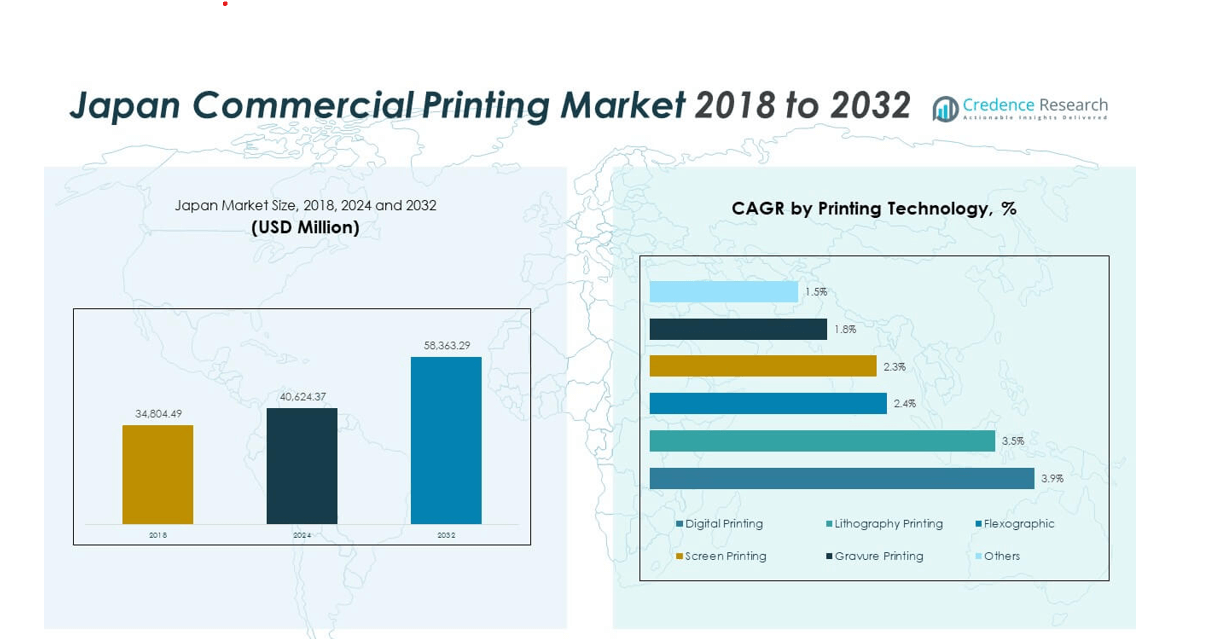

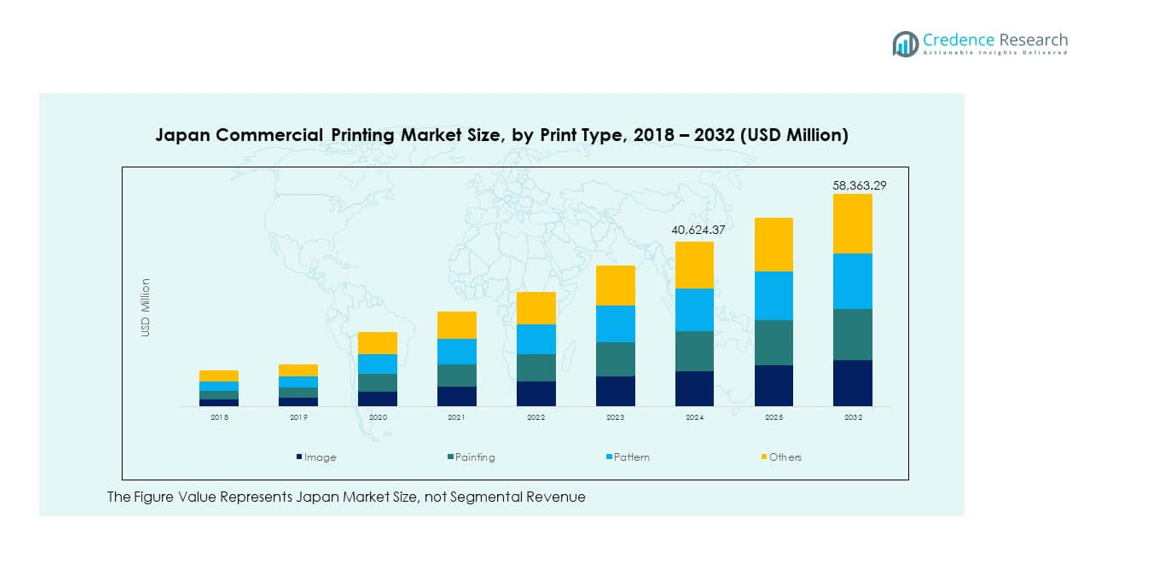

The Japan Commercial Printing Market size was valued at USD 34,804.49 million in 2018 to USD 40,624.37 million in 2024 and is anticipated to reach USD 58,363.29 million by 2032, at a CAGR of 4.63% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Commercial Printing Market Size 2024 |

