Market Overview:

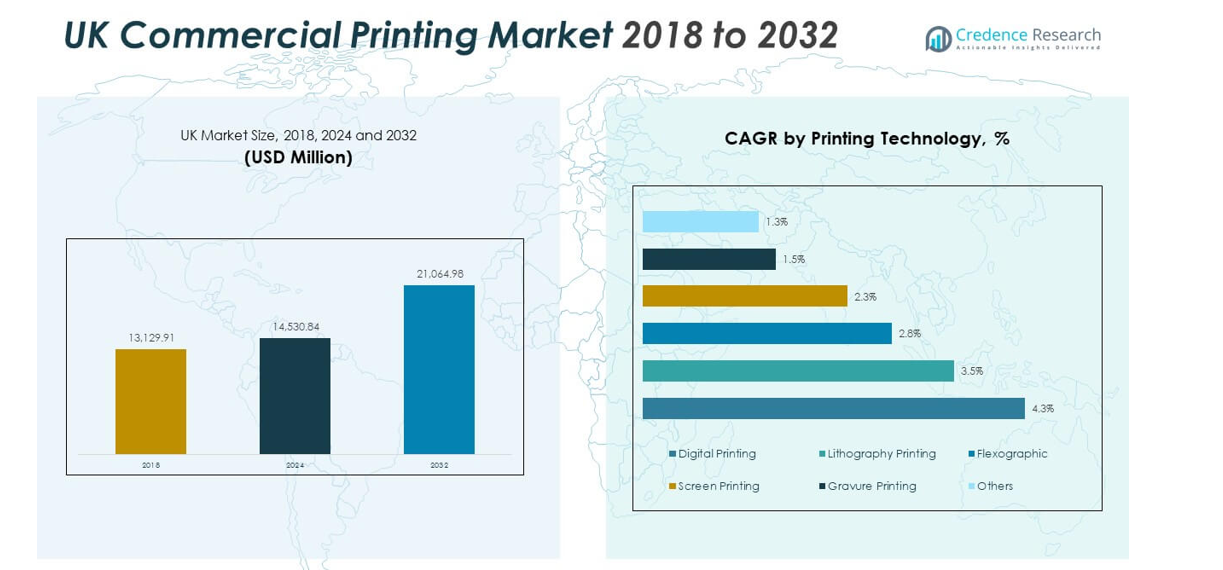

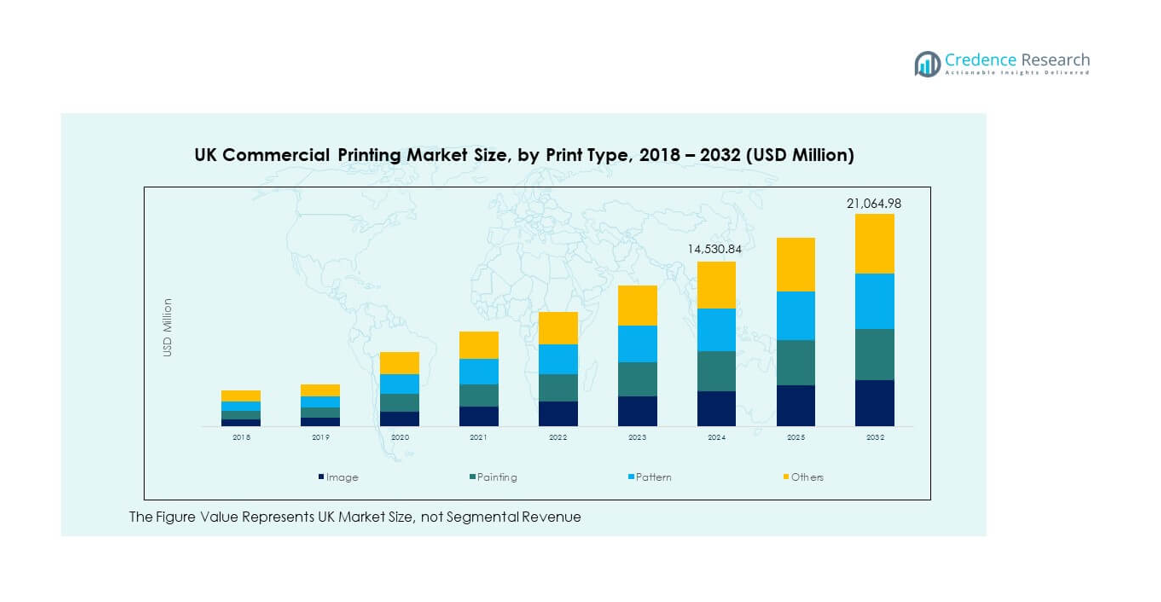

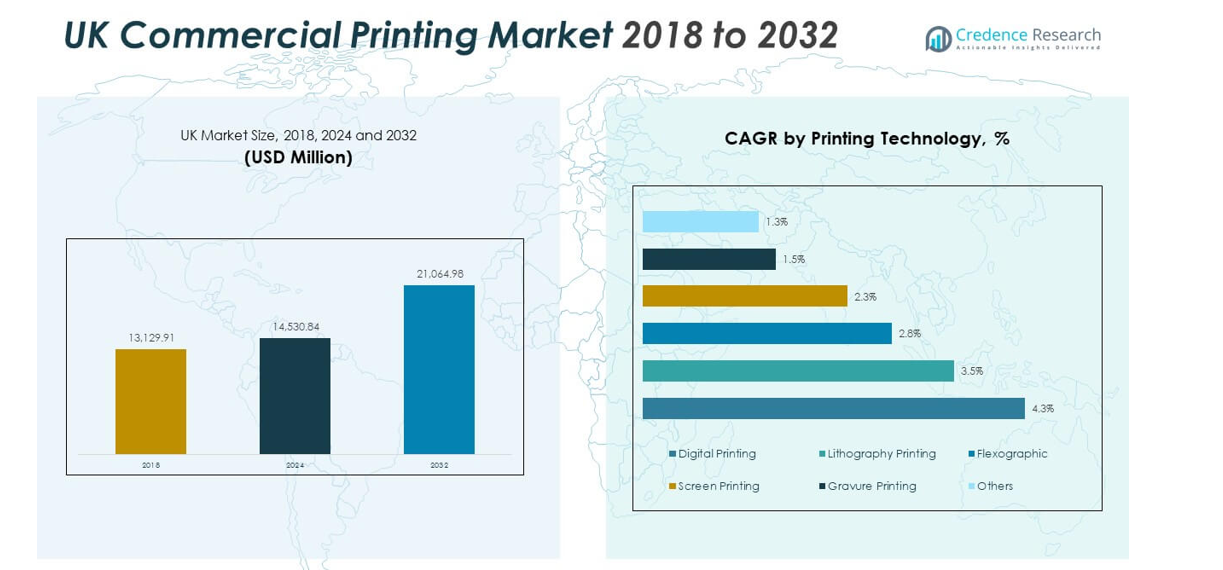

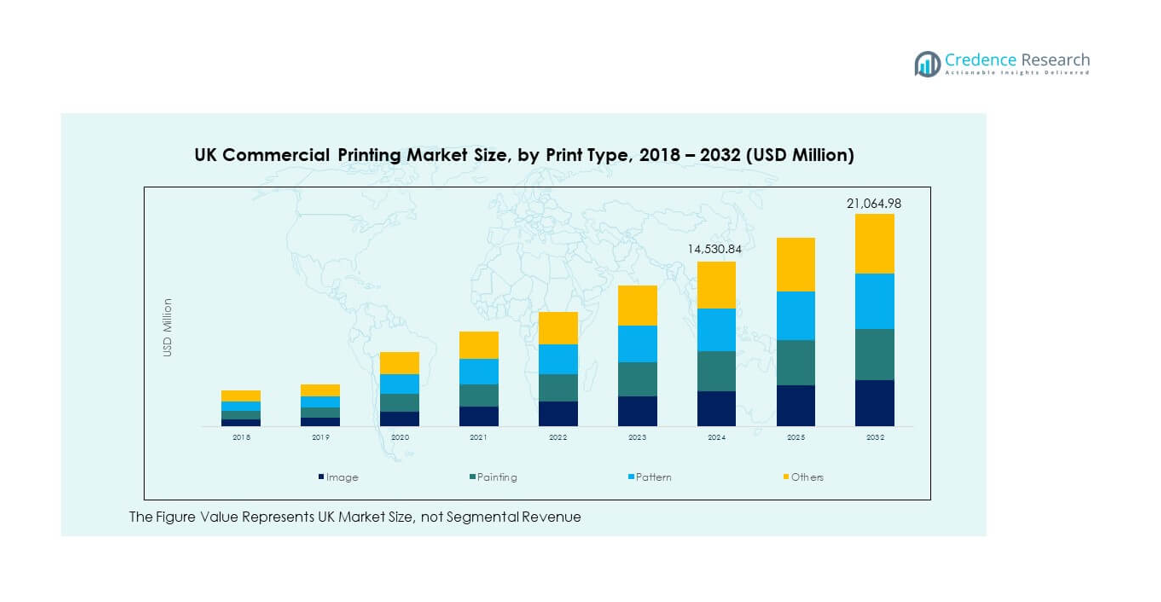

The UK Commercial Printing Market size was valued at USD 13,129.91 million in 2018 to USD 14,530.84 million in 2024 and is anticipated to reach USD 21,064.98 million by 2032, at a CAGR of 4.75% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Commercial Printing Market Size 2024 |

USD 14,530.84 million |

| UK Commercial Printing Market, CAGR |

4.75% |

| UK Commercial Printing Market Size 2032 |

USD 21,064.98 million |

Growth in the market is driven by rapid digitalization, demand for personalized print content, and expansion in packaging and labeling across consumer goods. Businesses seek advanced print technologies offering shorter lead times and high-quality results. Rising adoption of sustainable printing practices and eco-friendly inks boosts competitiveness. The shift toward hybrid print models combining digital and offset systems strengthens production flexibility. Print service providers upgrade equipment to meet customer demand for customized marketing, promotional, and packaging applications across industries.

