Market Overview:

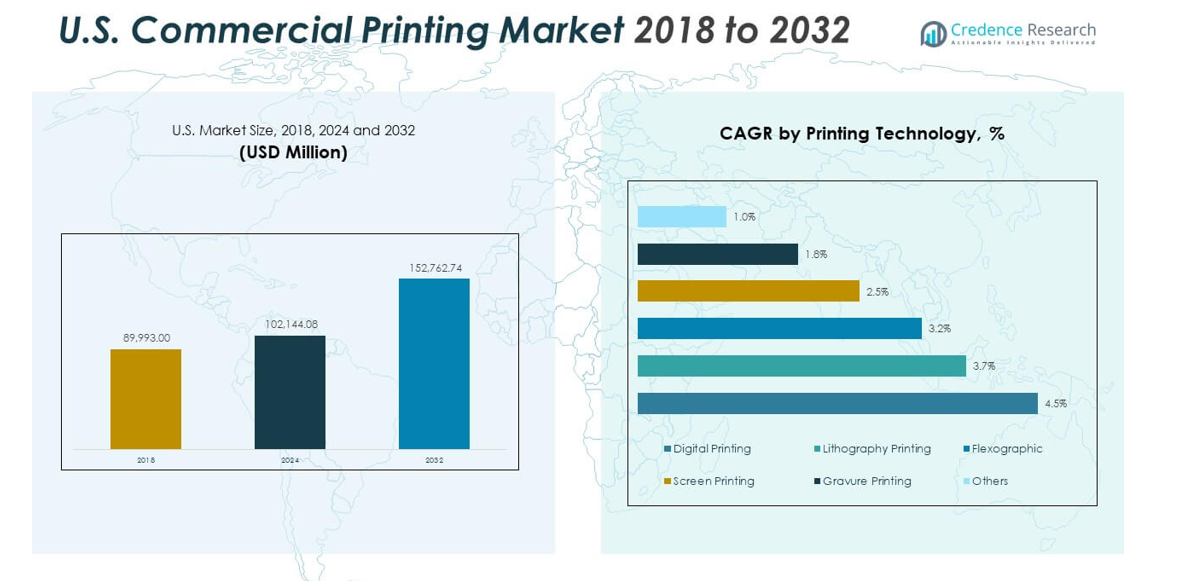

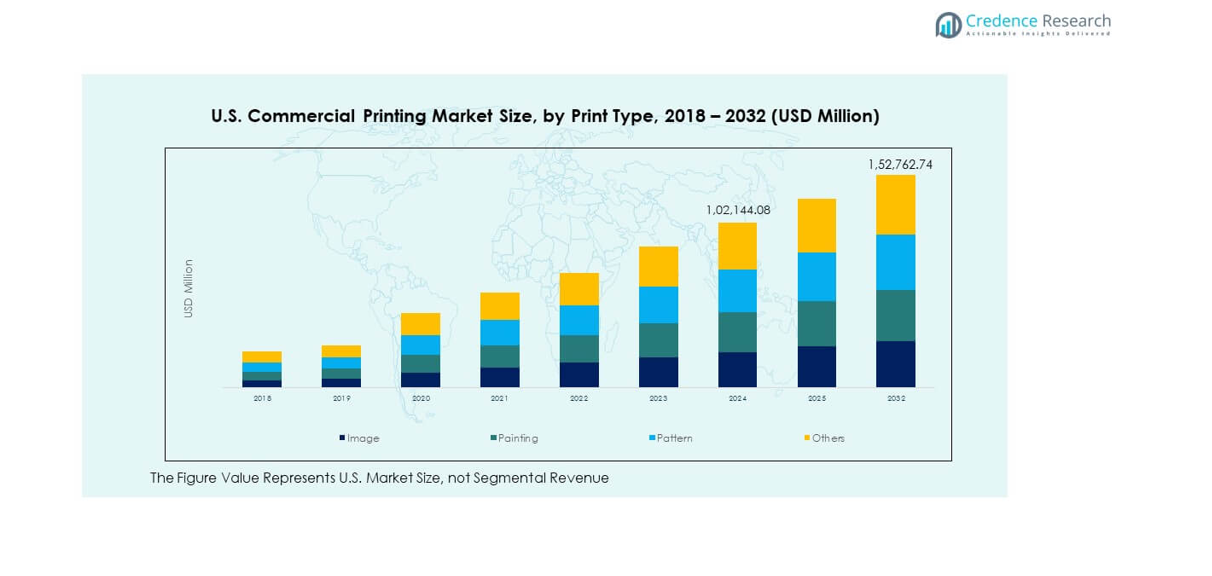

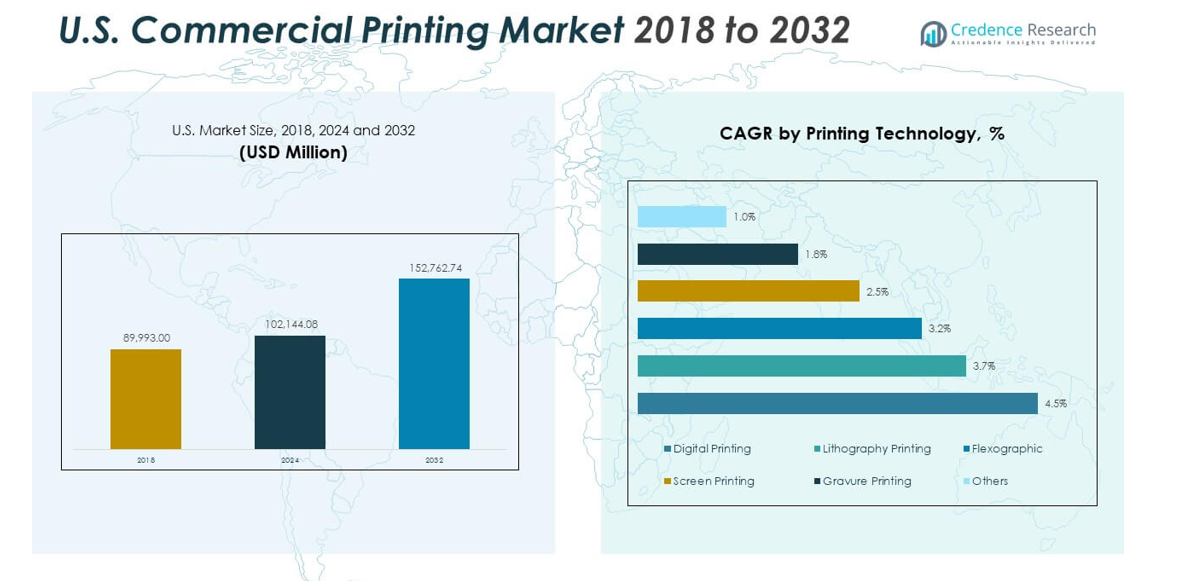

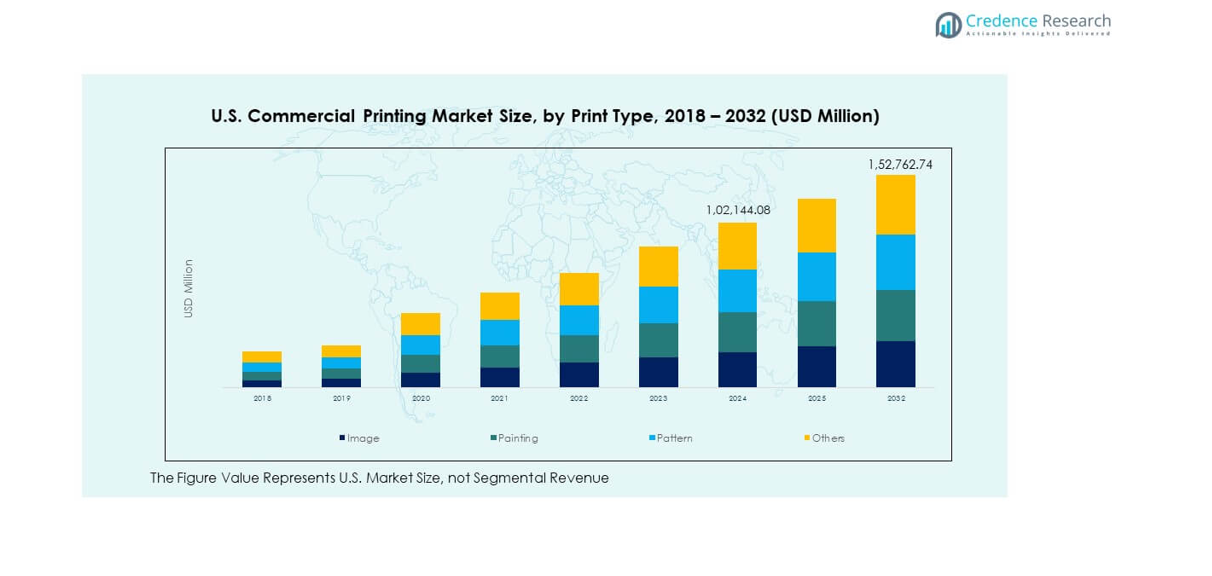

The U.S. Commercial Printing Market size was valued at USD 89,993.00 million in 2018 to USD 1,02,144.08 million in 2024 and is anticipated to reach USD 1,52,762.74 million by 2032, at a CAGR of 5.16% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Commercial Printing Market Size 2024 |

USD 1,02,144.08 million |

| U.S. Commercial Printing Market, CAGR |

5.16% |

| U.S. Commercial Printing Market Size 2032 |

USD 1,52,762.74 million |

Strong demand for sustainable and automated printing processes drives continuous innovation in print infrastructure. Companies invest in energy-efficient machinery, eco-friendly inks, and recyclable materials to meet regulatory and consumer expectations. Automation and AI integration optimize workflow, improving turnaround time and reducing operating costs. The growth of e-commerce, direct mail marketing, and product packaging further strengthens market demand. It reflects rising preference for value-added print services and data-driven personalization across business sectors.