USD 40,624.37 million |

| Japan Commercial Printing Market, CAGR |

4.63% |

| Japan Commercial Printing Market Size 2032 |

USD 58,363.29 million |

Growing digital transformation and demand for sustainable printing solutions drive market momentum. Businesses adopt automation and AI-enabled workflows to enhance accuracy, speed, and cost efficiency. Rising e-commerce activity strengthens packaging print demand, while variable data printing improves marketing personalization. The shift toward low-VOC inks and recyclable substrates aligns with national environmental goals. Digital presses reduce setup time, supporting short-run jobs and customized print campaigns across multiple industries.

The Kantō region leads the Japan Commercial Printing Market, supported by Tokyo’s strong corporate, publishing, and advertising base. Kansai follows with robust demand from industrial and consumer goods producers. Chūbu, Kyushu, and other regions maintain steady growth from packaging and local manufacturing demand. Urban areas drive premium and customized printing, while regional markets support educational, government, and retail sectors. The nation’s advanced production infrastructure sustains Japan’s leadership in quality, precision, and innovation within commercial printing.

Market Insights

- The Japan Commercial Printing Market was valued at USD 34,804.49 million in 2018, reached USD 40,624.37 million in 2024, and is projected to hit USD 58,363.29 million by 2032, registering a CAGR of 4.63%.

- The Kantō region dominates with approximately 45% share, driven by Tokyo’s concentration of publishing, corporate, and advertising industries. Kansai follows with about 16%, supported by manufacturing and consumer product printing. Chūbu contributes nearly 12% due to its strong industrial base and packaging activities.

- The Kyushu region, holding around 8% share, is the fastest-growing area due to expanding logistics, retail packaging, and investments in modern digital presses catering to regional commerce.

- By printing technology, digital printing and flexographic printing show the fastest growth rates at around 3.5% and 3.9%, supported by automation and on-demand print demand.

- By print type, image and pattern printing hold major revenue shares, reflecting Japan’s emphasis on design precision, branding, and high-quality visual communication across packaging and marketing materials.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

High Demand for Short-Run and On-Demand Printing Solutions

The Japan Commercial Printing Market benefits from rapid digitalization across enterprises and publishers. Businesses seek short-run print services for targeted marketing and flexible packaging needs. Demand for customized brochures, catalogs, and promotional materials rises with personalization campaigns. Advanced digital presses help reduce setup time and improve turnaround speed. The growing e-commerce sector increases the need for printed materials with quick delivery. Print-on-demand platforms attract SMEs seeking efficient print production without large inventories. Variable data printing drives engagement in direct mail campaigns. Automation and AI-enabled workflows optimize job sequencing and minimize waste.

- For example, Ricoh’s Pro C7200X digital press, widely used in Japan, features advanced automation like an Auto Calibration System that automates color density adjustments and registration setup. This system minimizes operator errors and reduces setup time considerably, allowing operators of varying skill levels to produce jobs efficiently.

Rise of Sustainable Printing Materials and Low-Emission Inks

Growing environmental awareness pushes Japanese printers to use eco-friendly inks and recyclable substrates. The market adopts water-based, soy-based, and low-VOC inks that reduce environmental impact. Print houses gain certifications such as FSC and ISO 14001 for sustainability compliance. Packaging producers adopt biodegradable paperboard and recycled films to meet circular economy goals. Clients prefer vendors that provide carbon-neutral or low-waste print operations. Regulatory pressure from green initiatives accelerates adoption of eco-label printing. Equipment suppliers introduce energy-efficient presses that cut power use by up to 30%. The sustainability trend strengthens long-term competitiveness for printing firms.