England leads the market due to its strong concentration of commercial print facilities, advertising agencies, and retail brand operations. London and the South East dominate through advanced digital infrastructure and corporate demand. Scotland holds steady growth supported by education and government printing. Wales and Northern Ireland continue to emerge as cost-efficient print production centers for regional clients. The market remains regionally diversified, supported by automation, improved logistics, and expanding creative design capabilities across the country.

Market Insights

- The UK Commercial Printing Market was valued at USD 13,129.91 million in 2018, reached USD 14,530.84 million in 2024, and is projected to attain USD 21,064.98 million by 2032, growing at a CAGR of 4.75%.

- England leads with a 65% market share due to its dense concentration of printing facilities, strong advertising base, and corporate clients, followed by Scotland with 18% and Wales with 10%.

- Northern Ireland, holding about 7% share, is the fastest-growing region supported by government incentives and emerging digital print infrastructure.

- Digital printing and lithography collectively capture nearly 60% of total market share, with digital printing expanding rapidly due to its versatility and lower setup costs.

- Image and pattern print types dominate segmental distribution, accounting for approximately 55% combined share, driven by packaging, retail, and high-quality promotional materials.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for Digital Printing and Variable Data Solutions

The UK Commercial Printing Market experiences robust demand for digital printing driven by personalization trends and short-run production needs. Businesses invest in inkjet and laser systems that deliver fast turnaround and high image quality. Brands require on-demand marketing materials tailored to specific customer segments. It benefits from reduced setup costs and flexible order quantities. Variable data printing supports one-to-one customer engagement across retail, banking, and healthcare. Companies adopt digital workflows that enable real-time design changes. Printers expand capacity with web-to-print portals for online job submission. This transformation boosts cost efficiency and faster service delivery across the market.