The U.S. Commercial Printing Market shows diverse regional growth patterns led by the Northeast and West regions, where publishing, advertising, and technology-driven printing remain dominant. The Midwest supports balanced expansion through strong manufacturing and logistics infrastructure that enables nationwide distribution. Southern states record rapid growth, backed by industrial development and emerging packaging hubs. Each subregion contributes through specific strengths in production capability, regional connectivity, and market specialization, reinforcing the sector’s nationwide resilience.

Market Insights

- The U.S. Commercial Printing Market was valued at USD 89,993.00 million in 2018, reached USD 1,02,144.08 million in 2024, and is projected to attain USD 1,52,762.74 million by 2032, growing at a CAGR of 5.16%.

- The North-East region leads with about 35% share, supported by high publishing, advertising, and corporate print activity across major states including New York and Massachusetts.

- The Midwest and Central U.S. hold roughly 25% share, driven by industrial printing and strong logistics that facilitate nationwide print distribution efficiently.

- The South and West regions together contribute about 40% to 50% share, with the South emerging as the fastest-growing area due to expanding retail, packaging, and manufacturing sectors.

- Among printing technologies, digital printing leads with a 4.5% CAGR, followed by flexographic at 3.7%, while lithography and screen printing show moderate growth, reflecting a shift toward flexible and short-run production formats.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Expanding Demand for High-Quality Digital and Short-Run Printing

The U.S. Commercial Printing Market advances due to growing demand for short-run and high-quality print jobs. Companies prefer digital presses that deliver sharp image output with minimal setup time. Brands emphasize fast turnaround to align with dynamic marketing campaigns and product launches. Variable data printing enables targeted communication that boosts customer engagement. It supports consistent color management across diverse substrates. Rising e-commerce activities lift the requirement for printed packaging and promotional materials. Firms expand their digital infrastructure to handle quick orders efficiently. Automation and cloud integration improve cost-effectiveness and uptime across production facilities.

- For instance, the HP Indigo 100K Digital Press delivers up to 6,000 B2 sheets per hour in Enhanced Productivity Mode and supports sheet sizes up to 750 × 530 mm. It handles substrates from 70 to 400 gsm and features continuous color calibration to ensure consistent, high-quality output during production.