Integration of Automation and Data-Driven Print Management Systems

Automation tools enhance production efficiency through digital workflow integration and predictive analytics. Japanese print facilities install cloud-based management systems for end-to-end monitoring. Data insights support real-time scheduling, job tracking, and preventive maintenance. Automated finishing units improve consistency across product lines. Firms adopt AI-powered layout optimization and defect detection systems. Integration with ERP platforms enables transparent cost and delivery management. Automation reduces manual errors and speeds up print runs. It also lowers operating costs, improving margins for commercial printers.

Expanding Role of Print in Brand Storytelling and Omnichannel Campaigns

Brands continue using print to enhance physical engagement with customers. The market benefits from rising demand for premium packaging and high-impact visual media. Luxury, cosmetics, and food sectors rely on tactile and personalized prints for brand differentiation. Augmented reality and QR-linked print campaigns merge digital and physical marketing. Print integrates with data-driven campaigns for personalized content delivery. Designers use advanced coatings and finishes to enhance perceived product value. Japan’s focus on craftsmanship and design precision maintains print’s cultural and marketing significance.

- For example, Shiseido has actively incorporated augmented reality in its marketing and retail strategies. For example, the company launched AR-based beauty experiences through its “Beauty AR Navigation” and immersive pop-up campaigns to enhance consumer engagement and product visualization. These initiatives highlight Shiseido’s focus on digital innovation in customer experience, though they are primarily implemented in retail and promotional settings rather than directly through product packaging.

Market Trends

Wider Adoption of Hybrid Printing Systems for Production Flexibility

Japanese printers increasingly deploy hybrid systems combining offset and digital capabilities. The approach supports faster turnaround without compromising color consistency. Print providers manage diverse jobs like packaging, advertising, and publishing with reduced setup time. Hybrid presses lower waste through digital proofing and calibration tools. Growing demand for variable data printing boosts hybrid press installations. Major vendors offer modular systems allowing easy upgrades. It enables firms to scale production efficiently across multiple job types.

- For example, Fujifilm’s Acuity Prime Hybrid, unveiled at FESPA 2023, is a mid-range LED UV wide-format printer capable of printing on both rigid and roll media up to 2.1 m wide. It reaches speeds of up to 141 m²/hr and supports up to seven ink channels including CMYK, white, clear, and primer, demonstrating high versatility for commercial and packaging print applications.

Growing Use of Automation and Robotics in Print Operations

Automation continues shaping Japan’s commercial print sector. Robotics handle repetitive workflows such as stacking, binding, and material handling. Smart sensors track print quality and reduce downtime through predictive alerts. Integration of automated inspection ensures accuracy in every print run. Robotics also improve safety in large-scale plants with heavy materials. Automation supports lean manufacturing, reducing idle time and manual labor dependence. It strengthens operational consistency for high-volume clients.

Digital Transformation of Print Supply Chains and Customer Interfaces

Print companies digitize client engagement through online ordering, remote proofing, and dynamic pricing. AI-driven print portals allow seamless coordination of artwork and specifications. Cloud-based collaboration enhances communication between design teams and production facilities. The shift enables real-time adjustments in layout or quantity before printing. Digital platforms improve transparency and shorten approval cycles. E-commerce integration allows clients to customize orders and track fulfillment easily.

Rise of Premium Finishing and Smart Print Enhancements

Japanese printers adopt advanced finishing techniques to stand out in a competitive market. Embossing, metallic foiling, and textured coatings enhance product appeal. Smart labels with NFC and QR codes link consumers to digital experiences. High-value packaging for cosmetics and confectionery relies on sophisticated visual effects. UV-curable coatings increase durability and color brilliance. Investment in 3D and lenticular printing adds depth and motion effects. The premiumization of print aligns with Japan’s focus on design excellence.

- For example, Mitsubishi Heavy Industries has long produced advanced printing and paper-converting machinery, including commercial web-offset presses and box-making systems used in Japan’s packaging sector. The company focuses on improving productivity, precision, and automation across large-scale printing operations, supporting industrial and packaging applications through its engineering expertise.

Market Challenges Analysi

Decline in Traditional Print Volumes and Rising Digital Media Competition

The Japan Commercial Printing Market faces steady decline in offset and publication print demand. Digital media channels continue diverting advertising budgets from print to online formats. Book and magazine publishers cut print volumes to manage inventory costs. Reduced demand for large-scale commercial print jobs pressures margins. Printers must balance traditional contracts with emerging digital services. Limited paper supply fluctuations also affect pricing stability. Firms seek differentiation through packaging and short-run jobs to counter volume loss.