Sustainable Printing Practices and Eco-Friendly Materials Adoption

Sustainability plays a major role in shaping printing strategies among UK firms. Customers and regulators pressure companies to adopt low-VOC inks and recyclable substrates. Eco-certified materials like FSC paper gain prominence across packaging and publishing. The UK Commercial Printing Market benefits from rising corporate commitments to net-zero operations. Printers upgrade to water-based and UV-curable inks to minimize emissions. Energy-efficient equipment and closed-loop systems cut waste in production cycles. Buyers value green labeling and transparency in supply chains. These measures help companies attract environment-conscious clients and comply with EU sustainability directives.

- For example, Antalis UK supplies paper from sustainably managed sources, prioritizing fiber certified by Forest Stewardship Council (FSC®) or Programme for the Endorsement of Forest Certification (PEFC™), to support eco-responsible printing choices.

Expanding Packaging and Labeling Requirements Across Industries

The growth of e-commerce, food delivery, and personal care industries fuels strong demand for printed packaging. Companies focus on vibrant labels and branded boxes to enhance visibility. The UK Commercial Printing Market gains traction as firms seek customization and durability in packaging prints. Printers supply high-resolution labels for pharmaceuticals and beverages. It encourages investment in flexographic and digital hybrid systems. Brand owners prefer local suppliers for quick restocking and design flexibility. Increasing retail competition strengthens packaging quality standards. Market players leverage color management tools and automation to improve print consistency.

- For instance, Domino Printing Sciences offers digital inkjet and labelling systems with 600 dpi resolution, which support high-resolution coding and labelling operations in life-sciences and other regulated industries.

Tecnological Advancement and Workflow Automation Integration

Technological upgrades redefine operational efficiency in printing facilities across the UK. Cloud-enabled production management and AI-based quality inspection become standard. The UK Commercial Printing Market benefits from automation that reduces downtime and human error. Robotics assist in handling materials and finishing operations. Firms integrate predictive maintenance tools to extend equipment life. Smart printers track ink usage and calibrate settings automatically. Workflow software connects prepress, printing, and postpress stages. These innovations improve productivity, sustainability, and responsiveness to fast-changing client needs.

Market Trends

Rise of Hybrid Printing Systems Combining Offset and Digital Capabilities

Hybrid printing merges the precision of offset presses with the flexibility of digital systems. Printers deploy these technologies to meet varied client demands. The UK Commercial Printing Market observes increased installation of hybrid lines in packaging and commercial print shops. It allows seamless transition between short and long runs without sacrificing color fidelity. Businesses reduce waste and time through integrated systems. Hybrid presses handle diverse substrates, expanding product offerings. The model suits on-demand publishing and promotional applications. This convergence reshapes operational economics and print service competitiveness.

- For instance, Micropress UK announced its investment in the UK’s first Heidelberg Jetfire 50 inkjet press in November 2025. The Jetfire 50, integrating seamlessly with offset technologies via Heidelberg’s Prinect workflow, delivers industrial productivity of up to 9,120 SRA3 sheets per hour with high flexibility and reliability, supporting diverse substrates and shorter run lengths.

Growth of On-Demand and Web-to-Print Business Models

Consumer behavior favors instant access and quick fulfillment across printing services. Web-to-print platforms expand across the UK, supporting remote job placement and online customization. The UK Commercial Printing Market grows through digital storefronts enabling file uploads and instant quotes. Print firms automate scheduling and proofing to accelerate delivery cycles. It boosts customer satisfaction and repeat purchases. Corporate clients adopt subscription-based print models for regular marketing campaigns. Demand rises for API-integrated solutions linked with e-commerce stores. This model enhances scalability for SMEs and enterprise clients alike.

Emergence of Smart Packaging with Embedded Digital Features

Smart packaging becomes a major trend across consumer goods sectors. Printers integrate QR codes, NFC chips, and variable barcodes into labels. The UK Commercial Printing Market adopts these technologies to enhance interactivity and traceability. It supports authentication and consumer engagement through mobile scanning. Food and pharmaceutical brands use coded labels to ensure transparency. Printers leverage specialized digital presses for consistent coding precision. Integration with data analytics helps companies track user behavior. This fusion of print and digital creates new revenue opportunities in value-added printing.