Rising Focus on Sustainable and Eco-Friendly Printing Practices

Environmental awareness fuels investments in sustainable materials and low-impact printing techniques. Companies adopt water-based and soy-based inks that reduce volatile organic compound emissions. Printers deploy energy-efficient systems and recyclable substrates to meet eco-standards. The U.S. Commercial Printing Market gains traction from clients that prefer green-certified suppliers. It drives long-term partnerships with environmentally responsible vendors. Corporate sustainability goals strengthen the transition toward carbon-neutral operations. Packaging firms adopt biodegradable laminates to support circular economy goals. Energy audits and green certifications enhance operational transparency and brand credibility. Demand from conscious consumers accelerates adoption of eco-responsible printing formats.

Integration of Automation and Artificial Intelligence in Print Production

Automation reshapes production lines by improving efficiency and reducing manual intervention. AI-based systems perform predictive maintenance and ensure real-time quality checks. Smart sensors monitor ink flow and detect print inconsistencies before they impact output. It allows printers to reduce waste and achieve higher consistency across large print volumes. Workflow automation software coordinates multiple print jobs simultaneously, cutting downtime. The U.S. Commercial Printing Market benefits from this digital transformation that enables flexible production capacity. Cloud-connected equipment supports remote management and data-driven scheduling. Predictive analytics optimize raw material use and resource allocation. Integration of robotics improves precision in packaging and post-print operations.

Growing Demand from Packaging, Retail, and E-Commerce Sectors

Expanding retail and e-commerce industries drive strong need for visually appealing and durable printed packaging. Brands invest in flexible labeling, folding cartons, and corrugated displays to enhance product visibility. It creates continuous opportunities for commercial printers to diversify offerings. High-speed digital presses enable mass customization for seasonal campaigns and promotions. The U.S. Commercial Printing Market strengthens its position through reliable supply to FMCG and logistics sectors. Packaging converters install UV-curable and hybrid inkjet systems to boost productivity. Consumer goods companies prioritize packaging that reflects brand identity and sustainability goals. Demand from direct-to-consumer businesses ensures consistent print volumes throughout the year.

- For instance, the EFI Nozomi C18000 Plus digital corrugated printer delivers production speeds up to 75 linear meters per minute and supports boards up to 1.8 meters wide. It is widely adopted by packaging converters for high-quality, customizable e-commerce and retail packaging, offering advanced color accuracy and variable data printing capabilities.

Market Trends

Emergence of Hybrid Printing Solutions Combining Offset and Digital Strengths

Hybrid systems gain prominence for merging the flexibility of digital printing with offset reliability. Printers integrate both platforms to manage short and long runs seamlessly. It enhances efficiency by enabling on-demand jobs with minimal changeover. The U.S. Commercial Printing Market evolves with the deployment of advanced hybrid presses. These systems allow real-time customization within mass production lines. Companies upgrade workflows to synchronize data handling between digital and conventional processes. Hybrid adoption reduces waste and speeds up fulfillment for packaging and publishing clients. Integration of color management software maintains print consistency across diverse applications. This approach bridges traditional craftsmanship with modern automation.

Expansion of On-Demand Printing Models Across Industries

The growth of digital infrastructure supports wider adoption of on-demand printing services. Businesses minimize inventory and print materials only when required. It enables quick revisions and personalization without storage overheads. The U.S. Commercial Printing Market benefits from cost-effective models that align with agile marketing needs. Publishers print smaller batches to meet fluctuating reader demand. Corporate clients use online portals for ordering business stationery and promotional assets. Automated print-on-demand systems integrate with cloud storage for secure data handling. It strengthens market presence by supporting real-time order tracking. This model fits the fast-paced needs of small enterprises and start-ups.

Rise of Smart Printing with IoT and Cloud Integration

Smart print ecosystems redefine efficiency through real-time monitoring and analytics. IoT-enabled devices track performance metrics and identify process bottlenecks instantly. The U.S. Commercial Printing Market leverages cloud connectivity for predictive servicing and remote troubleshooting. Data from networked printers enhances accuracy in workflow planning and maintenance. Printers integrate AI tools to adjust ink density and color calibration automatically. Smart dashboards give visibility across multiple facilities, improving utilization rates. It drives higher operational resilience and faster turnaround times. Vendors provide subscription-based print management solutions with performance insights. The adoption of connected technologies accelerates the industry’s transition toward Industry 4.0 readiness.