High Equipment Costs and Skilled Labor Shortage

Advanced digital and hybrid presses demand significant investment. Small and mid-sized printers face barriers to adopt next-gen systems. Maintenance costs increase due to reliance on imported parts and software upgrades. Skilled operators capable of managing automation and color calibration are limited. Training new talent remains a challenge in Japan’s aging workforce. Labor shortages drive up wages and slow production capacity expansion. Consolidation among print houses continues as firms seek shared resources and scale efficiency

Market Opportunities

Rising Demand for Value-Added Printing and Smart Packaging Applications

The Japan Commercial Printing Market gains new opportunities from connected packaging and interactive prints. Brands use embedded QR and NFC features for real-time consumer engagement. Premium packaging designs for luxury goods and electronics drive aesthetic innovation. Value-added services such as personalization and variable imaging increase client retention. Smart print features strengthen brand authenticity and anti-counterfeit protection.

Growth of Digital Printing Exports and Cross-Regional Partnerships

Japanese print manufacturers expand by serving regional clients across Asia-Pacific. High-quality standards attract international demand for specialty prints and packaging. Collaboration with Southeast Asian print service providers reduces production costs and lead times. Export-focused printers benefit from Japan’s reputation for precision engineering. Expansion into fast-growing e-commerce packaging markets presents long-term growth potential.

Market Segmentation Analysis

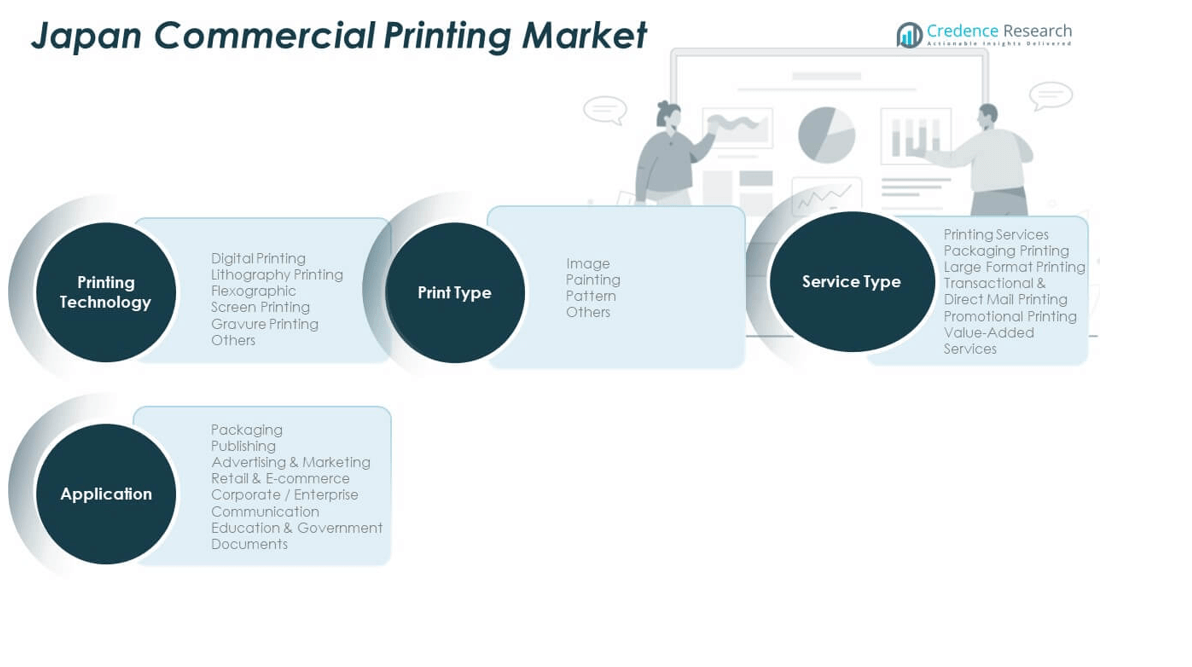

By Printing Technology

Digital printing leads Japan’s commercial sector due to strong demand for short-run and customized jobs. Lithography remains vital for large-volume production requiring consistent quality. Flexographic and gravure printing maintain their role in high-speed packaging lines. Screen printing supports specialty applications such as textiles and industrial labels.

By Application

Packaging dominates due to the growth of e-commerce and premium consumer goods. Publishing continues serving educational and corporate sectors despite digital shifts. Advertising and marketing prints maintain relevance in brand campaigns. Retail and e-commerce segments use variable printing for personalized labeling and promotions.