- For instance, Heidelberg has installed more than 3,000 Versafire toner-based digital printing systems globally. These presses support high-quality variable data printing and integrate seamlessly with Heidelberg’s Prinect workflow, enabling efficient digital production for commercial and packaging applications.

Shift Toward High-End Creative and Luxury Printing Applications

Premium branding needs drive growth in luxury and high-graphic prints. Clients demand metallic finishes, embossing, and spot UV coatings. The UK Commercial Printing Market expands its specialty segment with investments in finishing technology. It targets luxury packaging, event materials, and limited-edition prints. Print houses adopt digital embellishment units to reduce setup times. Designers collaborate closely with print specialists for unique outcomes. These aesthetic enhancements support product differentiation and brand prestige. This niche segment continues to strengthen profitability for innovative print service providers.

Market Challenges Analysis

High Cost of Raw Materials and Supply Chain Disruptions

Rising prices of ink, paper, and packaging substrates create strong financial pressure on printers. Import-dependent materials face shipping delays and currency volatility. The UK Commercial Printing Market endures cost instability due to global pulp and pigment shortages. It affects pricing strategies and contract margins. Printers explore local sourcing to mitigate supply risks. Energy expenses add to production costs, especially during peak demand. Many small firms struggle to pass costs to customers. Industry consolidation grows as larger firms achieve better resource optimization.

Rapid Digital Transformation and Decline in Traditional Print Demand

Digital media adoption reduces demand for newspapers, magazines, and physical catalogs. The UK Commercial Printing Market adapts through diversification toward packaging and short-run segments. It faces challenge maintaining legacy equipment profitability. Printers invest heavily in digital upgrades, requiring major capital allocation. Customer expectations for customization and faster turnaround add operational stress. Training and skill development become crucial for new technology adoption. Firms unable to modernize risk losing clients to digital-native competitors. Balancing tradition and innovation remains a key survival factor.

Market Opportunities

Expansion in Sustainable and Circular Printing Ecosystems

Environmental policies and corporate sustainability goals open new revenue channels. The UK Commercial Printing Market gains opportunities through eco-certified and recyclable products. It benefits from rising demand for low-carbon, biodegradable materials. Printers offering green certifications attract premium contracts. Adoption of renewable energy and waste reuse improves brand positioning. Firms offering consultation on sustainable printing gain competitive advantage. This segment aligns with evolving consumer preferences for responsible production practices.

Growth Potential in Customized Packaging and Promotional Materials

Brand owners increasingly focus on personalization to improve consumer engagement. The UK Commercial Printing Market sees opportunity in producing limited-edition and customized packaging. It supports small businesses with flexible quantities and variable designs. Digital print platforms enable short runs with superior color consistency. Printers offering 3D embellishments and smart features increase client retention. Expanding sectors such as beauty, beverages, and e-commerce continue to drive this segment’s profitability.