- For instance, Xerox Corporation’s ConnectKey technology integrates IoT sensors and cloud connectivity to enable predictive maintenance, remote troubleshooting, and real-time device monitoring. Its AI-powered print management software further optimizes ink consumption and color calibration, enhancing efficiency and reliability across smart printing environments.

Growing Influence of Digital Packaging and Personalization

Packaging becomes a key differentiator in consumer engagement strategies. Brands focus on unique designs, limited editions, and serialized packaging for stronger shelf impact. The U.S. Commercial Printing Market witnesses growth in digital printing lines catering to flexible packaging and labels. It allows companies to print variable barcodes, QR codes, and security graphics seamlessly. Demand for premium finishes such as embossing, spot varnish, and metallic coatings continues to rise. Digital finishing equipment enables cost-efficient short runs with luxury appeal. Packaging converters adopt inline inspection systems for quality assurance. It promotes consistent brand recognition across multiple distribution channels.

- For instance, HP Indigo’s digital presses enable variable data printing with serialized QR codes and barcodes on flexible packaging and labels, supporting personalized production at scale. The systems offer premium finishes such as embossing and metallic effects in short runs and feature inline quality inspection to maintain consistent brand presentation across diverse packaging channels.

Market Challenges Analysis

Rising Raw Material Costs and Volatile Supply Chain Dynamics

Volatile prices of paper, inks, and substrates create pressure on production margins. It forces printers to renegotiate supplier contracts and manage tighter cost structures. The U.S. Commercial Printing Market faces sourcing difficulties due to logistic bottlenecks and import dependencies. Smaller print houses struggle to maintain competitive pricing under unstable input costs. Firms adopt inventory optimization systems to handle fluctuating supplies efficiently. Environmental regulations add complexity by restricting certain chemical components. It leads to higher expenditure on compliant materials and alternative formulations. Printers diversify supplier networks to mitigate risk exposure. These challenges affect profitability and project delivery timelines.

Technological Disruption and Shift Toward Digital Alternatives

Wider digital media adoption impacts demand for traditional print advertising and publications. Online platforms reduce reliance on brochures, flyers, and magazines for marketing. The U.S. Commercial Printing Market adapts by repositioning toward packaging and personalized print applications. It demands continuous investment in upgrading digital infrastructure and workforce skills. High capital expenditure for next-generation printing presses limits access for small firms. The transition also creates learning gaps for operators trained in conventional methods. Printers must align their offerings with omnichannel communication strategies. Rapid pace of technological advancement challenges long-term equipment ROI and adoption cycles.

Market Opportunities

Growing Focus on Smart, Data-Driven Print Ecosystems

Printers explore data-driven business models to gain better insights into customer preferences. The U.S. Commercial Printing Market capitalizes on analytics to optimize operations and client engagement. Cloud-based platforms offer predictive performance metrics for print efficiency and cost control. It enables proactive maintenance scheduling and reduced downtime. Integration with marketing automation tools allows personalized campaign execution. Businesses leverage real-time dashboards to manage multi-location orders effectively. Growth in digital asset management and workflow software expands service capabilities. Printers offering data-backed solutions gain stronger brand partnerships and recurring revenue streams.

Rising Investment in High-Value Packaging and Industrial Applications

Packaging becomes a leading growth frontier with increased focus on brand identity and sustainability. Companies invest in advanced print technologies for flexible and corrugated packaging. It helps manufacturers achieve faster delivery and enhanced customization. The U.S. Commercial Printing Market benefits from higher spending by food, cosmetics, and healthcare brands. Hybrid printing and specialty coatings improve visual appeal and durability. Smart packaging with traceable QR codes enhances consumer interaction and security. Expanding industrial sectors also drive technical printing needs such as labels and components. Firms developing niche expertise in these segments achieve steady long-term contracts.