- For example, packaging printing is exemplified by SUN PRINTING CO., LTD. in Japan, which won the Innovation Print Awards 2025 Global in the Carton Packaging category. They use advanced digital presses on FUJIFILM technology, enabling precise, high-speed printing for premium packaging applications with reduced turnaround times.

By Service Type

Printing services form the market’s foundation with value-added offerings. Packaging printing grows with demand for sustainability and visual differentiation. Large-format and promotional printing cater to events and retail branding. Transactional and direct mail printing benefit from data-driven marketing. Value-added services like finishing, lamination, and design consultancy enhance client engagement.

By Print Type

Image and pattern printing remain central for visual branding and packaging aesthetics. Painting and decorative prints cater to art reproduction and creative design sectors. Other niche types include architectural, textile, and specialty substrate printing that reflect Japan’s design-oriented economy.

- For example, Dai Nippon Printing, a leader in high-resolution image and pattern printing, offers solutions with resolutions up to 1200 dpi for luxury brand packaging, enhancing visual branding aesthetics. They also provide specialty printing services in architectural and textile sectors, leveraging technologies aligned with Japan’s design-oriented economy.

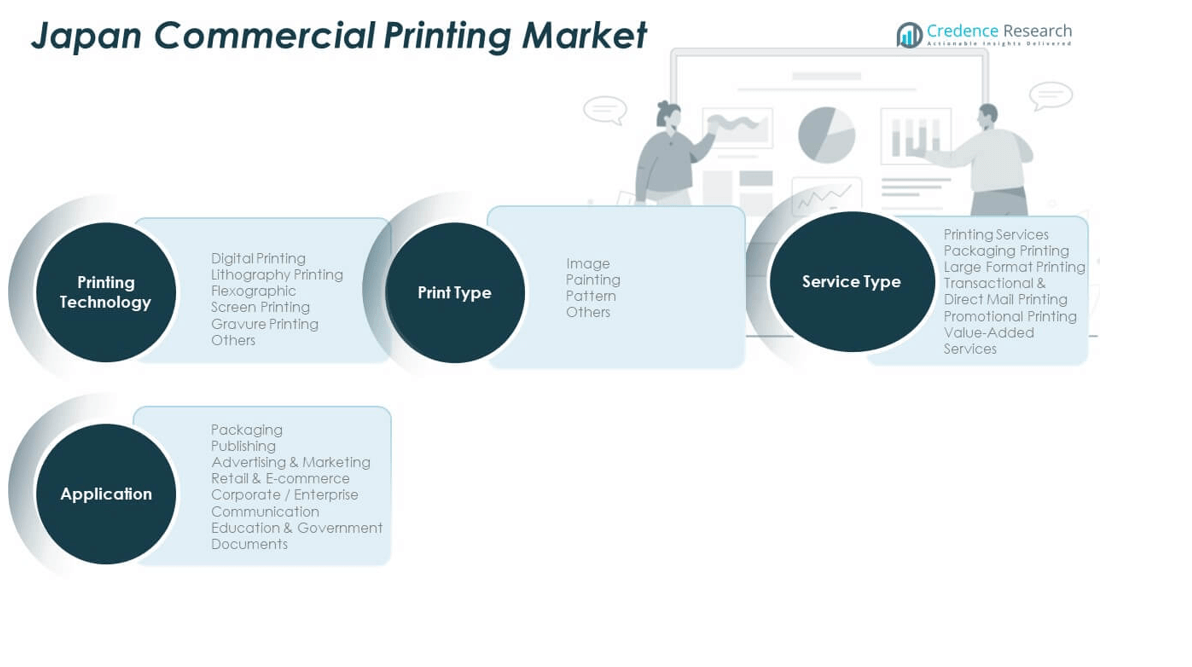

Segmentation

By Printing Technology:

- Digital Printing

- Lithography Printing

- Flexographic Printing

- Screen Printing

- Gravure Printing

- Others

By Application:

- Packaging

- Publishing

- Advertising & Marketing

- Retail & E-commerce

- Corporate / Enterprise Communication

- Education & Government Documents

By Service Type:

- Printing Services

- Packaging Printing

- Large Format Printing

- Transactional & Direct Mail Printing

- Promotional Printing

- Value-Added Services

By Print Type:

- Image

- Painting

- Pattern

- Others

Regional Analysis

Kantō Region — Dominant Market Share (~45 %)

Kantō, which includes the Tokyo metropolitan area, contributes roughly 45 % of Japan’s national GDP. Given its economic scale, high population density, concentration of corporations, and strong demand for corporate communication, packaging and advertising print, Kantō likely accounts for around 45 % of the commercial-printing demand in Japan. Major publishers, large-scale advertisers and e-commerce headquarters cluster here, fueling demand for high-volume printing and packaging services. High urban consumption and brand activity further push demand for premium print finishes and short-run, on-demand printing.