Market Segmentation Analysis

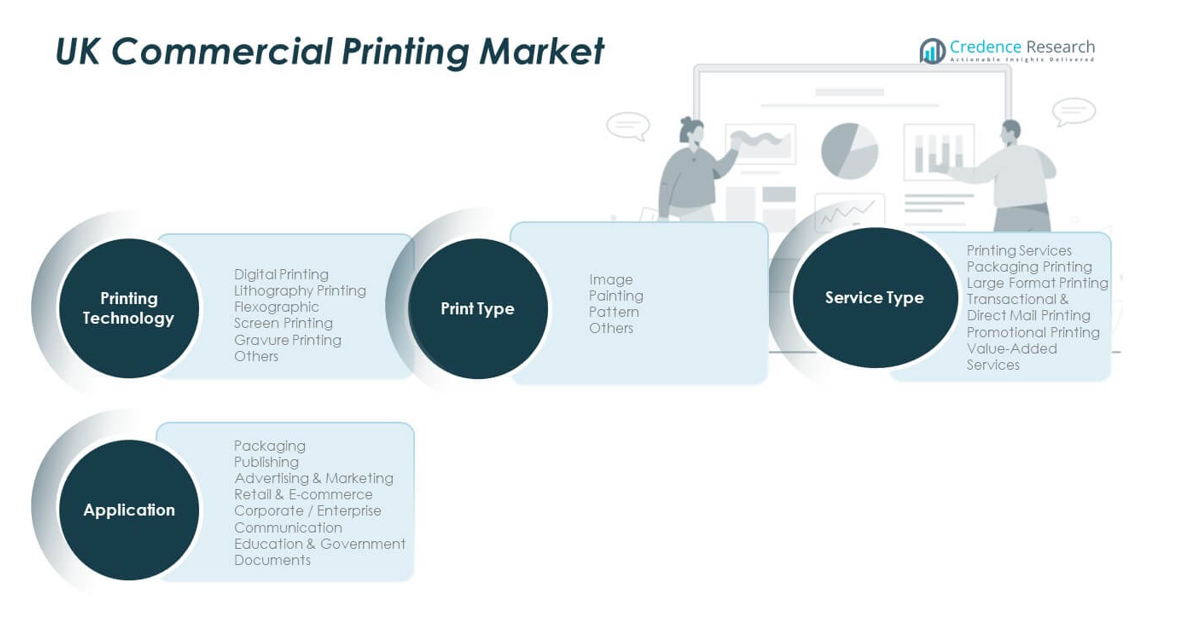

By Printing Technology

Digital printing dominates due to its adaptability, low setup cost, and fast delivery. Lithography remains essential for high-volume commercial jobs requiring consistent color. Flexographic printing supports growing packaging and labeling needs with durability benefits. Screen printing serves niche decorative and textile segments. Gravure printing sustains demand in long-run packaging formats. Others, including 3D and UV-curable methods, gain popularity for creative applications. The UK Commercial Printing Market leverages multiple formats to address client diversity.

- For instance, HP Indigo 6K Digital Press prints at up to 130 feet per minute in Enhanced Productivity Mode and supports seven ink stations covering up to 97% of the color gamut including specialty inks like Silver ElectroInk and Fade-Resistant inks. It handles substrate thickness from 12 to 450 microns and offers image resolution up to 812 dpi with High Definition Imaging technology, enabling quick and high-quality digital label production.

By Application

Packaging leads application use due to rising e-commerce and retail branding demand. Publishing maintains steady share across book and educational prints. Advertising and marketing drive creative collateral production for campaigns. Retail and e-commerce players rely on promotional displays and inserts. Corporate communication remains strong through brochures and business stationery. Education and government segments use high-quality document printing. Each sector fuels steady diversification in service portfolios across print houses.

By Service Type

Printing services form the core, covering commercial and promotional needs. Packaging printing grows fastest with emphasis on sustainable and smart labeling. Large format printing supports outdoor advertising, signage, and exhibitions. Transactional and direct mail printing regain strength through personalized outreach. Promotional printing covers catalogs, flyers, and event materials. Value-added services like finishing, design, and logistics improve overall service delivery. The UK Commercial Printing Market benefits from firms offering integrated, full-service solutions.

By Print Type

Image printing dominates marketing and packaging categories for visual branding. Painting and artistic prints cater to creative and decor markets. Pattern printing applies to textiles and specialty wallpapers. Others include custom signage and industrial prints tailored for specific uses. Each print type reflects expanding diversification within the UK Commercial Printing Market, supported by technology upgrades and evolving customer needs.

- For example, Heidelberg offers digital and offset presses that produce high-resolution images at over 800 dpi, used for marketing and packaging printing with exceptional color fidelity and consistency. Their presses support annual production volumes exceeding a billion images, underlining their importance in high-volume image printing for branding and marketing sectors.

Segmentation

By Printing Technology:

- Digital Printing

- Lithography Printing

- Flexographic Printing

- Screen Printing

- Gravure Printing

- Others

By Application:

- Packaging

- Publishing

- Advertising & Marketing

- Retail & E-commerce

- Corporate / Enterprise Communication

- Education & Government Documents

By Service Type:

- Printing Services

- Packaging Printing

- Large Format Printing

- Transactional & Direct Mail Printing

- Promotional Printing

- Value-Added Services

By Print Type:

- Image

- Painting

- Pattern

- Others

Regional Analysis

England leads the UK Commercial Printing Market with over 65% share driven by London’s strong corporate base, advertising agencies, and packaging demand from retail and consumer goods firms. The South East contributes heavily through logistics advantages and concentration of digital print facilities. Large commercial printers operate near industrial clusters supporting FMCG and publishing sectors. Urban centers like Manchester and Birmingham sustain constant demand for promotional and transactional printing. It benefits from advanced printing infrastructure and a diverse client mix. Strong investment in automation and sustainability supports competitive print output across this region.