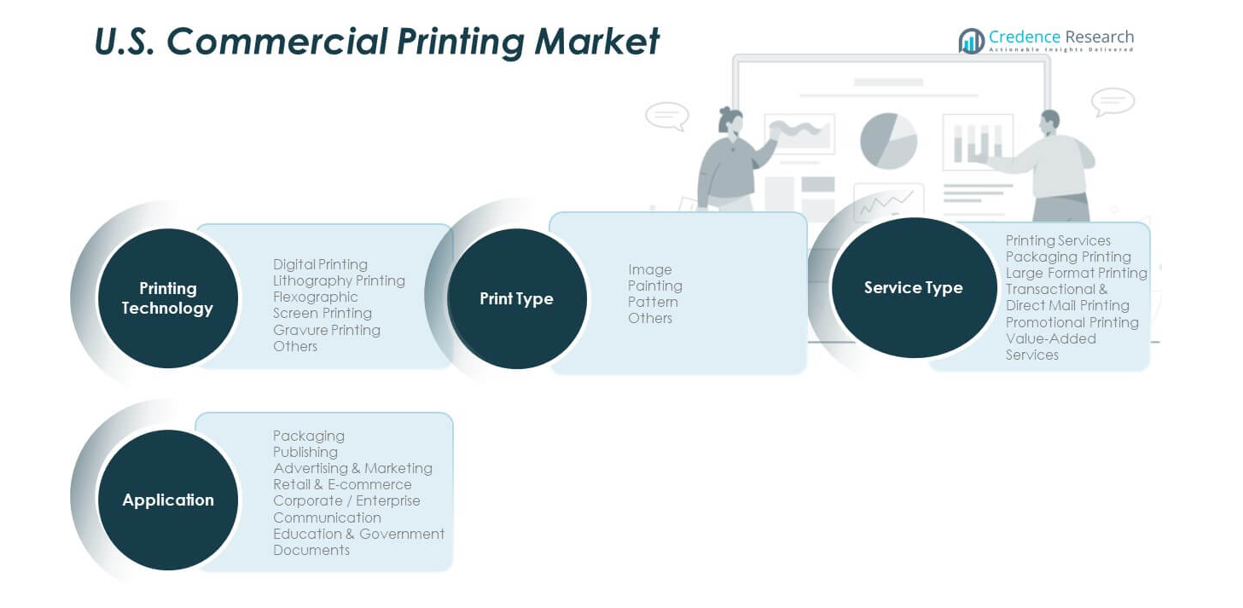

Market Segmentation Analysis

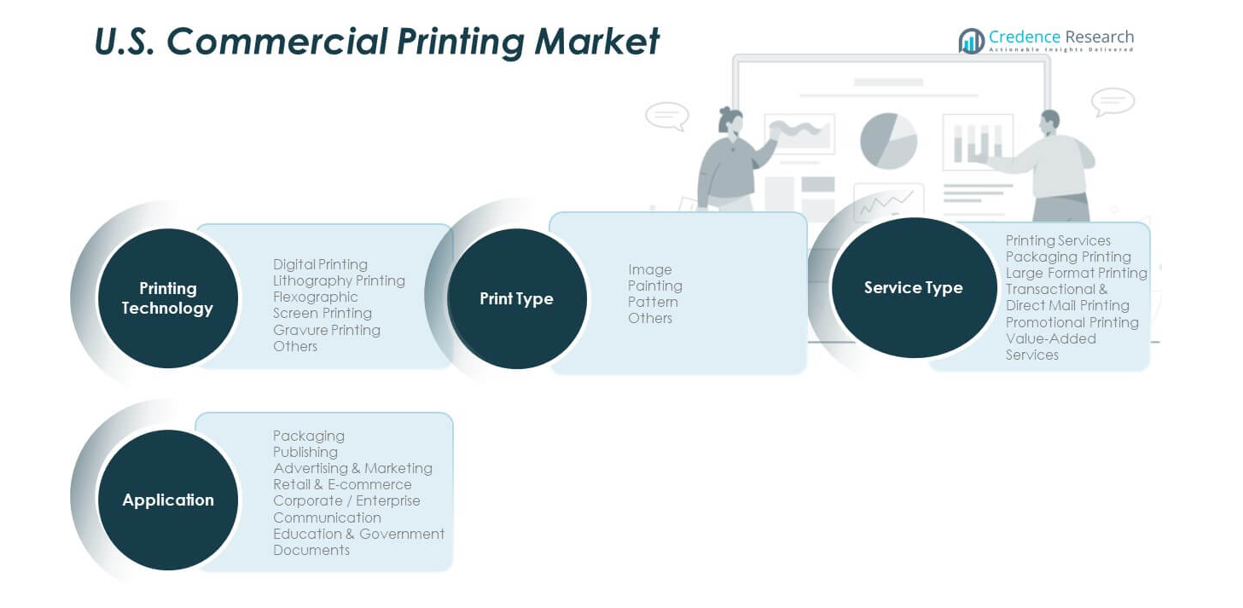

By Printing Technology

Digital printing holds a strong position with growing adoption across variable data and short-run jobs. It offers quick setup, minimal waste, and efficient customization. Lithography printing remains valuable for high-volume runs that demand consistent quality. Flexographic printing expands within the packaging industry due to its speed and flexibility. Screen printing maintains relevance in textiles and specialty graphics. Gravure printing caters to large-scale publication and decorative projects. Others include 3D and UV inkjet systems offering high precision and durable finishes. The U.S. Commercial Printing Market continues diversifying across these technologies to meet evolving industry requirements.

- For instance, the Xerox iGen 5 digital printing press delivers up to 150 A4 pages per minute at 2400 × 2400 dpi resolution, enabling high-speed, variable data, and short-run printing. It supports sheet sizes up to 14.33″ × 26″ and handles substrates up to 24 pt thickness, featuring automated image setup for precise calibration and consistent print quality.

By Application

Packaging dominates due to its essential role in product presentation and branding. Publishing sustains steady demand through books, magazines, and corporate reports. Advertising and marketing benefit from premium print materials that drive consumer engagement. Retail and e-commerce use printed inserts, labels, and displays to enhance customer experience. Corporate and enterprise communication depend on printed documentation for internal and client-facing use. Education and government documents maintain consistent printing volumes for compliance and accessibility. The U.S. Commercial Printing Market serves these application areas with tailored production strategies and scalable service portfolios.

By Service Type

Printing services form the backbone of the industry with large and small firms offering diverse solutions. Packaging printing shows rapid growth with the rise of consumer goods and logistics industries. Large format printing supports events, signage, and outdoor promotions. Transactional and direct mail printing remain vital for financial and utility communication. Promotional printing includes banners, brochures, and catalogs for brand marketing. Value-added services such as design support and finishing elevate client satisfaction. The U.S. Commercial Printing Market leverages these service layers to provide integrated solutions for modern communication needs.