Kansai Region — Important Secondary Hub (~16 %)

Kansai contributes about 16 % of Japan’s GDP. This region, anchored by Osaka, Kyoto and Kobe, supports a mix of industrial, manufacturing and consumer-goods sectors that drive demand for packaging, marketing materials, and specialized commercial print. Many mid-sized enterprises and traditional manufacturers are based here. Its role in manufacturing and export industries can boost demand for printed packaging, corporate communications and promotional materials — making Kansai a significant secondary region for the printing market.

Chūbu, Kyushu and Other Regions — Remainder Share (~39 %)

The central region Chūbu, along with other regions such as Kyushu, Chūgoku, Hokkaido/Tohoku, Shikoku, likely compose the remaining share. Chūbu holds substantial industrial output and population clusters. In these regions, demand comes from manufacturing-derived packaging, regional publishing, local retail and small to mid-scale enterprises. Urbanisation outside major hubs remains lower, reducing per-capita print demand; but manufacturing and regional trade support steady demand for packaging and commercial print. Rural and less-dense prefectures yield lower volume but still contribute meaningfully due to a broad base of industries and local businesses.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Dai Nippon Printing Co., Ltd. (DNP)

- Toppan Printing Co., Ltd.

- Kosaido Co., Ltd.

- Kyoiku Printing Co., Ltd.

- Nissha Co., Ltd.

- Toppan Forms Co., Ltd.

- Seikosha Printing Co., Ltd.

- Mitsumura Printing Co., Ltd.

- Toyo Ink Group Holdings Co., Ltd.

- Matsuoka Printing Co., Ltd.

Competitive Analysis

The Japan Commercial Printing Market features a mix of long-standing conglomerates, specialized printers, and agile digital-print houses. Large companies hold broad service portfolios that cover publishing, packaging, direct mail, and corporate print. These firms benefit from economies of scale, established client relationships, and integrated printing workflows. Mid-size and small print providers often focus on niche segments such as short-run digital jobs, promotional printing, or value-added finishing. They win clients by offering speed, flexibility, and customized services that large houses may not handle efficiently. Increasing demand for packaging printing and on-demand printing shifts competitive pressure toward modern digital- and hybrid-printing capabilities. Print houses that invest in automation, workflow software, and sustainable materials gain an edge over those relying on traditional methods. Firms that build strong ties with e-commerce brands, retail sector clients, or luxury product manufacturers tend to secure stable, high-margin contracts. Overall competition forces all players to optimize efficiency, adopt newer technologies, and tailor services to evolving customer requirements.

Recent Developments

- In November 2025, DNP teamed with F-SAS Technologies to launch a high-precision generative-AI solution for secure, on-premises document handling. The solution aims at industries requiring high confidentiality, like government, finance and manufacturing.

- In April 2025, TOPPAN Holdings completed its acquisition of the Thermoformed & Flexibles Packaging business (TFP) from Sonoco Products Company. The deal expands Toppan’s global sustainable-packaging business and enhances its packaging and film manufacturing footprint.

Report Coverage

The research report offers an in-depth analysis based on Printing Technology, Application, Service Type and Print Type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue shifting toward digital and hybrid printing as businesses demand fast, personalized production.

- Sustainable materials and low-emission inks will remain a major innovation focus among Japan’s leading print houses.

- Automation and smart workflows will reshape print operations, improving efficiency and energy management.

- Packaging printing will lead future revenue streams due to e-commerce growth and premium product branding.

- Integration of AR, QR, and NFC features will expand in marketing prints and connected packaging applications.

- Export-oriented printers will gain traction by serving premium packaging demand across Asia-Pacific markets.

- Large players will invest in next-generation inkjet and UV-curable systems to enhance print versatility.

- Talent development and digital upskilling will become critical as the market adapts to advanced production systems.

- Rising collaborations between printers and design agencies will strengthen end-to-end brand communication services.

- The Japan Commercial Printing Market will consolidate through mergers and partnerships, enabling scale and technology sharing across segments.