Scotland holds around 18% share and reflects steady expansion in government, education, and local publishing segments. Print houses in Glasgow and Edinburgh focus on short-run printing, design services, and sustainable packaging. The regional market benefits from public-sector tenders and tourism-related printing demand. It attracts investment from small and medium enterprises developing eco-friendly materials. Localized production models improve delivery speed and cost efficiency. It continues to evolve through partnerships with creative agencies and online platforms. Regional initiatives promoting digital adoption strengthen overall competitiveness.

Wales and Northern Ireland jointly account for roughly 17% market share supported by growing retail activity and SME-led commercial demand. Both regions experience rising adoption of digital and flexographic systems due to cost advantages. The UK Commercial Printing Market benefits from regional funding encouraging business digitization. Print firms expand offerings in signage, labeling, and transactional printing for local enterprises. Cross-border trade within Ireland and proximity to logistics hubs enhance business continuity. It creates new opportunities in export-grade packaging and specialized promotional materials. Emerging hubs near Cardiff and Belfast are fostering small-scale innovation in eco-printing practices.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Paragon Group

- HH Global

- St Ives Group

- Pensord Press

- Precision Printing

- Go Inspire Group

- BGP Media

- BCQ Group

- Howard Hunt Group

- The YM Group

- Wyndeham Group

- Hobs Group

- L&S Printing Company

- DG3 Europe

- Kingsbury Press

- McLaren Printing Group

Competitive Analysis

Competition within the UK Commercial Printing Market remains strong, led by large print service providers and diversified digital players. Major companies such as De La Rue plc, Polestar UK Print, Stephens & George, and Howard Hunt Group focus on advanced automation and digital transformation. It experiences constant rivalry among regional firms offering web-to-print, large format, and sustainable packaging solutions. Companies invest in AI-driven workflow management and energy-efficient presses to maintain operational efficiency. Partnerships with technology suppliers like HP, Canon, and Xerox improve innovation and production speed. Firms emphasize hybrid printing, integrating offset and digital capabilities to meet high customization demands. Market leaders leverage brand relationships and quality consistency to secure long-term contracts across publishing, retail, and advertising sectors. Mid-tier and local firms target niche segments such as eco-packaging and variable data printing, ensuring balanced competition and regional diversification.

Recent Developments

- In February 2024, HH Global completed the acquisition of UK-based Displayplan Ltd, enhancing its expertise and building on its global retail activation capability by adding design engineering and production management skills for complex point-of-sale solutions and experiential customer interactions. This acquisition strengthens HH Global’s creative and production teams, further advancing its connected shopper experiences for global retail brands.

Report Coverage

The research report offers an in-depth analysis based on Printing Technology, Application, Service Type and Print Type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The UK Commercial Printing Market will advance through sustained digital transformation and automation across production facilities.

- Demand for high-quality short-run printing will rise due to personalization and e-commerce expansion.

- Sustainability initiatives will drive stronger adoption of water-based inks and recyclable substrates.

- Hybrid printing technology will bridge offset precision and digital flexibility for packaging and publishing applications.

- Growth in luxury and premium packaging will elevate investment in finishing and embellishment technologies.

- AI-driven workflow systems will enhance productivity, reduce waste, and streamline scheduling across print operations.

- Localized production models will strengthen supply chain stability and shorten turnaround times for regional clients.

- Increased government and education spending on digital communication will sustain public-sector printing demand.

- Emerging opportunities in smart packaging and variable data printing will shape new service models.

- Continuous innovation, automation, and sustainable practices will define the competitive evolution of the UK Commercial Printing Market.