By Print Type

Image printing dominates creative and corporate materials with high color accuracy and finish quality. Painting and art reproduction grow among galleries and design houses seeking authenticity. Pattern printing expands in textiles, décor, and custom merchandise applications. Others include specialty graphics, embossing, and security printing for premium sectors. The U.S. Commercial Printing Market aligns its technology base to manage these varied demands with precision and consistency. It ensures broad coverage across commercial, industrial, and creative domains.

- For instance, Canon Solutions America’s image printing technologies deliver color accuracy above 99% with resolutions up to 2400 dpi, ensuring exceptional precision in corporate and creative print materials. These systems support high-fidelity marketing and branding applications, underscoring Canon’s focus on quality and consistency in commercial print production.

Segmentation

By Printing Technology:

- Digital Printing

- Lithography Printing

- Flexographic Printing

- Screen Printing

- Gravure Printing

- Others

By Application:

- Packaging

- Publishing

- Advertising & Marketing

- Retail & E-commerce

- Corporate / Enterprise Communication

- Education & Government Documents

By Service Type:

- Printing Services

- Packaging Printing

- Large Format Printing

- Transactional & Direct Mail Printing

- Promotional Printing

- Value-Added Services

By Print Type:

- Image

- Painting

- Pattern

- Others

Regional Analysis

North-East and East Coast Strongholds

The North-East region held roughly 30 % to 35 % of the U.S. Commercial Printing Market share in 2024. Dense population centers and high corporate activity in states such as New York, New Jersey, and Massachusetts drive strong demand for publishing, advertising collateral, and direct mail printing. Tight-timelines and proximity to major clients help printers fulfill urgent orders efficiently. It supports significant volumes of high-quality, short-run print jobs for marketing agencies and publishers. Established infrastructure and logistics networks in the region sustain steady growth. Firms in the region benefit from access to large client bases and quick delivery routes.

Midwest and Central States Contribution

Midwest and Central U.S. regions accounted for around 20 % to 25 % of the market share in 2024. States such as Illinois, Ohio, and Michigan host a mix of manufacturing clients and mid-size enterprises. Demand comes from packaging, industrial printing, and corporate communication. Printers meet needs for bulk runs of manuals, labels, and enterprise collateral. Lower operational costs and central location allow efficient distribution across the country. Facilities in this region often serve clients nationwide with favorable turnaround times. This central positioning supports balanced growth and cost-effective services.

South and Western Regions’ Growing Share

The South and West regions together made up approximately 40 % to 50 % of the market share by 2024. Rapid growth in retail, e-commerce, and manufacturing hubs in states such as Texas, California, Florida, and North Carolina drives print demand. Rising population and consumer markets create continuous need for packaging, retail labels, and promotional materials. Printers in these regions expand capacity to support dynamic packaging and direct-to-consumer goods. Investments in digital and hybrid printing technologies help meet high-volume demand. The region draws clients seeking scalable solutions with shorter lead-times and lower logistics costs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

Leading firms in the U.S. Commercial Printing Market compete on scale, technology, and service breadth. Companies such as Quad/Graphics Inc., RR Donnelley & Sons Company, Cenveo, Inc. and Acme Printing maintain large operations across multiple states. They offer full-service printing including packaging, publishing, direct mail, and large-format print. Their scale allows volume discounts, wide geographic coverage and better logistics. Mid-size and regional printers focus on niche offerings such as short-run digital printing, quick turn-around, and specialized packaging solutions. They leverage flexible workflows and customer-centric services to win smaller and agile clients. The U.S. Commercial Printing Market firms face pressure from digital media and online marketing alternatives. Incumbents invest in digital presses, hybrid printing, and automation to stay competitive. They also expand value-added services such as design support, fulfillment and supply-chain integration. New entrants target growing demand from e-commerce, retail packaging and personalized print-on-demand orders. These companies adopt advanced inkjet, label and packaging printing technologies to capture market share. They emphasize agility, fast delivery and competitive pricing. Larger incumbents respond by upgrading equipment, integrating AI-based workflows and expanding service portfolios.

Recent Developments

- In October 2025, PRINTING United Expo showcased leading trends in commercial printing including automation, AI technologies, embellishment, and wide-format printing all set to influence the market going forward, indicating ongoing innovation and adaptation within the U.S. commercial printing sector.

- In May 2025, Drummond, a company based in Jacksonville, Florida, acquired two commercial printing firms in the Atlanta metro area: Tucker Castleberry Printing and New London Communications. This move strengthens Drummond’s strategy for regional expansion in the Southeastern U.S., highlighting confidence in the commercial printing market for companies with scale and specialization.

- In July 2024, R.R. Donnelley & Sons Company (RRD) finalized the acquisition of digital print and marketing businesses from Vericast Corp, expanding its services and productivity solutions in the commercial printing market. Quad/Graphics Inc. partnered with Swiftly in June 2024 to advance its digital in-store retail media network, enhancing brand content distribution in physical retail locations.

Report Coverage

The research report offers an in-depth analysis based on Printing Technology, Application, Service Type and Print Type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The U.S. Commercial Printing Market will advance through stronger adoption of digital and hybrid press systems supporting flexible, short-run, and variable data printing.

- Sustainability will shape major investments, driving use of recyclable substrates, water-based inks, and carbon-neutral operations across large print facilities.

- Automation and AI integration will enhance productivity, reducing errors and operational costs across both packaging and publishing workflows.

- Growing e-commerce and retail packaging requirements will sustain steady print volumes and diversify demand across multiple product formats.

- Demand for smart packaging with QR codes and digital tracking features will expand opportunities for high-value print applications.

- On-demand and cloud-based print management models will gain traction among small and mid-size enterprises for cost-efficient solutions.

- Customization and personalization trends will redefine marketing, boosting growth in promotional, transactional, and direct mail printing.

- The Midwest and Southern regions will attract higher capacity investments driven by logistics advantages and manufacturing expansion.

- Hybrid print ecosystems combining offset precision and digital flexibility will reshape service offerings across the value chain.

- The competitive environment will favor firms with integrated service portfolios, advanced automation, and sustainability-driven differentiation.